Financial Help With Marketplace Plans In New York

The federal government provides financial assistance based on your income and household size. You can receive help through premium tax credits, cost-sharing reductions, or both when you enroll through the Marketplace.

- Premium Tax Credits : This lowers your monthly premium on any metal plan. Before 2021, you qualified for help paying for health insurance if you earned between a certain range .In 2021, you qualify for subsidy help if you pay more than 8.5% of your household income on health insurance. In 2020, more than half of New York enrollees received subsidies.9 The average subsidy was $325.10

- Cost-Sharing Reductions : This lowers your out-of-pocket costs only on silver plans. You must earn up to 250% of the FPL to qualify, or $43,100 for a family of two. Just 12% of New York enrollees got CSRs in 2020.11

What Does Health Insurance Cover

The Affordable Care Act instituted a number of controls on health insurance plans and providers. One of the biggest changes is that every health insurance plan, regardless of tier or provider, must offer at least some coverage for 10 essential benefits. Those benefits are:

These are the bare minimum services that every type of ACA-compliant plan must cover. Keep in mind that if you purchase a short term health insurance plan, these requirements dont apply.

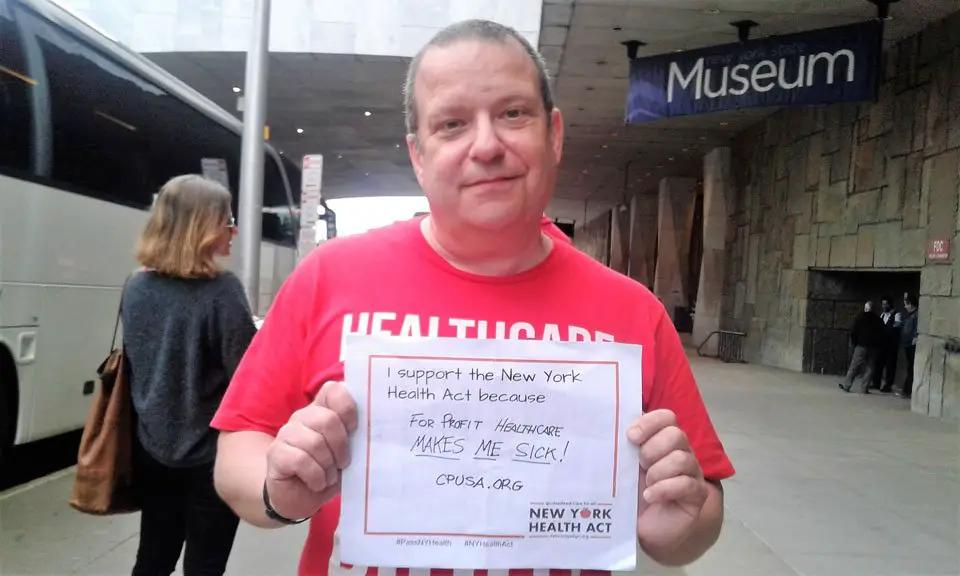

Why Should Businesses Support The New York Health Act

The New York Health Act would be hugely beneficial to businesses. Instead of paying a per employee premium, the business would pay a proportionally smaller tax to the government to offset the cost coverage. Business owners can focus on running their businesses, instead of fighting health insurance companies. The savings can be passed on to their customers, and allow them to pay more in wages. For more on the business case for universal, single-payer healthcare, visit: www.fixithealthcare.com

Read Also: Can I Have Dental Insurance Without Health Insurance

What Is The Benefit Of Private Health Insurance

The advantage of choosing a private health insurance plan versus a group health insurance plan offered by your employer is that you will likely have a wider range of choices in terms of insurance companies, plan types, tiers, networks, and various options from which to choose. Also, if you qualify for an ACA federal marketplace plan at Healthcare.gov, you may get some or all of your premiums paid for by the government, depending on how much you earn.

Private Versus Public Health Insurance

Private health insurance, offered through the ACA federal marketplace or directly from private health insurance companies, is different from public health insurance — meaning Medicare or Medicaid.

“Medicare is generally more cost-effective for Americans over age 65, the vast majority of whom qualify for Medicare,” says Martucci. “Medicaid, on the other hand, is a free or very low-premium health insurance option for low-income Americans and is a very good deal for those who qualify. But eligibility requirements vary significantly by state and in many places are restrictive to the point of excluding all but the most vulnerable people.”

Read Also: How Can A College Student Get Health Insurance

Finding The Best Health Insurance Coverage In New York

The best health insurance policy for your family will depend on the availability of plans in your area, as well as your medical and financial situation. When deciding on the right type of plan, you should determine affordability by reviewing the premiums and deductibles for each metal tier. Generally, if you have an emergency savings account and don’t expect to have significant health or medical expenses, then a lower metal tier plan with more affordable premiums would make more financial sense.

Gold and Platinum plans: Best if you expect high medical costs

Gold and Platinum plans are the highest tier health insurance policies available in New York. These plans often have the most expensive monthly premiums but come with lower deductibles and out-of-pocket maximums.

For example, if you frequently use expensive prescription drugs, an upper-tier health plan could be the right choice.

Silver plans: Best for people with low income or average medical costs

Silver plans are middle-ground policies that fall between Gold and Bronze plans with regard to premiums and out-of-pocket expenses. We would recommend a Silver plan in most situations â but if you are very healthy, Bronze may be best in terms of cost-effectiveness.

On the other hand, if you expect a lot of medical expenses, then a Gold plan may better fit your needs.

Bronze and Catastrophic plans: Best for young, healthy individuals

Do I Need To Use An Exchange

To access public health insurance, you will need to go through the government exchange. The only exception to personally using the exchange to sign up for Obamacare in New York is if you are able to seek help from a New York certified counselor or a private insurance agent who can discuss your options and select a plan, on your behalf, through the exchange.

Also Check: How To Sign Up For Health Insurance

Find Affordable Healthcare That’s Right For You

Answer a few questions to get multiple personalized quotes in minutes.

HealthCareInsider.com is owned and operated by HealthCare, Inc., a privately-owned non-government website. The government website can be found at HealthCare.gov.

This website serves as an invitation for you, the customer, to inquire about further information regarding Health insurance, and submission of your contact information constitutes permission for an agent to contact you with further information, including complete details on cost and coverage of this insurance.

HealthCareInsider.com is not affiliated with or endorsed by any government website entity or publication.

If you are experiencing difficulty accessing our website content or require help with site functionality, please use one of the contact methods below.

For assistance with Medicare plans dial 888-391-5203

For other plans please dial 888-380-0672

Will Ny Need Federal Waivers To Implement The Ny Health Act What About Erisa

In order to efficiently integrate existing federal funds into the new system, the New York Health program will seek waivers from the federal government that will enable bulk transfer of these funds to the state based on global, prospective budgeting.

Federal waivers will be sought to make the program easier to implement. However, the program works even if waivers are not received. The bill includes technical mechanisms that will work in the background, not affecting how NY Health works for patients and providers. Federal funds will continue to flow to New York, as they do now, and the NY Health program will be able to avail itself of them.

For a more thorough overview of the issue, read the FAQs on federal waivers and ERISA.

Also Check: How Much Is Health Insurance For Seniors

Different Types Of Plans

Shopping for a health insurance plan can sometimes feel like being in a grocery store and staring at rows of the same product for what seems like hoursonly its less exciting and way more expensive! But comparing plans could save you money. This is because the type of plan you choose also affects your health insurance costs.

Here are the plans and networks you can shop for in the health insurance marketplace:

New York Health Insurance Laws

The Affordable Care Act limits what restrictions and exclusions insurance companies can use to price your policy.

- Pre-existing conditions: Pre-existing conditions can’t be considered by insurance companies. People used to pay more for health insurance if they had a pre-existing condition, but the ACA now limits insurance companies from charging higher rates.

- Gender: According to a study by Health Services Research, women historically pay more for health care. The ACA mandates that insurance companies can’t charge men and women different prices for the same plan.

- Insurance and medical history: Before the ACA, people with previous medical problems or lapses in insurance coverage would often have to pay more for coverage. Thats no longer the case.

New York has a Family Planning Benefit Program, which requires insurance providers to offer some coverage for the following services for families:

- Pregnancy testing and counseling

- Screening and treatment for sexually transmitted infections

- HIV counseling and testing

- Most FDA approved birth control methods, devices, and supplies

- Emergency contraception services and follow-up care

- Transportation to family planning visits

Read the entire list on the New York State Department of Health website.

Don’t Miss: How Much Is Temporary Health Insurance

Your Gender And Marital Status

Under the Affordable Care Act, insurance companies are no longer able to charge consumers more based on their gender.8 But other factors do make a difference. For instance, if youre married and have kids, you can expect to pay more to cover your familys needs. Note that if your familys income falls below a certain level, a tax credit could save you money.9

But marital status arent the only things that determine how much you could be shelling out. Here are some other things insurance companies look for.

How To Get Your Uhip Card

Step 1: Check your yorku email.

- Undergrad students: Click here to access your yorku email with your Passport York. You should see an email titled SLF Coverage Card.

- Grad Students: Contact your Faculty on how to access your yorku email.

Step 2: Print your UHIP card and keep it with you in case of medical emergency.

Dont see the email from Sun Life with your UHIP Card? Here is what you can do:

Find out whether you have UHIP coverage, check your student account.

- If your student account shows the UHIP charge under the description , this means that you should have UHIP coverage.* In this case, get your UHIP card by registering on the Sun Life website. For a step-by-step process on how to register, click here. Once you register, click here to find out how to access your UHIP Card. If the registration asks for your member ID and policy number, it is as follows: Member ID is YU plus your student number and policy number is 050150.

- If you do not see the UHIP charge on your student account, then email with your student number.

*NOTE: If you dropped your courses, your UHIP will be terminated. In this case, you will see a UHIP reversal on your student account. This means that you do not have UHIP coverage. Please see the Leave of Absence section to inquire about getting covered under UHIP while taking a semester off.

You can also complete the Getting your UHIP Card quiz to find out how to get your UHIP card.

You May Like: Can I Buy Dental Insurance Without Health Insurance

Short Term Medical Insurance Stm

Due to recent changes in the law, these plans are now able to be purchased for 36 months at a time in many states.

STM plans are low-cost alternatives to the expensive ACA options. They are 100% real health insurance with large PPO networks. There are many benefit levels available to suit all budgets. While these plans do not cover pre-existing conditions and typically offer very little in the way of prescription coverage, they provide maximum premium savings.

Can I Buy Private Insurance

Private insurance that duplicates benefits offered under New York Health could not be offered to New York residents. Thats important to prevent a 2-tier system, so wealthy New Yorkers have a stake in maintaining the quality of New York Health. But private coverage could be sold for benefits that would be outside the NY Health program, like purely cosmetic surgery.

Also Check: Does Aarp Offer Health Insurance

Average Cost Of Health Insurance By Family Size

Along with your county of residence, the number of people covered under the health plan will affect the premiums you pay. Below, we have provided the average cost of a Silver health plan for a variety of family sizes. Note that, for a family, the average cost for a Silver policy is $1,894 no matter how many dependents are covered under the health insurance plan.

| Family size |

|---|

| $1,894 |

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.

Don’t Miss: How To Get Health Insurance Fast

Find Cheap Health Insurance Quotes In Your Area

Health insurance premiums have risen dramatically over the past decade. In the past, insurers would price your health insurance based on any number of factors, but after the Affordable Care Act, the number of variables that impact your health insurance costs decreased significantly.

In 2021, the average cost of individual health insurance for a 40-year-old across all metal tiers of coverage is $495. This represents a decrease of close to 2% from the 2020 plan year.

How Does Medicaid Provide Financial Assistance To Medicare Beneficiaries In New York

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesnt cover such as long-term care.

Our guide to financial assistance for Medicare enrollees in New York includes overviews of these programs, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

Read Also: Can You Opt Out Of Health Insurance At Any Time

How Would The New York Health Act Work

It would provide comprehensive, universal health coverage for every New Yorker and would replace private insurance coverage. You and your health care providers work to keep you healthy. New York Health pays the bill.

1. Freedom to choose your health care providers. There would be no network restrictions. Only patients and their doctors not insurance companies would make health care decisions.

2. Comprehensive coverage. All New Yorkers, regardless of immigration status, would be covered for all medically necessary services, including: primary, preventive, specialists, hospital, mental health, reproductive health care, dental, vision, prescription drug, and medical supply costs more comprehensive than commercial health plans.3. Paid for fairly. Today, insurance companies set the same high premiums, deductibles, and co-pays, whether its for a CEO or a receptionist, and a big successful company actually pays less than a small new business.

Where To Buy Private Health Insurance

You can purchase an ACA plan at Healthcare.gov through Aug. 15, 2021, in most states, or beginning again Nov. 1 each year.

You can buy a private marketplace plan directly from an insurance company or insurance broker at any time. Search online for carriers and brokers, and compare several different plans and premium costs to find the right product for you.

Recommended Reading: How Do I Know If I Have Private Health Insurance

How To Buy An Affordable Ny Individual Health Plan

Lets begin with the simplest and most basic rule of buying any insurance, dont buy more insurance than you need.

Heres what I mean:

When it comes to insuring your car, you probably dont choose a deductible of $250 because you know the premium would be too expensive, right? You would probably choose a deductible of $750 or $1000 because you know that in the event of an accident, you could pay some money out of pocket.

Well, this same concept applies to buying health insurance and making your coverage more affordable. If you want the insurance company to pay every time you go to the doctor for a sniffle or ache, your premiums are going to be very expensive.

On the other hand, if you have a policy with a deductible where you pay, lets say the first $2500 for medical care and then the insurance company pays 100%, you will save a lot of money on your premiums.

In other words, the higher the deductible you can afford, the lower your insurance premiums will be. Its a balancing act between how much you can afford in monthly premiums and coverage that fits your lifestyle and needs.

The mistake that most people make is they dont do the math of how much they can pay out of pocket if they have a major medical expense. We have all been conditioned over the years to think the insurance company is going to cover every procedure, every exam, every pill and every medical bill.

How Does New York Health Reduce Costs

New York Health reduces costs by cutting waste, not by denying care to patients. As proven in other countries, providing universal coverage is actually much cheaper since you arent paying for insurance companies marketing, claims denial departments, shareholder profits, or bloated CEO salaries. Also, when people have more access to care, they get treatments earlier before conditions worsen and become more costly. Even prescription medicine costs less, since the government could negotiate bulk prices.

In addition, doctors charge less when they dont have to pay for extra staff to manage all the intricate billing that comes with private insurers. The cost of employing huge departments to handle all this red tape gets passed on to you, making everything more expensive.

In fact, our government already spends MORE per person on healthcare just for the elderly and poor under Medicare and Medicaid than the Canadian government spends to provide healthcare for every citizen.

NYH controls costs through:

Also Check: How To Sign Up For Aarp Health Insurance