Health Insurance Marketplace: I Got Laid Off And Had Insurance Through My Job

The next place to look is the insurance exchanges set up under the Affordable Care Act. Losing health insurance that you got through your job is considered a “qualifying event” or Special Enrollment Period to enroll in a plan on all the health insurance exchanges. That means you can go to Healthcare.gov and shop for a new plan. The open enrollment period for 2020 has ended, but if youve just left your job and lost your employer-based health insurance, you qualify for a Special Enrollment Period that typically lasts 60 days.

Note that the 60-day period after you leave your job is the same amount of time you have to decide if you want COBRA, which means youll have to choose between one or the other during that time although there are exceptions to that rule. If you dont sign up during the Special Enrollment Period, youll need to wait until the next Marketplace open enrollment period, Nov. 1 through Dec. 15.

Within the Marketplace, the 2020 premiums for the average benchmark plan is $462, according to the Kaiser Family Foundation. But its unlikely youll pay the sticker price. Most people qualify for subsidies like premium tax credits and cost-sharing reductions on deductibles, copayments and other out-of-pocket expenses. The Kaiser Family Foundation also has a handy subsidy calculator so you can see what you might pay in premiums for these plans remember that your unemployment benefits count as income.

Is Your Employer Health Insurance Enough What Can Go Wrong

Most of us are offered employer health insurance as a perk attached to our jobs. It has become the norm now, and some toil hard to convince their companies to sign them up for it. It is indeed a great thing to have, but are you aware of whats covered under it? It may come as a shocker that the usual coverage doesnt include everything. Details of coverage are often not discussed at length with the employees, or worse yet, there is no communication at all. It is when an employee faces a critical illness that they come to know of the limitations.

HERES WHY IT ISNT ENOUGH?

- YOU LOSE YOUR JOB YOU LOSE YOUR HEALTH COVER When you lose your job, not only do you lose your job, but also the health insurance that goes with it. The common practice these days is to fire employees who fall sick. If you are unfortunate enough to lose your job because of an illness, any benefits attached to the employer-sponsored group policy will be ditched, and you will have to start from scratch. An individual health insurance policy is an effective way to protect yourself against such uncertainties its affordable and provides a lot of flexibility. While the premium for a cover that extends to your family members will be slightly more, it is well worth the expense.

Connect For Health Colorado Marketplace

Connect for Health Colorado may also help you meet the insurance requirement. Having health insurance can help protect your health and your financial future.

- If you dont have health insurance but make too much money for Health First Colorado, Connect for Health Colorado can help you learn if you qualify for federal financial assistance to help lower the costs of your insurance.

- If you do have health insurance, you still have the option to shop for a new plan at Connect for Health Colorado.

You may also be able to qualify for financial assistance through Connect for Health Colorado outside of open enrollment if you have experienced a qualifying life event such as losing your job-based coverage, getting married, or having a baby. Visit ConnnectforHealthCO.com for more information.

Don’t Miss: What Do You Need To Get Health Insurance

What Does No Charge After Deductible Mean

With most health insurance plans, once you hit your deductible, youll still need to pay some out-of-pocket expenses. Things like copays and coinsurance. However, if you have a plan that includes no charge after deductible, then youre insurance carrier will cover 100% of your costs after you reach your deductible.

If I Dont Have Health Insurance Where Do I Go To Get It

You can go online to the healthcare marketplace. The Marketplace site will ask you basic questions about your income, your family size, where you live, etc. and will provide an overview of the insurance options for which you qualify. But ultimately, you will have to decide what you want to spend and what is best for you and your loved ones.

You May Like: How Much Health Insurance Do You Need

If You Had No Health Coverage

Unlike in past tax years, if you didnt have coverage during 2020, the fee no longer applies. This means you dont need an exemption in order to avoid the penalty.

Important: Some states have their own individual health insurance mandate

If you live in a state that requires you to have health coverage and you dont have coverage , youll be charged a fee when you file your 2020 state taxes. Check with your state or tax preparer.

You will NOT get Form 1095-A unless you or someone in your household had Marketplace coverage for all or part of 2020.

Cobra Benefits: I Got Laid Off And Had Insurance Through My Job

The Consolidated Omnibus Budget Reconciliation Act is designed to provide exiting employees the option to continue the coverage they have through their employers group health plan. Employers with 20 or more employees are typically required to offer this option.

If you are eligible for COBRA, you usually have up to 60 days to decide if you want to continue your coverage even if you initially decline, you still have the option to sign up for it within that period. However under the rule issued this spring, that clock doesn’t start ticking until the end of the COVID-19 “outbreak period” that started March 1 and it will continue for 60 days after the COVID-19 national emergency is declared to be at an end. With this extension of the time frame to sign for up for COBRA coverage, people have at least 120 days to decide whether they want to elect COBRA, and possibly longer depending on when you were laid off.

The continuation coverage is available for up to 18 months your spouse and dependents can stay covered for three years, depending on the circumstance.

But heres where it gets expensive: The part of the premium that your employer used to cover is now your responsibility.

Recommended Reading: How Do You Get A Tax Credit For Health Insurance

Free Medical Services For Kids

- Insure Kids Now is a state and federal government program that provides medical, dental and psychological care for children who qualify. To see if you or your child qualifies, go to Childrens Health Coverage Programs in North Carolina.

- NC Health Choice for Children is a health insurance plan that covers hospitalization and outpatient care for children of families that qualify.

- To learn about managing finances while caring for a sick child, see Financial Management During Crisis provided by The Nemours Foundation.

What Is The Individual Mandate Penalty Fine

If you do not have health insurance, keep in mind that you may be responsible for paying the individual mandate penalty fine. The fine for not having insurance is calculated either as a percentage of your income or as a flat fee.

Not having health insurance will cost either $695 per every uninsured adult in your household and $347.50 per uninsured child with a maximum set to $2,085 or 2.5 percent of your household income.

You will pay whichever of the two is greater. If you only went without health insurance for a short period of time that was less than three full months, you might qualify for a short coverage gap exemption and will not have to pay the fine.

Read Also: How To Enroll In Health Insurance

Waiting Period To Get Public Health Insurance

In some provinces you must wait, sometimes up to 3 months, before you can get government health insurance. Contact the ministry of health in your province or territory to know how long youll need to wait. Make sure you have private health insurance to cover your health-care needs during this waiting period.

Covering Your Visit With Health Insurance

Unfortunately, in recent years, the percentage of uninsured and under-insured has increased. Currently, about 28 million Americans are uninsured and an estimated 30 million are underinsured. One reason the number of uninsured is rising is that the federal government is no longer requiring people to maintain health insurance, though five states do require it: California, Massachusetts, New Jersey, Rhode Island, and Vermont, plus the District of Columbia.

The individual mandate requiring virtually everyone to have health coverage or pay a tax penalty was passed in 2010 as a part of the Affordable Care Act. That financial incentive led many to get insurance, often carefully comparing and choosing a health plan that best suited their needs and budget. But now with this section of the ACA no longer being enforced by the federal government, many people have dropped their insurance.

Signing up for health insurance during the Open Enrollment Period helps you avoid shouldering the entire cost for large medical bills stemming from serious injury or illness. Most people declare bankruptcy due to medical costs, rather than for any other reason. Undoubtedly, having health insurance can play an indispensable role in helping people maintain their financial security.

Don’t Miss: Can You Terminate Health Insurance At Any Time

Short Term Medical Insurance

Short term medical is designed as temporary health insurance coverage for people who are in between major medical policies. Plans include a to help pay for catastrophic medical expenses and you can apply anytime during the year.

Short term plans last from 30 to 364 days with . These plans are not ACA-qualifying, which means they dont include the and dont cover pre-existing conditions. As a result, premiums are typically less than major medical, however, your premium amount depends on the benefits selected.

Learn about and see if its right for you.

How Can I Find A Dentist Without Insurance Near Me

The main question on the minds of most people is Where can I find a cheap dentist near me?’ You can call to check for dentists in your area and ask for prices without insurance.

No insurance? Call now to find a dentist near you.

to get connected or call

If you are looking for dental care without insurance, chances are you can find it, but you may have to do some looking around. By following these tips, you’ll likely find what you’re looking for. You can ask at your local health center, or your local dentist if they offer sliding-scale fees. You can also head to freedentalcare.us and type in your zip code to find a free or low-cost dentist near you.

Don’t Miss: What Does Health Insurance Cost In Retirement

Visit An Urgent Care Center

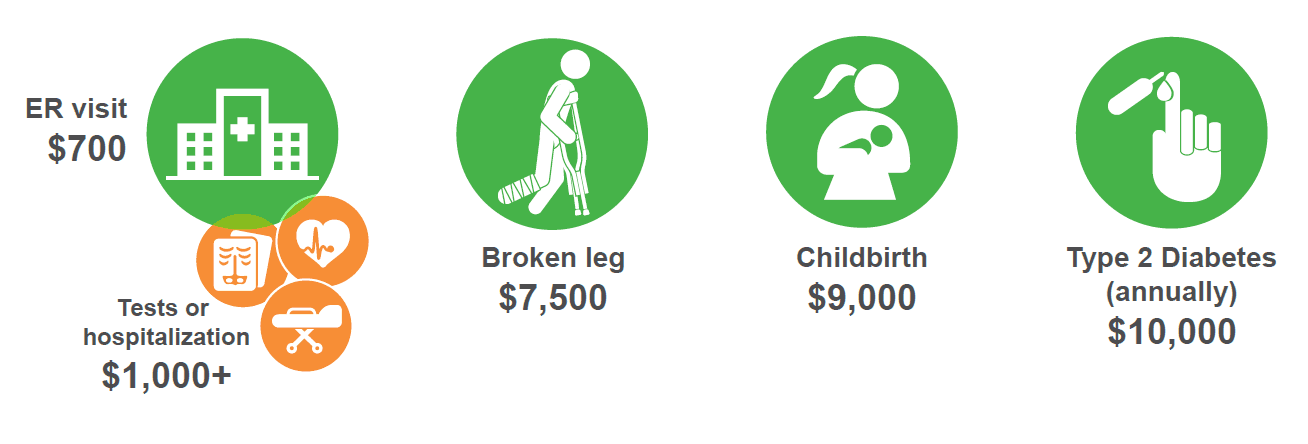

If youre not experiencing a true emergency, you may want to visit a nearby urgent care center. Urgent care professionals, who may be nurse practitioners rather than physicians, can treat minor illnesses or injuries. They will also advise you if they believe you need more medical care or if you should go to the ER. Urgent care often costs roughly half as much as a trip to the ER. For example, a visit to an urgent care center will cost you the office visit and any prescription drug or lab fee costs you may need. By comparison, an ER trip will entail hospital costs, doctor fees and then your prescription and lab fees, all of which are almost always considerably higher than those billed by an urgent care center. However, at an urgent care center, you may have to pay in advance if you dont have health insurance.

Can Doctors Refuse To Treat Patients Without Insurance

No, doctors cannot refuse to treat patients if you do not have insurance. However, they can refuse treatment if youre unable to pay for it.

The Emergency Medical Treatment and Active Labor Act ensures that all patients with or without insurance that are suffering from an emergency condition must be treated until that condition is stabilized.

With that said, if your condition is not an emergency and you are seeking treatment from a private doctor, the doctor has the right to refuse treatment if you are unable to pay for the services.

Read Also: How Does Health Insurance Work Through Employer

How Can I Be Sure My Insurance Provider Will Pay My Bills

Your health plan may:

- Require certain services to be authorized, or pre-certified, before you receive them

- Require you to notify them within a certain period of time after services are rendered

Find out your health plan’s requirements by reading the information given to you by your insurance provider or employer, or by calling your insurance provider directly.

You also may call a Cleveland Clinic billing representative to discuss insurance payment concerns at 216.445.6249 or 866.621.6385 .

I Don’t Have Dental Insurance And I Need Help

Is something no one should ever have to search on Google. But the unfortunate truth is that around 1/3 of adults in the US have no form of dental benefits coverage. And many of those who do have some dental benefits are grossly underinsured, meaning they still can’t afford the care they need. Either that or they are paying more than they can afford for monthly premiums or their deductibles.

The good news is that there are programs that can help. Chances are, you can find help paying for the dental work you need, the problem is the general lack of awareness that these programs do in fact exist. So we’re going to have a look at some of the ways that you can get the dental work you need even without insurance.

But before we start, it’s important that you understand that it may take some time and effort to find a program that can help you. In this article, we provide a place to start, but it’s up to you to make the necessary phone calls and do your due diligence to find a program that works for you. And don’t give up if at first, you don’t succeedyour dental health is extremely important and it’s likely that you will be able to find the help you need.

You might think you can’t afford dental insurance, especially if you’ve seen the monthly premiums for regular health insurance. But dental insurance is actually much less than health insurance.

Also Check: Can I Have Two Health Insurance

Ways To Pay Medical Bills With No Health Insurance

When you make the choice to go without medical insurance, you will need to be prepared to deal with the consequences. Planned or unplanned, medical procedures can cost quite a bit of money. When you do not have insurance, you are responsible for paying one hundred percent of the cost. If you cannot afford health insurance, you will need to take a proactive approach to dealing with your medical bills. With the rising cost of health care, many people find it difficult to afford health care costs even with insurance. It is important to be proactive because medical bills can lead to bankruptcy. If you do not have insurance, try to find a plan through the Affordable Care Act and enroll as soon as possible.

The Fee For 2018 Plans And Earlier

- You may owe the fee for any month you, your spouse, or your tax dependents don’t have qualifying health coverage . See all insurance types that qualify.

- You pay the fee when you file your federal tax return for the year you dont have coverage.

- In some cases, you may qualify for a health coverage exemption from the requirement to have insurance. If you qualify, you won’t have to pay the fee. Learn about health coverage exemptions.

Don’t Miss: Can Aflac Replace Health Insurance

How To Save Money When You Dont Have Health Insurance

When getting medical care without insurance, there are steps you can take to minimize cost:

RELATED: How can I save on my medication?

Everything feels harder when youre sick. Take these steps now, before you need healthcare, to ensure you are in a better place financially later on. Looking for discounts, coupons, payment plans, and comparing prices can be immensely helpful for your wallet while trying to navigate the healthcare system.

Why Are People Uninsured

Most of the nonelderly in the U.S. obtain health insurance through an employer, but not all workers are offered employer-sponsored coverage or, if offered, can afford their share of the premiums. Medicaid covers many low-income individuals however, Medicaid eligibility for adults remains limited in some states. Additionally, renewal and other policies that make it harder for people to maintain Medicaid likely contributed to Medicaid enrollment declines. While financial assistance for Marketplace coverage is available for many moderate-income people, few people can afford to purchase private coverage without financial assistance. Some people who are eligible for coverage under the ACA may not know they can get help and others may still find the cost of coverage prohibitive.

Key Details:

- Cost still poses a major barrier to coverage for the uninsured. In 2019, 73.7% of uninsured nonelderly adults said they were uninsured because coverage is not affordable, making it the most common reason cited for being uninsured .

Figure 7: Reasons for Being Uninsured among Uninsured Nonelderly Adults, 2019

Don’t Miss: How Much Is Private Health Insurance In Spain