Health Insurance Premium Tax Credit

The Health Insurance Premium Tax Credit is a tax credit for a participating health insurance company that enrolls qualified small businesses who were not previously covered by health insurance. The credit amount is passed on to the small business in the form of reduced premiums. The credit is based on the total of $1,000 per year for single coverage and $3,000 per year for family coverage or 50% of the annual premium, whichever is less.

Breakdown Of Health Insurance Costs In Arizona

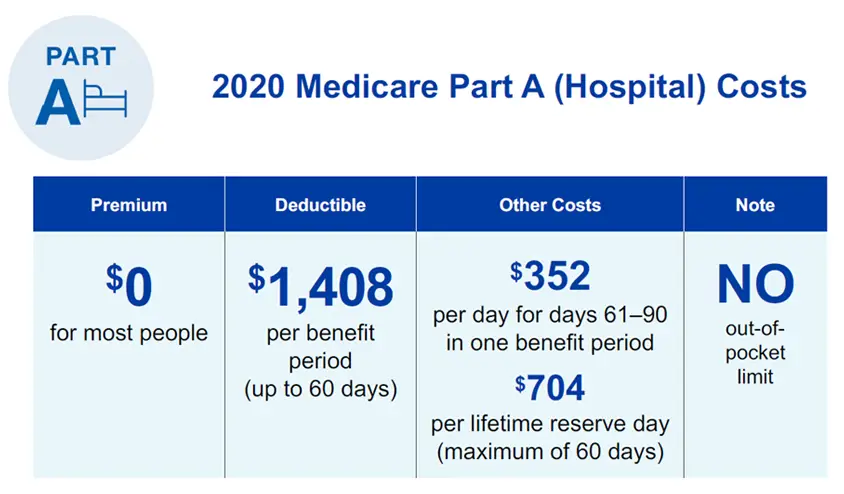

You may have heard the term “premium” when it comes to health insurance. A premium is the amount of money you pay monthly to have health insurance coverage. Whether you use your insurance or not, this money is never returned to you. Another familiar term is “deductible.” This is the additional money you are required to pay to any healthcare providers before your insurance company starts to make their promised contributions for any medical costs.

Keep in mind that deductibles are different from out-of-pocket costs. A deductible is an annual financial responsibility but out-of-pocket refers to how much you have to spend before your insurance company will pay 100% of your bill.

Deductibles and out-of-pocket costs typically reset each year, with the previous year’s expenses having no impact moving forward. So if you have a deductible of $5,000, for example, and you spent $3,000 out-of-pocket last year and your insurance renews with the sample plan in place, your out-of-pocket expenses are reset to $0 and that $3,000 from last year does not roll over. However, some plans in Arizona offer an exception to this rule and allow a rollover of your paid deductible amount from the previous year into the first quarter of the new insurance year.

Making The Decision Thats Right For You

Temporary short-term health plans are readily available to Arizona residents, allowing you to customize plans to fit your budget and health during the period youll need this gap coverage.

Most policies have supplemental health insurance or dental and vision insurance you can add on, giving you more complete coverage while you wait for permanent individual health insurance.

Take your time, read everything you can about any policy youre considering so you have a full understanding of what the plan will cover.

Don’t Miss: Starbucks Partner Health Insurance

Cheapest Health Insurance Plan By County

The lowest-cost health plan and its price will vary based on the region you live in. For instance, you would pay $218 per month less for the Blue AdvanceHealth Silver – Neighborhood Network health plan if you live in Santa Cruz County than you would as a resident of La Paz County. To help you find the best health insurance plan where you live, we identified the cheapest Silver policies in each county below.

| County name |

|---|

Ambetter From Arizona Complete Health

Ambetter plans from Arizona Complete Health give you a handful of plan options for cheap health insurance. The company also offers plenty of additional benefits if you enroll in an Ambetter plan. The My Health Pays rewards program allows you to earn cash for future purchases or services by making healthy choices. Your rewards can be redeemed for doctors visit copays, put toward your deductible, and even used to pay your monthly utility bills.

Recommended Reading: Does Starbucks Have Health Insurance

Change In Average Health Insurance Cost For 2022

From 2021 to 2022, health insurance rates across the nation increased by less than 1%. South Dakota saw the largest year-over-year jump in health insurance costs for a 40-year old on a silver plan increasing just over 23%. Including South Dakota, 27 states had their rates increase on average from 2021 to 2022.

Year-over-year rates decreased the most in Georgia, South Carolina and Nebraska, which all fell by more than 10% . Overall, 21 states experienced a decrease in health insurance premiums. Two states Idaho and Virginia saw no year-over-year change.

| State |

|---|

Policy premiums are for a 40-year-old applicant on a silver plan.

Average Health Insurance Cost By Age

Age plays a big role in the cost of a premium for health insurance generally, younger people have lower premiums, as they are seen as less risky and less likely to require more medical care.

Often, the starting point for an insurance rate is based on that of an individual who is 21 years old. According to ValuePenguin, the average health insurance premium for a 21-year-old was $200 per month. This is also an average for a Silver insurance plan — below Gold and Platinum plans, but above Bronze plans.

How does the breakdown of premiums by age look? Slowly in small increments, the average premium will increase. Ages 21-24 were all consistent at $200, but at 25 the premium goes up to $201 — about 1.004 x $200.

Slowly the amount it goes up increases. At 26 the average premium is 1.024 times the base premium, up to $205. By the age of 30, though, it has gone up for an average premium to $227, or 1.135 x $200.

Going through the list of ages, this pattern is pretty consistent. The average premium for a policyholder at 35 years is $244, 1.222 times the base rate at 40, it’s 1.278 times that rate to bring the average premium up to $256.

From here, though, the premiums start going up at higher rates. The average health insurance premium for a policyholder at 45 is $289, up to 1.444 times the base rate, and by 50, it’s up to $357, which comes out to 1.786 x $200.

Recommended Reading: How Long After Quitting Job Health Insurance

Cheapesthmohealth Insurance Plan In Arizona

There are several types of plans available for health coverage. Your medical needs and preferences will determine the appropriate plan for you.

HMO or Health Maintenance Organization plans are the most common type of health insurance in Arizona. These tend to be more affordable than other plan types. Its a good option if you can easily reach in-network providers since you must stay within your provider network to ensure the services are covered.

The cheapest HMO Silver plan in Arizona is Blue AdvanceHealth Silver – PimaFocus Network provided by Blue Cross Blue Shield of Arizona, costing an average of $330 per month.

Types Of Health Coverage

Before you look into your coverage options, its important to know the common terms youll see when shopping for health insurance.

- Deductible: Your deductible is the amount of money you have to pay for medical services before your insurance starts to pay. Deductibles usually reset each year, so youll have to pay the deductible every year youre enrolled in the plan.

- Coinsurance: The percentage of medical services you have to cover out of pocket. For example, you see your doctor and have a 20% coinsurance. You pay 20% of the visit bill and your insurance pays the remaining 80% if youve met your deductible.

- Copayment: Like coinsurance, a copayment is an amount you have to pay for medical services. Instead of a percentage of the cost of a service, however, a copayment is a fixed price for specific services. A doctors office visit, for example, may have a $20 copayment.

- Provider network: Your health insurance provider will contract with certain doctors and health care facilities, known as the provider network. You often receive a lower cost when you visit a doctor within your network.

- Out-of-pocket limit: This is the maximum amount of money youll pay out of pocket for medical services covered by your insurance plan. Your out-of-pocket limit doesnt include the cost of your monthly premiums.

Most health insurance plans fall into 2 types of coverage:

Don’t Miss: How Long Do Health Benefits Last After Quitting

Arizona Kidscare Childrens Health Insurance Program

If you have uninsured children in your household who dont qualify for Medicaid, they could receive low-cost health insurance through Arizonas KidsCare program.

Income and household size determine eligibility. If you have a family of four, for example, you must earn no more than $53,004. If approved, youll pay up to $50 a month for one child or up to $70 per month regardless of the number of children.

Whether You Use Tobacco

If you use tobacco, you will pay a premium that is up to 50% more than what non-tobacco users pay.

Here are some questions to think about as you compare plans:

- How high a premium can you afford to pay each month?

- How often do you visit the doctor or need other medical services? Try and add up the copayments you would need to pay for those appointments each month. Can you afford those?

- Do you like your current doctors? Which types of health coverage do they accept? Are you willing to switch doctors to save money?

- Are you okay with having a primary care physician who refers you to specialists when you need them? Or do you prefer being able to set up appointments with specialists on your own?

- Are you comfortable with having a deductible for hospital care, outpatient surgery, and emergency room services?

Each family has a different situation, and the right answers for you will depend on your specific needs. For example, if you know you will have to go to the doctor a lot, you may want to make sure that you dont have high copayments. Or, if you hardly ever go to the doctor, you may prefer to have a lower premium.

Don’t Miss: Kroger Part Time Health Insurance

What If You Need Extra Coverage

If you dont have enough money socked away for a rainy day ,5 one accident could wipe out your savings and leave you in serious debt.

Thats when you might opt to buy supplemental insurance for accidents and illnesses to ease your mind. For less than $30 a month, you can supplement your short-term health insurance policy with a plan that pays a flat cash rate if you suffer an unexpected accident or are diagnosed with a critical illness.6 Some plans also include hospitalization coverage. The money received from a qualified claim can be used for medical bills or other needs like paying the mortgage or child care. The check is yours to use as you see fit.

Employee Health Insurance Premiums

If you work for a large company, health insurance might cost as much as a new car, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. Kaiser found that average annual premiums for family coverage were $21,342 in 2020, which was nearly identical to the base manufacturer’s suggested retail price of a 2022 Honda Civic$22,715.

Workers contributed an average of $5,588 toward the annual cost, which means employers picked up 73% of the premium bill. For a single worker in 2020, the average premium was $7,470. Of that, workers paid $1,243, or 17%.

Kaiser included health maintenance organizations , PPOs, point-of-service plans , and high-deductible health plans with savings options in arriving at the average premium figures. It found that PPOs were the most common plan type, insuring 47% of covered employees. HDHP/SOs covered 31% of insured workers.

| Average Employee Premiums in 2020 |

|---|

| Employee Share |

| $104 |

Of course, whatever employers spend on their workers’ health insurance leaves less money for wages and salaries. So workers are actually shouldering more of their premiums than these numbers show. In fact, one reason wages may not have risen much over the past two decades is because health costs have risen so much.

Which type of plan employees choose affects their premiums, deductibles, choice of healthcare providers and hospitals, and whether they can have a health savings account , among many choices.

Also Check: Which Statement Is Not True Regarding Underwriting Group Health Insurance

The Cheapest Health Insurance In Arizona With High Out

If youre young and dont need a lot of medical care, getting a low-cost plan with a high out-of-pocket maximum can be a cheap health insurance option in Arizona. In a situation where you need medical attention, you may pay more out of pocket, but the savings come from the low monthly premium.

MoneyGeek looked at plans with out-of-pocket maximums of $8,250 and above, finding the cheapest policy to be Blue SimpleHealth – PimaFocus Network. Blue Cross Blue Shield of Arizona offers this plan to 26-year-old buyers for a premium of $197 per month.

Blue Cross Blue Shield of Arizona

Based on MoneyGeeks assessment, Blue Cross Blue Shield of Arizona offers the cheapest health insurance plan in Arizona with high out-of-pocket maximums. It is a Catastrophic plan, however, and is not available for everyone.

To qualify for a Catastrophic plan, you either have to be below 30 or have a hardship or affordability exemption. These plan types are an inexpensive way to ensure you have protection for worst-case scenarios such as getting severely sick or injured, but youll have to pay for routine medical expenses yourself.

Accident And Critical Illness Insurance

Accidental injuries and critical illness happen when you least expect them. Those unexpected expenses can strain any budget. Accident insurance5 and critical illness insurance,5 underwritten by Golden Rule Insurance Company, can help by paying cash benefits for covered injuries or illnesses.

Recommended Reading: Health Insurance For Substitute Teachers

Carousel Content With Slides

A carousel is a rotating set of images, rotation stops on keyboard focus on carousel tab controls or hovering the mouse pointer over images. Use the tabs or the previous and next buttons to change the displayed slide.

*For some plans

Healthcare is essential. Ambetter can help.

You can count on us to share helpful information about COVID, how to prevent it, and recognize its symptoms. Because protecting peoples health is why were here, and its what well always do.

Statistical claims and the #1 Marketplace Insurance statement are in reference to national on-exchange marketplace membership and based on national Ambetter data in conjunction with findings from 2019 Issuer Level Enrollment Data from CMS, 2019 State-Level Public Use File from CMS, 2019 Covered California Active Member Profile data, state insurance regulatory filings, and public financial filings.

What Is The Difference Between Bronze Silver And Gold Marketplace Plans

All three plan types cover all of your essential healthcare needs. The difference is the ratio of premium cost vs. out-of-pocket costs . Bronze plans generally have lower premiums, but higher OOP if you need a lot of care. Gold plans have high premiums that help limit OOP. Silver plans provide the best value for most people, in terms of premium costs vs. OOP – especially if you qualify for financial assistance which will further lower your premiums.

You May Like: Part Time Starbucks Benefits

The Cheapest Health Insurance In Arizona By Age And Metal Tier

Aside from the plans tier, insurance carriers consider other factors when setting premiums. When you enroll in a health care plan, your age can have a major impact on the cost of health insurance in Arizona.

There is an average $600+ difference in price between HMO plans for 26-year-olds and 60-year-olds. A Silver plan for a 26-year-old buyer costs $404 per month on average. In comparison, a 60-year-old buyer pays an average of $1,070 per month for a policy in the same metal tier.

Health Insurance Costs in Arizona by Age and Metal Tier

The cost of health insurance in Arizona is directly proportional to your age, meaning premiums are likely to be higher when youre older. Getting a plan from lower tiers such as Bronze or Expanded Bronze may result in a lower monthly premium, but you may end up spending more because of these plans high deductibles.

These plan prices are only based on sample profiles. They dont use information specific to you such as your income and exact age. They also dont account for tax premiums or other programs for which older people may be eligible, making their premiums more affordable. The best way to get an exact quote is to apply for a plan.

You can use the table below to switch between the buyers age and metal tiers. In addition, you can read MoneyGeeks guide on health insurance in Arizona to help you decide which metal tier you prefer.

Cheapest Health Insurance in Arizona by Age And Metal Tier

Sort by Metal Tier:

How Much Does Health Insurance Cost Per Month In Each State

The national average health insurance premium for a benchmark plan in 2021 is $452, according to the Kaiser Family Foundation. A benchmark plan is the average premium for each states second lowest cost silver plan.

The following data reflects the national average, and each states average, but does not include any reduction in cost from subsidies. Rates will vary by area.

Don’t Miss: Insusiance

Average Health Insurance Costs

With so many different variables impacting how much health insurance will cost a person on a monthly or yearly basis, were better off breaking things down instead of giving one general number.

So what are some of the biggest factors in determining how health insurance costs can vary? Certainly, the type of plan someone has and the tier of the plan she has to go a long way. Medical history not to mention whether the person is a smoker can play a role in whether insurers give a higher rate. Someone in need of insurance for a family is going to have a higher premium than someone seeking an individual plan.

Two factors that can also play a large role in healthcare rates and premiums is how old someone is and where he lives.

Benefits Of Health Insurance

Having health insurance has many benefits. It protects you and your family from financial losses in the same way that home or car insurance does. Even if you are in good health, you never know when you might have an accident or get sick. A trip to the hospital can be much more costly than you might expect. Consider these facts:

- The average cost of a trip to the emergency room for an adult is about $700, not including any tests or hospitalization, which may increase the bill to well over $1,000.1

- A broken leg can cost up to $7,500.

- Average costs for childbirth are up to $8,800 and well over $10,000 for C-section delivery.1,2

- The total cost of a hip replacement can run a whopping $32,000.

- These examples sound scary, but the good news is that, with the right plan, you can protect yourself from most of these and other types of medical bills.

Recommended Reading: Starbucks Health Coverage