One Final Point To Remember

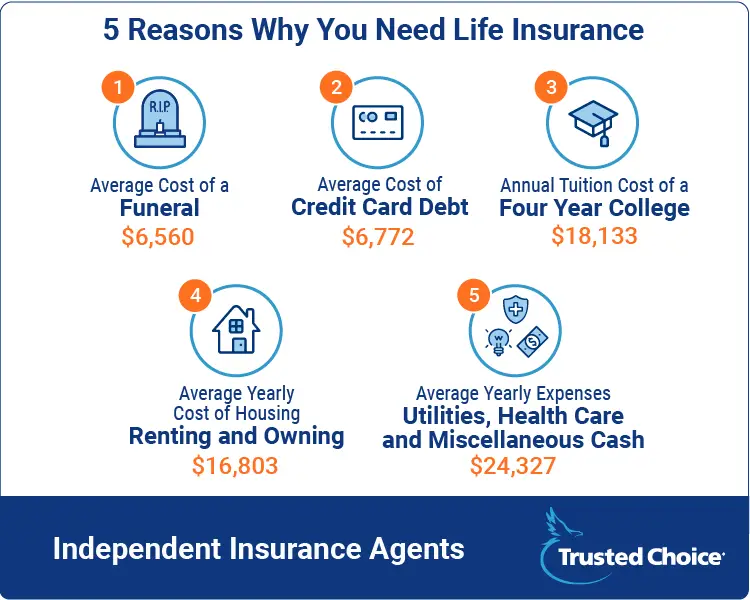

One word of caution: Stay away from gimmick policies like cancer insurance, accidental death or anything that packages your coverage with investments like whole life or universal life. These types of insurance policies are just a way for the seller to make extra money off you. You need an agent whos on your sidenot the side of the insurance company.

Thats why choosingthe right independent insurance agent is so important. An industry expert, like one of Daves Insurance Endorsed Local Providers , will work with you to make sure you have the policies that fit your life now and help you anticipate the coverage youll need for the future. Plus, if you ever have to file a claim, youll have a trusted advocate on your side who will guide you through the process.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Am I Required To Have Travel Health Insurance

Most countries do not require travel health insurance, but there are a few for which coverage is mandatory for entry. Here are the details on Countries that Require Travel Medical Insurance for Entry.

Schengen countries are one example, as they require visa applicants to prove they have travel medical insurance to cover expenses for repatriation, urgent medical attention, emergency hospital treatment and more.

If your destination isnt on the list of countries that require travel medical insurance, its still a good idea to protect your health with an IMG plan.

How To Enroll And Get Answers To Your Questions

You can learn more about and apply for ACA health care coverage in several ways.

-

Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or you’ll be directed to your state’s health insurance marketplace website. vary by state.

-

Find a local center to apply or ask questions in person.

-

Download an application form to apply by mail

Find the answers to common ACA questions about submitting documents, getting and changing coverage, your total costs for health care, tax options, and more.

You May Like: Where Do You Go If You Have No Health Insurance

Travel Medical Insurance For Visitors To The Us

If you are an expatriate living in the United States, it is highly recommended that you purchase additional medical coverage throughout your stay in the country. You want to ensure you are covered in case of an accident, a medical emergency, or sudden repatriation.

Make time to research if you will need travel insurance before entering the country. You must also research if the insurance needs to come from your home country, the US, or both.

If you plan to stay in the US for less than a year, a travel medical insurance plan may be enough to cover your needs. This is also an excellent option for younger travelers who need basic medical coverage for emergencies.

Most travel medical insurance plans provide coverage for accidents and illnesses, saving you from large medical expenses associated with doctor check-ups and hospital visits in the US. At the same time, this type of insurance will give you access to pharmaceutical care and translation services, should they be required.

For more information on travel insurance plans, see:

If you are an immigrant or an international citizen living in the US, it is recommended to get a global medical plan. We have guides that will help you choose the best international health insurance plan for your needs.

How To Get Health Coverage

You can get health care coverage through:

- A group coverage plan at your job or your spouse or partner’s job

- Your parents’ insurance plan, if you are under age 26

- A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace

- Government programs such as

Don’t Miss: Does Health Insurance Cover Birth Control Pills

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Get Coverage For New Technology

In cases where a new technology provides additional benefits vs. the older technology, consumers try several things to get the insurance company to pay. Many insurance companies require doctors to “prove” why the costlier procedure or product is more beneficial. Additionally, an insurance company may pay a specific amount for a procedure and the patient can pay the difference to get the new technologyin other words, partial coverage is available. The first step in this process is to discuss the coverage with the insurance company, determine what will be covered, and have an agreement with the physician for the total cost and what will be required to be paid by you.

Read Also: How Much Health Insurance Do You Need

What To Consider When Searching For Affordable Healthcare

Its easy to go for the lowest monthly price when selecting a health insurance plan, but there are a few things you should consider before doing so. Step back and assess you and your familys health care as a whole so it doesnt cost you more in the future. Look into annual costs and premiums, metal categories if considering ACA plans, health savings account or flexible spending account options and out-of-pocket costs.

If You Have Company Health Insurance

Find out if you’re covered under a group health insurance policy. If so, what are you covered for? The policy may end when you change employer or retire, so you should have a personal health insurance policy as well.

Do not wait until you stop working to buy a health insurance policy. By then, you may not be insurable due to age or poor health.

Recommended Reading: What Health Insurance Is Available In Nc

Guaranteed Universal Life Insurance

How it works: The death benefit is guaranteed and your premiums wont change. Theres typically little to no cash value within the policy, and insurers demand on-time payments. You can choose the age to which you want the death benefit guaranteed, such as 95 or 100.

-

Pros: Due to the minimal cash value, its cheaper than whole life and other forms of universal life insurance.

-

Cons: Missing a payment could mean you forfeit the policy. And since theres no cash value in the policy, youd walk away with nothing.

You Might Want Disability Insurance Too

Contrary to what many people think, their home or car is not their greatest asset. Rather, it is their ability to earn an income. Yet, many professionals do not insure the chance of a disability, said John Barnes, CFP and owner of My Family Life Insurance, in an email to The Balance.

He went on to say: A disability happens more often than people think. The Social Security Administration estimates that a disability occurs in one in four 20-year-olds before they reach retirement age. Disability insurance is the only type of insurance that will pay a benefit to you if you are ill or injured and cant do your job.

It’s true that you have disability benefits through workers compensation for injuries that happen while you’re on the job. Still, Barnes warns that workers comp does not cover off-the-job injuries or illnesses like cancer, diabetes, multiple sclerosis, or even COVID-19.

The good news is that disability insurance isnt likely to break the bank it can often fit into most budgets. Usually, the premiums of disability insurance cost two cents for every dollar you make, said Barnes. Certainly, the premiums vary based on age, occupation, salary, and health conditions. If you earn $40,000 a year, that works out to $800 per year .

Recommended Reading: What’s The Penalty For Not Having Health Insurance In California

Examples Of Potential Health Insurance Plans

While the array of potential options is fairly complex when it comes to health insurance, plans can be categorized into a few different types.

Traditional or fee-for-service plans are the original type of health insurance. You can go to any doctor, hospital, or specialist you’d like, but in exchange, you’ll pay more expenses out of pocket, have a deductible, and may only receive 80% coverage on remaining medical bills.

Managed Care insurance plansinclude Preferred Provider Organizations , Point-of-Service , and Health Maintenance Organizations . All of these plans work only with providers in a closed network. In exchange, patients pay lower premiums and have lower or no copays. PPO and POS insurance allows patients to go to providers outside their network and self-refer to a specialist, while PPOs are the lowest-cost plans, but don’t pay for any out-of-network visits, and patients must be referred to specialists by their doctor.

High-deductible insurance plans, sometimes known as catastrophic plans,are much lower in cost than other insurance plans, although you’ll have to pay a large amount of out-of-pocket money if you need care, so it still makes sense to put money aside each month, even if it’s into your own savings account instead of paid as a premium for insurance.

What Is Health Insurance For Self

Health insurance for the self-employed is any insurance plan purchased as an independent contractor or self-employed individual where you are required to cover the cost of your own employee benefits, including health insurance. You may have a couple of options for buying coverage, such as purchasing health insurance directly from a provider or through your states exchange or Heathcare.gov. You may apply during open enrollment which happens once per year every fall or after a qualifying life event.

Depending on your income, you may qualify for a discount through cost-sharing reductions, which may lower the cost of your deductible, co-payments, or co-insurance. To qualify, you must sign up for one of the Marketplace plans.

If your income is low, you may also see if you qualify for Medicaid, which could offer free or inexpensive health insurance. You may apply for Medicaid through the Marketplace or through your states Medicaid agency.

Also Check: How Do I Find My Health Insurance

What To Do If You Have A Problem With Your Policy

Contact your health plan to resolve your problem.

- Talk to your doctor and call your health insurer. Sometimes talking solves the problem.

- You can file a complaint with your health plan. A complaint is also called a grievance or appeal.

- Generally, your insurance company must make a decision within 30 days.

- If your health problem is urgent, your health insurance must do an Expedited Review. It must be done as soon as possible, in 72 hours or less.

If you are not satisfied with your health plan’s review process or decision, call the California Department of Insurance . You may be able to file a complaint with CDI or another government agency.

If your policy is regulated by CDI, you can file a complaint at any time. The CDI reviews cases that involve:

- Disagreements about the services your health plan must cover.

- Termination or cancellation/rescission of your insurance policy.

- Exclusions and limits on services that are usually covered.

- Timely access to medical care.

My claim was denied. Now what?

Your health insurance policy tells you how to appeal if your plan denies your claim or pays less than you think it should.

You have a right:

- To receive an explanation of your plan’s grievance and appeal procedures.

- To file a complaint, also called a grievance or appeal, with your plan.

- To receive an easy-to-understand written decision on your appeal.

- To file a complaint with CDI, Call 1-800-927-4357 or visit www.insurance.ca.gov.

Independent Medical Reviews

How Much Coverage Do I Need For Health Insurance In The Usa

Every day, we get asked these questions about insurance products:

- What is the typical cost for medical expenses in US healthcare facilities or hospitals?

- Is it possible to remove some of the benefits that I do not need to lower the cost of my plan?

- How much insurance coverage should I buy?

- I am a visitor/expatriate. Which insurance plan is best for my stay in the US?

- Your insurance policies are too expensive. Is it not more practical to pay for hospital bills? Besides, the chances that I will get hospitalized are low since I am living a healthy lifestyle.

These questions are very challenging to answer because several factors have to be considered in choosing the appropriate international health insurance plan.

Healthcare costs in the US vary by illness, procedure, and facility. The comparison is easy when you match treating a fever with operating on a kidney stone. However, when you compare removing kidney stones, with the difference being which facilities accept your insurance plan, then that is when your choice of policy will play an important role.

You have to consider the distance, availability, and doctors in the medical institute before you choose which policy to go with. Some facilities will charge way more for the same procedure than the hospital down the street.

Recommended Reading: What Is The Health Insurance For Low Income

Different Types Of Life Insurance

Common types of life insurance include:

-

Term life insurance.

-

Group life insurance.

All types of life insurance fall under two main categories:

Term life insurance. These policies last for a specific number of years and are suitable for most people. If you dont die within the time frame specified in your policy, it expires with no payout.

Permanent life insurance. These policies last your entire life and usually include a cash value component, which you can withdraw or borrow against while youre still alive.

Find Out Which Services Most Plans Decline

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Navigating health insurance coverage is a monumental task. Consumers generally have no say in which services are rendered, which services are covered, and how much they will ultimately be responsible for paying. It is not an uncommon scenario that a doctor requests a service, the patient follows the doctor’s orders, insurance pays only a portion or none at all, and the patient is left holding the bagand the bill.

Other common scenarios: A patient calls the doctor to ask for the price of a particular test or treatment, only to be told the price is unknown. Or a plan participant calls their health insurer to ask for the customary fee for a serviceto determine how much of it will be coveredonly to be told “it depends.” No one would go into the local electronics store and buy a TV without being told the price, but in medical care, this is basically what patients are expected to do.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Annual Costs And Premiums

The first thing youll likely notice when purchasing insurance is the annual cost, or the sum of your monthly premiums. The principal cost associated with coverage is the premiumthe amount you pay every month for the coverage, which could be subsidized by your employer or the government, says White.

Go With Term Life Insurance

Term life insurance provides life insurance coverage for a specific amount of time and if you die during that term, your family will receive a payout from the insurance policy. Its much less expensive and by far abetter value than whole life and other types of cash value insurance. Its the only way to go!

One of the biggest insurance myths out there is that you will always need life insurance. Thats just not the case! Heres the truth: You wont need life insurance forever if you plan wisely, dump debt, and build wealth. Well get into that in a second.

Read Also: Where To Go To Apply For Health Insurance

What Are Exclusive Provider Organizations

An EPO offers you a network of participating providers to choose from. Most EPO plans do not include coverage for out-of-network care except in the case of an emergency. This means that if you visit a provider or facility outside the plans local network, you will likely have to pay the full cost of services yourself.

Depending on the plan, you may or may not be required to choose a primary care provider . If you want to see a specialist in your network, you dont need a referral from a PCP.

What Insurance Do I Need For A Home Health Business

Fact-checked with HomeInsurance.com

Reader Question: What type of insurance would I need for a home health business, in which we assist people at their homes with their medical and personal needs? Employees drive their own cars at this point in time. We do not have company cars. Do I need liability insurance or some other form of insurance? What is the range of prices for the coverage I need?

The demand for home health care businesses is growing, especially as baby boomers become part of the elderly population. A lot of people, regardless of age, prefer having in-home care if theyre required to receive ongoing care versus going to a nursing home. Unfortunately, taking care of people in their homes also presents risks greater than those in a medical facility.

Any business should have liability insurance, but anything to do with health care makes it especially important to carry insurance as they are among the riskiest businesses and are often fraught with claims. This has a lot to do with the fact that home health care providers dont always have all the things they need in the field and are usually on their own, meaning any responsibilities fall squarely on your shoulders and the shoulders of your employees. Failure to do so can not only result in losing your business, but also in losing personal assets. Its an unfortunate reality, and we live in a litigious society.

The real question is if theres a risk of being sued. The answer is yes, explained Loughran.

Read Also: Where Can You Get Affordable Health Insurance