Instructions And Help About United Health Enrollment Cancellation Period

laws dot-com legal forms guide a DD Form 577 is a Department of Defense form used for recording appointments and terminations of an officer in military or governmental functions the form is used to identify and inform the officer of the appointment or the elimination of the appointment the DD Form 577 is available on the Department of Defense documentation website or can be supplied through the chain of command the first section of the DD Form 577 is to be filled out by the appointing authority the appointing authority must state the appointing officials name and title in boxes 1 camp 2 in box 3 the appointing Authority will identify itself with the Department of Defense component or organization name the appointing official will sign and date the form in boxes 4 camp 5 in section 2 the appointing Authority will identify the individual being appointed and provide their information taken from Department of Defense records boxes 6 through 11 must contain the name and contact informatio

Dont Miss: Kroger Associate Discounts

How To Get Cobra

Group health plans must give covered employees and their families a notice explaining their COBRA rights. Plans must have rules for how COBRA coverage is offered, how beneficiaries may choose to get it and when they can stop coverage. For more COBRA information, see COBRA Continuation Coverage. The page links to information about COBRA including:

The Group Plan Networks Were Not Impacted By The Aca Law

These are the original strong networks with the most providers.

Thatâs true for HMO and PPO although the HMO list is usually about 2/3rds the size of PPO.

Both carriers offer a full suite of dental, vision, life, etc to provider a comprehensive benefits package.

Weâre happy to run the numbers for both and see how your area and employee demographics match up.

You can request aquote for both Blue Shield of California and Health Net across PPO, HMO, HSA, HRA, and ancilliary benefits.

Recommended Reading: Is Community Health Choice Good Insurance

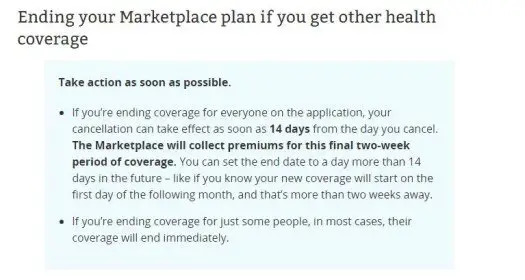

How To Cancel Your Marketplace Plan

You may need to end your Marketplace plan if you get other health coverage, or for another reason.

IMPORTANT:Don’t end your Marketplace plan until you know for sure when your new coverage starts. Once you end Marketplace coverage, you cant re-enroll until the next annual Open Enrollment Period .

-

If youre ending coverage for everyone on the application, your termination can take effect as soon as the day you cancel, or you can set the Marketplace coverage end date to a day in the future like if you know your new coverage will start on the first day of the following month.

-

If youre ending coverage for just some people on the application, in most cases their coverage will end immediately. In some cases, coverage will not end immediately, including when the household members who remain enrolled in coverage qualify for a Special Enrollment Period. The best way to make sure coverage ends on the right date is to contact the Marketplace Call Center and request the change.

When and how to end your Marketplace plan depends on your situation. Select the reason youre ending coverage below for step-by-step instructions.

Is It Possible To Cancel Your Health Insurance At Any Time Read On To Find Out

Are you thinking about whether you can cancel your health insurance at any time or not? If this question has been on your mind, then you will be happy to know that you can cancel your health insurance whenever you want to. However, it does come with some consequences.

Dropping a health care coverage strategy can be as simple as calling up your insurance agency and requesting that they drop the inclusion. In any case, dropping a health care coverage strategy without having another health care coverage strategy set up could depart you open to a fine in some states. Moreover, you will have to pay thousands of dollars for medical care in case of an emergency or if you are met with an accident.

In case youre outside of Open Enrollment, you can possibly buy medical coverage in the event that you fit the bill for a Special Enrollment Period. Its savvy to arrange your next medical coverage strategy before you drop your current approach. That way, you never have a gap in inclusion.

So to keep yourself safe from paying a hefty sum of hospital bills or even a fine for being uninsured in some states like Massachuesetts, it is significant that you have medical coverage. Obviously, the protection will likewise ensure you on the off chance that you experience a sudden mishap or sickness that lands you in the medical clinic. Should you experience a day to day existence change, nonetheless, that makes it hard to proceed with your present medical coverage strategy, you can drop it.

You May Like: Are Illegal Immigrants Eligible For Health Insurance

Id Cards & Your Unitedhealthcare Account

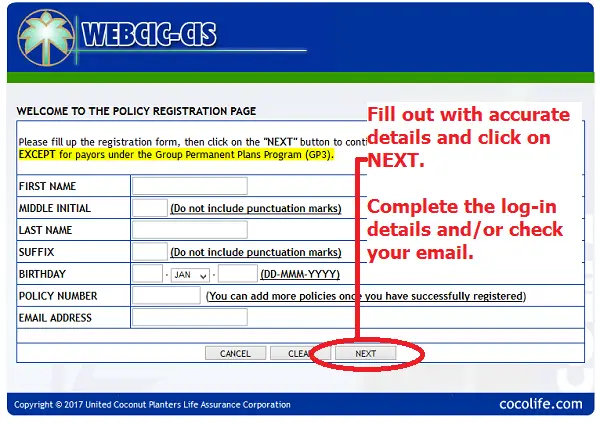

Your online UnitedHealthcare account is the resource for your insurance ID card, claim statuses, and policy information. Follow the steps below to create your account once the policy is active on August 7. If you created an account last year, you can use your existing login and do not need to create an account.

Helpful Tips When Cancelling Private Plans

- Get Carded: Youll commonly find the insurers customer care phone number for your policy, printed on your health insurance card and on your monthly premium bill.

- Watch Out for Waiting Periods: If youre covered through a new employer, remember that many workplaces require a 30- or 90-day waiting period before your coverage starts. To avoid an unexpected lapse in coverage, double check with your HR department to confirm exactly when your coverage begins.

- Write Down Confirmation Numbers: When you speak with an insurance representative, record the date in your notes, plus the representatives full name, the callback number, and your cancellation confirmation number. With that information at hand, it will be much easier to resolve any future issues that may arise.

You May Like: How To Find Health Insurance

How To Cancel Your Healthcaregov Marketplace Plan

How to Cancel Your Marketplace Subscription 1 If you are terminating coverage for everyone on the application, your termination can take effect as soon as the day you. If you are terminating coverage for only certain persons on the application, their coverage will usually terminate immediately. More to come…

How To Switch From Obamacare To Medicare

- Happy 65th Birthday: If you have a Marketplace plan, you can keep it until you decide to get Medicare. Most people enroll as soon as they are eligible through the Initial Enrollment Period, which begins three months before their 65th birthday and ends three months after their 65th birthday.

- If you like, you can keep your Marketplace plan, too. But once your Medicare Part A coverage starts, youll no longer be eligible for premium tax credits or other cost savings you may be getting. So youd have to pay full price for the Marketplace plan.

- There is another option after turning 65. You could continue getting your health insurance at work until you retire or lose your job.

Recommended Reading: How Can A College Student Get Health Insurance

The American Rescue Plan Act And Advanced Premium Tax Credit

For 2021 and 2022, the American Rescue Plan Act of 2021 changed how the advance premium tax credit is applied. The law increases premium tax credits for all income brackets for these years.

Here’s how it works. Previously, households with incomes that are more than 400% of the federal poverty level were not eligible for such tax credits. The new law allows families making more than 400% of the poverty level to claim premium tax credits.

There is still a limit to the program, but it works differently. Now, no family will pay more than 8.5% of their household income towards the cost of the benchmark plan or a less expensive plan. This means that many consumers will be eligible for higher tax credit amounts to help cover their Marketplace health plan premiums.

In practice, people across all household income levels will see lower premiums as a result of receiving more tax credits to reduce plan prices. Many low-income families and individuals will now have $0 premium plans to choose from.

This extension was automatically applied to all plans available through HealthCare.gov starting on April 1, 2021. This means that new consumers and current enrollees who submit an application and select a plan on or after April 1 will receive the increased premium tax credits for 2021 Marketplace coverage.

Before Purchasing A New Policy Check Your Current Coverage

Dont cancel your old policy until you have secured a new policy and reviewed the coverage. At the same time, make sure the coverage periods dont overlap as you cant legally submit claims to two different major medical policies.

If your employer reimburses you for your insurance premium or other eligible out-of-pocket medical expenses through a health reimbursement arrangement , double check your HRAs allowance, as this amount may affect how much you want to pay for your policy.

Also, check what type of HRA your company is providing. A group coverage HRA can be paired with group health insurance plans to help pay for deductibles, copays, and other out of pocket expenses, but it cant be used to reimburse premiums.

Don’t Miss: How To Get Health Insurance As A Real Estate Agent

What Are The Rates Of The Policies Offered

The amount youll pay for your Anthem BlueCross BlueShield insurance will depend on the coverage you want, as well as the deductible you choose. For example, one plan for a 27 year old non-smoker costs around $54 per month, although it has a high deductible. Another plan for the same person costs $102 per month and provides improved coverage with a more reasonable $2,500 deductible.

Youll need to carefully weigh your options in terms of how much you can reasonably afford to spend on premiums versus deductible and how much coverage that affords you. Should you have any questions, you can speak with agents via the sites Live Chat option to get answers to more complex questions.

Getting Started In The Marketplace

To get started, visit HealthCare.gov or your state’s version of it. Either way, you’ll get a quick side-by-side comparison of the plans available to you.

The database allows you to choose from four tiers of health insurance: Bronze, Silver, Gold, and Platinum. Bronze plans are the least expensive when it comes to your monthly health insurance bill. However, they have the highest deductibles, copayments, and coinsurance. Platinum plans have the most expensive monthly payments, but the lowest extra costs.

Choosing between these plans can be complicated, so make sure you take your time and read as much as you can about the benefits of the different plans before you make your decision.

During the enrollment process, you’ll learn whether you’re eligible for the advance premium tax credit or a cost-sharing reduction. If you are eligible, you’ll find out how much you can save. If you do qualify for savings, you must buy your plan through the Marketplace.

Recommended Reading: Is Life Insurance Health Insurance

Is Short Term Insurance For Me

Short term insurance may be for you if youâre:

- Unable to apply for Affordable Care Act , also called Obamacare, coverage because you missed Open Enrollment and you donât qualify for Special Enrollment

- Waiting for your ACA coverage to start

- Looking for coverage to bridge you to Medicare

- Turning 26 and coming off your parentâs insurance

- Between jobs or waiting for benefits to begin at your new job

- Healthyand under 65

For these situations and many others, Short term health insurance, also called temporary health insurance or term health insurance, might be right for you. It can fill that gap in coverage until you can choose a longer term solution.

How To Enroll And Get Answers To Your Questions

You can learn more about and apply for ACA health care coverage in several ways.

-

Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or you’ll be directed to your state’s health insurance marketplace website. vary by state.

-

Find a local center to apply or ask questions in person.

-

Download an application form to apply by mail

Find the answers to common ACA questions about submitting documents, getting and changing coverage, your total costs for health care, tax options, and more.

Read Also: What Is The Self Employed Health Insurance Deduction

Can You Cancel Your Health Insurance

The complicated answer to this question is yes, but there may be some restrictions. This varies from plan to plan. There are different policies that govern how a cancellation may work, depending on the coverage that you have. You may have an employer-sponsored plan, a government plan like Medicaid, a private plan, or a plan purchased through the ACA marketplaces. Each has their own policies to navigate.

Small Business Health Options Program Marketplace

The Small Business Health Options Program Marketplace – also known simply as SHOP – helps small businesses provide health coverage to their employees. While the SHOP Marketplace was previously only open to employers with 50 or fewer full-time equivalent employees, starting in 2016, some states may make the SHOP Marketplace available to businesses with up to 100 employees. If you have more than 50 employees and don’t know if you can use the SHOP Marketplace, contact your state Department of Insurance or the SHOP Call Center.

The SHOP Marketplace – which is also open to non-profit organizations – allows you to offer health and dental coverage that meets the needs of your business and your employees. SHOP offers flexibility, choice, and online application and account management. You can enroll in SHOP any time of year. Theres no restricted enrollment period when you can start offering a SHOP plan.

Businesses that offer health coverage through the SHOP Marketplace may be eligible for the small business health care tax credit.

You May Like: How Much Does Health Insurance Cost On Your Own

Before You Cancel Keep These Things In Mind

Now that you know how to cancel your Marketplace plan, just friendly reminders of some important things to keep in mind before you do.

- You wont be eligible for premium tax credits or other Marketplace plan savings once your Medicare Part A coverage starts. Youll have to start paying full-price for your Marketplace plan. Keep your Marketplace health plan coverage in effect until the day your Medicare coverage begins or you could risk having a gap in health coverage.

- You can cancel your plan at any time throughout the year, but you need to cancel your Marketplace health plan at least 14 days before you want your coverage to end. Enrolling in Medicare doesnt cancel your Marketplace plan, nor does cancelling through your plan provider. You need to cancel with the Marketplace center.

Can I Cancel My Health Insurance Without Penalty

Yes, usually you can cancel your health insurance without a penalty. However, if you reside in a state that has its own coverage mandate, you may face a tax penalty.1 Your cancellation may take effect beginning the day you cancel, or you may set a date in the future, such as when your new coverage will start.

Also Check: What Is A Premium Tax Credit For Health Insurance

Tips On How To Complete The Uhc Termination Form On The Web:

By making use of signNows complete service, youre able to perform any essential edits to UHC termination form, make your personalized digital signature within a few fast actions, and streamline your workflow without the need of leaving your browser.

Create this form in 5 minutes or less

Ending Your Marketplace Coverage Without Replacing It

You can end a Marketplace plan without replacing it any time. But there are important things to think about before you do.

Recommended Reading: What Can I Expect To Pay For Health Insurance

Reporting The Death Of An Enrollee

Its important to report the death of an enrollee to the Marketplace as soon as possible. This allows coverage of the deceased to be terminated and the premium tax credits and other savings for remaining plan members to be adjusted.

To get started, choose your situation and follow the instructions below: