How Often Can An Employer Change Providers

An employer can technically change health insurance companies at any time as long as they do not sign a long term contract. Most employers do a standard evaluation once per year to decide if they are going to keep their current plan and options. For a business, the process of finding a health insurance company and enrolling their employees is expensive and time consuming. Its not something they do if they dont have to.

Employees are actually more limited in their options. They usually are only able to join a health care plan right after being hired or during a yearly open enrollment period.

Looking for health insurance for your employees? Type your ZIP code into the search box and see FREE health insurance quotes right now!

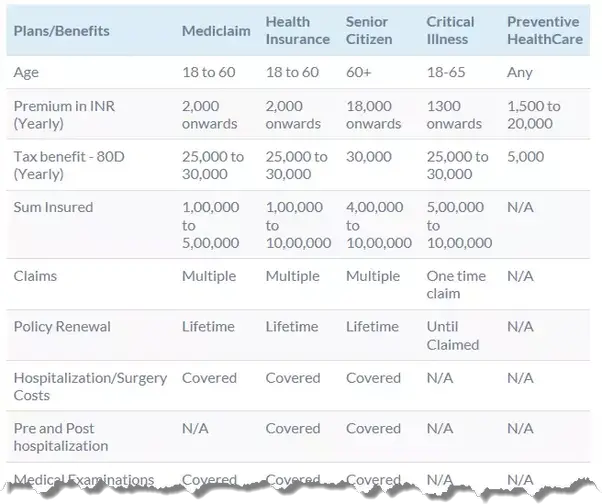

Senior Citizen Health Insurance Policies

Buying health insurance at an old age is difficult or unaffordable. I suggest you buy a health insurance policy for your parents before they get too old.

The Senior citizen policies are similar to individual health policies but come with stringent medical checkups, high premiums, a higher waiting periodfor pre-existing illnesses and a greater number of exclusion clauses.

These policies are usually bought by people who have already crossed 60 years of age but do not have any health insurance with them.

How To Compare The Best Health Insurance Companies And Plans

Even plans of the best health insurance companies can vary greatly. But the general rule of thumb is that the less you pay per month, the higher your deductible is. Higher premiums are usually associated with lower deductibles. Generally it is beneficial for those with existing health issues to opt to pay more per month and less out-of-pocket for services.

Those in good health often opt for a high deductible option in hopes that they never have to actually pay the deductible but would mostly be covered if something major happened.

A prescription plan is another important consideration when looking for the best health insurance. If you need to take medications regularly you’ll want to choose a plan with a good prescription plan. If you need to insure your entire family, you’ll want to look at family deductibles and maximums. Only full-coverage options will satisfy the minimal essential health care insurance required to get around paying the fine.

Monthly PremiumThis is your monthly payment for health insurance. It may be worth asking if you can get discounts for paying in advance or if you set up direct payments from your bank account.

DeductibleThe amount you are required to pay, not counting preventive care, before the insurance company starts paying out. Low-deductible plans offer deductibles of about $500, whereas high-deductible plans might be as much as $6600.

Don’t Miss: How Much Do You Pay For Health Insurance

How To Port A Health Insurance Policy

You don’t have to continue with your current health insurance provider if you do not want to since IRDAI now allows you to change your insurer without losing any existing or accumulated benefits.

Now IRDAI allows you to switch from one insurer to another while the new insurer will have to consider the credits you have gained from your previous insurer, where the credits refer to the completed waiting period in pre-existing conditions. The same thing applies if you switch from one plan to another within the same insurance company.

What can you do

- Switch from health insurance companies.

- Family floater/individual policy can be switched.

- Get insurance cover by your new insurer up to the sum assured as the old policy has.

- Both insurers should mutually complete the formalities as per the IRDAI timeline.

Criteria

Blue Cross Blue Shield Health Insurance

This health insurance provider is accessible in all 50 states

Reasons to Buy

The expansive nature of the Blue Cross Blue Shield network works both for and against the company. The vast amount of resources available to customers and its accessibility across all 50 states is a huge plus, and the health insurance provider goes to some lengths to make its customer-facing operations as easy to use as possible.

The fact that customers will be serviced by the local healthcare partner does mean that experiences can vary significantly depending upon which state they live in. These regional differences are definitely a factor in choosing the best health insurance for you, but in general, the fact that Blue Cross Blue Shield is accepted at such a large number of medical facilities is the winning factor. This makes it our top pick when it comes to best health insurance providers.

Don’t Miss: How To Enroll In Health Insurance

Find Cheap Health Insurance Policies In Your Area

The best health insurance company for you will depend on your health situation and budget. But it’s not always about the price tag. Some health insurers offer cheap coverage but offer less-than-stellar customer service or a limited provider network.

To help you shop for the best deal, we looked through premium costs, customer service, provider networks and the financial strength of the top health insurance companies. Here’s what we found.

Why Comparing Health Insurance Plans Is Important

It is understood that it can be difficult to choose the most suitable health insurance plan from a pool of them in the market. This is why you must compare health insurance plans using InsuranceDekhos health insurance premium calculator. The free tool not only allows you to calculate premiums for health insurance plans, but also lets you compare them in terms of premium and coverage benefits.

Comparing health insurance plans is hence recommended instead of buying the first plan you saw, as it helps you choose the most suitable one as per your requirement and make an informed decision.

Read Also: How Much Does It Cost For Health Insurance

How Hdfc Life Health Insurance Plans Help You

The Health Insurance Plans provide financial support for health related emergencies.

It helps meet various health insurance needs be it based on the life stage of a person or a specific disease.

Most people think that it will never happen to them yet so many are often proven wrong. A serious bout of ill-health often lands people in hospitals inflicting serious damage to their familys finances.

Preventing long term financial damage

A financially unprotected and ill-prepared family can suffer for years thanks to one medical emergency. This is one major reason why everyone needs to be covered by health insurance through a health insurance plan.

Medical inflation

Nobody is immune to the impact of inflation on their finances. Yet many are unaware that medical costs have risen faster than general price rise. The future is expected to be no different and that is one more reason people need to have medical insurance through health insurance plans and mediclaim policies.

Costly treatment of lifestyle diseases

Premature exit from long term investments

Max Bupa Heartbeat Family Floater Health Insurance Plan

Heartbeat family is comprehensive health insurance best-suited to a familys needs with international emergency coverage.

There are 3 variants in this plan Silver, Gold, and Platinum.

Silver variant It is a basic health insurance plan which covers inpatient care, pre and post hospitalization expenses and day care procedures. It also offers maternity benefits for 2 kids and covers the newborn baby also.

Gold variant The Gold plan covers up to Rs. 50 Lakhs and has all features of the Silver plan. You have higher room rent coverage up to the sum insured and maternity benefits covered up to Rs. 1 Lakh.

Platinum variant Offers insurance coverage up to Rs. 1 crore and all features of the Gold plan with additional features as below:

- Emergency medical evacuation & hospitalization facility.

- Covers international treatment for specified illnesses like cancer.

- Charges for OPD treatment and diagnostic services if required.

- Second medical opinion.

- Vaccination expenses for children up to the age of 12 years.

- Higher maternity benefit coverage of up to Rs. 2 Lakh.

Features

| Minimum Age for cover | Entry age for adults is 18 to 65 years. The entry age for dependent children is from 91 days to 21 years. |

| Maximum Age for Renewal |

You may also like to readBest term insurance plan in India

Read Also: How Much Does Health Insurance Cost In Ct

Hdfc Life Easy Health

This plan is an ideal top up for your existing health plan, to get lump sum coverage against critical illness and surgeries.

UIN: 101N110V02

-

Get lump sum payout if you are diagnosed with any one of the 18 critical illness and or 138 surgical procedures listed.

-

Get daily hospitalization cash benefit up to 5000.

-

Flexibility to pay premium as single pay or as regular payment.

-

Opt for triple benefits of receiving full sum assured for critical illness + surgical benefit + daily hospitalization cash benefit.

Changing lifestyles are causing diseases with expensive and prolonged treatments.

A Health insurance plan helps cushion your family finances from unexpected large medical expenses.

What Are Health Insurance Plans

A health insurance plan is a contract between the insurance company and the policyholder in which the insurer offers financial coverage for the healthcare expenses as mentioned in the policy document, for a specific period of time, as chosen by the insured. In India, there are a variety of health insurance plans that offer different features and coverage benefits.

Don’t Miss: Where Do You Go If You Have No Health Insurance

Smokers Can Not Buy A Health Insurance Plan

According to the survey, almost 49% of the applicants who consume alcohol or smoke are perplexed to buy a health insurance policy. But some health insurance companies give medical insurance coverage to them. But considering the risks, alcohol consumers and smokers will have to undergo a stringent pre-medical examination process and pay a higher premium to get health insurance coverage.

Will This Health Insurance Plan Be Affordable If Im Sick

Now imagine the opposite scenario, where you use your plan a lot: You come down with an infection and need to stay in the hospital for a few days, your partners prescription list grows, the kids break a few bones at practice on top of getting strep in the fall and more.

Its always hard to see situations like this coming, so its wise to be sure that your plan makes care affordable if you need to use it. In the end, youll want to aim for a good balance between expenses you can plan for and ones you cant .

Related questions to ask:

- How much will I have to pay before the plan starts to help ?

- Whats my share of the cost of other care, like getting an X-ray or staying in the hospital ?

- Whats the most Id have to pay for care next year ?

- Could I afford the out-of-pocket maximum if I had to pay it?

You May Like: Do You Have Health Insurance

What Is Health Insurance

Health insurance plans in India are basic indemnity-based insurance products, which are specifically designed to provide financial assistance against medical expenses incurred in case of hospitalization or critical illnesses.

- Health insurance in India is a contract between an insurance provider and a customer in which the insurer promises to pay for the medical bills if the policyholder is injured or sick in the future, resulting in hospitalisation.

- Health insurance covers medical expenses, which includes hospitalization expenses, treatment expenses, surgeries or any other medical cost.

Best For Wellness Care: Molina Healthcare

Molina Healthcare

Moodys Investors Service recently upgraded its credit ratings, and the wellness and preventive care services are excellent.

-

Limited coverage territory

Molina Healthcare serves 17 states, but only offers private health insurance to residents in California, Florida, Michigan, Mississippi, New Mexico, Ohio, South Carolina, Texas, Utah, Washington, and Wisconsin. It insures more than 4.6 million members across the United States. Coverage options, plan choices, and benefits vary by state. Many of its health plans come with low co-pays and cover essential medical care such as prenatal, emergency services, hospital care, vaccinations, lab tests/x-rays, prescription drugs, doctors visits, and vision insurance.

Molina has some excellent perks, wellness care, and preventive health care services for its health insurance members including adult immunizations, adult preventive services, child and adolescent immunizations, pediatric preventive health care, prenatal and postnatal care.

Also Check: How Do I Find My Health Insurance

Ayushman Bharat Yojana Or Pradhan Mantri Jan Arogya Yojana

Under this plan, more than 10 crore poor families can be covered in India. The maximum sum assured will be Rs.50,000 per family per annum. This scheme also provides medical insurance for pensioners. This scheme is only for those people who live in cities that are covered under the Ayushman Bharat Yojana. The holders of this policy will get cash benefits from any hospitals in India.

Certain Eligibility Criteria for Health Insurance In India

Nowadays, most of the insurance companies give coverage to individuals below the age of 45 without the need for any medical examinations or reports. Then also your previous health conditions will be taken into consideration by the health insurance companies. Youll have to submit a report of good health to check your previous health condition as the health insurance company is not compelling you to take a medical exam. If your previous health conditions are fit and fine, then this will help you to get plans for a lower premium. Those people who are above the age of 55 will be insisted on taking extra medical tests. These medical examinations can even tell whether you use alcohol or tobacco.

Mistakes that can be Avoid while Purchasing a Health Insurance Policy

You must look into the below-mentioned points before taking any health insurance.

Measures to Choose the Right Insurance Policy

- Picking the Right Coverage Amount: It is good to choose an insurance policy with high coverage as it will help you if you are prone to many diseases.

DOs:

Molina: Best Health Insurance Company For Small Budgets

Molina Healthcare is generally very well regarded thanks to its focus on helping underserved populations and lower-income customers. It also runs good wellness services that complement its healthcare offerings, with discounts on weight loss and smoking cessation programs, for example.

Molinas insurance is available to residents of 15 states, meaning that the network is slightly more limited compared to nationally-available polices. However, premium levels of customer satisfaction levels make it an attractive proposition where it is available. Molina operates a number of physical clinics and health centers in the states where it does operate.

Recommended Reading: How Can A College Student Get Health Insurance

Health Insurance Portability Works In The Following Ways:

- You can opt to switch between health insurance providers. Hence you can take a new policy with a different provider while retaining the credits earned from your existing policy.

- You can also switch health insurance policies by sticking with the same insurance provider.

- You can choose to switch from an individual policy to a family floater and vice versa.

- You can apply for a revised sum insured amount with your new insurer.

- Portability also includes enhancing the range of coverage you receive from health plans. You can enhance this range with the same insurance policy. To do so there may be medical testing and new waiting periods.

The novel coronavirus is highly contagious and lethal which has caused it to trigger a widespread global pandemic. The symptoms caused by exposure to coronavirus requires continuous and extensive treatment that can exhaust your financial reserves. It is crucial to exercise caution against COVID-19 and health insurance can be one way of protecting your finances against it. Rest assured, with the comprehensive coverage offered by Max BupaHealth insurance plans, you get full coverage against any COVID-19 related claims.

- All Max Bupa Family Health Insurance Plans

- All Max Bupa Wellness Health Insurance Plans

- All Max Bupa Top Up Health Insurance Plans

Safeguard you and your family with Health Insurance Plan.

Health insurance:

Mediclaim:

Here are the key differences between health insurance and mediclaim at a glance:

How To Choose The Best Health Insurance Plans In India

There is no one health insurance plan that fits the requirements of all. When buying health insurance online, you must look for a policy that not only suits your budget, but also offers you adequate cover.

Following are the things that you must consider when buying health insurance plans online:

1. Adequate Cover: The first thing that you must look for when buying a health insurance policy online is to check its inclusions. Ensure that the policy keeps you covered at all times by offering protection against a wide range of medical expenses. It is also recommended to take your familys health history into account and seek cover for any disease that runs in your family. For instance, diabetes, heart ailments, etc.

2. Affordability: To continue availing coverage benefits under the policy, you will be required to pay health insurance premiums on a regular basis. So, when choosing a health insurance plan for yourself and your loved ones, you must go with the one that you find affordable, so that you are able to pay the premium for a long term.

3. Flexibility: Flexibility means that you should be able to add coverage benefits as per your requirement, under a health insurance plan. There are several add-on benefits that you can choose voluntarily under your health insurance plans, by paying an extra premium at the time of policy purchase.

You May Like: How To Apply For Low Cost Health Insurance

Hdfc Ergo My: Health Suraksha Plan

You get covers like Air ambulance cover, infertility cover along with other benefits with My:health Suraksha insurance plan that is normally not covered with other insurers.

There are 3 variants of my:health Suraksha plan Silver Smart, Gold Smart and Platinum Smart Plans.

Silver Smart Plan with a basic sum insured up to Rs. 5 Lakhs covering basic hospitalization expenses, daycare procedures and domiciliary hospitalization expenses.

Gold Smart Plan with a basic sum insured up to Rs. 50 Lakhs with air ambulance cover and higher road ambulance limit.

Platinum Smart Plan with a basic sum insured up to Rs. 75 Lakhs with a cover similar to Gold Smart plan but with a higher limit.

Features

- Maternity expenses coverage normally available after a waiting period of 4 years.

- 20% co-pay in respect of claims for insured above 65 years and above.