Why Do I Need Insurance

No one plans to get sick or hurt, but illnesses and injuries can happen at any time. In some cases, they can be devastating to your health and leave you with overwhelming medical bills. Health insurance limits your risk of having to pay for very expensive illnesses and injuries by covering medical care and other services, such as hospitalization and surgery.

Health insurance also helps you protect your health and well-being, primarily through coverage of preventive care services.

Best Cheap Individual Health Insurance

The best health insurance companies offer exceptional customer service, seamless claims processing, great provider choices, flexible care options and affordable premiums. They are also reputable, exude financial strength and have a proven track record of success.

Here are Benzingas top picks for providers with the best individual coverage:

# of Healthcare Providers

Average Cost Of Health Insurance For A Single Male

The average cost of health insurance for men in 2020 was $438 per month without a subsidy, per eHealth data. Note that this research focuses on those who buy insurance through the marketplace.

The premium you pay for health insurance will also depend on the type of plan you select. Consider options like HMO vs. PPO when you make your choice.

Recommended Reading: Does Health Insurance Cover Breast Pumps

The Qualified Small Employer Hra

With a QSEHRA, employees purchase their own health insurance and get reimbursed for medical expenses, health insurance premiums, and other qualified costs with tax-free dollars by their company. To qualify, a company must have fewer than 50 full-time employees and cant offer a group health insurance policy to any employee.

Factors That Impact Health Insurance Rates

For a particular health insurance plan, the cost of coverage is determined by certain factors that have been set by law. States can limit the degree to which these factors impact your rates for instance, some states like California and New York don’t allow the cost of health insurance to differ based on tobacco use.

- Age: The health care cost per person covered by a policy will be set according to their age, with rates increasing as the individual gets older. Children up to the age of 14 will cost a flat rate to add to a health plan, but premiums typically increase annually beginning at age 15.

- Where you live: Health insurance companies determine the set of policies offered and the cost of coverage based on the state and county you live in. So a resident of Miami-Dade County in Florida, for instance, may pay lower rates for the same policy than a resident of Jackson County.

- Smoking/tobacco use: If you smoke, you could pay up to 50% higher rates for health insurance, though the maximum increase is determined by the state.

- Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each person’s age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

Recommended Reading: When Does New Health Insurance Start

How Do I Get Health Insurance On My Own

Individual policies

If your employer does not offer health insurance, or if the insurance offered does not meet your needs, you may want to purchase an individual policy.

Depending on your circumstances, you may be able to take advantage of subsidized health insurance through New Hampshire’s Federally Facilitated Health Insurance Marketplace. Learn more at www.healthcare.gov. To help you understand your estimated costs through the marketplace, Learn more

You can purchase an individual policy directly from a health insurance company. Learn more about health insurance companies serving New Hampshire.

For individual policies, you pay the entire premium. There are many plan designs with different costs, such as deductibles, co-payment, and co-insurance cost. The services covered also vary, so you will want to shop around to see what is available and ask questions about exclusions, limitations, and premiums to find the best fit for your health needs. Learn more.

Government health programs

If you are 65 or older, disabled, or have certain diseases, you may qualify for Medicare health benefits Learn more.

If you are low income or disabled, you may qualify for care and services through one or more Medicaid programs. Learn more at or call 800-852-3345, ext. 4344 or 603-271-4344.

How Much Does An Individual Health Insurance Policy Cost

While the cost of individual health insurance has increased by 123 percent for single coverage since 2008 , individual health insurance remains more affordable on average than group coverage through a company.

According to data gathered by AARP, the average health insurance cost for single coverage premiums in 2020 is $388 per month. For family coverage, the cost for premiums in 2018 is $1,520 per month.

Don’t Miss: Does Farmers Insurance Sell Health Insurance

How To Find An Affordable Plan That Meets Your Needs

Among eHealth customers who bought ACA individual health insurance, more than 75% chose Bronze or Silver plans. Your state may host an exchange for comparing and purchasing ACA plans or it may use the federal exchange at Healthcare.gov. Keep in mind, you arent limited to the exchange.

The licensed insurance brokers at eHealth can help you find the best health plan to meet your health coverage needs and your budget. They will listen to your priorities in health coverage and use their expertise to match your needs with health insurance options both on and off the exchange.

Average Cost Of Health Insurance In Florida For One Person

With so many different variables affecting how much medical insurance will cost an individual on a monthly or yearly basis, we are better off breaking things down instead of giving one general number.

So, what are some of the biggest factors in determining how health insurance costs can differ? Definitely, the type of health insurance plan someone has and the plans tier has to go a long way. Medical history not to mention whether the individual is a smoker can play a role in whether insurers give a higher rate. Someone in need of a family health insurance will have a higher premium than someone seeking an individual plan.

Two factors that can also play a significant role in healthcare rates and premiums are how old someone is and where they live.

Read Also: What Health Insurance Is Available In Nc

Types Of Individual Insurance Plans

There are several variations of individual health insurance plans you should be aware of.

HMO: Health maintenance organization plans are more affordable for consumers, and you may be able to receive preventive services without meeting your deductible. But with lower costs come drawbacks. You are obligated to choose in-network providers for services to be covered. These doctors, specialists and facilities are contracted with your provider to serve you at a reduced rate. Also, you wont have the luxury of seeing specialists without a referral from your primary care physician. And if you decide to venture outside of the network, you may be on the hook for 100% of the costs.

PPO: Preferred provider organization plans allow you to use both in-network and out-of-network providers. While the latter will cause you to incur increased out-of-pocket costs, a percentage of the services may be covered under your plan. Unlike HMO plans, you will not be required to choose a PCP provider, but you may be required to meet a deductible before coverage kicks in.

EPO: Exclusive provider organization plans only offer in-network benefits. This means you are only permitted to use select providers and hospitals to be eligible for coverage. If you receive care outside the network, you will be responsible for 100% of the costs incurred for services.

Total Out Of Pocket Costs

What people do see is their out-of-pocket expenses. Changes to supplemental insurance programs over the past years have impacted deductible rates as well as items covered.

Pre-existing conditions can also play a big part in how much you pay for health care. Your condition may prevent you from being able to get supplemental coverage. Most often, however, it means there are exclusions in your health plan or higher deductibles. Both of these mean higher costs to you.

Recommended Reading: How To Understand Health Insurance Plans

How Much Does Private Health Insurance Cost

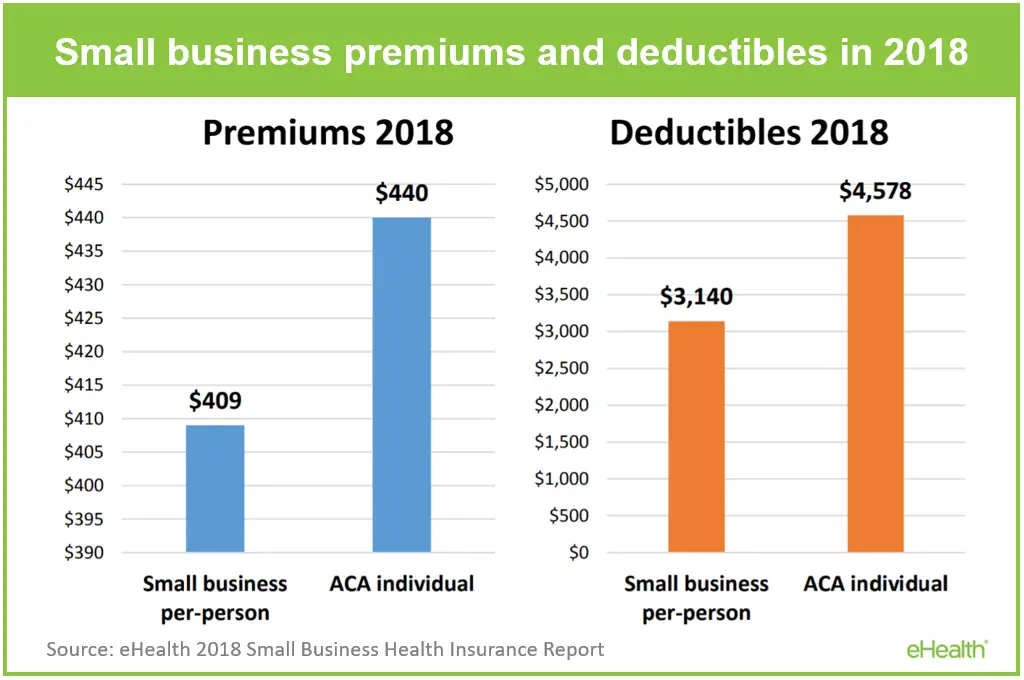

While many people are scared by the prospect of purchasing their own insurance versus enrolling in an employer-sponsored plan, some studies have shown that it can end up being more affordable than employer-sponsored plans.

A study from the Kaiser Family Foundation found that the average monthly premium for an employer-sponsored insurance plan for individual coverage in 2019 was $603. It was $1,725 for family coverage.

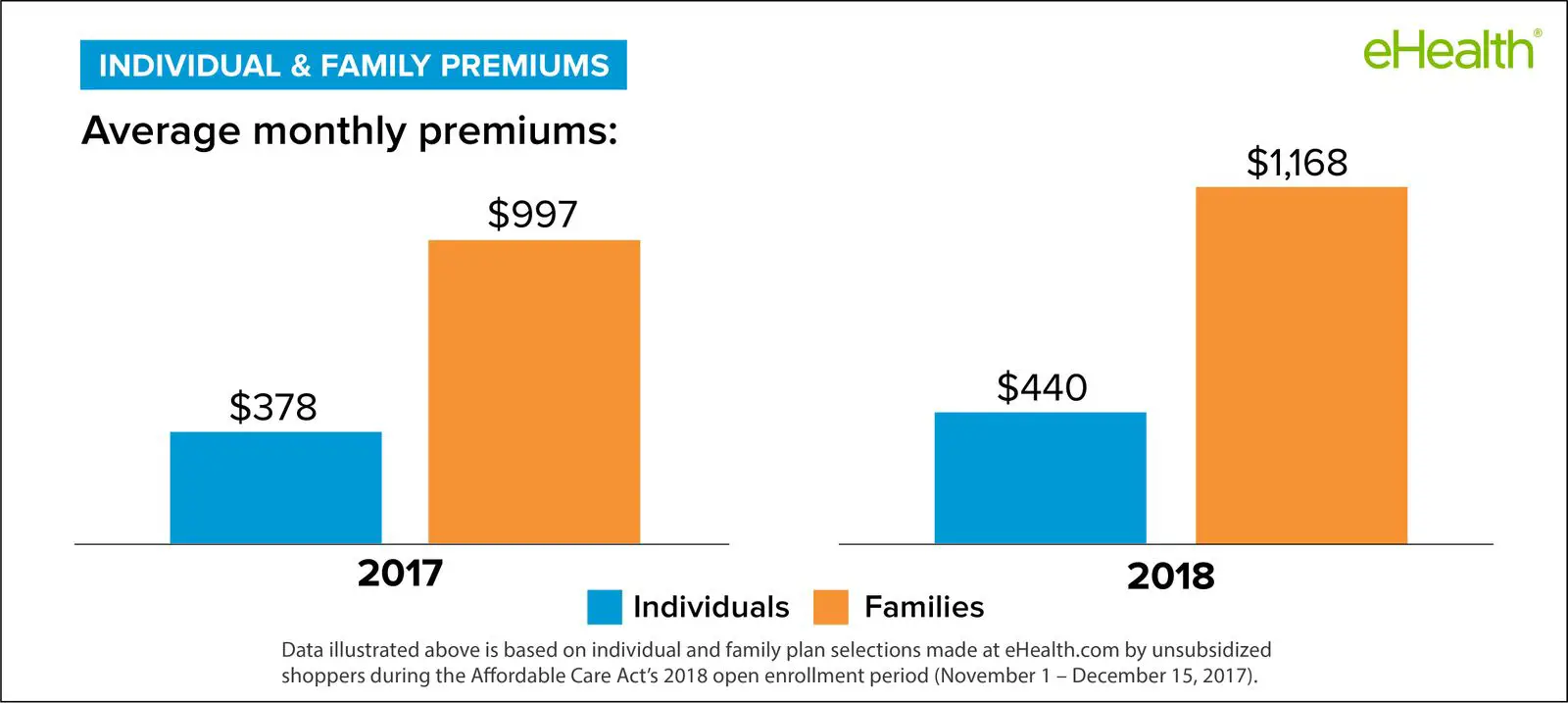

Conversely, according to the Kaiser Family Foundation, if you were to purchase your own insurance outside of an employer-sponsored plan, the average cost of individual health insurance was $440. For families, the average monthly premium was $1,168.

In addition, if you end up purchasing coverage through the Health Insurance Marketplace, you may qualify for a Cost-Sharing Reduction subsidy and Advanced Premium Tax Credits. These can lower the amount you pay for premiums, as well as lowering your deductible, and any co-payments and co-insurance you are responsible for.

Best For Customer Service: Cigna

Cigna was ranked as a top health insurance provider in the J.D. Power 2019 Customer Satisfaction Study. It offers individual plans for every budget. And its provider network is vast, so youll receive phenomenal service in all 10 states they serve.

Youll also have access to its health and wellness knowledge center. So you wont have to spend hours sifting through tons of websites to find the information youre looking for. You can also call Cignas customer service hotline 24/7 to get answers to your most pressing questions.

# of Healthcare Providers

Recommended Reading: Will Health Insurance Cover A Breast Reduction

Digging Deeper For Pricing Information

For more details, we consulted the 2020 Health Insurance Exchange Premium Landscape Issue Brief linked to the bottom of the press release. It reveals that 27-year-olds buying silver plans will see their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”

In fact, the benchmark plan premium for a 27-year-old in 2020 is a whopping $723 in Wyoming. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Mexicos 2020 benchmark plan premium for a 27-year-old is the lowest in the nation at $282.

All of these numbers only apply to the 38 states whose residents buy plans through the federal exchange at Healthcare.gov. Residents of California, Colorado, Connecticut, Idaho, Maryland, Massachusetts, Minnesota, Nevada, New York, Rhode Island, Vermont, Washington, and Washington, D.C. buy insurance through their state’s exchange.

Best For Provider Choice: Blue Cross Blue Shield

Blue Cross Blue Shield is a top provider of individual health insurance plans nationwide. It has been around since 1929 and insures 1 in 3 Americans.

In 2019, several commercial plans from Blue Cross Blue Shield were honored by J.D. Power for provider choice and customer satisfaction. It also ranked highly for benefits and coverage.

Beyond the high-quality benefits it offers policyholders, its vast provider network helps it stand out among the competition. You will find providers for a range of medical services in every state around the nation.

Also Check: How To Get State Health Insurance In Ct

Components Of Administrative Costs

The main components of administrative costs in the U.S. health care system include BIR costs and hospital or physician practice administration.4 The first category, BIR costs, is part of the administrative overhead that is baked into consumers insurance premiums and providers reimbursements. It includes the overhead costs for the health insurance industry and providers costs for claims submission, claims reconciliation, and payment processing. The health care system also requires administration beyond BIR activities, including medical record-keeping hospital management initiatives that monitor and improve care quality and programs to combat fraud and abuse.

To date, few studies have estimated the systemwide cost of health care administration extending beyond BIR activities. In a 2003 article in The New England Journal of Medicine, researchers Steffie Woolhandler, Terry Campbell, and David Himmelstein concluded that overall administrative costs in 1999 amounted to 31 percent of total health care expenditures or $294 billion5roughly $569 billion today when adjusted for medical care inflation.6 A more recent paper by Woolhandler and Himmelstein, which looked at 2017 spending levels, placed the total cost of administration at $1.1 trillion.7

Average Cost Of Health Insurance

One of the primary factors in your individual health insurance costs is your location, as prices will vary depending on the state and county where you live. In this first table, we look at health insurance premiums for 2021 and how they differ based upon the state you reside in.

| State |

|---|

Policy premiums are for a 40-year-old applicant.

Don’t Miss: How To Become A Health Insurance Broker In California

What Is The Average Cost Of Non

What do you pay if your income exceeds the 400% FPL ? The average national monthly non-subsidized health insurance premium for one person on a benchmark plan is $462 per month, or $199 with a subsidy. Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. Actual cost varies based on your age, location, and health plan selection,

Take a closer look. In a recent eHealth ACA Index report, we tracked costs and shopping trends among ACA plan enrollees who bought non-subsidized health insurance at ehealth.com during the nationwide open enrollment period for 2020 coverage.

Why Do Us Health Insurance Costs Keep Going Up

The cost of US health insurance has almost doubled in a decade, as the table shows:

| 2010 |

|---|

| $5,588 |

Whats behind this trend is the subject of debate some argue government programmes, such as Medicare and Medicaid , have relieved providers of pressure to keep insurance affordable.

However, its likely that some factors driving up the cost of healthcare in the USA may be similar to those in other countries, including population ageing and an increase in chronic illness. Check out how much medical treatment can cost abroad.

At the same time, a shift towards high-deductible health plans is increasing the out-of-pocket costs for Americans. Under such plans, families can be asked to pay for their first $14,000 of medical costs, so the impact may be greater even if their insurance package costs the same overall.

Irene Papanicolas

Visiting assistant professor in the Department of Health Policy and Management at Harvard Chan School

Also Check: Do You Have To Have Health Insurance In Florida

Factors Affecting The Cost Of Uk Private Medical Insurance

- Your age

The cost of private health care depends on two main factors: your personal circumstances and the policy options and cover levels that you choose.

We go into more detail on cover options in Best Health Insurance, but in brief your circumstances can mean how old you are, where you live, whether youre insuring just yourself or a whole family and so on.

It also includes things like your lifestyle choices – whether or not you smoke, for instance. However, even if you’ve quit smoking but use a vaporiser, your premium can still be higher than somebody who doesn’t smoke at all. This is because insurance companies usually ask about nicotine consumption rather than smoking cigarettes specifically.

Considering Public Health England found that e-cigarettes are 95% less harmful than smoking, we think this hike in premiums is unfair. For this reason, we’ve teamed up with ActiveQuote to get vapers a 10% cashback deal on their health insurance. Join our group to get a quote.

‘Cover levels’ mean the options and limits you select to cover treatments or amounts that the basic cover would not. We explore the cost of these below.

How To Shop For Private Insurance

If youre not covered through your employer, or not eligible for financial assistance through a state-funded program, you will likely have to buy private insurance for individual or family through a private health insurance provider, such as Independence Blue Cross.

You may be able to purchase a plan on the Pennsylvania Insurance Exchange , which has replaced healthcare.gov.

Start by finding out which private health insurance carriers are available in your area. Independence Blue Cross serves the Philadelphia and southeastern Pennsylvania regions . See if private health insurance plans from Independence are available in your ZIP code.

Shopping for private health insurance is much easier when you know what questions to ask. When it comes to health coverage, everyone has different needs and preferences. We can help you figure out what type of plan you want, how to find a balance of cost and coverage, and what other benefits you should consider.

Read Also: How To Be A Health Insurance Agent

Does My Us Health Insurance Cover Me Abroad

Most of the time, your domestic health insurance plan doesnt provide cover abroad, but there are some cases it will for instance, for emergencies, medical evacuations or during short trips. Contacting your provider is usually the best way to find out. Sometimes, even if your insurer will cover care in such cases, you may need to pay out-of-pocket and apply for reimbursement.