How Much Is A Typical Deductible In 2021

The average health insurance deductible is between $1,902 and $4,786 for plans purchased on the health insurance marketplace. Those who get their health insurance through an employer typically have lower deductibles, and the average deductible is $1,644 for covered workers.

However, there is a full range of possible plans with different deductible amounts. On one end, there are no-deductible health insurance plans where the cost-sharing benefits of your insurance policy begin right away. In contrast, high-deductible health plans mean that you’re responsible for a large portion of your health care costs before the insurance company contributes.

Deductibles can also vary based on the number of people in the household who are covered. In these cases, deductibles are tracked both by individual and by family. If an individual reaches their deductible, the cost-sharing benefits begin for that person only. If the family deductible is reached, cost-sharing benefits begin for everyone in the household.

Counts toward your deductible

- What you spend on copayments or coinsurance

Excluded from your out-of-pocket max

- Amount spent on monthly insurance bills

- Spending for out-of-network services or other uncovered health services

How Much Does Short

The average cost of short-term health insurance for a single person is $124 a month compared to $456 for an unsubsidized ACA-compliant plan. We found plans with very limited coverage, or coverage more suited to the concept of catastrophic plans , for as low as $60 a month. It can be confusing due to the lack of consistency in plan coverages, but it is recommended to shop and compare the options line by line.

Q: Can Your Spouse Legally Cancel You And Dependents From Health Insurance Policy

A: Yes, they can as long as it’s during open enrollment. A plan subscriber can remove anyone they want. Your spouse is not required to notify you or anyone else about who they decide not to insure.

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions.All content and services provided on or through this site are provided “as is” and “as available” for use.QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site.You expressly agree that your use of this site is at your sole risk.

You May Like: Does Health Insurance Cover Tooth Extraction

Both Spouses On One Plan

This is probably the most common choice for couples, even if both can get coverage from their employers. Since you are paying for only one plan, this could be the cheapest option. In some cases, the spouse who declines their companys coverage may even get a small financial bonus, since they are saving the company money by not taking the companys insurance.

Be sure to study each companys health plan offerings carefully. Different companies may offer very different levels of coverage and benefits. And they may differ in how much their employees must pay for their health insurance.

For example, your company may pay all or most of the cost for your own coverage, but charge you much more to add your spouse and children to your plan. Meanwhile, your spouses company may allow you to cover the whole family for less. So first, check the cost of each option.

Next, carefully compare the benefits offered by each spouses company. The company plan that is cheapest that is, that has the lowest monthly premium for the whole family may offer less coverage. The cheapest plan may have high deductibles or high copays, so if one or more member of your family has many medical problems, it could end up costing you more in the end.

Finally, be sure to check out each companys provider network. This is the list of doctors the plan will cover at the lower in-network price, meaning you pay less for your medical care.

How Do I Get Health Insurance Without A Job

If youre unemployed, you have several options for health insurance coverage. If you just recently lost your job — and also lost the health coverage associated with your employer — you may qualify for COBRA coverage that can help you keep continuous health insurance coverage. COBRA coverage allows you to keep your former employers plan, but its much more expensive.

Losing your job for any reason also qualifies you for a special enrollment period through the health insurance marketplace. This allows you to enroll for coverage at any time of the year. You usually have 60 days after you lose your coverage to enroll in marketplace coverage.

Finally, you also might qualify for free or low-cost coverage through Medicaid or the Childrens Health Insurance Program . Your household size and income determine your eligibility. Theres no enrollment period for these types of coverage — you can sign up at any time.

Read Also: What Does Health Insurance Cost In Retirement

How To Change Employer Health Insurance Plans

To make changes with an employer-based plan, you typically will have to wait for open enrollment. This time period varies by employer, so ask your human resources department for more details.

Typically, employers who start new coverage options on Jan. 1 of each year will host open enrollment during the previous fall. Open enrollment typically lasts for two to four weeks, but its important to clarify these details with your employer.

You may also qualify for a special enrollment period if you face a qualifying life event like losing other coverage, having a baby or getting married. Check with your employers benefits department to determine specifics about your companys open enrollment and special enrollment periods.

How Do We Prove We’re In A Domestic Partnership

The rules vary by state and health insurance administrators, but most companies will require you to sign a form that makes several declarations as to your relationship as a domestic partner. These declarations include things like: youve lived together for at least six months and intend to live together indefinitely, your relationship is public, and neither of you are married.

Your employer or health insurance administrator might also require you to provide documentation to prove your relationship. This could include a copy of both of your drivers licenses that show the same address, ownership of common property like a car or home, a joint bank account or credit card, and designation of each other as the primary beneficiary for life insurance.

Recommended Reading: What State Has The Cheapest Health Insurance Rates

Enroll Your New Family Member In Your Benefits

For most benefits, you must enroll your new family member within 31 days of the date they join your family or meet all the eligibility requirements. If you don’t enroll your family member during the PIE, you can enroll him or her during Open Enrollment. You may also enroll your family member in your medical plan only at any time with a 90-day waiting period.

Employees have the following options, depending on their benefits package. You can make changes through your UCPath online account.

| Benefits |

|---|

Can I Put My Girlfriend On My Health Insurance

April 1, 2015 By Rob Schwab

The short answer to this question is maybe. Whether or not you can add someone who is not your spouse to your existing health insurance depends largely on your insurance provider and the policy you hold. But there are circumstances that could help you qualify for such an addition. And with a little research, you should be able to find a way to make it happen. That said, unless you happen to work for a fairly forward thinking company that allows for the addition of partners to insurance, you might have to do a little digging to work out the details. Here are some options to consider if youre interested in adding your significant other to your health insurance policy without the aid of a legal facilitator

You should begin by speaking to your employer . Your HR representative should be able to help you determine if company policy allows for the addition of a domestic partner to your health insurance. If you are lucky enough to enjoy such an option, which is entirely at the discretion of the company you work for, you will likely have to provide some type of proof of partnership, such as a joint bill or joint ownership . If the company does not allow for this type of addition, or your health insurance isnt handled by your employer, your next step is to speak to a representative from your insurance provider.

Related

Also Check: Does Golden Rule Insurance Cover Mental Health

When Is It Best To Have A No

Health insurance with zero deductible or a low deductible is the best option if you expect to need major medical services during the coverage period. Even though these plans are usually more expensive to purchase, you could pay less overall because the insurer’s cost-sharing benefits will kick in immediately.

Changing Health Coverage Outside An Open Enrollment Period

It can be tricky to change your coverage to a spouses policy outside of the open enrollment period. Your current policys coverage period may not match up with your spouses policy coverage period and you could be refused coverage until open enrollment rolls around again.

If you are enrolled in a cafeteria plan and have had your hours reduced to 30 hours per week or less, or if youve purchased an individual health insurance plan through the federal Marketplace or state ACA exchange, among other specific instances, youre able to drop your group health insurance midyear.

Additionally, if your employer offers you a QSEHRA or an ICHRA, this triggers a special enrollment period , giving you 60 days from the time you are offered the HRA to change to your spouse’s individual insurance family plan.

Read Also: Can I Stop My Health Insurance Anytime

The Significance Of Domestic Partnership Health Insurance

Despite the fact that domestic partnership has not been recognized at the federal level thus far, the insurance industry and many individual states recognition of this lifestyle marks a significant shift in our cultural understanding of relationships in America.

Domestic partnerships have historically helped same-sex partners and families attain similar benefits to opposite-sex partners and families. Additionally, domestic partnerships existence and recognition have changed how we think about households, families, and relationships today.

Can You Get Health Insurance For Significant Other

- Asked May 6, 2014 in

Contact Jim Winkler Contact Jim Winkler by filling out the form below

Jim WinklerPROCEO/Owner, Winkler Financial Group, Houston, TexasGreat question! Unfortunately, I would need a little more information from you. Are you talking same sex partner? If so, that would depend upon whether the state you live in recognizes same sex relationships, and the providers stand on the issue. If you are talking common law partner, that also depends upon your State’s recognizing of common law marriages. If you are talking boyfriend or girlfriend, it may be wiser for them to get their own policy, and you make the payments. I hope that helps, if you would like more information, please feel free to contact me. Thanks for asking!Answered on May 6, 2014+0

Also Check: Do Employers Pay For Health Insurance

What Does Annual Deductible Mean

A health insurance deductible is the amount of money you pay out of pocket for health care services before your insurance plan starts contributing to the cost.

For example, if your deductible is $1,000, you’ll pay in full for the first $1,000 of your health care. Your insurer will keep a running total of how much you pay, and when you hit $1,000, the cost-sharing benefits of your health insurance plan begin. This could mean, for example, that instead of paying the full price of $250 for an X-ray, you could pay $50, and the insurance company will pay $200.

In health insurance, the deductible works on an annual basis, and after your new policy year begins, the running total of what you’ve paid will reset to zero. This could mean that your health care costs will be higher in the first part of the calendar year until you hit your deductible amount. Then for the rest of the year, you’ll get the cost-sharing benefits of your insurance plan, and you’ll pay less for covered health care services.

Can You Ask Your Employer To Add Domestic Partner Benefits To A Plan

You can also ask your employer to add domestic partner benefits to your company’s health insurance plan. Your employer may be more open to the idea if you can show that having plans for unmarried partners isn’t more costly than having plans for married spouses.

The coverage for domestic partners can be added to most workplace health plans without too much trouble.

Don’t Miss: Does Short Term Health Insurance Cover Pre Existing Conditions

What Is The Difference Between Domestic Partnership And Marriage

Domestic partners can receive the same health insurance thats offered to married employees.

“Domestic partner health insurance is when an insurance contract extends the definition of spouse to recognize domestic partners, Burns says. As a result, the health insurance benefits may be extended to the unmarried partner and their children.

Couples of the same sex, as well as those of the opposite sex, can share insurance under a domestic partner insurance coverage just as a married couple would, Burns says. The biggest benefit of this arrangement is a reduced insurance rate and the ability to be eligible for the employee benefits package, she adds.

Companies and insurance plans operate differently when it comes to a domestic partnership vs. marriage. Burns suggests you ask questions.

“Ask your benefits plan administrator to find out the specifics and make your formal request so that your partner may be added as soon as possible, she says. Most employer health plans will allow the addition of a domestic partner if the plan includes this kind of coverage.

Burns suggests contacting your HR person or the insurance company directly and ask if you can insure your domestic partner on your employee health insurance plan. If the answer is yes, find out what steps you need to take to get started.

If your employer’s health insurance plan does not provide domestic partner insurance, you can check with a private company, Burns says.

Domestic Partners And Federal Benefits

Domestic partners are eligible for certain benefits through a series of administrative actions. A June 17, 2009 Presidential memo allowed same-sex domestic partners of federal employees and retirees to apply under the Federal Long Term Care Insurance program, effective in July 2010. In November 2015 eligibility was extended to opposite sex partners as well under 5 CFR 875.

The 2009 memo also made both same sex and opposite sex domestic partners eligible as family members for employees to use sick leave for family care or bereavement purposes, as well as to use shared leave for family situations. Implementing rules are at 5 CFR 630.

A Presidential memo of June 2, 2010 further required that certain employee assistance program and similar benefits be expanded to same-sex domestic partners to the extent allowed by law.

For purposes of these policies a domestic partnership is defined as a committed relationship between two adults, of the same sex, in which the partners:

Agencies may choose to secure documentation to establish the existence of a domestic partnership but they are not required to do so. In determining whether to require documentation, agencies must consider whether a similar requirement is imposed upon opposite-sex spouses.

Don’t Miss: How To Apply For Kaiser Health Insurance

What Does No Charge After Deductible Mean

For policies with a set deductible amount, the consumer will pay out of pocket for their health care up until the total amount spent reaches the deductible amount. After this threshold amount is reached, the insurer will pay the remaining cost of covered medical services for the rest of the year. For example, if you have a $1,000 deductible, you could pay the first $1,000 of a $5,000 medical bill. The insurer would pay the remaining $4,000.

Editorial Note: The content of this article is based on the authorâs opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

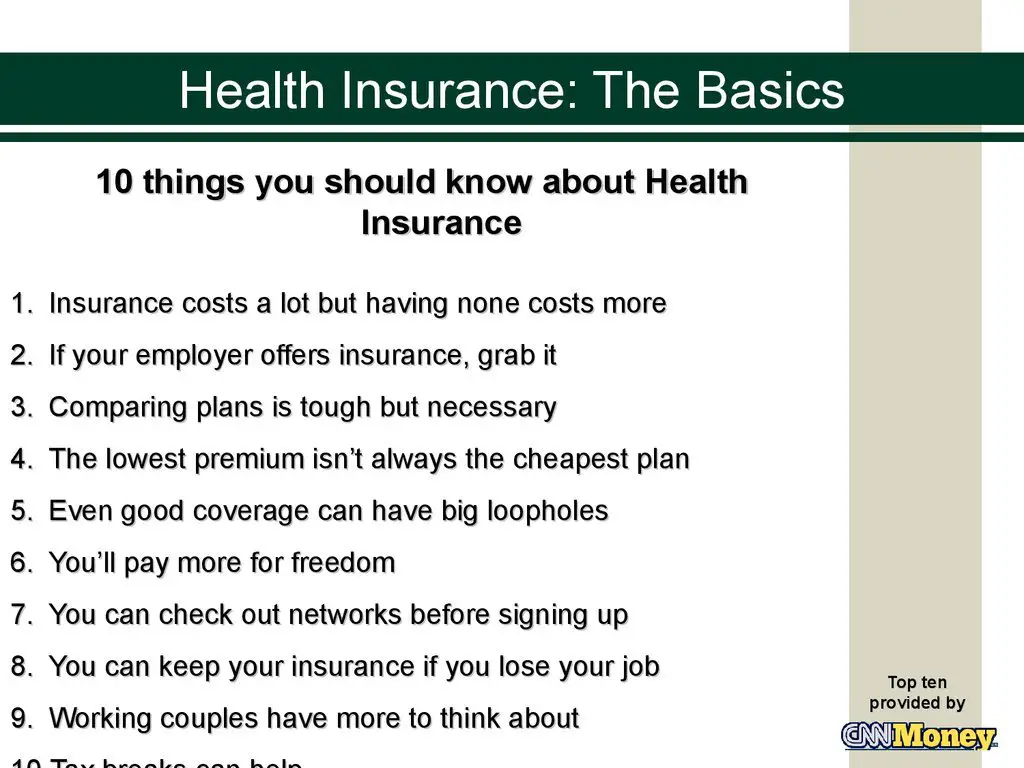

What Is An Open Enrollment Period

Open enrollment when you can make changes to your health insurance plan. You can also sign up for a new plan during open enrollment.

Youre able to enroll in a plan through:

- Your employer

- An individual health plan through your state’s or the federal government-run insurance marketplace or directly through an insurance company

- Medicare

During the annual open enrollment period, you can change your current plan or obtain new coverage. Its important to make these choices carefully, says Gretchen Jacobson, vice president, Medicare, for The Commonwealth Fund.

The best plan for your friend may not be the best plan for you, she says. Each plan has different benefits, different drug coverage and different health care providers in their networks.

Selecting the right health insurance plan can be challenging. Each year, millions of Americans have the opportunity to choose a new plan, or to tweak their existing coverage. But with so many options available, how can you know if you are making the right choice?

Get educated, says Paul Fronstin, director of the health research and education program at the Employee Benefit Research Institute. There are potentially options out there for you.

Fronstin adds that such alternatives may or may not be better than the plan you already have. But that is something you have to figure out, he says.

Don’t Miss: What Is A Gap Plan Health Insurance

Who Counts As A Domestic Partner

At the moment, there is no single rule for the whole country that states what a domestic partnership is. Each state can define what a domestic partnership is for itself. States also can decide what legal benefits partners who are not married can get.

It is more and more common for states to recognize domestic partnerships. Many states will count any committed couple in a relationship like a marriage who does not have an official marriage license.

In most cases, couples would need to have traits like a marriage. These could be:

- A shared home

- Joint bank accounts or credit cards

- Sharing bills and living costs