What Is The Self

The self-employed health insurance deduction is an adjustment to income, also known as an above the line deduction, because you dont need to itemize to benefit from it. If you qualify for the deduction, claiming it will reduce your adjusted gross income, or AGI.

The deduction allows self-employed taxpayers to deduct the amounts paid for

- Medical insurance

- Dental insurance

- Qualified long-term care insurance

The deduction isnt limited to the business owners health insurance costs. You can also deduct the premiums paid for your spouse, dependents and children who are younger than 27 at the end of the tax year, even if the children arent your dependents.

How Can You Qualify

While nearly any healthcare premium qualifies for this deduction, there are limits. Some essential qualifications for the self-employed health insurance deduction include:

- Neither you nor your spouse can be eligible for a separate employer-sponsored plan for any months worth of premium you are claiming.

- If you are operating as an S-corp, which is sponsoring your healthcare, the deduction cannot exceed your companys total profit in that calendar year.

- Entrepreneurs running multiple companies need to be sure that the sponsoring company has more income than their total health insurance premiums.

- You have to qualify as self-employed, which requires that you have no employees for whom you are filing a W-2. .

Coverage Options For The Self

- When you fill out a Marketplace application, youll find out if you qualify for premium tax credits and other savings on a health plan. This will be based on your income and household size.

- Youll also find out if you qualify for free or low-cost coverage through the Medicaid and CHIP programs in your state. This will depend on your income, household size, and other factors.

- Do a quick check to see if your expected income is in the range to save.

In the Marketplace you can choose from several categories of coverage, from plans with low premiums that mainly protect you in worst-case scenarios to plans where youll pay more each month but less out-of-pocket when you get health care services.

Also Check: Does Aarp Offer Health Insurance

How Tax Reporting Works For The Health Insurance Deduction

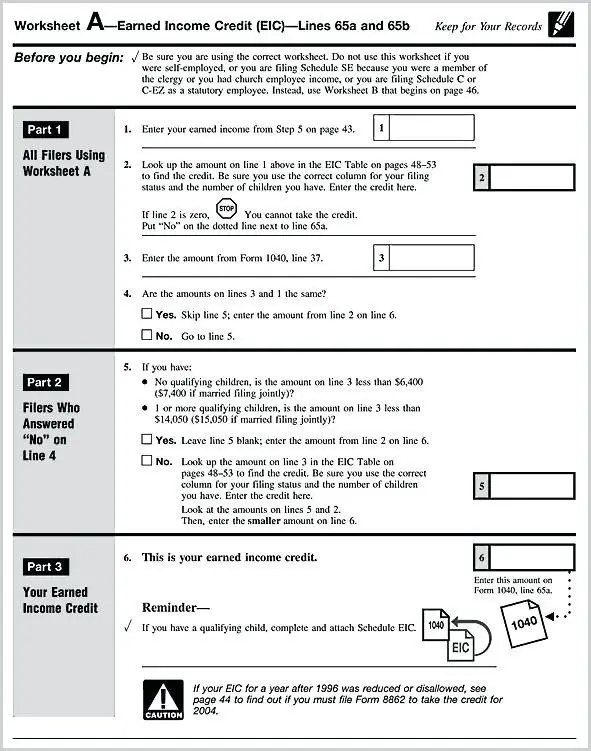

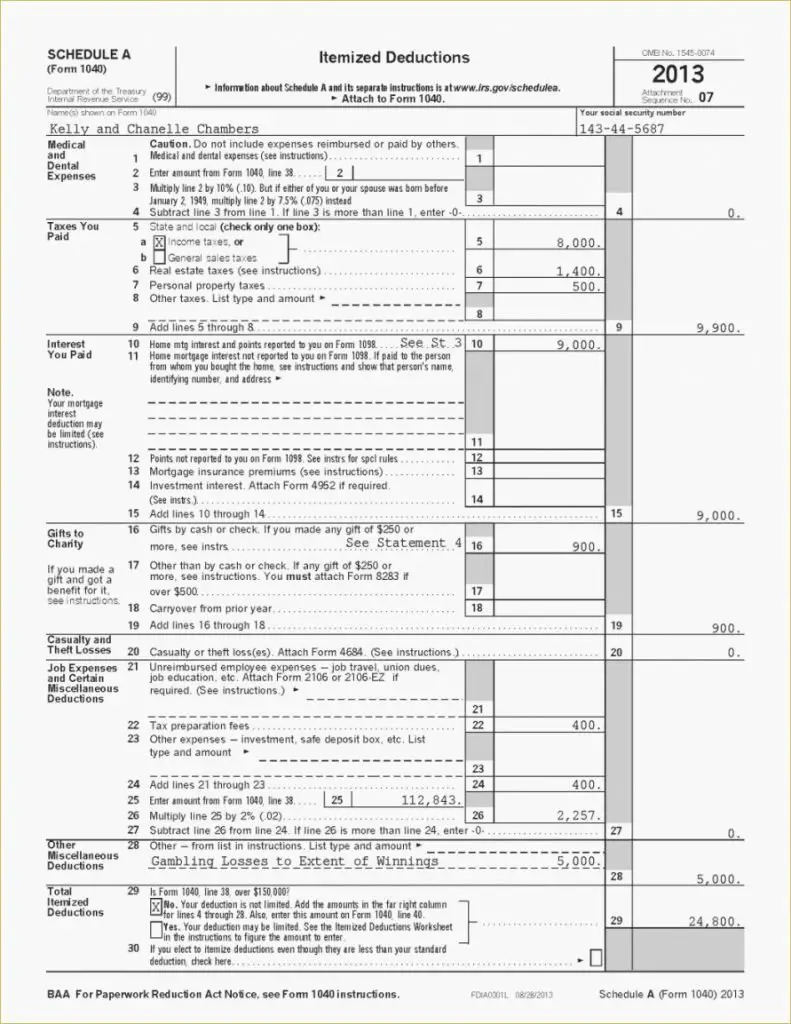

The self-employed health insurance deduction is taken directly on the Form 1040 as a personal deduction. This deduction should not be reported on the Schedule C if you are a sole proprietor. In the case that you do not claim 100% of your self-employed health insurance costs , you may include the percentages that you are deducting with medical expenses on Schedule A, which is subject to the 7.5% of Adjusted Gross Income limit . This AGI limit will increase to 10% in 2020.

Topic No 502 Medical And Dental Expenses

If you itemize your deductions for a taxable year on Schedule A , Itemized Deductions, you may be able to deduct expenses you paid that year for medical and dental care for yourself, your spouse, and your dependents. You may deduct only the amount of your total medical expenses that exceed 7.5% of your adjusted gross income. You figure the amount you’re allowed to deduct on Schedule A .

Medical care expenses include payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, or payments for treatments affecting any structure or function of the body.

Deductible medical expenses may include but aren’t limited to the following:

If you’re self-employed and have a net profit for the year, you may be eligible for the self-employed health insurance deduction. This is an adjustment to income, rather than an itemized deduction, for premiums you paid on a health insurance policy covering medical care, including a qualified long-term care insurance policy for yourself, your spouse, and dependents. The policy can also cover your child who is under the age of 27 at the end of 2020 even if the child wasn’t your dependent. See Chapter 6 of Publication 535, Business Expenses for eligibility information. If you don’t claim 100% of your paid premiums, you can include the remainder with your other medical expenses as an itemized deduction on Schedule A .

Recommended Reading: How Much Does Health Insurance Cost In Ct

Owning Your Own Small Business Can Get A Little Overwhelming Especially If You Have Employees And Are Trying To Manage Finances In Such Cases It Is Essential To Know About Sef

Self-employment and gig economy workers are on the ascent. In fact, self-employment has reached the highest levels since 1957. In case you are among the 44 million self-employed Americans, you may worry about finding quality, affordable health insurance. Normally, you may meet all requirements to pursue another health insurance plan during the open enrollment time frame, which happens each November 1 through December 15. On the off chance that you have had a qualifying life occasion, you can likewise enroll. Qualifying occasions incorporate getting married, having a child, or losing your past health insurance. Keep on reading to learn all that you need to know about self-employed health insurance.

What Type Of Health Insurance Is Tax

A tax deduction is a deduction that lowers a person’s liability by lowering their taxable income. Certain expenses incurred during the year, such as health insurance premiums, can be subtracted from the taxpayer’s gross income to calculate how much tax is owed.

The Internal Revenue Service defines the type of policy premiums you can claim as a self-employed health insurance tax deduction. To qualify for a self-employed health insurance deduction, the IRS states a policy must fall into at least one of the following three categories.

- Dental insurance

- Medical insurance

- Long-term care insurance

However, if you have an LTC policy, then you must have specific coverage. If the LTC policy qualifies, you can file a long-term care self-employed health insurance deduction. Note that the amount youre refunded varies by tax year and the covered persons age.

Recommended Reading: Is Health Insurance Mandatory In New York

Should You Consider Short

Short-term health insurance is a tool when youre in between jobs or health insurance periods. It can help provide coverage until the next enrollment period or serve as supplemental coverage to fill in any gaps in existing coverage.

However, short-term plans arent ACA-compliant, so coverage isnt guaranteed and is typically more minimal than traditional health insurance plans. For instance, essential health benefits found in ACA plans like prescription drugs, mental health and maternity care arent usually covered by short-term health plans.

Meals And Entertainment Expenses For Fishers

Claim the total amount you paid for food you stocked on your boat to feed your crew when you fished offshore.

Often, inshore fishers do not stock food. Instead, they bring meals from home for their crew because the trips are short . You can deduct the cost of these meals as long as the meals were a taxable benefit to your crew.

In some cases, you can deduct the cost of meals even though they were not taxable benefits. You can do this if your boat was at sea for 36 hours or more and the meals you provided for your crew were not taxable benefits. Also, if you gave meals to your sharespeople, generally the meals you provided for them are not taxable benefits because we do not consider sharespeople to be employees. The 50% rule applies to all self-employed sharespeople. However, they may be limited by the restriction noted above.

For more information about taxable benefits, see the T4130, Employers’ Guide Taxable Benefits and Allowances.

Recommended Reading: Is Eye Surgery Covered By Health Insurance

How To Save On Self

There are ways to lower your self-employed health insurance costs.

If you have a low income, you may qualify for special deductions on health insurance marketplace plans for things like your copays, deductibles, and co-insurance. Theres a personal health insurance deduction that allows self-employed individuals to deduct 100% of health insurance premiums.

Its applicable for federal, state, and local income taxes, and covers not only the policyholders but also any spouses and dependents. To qualify, you must have regular business income and no other active health insurance policy.

Another way to save on health insurance premiums is to get a high-deductible health plan . A HDHP has a deductible of at least $1,400 for single coverage and $2,800 for family coverage. You have to pay that amount out-of-pocket for health care services over a year before the health insurance begins to pay for care.

A high-deductible plan also has a health savings account or health reimbursement arrangement , which let you save tax-free for your future health care needs.

How Do I File Health Insurance Costs Paid For Myself And My Family

Once you confirm you are eligible to file, you’ll need to know where to deduct health insurance premiums for self-employed tax purposes.

The most direct way to claim your health insurance premium costs is to apply them as a deduction to your total gross income. When you take these deductions, the result is called your adjusted gross income, or AGI. Basically, your AGI is your gross income minus allowable adjustments, such as student loan interest or health savings account contributions. In summary:

Gross income – adjustments = AGI

Applying your premiums as an income adjustment provides two benefits:

- Your total tax liability is based on your AGI. If you use the insurance premiums to lower your AGI, you may have a lower tax debt.

- You can claim 100% of your eligible health insurance premiums as an income deduction.

If you don’t submit all your paid premiums as an income deduction, you can include the remaining costs with your other itemized medical expenses. You would have to do this, for example, if your health insurance premiums exceeded your business income. Keep in mind that if you combine premiums with your other itemized medical costs, you can use only 10% of your total eligible health-related expenses including premiums beginning with the 2021 tax year.

Recommended Reading: How To Enroll In Health Insurance

How Do I Enter Self Employed Health Insurance Deduction

It depends on what kind of business you operate.

If your self-employment income is through a sole proprietorship reported on schedule C. You will need to use TurboTax Home and Business or TurboTax Self-Employed online. To enter the insurance premiums, you will do as follows:

If the business is a partnership or an S-Corp, you will enter the self-employed health insurance at the end of the K-1 entry section.

The Premium Tax Credit

Who: Those who buy through the Marketplace , below a certain income

What: Reduced health insurance costs

Where:Form 8962

One of the provisions of the Affordable Care Act was the introduction of the premium tax credit. While this isnt a deduction, these are credits, or subsidies, that make your health insurance plan more affordable. The subsidies are meant to reduce the cost of your health insurance plan according to your income. More specifically, your subsidy amount is determined by where your income falls in relation to the federal poverty level. As a general rule, the closer you are to the federal poverty level, the higher subsidy you will receive. When you call Stride Health to enroll in health insurance and we tell you that you can get a subsidy of $100 per month, effectively lowering your monthly costs by that amount, thats the premium tax credit at work!

To receive a subsidy, your income must be between 100% and 400% of the federal poverty level .

You also need to meet a few other requirements to qualify for the premium tax credit. Youre eligible for the premium tax credit if:

-

You or a family member bought health insurance from the Marketplace

-

You cannot be claimed as a dependent by another person

-

You dont file your taxes as Married filing separately

-

You are not eligible to purchase health insurance through a spouse or employer

-

You are not eligible for Medicaid, Medicare, CHIP , or TRICARE

When you exercise the premium tax credit, you have two options:

Also Check: Does Short Term Health Insurance Cover Pre Existing Conditions

Breaking Down The Self

This post may have affiliate links. Please read the Disclosure Policy for complete details.

Youre self-employed, which means getting your own health insurance.

No more being able to take advantage of an employers plan.

Well, unless your spouse has access to a good one.

Or are young enough to be on your parents plan.

But, in general, youre on your own, and it sucks.

Not only are premiums rising each year, but so are deductibles.

Add to that the lack of help and affordable options the marketplaces provide, and the whole thing makes you want to scream.

Enter the self-employed health insurance deduction.

With this little gem, you may no longer have to itemize in order to deduct your health insurance premiums.

You may no longer have to meet certain minimums before your medical expenses qualify for deducting.

Thats a huge benefit.

Its not, however, without its drawbacks and confusing rules

Fees Deductible In The Year Incurred

If you incur standby charges, guarantee fees, service fees, or any other similar fees, you may be able to deduct them in full in the year you incur them. To do so, they have to relate only to that year. For more information, go to Interpretation Bulletin IT-341, Expenses of Issuing or Selling Shares, Units in a Trust, Interests in a Partnership or Syndicate and Expenses of Borrowing Money.

Recommended Reading: Where Do You Go If You Have No Health Insurance

How Much Is Health Insurance For Self Employed People

The cost of health insurance for self-employed workers is different for everyone and calculated based on several specific factors. Individual health insurance plans that are compliant with the Affordable Care Act typically involve these five factors:

- Age: Individual health insurance is typically more expensive for older people, as the risk for medical problems increases dramatically with age.

- Location: You may pay more or less partially based on how many health insurance options are in your area.

- Tobacco use: Smokers are at a much higher risk for medical issues, which can create higher premiums.

- Type of plan: The kind of health coverage can determine how much you pay, including whether you have to stay within a provider network for care and if you need referrals to see specialists.

- Deductible: Your monthly premiums are lower when you have a higher deductible. However, a higher deductible also means that you have to pay more out-of-pocket before your coverage kicks in. When you choose a lower deductible, you have to pay less out-of-pocket costs for medical care, but you will face higher monthly payments.

Christian Healthcare Ministries Dont Count For The Self

A new trend these days is to join a Christian Healthcare Sharing Ministry such as Medi-Share or Liberty HealthShare.

The simplest term for your expenditure within this type of organization is pooled-money contribution rather than an insurance premium.

These types of organizations are generally faith-based and collect a monthly fee from their members, then distribute the money.

Health insurance cannot be withheld based on faithor lack thereofyay, at least the government has some standards!

This is the first way in which Healthcare Sharing Ministries are dont qualify as a tax-deductible insurance expense because they arent.

Rather than paying the bills of the insured to the healthcare provider, the ministries reimburse the individual members, essentially transferring the money between individuals.

In addition, there are some items that are excluded from reimbursement based on Christian beliefs which further prevents it from being deducted as insuranceabsolutely zero judgment here, but stating a fact because people inevitably wonder why?.

So whats the attraction or benefit if it doesnt qualify for the self-employed health insurance deduction nor the standard insurance premium deduction?

Its cheaper than traditional insurance, in many cases outweighing the tax savings.

Don’t Miss: What Is A Good Cheap Health Insurance

What Is Self Employed Health Insurance Deduction

Big businesses and corporations get all kinds of tax breaks for health insurance. But what about self-employed people? What health insurance tax breaks do they get?

Self-employed people get to keep all of their income for themselves and their business, but they also have to cover all of their own expenses. Of those, health insurance is one of the biggest. To help offset this big expense, the government allows self-employed people to take a tax deduction for the cost of their health insurance. But what is this tax deduction and how does it work? In this article, weâll tackle both of those questions and more, so keep reading to find out!

The self-employed health insurance deduction is a way for self-employed people that qualify to deduct the health insurance costs for themselves, their spouses, and their dependents from their taxes. This tax deduction is limited to those that are not eligible for employer-subsidized insurance and whose businesses turn a net profit.

Being self-employed can be one of the most freeing experiences of your life. But having to cover all of your own expenses can be stressful. Trust me, Iâve been there myself. During my early years as a self-employed worker, I spent hours upon hours researching ways to save money or get a tax break. Thatâs when I stumbled upon the self-employed health insurance deduction. Everything you read here comes from my own experience as well as guidelines from the IRS.

Interest And Bank Charges

You can deduct interest incurred on money borrowed for business purposes or to acquire property for business purposes. However, there are limits on:

- The interest you can deduct on money you borrow to buy a passenger vehicle or a zero-emission passenger vehicle. For more information, go to Motor vehicle expenses.

- The amount of interest you can deduct for vacant land. Usually, you can only deduct interest up to the amount of income from the land that remains after you deduct all other expenses. You cannot use any remaining amounts of interest to create or increase a loss, and you cannot deduct them from other sources of income.

- The interest you paid on any real estate mortgage you had to earn fishing income. You can deduct the interest, but you cannot deduct the principal part of loan or mortgage payments. Do not deduct interest on money you borrowed for personal purposes or to pay overdue income taxes.

You May Like: How Much Health Insurance Do You Need