Other Important Covers To Look For:

Not all health insurance plans in India offer the same amount of coverage. Some insurance companies omit certain things to keep the cost of the plan on the lower side. However, this could end up hurting you in the long run. Therefore, when choosing a medical insurance policy, it is important you look out for these important features as well: 1. Ambulance charges Getting emergency transportation to the hospital is extremely important. However, it can also be quite expensive too! Keeping this in mind, the best health insurance in India will always cover ambulance charges. This ensures that, in a critical situation, you can get prompt help without worrying about the charges. 2. Day Care Procedures Medical emergencies do not always require overnight hospitalization. There are several healthcare procedures that are costly but require less than 24 hours of hospitalization. The best health insurance in India will cover a higher number of such procedures. In this regard, our plans cover 160+ day procedures.

3. Vaccination & health check-up charges: It is important to look for health insurance in India that covers these costs. Not only do our plans cover vaccination costs, but they also cover health-up charges as well!

When To Buy Health Insurance

Generally, there is only one period of time in which you are allowed to apply for Obamacare marketplace. This is called theopen enrollment period. You cannot purchase a health insurance plan outside of the open enrollment period unless you start a new job and get group health insurance, or if you qualify for a special enrollment period.

These enrollment periods are a relic of the individual health insurance mandate. Because health insurance companies must cover people regardless ofpreexisting conditions, the Affordable Care Act mandated that everyone buys health insurance, even if they believe they are healthy or do not need health insurance. Premiums from healthier customers who don’t use a lot of health care services help offset the cost of covering people who do need to use more health services. Whether this continues after the suspension of the individual mandate remains to be seen.

Common Terms That Can Be Confusing

Because health insurance policies are written in legal language and filled with medical jargon, they are often difficult to read and understand. Youre not alone if you find the wording intimidating and confusing.

We find that quite a few health insurance consumers are confused about what a deductible is as well as how it differs from their plans Out of Pocket Maximum, says Marc Lewandowski with Planning Needs Financial Group.

A good place to start is the Definitions section that will define the words used in the policy. Its helpful to review this section when reviewing your policy details.

Here are a few terms that can be confusing in your health insurance policy:

Don’t Miss: Can I Have Two Health Insurance

Compare Health Insurance Plan Metal Categories

When youre shopping for a plan on HealthCare.gov or your state exchange, the plans are shown in four metal categories. No, not like Mötley Crüe. More like Michael Phelps. The plans are tiered according to how much they cost and what they cover: Bronze, Silver, Gold and Platinum. Keep in mind that if youre eligible for cost-sharing reductions under the Affordable Care Act, you must pick a Silver plan or better to get those reductions.4

It’s good to know that plans in every category provide some types of free preventive care, and some offer free or discounted health care services before you meet your deductible. The way it basically works is that Bronze plans have the lowest monthly premiums but the highest out-of-pocket costs. As you work your way up through the Silver, Gold and Platinum categories, you pay more in premiums, but less in deductibles and coinsurance.

However, the extra costs in the Silver category can be minimized if you qualify for the cost-sharing reductions, so youll want to make sure youre getting the maximum value of those reductions when youre shopping for health plans. They can substantially lower your out-of-pocket health care costs,so get with one of our Endorsed Local Providers who can help you find out what you may be eligible for.

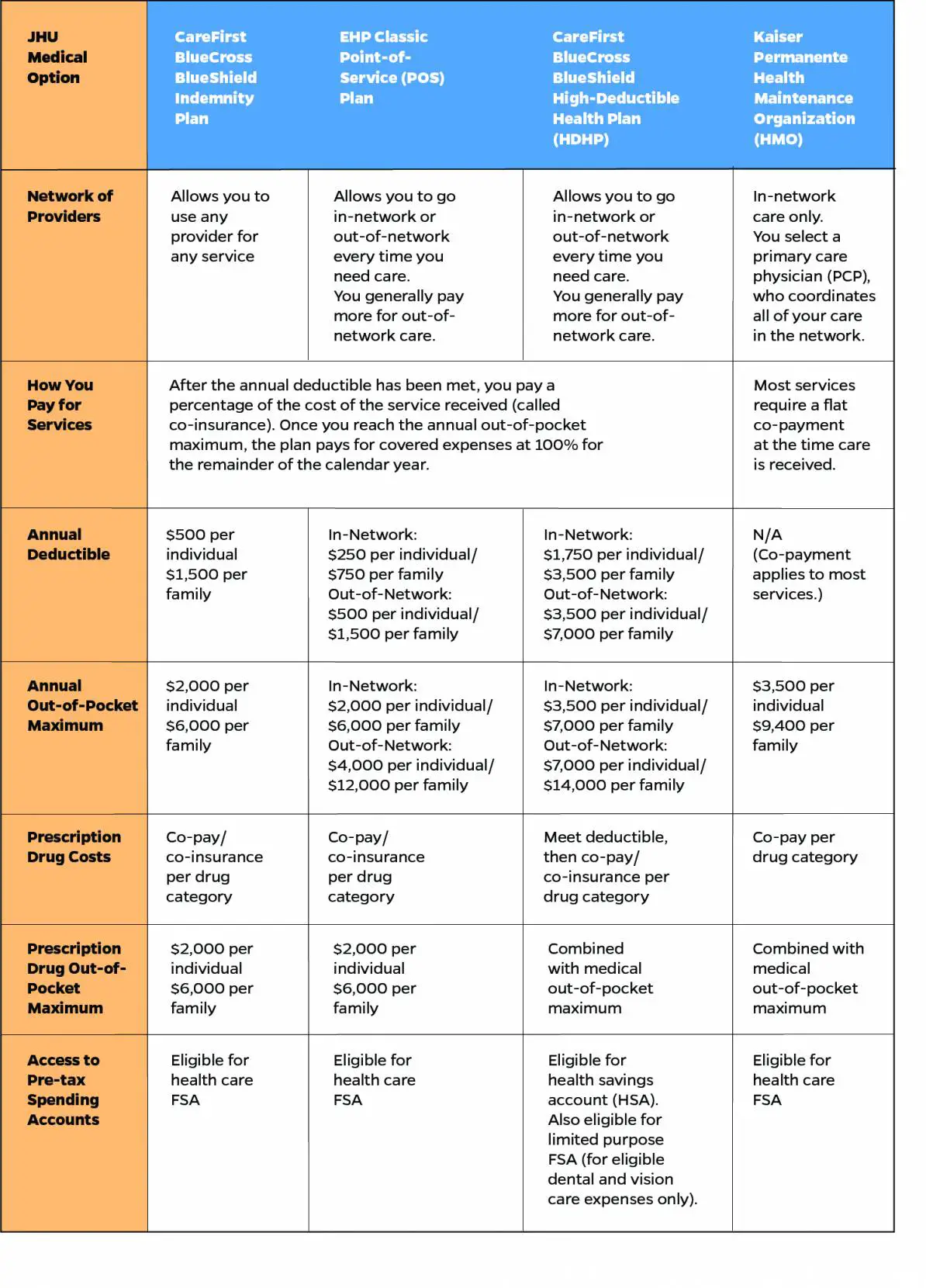

The table below shows the percentage that the insurance company pays and what you pay for covered expenses after you meet your deductible in each plan category.

|

Plan Category |

Consumer Guide To Understanding Health Insurance

Many of the requirements discussed in this guide do not apply if your employer “self-funds” its health benefits plan. This Self-fund means that the employer pays your health claims from its own funds and does not pay premiums to an insurance company. The employer decides the plan coverage, including employee eligibility, covered benefits and exclusions, employee cost-sharing and policy limits. Federal law exempts these self-funded plans from state insurance laws, so these plans do not need to include state mandated benefits. You can ask your employer if your health plan is self-funded.

You May Like: How To Cancel Oscar Health Insurance

Concepts Essential To Using Your Health Plan Wisely

Shereen Lehman, MS, is a healthcare journalist and fact checker. She has co-authored two books for the popular Dummies Series .

If youre new to health insurance there are seven basic concepts you must understand to avoid nasty financial surprises. If you dont understand these key concepts, you wont be able to choose a health plan wisely or use your health insurance effectively.

What Does Health Insurance Cover

Health insurance plans may cover a wide range of medical care and services. These often include preventive and non-preventive care, as well as emergency care, behavioral health, and sometimes vision and hearing.

What you pay out-of-pocket and what your plan helps pay for can depend on a number of factors. These factors include whether youve met your deductible, what your coinsurance is, if you are getting care from in-network providers and facilities, if your care is preventive or not, and more.

Here are examples of health insurance benefits your plan may cover:

Recommended Reading: Can I Be On My Parents Health Insurance

More Support Needed For Young Beneficiaries

While this is a small study that was conducted in a single city and state that uses healthcare.gov, it shows that even the highly educated young people in our study had difficulty making health insurance choices. However, our findings on the confusion over health insurance terms have also been demonstrated in studies of consumers across a variety of demographic groups. Other researchers have also verified, mostly in experimental settings, that people have a hard time making optimal health insurance choices, even after ensuring that they understand basic health insurance concepts or conducting their insurance experiments in a population of MBA students.

Their findings and ours help describe how young adults navigate the insurance selection process, and point to many areas where consumers could be better supported in the health insurance selection process.

In the area of health insurance literacy, tools to help consumers could be as simple as providing pop-up explanations of key terms, like deductible, when you hover your cursor over the term on the screen. Other tools might include total cost estimators that do the math for the consumer. This could provide an estimate that takes into account a plans deductible, coinsurance, copay and premium amounts, as well as how often that person predicts theyll use their insurance .

Look For The Right Coverage

Choose a health plan that secures you against a wide range of medical problems, and provides benefits including pre and post hospitalization, daycare expenses, transportation, illnesses that you may be at risk of due to your family’s medical history, etc. If you are buying health insurance for your family, check whether the policy meets the needs of each member of your family. Consider your requirements, compare plans on benefits and costs, and apply a little due diligence to choose a plan that caters to your needs.

Also Check: How To Get Temporary Health Insurance

Double Check Your Doctor

Having your preferred medical providers in your network is important, but it can be challenging to know if the insurers provider list is current, despite requirements for up-to-date directories.

Don’t believe that the doctors and hospitals listed in the insurer’s booklet or website are still on the plan, advises Adria Goldman Gross, with MedWise Insurance Advocacy.

When a provider is no longer credentialed with the insurance company it often takes 3 to 5 years for the list to be updated. I always recommend contacting the medical providers and the hospital to verify, she continues.

What Are The Metal Tiers

Remember earlier when we talked about how all health insurance plans split some of the costs between the insurer and the consumer?Metal tiers are a quick way to categorize plans based on what that split is.

Some people get confused because they think metal tiers describe the quality of the plan or the quality of the service they’ll receive, which isn’t true.

Here’s how health insurance plans roughly split the costs, organized by metal tier:

-

Bronze – 40% consumer / 60% insurer

-

Silver – 30% consumer / 70% insurer

-

Gold – 20% consumer / 80% insurer

-

Platinum – 10% consumer / 90% insurer

These are high-level numbers across the entirety of the plan, taking into account the deductible, coinsurance, and copayments, as dictated by the specific structure of the plan, based on the expected average use of the plan. These percentages do not take premiums into account. They also do not represent the exact amount that you’ll actually pay for medical services.

In general,Bronze plans have the lowest monthly premiums and Platinum plans have the highest, with Silver and Gold occupying the price points in between. As you can see from the cost-sharing split above, Bronze plan premiums are cheaper because the consumer pays more out of pocket for health care services. If you frequently utilize health care services, you’ll probably end up paying more out-of-pocket if you choose a Bronze plan, even though it has a lower premium.

Also Check: Does Cigna Health Insurance Cover International Travel

What Should I Do

Your doctor will try to be familiar with your insurance coverage so he or she can provide you with covered care. However, there are so many different insurance plans that its not possible for your doctor to know the specific details of each plan. By understanding your insurance coverage, you can help your doctor recommend medical care that is covered in your plan.

- Take the time to read your insurance policy. Its better to know what your insurance company will pay for before you receive a service, get tested, or fill a prescription. Some kinds of care may have to be approved by your insurance company before your doctor can provide them.

- If you still have questions about your coverage, call your insurance company and ask a representative to explain it.

- Remember that your insurance company, not your doctor, makes decisions about what will be paid for and what will not.

How Do I Use My Health Plan

Once you have enrolled in a health plan, be sure you understand your plan and the cost implications of various procedures and services. For example, going to an out-of-network doctor versus in-network traditionally costs a consumer much more for the same type of service.

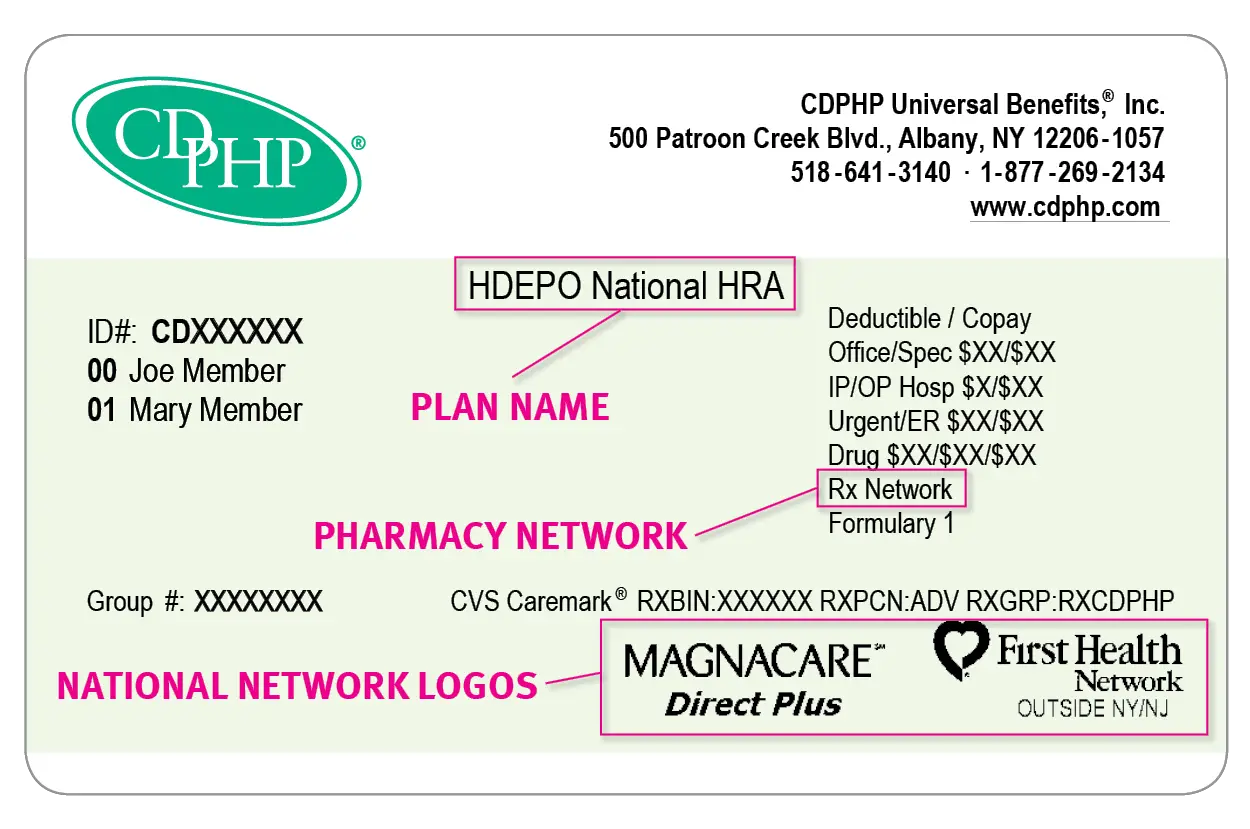

When you enroll you will be given a certificate or evidence of coverage. The insurance company may mail a copy to you or they might give you the access to it on a website. If you have a health plan through your employer, the employer will have information on your plan. Read your certificate and keep it handy to look at when you use health services.

Know Your Benefits and Exclusions

Be sure you know exactly what your plan covers. Not all health plans cover the same services in the same way. Your certificate will list all of the services that are covered under your plan. It will also tell you if any services have limitations . And it should tell what services are not covered at all . Do your homework, research all the options available and review your insurance policy before making any decisions.

How to Access Services

The plan certificate will tell you if you need to use network providers to be covered. It should tell you if you need to have the health plan authorize care before you see a provider. It should also tell you:

- If you need to have the plan authorize care before you see a provider

- What to do in case of an emergency

- What to do if you are hospitalized

Internal Grievance Protections

Read Also: How To Sign Up For Free Health Insurance

Review Your Current Insurance Plans

The next step is to review your current plans to see what coverage you have for each type of insurance.

If you work, start by reviewing the coverage given by your employer. Its a good idea to meet with someone from the human resources department to go over your questions.

If you dont work, you may want to talk about your insurance options with a hospital social worker or someone in the hospital financial information office. You can also contact your state or local health department.

When reviewing your insurance plans, be sure to read the policies themselves and not just the marketing brochures that describe them. An insurance policy is a legal contract that describes your rights and responsibilities, as well as those of the insurer. It deserves the same level of attention as any other legal document.

What About An Hdhp With A Health Savings Account

A high-deductible health plan can be any one of the types above HMO, PPO, EPO or POS but follows certain rules in order to be HSA-eligible. These HDHPs typically have lower premiums, but you pay higher out-of-pocket costs, especially at first. They are the only plans that qualify you to open an HSA, which is a tax-advantaged account you can use to pay health care costs. If youre interested in this arrangement, be sure to learn the ins and outs of HSAs and HDHPs first.

» MORE: HSA vs FSA: Whats the difference?

Recommended Reading: How Does Health Insurance Work Through Employer

Are Health Insurance Deductibles The Same For All Coverages

Health Insurance deductibles are not the same for all the coverages in your health insurance plan. Every plan is different, which is why understanding how the different kinds of deductibles work will help you.

Some coverages and medical expenses have lower deductibles than your overall plan, some covered medical expenses may have no deductible. It depends on the plan you have chosen and the kind of deductible your plan offers. To understand how much money you will end up paying out-of-pocket, you should ask your plan provider three questions.

Your Possible Yearly Cost:

Your possible yearly cost is:12 months of monthly premium payments + the out-of-pocket-max

Example:

Gabriel has a $405 per month premium payment. In 12 months, he will pay $4,860 inpremiums

His out-of-pocket max is $2,500. If he uses health care a lot, the most he will likelypay is $7,360.

Gabriel can save $208 a month to cover his out-of-pocket costs. If he has a medicalemergency he will not have to come up with $2,500 at one time.

Don’t Miss: What Causes Health Insurance Premiums To Increase

If Youre A Senior Citizen

If youâre above the age of 65, you qualify for Medicare. We go into more detail into Medicare below, but the gist of it is that itâs a federal program designed to help you cover health care costs into old age.

You can also purchase supplemental insurance, called Medigap, that can help pay for your deductibles, copayments, and coinsurance. Medigap plans may or may not make sense for you â make sure you know what youâre buying before you start to pay for it.

Should You Choose A Higher Deductible On Health Insurance

If you feel you are struggling to meet the cost of your health insurance, then you should consider if you are putting yourself at too much risk by taking a higher deductible to save money. It is very important to consider if you can afford the higher deductible in an emergency.

Putting yourself in a situation where you can not afford to pay the deductible in your medical plan is not a good idea, so think long term when choosing the health insurance plan. Its not about the cost today, it’s about the cost when you need to use the insurance.

TIP: Consider if you had to come up with that deductible tomorrow, would you be able to? If the answer is no, then find a plan that will work for your budget. Remember, the whole point of your health insurance is to get you the care when you need it.

Also Check: What Does Health Insurance Cost In Retirement

Important Key Words Explained

- Deductible: The amount you owe for covered health care services before your health insurance or plan begins to pay.

- Copayment: An amount you pay as your share of the cost for a medical service or item, like a doctor’s visit.

- Coinsurance: Your share of the cost for a covered health care service, usually calculated as a percentage of the allowed amount for the service.

- Premium: The amount you pay for your health insurance or plan each month.

- Network: The doctors, hospitals, and suppliers your health insurer has contracted with to deliver health care services to their members.

What Is Covered By Your Health Insurance Plan

Like most insurance products, what is covered and coverage levels will vary depending on the choices you make. While more expensive policies will carry higher coverage levels, they come at a price.

The ACA requires the following 10 items and services, referred to as Essential Health Benefit Packages , to be covered by all insurance policies. Coverage limits can vary by plan, so make sure you review your limits.

It is important to remember that coverage levels can vary between plans, and you will almost always be responsible for co-pays, co-insurance and deductibles.

Read Also: How Much Do I Have To Pay For Health Insurance