More Help Before You Apply

-

Estimating your expected household income for 2021

- You can probably start with your households adjusted gross income and update it for expected changes.

- Learn more about estimating income, and see what to include.

Including the right people in your household

Example Of How To Calculate The Health Insurance Subsidy

Keep in mind that the exchange will do all of these calculations for you. But if you’re curious about how they come up with your subsidy amount, or if you want to double-check that your subsidy is correct, here’s what you need to know:

Tom is single with an ACA-specific modified adjusted gross income of $24,000 in 2021. FPL for 2020 is $12,760 for a single individual.

How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

Don’t Miss: Can I Go To The Er Without Health Insurance

Understanding The Aca’s Premium Tax Credit Health Insurance Subsidy

The Affordable Care Act includes government subsidies to help people pay their health insurance costs. One of these health insurance subsidies is the premium tax credit which helps pay your monthly health insurance premiums.

Despite significant debate in Congress over the last few years, premium subsidies continue to be available in the health insurance marketplace/exchange in every state. And the American Rescue Plan has made the subsidies larger and more widely available for 2021 and 2022.

The premium tax credit/subsidy is complicated. In order to get the financial aid and use it correctly, you have to understand how the health insurance subsidy works. Here’s what you need to know to get the help you qualify for and use that help wisely.

Can I Save Money By Buying A Cheaper Plan Or Must I Buy The Benchmark Plan

Just because the benchmark plan is used to calculate your subsidy doesnt mean you have to buy the benchmark plan. You may buy any bronze, silver, gold, or platinum plan listed on your health insurance exchange. You may not use your subsidy to buy a catastrophic plan, though, and premium subsidies are never available if you shop outside the exchange .

If you choose a plan that costs more than the benchmark plan, youll pay the difference between the cost of the benchmark plan and the cost of your more expensive planin addition to your expected contribution.

If you choose a plan thats cheaper than the benchmark plan, youll pay less since the subsidy money will cover a larger portion of the monthly premium.

If you choose a plan so cheap that it costs less than your subsidy, you wont have to pay anything for health insurance. However, you wont get the excess subsidy back. Note that for the last few years, people in many areas have had access to bronze or even gold plans with no premiumsafter the application of their premium tax creditsdue to the way the cost of cost-sharing reductions has been added to silver plan premiums starting in 2018. And as a result of the American Rescue Plan, far more people are eligible for premium-free plans at the bronze, gold, and even silver levels.

Also Check: Where Do You Go If You Have No Health Insurance

Changes In Premium Payments After Subsidies

As shown in our earlier analysis, the ARPA lowers premiums not just for people who are newly eligible for financial assistance , but also for people who were already eligible for subsidies under the ACA and are now eligible for more significant financial assistance.

We estimate that the average savings for current individual market purchasers will be $70 per month , ranging from an average savings of $213 per month for people with incomes between 400% and 600% of poverty to an average savings of $33 per month for people with incomes under 150% of poverty . Households with multiple family members purchasing Marketplace coverage could see even greater savings. These estimates and the chart below include all current individual market enrollees, including the few who are still ineligible for a subsidy .

Under the ARPA, Marketplace shoppers with higher incomes will still be liable for a larger share of their premium than people with lower incomes. On average, current individual market enrollees who either stay or move onto the Marketplace will be expected to pay $205 per month for a benchmark silver plan, ranging from $0 per month for people with incomes below 150% of poverty to an average of $513 per month for people with incomes over 600% of poverty.

What’s In It For You: Stephanie Ruhle Breaks Down How Much You Could Be Getting In Covid Relief

For example, a single person who makes $30,000 annually will pay $85 per month in premiums on average under the new law for a silver-level plan instead of $195, according to an analysis by the Center on Budget and Policy Priorities. A family of four making $75,000 will pay $340 rather than $588 per month for similar coverage, the analysis found.

Everyone benefits from the changes, said Tara Straw, a senior policy analyst at the center, including people with incomes above 400 percent of the poverty level who were previously not eligible for premium tax credits.

An older customer not yet in Medicare with an income just over 400 percent of the federal poverty level in some states would be paying 20 percent to 30 percent of their income toward their health care premium, she said. Now that will be capped at 8.5 percent.

At the other end of the income spectrum, people with incomes up to 150 percent of the poverty level will owe nothing in premiums. Under the ACA, they had been required to pay up to 4.14 percent of their income as their share of the premium cost.

Steps to take now:

When: 2021

Who benefits: Anyone who has received or has been approved to receive unemployment insurance benefits in 2021.

Step to take now:

Don’t Miss: Can You Get Health Insurance Immediately

What Happens When You Under Or Overestimate Your Income

If you underestimate your adjusted gross income for the year and receive more subsidies than you should have, you may have to pay some or all of it back when you file your taxes. How much you repay depends on your income. If its under 400% of the poverty guideline for your family size, you may only have to pay back a portion of it. If your income exceeds that amount, youll have to repay the entire value of the subsidy.

If you overestimate your income and get a smaller subsidy than you deserve, the government will retroactively adjust your subsidy when you file your tax return. If you dont have a tax bill, youll get the remaining value as part of your tax refund.11

How Are Subsidies Calculated

The government determines subsidies based on your adjusted gross income , family size and directly.8 Your AGI is your gross income minus specific deductions, such as the student loan interest tax deduction and deductions for IRA contributions you may have made over the year.9

For example, if you live in Pennsylvania, are married, have no children, and have a household income of $30,000 per year, you earn 177% of the FPL. At that level, you would be eligible for subsidies. You could get up to $344 in financial assistance per month as a premium tax credit, which would cover 72% of your cost.10

Recommended Reading: Will Health Insurance Go Down

Answer A Few Easy Questions To Calculate Your Subsidy Eligibility In Seconds

By Hal LevyHealthcare Writer

How do you get help paying for health insurance and health coverage? It depends on how much you earn. In 2022, youre eligible for Obamacare subsidies if the cost of the benchmark plan costs more than a given percent of your income, up to a maximum of 8.5%. The cut-off threshold increases on a sliding scale depending on your income. The discount on your monthly health insurance payment is also known as a Premium Tax Credit , also known as an Advance Premium Tax Credit .

2022 health plans are measured against your projected income for 2022 and the benchmark plan cost. You qualify for subsidies if you pay more than 8.5% of your household income toward health insurance.

In 2021, premiums for new enrollees have averaged about $30 less per person per month, or 25%. For subsidized enrollees, the median deductible has dropped by 90% from $450/yr to just $50. If you already enrolled in an ACA plan and got a subsidy, you can change your plan and get the added savings through August 15th in most states.

If you decide to keep your current plan, you will receive a refund for the subsidy difference at tax time next year for the first 8 months of the year for September December, those enrolled via the federal exchange will see their additional subsidies automatically subtracted from their premium due amount.

Arpa American Rescue Plan Act Update

With the recent passage of the ARPA, there is now NO INCOME LIMIT for ACA tax credits! Those with incomes over the set 400% FPL income limit may now qualify for lower premiums, based on their location, age and income. Tax credits are based on the Second-Lowest Price Silver Plan in your zip code NOT exceeding 8.50% of your Modified AGI for tax year 2021. The tax credits can be applied to any metal level: Bronze, Silver, Gold or Platinum plans.

You May Like: How To Find Personal Health Insurance

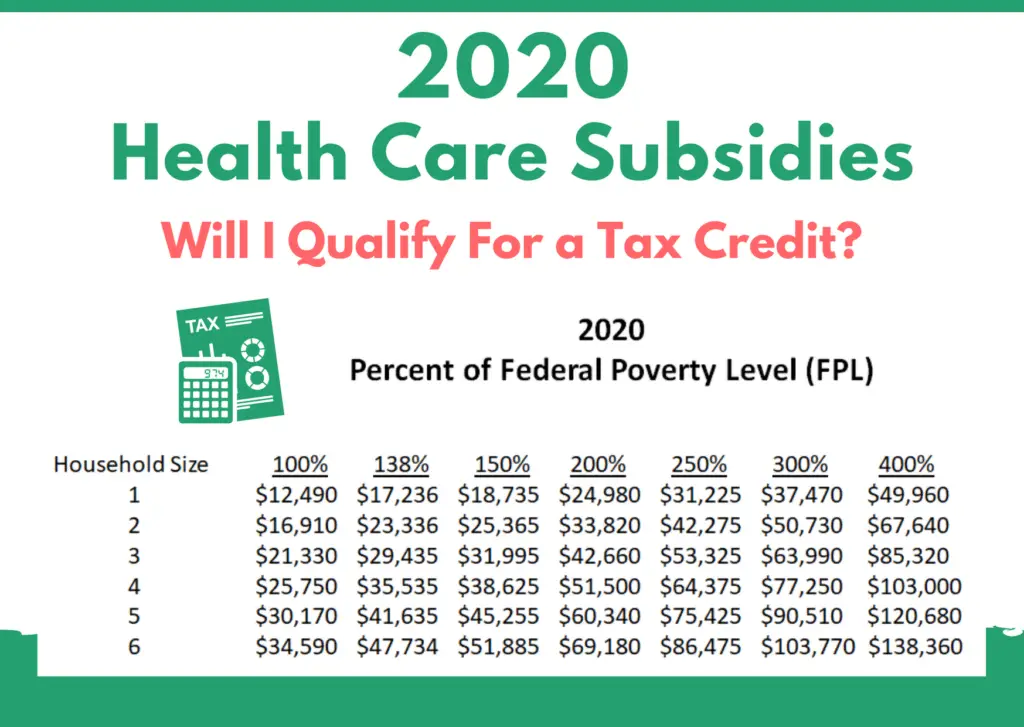

The 2020 Federal Poverty Guidelines Used In 2021

Below are the 2020 Federal Poverty Guidelines that went into effect in early 2020. These guidelines are the key to all income-based cost assistance under the Affordable Care Act, specifically, these guidelines are used for:

- Medicaid/CHIP between Jan 2020 Jan 2021 .

- Cost assistance on all marketplace health plans held in 2021 and purchased during open enrollment for 2021

- For special enrollment in 2021.

- For ACA taxes for the 2021 calendar year filed in 2022.

TIP: For mobile and smaller screen sizes, drag the table below to scroll and see the different poverty levels.

TIP: These tables will also be used for cost assistance for 2021 marketplace plans.

| 2020 POVERTY GUIDELINES FOR THE 48 CONTIGUOUS STATES AND THE DISTRICT OF COLUMBIA |

|---|

| Persons in Family/Household |

Do I Qualify For Medicaid

If you live in one of the 25 states and the District of Columbia that expanded Medicaid, the government is offering to fully cover insurance costs for anyone making less than about $16,000 for an individual and $32,500 for a family of four. If you make too much money for Medicaid, you still qualify for a subsidy through the insurance marketplaces. Those are available, for example, to people making $11,490-$45,960 per year.

The new health care law will provide around $1 trillion in subsidies to low- and middle-income Americans over the next decade to help them pay for health insurance.

Johanna Humbert of Galien, Mich., was pleasantly surprised to discover that she qualifies for an insurance subsidy, since her current plan is being canceled. Humbert makes about $30,000 a year, so shell get a subsidy of about $300 a month. The new plan is similar to her current one, but it will cost $250 about half of what she pays now.

You May Like: How To Add Dependent To Health Insurance

What Are The Subsidies

The Affordable Care Act includes two subsidies from the federal government that can make health insurance more manageable:

- Advanced Premium Tax Credit: If you have a lower income, you may qualify for this tax credit. When you enroll in a health plan through the Health Insurance Marketplace, you can use the credit to reduce your monthly premiums. Or, you can opt to receive it when you file your tax return for the year.2

- Cost Sharing Reduction: With the cost-sharing reduction, your out-of-pocket costs are lower. You could qualify for reduced copays, deductibles, and a smaller out-of-pocket maximum.3

Depending on your income and family size, you could receive one or both of these subsidies.

How The American Rescue Plan Act Affects Subsidies For Marketplace Shoppers And People Who Are Uninsured

The Affordable Care Act has provided subsidized health insurance on HealthCare.gov and state-run Marketplaces since 2014, with about 9 million people purchasing coverage with federal premium help. However, millions remain uninsured despite being eligible to purchase on the Marketplace. Some uninsured people have been priced out of the market because their incomes did not qualify them for a subsidy other uninsured people have been eligible for subsidized or even free Marketplace coverage but either did not know about the financial assistance available to them or still found coverage unaffordable or unappealing due to high deductibles. Additionally, people already purchasing Marketplace or off-exchange coverage may still face affordability challenges.

The March 2021 COVID-19 relief legislation, the American Rescue Plan Act , extends eligibility for ACA health insurance subsidies to people buying their own health coverage on the Marketplace who have incomes over 400% of poverty. The law also increases the amount of financial assistance for people at lower incomes who were already eligible under the ACA. Both provisions are temporary, lasting for two years, retroactive to January 1, 2021. A more detailed explanation of these enhanced and expanded subsidies and other coverage provisions of the ARPA can be found here, and an earlier analysis and interactive comparison of ARPA and ACA subsidies can be found here.

Don’t Miss: Where To Go To Apply For Health Insurance

What Is The Income Limit For Aca Subsidies In 20213

The income limit for ACA subsidies in 2021 for individuals is between $12,880 and $51,520.2,3 Families of four with a household income between $26,500 and $106,000 can also qualify for premium subsidies. How do you know if you qualify for a premium subsidy on your ACA policy? Well make it easy.

The chart below provides the qualifying income ranges in 2021 for the 48 contiguous U.S. states and the District of Columbia, effective January 2021.5 The income ranges for Alaska and Hawaii can be found on the U.S. Department of Health and Human Services .

Am I Eligible For A Health Insurance Subsidy

Who is this for?

If you need to buy your own health insurance, this explains how to find out if you can get help paying for it.

With few exceptions, the Affordable Care Act requires everyone to have health insurance. If you’re insured through your employer, or eligible for programs like Medicare or Medicaid, you’re covered.

If not, you’ll need to buy your own health insurance. Otherwise you’ll have to pay a penalty.

Do you already pay for your own insurance? Are you shopping for the first time? Either way, the good news is you may be able to get help paying for individual health insurance. This help is called a subsidy.

Read Also: Why Did My Health Insurance Go Down

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

To learn more about how we handle and protect your data, visit our privacy center.

What Else Do I Need To Know About How The Health Insurance Subsidy Works

If your subsidy is paid in advance, notify your health insurance exchange if your income or family size changes during the year. The exchange can re-calculate your subsidy for the rest of the year based on your new information. Failing to do this could result in getting too big or too small a subsidy, and having to make significant adjustments to the subsidy amount at tax time.

Also Check: How To Apply For Health Insurance As A College Student