Medicare Improvement Provisions Of The Affordable Care Act

The law includes numerous provisions designed to reduce Medicare spending, drive down costs, and improve coverage for Medicare beneficiaries. Among them:

Cost savings through Medicare Advantage

The ACA is gradually cutting Medicare costs by restructuring payments to Medicare Advantage, based on the fact that the government was spending more money per enrollee for Medicare Advantage than for Original Medicare.

Focus on prescription drugs

Medicares prescription drug donut hole issue was addressed by the ACA, which began phasing in coverage adjustments to ensure that enrollees would pay only 25% of donut hole expenses by 2020, compared to 100% in 2010 and before.

The donut hole closed a year earlier than expected for brand-name drugs, with enrollees out-of-pocket costs in 2019 capped at 25% of the cost of the drugs . By 2020, enrollees out-of-pocket costs were capped at 25% of the cost of both brand name and generic drugs while in the donut hole, and it will remain at that level going forward.

Free preventive services

Our 2022 Open Enrollment Guide: Everything you need to know to enroll in an affordable individual-market health plan.

Since 2011, Medicare beneficiaries have had access to free preventive care, with free Welcome to Medicare visits, annual wellness visits, personalized prevention plans, and some screenings, including mammograms all thanks to the ACA.

New funding for Medicare

Expanding access to care in underserved areas

Cost containment

How Much Is Health Insurance Per Month For One Person

Monthly premiums for Affordable Care Act Marketplace plans vary by state and can be reduced by subsidies. The average national monthly health insurance cost for one person on an Affordable Care Act plan without subsidies in 2022 is $438.1

Wondering how insurance premiums are decided? The Affordable Care Act ensures that insurance companies cannot discriminate based on gender, current health status, or medical history. Here are factors that determine health insurance premiums.

How Much Is Obamacare If You Have A Bad Health Year

Based on the figures discussed above, if you are not utilizing government subsidies and you use enough medical care in a single year to pay out your full annual deductible, your total costs in the course of a year can be quite high. For example:

- The average individual in 2016 may pay $3,852 in a year for monthly premiums and an additional $4,358 for his or her deductible, for a combined total of $8,210.

- The average family may pay $9,996 over a single year for monthly health insurance premiums under Obamacare and an additional $7,983 in deductibles, for a combined total of $17,979.

Notes:

* Unless otherwise noted, all dollar figures mentioned in this article are taken from eHealth, Inc.s 2014, 2015, and 2016 Individual and Family Health Insurance Index Reports, which can be found here. These report are based on the health insurance plans selected by eHealth shoppers not utilizing subsidies during Obamacare nationwide open enrollment periods.

Don’t Miss: How Much Is Health Insurance In Nc

Employee Health Insurance Premiums

If you work for a large company, health insurance might cost as much as a new car, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. Kaiser found that average annual premiums for family coverage were $21,342 in 2020, which was nearly identical to the base manufacturer’s suggested retail price of a 2022 Honda Civic$22,715.

Workers contributed an average of $5,588 toward the annual cost, which means employers picked up 73% of the premium bill. For a single worker in 2020, the average premium was $7,470. Of that, workers paid $1,243, or 17%.

Kaiser included health maintenance organizations , PPOs, point-of-service plans , and high-deductible health plans with savings options in arriving at the average premium figures. It found that PPOs were the most common plan type, insuring 47% of covered employees. HDHP/SOs covered 31% of insured workers.

| Average Employee Premiums in 2020 |

|---|

| Employee Share |

| $104 |

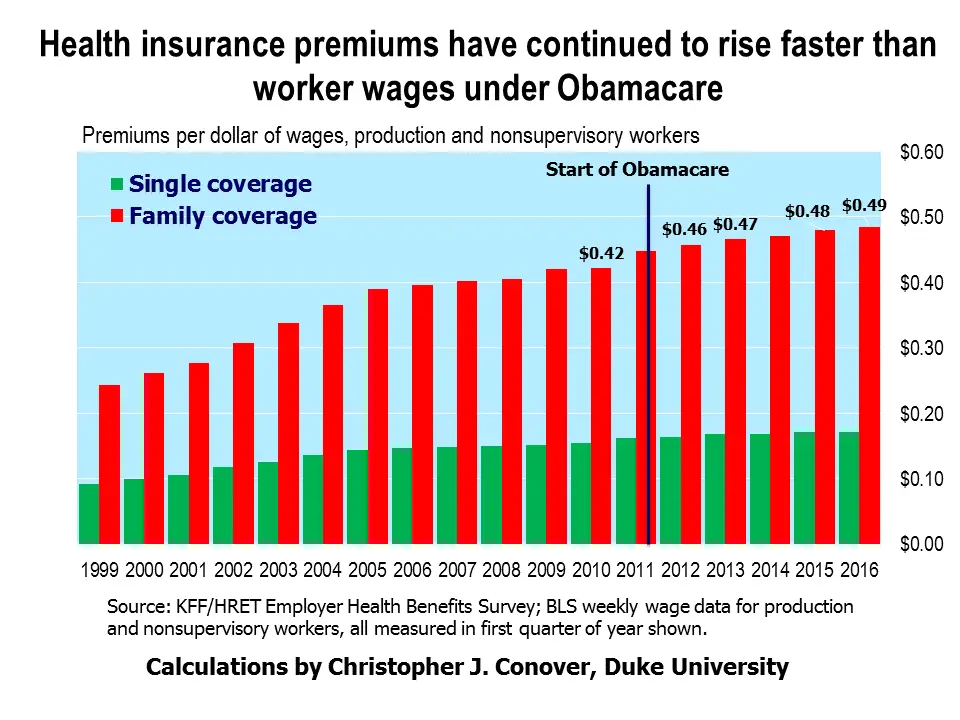

Of course, whatever employers spend on their workers’ health insurance leaves less money for wages and salaries. So workers are actually shouldering more of their premiums than these numbers show. In fact, one reason wages may not have risen much over the past two decades is because health costs have risen so much.

Which type of plan employees choose affects their premiums, deductibles, choice of healthcare providers and hospitals, and whether they can have a health savings account , among many choices.

Expanding Electronic Medical Records

The HITECH Act, enacted as part of the ARRA, encouraged the adoption of health technology in the form of EMRs. Money was offered to physician practices to meet compliance with health information technology or so-called meaningful use criteria or face penalties in Medicare reimbursement. EMRs offer the promise of aggregating records from many providers into a single, legible medical record as long as all providers seen by a patient participate in the same EMR system interoperability among systems is imperfect. The HITECH Act offers the promise of a more complete medical record that details the full history of care provided to a patient who applies for disability benefits. But it is important to note that the Social Security Administration listings are not structured to mirror how doctors use EMRs.

You May Like: Can I Add My Parents To My Health Insurance

How Do I Qualify For A Subsidy

- Whether you qualify for a premium tax credit depends on the estimated household income you put on your application.

- This healthcare.gov calculator will let you know whether you are eligible for a subsidy and how much.

- Make sure to include yourself, your spouse and anyone else you claim as a dependent on your income taxes, even those who don’t need coverage, when you estimate your subsidy.

What Does Obamacare Cost

Below we look at what ObamaCare costs individuals and families, what ObamaCare costs taxpayers, and what ObamaCare costs in terms of government spending.

FACT: The Affordable Care Act lowers costs based on income. Plans costs less than $100 a month for the majority of Americans who qualify for assistance each year.

Read Also: How Much Is Private Health Insurance In Spain

Unitedhealthcare Individual And Family Marketplace Plans

Looking for health care plans on the Marketplace? UnitedHealthcare Individual and Family Marketplace plans offer affordable, reliable coverage options for you and your family. As part of the American Rescue Plan Act , many individuals and families are now eligible for lower or in some cases $0 monthly premiums for Marketplace health coverage.

2022 open enrollment is now closed, but you may be eligible for a special enrollment period .Learn about special enrollment periods.

The Battle Over The Aca / Obamacare

From the earliest conversations about the Affordable Care Act, the law and its provisions have been vigorously opposed by Congressional Republicans.

The opposition has included numerous legal challenges over the ACAs constitutionality as well as efforts to repeal and replace the law. Consumer advocates note that this opposition worsened coverage options and drove premiums upward.

But the Biden administration has taken various steps to protect and strengthen the ACA, and the American Rescue Plan, enacted in March 2021, made the ACAs subsidies much stronger for 2021 and 2022 .

Read more about 50 benefits wed lose if the ACA were to be overturned, and 50 populations that are better off with the ACA in place.

Steve Anderson, healthinsurance.orgs editor and content manager, has been writing about health insurance and health reform since 2008. Steve is also co-founder and editor of medicareresources.org. In previous lives, he worked as a community journalist, public relations manager and director of public affairs.

Recommended Reading: Why Is Health Insurance So Expensive

I Am Enrolled In A Va Health Care Program Would I Be Eligible For Assistance To Pay Health Insurance Premiums On The Marketplace If I Choose To Purchase Health Care Outside Of Va

Since VA care meets the standard for health care coverage, you wouldnt be eligible for assistance to lower your cost of health insurance premiums if you chose to purchase additional health care coverage outside of VA. However, you may still purchase private health insurance on or off the Marketplace to complement your VA health care coverage.

Cost Sharing Limits Overview

The Affordable Care Act requires limits for consumer spending on in-network essential health benefits covered under most health plans. These are known as out-of-pocket maximum limits.

OOP maximums include deductibles, copays and coinsurance costs paid by consumers. They do not include health plan premiums or out-of-network costs.

OOP limits apply to most health plans. Specifically, they apply to all non-grandfathered individual and group plans, regardless of size or whether the plan is insured or self-funded.

Annual OOP maximum limits

The in-network OOP maximums are adjusted annually. Current amounts are:

Error loading table data.

Loading data…

Also Check: Do I Have To Offer My Employees Health Insurance

Q: How Does The Affordable Care Act Help Young Adults

Before the Affordable Care Act, many health plans and issuers could remove adult children from their parents’ coverage because of their age, whether or not they were a student or where they lived. The Affordable Care Act requires plans and issuers that offer dependent child coverage to make the coverage available until the adult child reaches the age of 26. Many parents and their children who worried about losing health coverage after they graduated from college no longer have to worry.

The Affordable Care Act Eliminated Caps On How Much Coverage People Got For These Essential Health Benefits

The Affordable Care Acts requirement that essential health benefits be covered without annual dollar caps provides patients with more health benefits and a lesser financial burden. While plans before the ACA stated that they covered many of these services, actual coverage was often unevenpatients often faced unexpected dollar limits on services that were technically covered by their plans, forcing them to pay the remainder of costs.

Additionally, this new definition of coverage enshrined in the ACA ensures that plans cover important services that are not currently covered by many plans:

- People with mental health or substance abuse disorders will have the peace of mind of knowing that their plan must cover their needs and that their coverage for these mental health services must be as comprehensive as their coverage for medical and surgical services.

- Women can rest assured knowing that they will have maternity coverage when they become pregnant.

- People with developmental and intellectual disorders will benefit from habilitative services that help them learn, keep, or improve functional skills when most plans now will only cover services to regain skills.

Americans were waiting a long time for substantial coverage of services that are essential to their health. The ACAs requirement that plans cover these essential health benefits offers a pathway to comprehensive health insurance for all Americans.

Don’t Miss: Does Health Insurance Cover Vasectomy

Average Health Insurance Premiums By Metal Tier

Health insurance plans are separated into metal tiers based on the proportion of health care costs the insurance plan is expected to cover.

The silver plan falls around the middle, with moderate deductibles, copays and coinsurance. The catastrophic and bronze plans offer the smallest amount of coverage, while platinum plans offer the greatest.

The average rates paid for health insurance plans are inversely related to the amount of coverage they provide, with platinum plans being the most expensive and catastrophic and bronze plans being the cheapest. The following table shows the average rates a 40-year-old would pay for individual health insurance based on the tier. Older consumers would see their rates increase according to the age scale set by the federal guidelines.

| Metal tier |

|---|

Policy premiums are for a 40-year-old applicant.

Obamacare Cost For The Average Family

The cost of ObamaCare for the average family differs based on several factors. Common estimates for an average family of 4 range from around $7,000 a year to $30,000 a year depending on factors such as plan choice, age, health status, access to cost assistance due to income, and region. To get a more in-depth look, please refer to our sections on the , , and our study of the recent .

NOTE: This study was done in 2014, costs have risen, but so have subsidy amounts.

Here is a case study of a family of four using the Kaiser Subsidy Calculator. The family has two adults who smoke and two children who dont smoke. They make 149% of the Federal Poverty Level . This shows a Silver plan costs $4,391 a year due to cost savings on their premium via tax credits and has 95% actuarial value due to out-of-pocket cost assistance. Remember the two types of cost assistance offered through the marketplace are help with out-of-pocket costs and help with premium costs. The family could pay less for a Bronze plan for $2,501 but have higher out-of-pocket costs, or more could pay more for a Gold plan and still receive subsidies. In their case, due to the way subsidies work, a Sliver plan probably makes sense since their out-of-pocket assistance drops significantly with a Bronze plan and doesnt increase with a Gold plan .

- Household income in 2014:

- You could receive a government tax credit subsidy of up to:

- $8,497

Read Also: Does Health Insurance Cover Baby Formula

Who Is Eligible For An Aca Subsidy

Subsidy eligibility is normally based on income , but subsidies might continue to be available in 2022 for people who receive unemployment compensation .

For income-based subsidy eligibility, a household must have an income of at least 100% of the federal poverty level . And although there is normally an income cap of 400% of the poverty level , that does not apply in 2021 or 2022. Instead, subsidy eligibility is based on the cost of the benchmark plan relative to the persons income. If its more than 8.5% of the persons income , a subsidy is generally available.

The Build Back Better Act would temporarily eliminate the lower income threshold for subsidy eligibility, which would close the coverage gap that still exists in 11 states that have refused to expand Medicaid. Low-income residents in those states would become eligible for premium subsidies in the marketplace, instead of having no access to financial assistance with their health coverage.

But in addition to income, there are other factors that determine eligibility for premium subsidies. Lets take a look at what they are:

Access to affordable employer-sponsored coverage

Access to Medicaid or CHIP

In addition, premium subsidies arent available to people who qualify for Medicaid or CHIP, since Medicaid and CHIP generally provide even more financial assistance than premium subsidies.

Age: Nothing but a number

The Medicaid coverage gap

Immigration status

What Is The Aca Health Insurance Marketplace

Established by the Affordable Care Act , the Health Insurance Marketplace is a platform that offers medical insurance plans to individuals, families, and small businesses. Fourteen states and the District of Columbia offer their own marketplaces, also known as exchanges, while the federal government manages a marketplace open to residents of other states. Marketplace plans are divided into four categories that range in cost and coverage. Though offered by private companies, all must meet certain criteria established by the state or federal government.

You May Like: How To See If I Have Health Insurance

To Calculate The Size Of Your Subsidy For 202:

1) Use this table to find out where your income falls in relation to the federal poverty level. Youll be looking at your projected 2022 income, but youll be comparing it to the 2021 federal poverty level, which is what the numbers in this table represent. As noted above, the numbers are higher in Alaska and Hawaii.

Normally, an income above 400% of the poverty level would make a household ineligible for premium subsidies. But in 2021 and 2022, premium subsidies are available above that level if theyre necessary in order to keep the cost of the benchmark plan at no more than 8.5% of the households ACA-specific MAGI.

In most states, if your income doesnt exceed 138% of the poverty level, youll be eligible for Medicaid. The other delineations are for determining the percentage of income that youd be expected to pay for the benchmark plan in the exchange, as described in the next step.

| Percent of Federal Poverty Level |

|---|

| Household Size |

| 6%-8.5% of your income | |

| 400% of FPL or higher | 8.5% of your income |

The subsidy will make up the difference between the amount an individual is expected to contribute and the actual cost of the areas second-lowest-cost Silver plan.

3) Determine out how much a benchmark Silver plan costs in the area where you live. You can scroll through the available quotes in your states exchange and see what the second-lowest-cost Silver plans premium would be for you and your family, or you can call the exchange.

Can I Still Enroll Through The Health Insurance Marketplace Even When Were Not In An Open Enrollment Period

Individuals with a qualifying life event can enroll in health coverage or change their coverage outside of the open enrollment period and have it be effective for that coverage year. This is called the Special Enrollment period. Qualifying life events include having a baby or getting married. Visit www.healthcare.gov/coverage-outside-open-enrollment to learn more about these qualifying life events and other circumstances for special enrollment.

Also Check: What Is My Health Insurance Plan

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you need to do in order to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.