Employer Cobra Notification Requirements

The federal COBRA law requires employers to maintain a timeline of notifications. Employers have a total of 44 days from the date of the qualifying event to notify the employee of their right to COBRA benefits. Specifically, employers must notify the group health plan administrator within 30 days of the employees termination or reduction in hours. After that notification, the employer has 14 days to give the employee the option to continue the current health insurance plan.

Dont Miss: Trustage Reviews

If My Employer Does Not Provide Health Insurance Benefits Or If I Am Working Only Part

Yes. Several programs are available for people without insurance in California.

Medi-Cal is Californias joint federal-state Medicaid program that provides free or low-cost health coverage. In general non-elderly adults with household income up to 138 percent of Federal Poverty Level , pregnant women with household income up to 213 percent of FPL, and children from birth through age 18 with household income up to 266 percent of FPL qualify for Medi-Cal. You can also get Medi-Cal if you fall within certain categories. To see if you are eligible for Medi-Cal, contact the Department of Health Care Services.

Childrens Health Insurance Program may provide health coverage to children in families that do not qualify for Medicaid. Similarly, Medi-Cal Access Program may provide health coverage to pregnant women with household income more than 213 percent of FPL.

Covered California Health Exchange is the California agency offering subsidized health insurance plans in accordance with the Affordable Care Act . Covered California helps individuals and families obtain health coverage that includes the minimum essential benefits required by Obamacare. If your household income is at or below 400 percent of FPL, Covered California may qualify you for subsidized plans with reduced premiums. If your household income is between 138 percent and 250 percent of FPL, Covered California may qualify you for extra discounts that reduce their cost for medical services .

New Requirement For Large Employers

As a result of the ACA, in 2016, large employers will have to pay a penalty if they do not offer health coverage or offer coverage to fewer than 95% of their full-time employees and their dependent children, and have at least one full-time employee receive a tax credit to purchase coverage in the Health Insurance Marketplace.

In addition, if a large employer does not offer coverage to full-time employees that is considered to be adequate and affordable, and at least one full-time employee receives a tax credit to purchase coverage in the Health Insurance Marketplace, the employer must pay a penalty. Only employees who dont have an offer of coverage considered to be adequate and affordable, and who meet certain income requirements, will be eligible for financial help to buy a plan in the Health Insurance Marketplace.

Learn more about large employer requirements at www.healthcare.gov.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

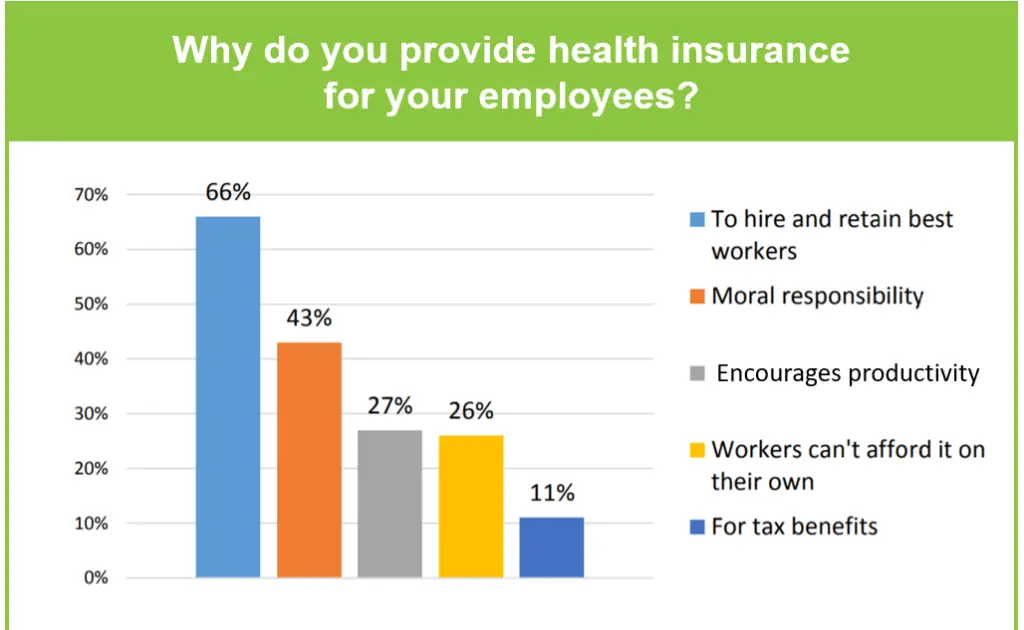

To Offer Or Not To Offer

Do employers have to offer health insurance? No, but in order to attract and retain top talent for your business, its highly recommended that you do so.

The fact is that many employers already offered health insurance long before the ACA because of how popular it was among working Americans.

Healthcare has become a requirement for many job seekers. With the current generation of workers showing that theyre more than willing to switch jobs to get the benefits they need, business owners need to carefully consider whether not offering healthcare plans is the best move for their organizations. If you want to prioritize employee health at your workplace and want to learn more about how Eden Health can deliver healthcare to your workforce, contact a member of our team.

Contact An Experienced Employment Law Attorney Today

If you believe that your employer has failed to provide required health coverage due to discrimination, your employment classification, or because an employment contract guaranteed you this right, an experienced employment law attorney can help. Legal issues surrounding employee benefits constitute an extremely complex, and constantly evolving area of law, and it is in your best interest to obtain legal counsel if you believe your rights have been violated in any way.

Read Also: Do Starbucks Employees Get Health Insurance

Minimum Medical Loss Ratio

The medical loss ratio is the percentage of premium dollars that a health insurer spends on health care costs and quality improvement. The ACA sets a minimum amount for the MLR.

For large group plans, the MLR must equal at least 85 percent of premiums. Taxes and fees are deducted before making this calculation. The MLR must be at least 80 percent for small group plans and individual plans. Some states have higher MLR minimums.

To calculate the MLR, we first place policyholders into pools. Theres a pool for each insurance market in a state and for each legal entity that issues coverage. We calculate an MLR for each pool. We dont calculate MLR separately for each customer or group.

If we dont meet the minimum MLR for any pool, we send out rebates. Fully insured medical plans are eligible for rebates. Self-insured plans are not. Most plans dont get rebates.

If a rebate is due for a given year, youll receive a notice on or before September 30 of the following year. In most cases, we send the rebate check to the employer. For individual policies, we send the rebate to the person who bought the health plan.

The federal government set guidelines that employers are required to follow when using rebate dollars.

How Do I Purchase Group Health Insurance For My Small Business

There are various means by which a small business employer can shop for group health coverage. Some of those include:

- Agent/Broker: There are two types of agents/brokers – those that can only sell for one carrier and those that can sell for multiple carriers . A captive agent can only provide quotes for plans sold by the carrier they represent. Independent agents can provide multiple quotes from multiple carriers. Various factors can determine which agent would be best for your group.

- SHOP: The Small Business Health Options Program was created in conjunction with the Affordable Care Act and provides an online medium for small business owners to search for and purchase group health insurance. You can visit for further information on the SHOP and/or to search for and purchase group health coverage.

- Carrier: Insurance carriers maintain websites through which, typically, you can search for and purchase their health insurance products. Some carriers will allow you to conduct the quoting and enrollment process online however, some may require you to call the carrier directly. An enrollment/eligibility specialist will then assist you through the process of purchasing a health insurance product.

Before purchasing, interview several licensed insurance agents who specialize in serving the health insurance needs of small businesses.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Savings For Your Employees

The amount that your employees contribute towards health insurance premiums can be paid from their pre-tax income allowing tax savings by reducing their taxable income. Additionally, obtaining insurance through the Marketplace can be costly. Offering your employees health insurance through your company will help them save more money in the long run.

Consumer Expectations Have Evolved

We no longer accept one-size-fits-all solutions in other areas of our lives, so why should healthcare be any different? Consumer needs and perspectives on health insurance coverage vary widely across many dimensions, including generational differences.

As a father of four, including a son who has newly entered the workforce, I have seen first-hand how differently younger generations think about their insurance plan options and experiences.

Younger generations have only lived a digital age and therefore have high expectations for flexibility, convenience, and personalization. They are generally in good health, so they are far less likely to be dealing with chronic conditions, specialized physicians and treatments, or high-cost prescriptions. Many are single and have not yet started families, which simplifies their considerations when choosing coverage. Younger generations are great adopters and proficient users of technology, and are therefore likely to be more receptive to change, and are at the forefront of adopting new technologies and experiences.

Its inevitable that demands for more personalization in healthcare will reach a tipping point and employer plans will either have to evolve to deliver these experiences, or consumers may take matters into their own hands, re-evaluating where they get their healthcare coverage.

Also Check: Can I Buy Dental Insurance Without Health Insurance

You May Like: Starbucks Health Insurance Plan

How We Got To Now

Interested in learning more about healthcare in America and how we got to where we are today? Download our eBook, The History of Employer-Sponsored Healthcare. Here, we discuss the on-going debate regarding the impact of the ACA’s employer mandate. It also takes you through a quick look at the historical timeline of employer-sponsored healthcare, providing context for the state of American healthcare as it exists today.

Do you offer family health insurance to your workforce? How do you handle premium differentials and/or surcharges? Leave us a comment below or contact us. Wed love to help you find solutions that work for everyone!

Does My Employer Have To Provide Health Insurance

Prefer to listen? Play the audio version of this article and follow along!

A common question among employees is does my employer have to provide health insurance? The answer? Not necessarily. The health care reform law, called the Affordable Care Act , requires certain employers to purchase health insurance or else pay a tax penalty.

Don’t Miss: Starbucks Partner Health Insurance

Offers Of Coverage By Non

For employers that are not applicable large employers under the ACA, determining whether an intern or temporary worker should receive an offer of coverage requires reviewing the terms of the plan document. What are your eligibility provisions? Do the interns or temporary workers meet those eligibility requirements? Are there any exclusions for temporary or seasonal workers? The answers to these questions should generally allow a non-ALE to determine eligibility under its plan for interns and temporary workers.

Summary Of Benefits And Coverage Disclosure Rules

Employers must provide employees with a standard “Summary of Benefits and Coverage” form explaining what their health plan covers and what it costs. The purpose of the SBC is to help employees understand their health insurance options. You could face a penalty for non-compliance. Learn more about SBCs and see a sample completed form.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Not All Employers Are Required To Provide Health Insurance

Employers arenât necessarily required to provide health insurance in the United States if they classify as a smaller business. The requirements fall in line with the number of employees a business has, and some state laws might change the requirements, depending on where you live.

Dr. Kate Tulenko, a health workforce expert at Corvus Health, explains why employers are not required to provide health insurance for their employees

âThe Affordable Care Act does require large employers to provide health insurance to 95% of their workers or pay a fine. The health insurance provided must meet certain affordability requirements and must cover a minimum set of essential services. Whether individuals have to pay a penalty if they do not have health insurance depends on their state of residence and is in flux due to lawsuits challenging the ACAâ.

Does An Employer Have To Offer Health Insurance To All Employees

There are no government laws expecting plans to give a similar advantage inclusion to all workers. Likewise with most other intentional advantages, managers are allowed to offer medical coverage to specific gatherings of workers and not others. For instance, managers can offer medical coverage just to full-time workers, just to representatives in certain occupation positions, just to salaried workers, or just to representatives with higher rank. Nonetheless, bunches must be founded on a real business based characterization, and all likewise arranged workers in a specific gathering must be dealt with the equivalent.

Don’t Miss: Do Part Time Starbucks Employees Get Benefits

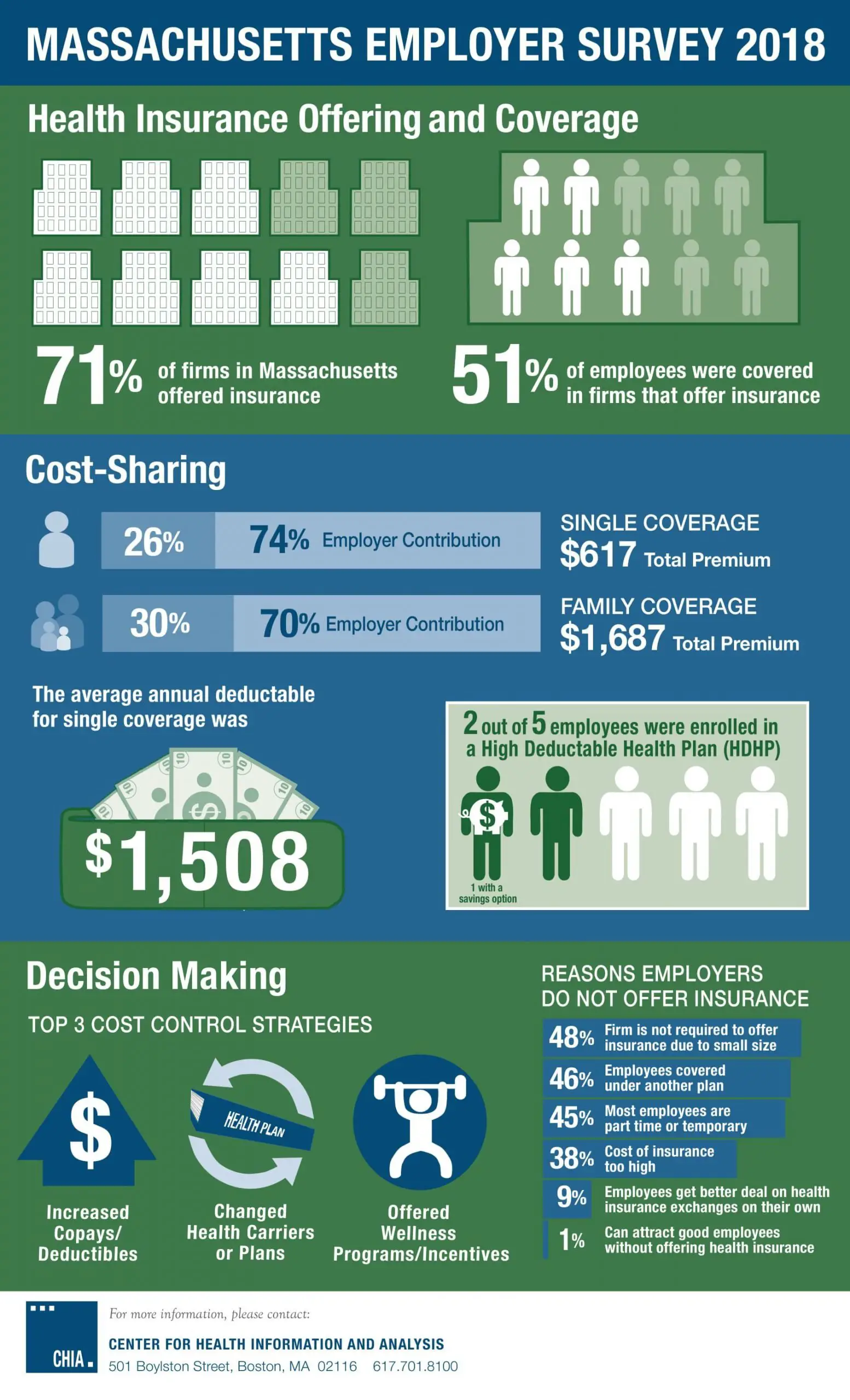

Financial Benefits For Employers That Offer Health Insurance

Not only do you make your employees happier by offering health insurance, but it benefits you as personally too. First, you can add yourself to the group plan and make sure youre covered .

In addition, tax credits and deductions can make offering health insurance even more of a win. The Small Business Help Options Program allows for tax credits up to 50% of the contributions paid towards your employee premiums, depending on the size of your company. And, in certain cases, you can deduct health insurance premiums that you pay as the business owner. You should talk to a tax attorney or financial advisor to see if youre eligible for any savings.

Last but not least, you can withhold insurance premiums as pre-tax deductions, lowering your employees taxable income and the related FICA taxes that you both have to pay. Its a win-win!

Employers Required To Offer Health Insurance

Beginning Jan. 1, 2014, employers with 50 employees or more will be required to provide health insurance coverage to full-time employees or face paying a penalty. The requirement does not apply to employers with fewer than 50 employees. The annual penalty for not offering coverage is $2,000 for every full-time employee beyond the first 30.

Employers that offer coverage to employees may also be subject to penalties if any of their employees choose to buy coverage through the local health insurance exchange instead of participating in the employer’s plan. These employers will be required to pay a $3,000 penalty annually for each of their employees who opt for coverage through the health insurance exchange and receive a premium tax credit for doing so. However, employers will not be subject to penalties if the coverage they offer pays for at least 60% of covered health care expenses for a typical population and employees do not have to pay more than 9.5% of their household income for the coverage. For more information about who can purchase insurance through an exchange and who qualifies for a premium credit, click here. Employers will not be penalized for any employee insured through a spouses employer, Medicaid, or Medicare.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Is Health Insurance Mandatory In 2020 In California

Effective January 1, 2020, a new state law requires California residents to maintain qualifying health insurance throughout the year. This requirement applies to each resident, their spouse or domestic partner, and their dependents. Get information about financial help to lower the cost of qualifying health insurance.

Employer Sponsored Health Insurance Is Not Required

To be clear, the Affordable Care Act , does not require employers to provide health insurance for their employees. However, there can be penalties for businesses with 50 or more full-time or full-time-equivalent employees who dont offer affordable health insurance coverage to employees. There is NO PENALTY for businesses with under 50 full-time-equivalent employees who do not offer health insurance coverage.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

If You Have Fewer Than 50 Full Time Equivalents As An Employer You Do Notneed To Offer Group Health Insurance

Before you breath a sign of relief, lets at some reasons why you may WANT tooffer health insurance to employees if under 50.

The vast majority of companies that offer group health benefits do so notbecause they have to.

They see the benefit in doing so and there are tricks to keep the costs down.

Before we get into the requirements for 50+ employee companies, lets look atthe key reasons most companies offer coverage.

Its tax deductible!

This is a huge advantage to group health coverage. The employer can write offthe premiums paid.

With a POP 125, employees can pay with pre-tax money for their share and theemployer can save on payroll tax.

You can generally cannot deduct employer contribution towards an employeesindividual health plans.

In fact, there can be huge penalties from the IRS for doing so.

$100/day/employee up to $36,500 per year.

Its definitely a message from the IRS that they mean business.

You May Like: Whats The Penalty For Not Having Health Insurance In California

Small Businesses And The Affordable Care Act

If you are a small business owner considering whether to purchase health insurance for your employees, here is a summary of considerations as they pertain to the Affordable Care Act:

- The ACA established the SHOP marketplace, allowing small employers a way to cost-effectively offer coverage to their employees.

- If you offer health insurance to employees, it must be offered to all employees similarly situated when they become eligible.

- You must provide a summary of benefits and coverage form describing the health plan, what it covers, and what it costs.

- You may choose to offer flexible spending accounts , but employees cannot contribute more than a limited amount.

- The ACA offers additional incentives for workplace wellness programs, which can reduce costs by up to 30%.

- Once you have more than 50 FTE employees, you will be subject to employer shared responsibility payments if you dont offer health insurance.

- If you provide self-insured health coverage, you must file an annual return with the IRS, reporting information for each covered employee. If you offer coverage through an insurance policy, the policy issuer will file the return.

- You may qualify for the small business health care tax credit if you cover at least 50% of premium costs for your employees, have fewer than 25 FTE employees, meet certain wage payment requirements, and purchase the coverage through the SHOP marketplace.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees