Life Insurance Or Health Insurance Which Insurance Is A Must

When it comes to buying insurance, a lot of people are split between life insurance and health insurance. Both these types of insurances have their own set of benefits. So, which one should you choose? â Life insurance, wherein your family will be financially secure in your absence?, Or health insurance, wherein you will have a strong financial back-up to meet medical costs when your health doesnât support you? Letâs find out.

What Is The Difference Between Life And Accident Insurance

With so many products on the market to protect you, it can be overwhelming to figure out the ones you need and the ones you dont. For example, life insurance and accident insurance policies provide coverage in the event of your death. However, one can also pay out if you are severely injured and one only pays upon your death.

How Does A Health Insurance Plan Work

The main objective of having a health insurance plan is to secure your finances at the time of medical crisis. Before buying this policy, read the inclusions and exclusions, and know the overall policy issuance process to make an informed health insurance decision. For example, some insurance companies conduct detailed medical examinations to assess your health conditions before issuing a health insurance policy.

The claim process is hassle-free and easy. You have two options to file a claim against your policy. A Cashless Claim is a method where you can get treatment in the network of hospitals . Your insurer will pay the medical bill directly to the hospital as per the terms and conditions.

On the other hand, you can opt for a Reimbursement Claim where you need to submit the hospital bills, medical reports, doctors prescriptions, etc. to the insurer. Once the verification is done from the insurance companys side, you will receive the claim amount.

Also Check: Do You Need Health Insurance To Go To Planned Parenthood

Benefits Of Health Insurance:

- The ability to afford medical expenses You will pay less for medical expenses when accidents occur or health problems suddenly appear.

- The possibility of lower rates- You could benefit from the network of doctors and hospitals whose fees have been negotiated at lower rates with your insurance carrier.

- Being able to take care of loved ones The ability to protect you and your familys health and financial well-being.

When choosing a health insurance plan, private health insurance can provide even more benefits that include:

- The possibility of faster treatment- You could see a doctor more quickly.

- The availability of extra privacy You might have access to a private room in a hospital.

- Access to additional treatments If you have a particular medical need you may find more options of care through private health insurance.

What Happens To Term Life Insurance At The End Of The Term

Generally speaking, when a term life policy comes to the end of its term you either have to buy another policy or go without life insurance. One exception: If you have a term policy with a guaranteed renewal clause, that will allow you to renew at the end of your term on a year-by-year basis, typically at a far higher rate. While expensive, it can be worthwhile if your health has declined or you are otherwise uninsurable.

You May Like: How Long Can My Dependent Stay On My Health Insurance

Choosing The Right Insurance Policy

With so many life insurance and health insurance plans available in India, individuals are spoilt for choice. However, deciding on a policy is not difficult because you can easily compare different plans and insurance providers online. Also, there are health insurance providers that offer a good discount if you buy health insurance for you and your spouse together. With a good idea of the benefits, inclusions, exclusions, claim settlement ratio, etc. of different insurers, you can pick the most suitable policy for yourself.

What Are The Different Types Of Health Insurance

Different types of health insurance are:Indemnity Health Insurance PlansIt is the traditional health insurance wherein the insured is eligible for a fixed amount of medical cover. Examples of indemnity health insurance are individual insurance, senior citizen insurance, family floater insurance, etc.PPO Health Insurance PlansPPO or Preferred Provider Organization Plans to allow the insured to receive insurance cover for visiting a selected group of health care providers.Point of Service PlansAs per Point of Service Plans, the insurance cover is offered for availing health services from a network of physicians approved under the plan.Health Maintenance Organizations PlansThis kind of plan requires the insured to avail services from a physician approved by any of the Health Maintenance Organizations.

Recommended Reading: Can I Buy Dental Insurance Without Health Insurance

After All Is Said And Done Which Type Of Policy Should I Buy

The truth is there are a lot of things to consider in addition to the type of policy you get. How much coverage do you need? What are all the different policy options ? Is there other coverage I need to protect my family?

Heres an easy way to get answers to all those questions: Just contact Guardian to find a financial professional who will take the time to learn about your unique situation, listen to your concerns, and clearly explain the different insurance options that best fit your needs and your budget from a company thats been helping protect families for over 150 years.

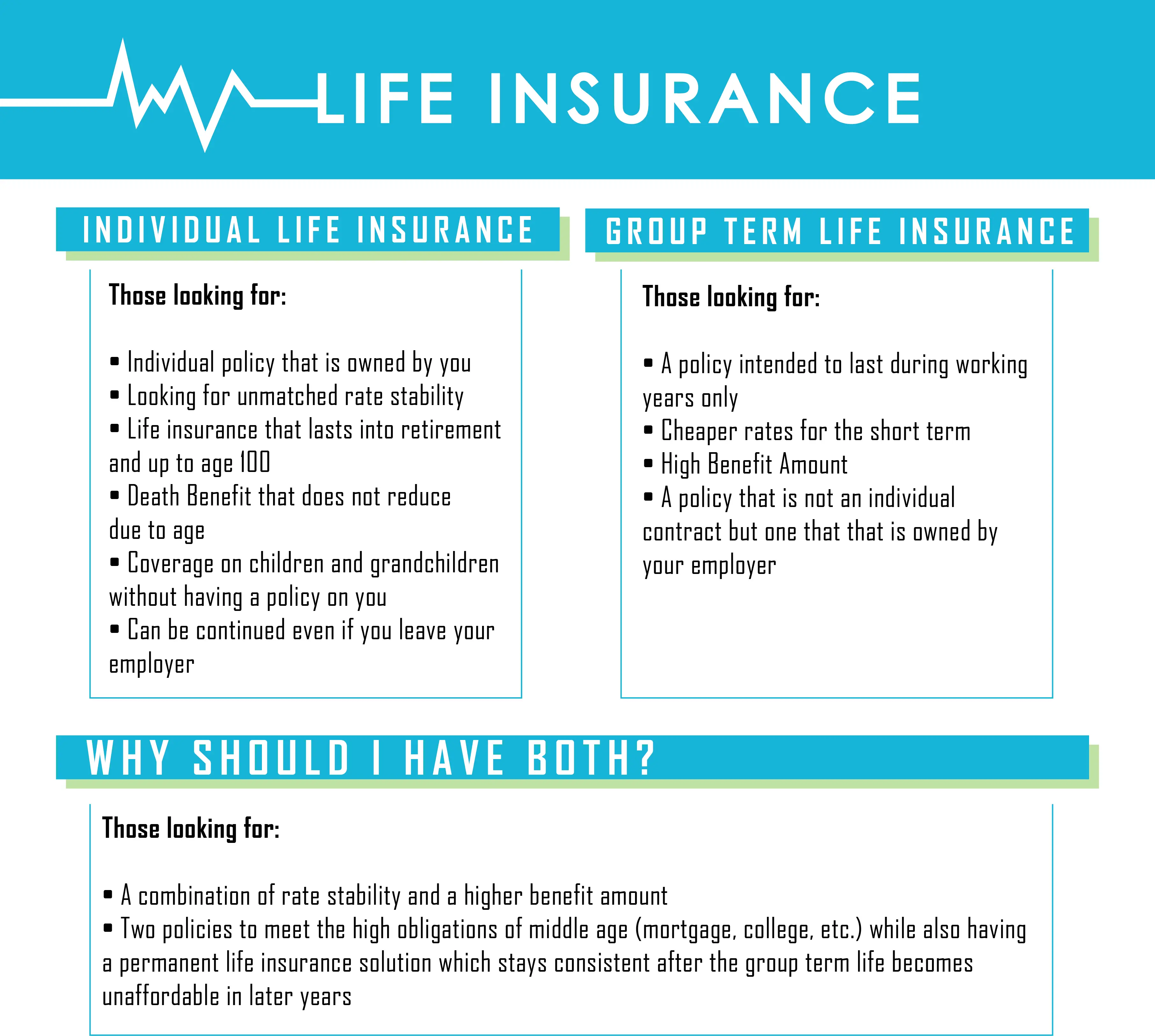

If you are an employee, taking advantage of your benefits at work is a smart and affordable way to get the financial protection you want for yourself and your family. Contact your HR department to review your plan details and determine how much life insurance is available to you. Your employer may provide life insurance as a benefit, or you may opt to pay for additional life insurance through payroll deductions.

Accidental Death And Dismemberment Insurance Basics

As the name implies, an AD& D policy covers death from accidents. That means it doesn’t cover death from natural causes like old age, or deaths from terminal illnesses.

AD& D insurance will also pay out some of the benefit in some instances of injury or accidental loss of limbs. While you will receive the full death benefit if you’re killed in an accident, an accident resulting in an injury may pay out a portion of the benefit. Your policy will outline how much of the benefit you’ll receive for different types of injuries.

Don’t Miss: How To Be A Health Insurance Agent

Why Is Medical Insurance Important

A medical insurance will help you to pay for various hospitalization and medical expenses that you will incur if you become ill or injured. These expenses will include a hospital room, professional and surgery fees and medical supplies and services. A medical insurance policy will also help you if can no longer work and earn an income because of illness or injury.

No matter what type of insurance you take on, make sure you understand what is covered and in the insurance policy. Ask for explanations on anything that you find is ambiguous from the insurance company.

Difference Between Health Insurance And Life Insurance

Life is not only beautiful but also uncertain, whatever you do however smart and hard you work, you are never sure what life has in store for you. Life Insurance is defined as a contract between the policyholder and the insurer, where the Insurance company pays a specific amount to the insured individual’s family upon his death, It is a financial product that pays you or your dependents a sum of money either after a set period or upon your death as the case may be.

In legal terms, it is a contract in which the insurer promises to pay a pre-decided sum of money that is ‘Sum Assured’ upon the death of the insured person or after maturity of the plan.

Recommended Reading: Does Health Insurance Cover Cpap Machines

Keep These Short Term Insurance Reminders In Your Long

With short term health insurance you are not buying an ACA health plan. That means you need to keep a few things in mind as you plan your coverage needs:

- ACA health plans are guaranteed issue, meaning you cannot be denied coverage based on preexisting conditions

- Short term insurance plans are not guaranteed issue, do not cover preexisting conditions, and you must answer a series of medical questions to apply for coverage

- ACA health plans are required to cover 10 essential health benefits, including maternity and newborn care, mental health and substance abuse disorder services

- Short term insurance plans do not have coverage requirements, so plans vary in what they cover. Check your plan details carefully

So, its true that you may save money by choosing short term health insurance. Just be sure you know what you are buying, and that its a good choice for you. For the right situation, short term insurance plans can definitely provide fast, flexible, temporary health insurance coverage that fits your needs.

Trauma Cover Vs Health Insurance

Trauma insurance pays you a lump sum benefit should you suffer one of the specified critical illnesses listed in your insurers PDS, for example, Alzheimers, heart attack and Multiple Sclerosis. This benefit can then be used to pay outstanding medical bills, replace lost income, or help you adapt to your new lifestyle.

Private health insurance is designed to take care of your immediate health concerns, for example, the ambulance fees, follow-up treatments, and medicines. It also allows you to choose your doctor, surgeon and hospital.

Read Also: What Is The Cost Of Health Insurance In Usa

Which Insurance Should One Buy

Given the several benefits of life insurance and health insurance, it is wise to opt for both. If it is difficult to afford the premium of both the plans, then the best thing is to arrive at your suitable cover amount and buy just that. For example, experts believe that you must have a life cover equivalent to ten times your current annual income. So, you need not buy a larger cover and, thus, can savour the benefits of life insurance as well as health insurance.

Life Insurance Vs Health Insurance

There are important differences between health and life insurance which you should consider before applying for either type of policy. Health insurance is designed to pay for treatment costs for example, urgent surgery whereas life insurance provides a cash sum to your loved ones if you die during the length of the policy, that could help pay for the mortgage or help with everyday living expenses.

Don’t Miss: What Health Insurance Covers Birth Control

Main Differences Between Life Insurance And Health Insurance

Life insurance is governed under section 80C and section 10 and health insurance follow the regulation set under section 80D.

The governing mandates laid by the income tax department are a very crucial part of the policy creation and purchase.

Hence through reading through will need the help of a lawyer. Best is to spend some monies and understand word to word of the section at concern.

Detail explanation of each section is hyperlinked below.

Contract and Coverage

A bond is signed by the insurer i.e. the life and health insurance provider based on the timeline, premium agreed, fixed amount to be paid by the insurer, type of policy, tax benefits, maturity term, accidental coverage, health claims and so much more.

There are numerous differences in the types of coverage offered and best is to connect with various service providers and they select the best deal.

In life insurance, the policy owner insures their life by paying a mutually decided premium on a monthly quarterly or yearly bases.

Post their death, the nominee is entitled to receive a fixed amount on a monthly base securing the future of their family.

As per health insurance, the insured person can improve and avail health benefits that cover their medical bills.

Also, just the person who takes the health policy benefits and the policy doesnt cover the family health.

Investment and Recovery

There Are Three Main Categories Of Health Insurance:

- Individual Health Insurance – An individual health insurance is a type of policy customized for a single person, to safeguard and cover oneself from various illnesses, accidents, hospitalization expenses and, other medical emergencies that may arise in one’s lifetime. Additionally, individual health insurance plans also provide for additional benefits like Maternity Benefit, OPD expenses, Critical Illnesses Cover, AYUSH, etc.

- Family Floater Health Insurance – A family floater health insurance is a type of policy customized to suit the entire family, under one single premium. The same protects and covers all family members against various illnesses, accidents, hospitalization, and other medical needs that may arise during one’s lifetime.

- Senior Citizens Health Insurance – As the name suggests, senior citizens health insurance is a type of health insurance policy designed for people above the age of 60. The same is customized keeping in mind the different physical and psychological needs of senior citizens and offers benefits such as Domiciliary Care, AYUSH, Organ Donations expenses, and Critical Illnesses among others.

Read more: Learn more about the benefits of COVID 19 Insurance Policy in India

You May Like: How To Apply For Hip Health Insurance Indiana

Life Insurance Vs Ad& d Insurance Faq:

What is the difference between life insurance and AD& D?

Life insurance pays a tax-free benefit to your beneficiaries if you die, whereas AD& D pays out to your beneficiaries if you die or are injured in an accident.

Do I need both life insurance and AD& D?

Most people only need life insurance, which covers more causes of death than AD& D and is equally or more affordable.

Is AD& D insurance worth it?

Most people donât need AD& D as a standalone policy. If youâd like some coverage for accidental injuries, an AD& D rider or standalone disability policy are better choices.

More about

Types Of Life Insurance Options

Death benefit

Provides a lump sum payment to your beneficiaries in the event of your death to help cover the cost of funeral arrangements, outstanding debts and mortgage payments.

Total and permanent disablement cover

Pays a lump sum amount if you become totally and permanently disabled as per the insurers definition because of a sickness or accident.

Trauma insurance

Provides a once-off benefit amount should you suffer any of the critical illnesses listed in your product disclosure statement .

Income protection insurance

Pays a monthly benefit of up to 75% of your personal exertion income should you be unable to work for longer than your waiting period due to an illness or injury.

Don’t Miss: How To Cancel Cobra Health Insurance

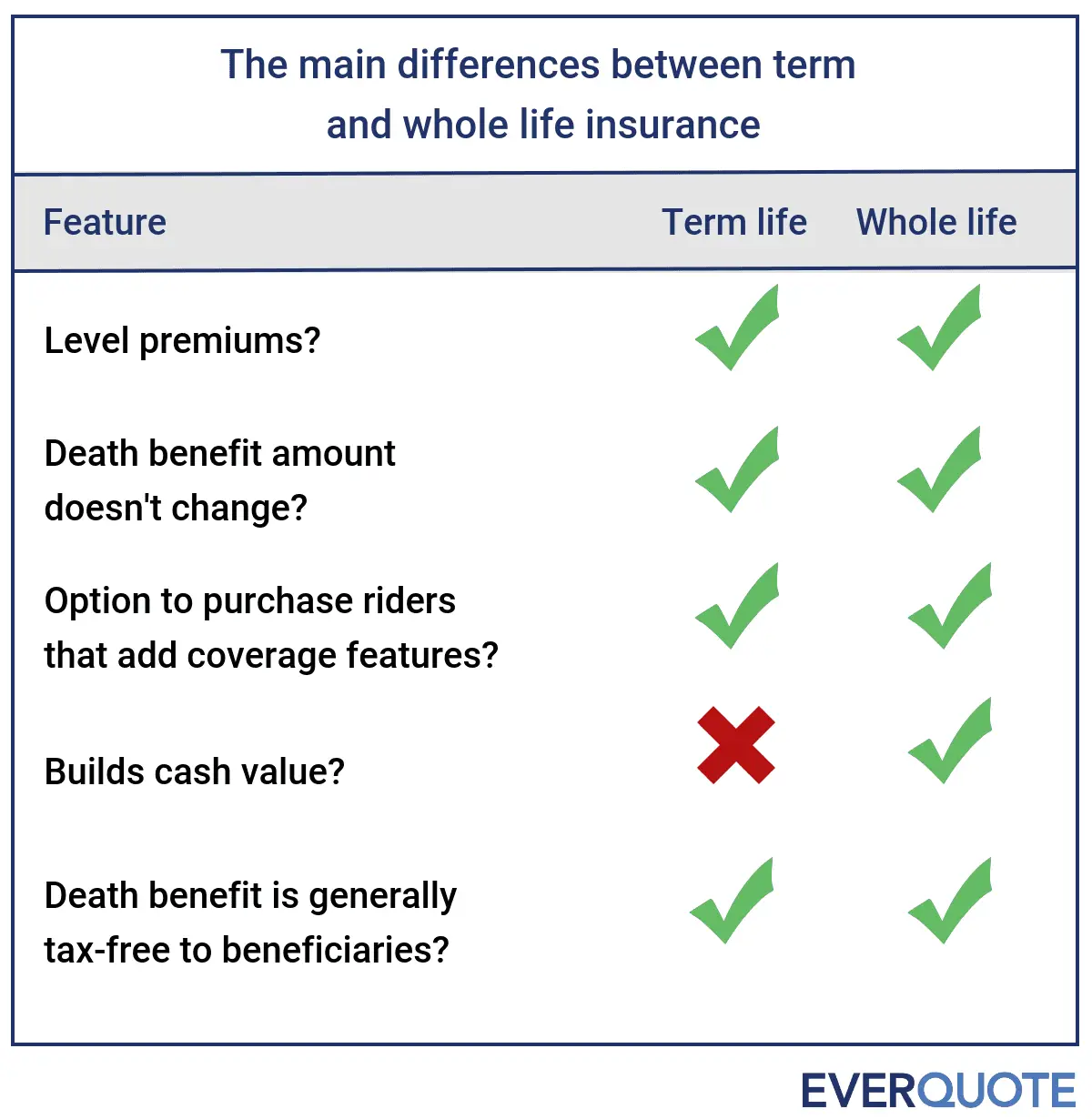

Is Whole Life Better Than Term Life Insurance

Whole life provides many benefits compared to a term life policy: it is permanent, it has a cash value investment component, and it provides more ways to protect your familys finances over the long term. Those features make it a better choice for many people but if youre only looking for the biggest death benefit you can get per dollar paid in premiums, then term life insurance may be a better choice.

What Are The Types Of Health Insurance

Different health insurance caters to different needs of the consumers.

1. Health maintenance organizations : HMOs require you to pick from a local network of participating doctors, hospitals, and other health care professionals and facilities. You must also select a primary care provider from the network for these sorts of health insurance policies.

2. Exclusive provider organizations : An EPO provides you with a network of participating providers from which to select. Except in the case of an emergency, most EPO plans do not cover out-of-network treatment.

3. Point-of-service plans: A combination of HMOs and PPOs. However, the provider network is usually smaller than a PPO network and the costs are also lower. In this type of plan, you also need to choose a primary care provider.

4. Preferred provider organizations : A plan that provides a huge number of doctors, hospitals, and other health care professionals and facilities to choose from.

Related Blog: Types of Health Insurance Policies in India

Recommended Reading: How Much To Employers Pay For Health Insurance

What Is A Health Insurance Policy

Health insurance is a contract between the insured and the insurer where the insured pays an insurance premium in exchange for financial coverage in case of hospitalization. Without health insurance, you might end up exhausting your savings to pay the hospital bills in case of a medical emergency. With such a cover, the savings need not be touched as the insurer settles most of the hospital bill on your behalf.

It’s How They Work Together That Matters

As you can see, these types of cover have almost nothing in common, except for one thing they can ease the financial stress of a life-changing event, and give you and your family peace of mind.

Having a combination of life and health insurance can provide the foundation for a comprehensive protection plan one that protects your family’s finances at any stage of life.

Also Check: How To Get Medication Without Health Insurance

Benefits Of Life Insurance:

- It offers peace of mind In the event you pass away during the coverage period, your loved ones will be financially protected.

- There is flexibility You get to choose what level of coverage and how long you want to keep the life insurance.

- There is certainty Unless you alter your coverage, your premium amounts shouldnt change.

What Is A Insurance Of Life

Life insurance is a contract stamped, signed and agreed by the insurer and the policy holder on the payment of a premium by the policy holder to secure the future of his family. Life insurance can also be called as life coverage or life insurance that is given to loved ones after leaving the world.

The objective of life insurance is to insure the life after the death of the breadwinner. Forbes magazine listed the purpose of life insurance well here.

Life insurance offers a death benefit to the beneficiary based on the cash value and the premium incurred. Lastly, this link will offer a good understanding of the classification, types, and plans.

Read Also: Is Health Insurance Mandatory In New York