Average Health Insurance Cost For A Single Male

What is the average cost of health insurance for men? There are a few factors that affect the price of your health plan. These may include your age and plan type and whether your job pays for part of your coverage.

Learn more about the costs of insurance and how you can get the best deal.

Chart: Average Cost Of Term Life Insurance By Age

The average cost of life insurance for a healthy, 30 year old is around $21 a month for a woman and $25 for a man for a $500,000 20-year term policy. If youre a smoker or suffer from major health conditions, expect to pay significantly higher premiums.

| Age |

|---|

| $1,661 |

-

How we got these rates

To find these rates, we averaged the premiums quoted by 14 life insurance companies for men and women in great health who dont smoke.

We sourced these rates from Policygenius in 2020, which means theyre subject to change. Not all life insurers offer policies for all ages, so the rates for some age groups may be averaged from fewer companies.

What Factors Affect Life Insurance Rates

Life insurers assess how risky you are to insure and assign you a life insurance classification. While you cant control some risk factors, you can take other steps to lower your rate like quitting smoking. Your insurer will look at:

Your policy

- Type of policy. Since term life insurance provides protection for a limited time, it costs six to 10 times less than permanent policies like whole life, based on our analysis of life insurance rates.

- Amount of coverage. This refers to the face value of your policy. A $1 million policy will be more expensive than a $250,000 or $500,000 policy.

- Term length. If you choose term life, youll pay a higher premium for a longer term like 30 years.

- Riders. Most insurers charge a fee to add riders to your policy, such as a waiver of premium or accelerated death benefit.

Your health and demographics

Your lifestyle

- Occupation. If your work puts you in dangerous situations miners, firefighters, exterminators or roof contractors you may pay more than someone with an office job.

- Activities. Underwriters assess your driving record, alcohol and drug use and your hobbies, awarding the safest applicants with the lowest premiums.

Also Check: How Long Insurance After Quitting

How To Find Better More Affordable Health Insurance

When it comes to drastically lowering your health insurance premium or deductible costs, experts say there arent many simple answers. However, among factors to consider are quitting any tobacco use and opting into a Health Savings Plan .

Handel says that an HSA is a type of savings account that allows a person to set aside money pre-tax, specifically to be used on health care costs now or down the road.

HSAs are useful, especially if you are higher income, Handel says. HSAs make the most sense for people in a higher income bracket because their marginal tax rate is higher, he adds. People in a lower income bracket, meanwhile, will not be saving as much because their tax rate is lower.

Some examples of how an HSA can be used include for doctor visit copays, dental expenses, vision expenses and for prescriptions. An individual can decide how much they want to contribute monthly or yearly to their HSA, which comes out of their paychecks, but the IRS caps the amount of how much someone can contribute to their HSA.

There are multitudes of variables that affect how much health insurance costs. And, while its not an easy expense to weigh or pay, the benefits of health insurance can outweigh the cost when it comes to routine care and medical emergencies.

How Much Is Health Insurance By State

Wondering how much private health insurance costs? The answer is that monthly premiums can vary significantly depending on where you live.

Variation in rates stems from factors like how much competition there is in a given state, forcing insurers to offer attractive rates. Expenses may also vary because of the expected health costs of a population. For example, in states where people tend to be less healthy or where doctors and hospitals charge more, insurance companies set higher rates to cover those costs.

Average Health Insurance Premiums by State for 40-Year-Olds

Scroll for more

- $7,646

Average health insurance rates are only part of the story. Your actual plan may cost you much more or less than the typical person pays.

Thanks to federal subsidies, many people find their premiums are much more affordable. More than 50% of people can find a Silver plan for less than $10 per month with federal cost-sharing adjustments.

Another way to save money on premiums is to opt for higher-deductible plans. You may pay less each month, but you are on the hook for more of the bill if you use health care services until you reach your deductible. If you dont use many services, this kind of trade-off may save you money in the long run.

You May Like: How To Keep Health Insurance Between Jobs

What If I Want Dental Coverage

If you have medical insurance that doesnât cover dental service, you can purchase standalone dental insurance. Typically, dental insurance premiums can range from $25-$50 per month. Dental insurance is important if you think you might need dental procedures in the future. Cleanings, crowns, bridges, and implants are usually covered and can be quite expensive without insurance.

Stand-alone PPO dental insurance plans usually use a 100/80/50 coinsurance structure. This means:

- 100% coverage for preventive care including cleanings, exams, and X-rays

- 80% coverage for basic procedures, such as fillings

- 50% coverage for major procedures, such as crowns and dentures

Administrative Factors And Health Insurance Cost

Estimates suggest 15 to 30% of healthcare spending in the USA is for administrative services, such as billing costs a large part of the difference between healthcare costs in the USA in Canada can be explained by administration spending. These might be higher due to the complex structure of healthcare in the USA, where federal, state and local governments, employers, insurers and citizens all have a share to pay.

Read Also: Part Time Starbucks Benefits

Average Cost Of Health Insurance For A Single Male

The average cost of health insurance for men in 2020 was $438 per month without a subsidy, per eHealth data. Note that this research focuses on those who buy insurance through the marketplace.

The premium you pay for health insurance will also depend on the type of plan you select. Consider options like HMO vs. PPO when you make your choice.

How Do I Find Affordable Health Insurance

Group plans are generally cheaper than individual plans. So if you are eligible for onethrough your employer, your union, or some other associationthat’s your best bet, in terms of coverage for the money. If that’s not an option, the public health marketplaces established by the Affordable Care Act offer affordable health insurance for individuals. In most of the U.S., you can sign up for a plan offered through the federal government via the HealthCare.gov site. However, 12 states run their own marketplaces, and residents sign up via their sites.

Don’t Miss: Kroger Associate Discounts

Average Health Insurance Premiums By Metal Tier

Health insurance plans are separated into metal tiers based on the proportion of health care costs the insurance plan is expected to cover.

The silver plan falls around the middle, with moderate deductibles, copays and coinsurance. The catastrophic and bronze plans offer the smallest amount of coverage, while platinum plans offer the greatest.

The average rates paid for health insurance plans are inversely related to the amount of coverage they provide, with platinum plans being the most expensive and catastrophic and bronze plans being the cheapest. The following table shows the average rates a 40-year-old would pay for individual health insurance based on the tier. Older consumers would see their rates increase according to the age scale set by the federal guidelines.

| Metal tier |

|---|

Policy premiums are for a 40-year-old applicant.

How Are Premiums Calculated

Premiums go up for everyone when healthcare costs more, and premiums rise for you specifically when you are riskier to insure.

There are limits to how widely companies can charge different people for the same plan, and as to how much profit insurers can make from a plan.

Premiums are generally based on your:

- Age

- All children aged 14 or younger add the same amount to ACA premiums. Monthly costs increase from age 15 onward.

Individual states can limit how much premium prices depend on this information , and how much your premium will change each year. Some states only allow price differences based on ZIP code, or require premiums to be based largely on age.

Premiums are unique to every person, and can seem almost random. Health insurers dont disclose their exact methods, but we know what tools they are allowed to use.

This is why websites like HealthCare.com must collect a certain amount of information to show you an accurate list of prices.

Some premiums may also be based on your:

- Health history

- Gender

Short-term plans and supplemental Medicare coverage may consider this information when setting monthly premium rates. Affordable Care Act plans cannot change your monthly premiums based on these items.

Don’t Miss: Insurance Lapse Between Jobs

The American Treatment Cost Gap And Health Insurance Cost

The raw cost of treatment is higher in the USA than in many countries, so this influences the cost of insurance. There are several reasons for this cost gap:

- Pharmaceutical drugs, for instance, cost nearly four times more in the USA than other similar countries.

- American doctors and nurses enjoy some of the worlds best pay the average registered nurse in California earns $113,240 so this also drives up cost.

- The American system also tends to favour more frequent interventions and complicated procedures, which comes with a price tag.

Due to the sizeable treatment cost differences, many international insurers including William Russell do not cover treatments that take place on American soil as part of our standard policies.

However, if youre an American citizen working overseas, then its good to know some of our international health insurance policies provide short-term cover for visits of up to 45 or 90 days. Find out more about our USA-45 and USA-90 international health policies.

How Much Is Healthcare Per Month For One Person In California

Theres another thing you should consider: how much is healthinsurance a month for a single person? When you factor in your premium and deductible, youll quickly come to the realization that individual healthinsurance premiums are expensive. If youve never had a health issue before, you may not be thinking about your health carecost as much as you should. Ask yourself what your health care costs would be if you didnt have healthinsurance. Then, you can decide whether or not youre comfortable with the high premiums.

If youve been thinking about individual coverage, this may be a good time to start shopping around. You may be surprised at the variety of plans and premiums in the individual market. Look into the different plans from different providers and consider how much youd be paying if you purchased the policy online. Read through the policy descriptions and make sure theres something in the plan that seems appealing to you. Remember, you dont have to buy the policy if you dont feel comfortable with it theres always another choice.

Recommended Reading: What Benefits Does Starbucks Offer Employees

Individual Versus Family Plans

An individual plan has one member, or just one person covered by the plan. Family plans cover two or more members.

Your planâs deductible and out-of-pocket maximum are based on whether you have an individual or family plan.

The deductible and out-of-pocket maximum for a family plan is usually double of an individual plan. So if the deductible for a plan is $2,000 for a family, itâs $1,000 for an individual. If the out-of-pocket maximum for an individual plan is $6,000, it will be $12,000 for a family, no matter how many people the plan covers.

You May Like: Starbucks Health Insurance Benefits

The States That Drink The Most Beer

After age 50, premiums rise tremendously. At age 53 the average premium is more than double the base rate, and by 55 the average premium is $446. At age 60, the average premium is $543. If a person is 64 years old, the average health insurance premium is $600 – 3 full times what it is at 21.

It is also important to note that while this is a general guideline, prices vary dramatically from state to state. Some states, like New York, don’t factor age into premiums at all.

You May Like: Is Umr Good Insurance

Determining How Much You Should Spend On Health Insurance

The amount you should spend on health insurance depends on a few different characteristics of health insurance plans: the deductible, premium, and cost-sharing mechanisms. Generally, plans with higher monthly premiums have lower deductibles and less cost-sharing. There are four tiers of health insurance plans available on the Marketplace:

What Are Health Care Memberships

Health care memberships can serve as an alternative to health insurance completely or as supplemental benefits. Membership plans like Mira are flexible, affordable, and cost transparent. Mira covers preventative, urgent care, lab tests, prescriptions, and gym discounts at thousands of clinics and 1600 labs in 35+ states. Now you can stay healthy without breaking the bank.

Read Also: 8448679890

How Much Does Individual Health Insurance Cost

BY Anna Porretta Updated on January 21, 2022

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans. Understanding the relationship between health coverage and cost can help you choose the right health insurance for you.

To see personalized quotes for coverage options available in your area, browse health insurance by state. If you already know which health insurance carrier youd like to purchase from, check out our list of health insurance companies.

Do Health Insurance Policies Change Depending On The Province

Yes. Each of Canadas ten provinces and three territories offers its own public insurance plan. Some are significantly different. All offer basic health care services. Beyond this basic care, some are more generous than others. As a result, private health insurance policies are also different between provinces and territories.

| Province/Territory |

|---|

Try our free health insurance comparison tool to get personalized quotes in just seconds.

Don’t Miss: Does Uber Have Health Insurance

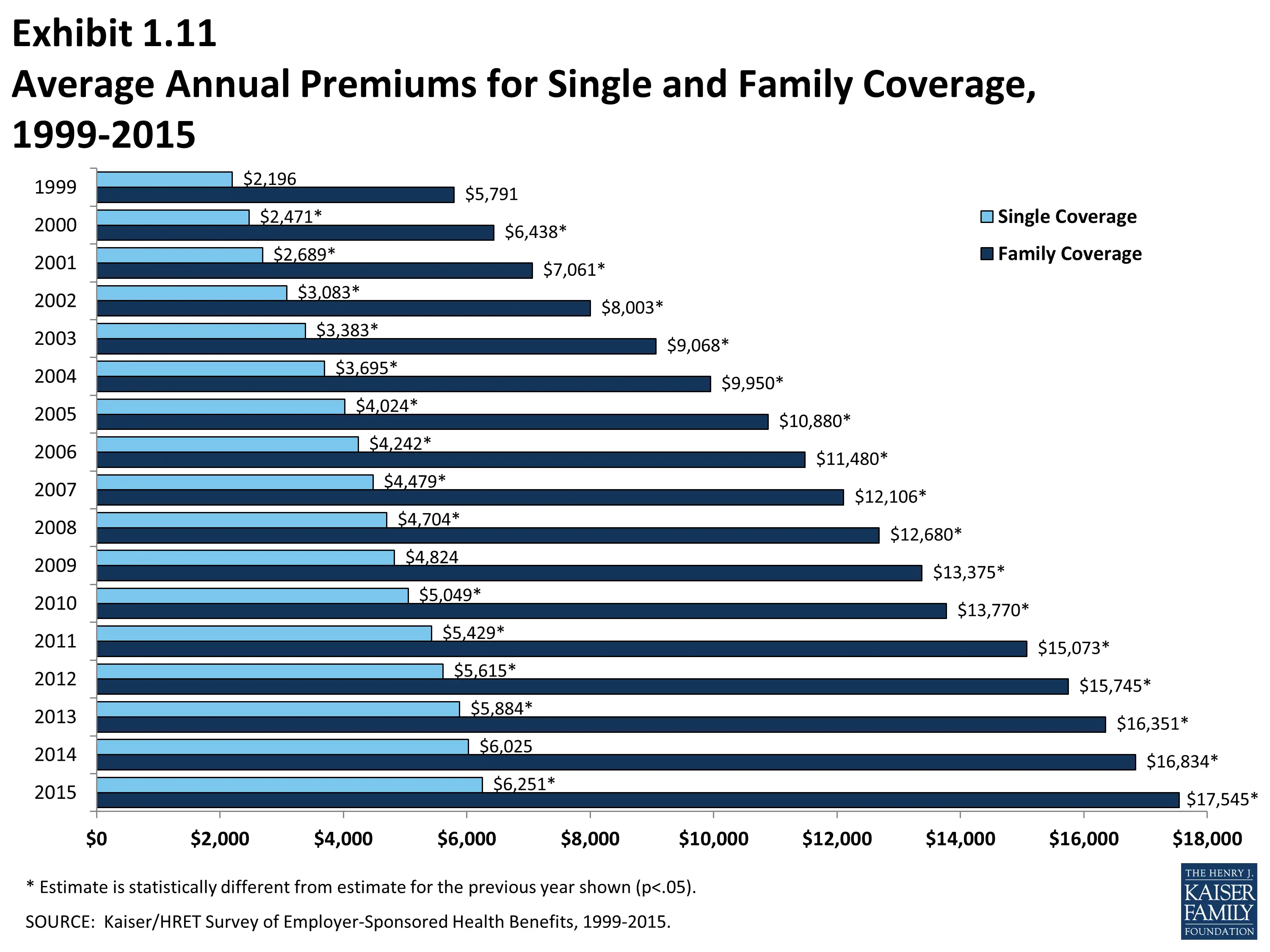

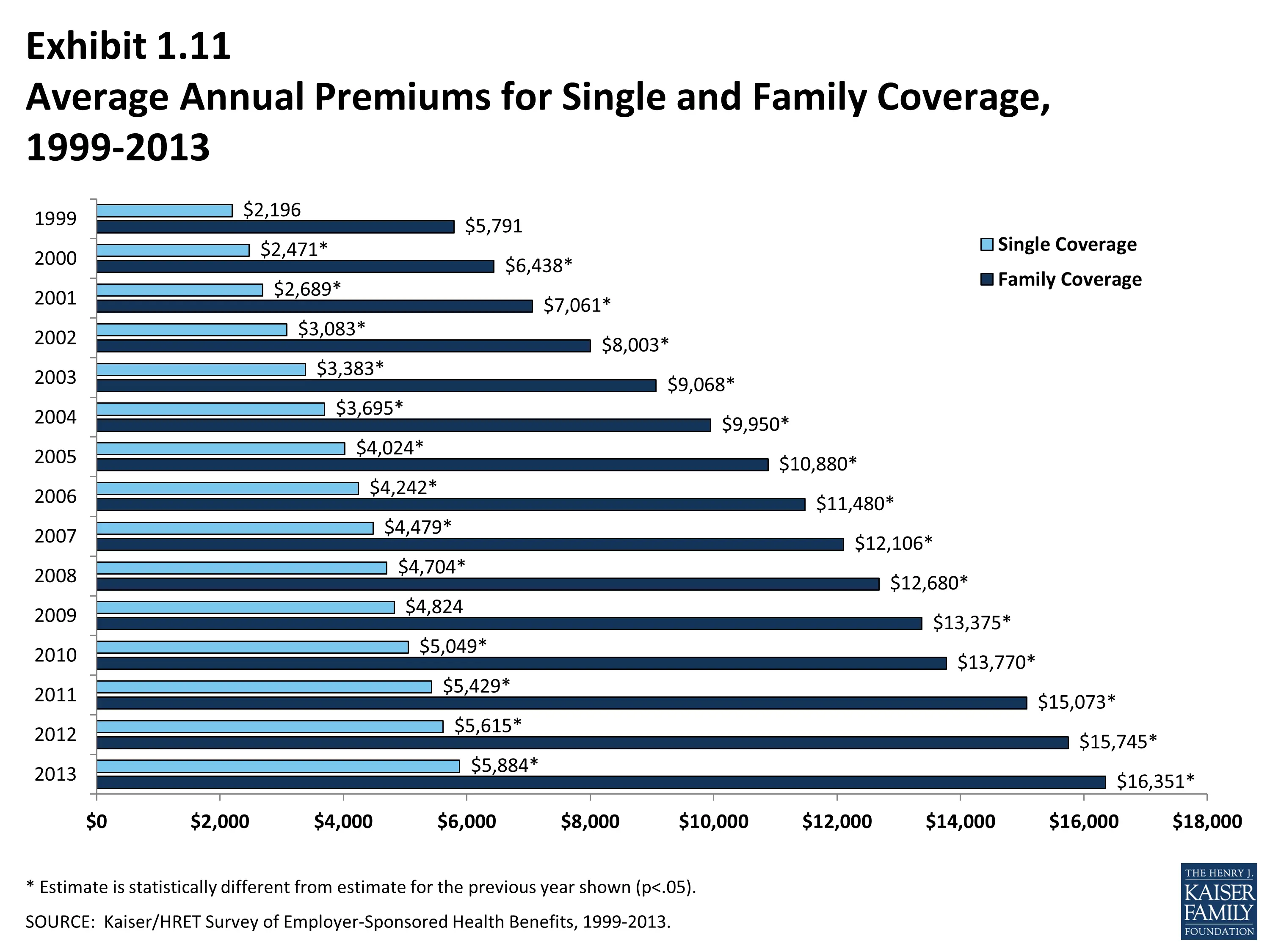

How Has The Average Cost Of Employer

Average employer-provided health insurance costs haveincreased modestly in recent periods. The KFF 2019 survey found that theaverage single premium increased by 4 percent, and theaverage family premium increased by 5 percent over theprevious year.

However, a long-term view of employer-sponsored healthinsurance costs reveals a larger change in the costs over time. According tothe KFF report, the average premium for employer-sponsored family healthcoverage increased 22 percent over the last five yearsand 54 percent over the last ten years.

Although average premium costs have risen over the pastseveral years, employer-provided health insurance may often be a more affordable option than individual healthinsurance coverage.

Source:Kaiser Family Foundation 2019 Employer Health Benefits Survey

What Are Average Health Insurance Costs

In the U.S., 55% of people receive health insurance through their employer, and 20% receive insurance coverage through government assistanceeither through Medicaid or Medicare according to the U.S. Census Bureau. Some peoplesuch as those who are self-employedchoose to purchase insurance privately, says Peter Kongstvedt, M.D., a health care expert and author based in Virginia. There are also 8% of people in the U.S. with no health insurance coverage at all.

The average health insurance cost for a single person who received health insurance through their employer in 2020 was $7,040 a year, according to data compiled by the Kaiser Family Foundation. The average cost of health insurance for a family in 2020 was $21,342 a year. These numbers represent what someone pays for a health care premium. A premium is the amount you pay each month to the health insurance provider, Dr. Kongstvedt says.

A premium is different from a deductible. A premium is what you pay up front , regardless of if you get health care or not. A deductible is something you pay in plans if you actually receive health care, Dr. Handel explains. For example, if the deductible for your health insurance plan is $1,000 a year, youll need to cover the other medical bills beyond that amount, he adds.

You May Like: Starbucks Open Enrollment 2020

How Much Health Insurance Coverage Do You Need

CNBCTV18.com

While buying health insurance, one is often in a fix about the amount of coverage one should go for. A conservative estimate should be at least Rs 5 lakh, considering the rising medical costs.

Given the rising medical costs and inflation, it is important to be prepared for any unforeseen expenses due to medical emergency. The best way to do so is by purchasing a health insurance policy. However, when it comes to getting a policy, the biggest question is how much should be the size of the health cover. Similarly, its always confusing to select a medical insurance that meets all your requirements apart from covering critical diseases.

Here are a few things to help you decide on a suitable insurance policy for your medical emergencies.

How much health insurance do you need?

The coverage need and cost of your health insurance plan will depend on your needs. The cost of premium for the insurance policy could vary depending on whether you want to get an individual policy or a family floater that covers your loved ones as well. If you want to include senior citizens in the policy, then you will need to consider the cost of treatment for their existing ailments too before deciding the coverage.

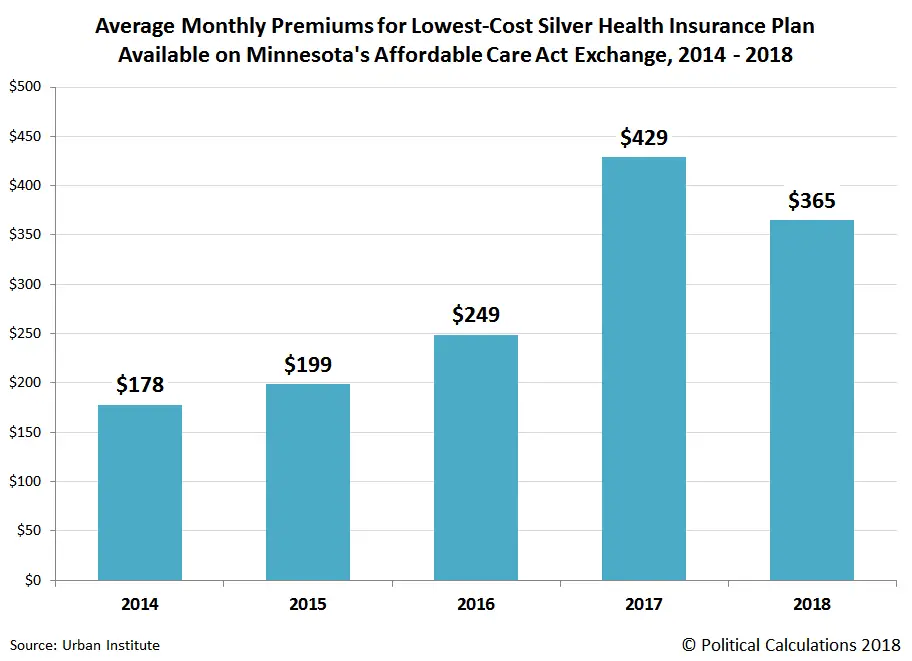

Donât Miss: Minnesotacare Premium Estimator Table