Special Considerations In Deciding Whether To Elect Cobra Continuation Coverage

In considering whether to elect continuation coverage, you should take into account that a failure to continue your group health coverage will affect your future rights under Federal Law. First, you can lose the right to avoid having pre-existing condition exclusions applied to you by other group health plans if you have more than a 63-day gap in health coverage, and election of continuation coverage may help you eliminate that gap. Second, if you do not purchase continuation coverage for the maximum time available to you, you will lose the guaranteed right to purchase individual health insurance policies that do not impose such pre-existing condition exclusions. Finally, you should take into account that you have special enrollment rights under Federal Law. You have the right to request special enrollment in another group health plan for which you are otherwise eligible within 30 days after you group health coverage ends because of the Qualifying Event listed above. You will also have the same special enrollment right at the end of continuation coverage if you purchase continuation coverage for the maximum time available to you.

Cobra Health Coverage Offers A Number Of Benefits:

Continuity in Coverage

Generally, your coverage under COBRA will be the same coverage you had while you were an employee. This is helpful if you would like to continue to see your same doctors and receive the same health plan benefits.

Coverage for Dependents

Your dependents are also eligible for COBRA coverage, even if you do not sign up for COBRA coverage.

Avoiding a Lapse in Coverage

COBRA can help those who need health coverage during the time between losing job-based coverage and beginning other health coverage.

Generous Time to Enroll

You have 60 days to enroll in COBRA once your employer-sponsored benefits end. Even if your enrollment is delayed, you will be covered by COBRA starting the day your prior coverage ended. You will received a notice from your employer with information about deadlines for enrollment.

Long-Term Coverage is Available

While COBRA is temporary, in most circumstances, you can stay on COBRA for 18 to 36 months. This coverage period provides flexibility to find other health insurance options.

However, the plan may require you to pay the entire group rate premium out of pocket plus a 2% administrative fee, so cost is an important consideration when exploring COBRA as a health coverage option.

Even If You Enroll In Cobra On The Last Day That You Are Eligible Your Coverage Is Retroactive To The Date You Lost Your Employer

How long do you have to sign up for COBRA? COBRA beneficiaries have 60 days to decide whether they want COBRA coverage. If you enroll in COBRA before the 60 days are up, your coverage is then retroactive, as long as you pay the retroactive premiums.

This means that if you incur medical bills during your election period, you can retroactively and legally elect COBRA and have those bills covered.

COBRA is expensive, but it also provides you peace of mind if you ever lose your job. Whether going with COBRA is the right choice for you depends on what you want from your health plan and how much youre willing to spend.

You May Like: What To Do If You Lose Your Health Insurance Card

How The Affordable Care Act Affects Cobra

The Affordable Care Act offers affordable health insurance for people, including those with cancer and other serious conditions. It makes sure that most insurance plans cover the health care that cancer patients and survivors might need.

The state insurance marketplaces offer health insurance options to people who dont have access through their employers. It can also help those who leave their jobs and lose their employers group insurance. And for some people, buying insurance through their states marketplace may cost less than paying for COBRA coverage.

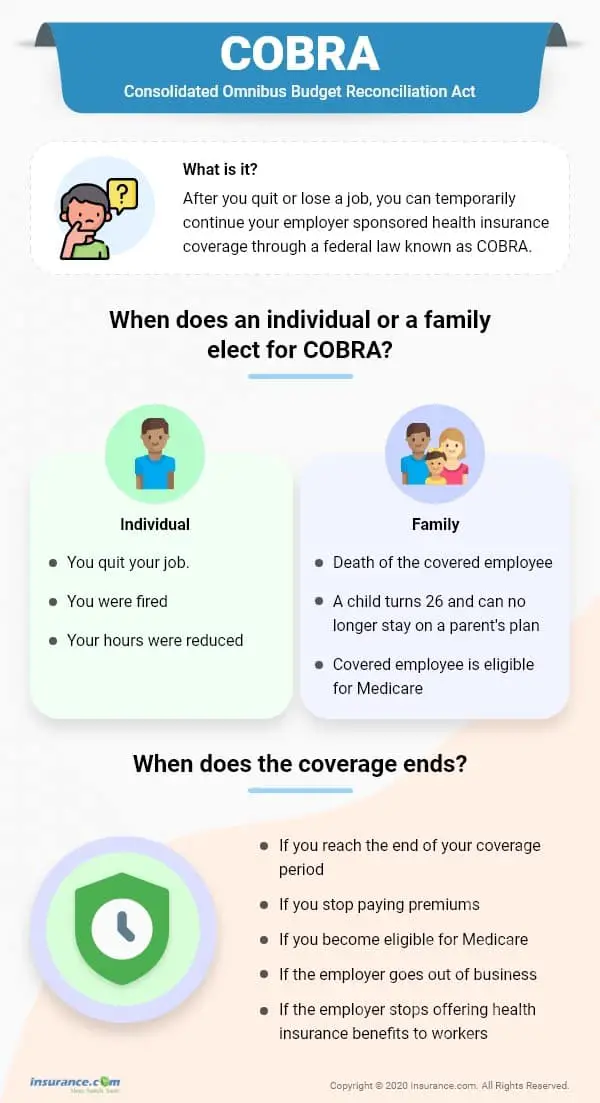

How Long Does Cobra Coverage Last

For an employee, COBRA coverage lasts for up to 18 months. A spouse or dependent child who becomes eligible for any reason other than the employee’s qualifying event can continue COBRA coverage for up to 36 months. For example, if the employee dies, the spouse can continue coverage for 36 months.

Different rules apply in some circumstances. For example, if a spouse is receiving COBRA coverage because the employee was laid off, both the employee and spouse would be entitled to receive benefits for 18 months. However, if the employee dies during this 18-month period, the spouse’s eligibility would be extended to 36 months.

Don’t Miss: How Much Is Health Insurance In Ny Per Month

What Does Cobra Cover

If you decide to enroll in COBRA insurance, the coverage you get is identical to the coverage of your previous plan. However, if there are any changes made to the employers group plan terms, those changes may also apply to your existing COBRA coverage.

Also, if you give birth or adopt a child while receiving continuation coverage, the child is automatically considered a qualified beneficiary.

Do I Qualify For Health Insurance After I Lose My Job What About My Family

Unless you work for the government or a church, and as long as you are employed by a business with 2 or more employees, you are a covered employee and eligible to continue your group health coverage. There is no requirement that you work for your employer for a certain amount of time. Your employer must also offer you a COBRA extension even if you are also covered by another policy, such as a spouses policy through his or her job.

You May Like: How To Pay For Health Insurance In Early Retirement

How Long Are Cobra Benefits

In the majority of cases, COBRA continuing coverage lasts 18 months after you become unemployed. There are some longer periods of coverage for special beneficiaries. Coverage may continue for a total of 29 months in the case of a disability. And non-employee qualified beneficiaries, such as spouses and dependents, may be eligible to continue coverage for a total of up to 36 months if there is a second qualifying event.8

COBRA is an important alternative for people who have lost employer-sponsored insurance, especially those beneficiaries with an ongoing health issue or those who want to keep their current healthcare providers. Knowing how COBRA works can help you evaluate your options.

How Long Can I Use Cobra

You can typically have COBRA coverage for 18 months. There are exceptions, though.

Your dependents may be able to keep COBRA coverage for 36 months if they became eligible for COBRA because you got a Medicare plan, you got divorced or legally separated or you die. Dependent children can also get the extended coverage after they turn 26 and lose your heatlh insurance.

Recommended Reading: Does Health Insurance Cover Therapy

Are There Other Health Insurance Options Available If I Don’t Choose Cobra

Depending on your needs and situation, there are a number of other heath insurance options, besides COBRA, that may offer the coverage you’re looking for. You may qualify for no cost or low cost plans, Affordable Care Act plans or short term plans for temporary coverage that can fill the gap until you find a longer term solution. These options may also cost less than COBRA continuation coverage, so it may be helpful to compare the cost and coverage options before you make a decision on your coverage.

How Does Cobra Coverage Work

COBRA is a short-term health care insurance thats usually available for up to 18 months after the termination date of your job .

You can get COBRA coverage if you worked for a business that employs 20 people or more. There are exceptions to this, so please call your COBRA administrator to get more information.

With COBRA, you can continue the same health care coverage through the plan you had when you were employed. That may include medical, dental and vision plans. If you choose to sign up for COBRA health care coverage, you wont be able to choose a new plan or change the coverage you had under that plan until the next open enrollment, if your employer offers an open enrollment to active participants. You will be asked to choose and pay for the same health care coverage you had with the plan you were under when you were employed. For example, if you had a medical plan and a dental plan, you can keep one or both of them. But you wouldnt be able to add a vision plan or change certain benefits within your medical plan if it wasnt part of your plan before COBRA.

Don’t Miss: How To Cancel Health Insurance Healthcare Gov

How Does My Health Plan Know To Offer Me Cobra

If youre eligible for COBRA health insurance, you wont get a COBRA election notice from your health plan if the health plan doesnt know about your life-changing event. Someone has to tell the health plan administrator. This is known as âgiving qualifying event notice.

The employer will tell your health plan if your loss of coverage is due to the termination of the employee, death of the employee, employee Medicare eligibility, or reduction of employee work hours. Its your responsibility to tell your health plan if your loss of coverage is due to divorce, legal separation, or a young-adult losing dependent status under plan rules.

In some cases, you may be tempted to withhold notice. If the employer and health plan dont know youre legally separated, you might think you wont have to pay the COBRA health insurance premiums. Youd just continue on with spousal coverage as though youre a married couple. Think again.

Youre required to give qualifying event notice in a timely manner. Not giving qualifying event notice is a type of fraud youre basically stealing health insurance coverage for which youre no longer eligible. The employer may demand reimbursement for its share of the monthly premiums paid for the coverage you were no longer eligible to receive. The health plan may demand reimbursement for the health care it paid for while you were receiving coverage fraudulently.

Also Check: Is It Legal To Marry For Health Insurance

How Long Does Health Insurance Last After Termination

According to the U.S. Bureau of Labor Statistics, tens of millions of employees get fired or leave their jobs voluntarily every single month. In other words, if you find yourself currently in between jobs, youre certainly not alone! While you look for new employment, understanding how to prevent gaps in healthcare coverage will help you maintain regular checkups, continue monitoring your health, and prevent unexpected worst-case-scenario emergencies from turning into long-term health and financial problems.

This page will cover the key things you need to understand regarding your employer-sponsored health insurance if you recently got fired from or quit your job, including the COBRA Act, differences between federal law and state law, stipulations for spouses and dependents, and more.

This article will discuss:

Also Check: Do I Have To Offer Health Insurance To All Employees

You May Like: Do I Have To Get Health Insurance Through My Employer

Am I A Qualified Beneficiary

To be considered a qualified beneficiary, you must be insured by the health plan the day before the qualifying event happens. In addition, you must be one of the following:

- An employee of the employer sponsoring the health plan.

- A spouse or ex-spouse of that employee.

- A dependent of that employee.

- An agent, director, or independent contractor that isnt technically an employee, but that participates in the health plan.

- In some cases, you may be eligible if youre a retired employee, retirees spouse, or retirees dependent child and youre losing coverage because your former employer is going bankrupt.

Am I Eligible For Cobra Health Insurance

Shereen Lehman, MS, is a healthcare journalist and fact checker. She has co-authored two books for the popular Dummies Series .

If you anticipate a change in your life, planning for health insurance after that change is an important part of maintaining your financial security and your health. A popular way to get health insurance after a major life event is to continue your employer-sponsored health insurance using COBRA continuation coverage.

If you get a divorce, become a widow or widower, or lose your job, losing your health insurance can add even more stress when your coping mechanisms are already maxed-out. If youre scrambling to find a new job, move, learn how to live without a partner, or all of those things at once, choosing a new health plan in the individual market can be overwhelming .

With COBRA continuation coverage, you dont have to pick a new plan. You simply continue the same employer-sponsored coverage you currently have. No starting over with a new deductible and out-of-pocket maximum mid-way through the year. No finding a new doctor because your current doctor isnt in-network with your new health plan. No transferring medical records or prescriptions. You can continue your current health insurance for up to 18 or 36 months , which should hopefully be time enough to get back on your feet and obtain new coverage.

To be eligible for COBRA, you must satisfy all three of the following requirements:

You May Like: How To Make Health Insurance Affordable

My Job Situation Has Changed Can I Get Health Insurance Through Cobra

If you lost your coverage through your work, COBRA is one of the coverage options you may consider. There are additional options, such as short term health insurance or Affordable Care Act plans that you may also consider. Learn more about coverage options to consider.

You may qualify for COBRA coverage if your job or life situation has changed. Here are some of the ways you may qualify:

- You lost your job, either voluntarily or by the decision of your company and you have lost your health coverage

- You had the number of hours per week you work reduced so you no longer get benefits and you have lost your health coverage

- You experience a qualifying event, such as the death of the covered employee, a divorce or legal separation from the covered employee or another event that may entitle you to COBRA coverage.

Why Are Cobra Insurance Premiums So High

COBRA insurance premiums are high because when you leave a job, you’re no longer part of an employer-sponsored health plan, which means you have to pay the full cost for the coverage. Usually, employers pay a significant portion of an employee’s healthcare premiums.

But even though COBRA premiums may be high, it’s still a good option for people who recently lost their jobs. That’s because COBRA allows you to keep your health insurance coverage for at least 18 months, which can be a big help if you have a pre-existing condition or need to see a specialist.

Read Also: What Does Coinsurance Mean In Health Insurance

How To Sign Up For Cobra

Your employer or health insurance administrator must let you know that you have a right to enroll in COBRA. You then have at least 60 days to decide if you want to sign up. You must tell the plan sponsor if you think you qualify because of divorce, legal separation, or the loss of dependent or child status. You can elect to take COBRA even if the primary employee elects not to do so.

You must pay your first COBRA premium within 45 days of accepting your plan. Contact the administrator or your company’s human resources department for help if you’re not clear about the process or if you didn’t receive a letter of eligibility.

Managing A High Cobra Premium

If you’re considering COBRA coverage but you’re concerned about the differences between the cost of insurance coverage through this program and the cost of insurance with the support of an employer, there are a number of important considerations to keep in mind.

When you lose your job, you generally lose your flexible spending account . If a job loss is threatened, you are allowed to spend your entire year’s contribution to the FSA before you become unemployed. If you were going to contribute $1,200 for the year but it’s only January, for example, and you’ve only had $100 withheld from your paycheck for your FSA, you can still spend all of the $1,200 that you were planning to contributesay, by seeing all of your doctors and filling all of your prescriptions immediately.

Upon choosing COBRA, you can change your plan during the employer’s annual open enrollment period and opt for a less expensive plan like a preferred provider organization , or health maintenance organization .

If available, a refundable tax credit called the Health Coverage Tax Credit can be utilized by qualifying individuals to pay up to 72.5% of qualified health insurance premiums, including COBRA continuation coverage. The HCTC program was due to expire on Dec. 31, 2020, but the Internal Revenue Service has extended the program through Dec. 31, 2021.

You can use your health savings account to pay COBRA premiums as well as medical expenses, which could significantly reduce the sting of losing benefits.

Read Also: Can You Deduct Health Insurance Premiums

Your Group Health Plan Qualifies Under Cobra

Whether you work for a big law firm in New York or a small public school in Nebraska, most employers who offer health care benefits are required to offer COBRA insurance to employees after they leave.

There are some exceptions, though. Employers with less than 20 employees dont necessarily have to offer COBRAthe rule for small firms varies by state through what are known as mini-COBRA plans.3 And if your employer is going out of business or ends its health insurance for everyone in the company, then continuation coverage cant be offered.

What Is Cobra And How Does It Work

“COBRA” stands for the Consolidated Omnibus Budget Reconciliation Act. The Act is a federal law that has required private insurers for employer-sponsored group health plans to keep job-based health coverage in place after qualifying events since 1986.

These events include being laid off or terminated, except for “gross misconduct,” and losing coverage due to a divorce or as a dependent after the death of the primary beneficiary. They also include having your work hours cut.

You May Like: Are Parents Required To Provide Health Insurance Until Age 26