How Private Health Insurance Works With Public Health Care

Private health insurance works with our public health care system to offer you more choice and quicker access to some health services.

This table compares public and private health care services.

This table shows a list of health services, provides information on how those services might be provided in the public health care system and what private health insurance might offer in addition.|

Health service |

|

|

You may be treated as a public patient in a public or private hospital. The public health care system will cover the cost of your treatment. As a public patient, you cannot choose your hospital, doctor or specialist. |

When you choose to be treated as a private patient in hospital:

As a private patient, you can choose your hospital, doctor and specialist. |

|

Doctor and specialist services outside of hospital |

Medicare covers some or all of the costs of services such as:

|

|

Some state and territory governments provide ambulance cover. |

You can choose policies that cover ambulance costs when they are not covered by your state or territory government. |

How To Choose The Best Health Insurance Plan

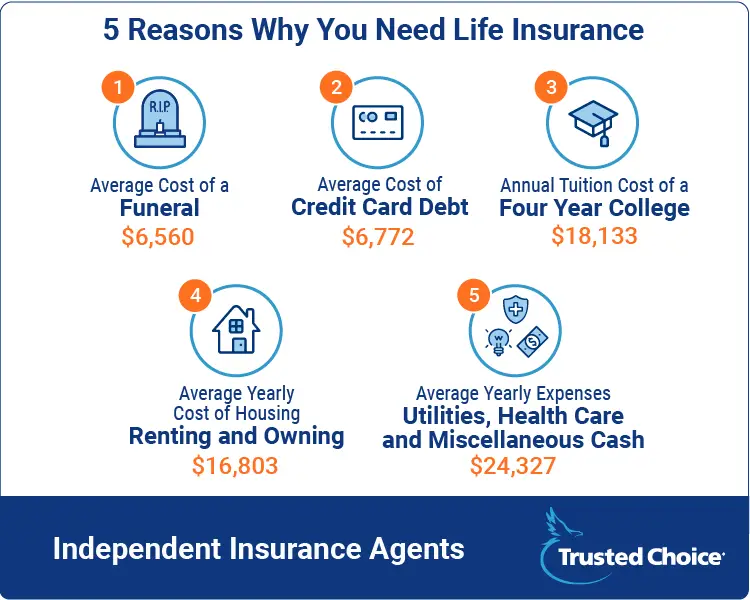

Financial planners will always look at health insurance as the starting point of all financial plans and goals. After all, illness and injury can strike at any time and a financial safety-net in the form of a health insurance policy can ensure that hard-earned savings are not depleted.

Buying a health insurance plan for yourself and your loved ones with adequate health cover certainly help reduce possible financial stress and burden.

The following features of health insurance plans should help you narrow down on a plan that secures you and your family:

- Study your family health history and learn what kind of health cover is needed

- Check out which indemnity cover suits you and your family

- Study your lifestyle or use a coverage calculator to estimate how much of cover is apt

- Study, in detail, the list of pre-existing ailments which are covered in the health policy

- Check if your health insurance company gives you a co-pay option

Option : Buy Through An Online Health Insurance Brokerage

Online health insurance brokeragealso called private enrollment websites or private exchangesoffers to help you compare health insurance plans or get the best available plan based on the information you give them. Comparison shopping is smart, but consumers should understand that these sites will not show them every plan in the market that meets their requirements.

Instead, these private exchanges will show a selection of plans that will earn them a commission if the consumer enrolls. They may display more prominently or provide more information on the plans that earn the brokerage a higher commission.

These marketing incentives dont necessarily mean the plans these sites offer arent good plans. It just means consumers should be aware that they might not be getting a complete picture of their options when they visit one of these sites.

Private enrollment websites may ask you for personal information that the federal and state marketplaces do not. They may ask about your height, weight, and pre-existing conditionsfactors that can affect your eligibility for plans that dont comply with the Affordable Care Act. Your personal information may also be used by the company behind the website you give it to as well as their business partners to market other products to you.

As with buying a policy directly from a health insurance company, you cannot get premium tax credits if you buy your health insurance policy through a private exchange.

Also Check: Is It Required For Employers To Offer Health Insurance

Most Common Exclusions Of Health Insurance Plans

- Pre-existing health conditions

Any sort of pre-existing health conditions, illness or medical conditions that the insured may or may not be suffering at the time of buying the health insurance plan are not covered. The insurance plan he/she opts for covers unforeseen medical situations. However, do note that pre-existing health conditions are covered, but with a clause of a waiting period. The waiting period for such pre-existing health conditions are defined in the policy kit.

- Cosmetic Surgery

Any form of cosmetic procedures and dental procedures that are done to enhance the physical look and appearance is excluded from health insurance. However, it is essential to note that when it is recommended by a doctor, medical practitioner, specialist or a general physician due to an accident and /or injury, then it is covered under your health insurance plan. In addition to these, joint replacement surgeries are also excluded from common health insurance plans.

- Injuries caused but intentional self-harm and suicide attempts

It is important to note that intentional suffering and injury caused to oneself or a harmful attempt to end ones life is not covered under any health insurance plan. Do keep in mind that such physical injuries are under, all circumstances , never covered by any health insurance policy.

- Alternative Treatment and Special Therapies

What Is The Individual Mandate

The health insurance marketplacesestablished by the AffordableCare Act provide coverage to 11.41 million consumers, according to anApril 2020 report from the Centers for Medicare & Medicaid Services .

Prior to 2020, if you went without Affordable Care Act compliant health insurance for more than two consecutive months, you would pay a penalty. This requirement was commonly known as the Obamacare individual mandate. The purpose of the penalty was to encourage everyone to purchase health insurance if they werent covered through their employment or a government-sponsored program. According to Kaiser Health News, the federal ACA penalty for going without health insurance in 2018 was $695 per uninsured adult or 2.5% of your income, whichever amount was higher.

In response to concerns about the affordability of marketplace ACA plans, congress passed the Tax Cuts and Jobs Act at the end of 2017. The law reduced the individual penalty of the Obamacare individual mandate to zero dollars, starting in 2019. Now that the individual mandate tax penalty has been removed, there is not a tax penalty at the federal level.

Don’t Miss: What Does Cobra Health Insurance Cover

How To Apply For A Plan

Applying for an insurance plan through the health care marketplace can be done online through healthcare.gov or a state site, over the phone, or through regular mail by filling out a form that can be mailed to you or downloaded from the Internet.

Before you fill out an online application, you’ll need to create an account on either healthcare.gov or your state’s marketplace.

You’ll need to know a few things about each person applying for coverage. Be ready to provide:

- Social Security numbers

- information about employers and income

- policy numbers for any current health insurance plans

If you have a job that offers health insurance but you’re not happy with it, you can choose to get coverage through healthcare.gov instead. But before you apply, you’ll need to fill out a form called an Employer Coverage Tool that can be found on the healthcare.gov website.

The application will ask for standard information like your name, your child’s name, your address, phone number, and email. You’ll need to answer questions about citizenship, dependents, and whether you plan to file a federal income tax return the following year.

If you want help paying for insurance, you will have to provide information about your yearly income . This includes income from jobs and other sources like:

- Social Security

- property rental

- alimony

If you pay alimony or interest on student loans, you can deduct the amount you pay when you fill out your application.

Is Short Term Insurance For Me

Short term insurance may be for you if you’re:

- Unable to apply for Affordable Care Act , also called Obamacare, coverage because you missed Open Enrollment and you don’t qualify for Special Enrollment

- Waiting for your ACA coverage to start

- Looking for coverage to bridge you to Medicare

- Turning 26 and coming off your parent’s insurance

- Between jobs or waiting for benefits to begin at your new job

- Healthy and under 65

For these situations and many others, Short term health insurance, also called temporary health insurance or term health insurance, might be right for you. It can fill that gap in coverage until you can choose a longer term solution.

Don’t Miss: Does Amazon Have Health Insurance

What Is Maternity Benefit In Health Insurance

Some maternity health insurance plans cover all expenses that are associated with childbirth. These expenses are covered up to a certain period bit pre and post- pregnancy. There are two ways of insuring childbirth – it can be a standalone policy or be included as an add-on in your existing health insurance plan with maternity cover by paying an extra premium.

Overseas Student Health Cover

If youre in Australia on a temporary visa, you should consider buying insurance to cover the costs of medical treatment. Find out more about health cover for overseas visitors and overseas students.

International students who havent been able to return to Australia due to COVID-19 should contact their private health insurer to find out about options for extending, or suspending, their cover. Some may offer a period of suspension, but they are not required to do so.

Read our collection of resources for international students.

A collection of resources about overseas student health cover for the general public and private health insurers.

You May Like: What Is The Best Supplemental Health Insurance For Medicare

Everything You Need To Know About The Medical Questions And Exam

Life insurance can help ensure that your dependents have the resources they need to replace your income should you die. But how do you go about purchasing coverage? And what can you do to get the best possible rate? Understanding the process for obtaining life insurance can help you get the coverage you need at a price you can afford.

Anything Can Happenknock On Wood

There doesnt need to be an accident to visit a doctor. Anything can happen when travelling. While tour guiding I had to see several doctors with a few of my clients. Luckily, they all could continue the tour, and best of all, the guests had purchased travel medical insurance for Canada. Some of my clients had to see a doctor for the following issues: Someone had – slipped off a boardwalk – a serious bladder infection – a severe allergic reaction to a wasp sting – a severe allergic reaction to a motion sickness patch – a prolonged period of nausea and thin stool – a toothache – a twisted ankle – signs of thrombosis

These are a few examples of what can just happen to you when travelling in Canada.

Also Check: How Much Is Temporary Health Insurance

Q What If I Forget To Bring My Health Card When I Go For Health Care

You may be charged for a health service if you do not have a health card. The ministry requests that the provider reimburse you for the service if it was an OHIP insured service and you can later show that you were covered by OHIP at the time of the service.

Your health care provider may ask you to fill out a Health Number Release to indicate your consent to the ministry providing your health number to them.

Submit Your Premium For Reimbursement

This last step is optional, but important if your employer offers an HRA. If you have an HRA allowance from your employer, youll likely be able to get a tax-free reimbursement on your premium.

All you need to do is submit documentation to your employer that shows the following:

- The premium amount

- The coverage date

- The insurance provider

After your employer reviews and approves the documentation, youll automatically get reimbursed every month up to your allowance amount. If your premium is more than your monthly allowance, then youll simply pay whats left out of pocket.

You May Like: Can I Be On My Parents Health Insurance

Q I Have Had My Name Legally Changed How Do I Have My New Name Put On My Health Card

To change your name on your health card to reflect your new legal name, you must visit a ServiceOntario Centre, complete a Change of Information and present the original of one of the following:

- Certified copy of the court order for a change in name

- Change of name certificate

- Adoption court order

If you do not already have a photo health card, you must also provide three original documents to prove citizenship, Ontario residence and identity.

If you have any questions regarding your own specific situation, call the ServiceOntario, INFOline at 1-866-532-3161.

Proof Of Identity Citizenship And Age

First, your health insurance premiums will be determined in part based on your age and zip code of residence, so proof of both your date of birth and current address will help providers calculate your potential rates according to the health plan you choose.Remember that you wonât need to provide all of these documents. Most insurers will just need one that displays your date of birth and identity, plus another certifying your citizenship, or a document that proves both :

-

Current driverâs license or photo ID. If you donât have a driverâs license, an official photo ID will do for insurance carriers if not from the Department of Motor Vehicles, an ID card from a federal, state or government agency, or a school ID card also qualifies.

-

Your birth certificate or proof of adoption records

-

A current passport is another way to verify your ID, U.S. citizenship and your age in one document.

-

Other optional documents, like marriage records, proof of military service, and official birth records from a hospital or doctor

Youâll need to provide some of the above documentation to prove the number of dependents in your household if youâre shopping for family coverage.If youâre not a U.S. citizen but looking for a domestic health insurance plan, youâll need one of these documents to show proof of identity and current immigration status:

-

I-551 permanent resident card

-

An employment authorization card, either I-688B or I-766

Also Check: How Much Does Private Health Insurance Cost In California

Am I Eligible For The Northern Patient Transportation Program

You may be eligible for northern transportation subsidy to help pay for transportation costs if you live north of the 53rd parallel in Manitoba and are required to travel long distances for specialty medical care.

The Northern Patient Transportation Program subsidizes medical transportation costs for eligible Manitoba residents in the north to obtain medical or hospital care not available in their home community. Subsidies may include costs for an essential escort .

Program eligibility is limited to Manitoba residents who live:

- north of the 53rd parallel from the Saskatchewan boundary to the west side of Lake Winnipeg

- north of the 51st parallel from the east side of Lake Winnipeg to the Ontario boundary

- on Matheson Island, when ground travel is not possible by winter road or ferry

Travel must be approved a physician and meet program eligibility. Patients who have coverage from an insurer or funder are not eligible for this medical travel subsidy. Examples include:

- Employers

- Manitoba Public Insurance

- Non-insured people

To process a transport request or for questions about the program, please contact your local office:

Thompson NPTP office

Complete The Online Application

The website will walk you through several questions to help determine your age, financial status, and location.

You can expect to provide the following information:

- Date of birth

- Current job and income information*

- Other income information such as pensions, rental income, alimony received, unemployment income, etc.*

- Current insurance information, if applicable, such as how you are insured *

- Payment information, such as a credit card or bank draft information

*These questions will only be asked if you are applying for federal assistance .

Aside from your tobacco use, there wont be any questions about your medical history. The ACA has mandated that no one will ever be charged more for insurance because of their health, so theres no need to worry about having any medical records on hand. All in all, the application should take you between 15 and 30 minutes.

Read Also: Does Short Term Health Insurance Cover Pre Existing Conditions

I’m Moving Away From Manitoba Permanently Am I Still Covered By Manitoba Health And Seniors Care

If you are leaving Manitoba permanently, you should apply to the Registration and Client Services Unit for an Out-of-Province Certificate. The terms of your coverage may be one of the following:

- If you are moving to another province or territory Coverage by Manitoba Health and Seniors Care will continue for the remainder of the month in which you arrive in your new province or territory plus two additional months . Immediately upon arrival to your new province or territory, be sure to contact that provinces or territorys health insurance plan to arrange for continuity of coverage.

- If you are moving to another country Coverage by Manitoba Health and Seniors Care will continue for the remainder of the month in which you leave Manitoba, plus two additional months.

- If you are moving away from Manitoba and are a Temporary Foreign Worker Coverage by Manitoba Health and Seniors Care will cease on the day that you depart from Manitoba.

If you are planning on moving permanently away from Manitoba, and wish to apply for continued health coverage, please contact Manitoba Health and Seniors Care at:

Registration and Client Services Unit Manitoba Health and Seniors Care300 Carlton Street Business hours: Monday to Friday 8:30 to 16:30General Inquiries Line: 204-786-7101 or Toll Free: 1-800-392-1207Fax: 204-783-2171 or Toll Free: 1-866-608-2983TDD/TTY: 204-774-8618TDD/TTY Relay Service outside Winnipeg: 711 or 1-800-855-0511

Insured Benefits Branch