Private Vs Public Insurance In Canada

As previously stated, medical insurance plans in Canada are publicly funded and privately delivered. Canadians can choose any primary caregiver they want as their visits are billed directly to the government.

Specialist visits are arranged by primary caregivers. They take place both in private offices and public facilities like hospitals and clinics.

Hospitals are almost always not-for-profit. However, non-essential services like cosmetic surgery are provided in private, for-profit centers.

Healthcare programs vary significantly from one city to the other. They reflect local concerns, city council spending priorities, and changing demographics.

Municipal public health programs generally are not considered when Canadians discuss their healthcare system. While they are thought of more as municipal services, they still make important contributions to Canadiansâ health and quality of life.

Private health insurance plans in Canada are typically for-profit programs administered by private companies. You will pay out of pocket for these plans, and they can become quite expensive.

One of the benefits of private insurance in Canada is that you will get greater access to a wider range of Canadian hospitals and doctors. Waiting periods are shorter in many cases, especially for more minor illnesses or procedures.

Best For Longest Policy Options: United Healthcare/golden Rule Insurance

United Healthcare

Why We Chose It: As the only provider that offers 36-month coverage , UnitedHealthcare won top choice for the longest policy options.

-

Up to three-year policy available in some states

-

$5,000 prescription coverage available

-

Preventative care wellness checks covered

-

Some pre-existing conditions may be covered after 12 months

-

May need to purchase supplemental insurance to cover accidents and critical illness

-

TriTerm only available in 18 states

-

Reduced out-of-network coverage that can vary

-

May be required to join FACT

UnitedHealthcare underwrites its policies through Golden Rule Insurance Company, a part of UnitedHealthcare since 2003. The company has been selling short-term health insurance for over 30 years, and policies are available in 24 states. UnitedHealthcare has a Moodys insurer financial strength rating of A1.

Quotes and comparisons are easily available on the UnitedHealthcare website. In some states, you must join a consumer organization, the Federation of American Consumers and Travelers , for an additional $4 per month charge. Policies vary in length from one month to 12 months, with the option for 36 months on the TriTerm Medical plan that is available in 18 states.

Some STM plans cover 100% of medical costs once you meet the deductible or there are options where you pay 20%, 30%, or 40% coinsurance until you reach the annual maximum. You can also add prescription coverage.

Insurance For Individuals In Indiana

You have a lot of flexibility when youre shopping for individual coverage. If youre healthy and dont need to see a doctor on a routine basis, you can save some money by shopping for a plan with a lower monthly premium and a higher deductible. Keep in mind that coverage wont begin until you meet your annual deductible, so you want to make sure you can afford out-of-pocket expenses if you find yourself in need of care.

There are three types of plans you can choose from and each has benefits and drawbacks.

- Health Maintenance Organization plans are the most affordable but only cover services received from providers within the plans network. Youre also required to obtain a referral anytime you need to see a specialist.

- Preferred Provider Organization plans allow you to see whomever you wish, but youll pay less for services received within the plans provider network.

- Point-of-Service plans have the benefits of an HMO without harsh penalties for seeing out-of-network providers. If you wish to see a specialist outside of the network, for example, you can do so at the cost of a higher copayment.

You May Like: Who Pays First Auto Insurance Or Health Insurance

How Long Must An Employer Hold A Job For Someone On Disability

It depends on whether the disability is work related or not. If work related usually 1 year. If not work related, if you qualify under family medical leave act, then you can take up to 12 weeks. To qualify, there has to be a minimum of 50 employees, you have worked there for a year, and have been full time.29 nov. 2012

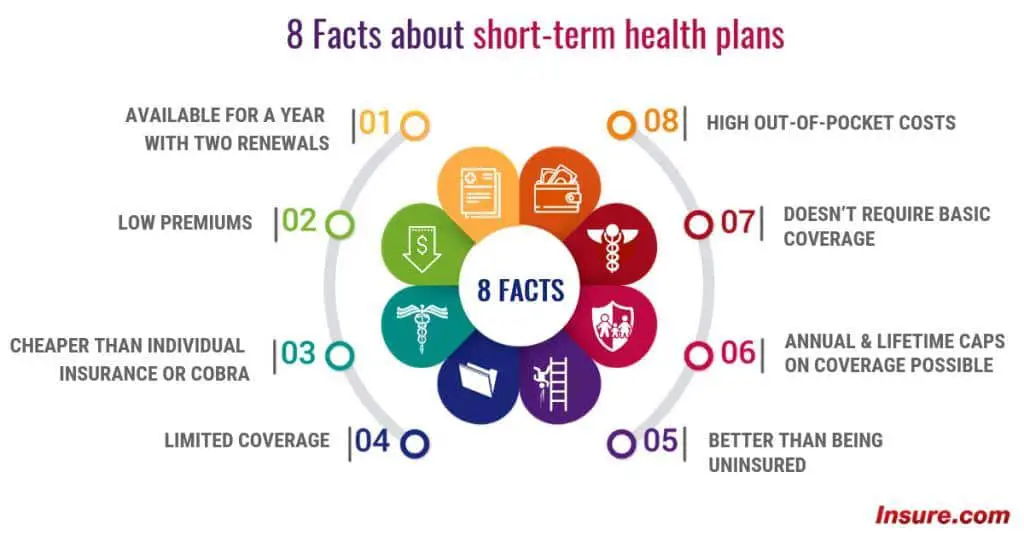

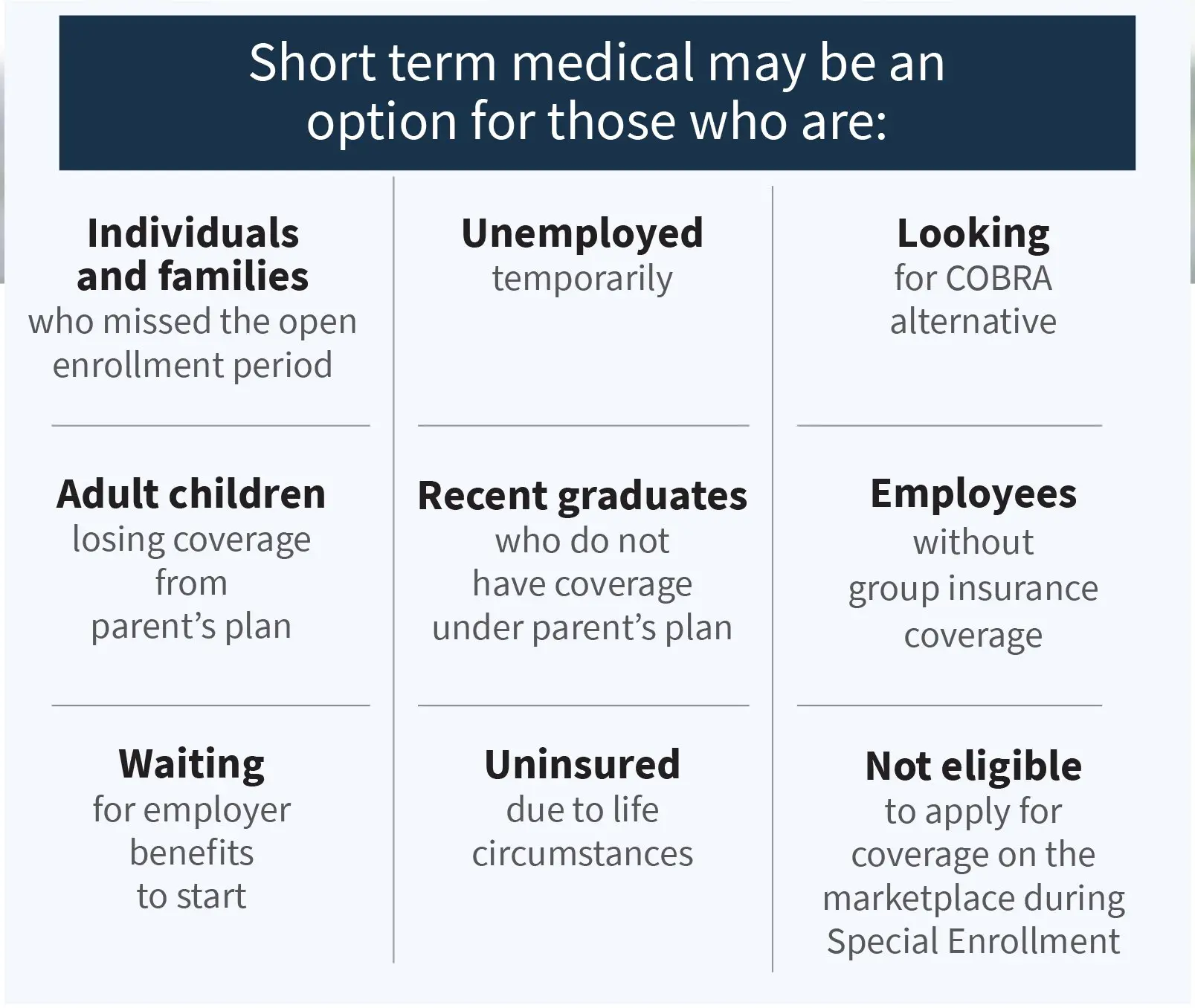

Is Short Term Insurance For Me

Short term insurance may be for you if you’re:

- Unable to apply for Affordable Care Act , also called Obamacare, coverage because you missed Open Enrollment and you don’t qualify for Special Enrollment

- Waiting for your ACA coverage to start

- Looking for coverage to bridge you to Medicare

- Turning 26 and coming off your parent’s insurance

- Between jobs or waiting for benefits to begin at your new job

- Healthy and under 65

For these situations and many others, Short term health insurance, also called temporary health insurance or term health insurance, might be right for you. It can fill that gap in coverage until you can choose a longer term solution.

You May Like: How To Apply For Low Cost Health Insurance

How Do You Buy A Short

Short-term health plans are sold through private insurance companies. Not all companies offer this type of plan. These plans are not available through the Health Insurance Marketplace and do not conform to Affordable Care Act guidelines. To buy a short term medical plan you can search for a private insurance company that offers them. Make sure to read all details before you buy or enroll. These plans can vary greatly in cost and coverage.

Can You Get Short

Not all states offer short-term health insurance plans. Theyre not permitted in Colorado, Connecticut, New Mexico and Rhode Island, while California, Massachusetts, New Jersey and New York prohibit the sale of these plans if they dont cover preexisting conditions. Delaware, Hawaii, Illinois, Maine, , Vermont and Washington state also maintain strict limits on short-term health insurance policies. Check your states policies to see whats available.1

You May Like: Does Short Term Health Insurance Cover Pre Existing Conditions

No Credits Or Subsidies With Short Term Health Insurance

You may be giving up on help by choosing a Short Term health insurance plan. If you get an ACA health plan, you may be eligible for help paying for your insurance in the form of:

- Tax credits on your premium

- Cost sharing reduction subsidies that can lower what you pay out-of-pocket for copayments, deductibles and coinsuranceF26

In contrast, Short Term insurance plans do not qualify for any credits or subsidies.

Insurance For Families In Indiana

You dont have the luxury of thinking only of your own needs when youre shopping for a family health insurance plan. While you may not require ongoing treatment, your child or spouse may need to see a specialist for a chronic medical condition. When youre reviewing policies, remember that youre looking for a plan that reduces your total out-of-pocket expenses. The plan that offers the lowest premiums may not be the least expensive option overall.

Consider factors such as your family deductible, your copayment for each medical service, and how well youre able to afford the monthly premium. The best plan for your needs will balance the cost of your medical services with the amount of money youre paying every month. Some HMOs may have networks that include the types of specialists you anticipate needing to see, which could make a particular HMO a cost-saving option if its in-network providers can offer the care your family needs.

Don’t Miss: Is Eye Surgery Covered By Health Insurance

Should I Purchase Short

Short-term health insurance should be used to fill a gap in coverage until you can find a longer-term health insurance option. Therefore, it is a temporary solution that could be a good option to consider in the following scenarios:

- Waiting period for employer health insurance

- Losing a job

- Don’t qualify for a special enrollment period

- Don’t qualify for COBRA insurance

- Students who may be in college and need coverage during the school year

- Aging out of a parent’s plan

- Need coverage before Medicare begins

What To Know About Insurance In Indiana

- Indiana allows you to purchase individual health insurance if your coverage through your employer isnt adequate.

- Open enrollment: Youre able to enroll for coverage during an open enrollment period that runs from November 1 to December 15 each year. If you miss Open Enrollment, you cant buy a marketplace plan until the next year unless you qualify for a Special Enrollment Period.

- Special enrollment: Life events such as getting married, moving, or having children may qualify you for a special enrollment period if you need to change your coverage or apply for insurance. You have 60 days from the time of the event to sign up for a new plan or make changes to your current plan.

- Premium tax credit: Indiana uses the federal Health Insurance Marketplace. If you want the Advanced Premium Tax Credit to help you pay your health care premiums, you need to purchase a plan through the exchange.

- Coverage types: About 53.3% of Indiana residents obtain their health coverage through an employer, while 4.4% have individual plans. An additional 17.7% are enrolled in Medicaid, and 14.8% of residents are covered by Medicare. Another 8.8% of Indiana residents are uninsured.

Also Check: Where Do You Go If You Have No Health Insurance

What Are The Pros And Cons To Short Term Health Insurance

If youre considering whether a short term health insurance plan is right for you, here are some pros and cons:

Pros:

- Designed to fill short-term gaps in coverage should you need it

- You can cancel coverage whenever youd like without penalties

- You can typically choose a plan that covers you up to a year, if you needed it

- Many different plan designs are available, depending on insurance carrier

Cons:

- Significantly higher deductibles than traditional health plans with other possible unforeseen costs

- No coverage for pre-existing conditions and limited coverage for most services

- A medical questionnaire may be required to be approved for coverage

- Coverage is not mandated or standard, so plans vary greatly in covered services and costs with very little government oversight

Short term health plans are not a good fit for everyone. For comprehensive coverage and benefits, make sure you enroll in a traditional health plan. This is either a plan offered through your employer or one you buy on your own through an individual insurance company or the Health Insurance Marketplace.

Health Insurance In Canada For Non

As an expatriate in Canada, you have several options to get medical treatment and coverage from private insurance providers in Canada. For healthcare in Canada for non-residents, especially for those who may not be eligible for local plans, we recommend the following providers below.

For instance, the GeoBlue Xplorer plan is an excellent option for US citizens living in Canada. It provides up to 9 months of coverage back in the USA and in other countries.

Aetna International, on the other hand, provides comprehensive coverage at an affordable rate for international citizens worldwide.

Cigna Global is another great option that can cover a wide variety of medical conditions. It also has a modular plan design that will let you tailor fit the level of coverage you need for specific situations.

We have a team of international insurance brokers who can walk you through the pros and cons of each option. We can provide more information about each plan and provider to help you decide which is the best and most appropriate plan for you and your family.

Read Also: Can I Buy Dental Insurance Without Health Insurance

Waiting Period To Get Public Health Insurance

In some provinces you must wait, sometimes up to 3 months, before you can get government health insurance. Contact the ministry of health in your province or territory to know how long youll need to wait. Make sure you have private health insurance to cover your health-care needs during this waiting period.

Should I Pay For Short Term Disability

In general, we can only recommend short-term disability insurance if offered by your employer either for free or at a low cost. Private short-term disability insurance is most likely not worth your money its often just as expensive as long-term disability insurance despite having a shorter coverage period.

Also Check: Do You Have Health Insurance

Youre In An Employer Waiting Period

In some jobs, the waiting period before new employees become eligible for employer-sponsored health insurance benefits may be as long as 90 days. It could also be as short as a few weeks. Depending on your circumstances, it may seem reasonable to coast through your orientation period uninsured.

Why risk it? A single month of short-term health insurance can be well worth the premiumoften one-third of what a major medical health insurance premium costs. Plan details such as deductibles and coinsurance can often be customized to your needs, and there is no waiting period to begin. Coverage typically starts within 24 hours after you pay your initial monthly premium.

Finding A New Family Doctor

You might not have a family physician or a nurse practitioner just like many Canadian citizens and expats living in the country. If you are one of them and you need access to healthcare services, you will have to either visit a community walk-in clinic or go straight into the emergency room for more serious concerns. This system may work just fine, especially if you are in good health. However, it can be a source of frustration, especially if you cannot find an office that is accepting new patients.

There is no standardized way to find a family physician in Canada. It often comes down to asking family, friends, or colleagues who they would recommend, and hoping they will put in a good word to connect you with the doctor.

In some provinces, there is a database where you can register your information to be matched with a family physician. In Ontario, for example, the Health Care Connect program considers preferences like language services and travel distance in matching a physician.

If you are an expat or a non-resident in Canada, the best advice is to start looking for a physician right away. Find a doctor you can contact long before you feel unwell. It may take several months before you get matched with a physician, so it is better to be proactive in searching for one.

Recommended Reading: How Do I Find My Health Insurance

What You Need To Know Before You Buy A Short

Short-term medical plans do not meet the definition of an individual or group health insurance plan under the federal Affordable Care Act or Washington state law. This means short-term medical plans are exempt from a number of coverage mandates ACA-approved health insurance plans must provide to plan enrollees.

How Do I Enroll In Indiana Individual And Families Insurance

The enrollment process for health insurance coverage is identical for individuals and families, but before you purchase a plan, you need to evaluate your needs. Factors to consider include:

- How many individuals need coverage

- How much you can afford to pay in premiums and out-of-pocket costs

- Your family members medical needs

- What type of plan youd prefer

You Need To Fill A Gap Between Employer Coverage And Your Next Job

As the saying goes, hope for the best and prepare for the worst. Even if you think youll land a job with benefits right away, it is wise to secure temporary health insurance coverage.

When you are unemployed and in between job-based health insurance plans, its often tempting to wait it out and remain uninsured. After all, the strain of household budgets and health insurance premiums can break the bank. But so can unexpected medical bills.

Short-term health insurance premiums are often a fraction of major medical insurance premiums. Plans usually include benefits related to inpatient and outpatient hospital care, emergency room visits, surgical services, ambulatory services, and intensive care, among other things. Keep in mind, you will still have to pay your medical bills until you reach your deductible and cover out-of-pocket costs for copays on covered services. If you reach the end of your policy and still need coverage, depending on your states laws, you can typically apply for and enroll in a new policy.

How Much Does Short Term Health Insurance Cost

If youre considering temporary health insurance, typical upfront costs include:

- Premium: This is the monthly fee you pay for having coverage. The premium will vary depending on the level of coverage you choose, including deductible and coinsurance, as well as the types of services covered.

- Deductible: The deductibles on short-term health plans can be significantly higher than other more traditional health plans. You pay out of pocket for services until you meet your deductible. Then your plan starts sharing costs.

- Coinsurance: This is the percentage of costs you share with your plan after you meet your deductible. Its often shown as a percentage. Most short term plans have a deductible and coinsurance.

- Copay: This is a fee you may have to pay when you visit a doctor usually payable at the time of the visit. Some short term plans require you to pay a copay for certain doctor visits.

- Other out-of-pocket costs: If there are health care services not covered by your short term plan, you could end up paying all costs. For example, some short term plans may not cover or may limit your coverage for maternity care, mental health or substance use services, vision care, or dental carethese are costs youd have to pay yourself for any services you receive.

Other costs may apply depending on what type of coverage you buy. Read all plan information carefully before choosing so you are informed on what your plan may actually cost you.