New York Individual Health Insurance Plans Overview

You can purchase health insurance in New York through the NY State of Health marketplace. Health insurance in New York is one of the most heavily regulated in the United States. While the federal Affordable Care Act limits how insurers can price their policies, New York’s regulations are even more restrictive.

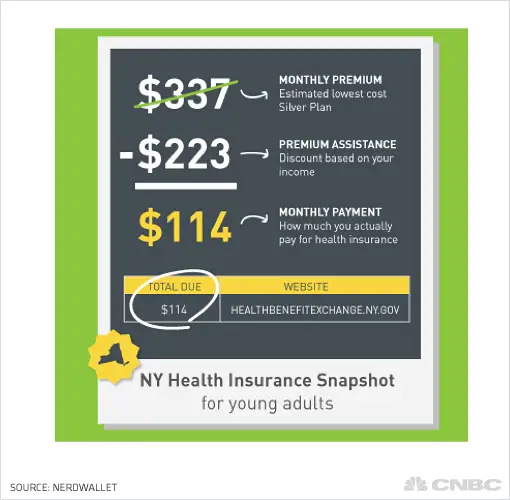

For both individual plans and small-business plans, all consumers living in a specific location pay the same price for health insurance. This means younger New York residents pay more for health coverage than they would in other states, while older residents pay less than they would in other states.

Open enrollment in New York begins Nov. 1 and continues through Jan. 31.

If you are a first-time buyer, then you can purchase a health insurance plan once enrollment opens, while people who are renewing a plan can do so beginning Nov. 16. If you buy a health plan before Dec. 15, then your effective coverage will begin Jan. 1. New York’s exchange portal also lists brokers who can provide guidance and help you enroll in a health plan.

Unitedhealthcare Senior Care Options Plan

UnitedHealthcare SCO is a Coordinated Care plan with a Medicare contract and a contract with the Commonwealth of Massachusetts Medicaid program. Enrollment in the plan depends on the plans contract renewal with Medicare. This plan is a voluntary program that is available to anyone 65 and older who qualifies for MassHealth Standard and Original Medicare. If you have MassHealth Standard, but you do not qualify for Original Medicare, you may still be eligible to enroll in our MassHealth Senior Care Option plan and receive all of your MassHealth benefits through our SCO program.

How Do I Get Health Insurance

Health insurance gives you better access to medical services, can improve your health, and protects you from paying high out of pocket costs if you get sick. New York State has a health insurance marketplace where you can shop for both public and private health plans called the NY State of Health, or NYSOH. You also have the option to purchase off-marketplace plans offered by various insurance companies. These plans are all subject to the Affordable Care Act rules of minimum essential coverage and other ACA protections. Some important things to consider when choosing a plan are your eligibility, the services and benefits offered by the plan, and the cost of the plan.

Below is a list of health insurance programs offered in New York State. Click on the program to find out more information about your health plan options. If you need assistance choosing a health plan that works best for you, please contact CHA at 888-614-5400.

Also Check: Is Health Insurance Required In Indiana

Other Ways To Get Health Insurance In New York

Most New Yorkers who arent eligible for Medicare or Medicaid get health insurance through their employer. Employer-sponsored health insurance is usually the most affordable health insurance option, too.

However, besides an employer or the ACA marketplace, there are other ways to get health insurance coverage

- An individual health plan outside of the ACA marketplace. These plans provide additional options to ones found on the marketplace, but they arent eligible for subsidies. If you qualify for subsidies, you may stay with an ACA marketplace plan.

- Catastrophic health insurance is available to people under 30 and those eligible for a hardship exemption. Catastrophic health plans have low premiums and provide similar coverage found in a standard health plan. However, these plans also have high out-of-pocket costs. Catastrophic plans can have individual deductibles up to $8,550 in New York. Members have to pay that amount out of pocket for health care before the plan begins kicking in money to help pay for health care services. The plan picks up all costs once you reach that level. Find out more about catastrophic health plans in New York.

Still not sure about health insurance eligibility? Check out Insurance.coms Health Plan Findertool to explore your health insurance eligibility.

Cobra Coverage For Freelancers

As mentioned, you will qualify for Special Enrollment if you leave your job and need to get individual coverage. But if youâd like to keep your employer-sponsored plan, you may be able to use COBRA.

COBRA, which stands for Consolidated Omnibus Budget Reconciliation Act, is a program that allows employees to keep their employer-sponsored health insurance plan when they leave their job, whether voluntary or not. It works by converting a group plan to an individual plan. Your employerâs insurance provider should be able to advise you on your eligibility and the cost of COBRA coverage.

The major note with COBRA coverage is that itâs expensive. Your employer usually subsidizes health coverage for you, which means the cost you pay isnât the full cost of a plan. If you elect to use COBRA coverage, you will need to pay the full price of the plan, plus a 2% administrative fee. This will end up costing you hundreds of additional dollars per month, so it may only be viable as a short-term option.

Even if you like your employerâs insurance plan, make sure to compare the full cost of COBRA coverage with the cost of other plans in the marketplace. Talk to your employerâs insurance provider to learn more about how much COBRA coverage would cost. Soon after you leave a job, you should also receive a letter from the insurer explaining how the COBRA plan works and exactly how much the monthly premium is.

Also Check: How To Enroll In Health Insurance

Signing Up For Coverage Today Doesn’t Mean Your Coverage Will Be Effective Immediately Here’s What You Need To Know To Get Coverage In Place Asap

What are your options for buying a health plan in the individual health insurance market today, tomorrow, or at any other point during the year?

- Health insurance & health reform authority

- Open enrollment for 2022 health coverage begins November 1, 2021, and will continue until January 15 in most states.

- Consumers in most states can buy short-term coverage at any time during the year and coverage can be effective within days often by the next business day.

- If you have a qualifying event or are Native American, you can buy ACA-compliant coverage today, but probably will have to wait until at least the start of next month before the coverage is in force. A new year-round special enrollment period has also been added for households that are subsidy-eligible and have income up to 150% of the poverty level.

- People with modest incomes in New York, Minnesota, Massachusetts, and Connecticut can enroll in health programs year-round.

The mere fact that youre reading this article suggests that you need to buy health insurance coverage soon. So what are your options for buying a health plan in the individual health insurance market today, tomorrow, or at any other point during the year?

What Metal Tier Of Health Insurance Should I Purchase

The best metal tier of health insurance will depend on your health, insurance needs, age and family situation. Generally, younger and healthier individuals will not require a higher metal tier such as Gold or Platinum since they will not use the insurance as frequently.

On the other, families with children may want to consider Silver health insurance as this policy will have considerably more coinsurance benefits compared to Bronze or Catastrophic. Individuals with monthly drug prescriptions or personalized health care will want to consider a Gold plan or higher since these provide the most benefits. Read more

You May Like: How To Apply For Health Insurance In Wisconsin

Find Cheap Health Insurance Quotes In Your Area

Health insurance premiums have risen dramatically over the past decade. In the past, insurers would price your health insurance based on any number of factors, but after the Affordable Care Act, the number of variables that impact your health insurance costs decreased significantly.

In 2021, the average cost of individual health insurance for a 40-year-old across all metal tiers of coverage is $495. This represents a decrease of close to 2% from the 2020 plan year.

Health Plans By State

Cigna offers Individual and Family Health Insurance Plans in AZ, CO, FL, IL, KS, MO, NC, TN, UT, and VA.

Select your state to see the plans we offer.

Loading…

1 Cigna provides access to virtual care through a national telehealth provider, MDLive located on myCigna, as part of your health plan. Providers are solely responsible for any treatment provided to their patients. Video chat may not be available in all areas or with all providers. This service is separate from your health plans network and may not be available in all areas or under all plan types. $0 virtual care benefit not available for all plans in AZ and CO. Some plans may apply a copay, coinsurance or deductible. Virtual care does not guarantee that a prescription will be written. Refer to plan documents for complete description of virtual care services and costs, including other telehealth/telemedicine benefits. A primary care provider referral is not required for this service.

2 Plans may vary. Includes eligible in-network preventive care services. Some preventive care services may not be covered, including most immunizations for travel. Reference plan documents for a list of covered and non-covered preventive care service.

3 Referrals are required for residents of Illinois.

5 Discounts available with the Cigna Patient Assurance Program. $25 is the maximum out-of-pocket cost for a 30-day supply of covered, eligible insulin.

- I want to…

Also Check: How To Sign Up For Aarp Health Insurance

Option : Buy Through An Online Health Insurance Brokerage

Online health insurance brokeragealso called private enrollment websites or private exchangesoffers to help you compare health insurance plans or get the best available plan based on the information you give them. Comparison shopping is smart, but consumers should understand that these sites will not show them every plan in the market that meets their requirements.

Instead, these private exchanges will show a selection of plans that will earn them a commission if the consumer enrolls. They may display more prominently or provide more information on the plans that earn the brokerage a higher commission.

These marketing incentives dont necessarily mean the plans these sites offer arent good plans. It just means consumers should be aware that they might not be getting a complete picture of their options when they visit one of these sites.

Private enrollment websites may ask you for personal information that the federal and state marketplaces do not. They may ask about your height, weight, and pre-existing conditionsfactors that can affect your eligibility for plans that dont comply with the Affordable Care Act. Your personal information may also be used by the company behind the website you give it to as well as their business partners to market other products to you.

As with buying a policy directly from a health insurance company, you cannot get premium tax credits if you buy your health insurance policy through a private exchange.

Finding The Best Health Insurance Coverage In New York

The best health insurance policy for your family will depend on the availability of plans in your area, as well as your medical and financial situation. When deciding on the right type of plan, you should determine affordability by reviewing the premiums and deductibles for each metal tier. Generally, if you have an emergency savings account and don’t expect to have significant health or medical expenses, then a lower metal tier plan with more affordable premiums would make more financial sense.

Gold and Platinum plans: Best if you expect high medical costs

Gold and Platinum plans are the highest tier health insurance policies available in New York. These plans often have the most expensive monthly premiums but come with lower deductibles and out-of-pocket maximums.

For example, if you frequently use expensive prescription drugs, an upper-tier health plan could be the right choice.

Silver plans: Best for people with low income or average medical costs

Silver plans are middle-ground policies that fall between Gold and Bronze plans with regard to premiums and out-of-pocket expenses. We would recommend a Silver plan in most situations â but if you are very healthy, Bronze may be best in terms of cost-effectiveness.

On the other hand, if you expect a lot of medical expenses, then a Gold plan may better fit your needs.

Bronze and Catastrophic plans: Best for young, healthy individuals

You May Like: Can I Have Two Health Insurance

Cobra Extension For Young Adults In New York

Children who turn 26 typically are no longer eligible to stay on their parents plan. However, New York allows parents to extend that coverage until the age of 29.

The state law is meant to help young adults who dont have access to their own employer-sponsored health insurance. Children until the age of 29 can get coverage on a parents employers plan either through two options:

- Young adult option — Employees or their eligible children can select this option and pay an additional premium, which must be within 100% of the plans single premium rate. This option allows an adult child to stay on a parents health insurance until 29 without paying for COBRA coverage, which is more expensive.

- Make available option — This coverage happens when an employer allows parents to extend coverage for children under standard family coverage until the age of 29.

Check with your employer to find out more about these options.

What Plans Are Available

New York State of Health plans are organized into four categories:

- Bronze plans have the lowest monthly premiums and the highest deductibles and copays and cover roughly 60 percent of care costs. Theyre designed to help you in case of serious illness or injury.

- Silver plans have moderate monthly premiums, deductibles and copays and cover roughly 70 percent of care costs. Theyre the only plans eligible for cost-sharing subsidies.

- Gold plans have higher monthly premiums and lower deductibles and copays and cover roughly 80 percent of care costs.

- Platinum plans have the highest monthly premiums and the lowest deductibles and copays and cover roughly 90 percent of care costs. These are for people who have significant health care needs and are willing to pay the highest premiums.

New York State of Healths comparison tool allows you to estimate costs and benefits of various plans and check whether you might qualify for financial assistance.

Recommended Reading: How To Get Temporary Health Insurance

Who Shops On The Marketplace

If you and your family don’t have health insurance coverage through your job, you can choose a health plan from the Marketplace and pay for it on your own. If you are self-employed or unemployed, the Marketplace is a place to go for health coverage. If your employer offers health insurance coverage, you can still shop the Marketplace, but you will pay full price for your plan. Everyone who shops the health insurance Marketplace must be a U.S. citizen and live in the United States. If you qualify for Medicare, you are not eligible to shop the Marketplace. People who are incarcerated are also not eligible.

Short Term Medical Insurance Stm

Due to recent changes in the law, these plans are now able to be purchased for 36 months at a time in many states.

STM plans are low-cost alternatives to the expensive ACA options. They are 100% real health insurance with large PPO networks. There are many benefit levels available to suit all budgets. While these plans do not cover pre-existing conditions and typically offer very little in the way of prescription coverage, they provide maximum premium savings.

Recommended Reading: How To Get Health Insurance As A Real Estate Agent

Average Cost Of Health Insurance In Ny

The average individual on a private health insurance plan pays around $440 each month for coverage. The average family plan holder pays around $1,168 per month. However, the specific amount youll pay depends on a number of factors, including your location, the people on your plan and your deductible.

What Kinds Of Health Insurance Plans Are Available On The Marketplace

There are four levels of health plans that you can buy on the Marketplace: Bronze, Silver, Gold, and Platinum. Each level pays a different portion of your health care bills.

You will also pay a portion of your health care expenses through your monthly premium, copays, deductible, and coinsurance. The amount you pay depends on your plan.

The right plan to choose will depend on many factors, which vary from one person to another.

Read Also: How To Get Health Insurance At 19

What About Healthcare Cost Sharing Ministries

A health care sharing ministry is an organization that facilitates sharing of health care costs among individual and families who have common ethical or religious beliefs. A health care sharing ministry is not actual insurance, is not regulated by the Department of Insurance, does not use actuaries, does not accept the risk or make guarantees, and does not purchase reinsurance policies on behalf of its members.

While members of these plans are exempt from paying the tax penalty for not having health insurance, there is still a significant risk to these plans. Because these plans are not actual insurance and because of the significant risk we do not endorse these plans.

Age 29 Rider Coverage Expansion

Under the Affordable Care Act, young adults can be covered under their parents’ health insurance plans up to the age of 27. Because of the way insurance is priced in New York, it is preferable for young adults to stay on their parents’ plans until the legal age limit, since the additional cost is at most 70%â85% of the parents’ health plan premium.

For example, say your young adult child has passed the age of 27 but does not have a job or sustainable income to pay for their own insurance. In this case, you could pay a small extra premium along with your normal health insurance rate that would allow your coverage to support your son or daughter. To qualify, the young adult must:

- Be unmarried.

- Not be insured or eligible for insurance through their employer.

- Live, work or reside in New York state or the insurance carrier’s coverage area.

Don’t Miss: Is It Required For Employers To Offer Health Insurance