Aflac Health Insurance Says

Aflac offers the following variety of health insurance coverage options and types:

- Hospital confinement indemnity pays benefit for hospital stays when 23 hours or more is required due to a sickness or injury covered by the plan.

- Hospital confinement sickness indemnity pays benefit for the fees related to doctor visits, diagnostic exams, surgery, and hospitalization.

- Hospital intensive care pays for associated costs of stays in an intensive care unit.

- Specified health event payment in the event of a stroke, heart attack, coma, or other covered event.

- Cancer / specified disease pays benefit for treatment, including chemotherapy, radiation and hospital stays.

Contact Aflac at:

Aflac Supplemental Health Insurance Coverage

Although Aflac does not provide health insurance in the traditional sense, they go much further than simple accident insurance. They provide supplemental insurance for hospital coverage, cancer treatments, dental and vision insurance, long-term health care, short-term health care, intensive care insurance, and much more. Aflac also provides life insurance from term to whole life and they also have special policies for children.

If you are considering purchasing supplemental insurance, but you are not really sure if you need it, speak to an independent representative to determine if you need supplemental and what kind of supplemental insurance you should carry. Making this kind of decision can be overwhelming, especially if you are not familiar with all of the available coverage and you may need an expert to help you sort out where your regular health insurance starts and stops and how Aflac can help you.

Other Ways To Use Supplemental Insurance

Another effective use of supplemental insurance is for dental and vision care, which sometimes isnt included in an employers medical plans.

For example, the deductibles for major dental and vision operations can sometimes be quite high. A supplemental plan can help you pay for a high-deductible operation, especially when you believe one may be in your near future.

Read Also: Can You Add A Boyfriend To Your Health Insurance

What Is Excluded From Cancer Coverage

As you should with any insurance coverage youâre evaluating, read a potential cancer insurance policy judiciously before you apply for it. Youâll find that some cancer policies donât cover certain cancer types, such as non-melanoma skin cancer, or side effects from cancer treatment, including pneumonia or dehydration.

Supplemental Insurance Can Be A Sidekick To Traditional Health Insurance

Supplemental insurance coverage isnt comprehensive its designed to work alongside and cover the gaps left behind by a typical health-insurance policy. This is accomplished by paying benefits directly to you, giving you a buffer to overcome the potential financial burdens of an unexpected hospital stay, illness or accident.

The time you spend in the hospital, or simply ill at home, may also result in lost wages. You might have travel costs from plane tickets or hotel lodging if you have to travel far to be seen by a specialist or to undergo surgery in a hospital known for its specialization in your condition. These costs are often covered under a supplemental insurance policy in the form of monetary assistance. For example, cancer insurance and critical-illness supplemental insurance pay out a cash benefit in the event youre diagnosed with cancer or suffer a heart attack or stroke.

There are also supplemental insurance products designed to cover more than a typical insurance policy.

You May Like: Starbucks Dental Coverage

Financial Value And Ratings

Aflac is a leading supplemental insurance company with excellent financial ratings. The organization has an A+ rating with Better Business Bureau and an A+ rating from A.M Best. In 2017, Aflac earned the 126th spot on the Fortune 500. In addition, they were also ranked number 91 on the Fortune list of Best Companies.

Aflac Insurance Customer Satisfaction

As expected for a company this size, Aflac Insurance reviews show high customer complaints. According to the National Association of Insurance Commissioners , when it comes to company complaints, Aflac ranks below the national baseline index of 1.0.

Individual life insurer Aflac has a complaint index of.78, which indicates that, on average, the insurer has received fewer registered complaints. Another rating agency, AM Best, gives Aflac an A+ rating, which demonstrates the companys historical ability to pay claim payments.

Compared to its competitors, Aflac Insurance is a standout provider and performs well with its range of insurance premiums and riders available to add on. Aflac Insurance can be advantageous if you are looking for a top-up to your current health or life insurance.

If you are worried about making up any shortfall in your income or excess medical bills, Aflac insurance plans can help you cover any additional costs.

- Policies are available directly from Aflac Insurance or through many workplaces.

- Available in all 50 states and also Washington D.C.

The Cons

- It is a supplemental insurance primarily offered by your workplace

- Limited term insurance options

- Maximum coverage you can get is $500,000

Also Check: Starbucks Employee Health Insurance

In Case If You Are Unable To Work And Not In The Hospital But In Isolation At Home Aflac Short

In Order to get Cover in this case Documentation with a positive presumptive diagnosis code will be necessary, including both employer and physician statements indicating you are disabled, not working and, if applicable, not receiving 80%* of your pay or in the case of group products, 60%* of your pay. Any required elimination period would need to be met as outlined by the policy. Benefits for events other than disability will be paid as outlined in the policy.

Aflac Insurance Customer Service

You can find your Aflac policy number in your welcome letter in the policy package you receive when you take out the Aflac supplemental life insurance.

Additionally, you can make payments online via your MyAflac portal, online banking, or phone payments. You can also contact Aflac customer services at 800-992-3522, between 9 am to 7 pm ET. You can also use Aflac customer service chat between 8 am and 8 pm ET. If you want to contact them via fax, the number for claims is 877-442-3522.

Don’t Miss: Evolve Health Products

How Does Aflac Work And How Does It Work

Aflac does not engage with medical providers directly, instead preferring to make payments directly to your bank account. Supplemental insurance is based on the premise that major medical coverage does not always cover the entire cost of treatment. For example, if you have a $10,000 deductible for general illness or injury, then you would need to pay out of pocket for care before your insurance company would be required to pay anything.

There are three main types of supplemental insurance: deductibles and coinsurance for hospitalization and surgical procedures disability insurance and life insurance. This article focuses on discussing how Aflac works and how it works.

How does it work? When you sign up for a policy, you will be asked which benefits you want to include in your policy. These can include disability, life, hospitalization, and cancer. You will also be able to select whether you want to include vision coverage as well. If you choose to include these benefits, then when you file your tax return each year, you will be able to take any credits available to you against the taxes you owe. If you do not include these benefits on your policy application, then you cannot claim them on your tax return.

The next step is to send in some information about yourself and your family.

Claims Experience With Aflac

Customers can file their claims with Aflac Insurance in three different ways. The Aflac website has claims forms that can be downloaded, filled, and then either mailed or faxed to the company. Policyholders can also use the SmartClaim system to file their claims by logging into their customer account and accessing the claims system.

Aflac claims are handled electronically after Medicare approves and processes the claim. Customers can take advantage of Aflacs One Day Pay systems which can help policyholders to receive benefits payments within 48 hours. Using the SmartClaim system, customers can fill out claims forms, upload all necessary supporting documents, and upload their forms quickly to receive a fast response. For claims that require more investigation, Aflac promises to process them under 4 days, which is an excellent processing time.

Read Also: Is Umr Insurance Good

Compare Aflac Health Insurance Quotes

There is no need for anyone to go without the health care coverage that they need. There are many affordable plans available and supplemental coverage can be purchased at minimal cost.

Using the quote tool at the top of the page will ensure that you receive the most affordable rates possible for the coverage that you need and comparing plans gives you the ability to make educated choices. Do not allow health issues to ruin your financial future, insure yourself and be prepared for every contingency.

You will feel better each day knowing that you have coverage for both illness and injury. Take a few seconds, input your zip code above, and start getting quotes from top health insurance providers almost immediately. Get started now!

Important Things To Consider

Many people are asking if it is worth it to purchase an Aflac insurance plan. A former Aflac representative stated on an online forum that it all depends on everyones lifestyle.

Individuals can purchase cancer insurance, dental insurance, accident insurance, life insurance for children, or critical illness insurance, while short-term disability insurance, life insurance for adults, vision insurance, and hospital insurance are sold only through a workplace.

Unless you change your premium in the future it will not increase as you get older.

A medical underwriting process will be required if the medical amounts are more than $3,000.

Your benefits are transferable even if you quit the job.

Actually, the Aflac policies are not funded by employers, but by the employees. They will choose the right plan for them and the costs will be deducted from their salary.

Read the fine print carefully before signing the contract to know all the conditions and exclusions. You will want to know how you can be covered in case of a claim.

Also Check: Kroger Health Insurance Part-time

Aflac Life Insurance Review 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Bottom line: Aflac only sells life insurance through the workplace, but you can buy a supplemental policy if you need more coverage.

You may hear a duck sound in your head when you think of Aflac, but the companys position in the insurance industry is no quacking matter. Aflac is a top seller of insurance benefits at work, such as supplemental life insurance, which you can purchase on top of your employer-provided coverage. Availability varies among employers.

Why you can trust NerdWallet: Our writers and editors follow strict editorial guidelines to ensure the content on our site is accurate and fair, so you can make financial decisions with confidence and choose the products that work best for you. Here is a list of our partners and heres how we make money.

Aflac Enhances Group Critical Illness Insurance To Include Serious Mental Illnesses And Infectious Diseases Like Covid

Aflac Incorporated, a leading provider of supplemental insurance products in the U.S., today announced the launch of its newly redesigned Aflac Group Critical Illness Insurance to help employers better support the changing needs of their valued workers in a post-pandemic environment. The newly designed product includes more standard and optional benefits, giving employers greater flexibility to design the coverage plan that meets the unique needs of their workforce. This has become increasingly

Also Check: Do Substitute Teachers Get Health Insurance

Find A Plan That Fits Your Needs

- A- A.M. Best Company*

To read TZ Insurance Solutions LLC’s Privacy Policy, .

For California residents, CA-Do Not Sell My Personal Information,

Accident In Idaho, Policies A36100IDA36400ID, & A363OFID. In Oklahoma, Policies A36100OK A36400OK, & A363OFOK. In Virginia, Policies A35100VA-A35400VA, A35B24VA and A35BOFVA.

Dental In Idaho, Policies A82100RID through A82400RID. In Oklahoma, Policies A82100ROK through A82400ROK. In Virginia, Policies A82100RVA through A82400RVA.

Cancer In Arkansas, Policies A78100AR-A78400AR. In Idaho, Policies A78100IDA78400ID. In New York, Policies NY78100NY78400. In Oklahoma, Policies A78100OKA78400OK. In Oregon, Policies A78100ORA78400OR. In Pennsylvania, Policies A78100PAA78400PA. In Texas, Policies A78100TXA78400TX. Coverage may not be available in all states including but not limited to Virginia.

Critical Illness In Idaho, Policies A74100ID, A74200ID, A74300ID. In Oklahoma, Policies A74100OK, A74200OK, A74300OK. In Oregon, Policies, A74100OR, A74200OR, A74300OR. In Texas, Policies A74100TX, A74200TX, A74300TX. In Virginia, Policies A74100VA, A74200VA, A74300VA.

Coverage is underwritten by Aflac. In New York, coverage is underwritten by Aflac New York. WWHQ | 1932 Wynnton Road | Columbus, GA 31999

Aflac Accident Insurance Payout

You never know what is going to happen next second. So better be prepared to endure the forthcoming circumstances. While we are on the road we dont know when we will face any accident. Thats when we get the advantage of Aflac group accident cover. This policy also covers your family if they are involved in the accident. You and your family members will also get the insurance benefits of this policy from Aflac. Here is the detail of Aflac group accident insurance plan.

Accident Emergency Treatment Benefit Aflac will pay $120 for the insured and the spouse, and $70 for children if a covered person receives treatment for injuries sustained in a covered accident. This benefit is payable once per 24-hour period and only once per covered accident, per covered person.

You May Like: Umr Insurance Arizona

The Duck Makes Its First Appearance

Before Aflac started plastering the airwaves with cute duck commercials, the company was a little-known player in the world of supplemental insurance.

But all of that changed when, on January 1, 2000, the world was introduced to the Aflac duck.

This adorable commercial was called Park Bench, and was broadcast during a college football game.

Since then, the corporate mascot has appeared in more than 75 commercials, helping to make the company a household name instead of an unknown quantity.

These commercials are among the most successful in advertising history.

And since Aflac does most of its business in Japan, it was inevitable that the duck would become as big there as he is in the States.

He was introduced in that country in 2003, making the Aflac brand even more popular there than it was before.

And thats saying a lot because Aflac has been insanely in demand in Japan since around 1974.

The squawking Aflac duck moved on from his burgeoning fame in the US and Japan to become one of the biggest corporate mascots in the world.

And in 2004, he was even was inducted into the Advertising Walk of Fame.

In 2011, the mascot attained the only kind of lasting fame that truly mattersbecoming a balloon in the Macys Thanksgiving Parade.

The runaway popularity of this advertising character caused Aflacs brand recognition to soar from 11 to an incredible 94 percent in a mere 14 years!

What Is Aflac How Much Is It Where To Get It

What is Aflac insurance? Weve all seen that duck on TV, and who makes us laugh time and time again. But exactly what IS the insurance offered behind our feathery friend?

What Is Aflac Insurance?

Aflac is not health insurance. It is insurance for daily living. Also known as voluntary supplemental insurance, Aflac helps covered persons by paying them cash benefits, unless assigned, to help with out-of-pocket expenses that arise from covered accidents or illnesses. In the event of a covered loss, cash is paid to covered persons regardless of any other insurance they may have.

http://www.youtube.com/watch?v=uwaCtLlVTdg& feature=player_embedded

How It Works

Think about all the major medical health insurance expenses associated with being involved in an accident or major illness. You have co-pays when you go to the doctor or get a pharmacy prescription. You have an annual policy deductible to meet before benefits gets paid, and many times you even have co-insurance to contend with for ER visits and hospital stays. And what if you have a major dread disease like cancer and you want to see a specialist outside of your home state. Does your major medical insurance cover you and your supporting family members travel, lodging, and food expenses? No, it doesntand it never will. Even all the healthcare reform laws will not help you with covering out of pocket expenses. These are the exposures that Aflac addresses.

-Cancer

How Much Is Aflac Insurance?

Administration Ease

Read Also: Starbucks Healthcare Benefits

Other Aflac Perks Worth Considering

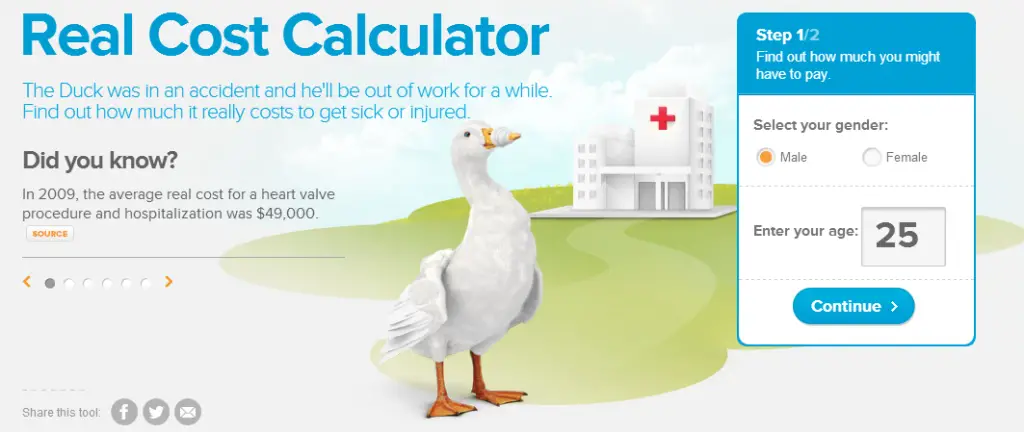

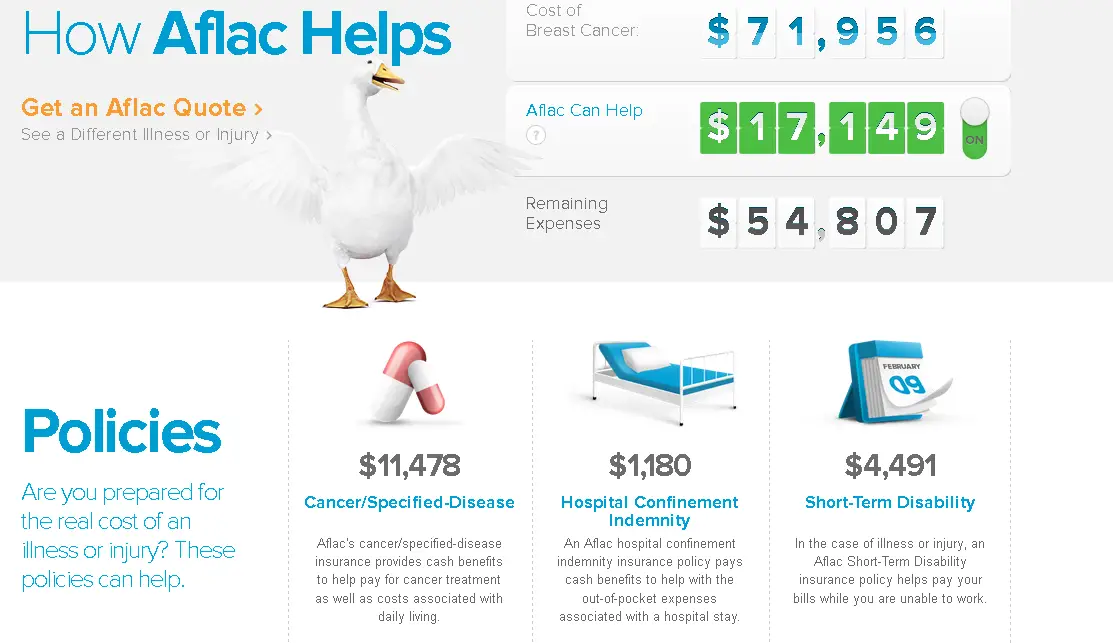

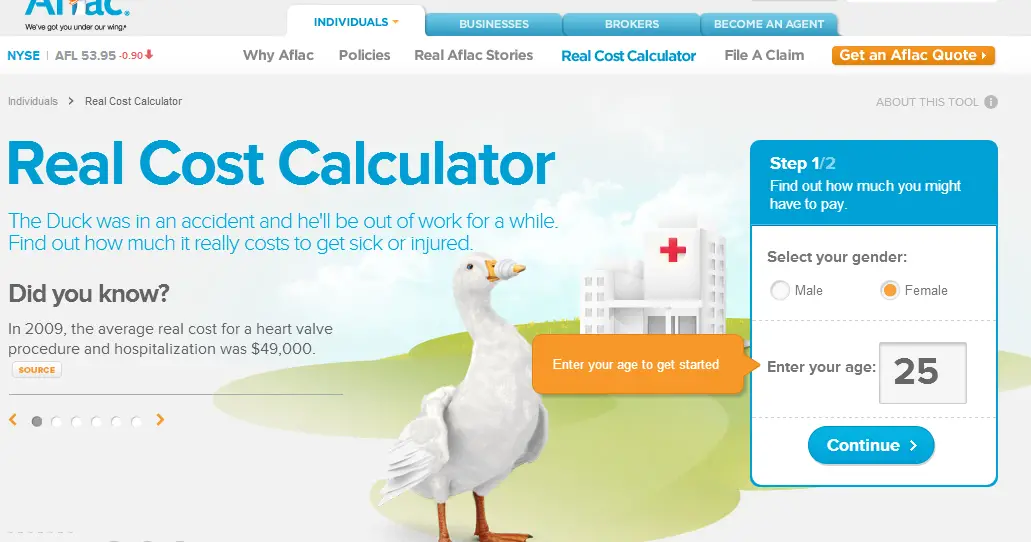

For those unsure of their life insurance needs, Aflac has two online calculators that could help with estimating coverage. The primary life insurance calculator has eight questions to get an understanding of how much life insurance coverage is needed, while the supplemental insurance calculator can provide a picture of how much medical costs might be associated with different procedures.

How Much Does Aflac Insurance Cost Per Month

The monthly cost of Aflac insurance is influenced by many factors including the type of policy that you want to sign up for, the applicant, the annual salary, and the deductible. However, the average cost of the majority of the Aflac insurance policies is anywhere between $10 and more than $30 per month.

For example, an applicant who is 55 years old and makes around $75,000 per year would have to pay anywhere between $70 and $100 per month, while an applicant who is 24 years old and makes $30,000 per year would have to pay $30 to $45 per month.

In the table below you will find the price estimates for short-term disability insurance.

| Salary | |

|---|---|

| $12-$21 | $15-$25 |

The #1 selling product for the company is the personal cancer indemnity plan. It protects in the unfortunate situation of cancer, stroke or heart attack. The monthly premium costs are anywhere between $9 and $15 per individual, depending on its age. Also, if there is another applicant added the costs would increase at $10 to $25 per month.

Another product designed to cover the health problems is the personal sickness indemnity plan, which costs anywhere between $8 and $14 per month, per individual, depending on the age of the applicant.

For instance, according to a member of the Disboards.com forum, the monthly costs are around $20 and the policy covers any health problems such as coma or heart attack.

Also, a member of the WhattoExpect.com forum claims that the monthly costs of a policy are around $50.

Also Check: Starbucks Partner Health Insurance