Why Is It Necessary For Me To Have A Health Plan

You might not need it now since you are healthy and young, but youll definitely see its usage and advantages the moment you developed a disease or got into an unexpected accident or emergency later in life. These things are inevitable and when that time comes, its always better to be prepared, at least, to have an accessible health insurance plan at hand.

How To Apply For A Health Card

HMO or health card is usually a benefit provided by an employer. As part of the employment package, some companies enroll their workers to an HMO of their choice for their own protection.

However, even individuals who are unemployed, self-employed or voluntary members can easily get a health card as they wish.

Applying for a health card in the Philippines is quite easy. You simply need to choose the service provider and sign up for any offers that suit your budget and needs.

Most of them have online application for a health card. However, you can also go to the nearest office branch of the company that you selected.

Best Hmo For Corporate And Small/medium Enterprises

Are you a business-owner? Do you want to protect your workers from the worst during times of sickness?

A corporate or SME HMO plan is built specifically for the needs of businesses. It can accommodate more enrollees that what can be offered in a family plan. Clients may have to reach the required minimum number of employees as principals and there may be a limit to the total number of enrollees.

There are two options that companies can go for: premium-based or third party administration . In a premium-based HMO plan, theres fixed cost, fixed or pre-defined benefits and exclusions, and the risks are shouldered by the HMO provider.

Under TPA on the other hand, the business sets up a health fund. Whenever an employee avails of any of the healthcare services, it gets deducted. Costs of the services are generally lesser due to the volume discounts especially when there are many enrollees. The business needs to make sure that the health fund is replenished. The HMO provider meanwhile will charge fees for administrative service, access, and other such expenses. The benefit is that the business only has to pay what is utilized rather than paying a fixed premium.

HMO companies have different sets of plans for SME and corporate accounts. While there are a few that provide information on these group plans, some dont have any. There might also be a need to look at the demographics of your employees, age, dependents, etc.

Also Check: How Much Does It Cost For Health Insurance

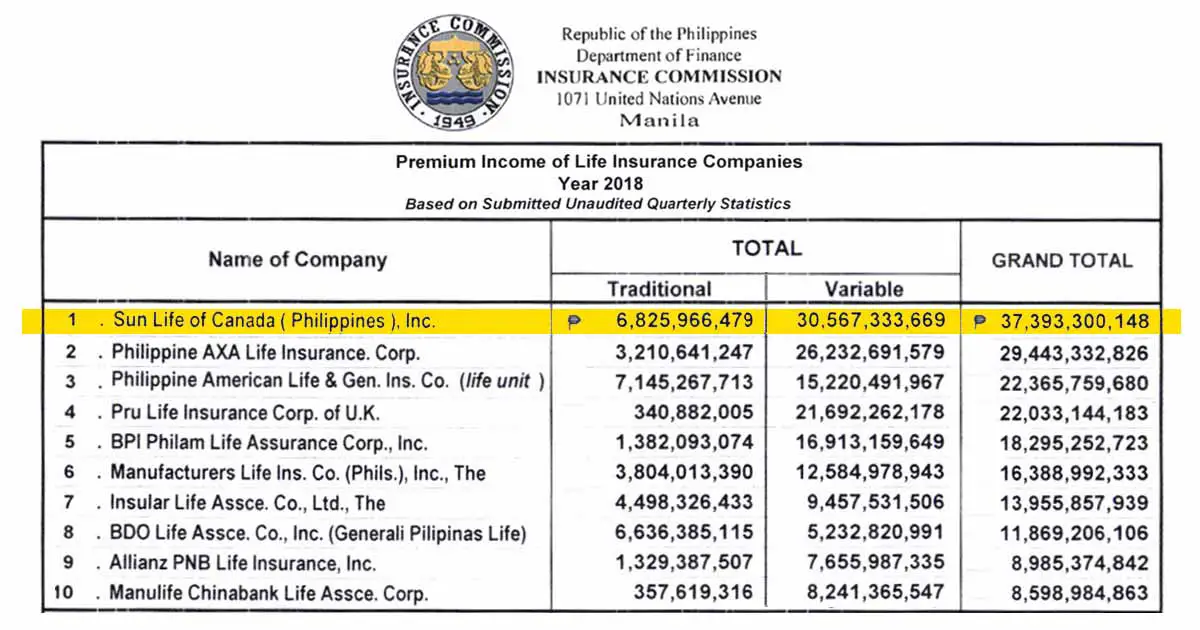

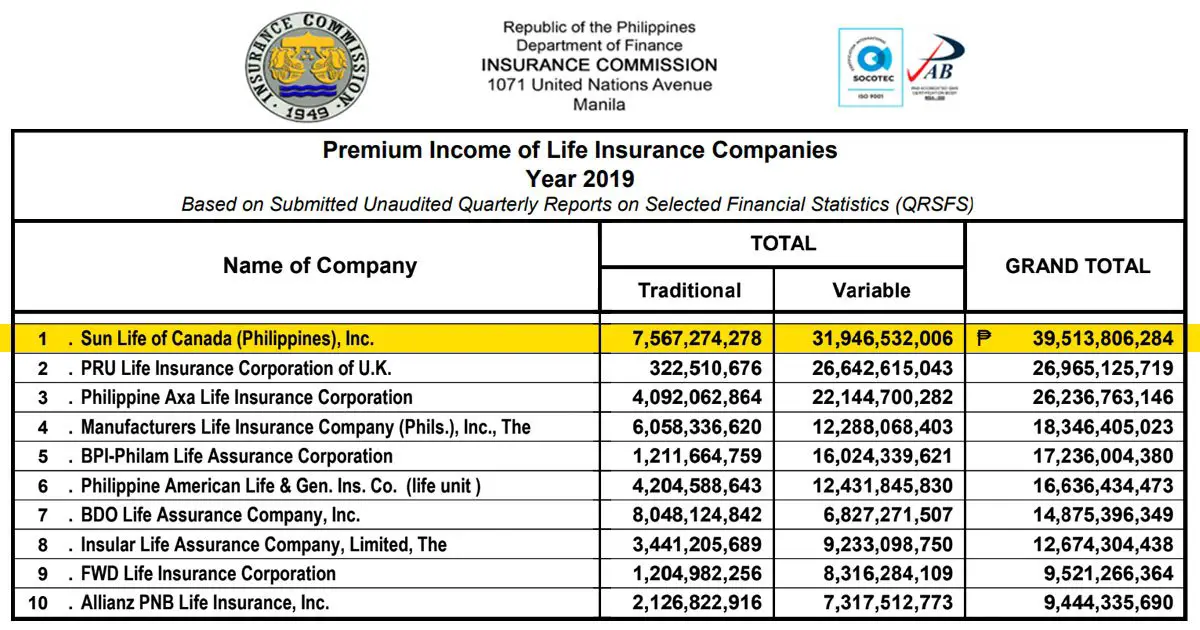

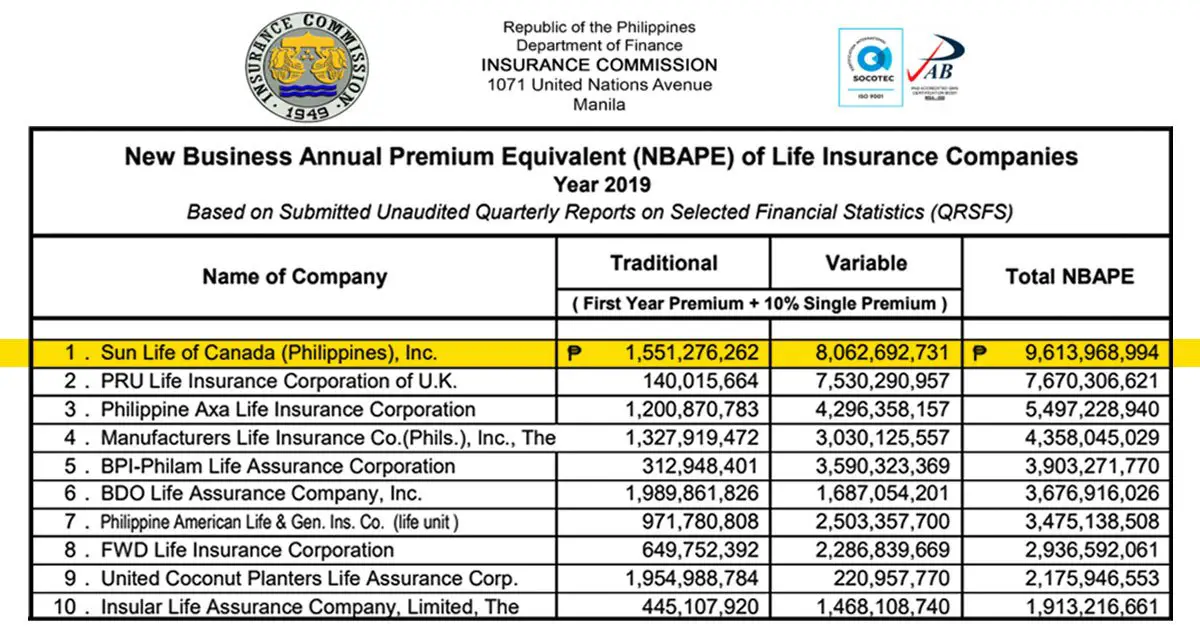

Sun Lifes Traditional And Vul Plans

It is why its important to consider the standing of an insurance company before availing of any insurance plan. You want that by the time that the need arises, the company is still performing well to fulfill its obligations to you. But this shouldnt be the sole basis for getting a plan might as well consider convenience, customer service, a reputable Financial Advisor, etc.

If you want income protection with a wealth accumulation plan, then a VUL plan is perfect for you. VUL plan is designed to give you financial security and peace of mind while growing your money over time. You can request a quotation and financial consultation by following the link below.

If you want a cheaper VUL from Sun Life, then you can follow the link below. It is for those who are looking for other VUL plan with a cheaper tag. It has better life insurance coverage than Sun Maxilink Prime but with a lesser investment fund.

*****

From The Life Insurers

For 2018, a total of 25,706 stand-alone healthinsurance policies were issued by life insurance companies. It insured a totalof 745,800 lives at a generated premium income of P7 billion .This means that most of the health insurance policies were group policies. Forcomparison, in 2017, a total of 17,406 health insurance policies were issued toindicate an increase of 47.68 percent from 2017 to 2018. In all, 605,309 liveswere insured to indicate a 23.21-percent increase from 2017 to 2018. Finally,premium income in 2017 was P5.6 billion to indicate a 25.56-percent increase from 2017 to 2018.

The top 10 life companies providing healthinsurance are: 1) United Coconut PlantersLifeP3.55 billion 2) Asian LifeP2.53 billion 3) FWD Life InsuranceP336 million 4) Philippine AXALifeP289 million 5) Insular LifeP204 million 6) Sunlife GrepaP122 million 7) Fortune LifeP89 million 8) Pioneer LifeP38 million 9) BPI PhilamP20 million and 10) Philam LifeP13 million . As can be seen,United Coconut Planters Life is the industry leader in health insurance withalmost half of the premiums earned. Asian Life is at second place in 2018.

Also Check: Can You Get Health Insurance After Open Enrollment Ends

Health Cards For Frequent Travelers

Those who travel frequently should get an HMO plan that correspond to their activities. For example, an HMO company that has an extensive network of hospitals in the country should be a priority.

On the other hand, a plan the covers emergency room expenses with the highest rate is an ideal health card as well for travelers.

Best Expat Insurance Companies And Plans In The Philippines For Foreigners

Cigna Global Health Insurance was one of the first plans available to expatriate or global citizens living in Asia, and they remain a leading international provider in the Philippines. Free Cigna Quote / Apply

- The flexibility to tailor a plan to suit your individual needs

- Access to Cigna Globals trusted network of hospitals and doctors

- The convenience and confidence of 24/7/365 customer service

Another option is Aetna International With more than 160 years of experience in healthcare, Aetna has specialized in international health benefits insurance for more than 55 years with a growing global footprint to reach wherever you travel. They have been recognized with prestigious awards as Best International Private Health Insurance Provider and Health Insurer of the Year. Free Aetna Global Quote / Apply

Don’t Miss: Can You Get Health Insurance Immediately

Whats The Average Cost Of Health Insurance

Here are some plans and their expected cost:

| Name / Type | |

|---|---|

| SUN Healthier Life Plan | 9,900 |

You may need to think ahead to ensure your medical needs are met when youre overseas. This could mean paying for your health insurance ahead of time. Wise can help you reduce costs when transferring money abroad. Wises Borderless account can help you hold and manage your money between multiple currencies so you have it ready when you need it the most. Which means if you are surprised with hospital bills or a monthly health insurance payment, you can send your money to the Philippines just when you need it the most.

Best Hmo Prepaid Cards

Prepaid HMO cards are the most affordable healthcare plans available in the Philippines today. Pinoys who are on a tight budget can actually get them. Theyre becoming popular because theyre easy to get, comparatively affordable, and open for everyone. There are some that you can acquire without going through medical exam, underwriting, etc.

Their coverage is limited to whatever benefits theyre purchased for. So if you got one for emergency services, you can use the card at the admitting section of hospital so you can avail of the necessary medical attention. Healthcare services are also most of the time similarly limited within the network. The validity is generally good for one year and coverage commonly expires at the end of validity period.

So what are the best HMO prepaid cards in the Philippines?

- Consultation

- Emergency

- Hospitalization.

Some cards have a combination of two or more of the above types, so its best to follow the links on the table. They lead to companys websites that offer updated and more complete information of their included services.

You May Like: What Is A Gap Plan Health Insurance

Getting Health Insurance In The Philippines: A Complete Guide

Wise

The Philippines is a popular destination for overseas travellers. The countrys healthcare is considered good by international standards, and government reforms in the past 2 decades are pushing the country closer to universal healthcare. Foreigners qualify for this coverage, and this might be a great reason to consider the Philippines for long-term visit or a permanent relocation.

This guide should help give you a better overview of the healthcare system and insurance options in the Philippines, and how to get healthcare coverage when you get there.

Health Insurance In The Philippines

Medical costs in the Philippines may be a lot lower than most westerners are used to, but if you are paying these expenses out of pocket they can easily become a heavy burden on your personal finances, especially if you develop a chronic condition that requires long term treatment. The only way to truly protect yourself from the high medical costs around the world is with a health insurance plan. We can offer locally compliant international health insurance plans for the Philippines that are globally portable and guaranteed renewable for life, so that you can be assured no matter where you go in the future, you will have the quality protection that you deserve.

Read Also: Does Farmers Insurance Sell Health Insurance

Complete The Application Process

The final step is to actually submit an application for an HMO plan. Most companies nowadays let you apply via their website. Note, however, that some may require you to complete a medical exam/lab test and submit personal health data so be ready just in case.

Read the fine print and ask questions to their representative to make sure all your expectations will be met or clarified.

Get Affordable Healthcare When You Need It

Being a freelancer or self-employed means nobody will take care of your hospital billsexcept yourself.

Getting an HMO gives your much-needed safety net for any medical need.

Can you instantly fork out Php 50,000 for hospital bills?

Losing income due to hospitalization drains your income already, and it hurts more to be burdened with expensive medical bills.

With an HMO plan, you can rest assured that after a trip to the hospital, your income and savings wont be wiped out, and you wont have to borrow money from anyone.

Also Check: Can A Child Have 2 Health Insurance Plans

Types Of Life Insurance In The Philippines

Here are your different options for insuring yourself and your family.

1. Term Insurance

This type of life insurance provides protection over a specific time frame, ranging from one to over 10 years. Death benefits are paid to survivors if the insureds death occurs within the policy period. If you outlive the term period, your coverage ends and youll get nothing back.

Being a pure form of insurance, term insurance has no savings component, making it the least expensive insurance type. Term life insurance in the Philippines is ideal for low-income earners who cannot afford whole life insurance but want maximized protection at a minimal cost.

2. Whole Life Insurance

Unlike term insurance, whole life insurance provides protection for your entire life or until youre 100. Besides death benefits, it also has a savings component in the form of cash values and dividends. You can enjoy this savings component while youre still alive to fund your retirement or your childs college education.

3. Prepaid Health Cards

Unlike the other health insurance types, this one is a little bit more special. Similar to an e-voucher, a prepaid health card allows you to have a one-time visit to selected medical facilities and avail of certain treatments depending on your card.

In general, three types of prepaid cards come with any of the following coverage:

- Emergency care

- Hospitalization

- Preventive care

Read more:

What Does In Network Mean

HMO companies have a network of hospitals, laboratories, and medical facilities with which they have existing partnership. They also have a list of doctors, specialists, and experts that are signed up with them.

When a member gets sick, they are recommended to get medical help within the network. Services can be performed faster because the HMO companies and healthcare providers may already have existing process in admitting members, determining the benefits and coverage, identifying medical experts who can best give treatment, etc.

When a member gets sick and seeks treatment out of network, HMO companies may not have established a way to deal with the hospital or medical facility. The member may be asked to pay the costs out of pocket, submit proofs of the medical services and expenses, and wait for a refund.

Another thing about out of network is that the HMO plan might have a limit on the benefits on each and every service, lab tests, medicine, etc. In which case, there is a likely chance the member would need to pay any excess amount even when they are still within their annual benefit limit.

Recommended Reading: What’s The Penalty For Not Having Health Insurance In California

Why Should I Get Health Insurance

The main reason why you should get health insurance is to avoid paying expensive medical expenses. Healthcare in the Philippines isnt as accessible and affordable compared to most countries. And while PhilHealth provides basic health insurance for most Filipinos, their coverage is barely enough to cover minor illnesses, let alone major ones.

When it comes to you and your familys healthcare, youll need all the financial help you can get. So while everyone in your family is still healthy, you should consider getting a health insurance policy to ensure that an emergency medical situation wont lead to financial ruin.

What Are The Things To Look For In An Hmo Plan

With so many options to choose from, you may now be at a loss on what to do. Here are some of the important things that can help you make a decision in purchasing a PH HMO plan.

These are very salient points that you should go over with the provider or sales agent. You need to ask about them so that your expectations are set right from the get-go.

Here are the things that you may want to discuss.

Don’t Miss: Does Amazon Have Health Insurance

You Cant Rely Solely On Your Philhealth Benefits

While PhilHealth benefits are helpful in reducing your hospital bills, they arent enough to cover all your medical expenses.

Also, PhilHealth doesnt cover many healthcare services such as check-ups and annual physical exam.

This is where HMO providers bridge the gap. By getting an HMO, youll get a wider coverage for different medical services in the Philippines.

Hmo For Senior Citizens

For those with senior citizen parents who are above 60 years old, a health card can provide a sense of security. It is quite common for seniors to have health problems as they become weaker due to aging.

Related:Senior Citizen HMO Cards

Dont worry, there are cheap health cards for senior citizens that you can avail. Simply choose the one with an attractive benefit package.

In this case, letting the HMO pay for the medical services incurred will be a lot more convenient than shelling out of pocket money.

HMO For Above 65 Years Old

If you are still able to work or has a source of income, it may be a good option to give them a health card suitable for senior citizens to protect them from unexpected expenses on health care.

Those with a good source of income, say for example self-employed or business owners, a health card can provide convenience in any future health problems.

If you are a senior yourself, then getting a health plan from an HMO may be a practical decision.

Don’t Miss: What Causes Health Insurance Premiums To Increase

Best Hmo For Single Freelancers Self

Pinoys who are single, freelancers, self-employed and other individuals may want to avail of a healthcare insurance too. The easiest way to do that would be to get a prepaid card as discussed above. However as you can see from the above table, you might be looking for a more comprehensive coverage that includes in-patient, outpatient, emergency, and dental care services.

Consider getting a health/HMO plan if youre not a dependent or qualified member of any family, group or corporate plans. There could be many reasons why this is so: age requirements, no longer employed by the company, or youre engaged in your own small business or freelancing career.

Again, the list below is by no means the only products out there. Reach out to any rep or company and see if they have an individual plan that might suit you.

| Name | |

|---|---|

| Pacific Cross Health Care. Inc | USD 2 million ABL, travel abroad coverage for less than 90 days, comes in three variants |

| Pacific Cross Health Care. Inc | Issue age 21 35 y.o. 250K ABL per illness per lifetime, renewable until age 40 |

| 100 million ABL, plan can be taken advantage within and outside the country |

Health Cards For Kids

You can also have your kids covered by an HMO account. In order to save on medical expenses, card holders may have their kids covered by their accounts but you can also avail of products specifically for them.

Although it would mean additional expenses, you will have better peace of mind and financial security during times when your kids get sick.

See the best HMO for kids options that you can avail.

Read Also: Is Cigna Health Insurance Any Good

Pacific Cross Health Care

Pacific Cross provides HMO, Medical, Travel, and Personal Accident Insurance. Founded in the Philippines in 1949, it operates with sister companies across Asia, with a strong focus in the ASEAN region.

- Maximum benefit limit: Up to P250,000 per illness per lifetime for Lifestyle Plan

- Monthly premiums: starts at P23,000 annually

- Features/Benefits:

- 20% discount on laboratory tests

Pros:

- Affordable and accessible preventive healthcare

- No age limit and required medical exam for card purchase

- Discounts and freebies in optical shops, restaurants, wellness centers, hotels, and beach resorts

- Online and text services for membership application and renewal

Cons:

- Limited to preventive healthcare only need to buy an additional health card if you want your other healthcare needs covered

- Can be used on weekdays and by appointment only in MediCard free-standing clinics where you purchased your card

- Consultations with specialists such as ophthalmologists and EENT doctors cost an additional Php 350 fee

Ideal For: People looking for an affordable emergency health card with additional disability, death, and burial benefits

HMO Type: Prepaid health card for emergency care

Prices:

- Php 720 for a maximum coverage of Php 140,000

- Php 1,200 for a maximum coverage of Php 280,000

Benefits:

Pros:

- Can be availed at any of 1,000 EastWest Healthcare-accredited hospitals nationwide

- Automatic renewal through PNBs auto-debit arrangement

HMO Type: Prepaid health card for emergency care

Benefits:

Pros:

Cons: