How Does Accident Insurance Work

Accident insurance provides specific cash benefits for injuries caused by a covered accident. These cash benefits may be used for expenses like copays and deductibles. Like disability insurance, your accident insurance policy should pay you or your beneficiaries a cash benefit whether the injury occurred on or off the job. And you can use the money however you want pay off bills or take a vacation.

So how does it work?

Lets say your child, who is already covered on your accident insurance policy, fractures his ankle during a football game and is taken by ambulance to the ER. X-rays determine he has a severe fracture, requiring a hospital stay. Your son is released the next day with a nifty little cast. Because you havent met your deductible for the year, you find your health insurance doesnt cover the entire medical bill. So, youre left paying hundreds or thousands of dollars out-of-pocket. However, since you have accident insurance, you can simply submit this claim to the insurance company you bought it from. After the claim has been approved, you receive the cash .

Here are some of the advantages to having an accident insurance policy:

- Immediate protection within days of receiving your application

- Helps cover out-of-pocket expenses

- Benefits are paid directly to you

- Guaranteed issue or guaranteed renewable

- No deductibles, copays or coinsurance

- Health Savings Account friendly

How Much Does An Emergency Visit Cost Without Health Insurance

A trip to the emergency room will also cost $50 to $150 just to check-in without insurance. But this is where the big numbers come in: The tests and the doctors fees. Your $50 to $150 goes to the hospital. The doctor you see may charge you another $100 to upwards of $1,000 for the level of service. And an ER visit may require CT-scans, MRIs, or more, all with a price. Those X-rays at $140 and CT scans up to $1,146 are fully your responsibility. If you are admitted for an overnight stay, the hospital room and service will be additional, as well.

Healthcare Blue Book found an ER visit for a minor problem ranges from $431 to $1,343. The prices climb by the severity of the health issue with a very severe problem, pricing between $1,056 to $3,295.

How To Get The Best Deal On Pet Insurance

If you decide pet insurance is the right avenue for you, its time to do some research to get the best possible deal. For starters, you should insure your pet as early as possible to make sure any illnesses that pop up are covered. Most plans do not cover preexisting conditions, meaning anything your pet suffered previously will not be covered and youll have to pay out of pocket. The earlier you get coverage coverage, the sooner youll reach your deductible and receive backing from your insurance provider.

You can also do a little math and add up quotes from a provider to estimate a lifetime cost and compare with other companies. Get a monthly premium quote based on your pets age, and multiply by 12 to get the annual cost. Follow the same process for each year of your pets life and add up all the annual premiums to get your overall estimated cost. Try the same process with another company youre considering to see which costs the least overtime.

You May Like: Which Is The Best Health Insurance Company In Texas

Is Investment In Health Insurance Worth It

Todays disrupted lifestyle has made it extremely difficult to stay healthy. In fact, most of the millennials today are suffering from diseases related to lifestyle. We all are aware that medical treatments cost a bomb. This makes it vital for everyone to invest into a suitable medical insurance plan. The benefits of health insurance in India cannot be overstated. Purchasing a health insurance policy can help you receive medical care without blowing up all your savings. Health care plans today offer much more than mere hospitalisation expenses.

Here is a little brief on the benefits of health insurance plans and why the investment might be worth it!

Every health insurance plan covers cost of medical treatments in case the policy holder gets in an accident or incurs an illness.

Technological advancements in medical field has made it possible for medical procedures to be performed in less than 24 hours and hence they do not need you to be hospitalised. Nearly every health insurance plan covers day care expenses in their network hospitals.

Most insurance plans that offer cashless hospitalisation policy for over 6600 hospitals in India. The claim procedure is fairly quick and easy and saves one from worrying about immediate cash arrangements at the time of a medical emergency.

Compare Health Insurance Policies The Easy Way

Save time and effort by comparing a range of Australia’s health funds with iSelect*

*iSelect does not compare all health insurance providers or policies in the market. The availability of policies will change from time to time. Not all policies available from its providers are compared by iSelect and due to commercial arrangements, your stated needs and circumstances, not all policies compared by iSelect are available to all customers. Some policies and special offers are available only from iSelects contact centre or website.

Recommended Reading: How Long Can My Dependent Stay On My Health Insurance

When Is Something Not Insurable

In addition, events that are classified as having a high probability and high cost are generally not insurable by insurance companies as these present significant risk. This is represented by the top right hand corner of the graph. An example of this type of scenario may be a person that wishes to build a house in a known flood plain. Insurance companies are likely to view the probability of a flood occurring and the associated cost of resulting damage as too high, making it therefore impossible for this person to obtain flood insurance.

What Costs Does Pet Insurance Cover

Every pet insurance company is different, and every plan is different. Most commonly, pet insurance covers unexpected accidents, injuries, and illnesses, whether your dog swallowed something they shouldnt have, or curiosity got the best of your cat. Your insurance policy will offset the costs of dealing with those often-expensive issues.

Pet health insurance is a great option because it allows pet parents to focus on whats best for their four-legged friends health, Liz Watson, Vice President of Crum & Forster Pet Insurance Group and provider of ASPCA Pet Health Insurance, says. It makes it easier to provide the very best care to keep your pet healthy or cover veterinary services that may arise from an illness or injury. Some plans offer coverage for regular vet checkups with a higher premium. Typically, pet insurance companies do not cover any preexisting conditions.

Also Check: How To Sign Up For Aarp Health Insurance

Buying Your Own Health Insurance Just Got A Lot Less Expensive

If youve already bought a plan on Healthcare.gov, or you didnt because it was too pricey, act now to save money.

Last month, hundreds of millions of Americans got a cash infusion from the government as part of the American Rescue Plan.

But starting this month, another part of that law could have an even bigger effect on the wallets of tens of millions of Americans.

Thats because starting April 1, the law makes health insurance much less expensive for people who dont get it from their job, Medicare, Medicaid, or military and veterans programs.

The program, which will last through 2022, increases the financial help thats available to people who buy their own insurance through the national Marketplace at Healthcare.gov.

That includes both people who already bought a plan for this year, and people who dont have insurance right now.

That means the monthly premium for a particular plan will be lower than before for many people, much, much lower. Or, you might be able to get an even better insurance plan for what a lower-level one used to cost.

And thats on top of the fact that having health insurance can save you hundreds or thousands of dollars if you get sick or injured.

The Open Enrollment period for anyone who wants to take change or choose their plan through Healthcare.gov for this year runs through August 15. Changes to cost and coverage take effect soon after approval. You will still have to pay any co-pays, co-insurance and deductibles that a plan has.

Discover The Better Way To Save Costs On Medical Expenses In Canada:

Paying for your medical expenses out-of-pocket is using your after-tax dollars. That’s why there is a more efficient and cost-effective method available to incorporated businesses to pay for all health and dental related expenses using pre-tax dollars. This tax plan is called a Health Spending Account. It is an alternative to health and dental insurance which allows business owners to pay for 100% of their medical expenses with before-tax money .

Recommended Reading: Does Golden Rule Insurance Cover Mental Health

Do You Want Shorter Wait Times

If your surgery canât be put off by more than 24 hours, itâs classified as an emergency. According to our universal health system, you have access to the care you need. Anything else is considered âelective surgeryâ, and youâll be put on a waiting list if you use the public system.

Elective surgery can include removing wisdom teeth in hospital, a joint replacement or cataract surgery. âPublic elective surgery waiting times have generally been longer than private. But weâve really seen them blow out over the past year due to the pause on elective surgery last year due to COVID. Now, thereâs a huge backlog in some states for public elective surgery,â says Ms Crowden. âIf youâre unwell or youâve been injured, thatâs a stressful time anyway, without having to wait for longer than you want to for the surgery you need. By having private cover, youâre generally going to be able to have your treatment quicker.â

Is Your Health Insurance Worth It 5 Questions To Ask Yourself

If youre a private health insurance member, youre probably all too familiar with both the rising cost of premiums each year and the constant internal battle of is private cover really worth it?

Its certainly frustrating dishing out your hard-earned cash for something that you dont necessarily see a return from in the short term. Especially if youre fit and healthy and cant even remember the last time you even had a cold.

So as the second premium rate rise in just six months looms on April 1st and premiums creep up again, this time by an average of 2.74 per cent, it could be time for you to finally sit down with your private health insurance over a glass of wine, look it dead in the eye and say is this really working?

Here a few questions prompts to get the conversation started.

Read Also: How To Get Life And Health Insurance License In Texas

Is Health Insurance Worth The Price

Millions of Americans are willing to buy health insurance but only if it is available at steep discounts.

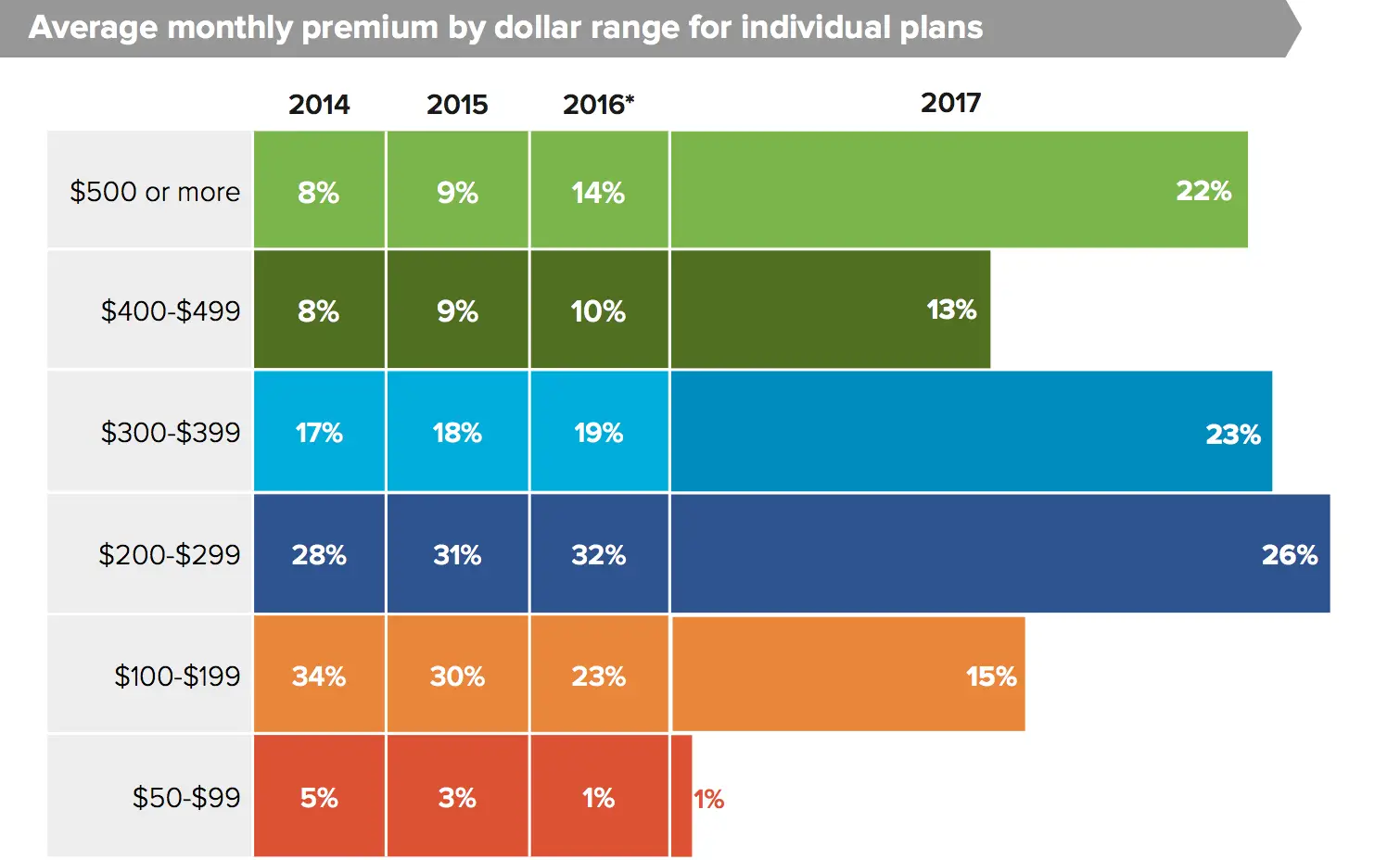

That somewhat surprising conclusion is suggested by two recent Department of Health and Human Services reports, including one released last week analyzing average premiums paid by the 4.7 million people who have obtained subsidized coverage through federal health exchanges.

That study found that people who qualified for health insurance subsidies paid an average of $82 a month for coverage, with nearly half paying $50 per month or less. On average, subsidies covered 76 percent of the premiums, a great deal for those who are getting government help.

Absent that help, most consumers apparently didn’t think health insurance was worth the price. An HHS report from last month found that three out of four people who completed applications chose not to select a health plan once they learned that they would have to pay the full premium. According to that study, nearly 4.8 million people who went through the rather laborious application process were told that they did not qualify for subsidies. Of those, just over 1.2 million selected a health plan. For the rest, paying full price for coverage was not an appealing option.

Policymakers have long assumed that there is a great pent-up demand for health insurance. Few people, it has been argued, were uninsured by choice. They were either too poor to afford coverage or had medical conditions that rendered them uninsurable.

Understand The Terms And Conditions

Not all medical services or procedures will be covered or be covered in full by your chosen policy. You may also need to serve a waiting period before being able to make a claim. Consequently you need to understand the terms and conditions of your chosen insurance policy before purchasing insurance or switching insurers.

Dont just rely on the insurers website. It is also important to read your chosen policys Product Disclosure Statement carefully. Ask the insurer questions to clarify your understanding of what is included in the policy and make a record of the conversation.

Don’t Miss: How To Cancel Oscar Health Insurance

How A Year’s Worth Of Extras Cover Can Pay For Itself In A Week

Believe it or not, it’s easy to claim more money back in a week than you’ll pay in health cover premiums all year.

Extras health insurance is the little brother to hospital cover. Significantly cheaper, it helps towards the cost of non-hospital healthcare, like dentistry, optical and physiotherapy.

So is it really worth it? Well, yes, as long as you use it.

In fact, extras is actually one of the few types of insurance where you can easily claim back the price of your premium, without anything going too awry. Plus, you can do it in just a few days.

Yes, you might need to stomach a trip to the dentist or commit to an exercise course, but it’s pretty easy to guarantee value from your extras policy every year. Here’s how it’s possible:

Compare policies

The most important thing to do is compare your extras policies carefully to find cover that suits your needs. You might decide you want to spend more money for higher annual limits or just need the basics to help with regular healthcare.

Pay attention to what benefits are included, as well as waiting periods, annual limits and – of course – the price. Mid-range extras policies usually cost around $10-$15 a week.

This article isn’t sponsored but, for the sake of an example, I’ve used ahm’s lifestyle extras policy which costs $11.70 a week or $608.40 a year. I’ll be using these figures throughout, so you can see how easy it is to make an extras policy work for you.

Monday: Dental check-up

Tuesday: Exercise course

Heres The Bottom Line

For singles with an income above A$105,000, and for families with an income above $180,000, its worth buying private hospital cover even if you dont think youll use it. Ill explain why in a moment.

People with incomes below these levels need to compare value and costs. The decision varies a lot depending on your age.

Three key polices affect your premium costs: the Medicare levy surcharge, government rebates, and discounts for younger people.

Throughout this article, were talking about hospital cover, not extras like dental, optical or physio, which arent affected by these policies. You can buy extras cover separately without hospital cover. Extras cover is much cheaper than hospital cover, and an easier decision overall you can readily compare how much you stand to gain from extras cover and then weigh that against how much it will cost you.

Here are the main things you should factor in when deciding on hospital cover.

You May Like: What Type Of Insurance Is Health Partners

You Can Be Covered For Dental Care And Other Extras

Medicare generally does not cover dental care in Australia, meaning youre likely to pay out of pocket for any kind of dental treatment, be it a simple check up and teeth cleaning or something more intensive like a root canal. The extras component of private health insurance can cover all or part of the cost of dental treatment, meaning that your out-of-pocket expenses are potentially a lot lower if you need a major procedure, as long as its included in your level of coverage and any waiting periods no longer apply.

In addition to dental care, extras cover generally includes a range of other services that Medicare does not, including physiotherapy, remedial massage, chiropractic services and optical services. Where you would normally pay the total cost of these services, extras cover will allow you to claim a portion back, up to your annual limits.

How Much Does A Primary Care Visit Cost Without Health Insurance

If you choose to forgo health insurance, you will have to pay the full fees for doctor visits. Perhaps you are healthy and only need an annual checkup? The average cost of visiting a doctor for a checkup without health insurance can cost between $200 and $300. A new patient office visit up to 30 minutes can cost upwards of $578, according to the Healthcare Blue Book.

You May Like: How To Get Health Insurance Self Employed

You Only Want The Life Coverage

If you are only worried about the scenario of you dying while on your flight or during your trip, you are better off getting personal life insurance coverage. It is important to remember that you are more likely to die walking across the street or in your car than you are while vacationing. Like the above point, you might already be covered through work for life insurance and if you already have personal life insurance, it is definitely not needed.