How Much Is Aetna Health Insurance

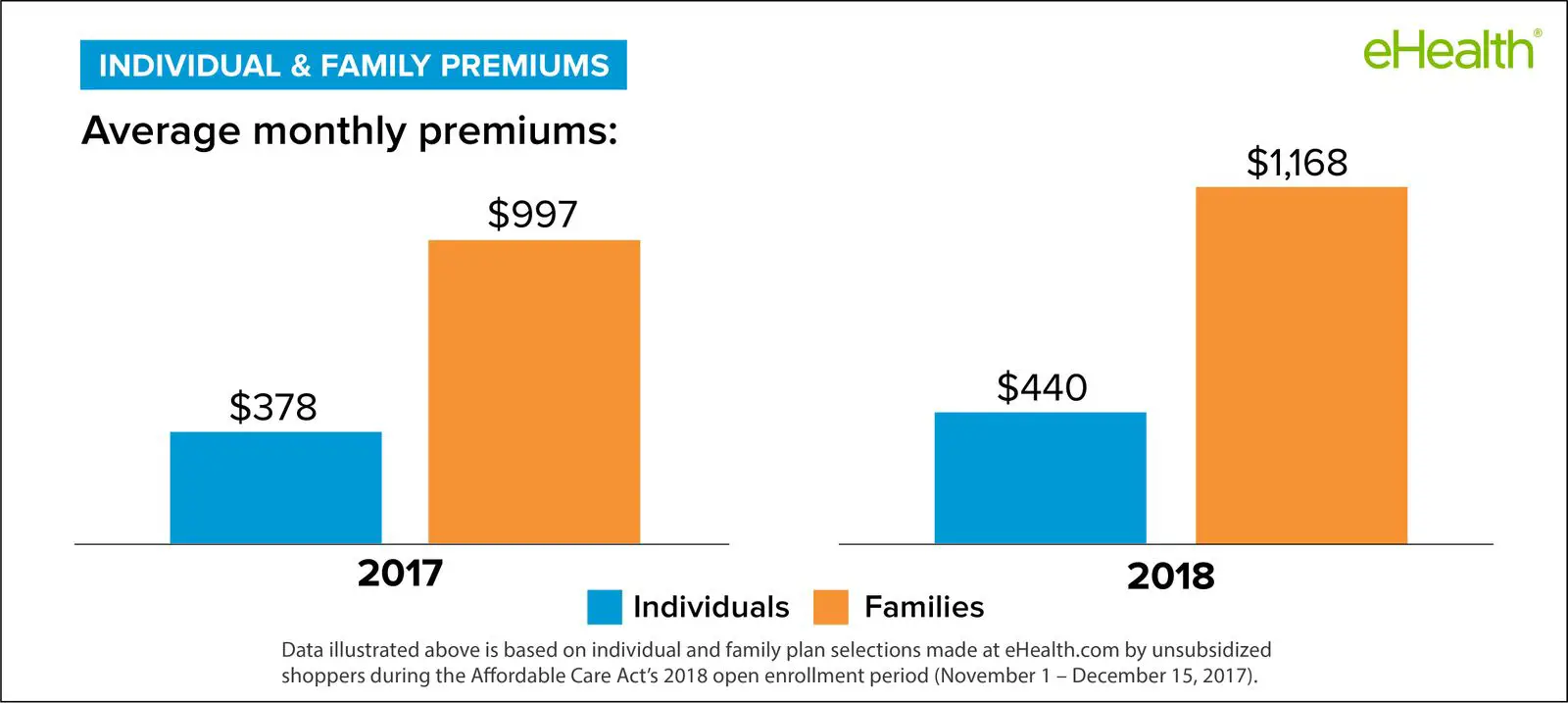

Among eHealth shoppers, the average premium for an ACA-compliant health insurance in 2018 was $465.86 for an individual plan, although insurance costs can vary significantly depending on the kind of plan you choose, the benefits included and your location.In 2017, the last year Aetna sold ACA-compliant individual health insurance plans, premiums for plans not eligible for a subsidy averaged $525.07. Premiums plans that were eligible for a subsidy averaged $374.55, and the average cost of a dental insurance policy from Aetna averaged $64.40

| Year | |

| Obamacare/ACA Coverage without a subsidy | $525.07 |

| Obamacare/ACA Coverage with a subsidy | $374.55 |

How Much Does Health Insurance Cost

10 Minute Read | October 14, 2021

The average individual in America pays $452 per month for marketplace health insurance.1 But costs for health insurance coverage vary widely based on many factors.

Maybe you just turned 26 and are off your parents plan . Or maybe youre facing a job loss and need to replace your former employers coverage. Or youre just looking for other options besides your employers plan. No matter your situation, youre wondering: How much does health insurance cost?

Everyone knows health insurance is expensive. It can pretty quickly suck the life out of your monthly budget. But just how expensive is it? And why is it so costly? Are there ways you can pay less?

Well, youre in the right place! Ill walk you through everything you need to know about health insurance costs, what all those terms mean and what factors make up that hefty price tag.

Let Ehealth Help You Find The Right Plan For You

eHealth offers the same plans and prices available at healthcare.gov, as well as other affordable alternatives that arent available through the federal marketplace. We also have a prescription drug tool that can help you identify a plan that offers the best prices for your medications. In addition, our licensed agents are available to answer any questions you may have. Get started today by using our free comparison tool and checking out all individual and family health insurance plans in your area!

Read Also: What’s The Penalty For Not Having Health Insurance In California

What Options Do I Have To Reduce The Cost Of Health Insurance Plans For Families

There are a number of government incentives and other programs that provide or help pay for health insurance plans for families who have trouble affording them. These include:

- ACA Subsidies The Patient Protection and Affordable Care Act, popularly known as Obamacare, provides tax credits to individuals and families who have trouble purchasing health insurance for themselves. Generally speaking, the lower your income and the more family members you have, the larger a subsidy youll qualify for. These benefits immediately go toward the cost of purchasing health insurance plans for families.

- CHIP Plans The Childrens Health Insurance Program, or CHIP, is a joint Federal-state effort to provide free or inexpensive insurance to families with children. The specific requirements for this program vary from state to state, but, in general, your family will qualify if you make too much money to qualify for Medicaid but your income is below 200% of the poverty line.

- Other Options Many states have specific programs designed to help cover the cost of health insurance for large families. Between these state programs and the federal ones listed above, you should qualify for at least some assistance if you have health insurance for a family of four and you make less than $98,400 a year.

How Much Does It Cost For Health Insurance In Canada Today

There are many countries in the world today that provide what is called universal healthcare. Some of these countries have been doing so for well over 100 years. This type of coverage will allow their citizens to go to doctorsto get treatments, as well as get prescription medications, free of charge. Of course, they are paying for this health insurance through their taxes, but by comparison to paying for health insurance as they do in the United States, it is a much more cost-effective solution. In the country of Canada, they have been offering single-payer universal healthcare since 1966. However, there are those that may actually pay for their health insurance to some degree. This is an overview of how much it will cost for Canadians to have health insurance.

How Much Does Health Insurance Cost In Canada?

The cost of health insurance for each individual, taken directly out of their taxes, comes out to $2000 Canadian money. When extrapolated to a monthly cost, this comes out to just over $160 per person per month. If they were to visit a doctor or have a procedure done, all of this would be covered by the policy. However, some things are not covered by this universal healthcare which is why many Canadians will pay for additional health insurance coverage.

What Is Not Covered By Universal Healthcare In Canada?

Total Cost Of Health Coverage In Canada

Don’t Miss: What Does Health Insurance Cost In Retirement

What Is The Average Cost Of Non

What do you pay if your income exceeds the 400% FPL ? The average national monthly non-subsidized health insurance premium for one person on a benchmark plan is $462 per month, or $199 with a subsidy. Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. Actual cost varies based on your age, location, and health plan selection,

Take a closer look. In a recent eHealth ACA Index report, we tracked costs and shopping trends among ACA plan enrollees who bought non-subsidized health insurance at ehealth.com during the nationwide open enrollment period for 2020 coverage.

How Does The Size Of My Family Impact My Insurance Cost

Who is this for?

If you purchase your own health coverage, this explains how the number of people covered by your insurance affects your monthly payment and other costs.

The size of your family doesn’t necessarily determine what you spend on doctors and prescriptions. A healthy family of six could spend less than a married couple with chronic conditions. But when it comes to your health insurance costs, the number of people on a plan does affect what you pay. We’ll show you how.

Don’t Miss: How To Get Health Insurance For My Small Business

Average Health Insurance Cost By State

Residents of different states can see some pretty stark differences in the average cost of health insurance. Which states have the highest premiums, and which ones have the lowest?

Using ValuePenguin data on certain states, the state with the highest monthly rates is Alaska at $426 for a 21-year-old. Multiplying for someone who is 30, that becomes $483.51. It becomes $544.43. for a 40-year-old, and a whopping $1,156.16 for a 60-year-old. The second-highest rate is in Wyoming at $366. Doing that math again, for those who are 30, 40 and 60 that figure turns into $415.41, $467.75 and $993.32, respectively.

These are particularly extreme examples, but even states that aren’t quite as high compared to the average rates can have monthly premiums not everyone can afford. The average health insurance premium for a 21-year-old in Florida is $285 not as large as Alaska or Wyoming, but still a lot, especially as a person gets older .

Still, there are states where premiums aren’t as expensive as these. Utah, for example, has an average cost of $180. While $180 can still be quite a lot of money per month for someone working in Utah at 21 , it is still a lesser figure than other states. In Montana, the average health care premium for someone at 21 is $210 per month. Check your state for more details, because the range of premiums can vary even more wildly than you may expect. ValuePenguin’s list did not include every state, such as Massachusetts.

Does Affordable Care Act Apply To Expats

Unfortunately, not anymore. Today, the US Government does not require anyone to subscribe to an ACA-compliant health insurance policy. However, a handful of states still impose a penalty on people who do not comply with the ACA. These are:

- California

- Massachusetts

- New Jersey

Other states are also currently processing legislation that will make health insurance compulsory, so before you move to the USA, check your new states laws.

Also Check: How Much Is Temporary Health Insurance

How Do You Choose A Plan That Meets Your Budget And Needs

To settle on the right plan, think about how you typically use healthcare services. For example, ask yourself:

- How often do you usually visit the doctor? Once a year for a checkup, or monthly to monitor a health condition? Was last year typical, or unusual?

- Are you expecting larger-than-average health expenses next year or do you only expect to use preventive care services? For example, are you having a baby? Were you recently diagnosed with a condition that will require regular treatment?

- What prescriptions do you take regularly?

- How many healthcare providers do you typically see? Just a primary care doctor, several specialists over the year, or just the provider at your local retail or urgent care clinic?

- Do you and your family have one or more chronic health conditions?

- Have you or any of your family members been diagnosed with COVID-19 in the past year?

- Have you postponed healthcare services because of COVID-19?

It may be helpful to add up what you spent last year, just as a general guideline.

Make sure you look at all costs, not just the premiums. For example, a high-deductible plan can work out to your advantage if you are relatively healthy and only expect only to use preventive care services, since those services are at 100%. These types of plans typically have lower premiums. However, if you have a chronic condition that requires a lot of care, you might consider a plan that has a higher premium but lower out-of-pocket costs.

Dont Forget to Shop Around

Average Health Insurance Cost By Age

Age plays a big role in the cost of a premium for health insurance generally, younger people have lower premiums, as they are seen as less risky and less likely to require more medical care.

Often, the starting point for an insurance rate is based on that of an individual who is 21 years old. According to ValuePenguin, the average health insurance premium for a 21-year-old was $200 per month. This is also an average for a Silver insurance plan — below Gold and Platinum plans, but above Bronze plans.

How does the breakdown of premiums by age look? Slowly in small increments, the average premium will increase. Ages 21-24 were all consistent at $200, but at 25 the premium goes up to $201 — about 1.004 x $200.

Slowly the amount it goes up increases. At 26 the average premium is 1.024 times the base premium, up to $205. By the age of 30, though, it has gone up for an average premium to $227, or 1.135 x $200.

Going through the list of ages, this pattern is pretty consistent. The average premium for a policyholder at 35 years is $244, 1.222 times the base rate at 40, it’s 1.278 times that rate to bring the average premium up to $256.

From here, though, the premiums start going up at higher rates. The average health insurance premium for a policyholder at 45 is $289, up to 1.444 times the base rate, and by 50, it’s up to $357, which comes out to 1.786 x $200.

Don’t Miss: Is It Required By Law To Have Health Insurance

How Cobra Costs Are Determined

COBRA can help you keep your current insurance for a period of time of 18 to 36 months, but it is costly. The cost is calculated by adding what your employer has been contributing toward your premiums to what you’ve been paying yourself, and then adding a 2% service charge.

For some people, the cost of COBRA can be unmanageable. This is because the employer is the one who is responsible for the lion’s share of the monthly premiums when you have job-based insurance.

A 2020 study from the Kaiser Family Foundation reported that employers pay an average of 83% of the cost of an employee’s health insurance. If family members are added, the employer still picks up around 74% of the cost.

Us Family Health Insurance Premiums Surpass $21000

The average premium for family coverage in employer health plans is up about 4% this year to more than $21,000 and employers are picking up more of the tab.

Workers on average arent being asked to pay more in premiums for family coverage and those with individual coverage through their work arent seeing increases in deductibles, according survey results Thursday from the California-based Kaiser Family Foundation.

The findings speak to the stability of health benefits in the pre-pandemic economy when employers were competing for talent in a tight labor market, said Matthew Rae, an associate director at the foundation, which has surveyed employers on health plan costs for 22 years. Obviously, the current labor market is vastly different, Rae noted, with last months unemployment rate roughly twice the comparable figure last year.

The premiums and health plans that we were asking about were plans that employers were setting a year ago when we had historically low unemployment, Rae said.

I would expect that not that many employers are going to make huge changes in the generosity of their plans over the next couple of months, he said. But the economic situation is really hard to put your finger on. It could be that employers will have to think about the generosity of their plans if they are really facing a lot of other costs.

Twenty-one thousand dollars each year just to cover a family of four its an unbelievable amount of money, Rae said.

You May Like: How Does Health Insurance Work Through Employer

Medium To High Level Pricing Plans

If you are in need of a plan that covers a little more but still within a certain budget, you can usually find something that is both affordable and fairly comprehensive. For instance, there are plans that will share the cost of prescription drugs and other treatments like physiotherapy.

There are plans that offer a lot of coverage as well, including prescription drugs, dental, massage therapy, medical equipment and much more, but expect to pay accordingly. If you need a lot of medical services, items or drugs, this may be the best option for you.

If you previously had a company group plan and wish to have an individual plan of your own, there are plans that will accept you, even with pre-existing conditions. You are guaranteed coverage if you apply within 6090 days of losing your previous coverage.

The Qualified Small Employer Hra

With a QSEHRA, employees purchase their own health insurance and get reimbursed for medical expenses, health insurance premiums, and other qualified costs with tax-free dollars by their company. To qualify, a company must have fewer than 50 full-time employees and cant offer a group health insurance policy to any employee.

Read Also: What Causes Health Insurance Premiums To Increase

Changing From Family Plan To Single Plan

A single plan is simple enough to figure out with COBRA. It gets a bit more complicated if you need to switch from a family plan to a single plan. This can happen if you get divorced or turn 26 and are no longer eligible for coverage on your parents plan.

In instances like these, the HR officer will look up the rate for single coverage on the same health plan you are currently enrolled in. To calculate the COBRA cost, the HR officer will have to determine:

- What you would have been contributing to an individual plan. If you are a family member , your contribution would typically be higher than the employee . In some cases, dependents may be responsible for the entire amount if the employer does not contribute to family coverage.

- What the company would have been contributing toward that premium. If you are the employee , the amount should be clear-cut. If you are the dependent, the contribution can vary depending on the employer.

After adding these two figures together, you would add another 2% to calculate your total COBRA premium costs.

How Much Is Family Health Insurance

As with almost all types of health coverage, there are several different costs associated with family plans, including:

- Premiums Premiums are monthly payments that you make to remain enrolled in your family health insurance plan. The average premium for major medical health insurance plans for families was $1,152 a month in 2020.

- Deductibles A deductible is the amount of money you must pay out of pocket for healthcare before your insurance kicks in. For example, if your family health insurance plan has a $10,000 deductible, youll need to pay all your medical bills until youve spent $10,000 your insurance will then cover much of the remaining care you get that year. On average, health insurance plans for families had deductibles of $8,439 in 2020. Average deductibles have also been rising, though not as rapidly as premiums.

- Various costs- There are other costs associated with health insurance plans like copayments, coinsurance, and out-of-pocket maximums. You will want to assess your familys health care needs to determine how these costs will affect you. If you foresee needing a lot of care, then you may want to opt for a plan with a higher premium, but lower costs elsewhere, like your coinsurance, copayment, and deductible.

While these are average costs, specific pricing will vary based on the plan you choose, the amount of coverage you receive, and the number of people in your family to be insured.

Recommended Reading: Is Cigna Health Insurance Any Good