So How Much Will Health Care Cost In Retirement

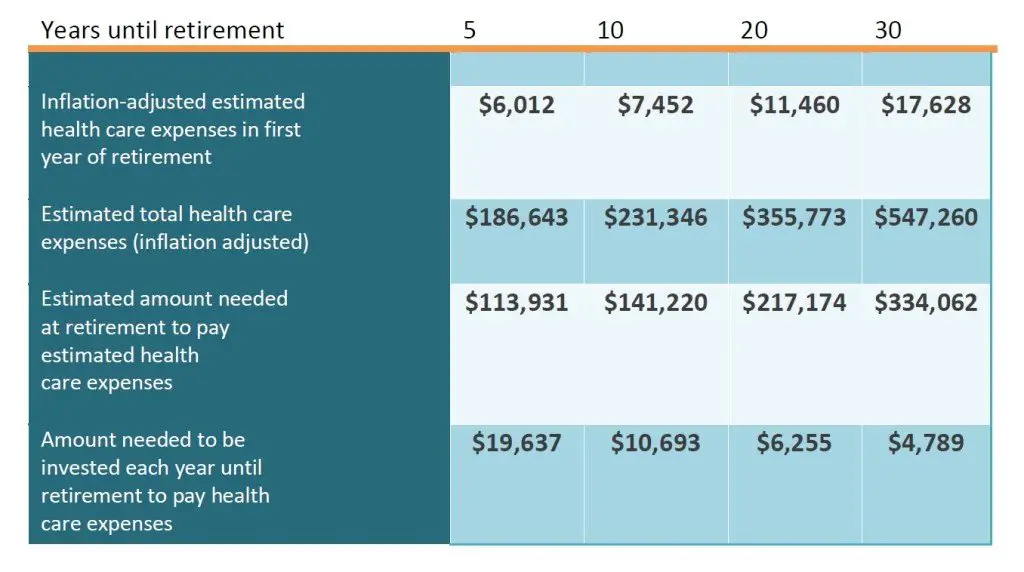

In real numbers: A couple who retires at 65 needs $270,000 in savings, for a 90% chance of having enough money to cover health care costs in retirement .5

But Medicare saves the day, right?

Not quite. Some people think its free, but you do pay premiums for coverage. And it doesnt pay for everything. A study by Principal® found that 44% of retirees struggle to predict and manage health care and long-term care costs.6 Out-of-pocket expenses depend on your age, overall health, where you live, income, and if you have supplemental Medicare policies.

While people often worry about how theyll pay for health care in retirement, they tend to think of it as medical costs. Its really a broad category of expenses, including:

- dental,

- prescriptions,

- and even long-term care.

With costs climbing, its never too early to plan for health care expenses in retirement, even if thats still 10 to 20 years away, says Heather Winston, assistant director of financial advice and planning at Principal.

Find out how much Medicare may cost you with the out-of-pocket estimator tool on Medicare.gov.

Provincial Health Care Plans: Whats Not Covered

- Prescription drugs outside the hospital are not covered by most provincial health care plans, for most people. There are some exceptions, including people on low income and people over 65. Some provinces will cover a percentage of certain prescription drug costs for anyone over the age of 65.

In Ontario, for example, the Ontario Drugs Benefit Program means that retirees over 65 with a moderate to high income will pay the first $100 of any prescription costs in a year and then $6.11 for each subsequent prescription. However, this is only for the 4,400 prescription drugs covered by the program. For any others, you have to pay the full amount. In Alberta, meanwhile, the over 65s pay 30% of the prescription cost, if it is on the Alberta Drug Benefit List. Otherwise, they have to pay the full amount.

Most retirees under 65 pay their full prescription cost, sometimes thousands of dollars a year, unless they have low income. This is one of the key reasons why health insurance for retirees in Canada can be so important.

- Dental treatment is rarely covered by any provincial health care plan. It can also be one of the largest health care expenses for retirees. Simple check-ups can cost $100-plus and major treatments can cost thousands.

Some provinces will provide limited free dental services to people aged 65-plus with low income. Others will only provide these free dental services if you already qualify for other assistance programs.

Take Advantage Of Open Enrollment

If you choose to purchase health insurance coverage through the marketplace, you may have to wait to do so until the open enrollment period. Open enrollment usually begins in November and lasts through the middle of December each year. You may be able to sign up for a plan outside of the open enrollment period if you experience a significant life event, such as moving to a different state, losing previous health insurance coverage, getting married, or having a child.

Also Check: Is It Required For Employers To Offer Health Insurance

Spousal Benefits Can Enable Insurance For An Early Retirement

An option that you may have if you are married is to use your spouses health insurance plan, Purkat explains.

I see in many cases, one spouse may be retiring early, but the other is still working full-time, Says Purkat. This is a great situation because if you can cover the years before you turn 62 with your spouses insurance, it can save you a lot of money.

The Costs Of Healthcare Coverage

No matter which type of coverage you choose, you’ll still be responsible for all premiums, deductibles, copayments, and coinsurance. For the lowest monthly payment, you can choose to go with Original Medicare — but you’ll face higher out-of-pocket expenses. With an Advantage plan, you’ll likely have higher premiums, but greater coverage and fewer out-of-pocket costs.

Most people won’t pay a premium for Part A coverage as long as you’ve paid Medicare taxes for at least 10 years, but you will have a deductible of $1,364 per benefit period — which begins when you’re admitted to a hospital and ends 60 days after you leave the hospital. Then with Part B coverage, the standard premium is $135.50 per month, but it may be higher depending on your income. Part B also has a deductible, though it’s just $185 per year.

If you also enroll in Part D coverage, that will be an additional cost. This type of insurance is offered through private, Medicare-approved providers, so prices will vary based on your individual plan, but the maximum deductible for 2019 is $415 per year.

Medicare Advantage plans are also offered through third-party insurance companies, so rates can vary widely based on your location, the provider, and the amount of coverage you’re receiving. But you’ll typically still have to pay a premium, usually along with the standard Part B premium as well.

Read Also: Is Eye Surgery Covered By Health Insurance

How Much Does Retirement Health Care Cost

Today’s retirees and soon-to-be retirees feel pretty confident about their next phase. But a major concern keeping them up at night is the idea of paying for health care. In fact, a PwC financial wellness study found that 38% of baby boomers said that health care costs are a top fearhigher than those who were most afraid of running out of money!

It doesn’t have to be that way! Health care is a line item in your annual retirement budget, just like food, clothing, and shelter. And like those other expenses, you can plan for it.

Our research has revealed 6 factors that can nudge your personal annual health care spending higher or lower.

How Can I Save Time

You’re probably more interested in keeping up with your grand-kids, or improving your golf game, than thinking about health insurance. Save your time for the things that matter. It helps to choose a plan with a customized, easy-to-use online website and mobile app, so you can manage your health wherever you are. Get health information, find in-network providers, pay your health insurance premiums, view your health care claims, and print temporary ID cards.

And when you have a health concern on your mind, you want answers. It helps to have a health information line to call. Talk to a clinician 24/7 to get information and help finding answers to your health-related questions.

Recommended Reading: Where To Go To Apply For Health Insurance

Until You Can Go On Medicare Youll Need Health Insurance On Your Own And Of Course That Can Be Pricey Subsidies Through The Affordable Care Act Can Be A Big Help But You Need To Manage Your Income To Qualify Here Are Three Tips To Help Make That Happen

Rising health care costs can be a risk at any age. If you want to or need to retire early, health care costs are an especially important part of retirement planning, since Medicare doesnt kick in until age 65. That means you need to find health insurance at a time when youre vulnerable to higher costs and also lack a paycheck.

The Affordable Care Act was intended to make insurance more affordable and equitable, eliminating previous pre-existing condition requirements and tying income to federal health insurance subsidies. These subsidies are triggered, provided your income meets certain thresholds, when you purchase health insurance either through the federal health care exchange at healthcare.gov or a state insurance exchange. In 2021, there were 15 state-run marketplace exchanges that serve residents of those specific states everyone else is served by the federal ACA marketplace exchange.

For 2021 and 2022, some special rules were introduced through President Bidens American Relief Act designed to increase health insurance affordability for those with current marketplace coverage, those who are uninsured and those who lost employer coverage during the pandemic. Subsidies have risen for every income level, and premiums are capped at 8.5% of adjusted gross income.

What Will You Spend On Health Care Costs In Retirement

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Health care costs make up 9% to 14% of the average older households spending. But what you will spend on health care costs in retirement could be less or potentially a lot more.

A 65-year-old woman typically could expect to pay $3,300 to $7,700 annually for premiums and out-of-pocket medical, dental and vision costs in 2018, according to a study by Vanguard Research and Mercer Health and Benefits. But her costs could top $21,800 in some scenarios, the researchers found.

Also Check: How To Cancel Oscar Health Insurance

How Much Does Health Insurance Cost When You Retire

The health insurance premiums remain the same both before and after retirement. However, federal employees pay their portion of the premium on a biweekly basis. Retirees pay their portion on a monthly basis. However, if you remain on the same health plan before and after retirement, your total yearly premiums and benefits will remain the same.

It is important to note that part time federal employees typically have to pay more for their health insurance than full time employees. . However, upon retirement, part time and full time employees receive the same government contribution .

Another important fact is that you are not allowed to participate in flexible spending accounts, also called FSAs, upon retirement. The IRS has specified that FSAs are a salary benefit and therefore cannot be used by people receiving an annuity.

Health Benefits In Retirement

Health insurance eligibility in retirement depends on whether you are a state or local employee and what your employer offers. If you are not certain about what your employer offers, go to the Benefits Available to Me page to search for your benefits by current employer name, or last employer name if you are retired.

Recommended Reading: What’s The Penalty For Not Having Health Insurance In California

It Is Important To Find Coverage For Routine Medical Checkups And Prescriptions As Well As Hospital Stays And Unexpected Health Conditions

Medicare can be a lifesaver, but choose the wrong type of plan for your needs, and you could end up paying thousands more than you need to. Medicare kicks in at 65 for most people. Medicare can be a lifesaver, but choose the wrong type of plan for your needs, and you could end up paying thousands more than you need to. So over the past 20 years or so, the percentage of big companies offering retiree add it all up, and you need to get serious about stashing away some money today to help cover your health costs in retirement.

Be Realistic About Costseven If Youre Healthy

Be sure to include the costs of premiums and out-of-pocket expensesTooltip Medical expenses that arent covered by your insurance company. For example, copays, coinsurance, deductibles and other qualified medical expenses that you pay. in your retirement budget. In general, you can plan on spending about $850$1,150 a month before age 65. When Medicare kicks in at age 65, you can plan on spending about $450$600 a month .1 For a more accurate estimate based on where you live, inflation and other factors, consider talking to a financial planner.

You May Like: How Much Is Health Insurance In Costa Rica

Do I Need Health Insurance If I Have Medicare

While Medicare is an excellent option for retirees, you wont qualify for it until you turn 65. If you retire before that date, youre responsible for getting your own coverage.

However, even eligible Medicare beneficiaries may need additional insurance.

Medicare covers a large portion of your health expenses, but it doesnt pay for all of your necessary medical services. Original Medicarewhich is made up of Medicare Part A and Medicare Part B doesnt cover:

- Dental care

- Prescription drugs

- Routine foot care

If you want insurance that covers the above services, youll need additional coverage, such as a Medicare Advantage Plan.

How Can I Use Hsa Funds

HSA withdrawals to cover qualified medical expenses are tax free. This gives them a major advantage over IRAs or 401s, which require taxes to be paid on withdrawals.

If you are younger than 65 and you withdraw the money for other purposes, you will owe a 20 percent tax penalty. However, if you are older than 65, withdrawals for other purposes are taxed the same as withdrawals from other qualified retirement savings accounts, such as 401s.

Qualified health expenses include things not covered by Original Medicare, such as dental care and hearing aids. Some Medicare Advantage Plans offer extra benefits that Original Medicare doesnt offer, such as vision, hearing, and dental.

HSA funds can also be used to cover specific health insurance premiums:

- Long-term care insurance

- Health care continuation coverage

- Health coverage while receiving unemployment compensation

- Medicare and other health coverage if you are 65 or older

To get the most out of your HSA for retirement savings, you should contribute the maximum possible. If you can avoid it, dont use your HSA funds for medical expenses before retirement. Consider this money earmarked for your retirement health care costs.

Also, shop around for HSA administrators that allow you to invest the money in high-quality, low cost options.

You May Like: What Causes Health Insurance Premiums To Increase

People Forget About Health Care Costs

Many retirees and people getting ready to transition out of the workforce forget to budget for healthcare when they estimate their expenses in retirement. Why? Their employer is often picking up the majority of the tab and the remaining cost comes out of their paycheck. They think they need the same amount of take-home pay that they currently have, but they forget that they will now be responsible for paying their health care premiums in addition to the out-of-pocket costs.

Early Retirement Health Insurance Are You Eligible For Cobra

In certain circumstances, if you lose your job, you can still be eligible to benefit from your companys group health plan for a limited period of time. Using the Consolidated Omnibus Budget Reconciliation Act , you can expect to be paying about 2% more than the full cost of health insurance on your old companys plan, says founder and CEO of Northwoods Financial Planning, Corey Purkat.

It is going to be more expensive than if you were still employed at a company, but it will still be less expensive than paying for your health insurance on your own, He says. The only way someone wouldnt be eligible for COBRA would be in situations where there was a very good reason a person was let go, such as a criminal investigation.

Continuation coverage under COBRA is typically available for a relatively short period of time, typically 18 to 30 months.

Recommended Reading: How To Get Health Insurance Fast

Types Of Health Care Premiums

There are five types of health care premiums you are likely to have in retirement:

- Medicare Part B: This goes up as your income goes up. In 2021, you pay $148.50 per month if you made less than $88,000 in 2019. If you made more, you would pay more.

- Medigap or Medicare: If you want insurance for costs that are not covered by basic Medicare you’ll look at buying either a Medigap policy or a Medicare Advantage Plan, as well as prescription drug coverage. If you have a Medigap policy, it may not cover costs for dental, vision, and eye care, potentially leaving you with some big expenses, particularly for dental needs.

- Advantage Premiums : If you have a Medicare Advantage policy, which includes dental, vision, and eye care, it may not provide as much additional hospitalization coverage, potentially leaving you and your family with a big bill should a chronic or severe illness comes along.

- Medicare Part D coverage : This includes prescription drugs for self-administration. Drugs administered by a professional like a nurse or physician will usually fall under Medicare Part B coverage. Those covered with Part D coverage will pay a co-pay per prescription. Also, some drugs are excluded from coverage.

- Long-term care insurance premiums: Medicare does not cover the majority of long-term care costs you might experience. If you want to be assured you have funds to cover these costs, consider long-term care insurance.

Health Savings Accounts : Saving For Retirement Health Care

Health Savings Accounts can be a good way to save for health costs in retirement. But this option is not available to everyone, and it has limits.

HSAs are an option only for people with high-deductible health insurance plans and no other health insurance. To be considered a high-deductible plan, the insurance policy must have a deductible of at least $1,350 for self-only coverage and $2,700 for family coverage, as of 2019. These deductibles dont apply to preventative care services.

HSA accounts are not available to people who qualify for Medicare or are claimed as dependents on someone elses taxes.

The accounts take pre-tax deposits to cover health care costs that are not covered by insurance. The unspent money in an HSA rolls over from year to year. The accounts are also portable and stay with you when you change jobs or stop working.

According to the Society for Human Resource Managements 2019 Employee Benefits Survey, HSAs are currently offered by 56 percent of employers. If your employer doesnt offer an HSA, some banks and other financial institutions offer them for people with high-deductible health insurance.

As of 2019, if you have a high-deductible health plan, you can contribute up to $3,500 to an HSA for self-only coverage and up to $7,000 for family coverage, according to Healthcare.gov. For 2020, you may contribute up to $3,550 for self-only coverage and up to $7,100 for family coverage.

Read Also: How Much Do Health Insurance Agents Make