Support And Advice If You Have Gpa

For more information and advice, you may find it useful to check the Vasculitis UK website.

Vasculitis UK is an organisation for people with vasculitis . GPA is a type of vasculitis.

The Vasculitis UK website has information about living and coping with vasculitis, including advice about general health, benefits and insurance.

What Are The Benefits Offered Under The Gmc

1 Hospitalization Expenses

All the expenses that occur while the employee is hospitalized is covered under this policy. The cost of the hospital stay, the medical amenities, and the equipment costs charged by the health institution is fully covered. In some cases, insurance policies also provide a cover for certain diagnostic procedures such as CT Scan, X-Ray, MRI, blood tests, etc. at an additional premium.

2 Pre and Post Hospitalization Expenses

The pre-hospitalization expenses such as doctors consultation fees, pathological tests, and post-hospitalization expenses such as tests to confirm the bodys response to the treatment, medicines, doctors follow-up, etc. are covered under the policy. However, depending upon the insurance company, this coverage is limited to 30 days of pre-hospitalization expenses and 60 days of post-hospitalization expenses.

3 Reimbursement of out-patient expenses

In some cases, employees have to undergo ENT, Ophthalmological, and dental treatments, pacemaker placement, dialysis, chemotherapy, which are not usually covered under the normal group medical insurance policy. However, at an additional premium, some companies provide these additional covers too.

4 Maternity care and infant health coverage

5 Family Floater Cover

6 Day Care Procedures

Any medical procedures that are conducted in a specialized daycare center under which the employee is discharged the same day, are covered under this policy.

7 Cashless Hospitalisation

Necessity Of Gpa And Gmc Insurance Policy

Companies need to consider the needs of their employees and keep them happy and satisfied to build a better business and working environment. Companies take several efforts on this front and try to offer the possible benefits to their employees. Such initiatives motivate the employees to do better and be a part of the organisation for a comparatively longer duration. Considering the needs of the employees may also in return enhance the reputation of the company and have more aspirants willing to join the company.

One such benefit that we are going to talk about today is insurance. Employers offer various policies to their employees, but the two most popular ones are General Personal Accident Policy & Group Medical Coverage . This policy can be highly beneficial as it helps cover the employees under certain unprecedented situations that might lead to a high financial burden. Scroll down to read more about these policies in detail and understand whether one should opt for one or not.

Lets talk about GPA first! Life is all about uncertainty, and there can be situations such as accidents that can lead to fatal injuries or disability. This group insurance policy comes as a savior under such situations. It covers unfortunate circumstances and comes with accidental death cover, displacement cover for depreciation, education fund coverage for dependents, cover for transportation/ambulance, and total/partial/permanent disability.

The author is Director, Probus Insurance

You May Like: How To Enroll In Health Insurance

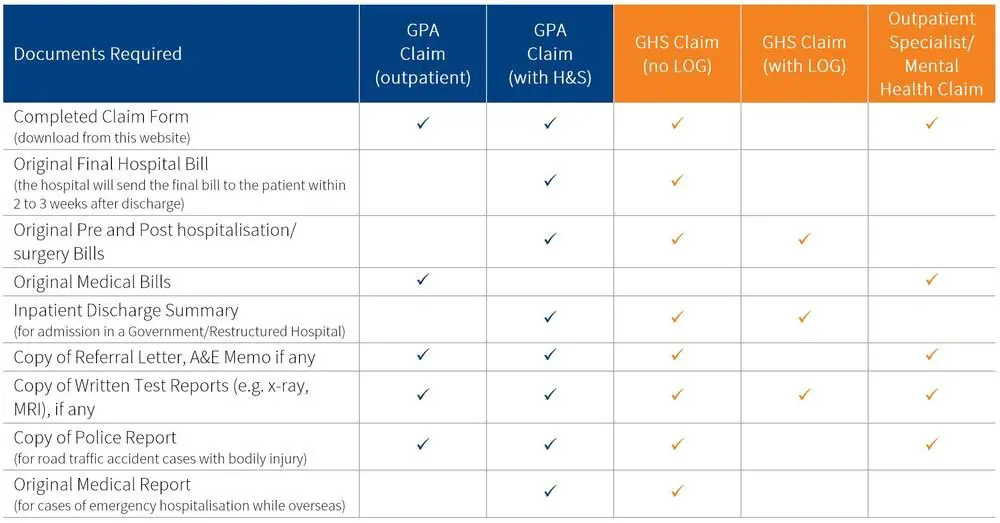

Documents To Submit For Raising A Claim Under The Gpa Insurance Policy

To raise the claims under the GPA Insurance Policy, you will need to submit a few documents. These documents differ according to the type of GPA Claim you want to raise. This means the required documents will be different for a Death Claim than for a Permanent Total Disablement. We are showing them below. Check them out!

For Death Claim

Your Low Gpa Might Not Be A Huge Problem If:

Its Above a 2.0

As long as your GPA is higher than a 2.0, there will be some colleges where you have a good chance of acceptance. If it’s below a 2.0 it will be very hard to get into most schools.

You Did Well on Standardized Tests

As I mentioned earlier, standardized tests are the most important thing colleges will consider apart from your GPA. If you do extremely well, they will be more likely to give you a chance despite your low GPA. Studying for standardized tests and improving your scores is much easier than improving your GPA, so if your GPA isnt where you want it to be, try to focus on score improvement to get the most bang for your buck in the college admissions process.

You Challenged Yourself

If your GPA is on the lower side, but you earned it in difficult classes or challenged yourself more and more over the course of high school, colleges will take this into account. Your GPA itself is less important than the road you took to get there.

Want to build the best possible college application?

We can help. PrepScholar Admissions is the world’s best admissions consulting service. We combine world-class admissions counselors with our data-driven, proprietary admissions strategies. We’ve overseen thousands of students get into their top choice schools, from state colleges to the Ivy League.

We know what kinds of students colleges want to admit. We want to get you admitted to your dream schools.

Don’t Miss: Can Aflac Replace Health Insurance

Lets Discuss Gpa Insurance Policy

As you can see from its name, this insurance policy helps individuals cover the expenses in case of an accident injury, accidental disability, or accidental death. Employees are considered to be the greatest asset for any organization, and a GPA insurance policy is the method by which the company shows the value to the company. The Insured sum on a GPA Policy can vary from the insurance company and can also be customized according to the Employees Salary or category or as per the companys requirements.

Similar to the GMC Insurance Policy, the benefits will be similar to all individuals in a group, that too at an affordable premium cost. The best thing about this policy is that it is not necessary to be on duty to enjoy the benefits. The policy will cover individuals whether they are on duty or not.

What Is Not Covered Under Group Personal Accident Insurance

- securenow_insuropedia

What Is Not Covered Under Group Personal Accident Insurance?

The below-mentioned causes of injury or death are not covered under a group personal accident insurance:

- Natural Death

- Death or injury while under the influence of intoxicating liquor or drugs

- Death or injury while engaged in an adventure sport or hazardous activity

- Any pre-existing condition and disability or accident arising out of it

- Consequential loss of any kind and legal liability

- Damages due to war, civil war, invasion, act of foreign enemies, revolution, insurrection, mutiny, seizure, capture, arrest, restraint or detainment, confiscation, nationalization, or restitution by or under the order of any government or public authority

- Payment of compensation in respect of death or injury because of attempting suicide

- Pregnancy including childbirth, miscarriage, abortion, or complication arising therefrom

- Venereal or Sexually transmitted diseases

- Curative treatments or interventions

You May Like: Are 1099 Employees Eligible For Health Insurance

Purchase An Insurance Plan On The Marketplace

In case your employer doesnt provide insurance, or if the price is too high, as a resident alien, you can always acquire an insurance plan on the which is actually the website HealthCare.gov. This allows you to browse through different insurance plans and choose the one that best addresses your individual needs.

The same way in which you can browse on Stilt to get the right loan for purchasing gold jewelry or any other acquisition you might have in mind, HealthCare.gov makes it easy to find what you need. However, when it comes to ACA plans, they are readily available to buy during the open enrollment period.

If you are outside this window, then getting a short-term plan might be an option worth considering.

What Health Insurance Pays For Gym Membership

If you are an avid gym goer, it is reasonable to want to save money on dues and fees wherever you can especially if you can get your health insurance to pay for it. The good news is that this is actually possible! Many health insurance companies, although they will not pay for the entire membership, do offer partial coverage for certain gym amenities. So keep reading if you want to find out which health plans and programs can help you save money on your gym attendance.

Don’t Miss: When Does Health Insurance Renew

How To Reduce Your Rate For Gpa If You Already Have A Gtl Cover

- securenow_insuropedia

GPA and GTL offer accidental and life coverage respectively. Both are fixed benefit policies aimed at providing financial security to the employees family upon the death of the employee.

Coverage for GPA and GTL are as under

| 2. Permanent Total Disability | |

| 3. Permanent Partial Disability | |

| 4. Temporary Total Disablement | |

| Add-ons | |

| 1. Accidental Medical Expenses | 1. Terminal Illness |

| 2. Critical Illness Rider | |

| 3. Mobility Extension | 3. Accidental Death Benefit Rider |

| 4. Last Rites Expenses |

GPA covers only accidental death, however, the scope of GTL policy is broader to cover both normal and accidental death. For example If an employee is covered under both GPA and GTL insurance, upon his/her death due to an accident both policies will trigger however in the case of natural death only GTL will trigger.

Additional Read: What are the different types of Disabilities covered under a Group Personal Accident Plan?

Since both policies are tailor-made, i.e. a corporate can select the benefit structure for its group policy. In case the corporate decides to remove the dual coverage for accidental death, he/she can opt out of the accidental death benefit from the GPA policy. The accidental death benefit is a critical policy benefit, removing this benefit leads to significant savings in the cost of GPA policy.

For further information visit SecureNow or connect with us on

What Are The Exclusions Under The Gmc Policy

Following are the permanent exclusions:

- Diseases caused due to drug or alcohol abuse

- Alternative treatments not specified under the policy

- Treatments done outside the policys geographical limits

- Injuries caused due to war, mutiny, military action, etc.

- Cosmetic treatments not specified in the policy

- Self-inflicted injuries

- Engaging in criminal or unlawful activities

Also Check: What’s The Cheapest Health Insurance I Can Get

Problem Two: Private Sector Spending

Medical research has pushed the boundaries of what doctors can do for us in every direction. As a result, we could probably spend the entire gross domestic product on health care in useful ways:8

The Cooper Clinic in Dallas now offers a comprehensive checkup for about $2,500. If everyone in America took advantage of this opportunity, the U.S. annual health care bill would increase by one-half.

More than nine hundred diagnostic tests can be done on blood alone, and one does not need too much imagination to justify, say, $5,000 worth of tests each year. But if everyone did that, U.S. health care spending would double.

Americans purchase nonprescription drugs almost twelve billion times a year, and almost all of these are for selfmedication. If everyone sought a physicians advice before making such purchases, we would need twenty-five times the current number of primary care physicians.

Some 1,100 tests can be done on our genes to determine if we have a predisposition toward one disease or another. At, say, $1,000 a test, it would cost more than $1 million for a patient to run the full gamut. But if every American did so, the total cost would be about thirty times the nations total output of goods and services.

Does Original Medicare Pay For Gym Memberships

Original Medicare does not cover any gym memberships or gym-related costs. However, Medicare Advantage plans do offer partial coverage or complete coverage for gym memberships. There are also other private health insurance options that can cover gym memberships if you are not enrolled in the Medicare Advantage plan.

Also Check: Where To Go If No Health Insurance

Why Choose The Bundled Plan

- Savings – As opposed to buying each plan on its own, you can save more with bundled plans.

- No guesswork – You get convenient, core coverage at reasonable prices.â

- Flexible – If you please, you can further top up the plan by adding more coverage.

You can increase the coverage for your group health insurance plan by simply adding on a bundled plan. One of the frequent choices is Group Personal Accident and Group Terms Life Insurance .

Problem Five: Lack Of Actuarially Priced Insurance

An increasingly common feature of insurance markets is guaranteed issue regulation, which forces insurers to sell to all applicants, no matter how sick or how well they are. Perversely, this practice, when combined with community rating, encourages healthy people to avoid high premiums and stay uninsured. After all, why buy health insurance today if you know you can buy it for the same price after you get sick? Under pure community rating, insurers charge the same price to every policyholder, regardless of age, sex, or any other indicator of health risk. Despite the fact that health costs for a sixty-year-old male are typically three to four times as high as those for a twenty-five-year-old male, both pay the same premium. Modified community rating allows for price differences based on age and sex, but not on health status.

Ironically, many large corporations community rate insurance premiums to their own employees, even though not required to do so by law. To the extent that employees pay part of the premiums for these plans, the premiums tend to be the same for everyone, regardless of expected costs. Whether in the marketplace or inside a corporation, distortions in prices produce distortions in results. People who are overcharged tend to underinsure. People who are undercharged tend to overinsure. In general, people cannot make rational choices about risk if risks are not accurately priced.

Also Check: How Much Is Health Insurance When You Retire

Difference Between Gmc And Gpa Insurance Policy

Team AckoOct 11, 2021

Certain health insurance policies can be a bit tricky to comprehend. This is often the case when it comes to Group Medical Coverage and Group Personal Accident policies. They are similar but not the same. Whether you are an employer looking to pick a suitable cover for your employees or an employee wanting to understand more about your employer-offered health insurance policy, the following sections will clear the fog and lend clarity. Read ahead to know the meaning and difference between GMC and GPA insurance policies.

Your High Gpa Will Be A Big Asset If:

You Earned It in High-Level Classes

Above all, colleges want to see that you’re willing to challenge yourself intellectually. If you managed to earn a high GPA while taking difficult courses, this will show them that youre both intelligent and driven. Even if you took easier classes at the beginning of high school and then went on to take more challenging ones later, your course record will demonstrate that you’re engaged in learning and willing to push yourself.

Your Standardized Test Scores are Just OK

If you aren’t a great test taker and didnt get awesome scores on the SAT or ACT, your GPA will help you to rise above the crowd despite this. More and more schools are starting to see GPA is a more reliable metric than standardized tests for judging academic potential. A high GPA shows determination over time and is the most reliable indicator of a students ability to ultimately graduate college.

Your GPA Stands out from Other Students in Your Class

If very few other students at your school achieved a GPA similar to yours, this indicates that you were willing to go above and beyond to get high grades in difficult classes.

Also Check: Does Health Insurance Cover Tooth Extraction

Where Can You Purchase Health Insurance

You can purchase individual health insurance directly from the insurer, through a third-party company, or through the Marketplace! If you wish to enroll through the Marketplace, you must register within the Open Enrollment Period or special enrollment period if you qualify. To learn more about the enrollment dates and guidelines you can find easy instructions right now on HealthCare.gov. Whether you choose to take a program with gym benefits or not, it is always important to live a healthy lifestyle to help reduce the risk of future illnesses. Even if you dont receive any direct benefit from your health insurance provider, the improved health over time will save you money on your medical costs in the long run.

Welcome To The University Of California Irvine Student Health Insurance Plan

The University of California requires all registered students to have health insurance as a non-academic condition of enrollment. To assist students in meeting this requirement, the University provides the UC Student Health Insurance Plan .

UC SHIP is a comprehensive health insurance plan that includes medical, mental health, dental, vision and pharmacy benefits. The plan features year-round, world-wide coverage utilizing the Anthem Blue Cross Prudent Buyer PPO network. The Student Health Center and UC SHIP offers peace of mind for both parents and students in providing convenient, affordable coverage for services on campus and in the UC Irvine community.

All full and part-time undergraduate and graduate students are automatically enrolled in UC SHIP once registration fees are assessed. Note that the acronyms “GSHIP” and “USHIP”, wherever they appear, pertain to the graduate student plan and the undergraduate student plan respectively. The UC SHIP fees appear on the students campus billing or ZOT account and they are segregated into three components: 1) ADMIN fee 2) PREMIUM fee and 3) BROKER FEE.

Students can choose to keep UC SHIP, or waive enrollment if they have other health insurance coverage that meets the waiver criteria established by the University of California. Once granted, the waiver is in effect for the current term and the remainder of the academic year. A new waiver request must be submitted at the beginning of each academic year.

Recommended Reading: Can You Get Medicaid If You Have Health Insurance