What Are Preferred Provider Organizations

PPOs typically offer you a large network of participating providers so you have a lot of doctors, hospitals, and other health care professionals and facilities to choose from. You may also choose to see providers from outside of the plans network, but you will pay more out-of-pocket.

Choosing a Primary Care Provider is not required with these types of health plans, and you can see specialists without a referral.

Consider Your Familys Needs

If youâre married and/or have children, think about what your family needs from a healthcare plan. Because coverage can change from year to year, itâs helpful to know what plan work better for your circumstances. For example, if you and your spouse have significantly different healthcare needs, it may be beneficial to keep separate plans with differing levels of coverage or different pricing.

Health Coverage For People With Disabilities

If you have a disability, you have three options for health coverage through the government.

-

Medicaid provides free or low-cost medical benefits to people with disabilities. Learn about eligibility and how to apply.

-

Medicare provides medical health insurance to people under 65 with certain disabilities and any age with end-stage renal disease . Learn about eligibility, how to apply and coverage.

-

Affordable Care Act Marketplace offers options to people who have a disability, dont qualify for disability benefits, and need health coverage. Learn about the .

Recommended Reading: How Much Is Health Insurance For Independent Contractors

Exclusive Provider Organization Plans

EPOs are managed care plans that cover only care delivered by in-network health care providers. Comparing EPOs versus HMOs, EPOs usually have more providers to choose from. If you want to see a provider outside of the plans network, you may not get coverage unless its an emergency.

EPO insurance plans may or may not require members to have a PCP and dont usually make members file paperwork. EPO plans are more flexible than HMOs but less flexible than some other health insurance plan types. The costs are typically in between as well. EPOs tend to be more expensive than HMOs but less expensive than more flexible options like PPOs.

EPO plans are ideal for budget-conscious people who dont want to be as limited as they would be in an HMO. If your preferred doctors or hospitals are in the approved network, EPOs may be a good option.

What Is Health Insurance And Why Do I Need It

Health insurance also referred to as medical insurance or healthcare insurance refers to insurance that covers a portion of the cost of a policyholders medical costs. How much the insurance covers depends on the details of the policy itself, with specific rules and regulations that apply to some plans.

If you dont have health insurance and you end up needing medical care, you can be left with insurmountable medical bills or even face situations in which medical providers refuse to treat you.

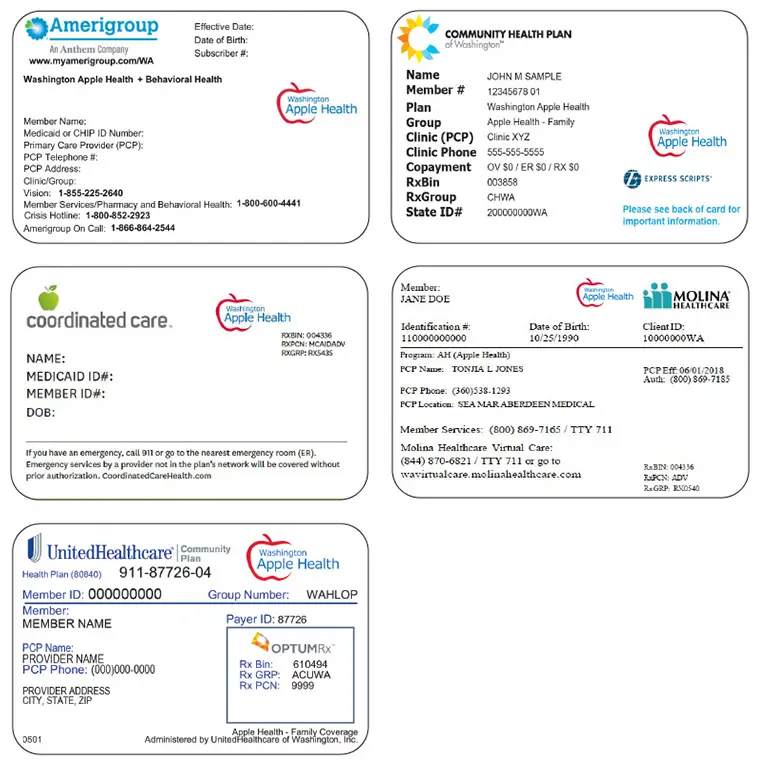

Only screening and stabilization in a hospital emergency department are guaranteed if youre uninsured . Other than that, its up to the provider to decide whether to treat you if your ability to pay for the care is in question. Even if your out-of-pocket costs seem high under the health plans available to you, having a health insurance card might make the difference between being able to obtain care or not.

Its also important to understand that you cannot just purchase health insurance when a medical need arises. Regardless of whether youre buying your own coverage or enrolling in a plan offered by an employer, theres an annual open enrollment period that applies, and enrollment outside of that window is limited to special enrollment periods triggered by qualifying events.

Also Check: Where To Go To Apply For Health Insurance

High Deductible Health Plan

High-deductible health plans have deductibles of $1,400 or more for an individual and $2,800 for a family in 2022. An HMO, PPO or another type of insurance policy could be an HDHP. HDHPs usually have lower monthly premiums, so they can save you money if you dont have complex or costly health care needs. Even if you do, you should do the math to make sure that the higher premiums are worth it, even if you have to pay the full deductible amount out-of-pocket.

High-deductible health plans are often paired with a health savings account . An HSA is a special kind of savings account that lets you set aside tax-free money for your HDHP deductible and other qualified medical expenses. HSA balances roll over each year, so you may be able to build up a cushion to absorb future medical costs.

What Are Private Health Insurance Plans

Any health coverage thats not received through a government program is considered private health insurance, the other main type of health insurance.

Many people get health insurance through a group plan from their workplace. This employer-sponsored health insurance is also a type of private health insurance. With a workplace health plan, your employer pays part of the cost, giving you lower premiums.

An individual health plan purchased on healthcare.gov, the health insurance marketplace, or outside of it like directly from an insurer’s website or through an insurance broker is also a form of private health insurance coverage.

Regardless of where you get private health insurance, the plan must provide the insured with ten essential health benefits, like preventive care and ambulatory services, as set out in the Affordable Care Act, which well discuss more later.

If youre buying health insurance through the Obamacare marketplace, you may need to buy during the open enrollment period. There are different enrollment periods for buying a public health plan, depending on the program.

Outside of the open enrollment period, youll need to have a qualifying life event to initiate a special enrollment period to buy a marketplace health insurance plan.

Check out your private health insurance options.

Read Also: How Much Does Bronze Health Insurance Cost

The Catch: Your Health Plan’s Network

Here’s the snag: The co-sharing scenario highlighted above works only if you choose doctors, clinics and hospitals within your health plan’s provider network. If you use an out-of-network doctor, you could be on the hook for the whole bill, depending on which type of policy you have. This brings us to two related terms:

What Does Covered Mean Anyway

If a service is covered, it means your health plan will pay for some or all of the cost. In most cases, your doctor also needs to be on the list of doctors that take your insurance, called a network. How much your health plan pays for depends on what type of care you use and where you get it.

For example:

- Some covered services are completely free to you, like going to the doctor for your annual exam. Your plan pays everything.

- For others like seeing the doctor for a lingering sinus infection or filling a prescription for covered antibiotics youll pay a fee. The amount you pay will be different depending on the type of plan you have and whether or not youve taken care of the amount you have to pay before your plan starts helping you .

To get the biggest bang for your buck, use services your health plan covers whenever possible.

Read Also: How To Get Health Insurance For Just My Child

Keep In Mind The Difference Between Hmos And Ppos

With Health Maintenance Organizations , youâre generally only covered if you see doctors within the HMO network. On the other hand, Preferred Provider Organizations often provide some coverage for out-of-network services. HMO networks tend to be smaller, and itâs likely youâll need to name a primary care physician who will refer you to any necessary specialists.

These plans also tend to have lower premiums and deductibles. PPOs often have wider networks and donât require referrals, but tend to be more expensive.

What Type Of Health Insurance Should I Get

Choosing the right health insurance starts with understanding your options based on your eligibility. If you qualify for government programs such as Medicaid or Medicare, these are likely your most affordable options.

The most important factors will be personal to you within your specific set of options. Consider what doctors you need or want to be able to see. Are they available in the plans network? Will you have to go through hoops or pay more to see them?

Consider your budget and what you value most. Would you rather save money but be locked into a specific provider network and live with more rigid rules and requirements? Or is it worth spending more to have more flexibility? Even if your budget is tight, you should be able to find affordable health insurance options, especially since subsidies have been temporarily expanded on marketplace plans.

Also, think about how often youre likely to need to see a doctor or get care. If you dont need many services, a high-deductible plan may work well. But, if you have a chronic condition, a lower-deductible plan that covers more of your costs may be best.

Also Check: Does Health Insurance Cover Hearing Aids

What Types Of Health Insurance Are Best For Me

Start by understanding your specific health care needs:

- If youre in good health and dont visit a doctor often,health insurance plans with higher deductibles typically have lower insurance premiums and could help save you money.

- If you require or expect more than just preventive care,consider plans that have lower deductibles and coinsurance, for more predictable costs.

You Can Keep Your Plan Longer With State Continuation

Texas law requires some group plans to continue your coverage for six months after COBRA coverage ends. Your plan must be subject to Texas insurance laws. State continuation doesnt apply to self-funded plans since the state doesnt regulate them.

State continuation lets you keep your coverage even if you cant get COBRA. If you arent eligible for COBRA, you can continue your coverage with state continuation for nine months after your job ends. To get state continuation, you must have had coverage for the three months before your job ended.

You usually cant get state continuation if you were fired.

Recommended Reading: What Does Deductible Mean In Health Insurance

Choosing A Health Insurance Plan

Reading the fine print is important when choosing health care plans. These questions may help:

- Can I go to any doctor, hospital, clinic, or pharmacy I choose?

- Are specialists, such as eye doctors and dentists covered?

- Does the plan cover special conditions or treatments such as pregnancy, psychiatric care, and physical therapy?

- Does the plan cover home care or nursing home care?

- Will the plan cover all medications my physician may prescribe?

- What are the deductibles? This is the amount you must pay each year before your insurance company will begin paying claims.

- Are there any co-payments? This is the amount of money you pay each time you receive medical services or a prescription.

- If there is a dispute about a bill or service, how is it handled?

Common Types Of Health Insurance Plans

Originally published on August 30, 2022. Last updated August 31, 2022.

Whether you’re looking at individual health insurance for yourself or group health insurance for your employees, there’s a wide range of health insurance options available.

Knowing the various policy types and health plan names will prepare you for evaluating your options when you’re ready to enroll in a new plan. The more familiar you are with the different insurance plan types and their alternatives, the better equipped you’ll be to pick one to fit your organization’s budget and needs.

This article will review the most common types of health plans available and a few alternatives to help you decide which is right for you, your family, or your organization.

Don’t Miss: Why Is It Important To Have Health Insurance

One Size Does Not Fit All

If your household income doesnt exceed 200% of poverty , a Silver plan with integrated cost-sharing subsidies will likely be the best choice for you, and will likely provide a better overall value than the Bronze, Gold, or Platinum plans.

This might also be true for people with income between 200 and 250% of the poverty level, but as noted above, a Gold plan might be a better value in some areas, due to the way some states and insurers are adding the cost of CSR to premiums.

People who have moderate pre-existing conditions and expect to file claims during the upcoming year will probably be better served by a higher-level plan , regardless of premiums.

But very healthy applicants may find that they prefer the lower premiums of a Bronze plan, despite the potential for higher costs if they do need to file a claim. And enrollees with very serious medical conditions, who know they will meet their plans maximum out-of-pocket no matter what plan they select, might find that theyre also better off with a lower-cost Bronze plan , since the combined total cost of the premiums and out-of-pocket exposure might end up being lower.

Theres no one-size-fits-all when it comes to health coverage each persons health history, risk tolerance, and budget have to be taken into consideration when selecting a plan.

Spousal Benefits Can Enable Insurance For An Early Retirement

An option that you may have if you are married is to use your spouses health insurance plan, Purkat explains.

I see in many cases, one spouse may be retiring early, but the other is still working full-time, Says Purkat. This is a great situation because if you can cover the years before you turn 62 with your spouses insurance, it can save you a lot of money.

You May Like: What Is A Ppo Health Insurance Plan

How To Choose Health Insurance: Your Step

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

You typically have a limited amount of time to choose the best health insurance plan for your family, but rushing and picking the wrong coverage can be costly. Heres a start-to-finish guide to help you find affordable health insurance, whether its through a state or federal marketplace or through an employer.

How Does Health Insurance Protect Enrollees

Having health insurance provides a safety net in case you end up with a serious injury or illness: All non-grandfathered, non-grandmothered major medical health insurance plans will cap your in-network out-of-pocket costs at no more than an amount determined by CMS each year, regardless of how high your medical bills actually get. For 2022, its $8,700 for a single person and $17,400 for a family, although many plans have lower limits .

Health insurance also helps with smaller expenses in the form of free preventive care and, depending on the plan, copays for things like office visits and prescription drugs.

Thanks to the Affordable Care Act , all non-grandfathered, non-grandmothered individual and small-group major medical plans include coverage for the types of care that are considered essential health benefits under the ACA, without any maximum cap on how much the insurance plan will pay for your care. .

Recommended Reading: Why Is Private Health Insurance So Expensive

What Is The Difference Between An Epo And Pos

Both EPO and POS plans require members to see doctors within a set network, but POS plans offer more flexibility. If you want to go to a doctor outside the network with a POS plan, youll pay more, but its allowed. Youll probably pay more overall for the flexibility of a POS plan.

About the Author

Deb Gordon is author of The Health Care Consumers Manifesto , a book about shopping for health care, based on consumer research she conducted as a senior fellow in the Harvard Kennedy Schools Mossavar-Rahmani Center for Business and Government between 2017 and 2019. Her research and writing have been published in JAMA Network Open, the Harvard Business Review blog, USA Today, RealClear Politics, TheHill, and Managed Care Magazine. Deb previously held health care executive roles in health insurance and health care technology services. Deb is an Aspen Institute Health Innovators Fellow, and an Eisenhower Fellow, for which she traveled to Australia, New Zealand, and Singapore to explore the role of consumers in high-performing health systems. She was a 2011 Boston Business Journal 40-under-40 honoree, and a volunteer in MITs Delta V start-up accelerator, the Fierce Healthcare Innovation Awards, and in various mentorship programs. She earned a BA in bioethics from Brown University, and an MBA with distinction from Harvard Business School.

What Is Short Term Health Insurance

Short term health insurance, also called temporary health insurance or term health insurance, may be right for you if you need to fill a gap in coverage until you can choose a longer-term solution. It might be a good option if youre in between jobs, waiting for coverage to start, looking for coverage to bridge you to Medicare, turning 26 and coming off your parents insurance or many other situations. Short term health insurance offers flexible, fast coverage for those dynamic times of change in your life.

Also Check: How Much Does Blue Cross Health Insurance Cost

Health Insurance And The Affordable Care Act

At one point, you had to pay a penalty on your federal tax return if you weren’t insured, but the fine was rescinded for the 2019 tax year and beyond, though some states may still have mandates.

Even though there’s no longer a penalty, you’re protecting both your health and your financial status by taking out a health insurance policy.