Know Your Hra Options

QSEHRA: a Qualified Small Employer HRA allows small employers to set aside a fixed amount of money each month that employees can use to purchase individual health insurance or use on medical expenses, tax-free. This means employers get to offer benefits in a tax-efficient manner without the hassle or headache of administering a traditional group plan and employees can choose the plan they want. The key thing to remember here is that all employees must be reimbursed at the same level. The QSEHRA is designed for employers with less than 50 employees to reimburse for premiums and medical expenses if the plan allows.

ICHRA: an Individual Coverage HRA allows employers of any size to reimburse any amount per month for healthcare expenses incurred by employees on a tax-free basis, starting at any time of the year. The distinguishing element of this HRA is that employees can be divided into an unlimited number of classes, like hourly vs. salary or even based on location, and be reimbursed at different levels. The ICHRA is for companies of any size. There are no limits to how much an employer can offer for reimbursement.

What Do Employers Gain

If workers prefer to obtain health insurance through their employers rather than on their own, why are employers willing to act as their health insurance agents? Part of the explanation undoubtedly rests with the tax incentives for employers to offer coverage to workers and their dependents. Payments for health insurance are deducted from gross revenues in calculating the employer’s taxable income, and they also are excluded from the base payroll in determining the employer’s share of the payroll tax for Medicare and Social Security. More important, however, employers may want to offer health insurance to their workers because failing to do so could harm the firm’s performance. The evolution of company-sponsored medical care plans suggests that employers have long recognized the value of providing health insurance to workers. With the rapid growth of manufacturing and unions before World War I, the provision of welfare benefits, including health insurance, was widely acknowledged to be good business: The employee plans

relieved the employer of the solicitations for aid for the destitute dependents of deceased employees also, it was not necessary for the employees to pass the hat among themselves during working hours for the same purpose the program assisted in attracting better employees and in retaining those already employed, employee morale was enhanced, job relations improved and the public relations of some firms favorably affected.

Why Do Workers Want Employment

Workers want health insurance for themselves and their families in order to protect against the catastrophic costs of serious illnesses and to ensure access to medical care. For those without the time or income to save for it, insurance may be the only way to obtain medical care that would otherwise be unaffordable . Although it is possible for individuals to purchase insurance on their own, the high cost of private individual coverage, barriers to access to that coverage, and steep transactions costs help account for the value of group coverage to workers and thus explain why, in the absence of any viable alternative, workers demand coverage through their employers.

Employment-based coverage is far less expensive than individually purchased coverage, for several reasons. First, through pooling, employers can reduce adverse selection and administrative expenses. These cost advantages are significant, especially for large firms. Moreover, employers are able to offer relatively inexpensive health insurance because most people covered by employment-based plans are in good health. Those people who are most expensive to insurethe elderly and people with serious disabilities and chronic conditionsare typically covered by public programs such as Medicare and Medicaid, thereby reducing the cost of employment-based insurance .

Also Check: What Does Health Insurance Cost For An Individual

How Has The Average Cost Of Employer

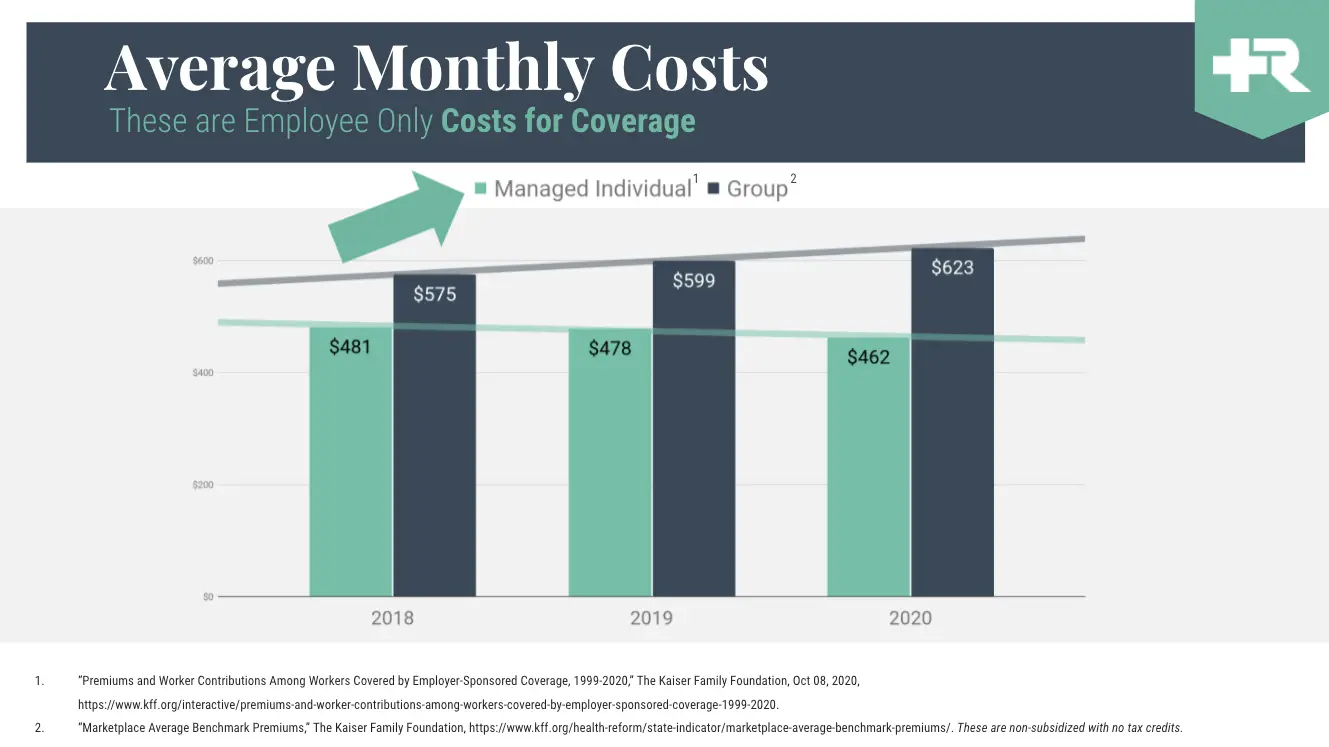

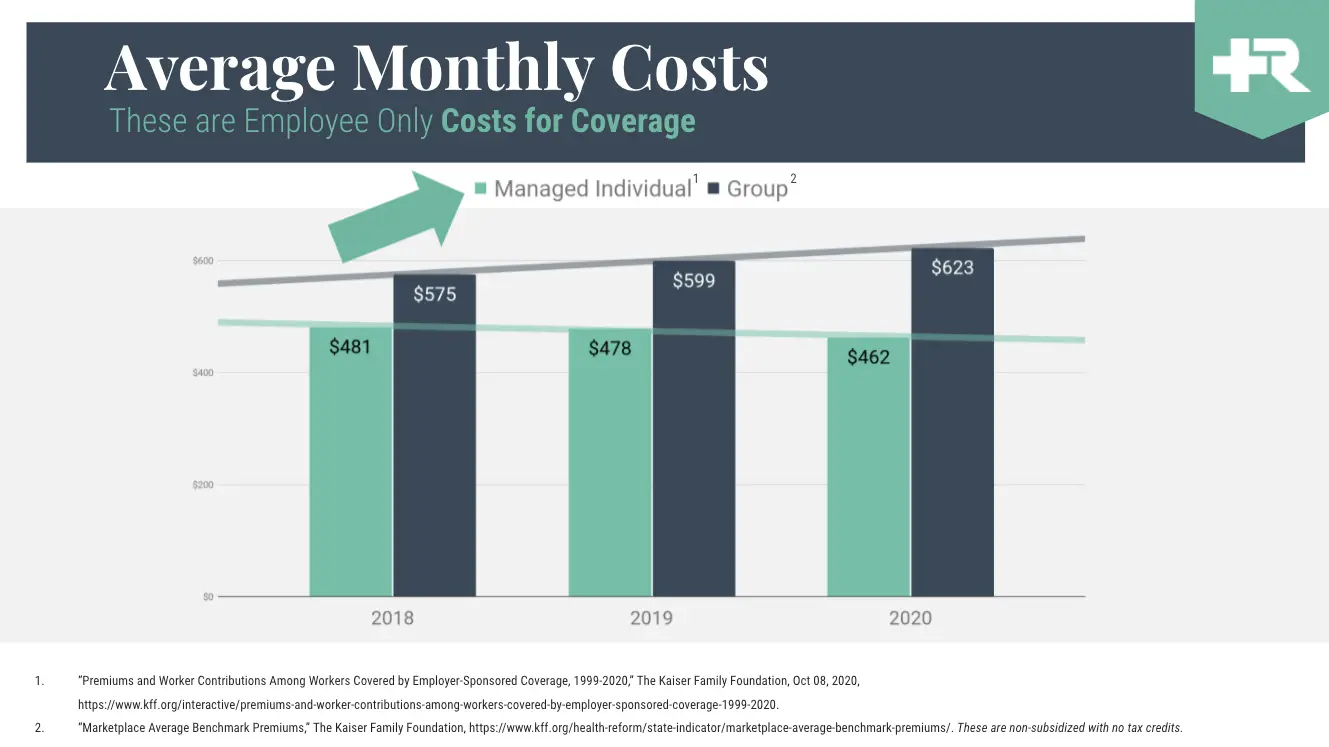

Average employer-provided health insurance costs haveincreased modestly in recent periods. The KFF 2019 survey found that theaverage single premium increased by 4 percent, and theaverage family premium increased by 5 percent over theprevious year.

However, a long-term view of employer-sponsored healthinsurance costs reveals a larger change in the costs over time. According tothe KFF report, the average premium for employer-sponsored family healthcoverage increased 22 percent over the last five yearsand 54 percent over the last ten years.

Although average premium costs have risen over the pastseveral years, employer-provided health insurance may often be a more affordable option than individual healthinsurance coverage.

Source:Kaiser Family Foundation 2019 Employer Health Benefits Survey

Factors That Determine Your Employer Health Insurance Costs

Many factors go into determining a business health insurance cost. Employers must take these factors into account when researching different employee health plans.

Average Employee Age: An older workforce will command higher premiums. This is simply because younger people are less likely to make a significant claim for healthcare costs.

Location: Healthcare costs differ by state, as does the general cost of living. However, geographical healthcare costs cannot be determined by the general health of a town, city, or states population.

Tobacco Usage: In most states, insurers can add tobacco surcharges for those employees who smoke. There are just a few states that outright ban tobacco surcharges on employer health insurance plans.

Family Size: When family plans are offered, employer health care costs rise as insurers are permitted to increase premiums based on family size. The larger your family, the more youll pay under these plans.

Under the terms of the Affordable Care Act , insurers are not able to factor in the medical histories of enrollees, gender, medical claims history, or the industry the business operates in.

Don’t Miss: Who Qualifies For Health Insurance Subsidies

Additional Details On The Employer Mandate

Employers with 50 or more full-time and/or FTE employees must offer affordable/minimum value medical coverage to their full-time employees and their dependents up to the end of the month in which they turn age 26, or they may be subject to penalties. The amount of the penalty depends on whether or not the employer offers coverage to at least 95% of its full-time employees and their dependents.

Employers must treat all employees who average 30 hours a week as full-time employees.

Dependents include children up to age 26, excluding stepchildren and foster children. At least one medical plan option must offer coverage for children through the end of the month in which they reach age 26. Spouses are not considered dependents in the legislation, so employers are not required to offer coverage to spouses.

Assume each employer has 1,000 full-time employees who work at least 30 hours per week.

The regulations allow various calculation methods for determining full-time equivalent status. Because these calculations can be complex, employers should consult with their legal counsel.

Here are some considerations to help determine how part-time and seasonal employees equate to full-time and FTE employees.

U.S.-issued expatriate plans meet the employer mandate.

Effective July 16, 2014, the employer mandate no longer applies to insured plans issued in the U.S. territories . A territory may enact a comparable provision under its own law.

How You Can Control Group Health Insurance Costs

The cost of providing health insurance to employees depends on the following factors:

- The insurance carrier

- The type of plan you choose

- The network of providers in a plan

- Plan features: deductibles, copays, out-of-pocket maximums

- Your location

- Your contribution amount

- The demographics of your employees .

Recommended Reading: How Much Do You Pay For Health Insurance

How Much Do Health Benefits Cost Employers

Health insurance costs vary widely but the average annual premiums for employer-sponsored coverage in 2020 were $7,470 for single coverage and $21,342 for family coverage. When you take into account the average contributions by workers, that brings the employer costs to $6,227 and $15,754 respectively.

Health Reimbursement Arrangements Are Another Way To Control Costs

Instead of purchasing a group health insurance policy and paying premiums set by the insurance company, an alternative strategy is to use a health reimbursement arrangement to reimburse employees for premiums and out-of-pocket medical expenses. With this strategy:

- The employer sets an annual or monthly allowance they will agree to reimburse employees for medical costs.

- Employees purchase their own health insurance plan on a private exchange or the health insurance marketplace. A key advantage is they get to choose a plan from a provider of their choice that has the features they need most.

- As employees pay premiums and associated medical costs, the employer reimburses the employee up to their allowance balance.

For example, a young employee might opt for a higher deductible plan to eliminate or minimize out-of-pocket spending on premiums, while an older employee might choose a plan with a lower deductible and maximum out-of-pocket maximum. Learn why individual health insurance is more affordable than group health insurance.

The cost savings from providing health benefits with a reimbursement strategy can be significant. First, the employer is in control of the amount they spend. The cost of the health benefit is the amount of reimbursement they choose to offer and can afford.

Don’t Miss: How Much Is Health Insurance Usually

Employee Health Insurance: How Much Should The Employer Pay

Health insurance is a benefit most full-time employees expect, but businesses struggle to find the right balance between cost and benefit.

By: Sean Peek, CO Contributor

There are several ways that small businesses can offer employee health insurance benefits in an affordable manner.

Health insurance is a standard benefit that many full-time employees expect from their employers. However, for many businesses, this often means devising the best way to offer this benefit while keeping costs as low as possible.

Reports have indicated that 2018 employer health insurance costs are up 5% from 2017, so its crucial to find a plan that not only works for your employees, but for your businesss long-term health as well.

If youre looking to provide health insurance to your employees, or you want to change your existing offering, its important to understand the various plans and costs associated with the process.

How Much Do Employees Pay For Health Insurance

There are a couple of factors that will influence how much an employee pays for health insurance. The first is what type of insurance coverage theyre getting. Single insurance policies will obviously cost less, while family plans will represent a larger expense on both the employer and employee.

On average, 82 percent of single-person insurance policy premiums are employer covered. That number drops to 71 percent for family plans. Of course, each business will have a different plan and set up.

This means youll end up paying 18 percent of your total premiums, or 29 percent under a family plan. You can use a paystub generator to better visualize how these deductions work. This may be necessary if you are self-employed, as a paystub showing deductions is an important financial document.

The average amount that the employer puts into health insurance will also depend on the size of the business. Larger companies usually have more money and can benefit from group discounts, leading to higher contributions.

Smaller and less wealthy organizations, like non-profits, wont be able to contribute as much. As a result, employees at those organizations will likely pay more each paycheck. In some cases, you may not even have access to an employer-funded health insurance plan.

You May Like: What Is The Self Employed Health Insurance Deduction

Employer Shared Responsibility Payment

Certain businesses with 50 or more full-time and full-time equivalent employees that don’t offer insurance that meets certain minimum standards may be subject to the payment. Learn more about the Employer Shared Responsibility Payment from the IRS.

IMPORTANT: No small employer, generally those with fewer than 50 full-time and full-time equivalent employees, is subject to the Employer Shared Responsibility Payment, regardless of whether they offer health insurance to their employees.

Small Employers Contribute Significantly Less To Family Coverage

While large employers contribute a significant amount to employees healthcare, small employers tell a different side of the story. 27% of covered workers in small firms are in a plan where the employer pays the entire premium for single coverage, compared to only 4% of covered workers in large firms. Similarly, 28% of covered workers are in a plan where they must contribute more than half of the premium for family coverage, compared to 4% of covered workers in large firms.

A likely reason for this is that small businesses simply cant afford to make the kind of contributions larger employers can. After all, even a 50% contribution may be more than whats available in a small employers benefits budget.

Considering that only 48% of firms with three to nine workers offer coverage compared to virtually all firms with 1,000 or more workers that offer coverage, small employers may also feel that they dont have enough employees to make investing in health benefits worth it at all. in order to offer a health benefit at all.

Read Also: Does Aarp Offer Health Insurance

Organizational Performance And Profitability

Perhaps the most important impact of health insurance is its effect on firms productivity and profitability, although these effects were not directly tested. Similarly, no studies compared the quality or ability of workers employed by firms providing health insurance with workers at firms that did not offer insurance. However, the evidence that firms offering health insurance paid their workers higher wages than did those not offering health benefits suggests that insured workers may be more productive than uninsured workers. A complementary explanation is that workers with health insurance also received a wage premium, or an efficiency wage.

Some analysts make a similar argument with regard to pensions and productivity: The strength and durability of the wage/pension relationship across different data sets and empirical procedures support the view that pensions enhance productivity . More remains to be learned about how health insurance fits into a compensation structure that enhances work effort. However, the fact that firms making a wide range of investments in workers typically start with health insurance suggests that health coverage comes to mind first when employers consider making human capital investments in their workforce.

The Importance Of Affordable Employer

Understanding the average cost of employer-sponsored health insurance can help small business owners explore coverage options for themselves, their families, and their employees.

According to an of small business owners, the top two most important factors for small employers when choosing a group health plan are affordable monthly premiums and out-of-pocket costs.

Source: eHealth 2018 Small Business Health Insurance Report

Recommended Reading: How To Understand Health Insurance Plans

Annual Poll Of Employers By Kaiser Family Foundation Finds Premiums Rose 5% For Family Plans Its The Cost Of Buying An Economy Car

For an individual employer plan, the average total premium cost was 4% higher than last year.

The average total cost of employer-provided health coverage passed $20,000 for a family plan this year, according to a new survey, a landmark that will likely resonate politically as health care has become an early focus of the presidential campaign.

Annual premiums rose 5% to hit $20,576 for an employer-provided family plan in 2019, according to the yearly poll of employers by the nonprofit Kaiser Family Foundation. On average, employers bore 71% of that cost, while employees paid the rest.

Its a milestone, said Drew Altman, chief executive of the foundation. Its the cost of buying an economy car, just buying it every year.

Employees costs rose at an even faster clipthe average annual amount workers paid toward premiums for the family plans grew 8%, to $6,015 this year. The average deductible for single coverage, which employees pay out of their pockets before insurance kicks in, went up as well, to $1,655, though that didnt factor in plans with no deductible at all.

For an individual employer plan, the average total premium cost was $7,188 in the 2019 survey, or 4% higher than last year.

Elkay, which makes products including sinks and faucets, and does interior design work, tries to keep workers share of health costs at roughly 20%, with the company bearing the rest, Ms. Partington said.

If our costs go up, theirs is going to go up in that same proportion.

Related

How Can I Lower My Companys Health Insurance Costs

If youre like most employers, the high cost of insurance premiums is a big concern. You may be wondering if theres anything you can do to help control your expenses. Fortunately, there are some strategies that can lead to lower costs:

- Encourage those 65 and older to enroll in Medicare. By having qualified workers secure Medicare coverage, it will lower the average age of your group.

- Increase deductibles. To lower your premiums, shifting more costs to employees by raising deductibles can lower the employer portion of health insurance costs.

Also Check: How To Get State Health Insurance In Ct

What Can You Contribute To Health Insurance Premiums

These numbers are averages there will be many employers who pay less than this, but plenty who pay more.

When making these decisions, be sure to check the average contribution your local peers are making to their employees health insurance premiums. Because youll be competing for the same talent pool, youll want to be sure your benefits are on par with other companies in your geographic area.

Do Employers Have To Cover Family Members

With a group insurance plan, employers usually offer coverage to legal spouses and dependent children.

The ACA requires you to provide dependent coverage to age 26. If you do not, you might have to pay a penalty. You can choose to cover dependents over 26 years old, but you are not required to.

Employers are not obligated to pay premiums for dependents. However, you can contribute towards premiums for dependents. Or, you can require employees to pay the full premium cost for dependents.

You are not required to cover your employees spouses. Some companies decline coverage when a spouse can receive insurance from their own employer. Or, they might charge the employee more to cover the spouse.

According to the Kaiser Family Foundation, most small businesses pay part of their employees family plans. Compared to single plans, small employers usually pay the same amount or more:

- 45% provide the same dollar contribution for single and family plans

- 45% make a higher dollar contribution for family plans than single plans

- 3% vary their approach with the class of the employee

- 7% take a different approach

On average, small businesses contribute more to single coverage but less for family coverage than large companies do. Employees of small firms pay $1,021 for single coverage vs. the large firm cost of $1,176. Small firm employees pay $6,597 for family coverage vs. the large firm cost of $4,719.

Also Check: How Much Does It Cost For Health Insurance