Do I Need Health Insurance

If youre wondering whether you need insurance, chances are you do.

Welcome to HealthQuotes.ca, where you can get instant Canadian health insurance quotes and travel insurance quotes online. Compare different insurance plans from competing Canadian insurance companies side-by-side.

Save your valuable time and money and get the benefits that are just right for you! Shop for Individual Health, No-Medical Exam Health Insurance. Keep you and your family safe both day-to-day and while travelling.

How To Enroll And Get Answers To Your Questions

You can learn more about and apply for ACA health care coverage in several ways.

-

Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or you’ll be directed to your state’s health insurance marketplace website. vary by state.

-

Find a local center to apply or ask questions in person.

-

Download an application form to apply by mail

Find the answers to common ACA questions about submitting documents, getting and changing coverage, your total costs for health care, tax options, and more.

Choose Among These Five Different Options

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

If you need to buy health insurance, youre in good company. In 2020, the number of uninsured people in the United States increased to approximately 30 million individuals. Well explain each option for buying your own health insurance so you can decide which path might be best for you.

Read Also: How Much Is Aetna Student Health Insurance

Cheap Health Insurance: Find Low

In 2022, the cheapest health insurance is Kaiser Permanente, which costs an average of $338 per month for a Bronze plan.

The cheapest individual health insurance for most people is a Bronze plan, which provides basic coverage at affordable rates. But the plans with the cheapest premiums may cost you more in the long run if they have a limited network of doctors or lower cost sharing benefits. To find the best cheap health insurance for you, start with the health coverage you need and then compare the cheapest quotes.

Am I Eligible For The Northern Patient Transportation Program

You may be eligible for northern transportation subsidy to help pay for transportation costs if you live north of the 53rd parallel in Manitoba and are required to travel long distances for specialty medical care.

The Northern Patient Transportation Program subsidizes medical transportation costs for eligible Manitoba residents in the north to obtain medical or hospital care not available in their home community. Subsidies may include costs for an essential escort .

Program eligibility is limited to Manitoba residents who live:

- north of the 53rd parallel from the Saskatchewan boundary to the west side of Lake Winnipeg

- north of the 51st parallel from the east side of Lake Winnipeg to the Ontario boundary

- on Matheson Island, when ground travel is not possible by winter road or ferry

Travel must be approved a physician and meet program eligibility. Patients who have coverage from an insurer or funder are not eligible for this medical travel subsidy. Examples include:

- Manitoba Public Insurance

- Non-insured people

To process a transport request or for questions about the program, please contact your local office:

Thompson NPTP office

Also Check: Where Is My Health Insurance Policy Number

Insurers Must Now Provide Online Calculators For Patients To Estimate Their Bills For 500 Nonemergency Services

As of Jan. 1, health insurers and employers that offer health plans must provide online calculators for patients to get detailed estimates of what they will owe taking into account deductibles and copayments for a range of services and drugs.

Need medical treatment this year and want to nail down your out-of-pocket costs before you walk into the doctor’s office? There’s a new tool for that, at least for insured patients.

As of Jan. 1, health insurers and employers that offer health plans must provide online calculators for patients to get detailed estimates of what they will owe taking into account deductibles and copayments for a range of services and drugs.

It’s the latest effort in an ongoing movement to make prices and upfront cost comparisons possible in a business known for its opaqueness.

Insurers must make the cost information available for 500 nonemergency services considered “shoppable,” meaning patients generally have time to consider their options. The federal requirement stems from the Transparency in Coverage rule finalized in 2020.

So how will it work?

Not all drugs or services will be available in the first year of the tools’ rollout, but the required 500-item list covers a wide swath of medical services, from acne surgery to X-rays.

Starting in 2024, the requirement on insurers expands to include all drugs and services.

But that isn’t a given.

A Health Insurance Broker Or Agent

A health insurance broker or agent can help you navigate the wide range of insurance options and enroll in the best health insurance plan for you. You dont pay any fees when working with agents or brokers, as theyre paid on commission by insurers.

To find a broker or agent, you can use the federal governments Find Local Help tool to set up in-person, phone or email appointments. You can also enter your phone number or email address to be contacted by an agent or broker to talk about plan choices. Agents and brokers must be licensed in their states to sell health insurance.

Also Check: How Long Can You Have Cobra Health Insurance

When Can I Purchase Cheap Health Coverage

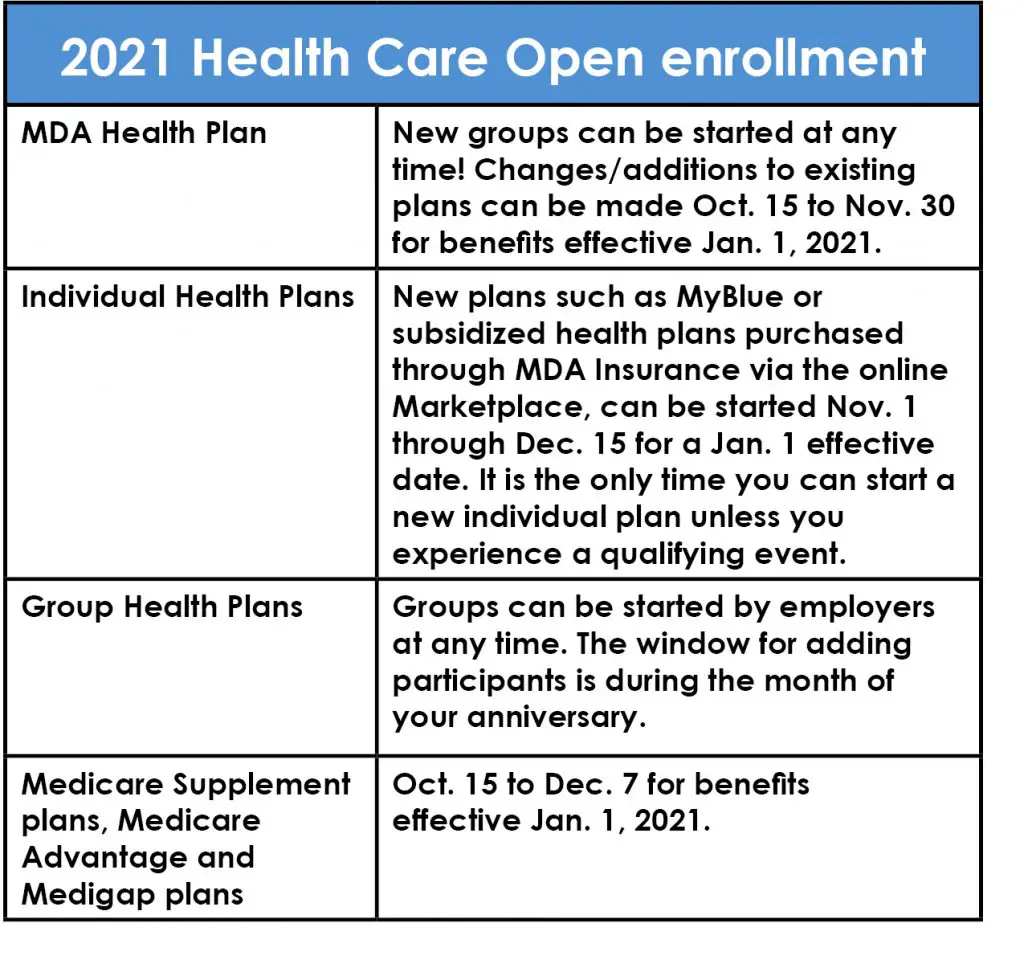

Health insurance coverage can be purchased by anyone during the annual open enrollment period . During this period, you can access your state or federal health insurance marketplace and shop around for coverage from a variety of providers. If you need coverage outside of this time, then you may qualify for a special enrollment period , which allows you to still buy coverage. However, qualification usually only occurs if you have lost a job, had a child or recently gotten married.

When Your Situation Changes We’re Here For You

If the health and dental insurance coverage provided by your employer is about to end or has recently ended, we’ve designed a plan that offers you the opportunity to continue to receive the security you’re used to.

Group Conversion lets you continue health and dental coverage without interruption so you and your family can enjoy the peace of mind that comes from knowing you’re protected from the financial hardship of unexpected health costs.

Your group plan doesn’t even need to have been provided by Blue Cross. Group Conversion is available for the initial transfer from any recognized Canadian group benefits plan within 60 days as long as you have been covered for at least 6 months under a group plan. And there’s no need to complete a medical questionnaire, so there’s no need to worry about prescription medications that you’re already taking.

Recommended Reading: Does Usaa Have Health Insurance

Ny Mn And Ma Residents With Fairly Low Income Can Enroll Year

New York and Minnesota have Basic Health Programs , both of which offer year-round enrollment and are available to residents with income up to 200 percent of the poverty level.

Massachusetts has a program called ConnectorCare, which is available to residents with income up to 300% of the poverty level. ConnectorCare enrollment is available year-round, but only for people who are newly eligible or who havent enrolled previously.

If youre in one of these states and have an eligible income, you may still be able to sign up for coverage regardless of what time of year it is.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health marketplace updates are regularly cited by media who cover health reform and by other health insurance experts.

Were Here To Help You Understand Health Insurance

I really appreciate you taking the time to help out and explain things to people who need it the most.

Thank you, Louise! This is extremely helpful and makes me feel better prepared to navigate my transition.

Louise, Thank you so much for the clear and very helpful response. Ive learned a lot from you on the subject.

Thank you, Louise for your detailed answer. Your first paragraph is exactly what we were looking for!

Thank you so much this is one of the clearest articles on the income limits and subsidy amounts.

Don’t Miss: What Is Washington Apple Health Insurance

Ask Your Association School Or Church

Some membership associations and churches offer group plans to their members. Colleges often offer plans to their students. Because group plans spread costs out over more people, theyre usually less expensive than plans you buy directly from an insurance company or agent.

Note: Health care sharing ministries arent regulated by the state, and there is no guarantee they will pay claims.

How Do I Get Health Insurance If I Have A Disability

If you have a disability, you may be able to get coverage through Medicare or Medicaid. These government programs offer comprehensive health coverage.

You can also get coverage through the ACA marketplace. Depending on your household income, you may get a subsidized ACA plan that may provide premium tax credits and cost-sharing subsidies that reduce out-of-pocket costs.

You May Like: How To Get Health Insurance For Small Business Owner

Are You And All Applicants Residents Of Bc Or The Yukon Actively Enrolled Under The Government Health Plan

Our Individual Insurance Plans are provided ONLY to residents of BC or the Yukon who are actively enrolled in the Government Health Care plan.

-

Are you a resident of another province?Please contact Blue Cross Canada at www.bluecross.ca to find your provinces’ blue cross.

-

Are you a visitor to Canada and arrived within the last 30 days?You may find more information about our “Visitors to Canada Travel Plan”.

Please feel free to contact us if you have any further questions at or e-mail us.

Vision Care

Pacific Blue Cross covers the cost of prescription lenses, frames, contact lenses and laser eye surgery up to a predetermined maximum.

Registered Therapists

Benefits are paid for visits to: naturopaths, massage therapists, physiotherapists,chiropractors, speech pathologists, chiropodists/podiatrists, psychologists, audiologists,acupuncturists, and nutritionists. This is an increasing benefit coverage up toa predetermined maximum.

Benefits cover costs for semi-private or private hospital rooms .

Hospital Daily Cash Benefit

If you are confined to a hospital, we will pay you $20 a day, for up to 90 days,from the 4th day of hospitalization, up to age 65.

Local Ambulance Private

Benefits cover the cost of ambulance fees in emergencies, including air ambulanceand Treat No Transport.

Includes payment for Treat-No-Transport, charges for treatment when an ambulanceis called to the scene of an accident or place of illness and transportation tohospital is not required.

See Why Over 20000 Canadians Already Put Their Trust In Freedom To Choose Health And Dental Insurance

-

Get up to $250,000 in prescription drug coverage

-

No termination age, so youre never too old for coverage

-

Apply in less than 15 minutes, no medical exam needed

-

Make claims online and get reimbursed fast

-

See paramedical specialists like physios or psychologists without a doctors note

-

Bundle coverage with extras like travel medical insurance or major dental

Recommended Reading: Where Can I Find Cheap Health Insurance

Learn More About Health Care Costs

For those who can’t afford health insurance there are a few options to get help paying for health care costs, including:

Shop for health insurance and find out how to choose a health care plan that’s right for you.

I’m New To Manitoba How Do I Apply For Coverage

If you are eligible , coverage will begin on the first day of the third month after your arrival in Manitoba. For example, if you arrive on April 29, April will count as the first month, with May and June as the following two. Therefore, in this case your coverage would begin July 1.

When you register, you will need to:

- Complete a Manitoba Health Registration Form

- Provide your previous province’s/territory’s health card number

- Provide valid proof of legal status in Canada

Provide proof of residence in Manitoba: 6 months in a calendar year.

How to Prove Your Residence in Manitoba

Please provide any one of these documents, subject to the documents being acceptable to Health:

- Signed mortgage agreement

- Signed long term rental or lease agreement

- Current Employment Confirmation

- Notarized letter from the homeowner or leaseholder stating: names of the applicants for Manitoba health coverage living with them in the residence and length of stay

- Letter from a Resettlement Assistance Program providers/Letter from Sponsorship Agreement Holders, regarding the applicant’s residence in Manitoba

Any two of these documents, subject to the documents being acceptable to Health:

- Utility Bill telephone, cable/satellite TV, gas, water/sewer

- Insurance policy

- Property Tax Bill

- Valid Manitoba Driver’s License

Main floor, 170 Goulet St.Winnipeg MB

Rural areas: Contact the city or municipal office in your area, or visit the Bilingual Service Centre nearest you:

51 Rogers St

Read Also: Will Health Insurance Pay For Tummy Tuck

Membership Organizations And Association Health Plans

People who dont have employer-provided health insurance, are self-employed, are unemployed or own small start-ups may still be eligible for a group health insurance plan. These health plans require membership to a professional, trade or membership organization. You can check to see if your organizations offer association health insurance. Association health plans let freelancers, small businesses and self-employed people band together to buy group health insurance at discounted rates.

Be wary of plans provided through some membership organizations that are health services discount plans rather than actual health insurance. These plans may save you money on prescriptions but they dont have broad coverage.

Consumers shopping outside the marketplace should also be cautious of health care-sharing ministries, where individuals of a shared faith contribute money to a health care cost pool distributed by a ministry to pay for certain health-related expenses. This is not health insurance and doesnt cover pre-existing conditions or guarantee reimbursements.

What If I Have To See A Doctor While In Another Province

Manitoba has agreements with all Canadian provinces to allow physicians to bill your provincial health plan, although some physicians may choose to bill you directly. If you are admitted to an approved hospital anywhere in Canada, Manitoba Health will pay the standard rate. Because some services are excluded, you are encouraged to obtain additional health insurance before travelling. Contact Manitoba Health for more information.

Note: You must show your Manitoba Health card to the doctor or hospital.

Recommended Reading: How Much Is Health Insurance Under Obamacare

I Lost My Job And My Health Coverage Can I Buy A Marketplace Plan Now Or Do I Have To Wait For The Next Open Enrollment

Yes you can apply now. HealthCare.gov and all state marketplaces allow a special enrollment opportunity when people lose other coverage. This includes loss of job-based coverage as well as loss of Medicaid.

In general, you have 60 days following the loss of other coverage to apply for a special enrollment opportunity through the Marketplace. In HealthCare.gov and some other states, if you have advance notice of your coverage loss, you can apply for the special enrollment opportunity up to 60 days in advance.

HealthCare.gov will ask for proof of coverage loss before you can sign up for new coverage. For example, you may have received a notice from your employer indicating that your job-based coverage will end. You will have to submit documentation and have it approved by HealthCare.gov before you can complete your application and choose a new health plan.

In general, your new Marketplace coverage will take effect on the first of the month following the date you select your new plan. If you apply in advance of coverage loss, in HealthCare.gov states you can elect to have new coverage begin on the first day of the month following the date your old coverage ends.

Navigators are available to help people through this process. You can find the program closest to you at Find Local Help.

What Is Known About Lecanemab

Lecanemab, a monoclonal antibody, is not a cure but works by binding to amyloid beta, a hallmark of Alzheimers disease. In late November, results from an 18-month Phase 3 clinical trial published in The New England Journal of Medicine showed that lecanemab reduced markers of amyloid in early Alzheimers disease and resulted in moderately less decline on measures of cognition and function than placebo at 18 months but was associated with adverse events.

The results also showed that about 6.9% of the trial participants given lecanemab, as an intravenous infusion, discontinued the trial due to adverse events, compared with 2.9% of those given a placebo. Overall, there were serious adverse events in 14% of the lecanemab group and 11.3% of the placebo group.

The most common adverse events in the lecanemab group were reactions to the intravenous infusions and abnormalities on their MRIs, such as brain swelling and bleeding called amyloid-related imaging abnormalities, or ARIA, which can become life-threatening.

Some people who get ARIA may not have symptoms, but it can occasionally lead to hospitalization or lasting impairment. And the frequency of ARIA appeared to be higher in people who had a gene called APOE4, which can raise the risk of Alzheimers disease or other dementias. ARIA were numerically less common among APOE4 noncarriers, the study showed.

Also Check: How To Sell Health Insurance From Home