Whats Covered Through The Usc Ship/aetna Plan

SHIP/Aetna 3 Tiers of coverage:

- Tier 1, USC Designated Preferred Care Providers 90% Coverage

- Keck Medicine of USC

- Childrens Hospital Los Angeles

- USC Verdugo Hills Hospital

- USC/Norris Comprehensive Center and Hospital

- Las Encinas

Copays: $20 copay for all primary care and behavioral health visits with Tier 1 and Tier 2 providers $50 co-pay for all walk in clinic visits/urgent care visits to insurance-based urgent care centers.

Is Financial Assistance Available For The Student Health Insurance Plan Premium Link

Some domestic undergraduate students may be eligible for a Syracuse University grant to cover the Student Health Insurance Plan premium. In addition, some domestic and international students may be eligible for loans.

- Undergraduate and graduate students need to submit, in writing, a request for consideration for assistance to the Office of Financial Aid and Scholarship Programs.

- Law students must complete the budget adjustment request form and send it to the College of Law Office of Financial Aid for consideration.

- Please note, domestic students must have a FAFSA form on file in order to be considered for grant or loan assistance.

Finding The Most Affordable Plan For You

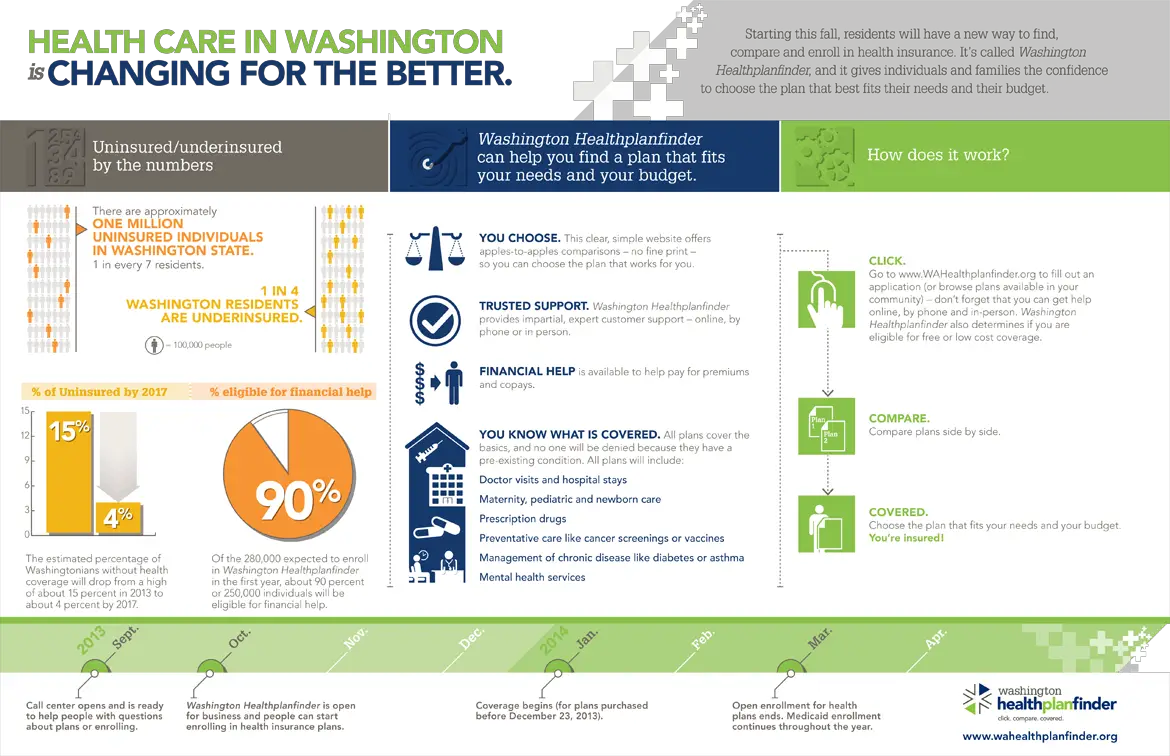

You may be eligible for a subsidy if you decide to purchase an ACA-compliant plan, which could make your coverage more affordable. A subsidy is financial assistance from the federal government to help you pay for your health insurance. Learn more about Obamacare subsidies and whether you could qualify for financial assistance or contact an eHealth representative if you have questions.

A non-ACA-compliant plan that doesnt offer all of the ACAs essential health benefits may wind up being cheaper per month, even without a subsidy. For example, if you are generally healthy, you may save money by choosing a smaller amount of health insurance coverage. Although you will pay more out of pocket when you need medical care, you will also save more each month.

Also Check: Starbucks Health Insurance Cost

Do I Need To See My Primary Doctor Before Starting Therapy

Whether or not you need a referral from your primary care physician before you start therapy depends on the type of plan your school offers. If your plan is an HMO plan, then you will need to see your primary care physician to attain a referral for mental health services before Aetna will begin its coverage. However, if you have a PPO plan, then you will not need a referral and can begin your therapy journey when youre ready. The same is true for the EPO student health insurance plans.

Its important to understand your schools policies around therapy referrals before you begin your search for a great therapist. Many schools require that their student health center providers meet with you before you seek support from a non-university affiliated therapist. To learn more about your schools requirements, visit your student health centers website and look for mental health resources.

Find vetted therapists who are in-network with Aetna Student Health Insurance

How Much Does Aetna Dental Insurance Cost

If youre shopping for affordable dental insurance, youre probably wondering how much an Aetna dental plan costs. Aetna is one of the leading health insurance providers in the nation, and their dental plans are accepted by thousands of dentists. But if youre signing up on your own because dental is separated from health plans offered by your employer, you may be trying to decide which Aetna dental insurance plan is the best for your needs.

Don’t Miss: Starbucks Pet Insurance

Student Dental Insurance Plan

The Eastman Institute for Oral Health on Elmwood Avenue by the UR Medical Center offers the University of Rochester Student Dental Plan for full-time students. This plan provides convenient dental care with fully qualified dentists. We make it easy for busy undergraduate and graduate students to keep a healthy smile. Dental services provided by Eastman Dental and Strong Memorial Hospital Department of Dentistry are in network.

The UR Student Dental Insurance Flyer 2021-2022 and UR Dental Insurance Application 2021-2022 provide information about the services provided. Coverage is from August 1st through July 31st. Students who want to enroll in the UR Student Dental Insurance Plan must complete the application form by September 30th. For more information, go to the Eastman Institute for Oral Health website and scroll down the page to University of Rochester Students. If you have questions about the Student Dental Insurance Plan for University of Rochester students, please contact Customer Service at Excellus BlueCross BlueShield at 1-800-724-1675.

How We Chose The Best Health Insurance For College Students

To identify the best health insurance for college students, we looked at multiple options, including Medicaid, Health Insurance Marketplace plans, school-offered insurance, short-term policies, and insurance offered by private companies. In total, we looked at 17 different options and evaluated them based on their total annual cost, availability, provider network, and financial stability rating. Because college students are typically on a tight budget, particular attention was paid to plans that offered low premiums and comprehensive coverage.

Recommended Reading: Starbucks Insurance For Part Time Employees

S To Enroll For Voluntary Students & Dependents

To voluntarily sign up for student health insurance plan, go to the JCB Student Insurance Portal

- If you have any problems accessing the site please contact JCB at 206-201-0291 or

Cvs Caremark Mail Service

Save time and money by ordering your prescriptions through Aetna’s mail-order prescription drug service, CVS Caremark Mail Service .

CVS Caremark Mail Service offers you:

- Convenience — Quick, confidential shipping of your maintenance medications right to your home, your place of work or any other location you choose.

- Ease of use — Our simple, two-step process makes ordering your maintenance medications easy.

- Quality of service — Registered pharmacists check orders for accuracy and are available 24 hours a day, 7 days a week in case of emergency.

- Cost savings — Depending on your Aetna pharmacy benefits and insurance plan, you could save money by using CVS Caremark Mail Service , and standard shipping is always free.

You May Like: Starbucks Insurance Cost

Student Health Insurance Plan : Coverage And Costs

Insurance coverage ensures that students have accessto additional care outside of USC Student Health primary care services, such as longer term mental health care, visits to urgent care centers after hours, specialist visits, surgery/hospitalization coverage, as well as prescription coverage and vision care.

Premium Rates for 2021-2022:

FOR ALL ON-CAMPUS DEGREE PROGRAMS

- Fall 2021 rate: $753

- Spring 2022 rate: $1,363

FOR ONLINE DEGREE PROGRAMS

- Fall 2021 rate: $1,383

- Spring 2022 rate: $2,622

NOTES:

International travel programs insurance rates are individually quoted by the Insurance Office.

Dental plan is available separately, contact the Insurance Office through .

Vision care is included in the SHIP/Aetna plan .

Spring charges for SHIP/Aetna are typically higher than fall, as the coverage period is longer .

Currently, referrals are not required for specialist visits .

How Do I Buy An Aetna Medigap Policy

The best time to purchase a Medigap policy is when you are first eligible. During this time, youll have access to all of the insurance companys plans, as well as access to the best prices and variety of policies. There is a six-month Medigap open enrollment period that starts on the first day of the month during which you are 65 or older and enrolled in Medicare Part B. You can still purchase a Medigap policy even after your Medigap enrollment period however, the insurance company will use medical underwriting, which may limit the policies you can purchase.

Here is a step-by-step guide to purchasing an Aetna Medigap policy:

Searching by state on Aetnas home page

Comparing Aetna Medigap plans and prices

Don’t Miss: Proof Of Va Health Insurance For Taxes

How To Maximize Open Enrollment Periods

There are a number of ways you can make the most of open enrollment. First and foremost, know when youre eligible. Your open enrollment period depends on how and where you purchase insurance, says Koleen Cavanaugh, vice president of marketing at Independence Blue Cross in Philadelphia.

Then, take the time to assess your health needs and lifestyle. To do so, Kyu Rhee, M.D., Aetnas senior vice president and chief medical officer, recommends answering the following questions:

- Do you have a primary care physician or use any medical specialists?

- What medications do you take?

- What diagnostic tests, such as blood tests or imaging, do you need?

- Are you due for key preventive screenings like vaccinations and cancer screenings?

- Are you managing one or multiple chronic conditions?

- Do you anticipate any surgeries or procedures?

Once you home in on what youre looking for, shop around for coverage. Dylan H. Roby, associate professor of Health, Society and Behavior at the University of California, Irvines Program in Public Health, recommends looking for a plan that meets your needs for the upcoming yearregarding monthly premium prices and in terms of health needs.

You can also speak with a local trusted broker or licensed insurance advisor to help you learn about the different plans available in your area. Many insurers also offer local seminars that offer insight on plans and allow for questions, says Shukla.

Featured Health Insurance Partners

Filling Your Prescriptions And Refills Is Easy

When you take your prescription to an Aetna participating pharmacy, there is no claim to file when you present your identification card. If you do pay for a prescription, you may be eligible for a reimbursement, less any applicable copay amount. Please check your Plan Design and Benefits Summary. Please review your plan documents for information on your specific Plan of benefits, including covered and excluded drugs, applicable copays, a list of participating pharmacies and claim forms.

You May Like: Starbucks Health Insurance Eligibility

Which Aetna Medigap Plan Is Right For Me

Choosing the right Aetna plan doesnt have to be complicated. Weve outlined our recommendations for the companys various Medigap plans so you can find the one thats right for your budget and lifestyle.

Pro Tip: For seniors enrolled in the Medicare Part A deductible plan, Aetna plans B, D, G, N, C, and F will provide the most benefits and coverage, while plans C and F are best for those enrolled in the Medicare Part B deductible plan.

Those who need basic, comprehensive coverage

In general, Aetnas Medigap Plan A and Plan B provide comprehensive coverage for many seniors needs, including hospital coverage, hospice care, home healthcare, and assistance with copayments for routine appointments.

Seniors who travel frequently or are in need of highly skilled care

If you need more skilled care and currently live in or plan to move to a skilled nursing facility, plans D, G, N, C, and F will limit those additional costs. These plans also provide international emergency coverage, making them reliable options for seniors who travel frequently.

Seniors on a tight budget who dont have frequent doctors appointments

For seniors who dont need to visit the doctor as often, Plan N is one of the least expensive options however, youll be charged a $20 copay for every office visit and a $50 copay for emergency room visits. You should also know that Plan N copayments dont count toward the annual Part B deductible.

Seniors with chronic health conditions or frequent appointments

Student Health Insurance Advisory Committee

The Provost of the University of Pennsylvania sponsors a Student Health Insurance Advisory Committee with cross-University representation and health insurance expertise. SHIAC meets regularly throughout the academic year to discuss to. review, evaluate and negotiate the renewal of the Penn Student Health Insurance Plan .

Read Also: Insusiance

How Much Does International Student Insurance Cost

The cost of health insurance for international students depends on the following factors:

- The period of study. If you are only doing a semester abroad, it will cost less than if you were pursuing an entire four-year degree.

- How much coverage you want. If you add the optional coverage items, such as sports, dental, vision, or maternity, then the price of your policy will increase.

- Whether you have any dependents. Adding dependents will bring up the price of the policy.

- Whether it is international insurance. International insurance covers more places, therefore it costs more.

- Whether you want coverage in the US. Usually, due to the very high cost of healthcare in the United States, health insurance plans that include the US are more expensive than those that do not.

For example, a one-year health insurance plan for an international student in the US can range from $500 to over $1,000 a year.

Remember: Do not choose the cheapest student insurance policy. If it does not cover you adequately, in cases of emergency, it will end up costing you more.

Does The Aetna Student Health Plan Cover Online Therapy

Yes, the Aetna Student Health Plan offers coverage for online therapy. This opens the doors for many clients who arent able to physically attend therapy sessions each week, whether for a physical limitation or because of the constraints of a busy student schedule.

Your coverage for therapy costs will remain the same, whether you visit your therapy in-person or online. This includes the same copayments or coinsurance rates.

Recommended Reading: Starbucks Dental Insurance

The School Plan Could Be A Better Deal Or Not

Its worth checking if the university plan is cheaper, as it was in the case of a dad who wrote in. His daughter attends George Washington University, where her annual premium of $2,690 is almost $100 cheaper per month than her old Kaiser Permanente plan.

Sometimes the colleges plan has better coverage, too. Our current insurance only works in NYC, wrote another dad. Now his kids are covered on student plans at the University of Colorado, Boulder, and Cornell University, for less than $200 or $300 a month.

Compared to tuition and lodging and books its an incredible bargain, he said.

Of course, whats a good deal for one person is exorbitant for another. A mom recalled her shock on learning the $1,643-per-semester premium to cover her son at the University of California, Berkeley. She is looking for alternative plans through Kaiser Permanente and Covered California, that states ACA exchange. What she chooses will be especially important this spring, when he turns 26 and can no longer stay on her plan.

Premium Costs And Coverage For 20212022

Health insurance premiums are billed to the student’s account. The cost of the Aetna student health plans for the 20212022 academic year are:

- Domestic student plan: $1,910 annual rate .

- International student plan : $2,040 annual rate .

A description of the plan benefits can be found at aetnastudenthealth.com.

Fall semester insurance coverage begins August 1, 2021 and ends December 31, 2021. Spring semester coverage begins January 1, 2022 and ends July 31, 2022. If you are enrolled for the fall semester, your enrollment will be automatically renewed for the spring semester. As indicated above, you may not waive coverage midyear. If you waive your insurance for the fall semester, you will automatically be waived for the spring semester.

Some New York Tech graduate and part-time students will not automatically be enrolled, Unfortunately, there is no longer a voluntary enrollment process for these students. We look forward to assisting you with any questions regarding the mandatory enrollment and waiver process. Please feel free to contact the Office of Counseling and Wellness:

- Yahaira Ruiz at or 212.261.1770

- Michael Schneider at or 212.261.1773

You May Like: Health Insurance Starbucks

Does Insurance Cover Lasik

The short answer is: not usually. Most health insurance companies dont cover LASIK, as they consider it to be an elective procedure. Some vision insurance plans do offer a one-time discount of $100 to $200 or a specific percentage off the total cost. Two vision plans that offer discounts, for example, are United Health Golden Rules, which offers an unspecified discount on laser eye surgery or laser vision correction and Direct Vision Insurance, which also offers an unspecified discount specifically on LASIK eye surgery. Plans like Aetnas Vision Preferred offer 15% off procedures performed using the U.S. Laser Network.