Contact A State Agency

Some states have an insurance hotline you can call for assistance or forms to assist you in tracking down lost life insurance policies. Online, nearly all state insurance departments can be found by typing “insurance.xx.gov” in your search bar, replacing “xx” with your state’s two-letter abbreviation.

If you are looking for an old life insurance policy and the major life insurance carriers or your state’s Department of Insurance have no record, call your state’s Department of Revenue, as the benefits may have already been turned over to the state as unclaimed property. Also check with states where the deceased lived previously or at the time of death.

Warning

Before paying a third-party company to conduct a search, check for complaints of fraud or abuse against that company. Some companies have been accused of fraudulently acquiring names, addresses and social security numbers by pretending to be policy hunters.

Q Doesn’t The Government Already Know About This Death A Death Certificate Has Been Issued

It is important to notify the ministry as soon as possible when an insured person dies. The attending physician forwards this information to the ministry but this may take some time and the doctor is not responsible for the collection and return of the health card. The person who is looking after the affairs of the deceased must return the health card to the ministry.

Benefits Of Comparing Medical Insurance Plans Online

Explained below are some benefits of comparing health insurance plans online:

Utmost Ease – It is extremely easy to compare different health insurance plans online. You can compare different plans using InsuranceDekhoâs health insurance premium calculator. It is a free tool which makes it easier for you to decide which health insurance policy you must opt for.

Free Quotes – InsuranceDekhoâs premium calculator is a free tool that you can use to check quotes and coverage benefits n number of times without having to pay anything.

Convenience – Comparing health insurance plans offline is not as convenient as comparing them online. It would be way too tedious if you have to visit one office to another, get quotes and understand coverage benefits before shortlisting one health insurance policy. Hence, it becomes easier when you compare health insurance plans online.

24*7 Availability – You can compare health insurance plans anytime as per your convenience. Unlike the online process, the offline process has fixed working hours and hence you wonât be able to visit an insurance companyâs branch office late at night to compare health insurance plans.

Saves Time – When comparing health insurance plans online, you will not be required to spend so much time filling forms or discussing with agents or executives. All you need to do is fill a quote and several health insurance plans will be displayed on your screen which you can compare easily. This saves you enough time.

You May Like: Does Starbucks Have Health Insurance

You May Have More Than One Health Insurance Card

If you have separate prescription drug, dental or vision coverage, you might get for each of these plans. You also may have more than one insurance card if your family is covered by more than one plan.

For instance, if you have major medical health insurance and a supplemental medical gap policy to help with your high deductible, you will want to show both health insurance ID cards when you visit the doctor. In this example, where youâre using a secondary health insurance policy alongside your major medical coverage, the medical gap insurance does not coordinate benefits with the major medical provider, so your provider will need to contact both insurers.

If you have a flexible spending account or health savings account , you may have yet another type of card â a debit card that you can use to spend on qualified healthcare services , medication and supplies.

Insurance With Lower Monthly Premiums

Short term health insurance can provide temporary and limited benefits for a lower premium if you qualify. STM is not a replacement for comprehensive major medical coverage.

Q What If My Red And White Health Card Is Lost Stolen Or Damaged

To report your lost, stolen or damaged health card you can call the ServiceOntario INFOline at 1-866-532-3161, for TTY service please call 1-800-387-5559.

To replace your red and white health card, you will have to switch to a photo health card. To convert your card:

For information regarding ServiceOntario centres in your area, go to ServiceOntario.ca/locations or call the ServiceOntario INFOline at 1-866-532-3161.

If you find your reported lost or stolen health card, keep it only until your new photo health card arrives in the mail and then destroy the old health card because it will no longer be valid. Make sure you have your new photo health card before destroying the old health card.

Also Check: How Long Do I Have Insurance After I Quit

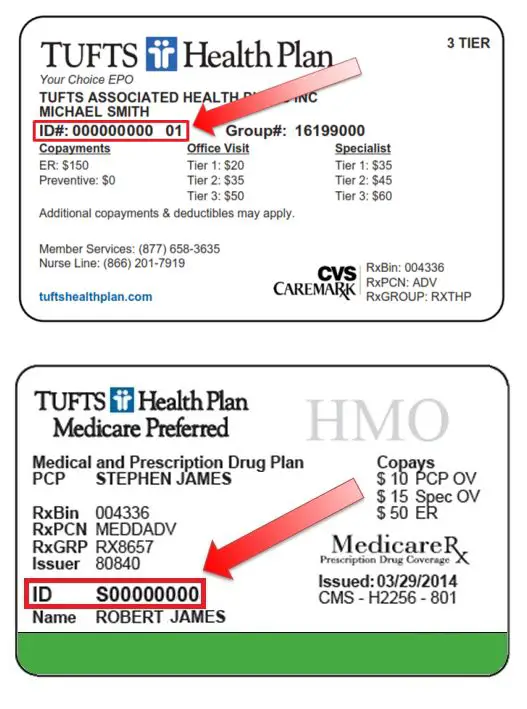

Getting The Id From Your Health Insurer

If you misplace or lose your health insurance card, you will need to get the medical ID number from the health insurance company. And that means contacting them somehow.

Below are tips you can use.

- You can reach out to your health insurer by phone, in person or online. And if your health insurance is offered by your employer, the number may be available via your HR department.

- Once you contact the health insurance company offline, online or in person, explain your issue. And follow the instructions they give you on how to confirm your medical ID number and get a new card.

- You may have to upload other personal identification documents, such as your drivers license, work ID or Social Security number to confirm your identity. So, be prepared for that.

Once you offer all the required information, all you have to do is to wait for them to send you the relevant medical ID information.

What Is My Policy Number

We used health insurance as a case study, when you purchase an insurance policy from the company, the insurance provider will give you an online account. You will now be given a unique number which acts as an account number or ID.

The purpose of the insurance policy number is basically for identification and billing purposes. When you visit a doctor, the cost is usually billed to your insurance company you register to, using your insurance policy number which can be found in your card. If your family members are also insured in your insurance company, they will have their own unique number also.

Read Also: Who Is The Best Home Insurance Company

You May Like: Kroger Associate Discounts

What Is A Health Insurance Policy Group Number On An Insurance Card

If you have coverage from an employer-based health insurance plan, there will most likely be a group number on your insurance card, as well.

It is assigned to your employer by the insurance company and can also be beneficial for both you and your health care provider in finding out what your coverage entails and submitting insurance claims.

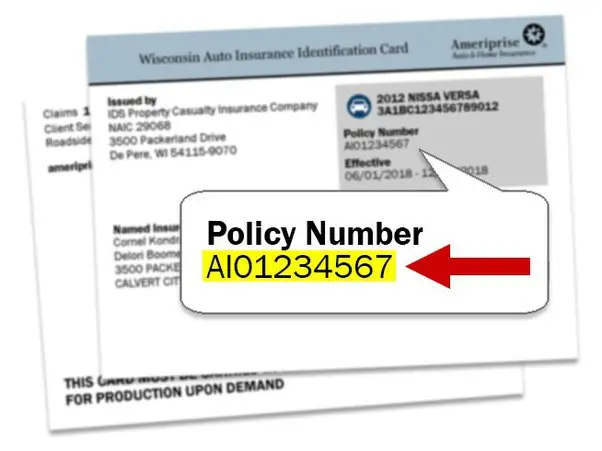

What Are Examples Of Other Insurance Policy Numbers

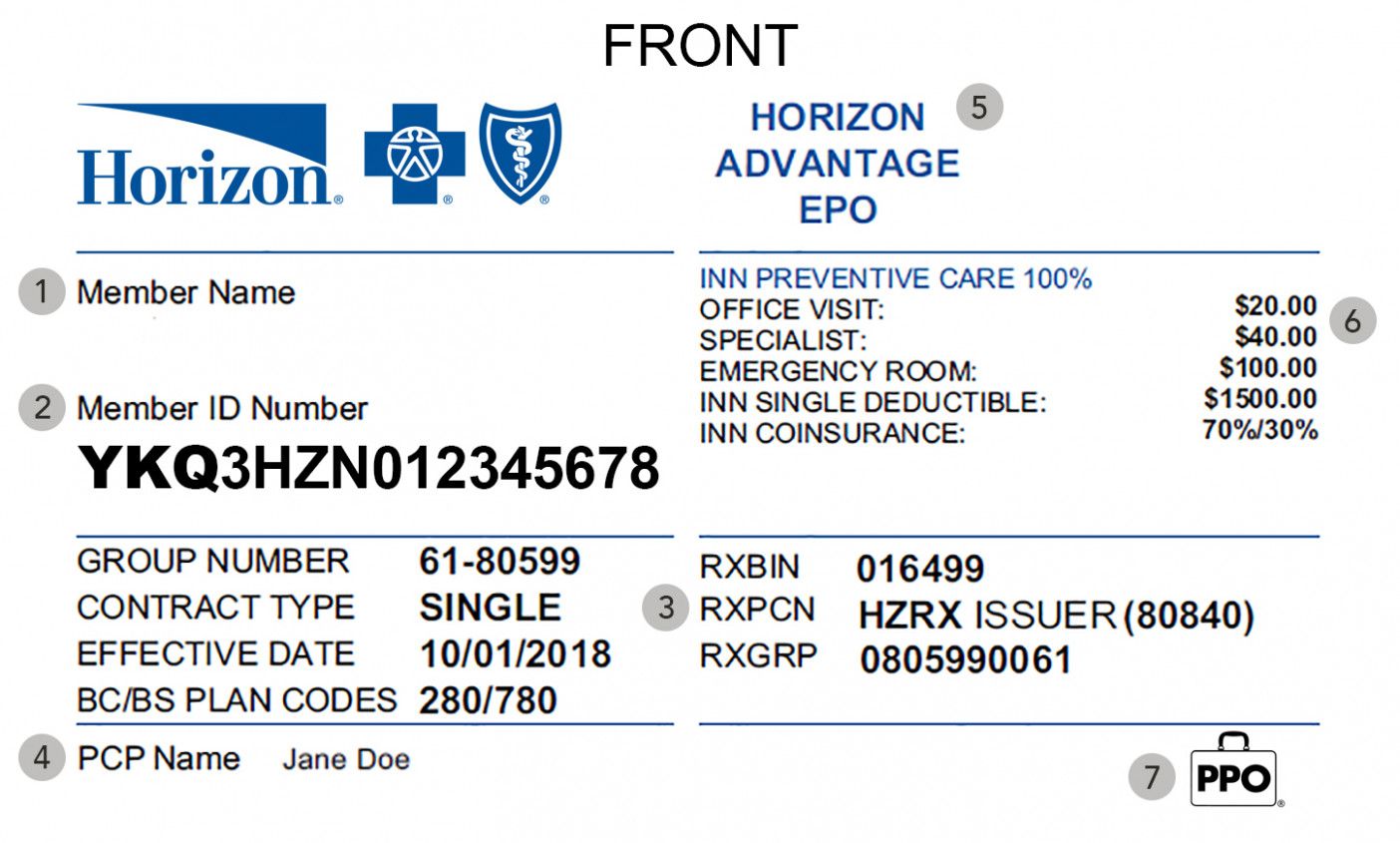

Other insurance companies have set formulas for their policy numbers to make them easier to identify. For example, most Horizon NJ Direct policy numbers start with NJX3HZN followed by a unique group of numbers that are individual to you. Your group number will also be listed on this card.

Your policy number is typically listed on the front of your insurance card along with other basic information to verify your identity and eligibility for benefits.

Find health insurance with a free quotes comparison at the bottom of this page!

Also Check: Is Umr Health Insurance Good

Where Can I Find My Policy Number And What Is It

Your health insurance policy number is typically found on the front of your insurance card. This number is unique to you and it is used to identify your plans benefits and the services that you are eligible for. Your medical provider will use this number for billing purposes, as well as to verify your plan.

If you need to contact your health insurance provider, you will usually need to give this number to the customer service representative to ask any questions about your plan.

Enter your zip code above to compare health insurance quotes online for free!

How Do I Find My Old Health Insurance Information

In NSW Health, clinicians can view their patients My Health Record information in the HealtheNet Clinical Portal, which is accessed via their local electronic medical record system. For more information about My Health Record: Visit: www.myhealthrecord.gov.au. Call the My Health Record Helpdesk on 1800 723 471.

Also Check: Starbucks Health Insurance Deductible

What Else Is Listed On My Health Insurance Card

Several other pieces of information are also listed on your insurance card. Basic information such as your name, the name of the health insurance company, and the name of the policy subscriber, if it is not you. Other covered family members may be listed on the card, as well.

If you have an employer-based health plan or another type of group plan, the group number will also be listed on the health insurance card. It identifies your plan and the benefits associated with your plan, but it is separate than your member ID number. Everyone in the group has the same group number.

The plan type might also be listed on your health insurance card. Your card may say PPO, HMO, or EPO. These are the most common types of health insurance plans. HMO plans require you to select a primary care physician who is in charge of your healthcare decisions.

With most HMO plans, you will need a referral from this primary care provider before seeing any specialist. You can only see providers within your HMO network. The good thing about HMOs is that they usually have a low monthly premium and a low deductible if there is one at all.

PPO plans do not require you to choose a primary care provider or seek referrals for a specialist. You may be able to see an out of network provider for some services, but the cost will be higher. PPO premiums are often higher than HMO premiums and they may contain a deductible, as well.

A Business Owner Who Has Employees

If you start a business and you have employees, you might be required to offer them health insurance. Even if its not required, you might decide to offer health insurance to be a competitive employer that can attract qualified job candidates. In this situation, you will be required to purchase a business health insurance plan, also known as a group plan.

Read Also: Starbucks Benefits For Part Time Employees

Get The Most From Your Plan

- Track your spending balances to keep your budget in check.

- Search claims and see a detailed breakdown of your care and costs.

- Set up a video visit and get virtual care when and where you need it.

And, we keep making improvements to your experience with us. Look for updates on an easier way to search for providers, services and more.

Your Bcbs Id Card Contains Vital Health Insurance Information

|

You can use the first three numbers on your member ID card to find your local BCBS company’s website. There, you can log into your account and access your benefits. |

Some items go everywhere with us. Our phones, keys, drivers licenses and credit cards are kept at our fingertips at all times. Its easy to see why. Those items are unique to each of us, and provide access to the things we need. When it comes to healthcare services, that item is your Blue Cross Blue Shield ID card.

Keep it in a safe, easily accessible place like your wallet. Your card contains key information about your health insurance coverage that is required when you need care or pick up a prescription at the pharmacy. Keeping your card in a secure location will also help protect you from medical identity theft.

If you have misplaced or havent yet received your BCBS ID card, a temporary ID card may be available online. Visit your local BCBS companys website for details.

When your BCBS ID card arrives in the mail, take a moment to look for these five things:

Don’t Miss: Substitute Teacher Health Insurance

Why Is Your Policy Number Important

It is extremely important that any healthcare providers you visit get your policy number right. The reason is that this number is what will be used to track and route billing for your account. If healthcare providers enter an incorrect policy number, your claim will almost certainly be denied.

When this happens, healthcare providers may attempt to collect their payment from you directly. If you want your medical expenses paid for by your insurance policy, your policy number will expedite the process. Without it, your provider cannot keep track of medical billing and youre the one who will have to deal with correcting the situation.

What Else Is On My Health Insurance Card

There is a lot of other important information that may be listed on your health insurance card. The information and the way it is listed may vary depending on your specific provider and if your plan is employer based. In addition to your policy number, other basic identification information may be listed on the card, such as your name, the name of the insurer and their contact information, as well as the name of the subscriber to the policy, if that is not you.

The group number may also be a number on your card if your coverage is through an employer-based insurance plan or another type of group plan.

Everyone insured through the group policy will typically have the same group number. It helps providers identify the benefits your plan offers and may also be used for processing claims and for billing purposes, in addition to your policy ID number.

Additionally, the type of plan you have might be shown on the front of your insurance card. The main types of plans that you might see listed are health maintenance organizations , preferred provider organizations, exclusive provider organizations, and High Deductible Health Plans . The types of plans differ in their regulations when it comes to referrals, seeing out of network providers, and how much your out of pocket costs will be.

You May Like: Starbucks Part Time Insurance

When Can I Buy Private Health Insurance

Most types of health insurance have an open enrollment period during which you can sign up for private health insurance. This is true whether you buy insurance via the Affordable Care Act health insurance exchange in your state, sign up directly through the insurer, enroll in the plan that your employer offers, or sign up for Medicare.

Certain life events can trigger a special enrollment period, which will allow you to change your health insurance coverage outside of the normal enrollment period. These events include getting married or divorced, having a baby, losing your job-based health insurance, or moving out of your health plans service area.

What Is My Health Insurance Group Policy Number

To sum it up

- Group health plans offer Insurance coverage based on employer-sponsored health plans as part of the employee benefits package

- Regulations concerning Multiple Employer Welfare Arrangements, a medical insurance plan offered collectively by several organizations that have connected to provide health coverage to their employees

- After enrolling for health insurance, your Insurance provider gives a policy number to identify your registered account- the importance of group and individual policy numbers

- How to identify your Group Policy Number- the number given to employees by their employer to specify the health insurance coverage that they are a part of

People with varied backgrounds, conditions, and circumstances could find stability in the health Insurance domain. A group health insurance policy number is given to employees to identify their card details and the dependents on that account.

If you have not utilized your health card for a long time or recently switched health insurance providers and you cannot get sufficient information from your new insurance card, it can be quite confusing.

Read on to find out how to locate your group health insurance number.

Looking for coverage? Enter your zip above for free a health insurance costs comparison.

Also Check: 8448679890

What Is Your Application Id Number

Your marketplace plan ID is different than your application ID. You will receive your application ID along with your eligibility results after you apply for marketplace coverage. After you receive your application ID, you will need it to continue on with your application, compare different plans and prices, and to officially complete your health care enrollment.

You may need to provide your application ID to a representative you are speaking with on the phone or you may need to type it in after you log in to your account and find your existing application if you are filling out the forms online.

How Much Does Private Health Insurance Cost

While many people are scared by the prospect of purchasing their own insurance versus enrolling in an employer-sponsored plan, some studies have shown that it can end up being more affordable than employer-sponsored plans.

A study from the Kaiser Family Foundation found that the average monthly premium for an employer-sponsored insurance plan for individual coverage in 2019 was $603. It was $1,725 for family coverage.

Conversely, also according to the Kaiser Family Foundation, if you were to purchase your own insurance outside of an employer-sponsored plan, the average cost of individual health insurance was $440. For families, the average monthly premium was $1,168.

In addition, if you end up purchasing coverage through the Health Insurance Marketplace, you may qualify for a Cost-Sharing Reduction subsidy and Advanced Premium Tax Credits. These can lower your premium payment amounts, your deductible, and any co-payments and co-insurance for which you are responsible.

Also Check: Does Kroger Offer Health Insurance To Part Time Employees