Will I Need To Get A New Doctor

That depends. Major insurance providers, including Empire Blue Cross and UnitedHealthcare of New York, offer New York State of Health plans, but not all doctors accept them. You can talk to your primary care physician or use the New York State of Healths comparison tool to see whether a certain doctor or practice will accept a marketplace plan.

Different Ways You Can Sign Up For Obamacare In 2018

Enrolling on the ExchangesBefore you get started, know that you cant sign up for health insurance until the open enrollment period starts. For coverage beginning in 2018, that date is November 1. In the meantime, you can prepare for the open enrollment period by gathering the right documents and researching your options. The better prepared you are, the easier your enrollment process will be. Lets assume youre ready to sign up for a plan on the marketplace. You have four options for enrolling:

- Online

- With in-person assistance

Open Enrollment For Obamacare Plans

- Open enrollment for 2022 runs from November 1st, 2021 to January 15th, 2021.It was extended by 30 days.

- If you are between enrollment periods and have lost coverage for reasons other than non-payment, or if you have a qualifying life event, like getting married, you may qualify for special enrollment.

- If you dont qualify for special enrollment, dont have coverage, and are in-between enrollment periods then options are generally limited to short-term health insurance, Medicaid, and CHIP. Unlike in previous years, short-term health insurance plans, while inferior to ACA plans, have greatly improved thanks to some of the larger carriers bringing forward plans that make some attempt at being more robust long-term solutions. Short-term plans from United Healthcare and National General are two examples. One piece of advice regarding short-term plans, avoid smaller companies with limited information and track records.

ObamaCares 2022 open enrollment season starts Nov 15 2021 and ends Jan 15 2022. Plans start Jan 1 2022.

Read Also: Can A Child Have 2 Health Insurance Plans

Maximums And Deductibles On Hsa

The maximum and deductible requirements for HSA qualifying plans are not the same as maximums and deductibles on health plans in general. Below are the HSA limits for 2022.

Minimum Deductible for HSA Eligibility 2022

- $1,400 for self-only coverage

- $2,800 for family coverage

NOTE: It is $2,800 for embedded individual deductible NOTE: The minimum deductible, which is the minimum deductible your High Deductible Health Plan must have after cost assistance.

Maximum Out-of-Pocket Limit for HSA Eligibility 2022

- $7,050 for self-only coverage

- $14,100 for family coverage

NOTE: The maximum out-of-pocket is the highest maximum a plan can have to qualify for an HSA. TIP: The maximums are slightly lower on HSA compatible plans than they are in general on health plans. This has to do with the fact that the rates are raised by different mechanisms. The difference allows for non-HSA compatible high deductible plans. Thus, if you want an HSA, make sure your plan is HSA Eligible.

HSA Contribution Limit for 2022

- $3,650 for self-only coverage

- $7,300 for family coverage

NOTE: 55 plus can contribute an extra $1,000. TIP: See Revenue Procedure 2021-25 for final HSA levels.

Get Covered During Open Enrollment

Despite what you might have read elsewhere, or heard on the radio, or seen on TV, Obamacare has continued to be a success for tens of millions of consumers who have better access to health insurance under the law.

The reality is, while there have been some repeal and replace attempts in Congress and some changes under Trump, the Affordable Care Act is still the law.

That means there is still guaranteed coverage for people with pre-existing conditions and Americans can still qualify for cost assistance based on income.

The only stipulation is, to qualify for cost-assisted coverage that meets the standards of the Affordable Care Act, you have to sign up during each years open enrollment season!

How to get covered under ObamaCare: or get in touch with a HealthCare.Gov approved broker during open enrollment each year to get coverage that qualifies for cost assistance based on income.

Don’t Miss: How To Apply For Low Cost Health Insurance

Is There Any Other Financial Assistance Available

Yes. If you qualify for a premium tax credit, you may also qualify for a cost-sharing reduction that would help you pay for such out-of-pocket expenses as deductibles and copays. You must enroll in a Silver-level plan to get this assistance. If youve collected unemployment benefits this year, even for just one week, you may qualify for an almost $0/month premium health coverage option, thanks to the American Rescue Plan. If, however, you’re already enrolled in a marketplace plan, you can update your application to apply this additional subsidy moving forward. You’ll also be able to claim the additional subsidies for the months during which you were eligible when you file your 2021 federal income tax return. This extra financial help will expire at the end of 2021.

Question : Is My Current Health Insurance Policy Compliant With The Law And If Not How Do I Get Insurance That Does Comply

The third question you should ask yourself is whether your current health insurance, if you have it, complies with the new law. If you already have health insurance through your employer or through a private insurance company, chances are that it complies with the law because most do. Plus, your company is required to tell you if your insurance isnt compliant.

If youre wondering what an Obamacare-compliant insurance policy looks like in the first place, its easy: it looks either the same or better than your policy terms probably looked like before the Affordable Care Act was passed. This is because legislators wrote the law to help better serve consumers, protect the American people and hold insurers more accountable for their actions.

Obamacare outlines 10 types of services that everyone with health insurance should always be covered for under every circumstance. Before the ACA took effect, it was clear that there were some people who were not getting their moneys worth when it came to health insurance. Some companies simply charged too much for too little. Under the Affordable Care Act, even if you choose the lowest-cost plan with the least amount of coverage, you still receive at least the same 10 essential benefits as someone who buys a more costly plan. Receiving these benefits does not mean that they are free, just that you will not be denied coverage for these services no matter what.

Also Check: Who Pays First Auto Insurance Or Health Insurance

Obamacares Effect On Connecticut Health Insurance

Connecticut has been able to successfully ensure that 90% of its residents have healthcare coverage and has significantly decreased their uninsured population. The state-run exchange, Access Health CT, has also been a rousing success that has avoided many of the technical problems other state run exchanges have experienced.

Because they have been so successful, Connecticut is moving on to other initiatives such as educating their beneficiaries how to appropriately utilize the healthcare systems and price transparency.

Is There A Penalty For Not Having Insurance

There is no federal government penalty for being uninsured in 2021, but you still need coverage!

The ACAs federal individual mandate penalty has been $0 since the start of 2019, and that continues to be the case in 2021. People who are uninsured do not face a penalty, unless theyre in a state that has its own individual mandate and a penalty for non-compliance. Four states and DC impose tax penalties for not having health insurance:

- Massachusetts

- District of Columbia

You May Like: How Much Health Insurance Do You Need

What Happens If I Decline My Health Insurance Through My Employer

If you decline individual health insurance through your employer, you can enroll in an Obamacare plan through the Marketplace. Although you most likely will not qualify for any subsidies or other financial assistance. You will only be able to qualify for cost savings if the following applies:

1. Your employer-sponsored health plan doesnt meet the minimum value standard.

If your employer-provided plan does not include substantial coverage , it doesnt meet the standards. And if it doesnt pay for at least 60% of covered medical costs, it wont either.

2. The cheapest plan through your employer costs more than a certain percentage of your household income.

And again, that plan must meet the minimum value standard. This number is 9.83% and each year the IRS issues an update on this percentage. This calculation is made using your portion of the monthly premium that covers you, the employee. This does not include premiums for others in your family.

Most job-based health insurance plans are deemed to be affordable and found to meet the minimum value standard. But if your employer-sponsored plan isnt, you may qualify for a Marketplace subsidy depending on your income level.

A reminder: You can only enroll in a Marketplace plan during the annual Open Enrollment period, unless you qualify for a Special Enrollment Period. Grab our free guide to enrolling in Marketplace insurance for more information.

Can I Get An Obamacare Subsidy To Help Pay For Cobra

No. Both the premium tax credit health insurance subsidy and the cost-sharing subsidy can only be used with health plans purchased through the exchange . If you buy health insurance outside the exchange, whether its COBRA continuation coverage or other private health insurance, you cannot use an Obamacare subsidy to defray the cost.

As noted above, the American Rescue Plan has created a federal subsidy that covers the cost of COBRA or state continuation coverage through September 2021, for people who involuntarily lost their jobs. And employers can choose to offer their own subsidies for COBRA coverage, so you might see that as part of a severance package, for example. But those are not the same as the “Obamacare subsidies” that people receive if they purchase individual coverage in the exchange.

You May Like: How Much Is Temporary Health Insurance

Types Of Health Insurance Plans

When purchasing health insurance, your choices typically fall into one of three categories:

- Traditional fee-for-service health insurance plans are usually the most expensive choice. They offer the most flexibility in choosing health care providers.

- Health maintenance organizations offer lower co-payments and cover the costs of more preventive care. Your choice of health care providers is limited to those who are part of the plan.

- Preferred provider organizations offer lower co-payments like HMOs but give you more options when selecting a provider.

Health Coverage For People With Disabilities

If you have a disability, you have three options for health coverage through the government.

-

Medicaid provides free or low-cost medical benefits to people with disabilities. Learn about eligibility and how to apply.

-

Medicare provides medical health insurance to people under 65 with certain disabilities and any age with end-stage renal disease . Learn about eligibility, how to apply and coverage.

-

Affordable Care Act Marketplace offers options to people who have a disability, dont qualify for disability benefits, and need health coverage. Learn about the .

Recommended Reading: What Is Aetna Health Insurance

Trumps Attacks On The Marketplace

The CMS report on 2020 enrollment shows that the marketplaces remain an important source of coverage and financial assistance for millions of low-income and middle-class Americans. Nationwide, 87 percent of people enrolled in marketplace coverage benefit from financial help toward premiums 52 percent benefit from reduced deductibles and other cost-sharing and at least 90 percent live in a household with an income that is 400 percent of the federal poverty level or less.

Nevertheless, the Trump administration has taken numerous actions to discourage enrollment in the marketplaces, from seeking the full repeal of the ACA to meddling with financial assistance rules. While the enrollment period for 2017 coverage was still open when President Barack Obamas term ended, the Trump administration took actions to undermine the ACA within days of taking office, including canceling television ads for the marketplace outreach campaign. By one estimate, Trumps actions resulted in 500,000 fewer people enrolling in coverage for 2017.

To varying degrees, states have responded by implementing policies to mitigate the damage of the Trump administrations actions. For example, several states have enacted their own individual mandates, and others have reinstated rules on short-term plans.

If You Have Questions Ask For Help From A Licensed Health Insurance Professional

Open enrollment is the only time of year that individuals and families can obtain health insurance that meets the Minimum Essential Coverage requirements that qualify for cost assistance. These are plans that can not reject an individual if they have a pre-existing condition.

With that said, each health insurance type has its own enrollment period. Coverage options outside of open enrollment include qualifying for a Special Enrollment Period, Medicaid, and CHIP. If you dont have access to these, consider your Short Term Health Insurance options.

Want To Explore All Of Your Options Right Now? Compare Obamacare Rates With HealthNetwork

You May Like: How To Stop Health Insurance

Essential Obamacare Facts For 2022

For 2022 there are three main things to consider. 1. Getting covered during open enrollment , 2. making sure you are ready to file your taxes as they relate to healthcare at tax time, and 3. keeping an eye on the latest healthcare reform news . With that in mind, here are some essential facts related to the above points .

- As noted above, ObamaCares 2022 Open Enrollment period for 2022 health plans starts November 1, 2021, and ends January 15, 2022 in most states.

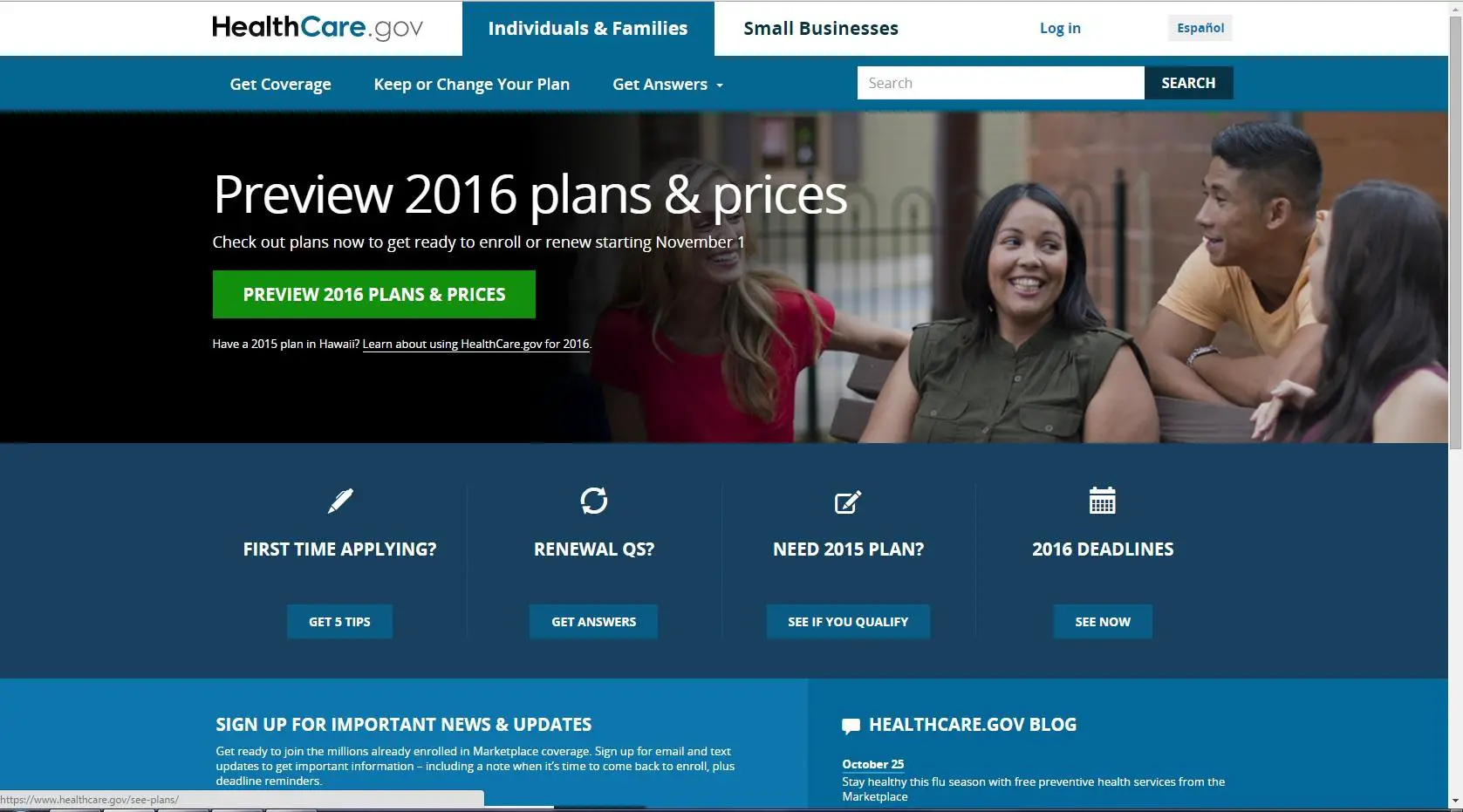

- HealthCare.Gov is the official website to use if you want to lower costs on private health insurance and qualify for Medicaid under the Affordable Care Act! Make sure to shop during open enrollment for coverage inside or outside the marketplace.

- Those who use the marketplace may qualify for one or more of three different types of assistance based on family size and income. First, premium tax credits lower premiums. Second, out-of-pocket cost assistance lowers out-of-pocket costs on Silver plans. Third, Medicaid and CHIP are free or low-cost health insurance for low-income individuals and families.

- Despite rate increases, many families will be able to get a plan for less than $100! This is true each year, primarily because the ACAs Advance Premium Tax Credits cap premiums based on household income and family size. Learn more about how cost assistance works with the Affordable Care Act.

What Do I Do

When you first become eligible for COBRA, look carefully at your financial situation and research how much your COBRA premiums will be. Ask yourself if youll be able to afford COBRA premiums given the change in your financial situation caused by your qualifying event.

Next, find out whether or not youll be eligible for help paying for health insurance you buy through the exchange. If youre eligible for a subsidy, how much will you have to pay, after the subsidy is applied, for an individual market plan comparable to your current coverage?

Would it be more affordable to purchase a less robust policy? You’ll likely find options in the exchange with higher deductibles and out-of-pocket costs, but the premiums for those plans are also likely to be lower than the premiums to continue your group plan via COBRA.

Compare your cost for subsidized individual market coverage with your cost for COBRA continuation coverage. Factor in your comfort level with your current health plan versus changing health plans, including things like whether your current doctors are in-network with the available individual market plans, and whether the drug formularies for the available individual market plans include the medications you take.

Also Check: How Much Does Private Health Insurance Cost In California

What Plans Are Available

New York State of Health plans are organized into four categories:

- Bronze plans have the lowest monthly premiums and the highest deductibles and copays and cover roughly 60 percent of care costs. Theyre designed to help you in case of serious illness or injury.

- Silver plans have moderate monthly premiums, deductibles and copays and cover roughly 70 percent of care costs. Theyre the only plans eligible for cost-sharing subsidies.

- Gold plans have higher monthly premiums and lower deductibles and copays and cover roughly 80 percent of care costs.

- Platinum plans have the highest monthly premiums and the lowest deductibles and copays and cover roughly 90 percent of care costs. These are for people who have significant health care needs and are willing to pay the highest premiums.

New York State of Healths comparison tool allows you to estimate costs and benefits of various plans and check whether you might qualify for financial assistance.

Applying For Obamacare Via An Insurance Company

You can also search for Obamacare plans directly with health insurance companies. This might be an insurer that has been around for decades or a newer company that only exists online. In either case, if you apply online, the insurer may redirect you at some point to the health insurance marketplace â either healthcare.gov or your state exchange â to complete your application. Remember that the insurance company will only show you their health plans. So if you want to comparison-shop for insurance coverage, it may be best to go directly to the marketplace to see all the plans.

Don’t Miss: Are Abortions Covered By Health Insurance

With A Special Enrollment Period

-

If you experience certain types of life changes like losing health coverage, getting married, moving, or having a baby you may qualify for a Special Enrollment Period to enroll in a Marketplace plan. If eligible, you may qualify for help paying for coverage, even if you werent eligible in the past. Learn more about lower costs.

Can I Refuse Health Insurance From My Employer And Get Obamacare

Yes, the Affordable Care Act ensures that almost all Americans can buy individual and family health insurance from its online Marketplace, aka Obamacareeither the federal exchange or a state-run one. However, you most likely will not qualify for any subsidies, tax credits, or other financial assistance. The only way you might be eligible is if a) your employer-sponsored health plan doesnt meet the minimum value standard of coverage required by the ACA, or b) the cheapest plan through your employer costs more than a certain percentage of your household income. Even without the subsidy, though, a Marketplace plan may offer a more economical deal than your employer-based insurance, so comparison-shopping never hurts.

You May Like: Can I Go To The Er Without Health Insurance