Aca Premiums Were In Line With Employer Premiums Prior To Trump Actions

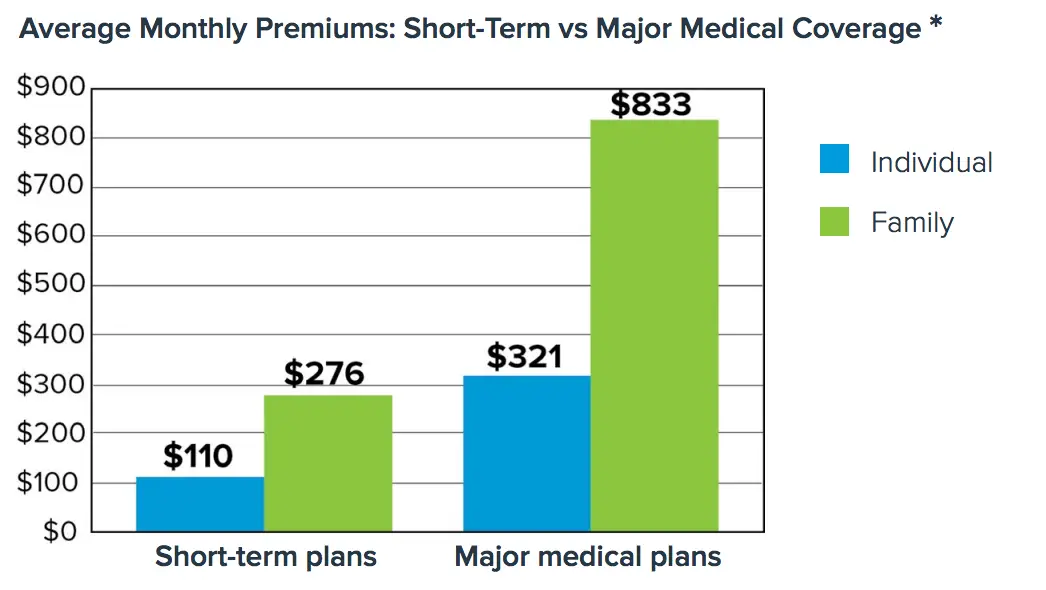

Discussions about affordability challenges for middle-income individual market consumers often start from the assumption that premiums in the ACA individual market are far higher than in other health insurance markets due to severe adverse selection. This impression was reinforced by large premium increases in 2017 .

But in fact, as of 2017 after these premium increases ACA individual market premiums were roughly in line with premiums for employer coverage with similar out-of-pocket costs , a reasonable proxy for the cost of providing private coverage to a broad cross-section of the population. For example, about 60 percent of ACA marketplace consumers lived in states where benchmark premiums for ACA coverage were below or equal to employer premiums, and another 17 percent lived in states where they were no more than 10 percent higher, according to an Urban Institute analysis. Individual market plans often have narrower networks than employer plans, which lowers prices, and so similar premiums indicate that the individual market risk pool was likely modestly weaker, on average. But the data contradict claims that healthy people have largely exited the ACA marketplaces or that the structure of the ACA inherently leads to very high premiums.

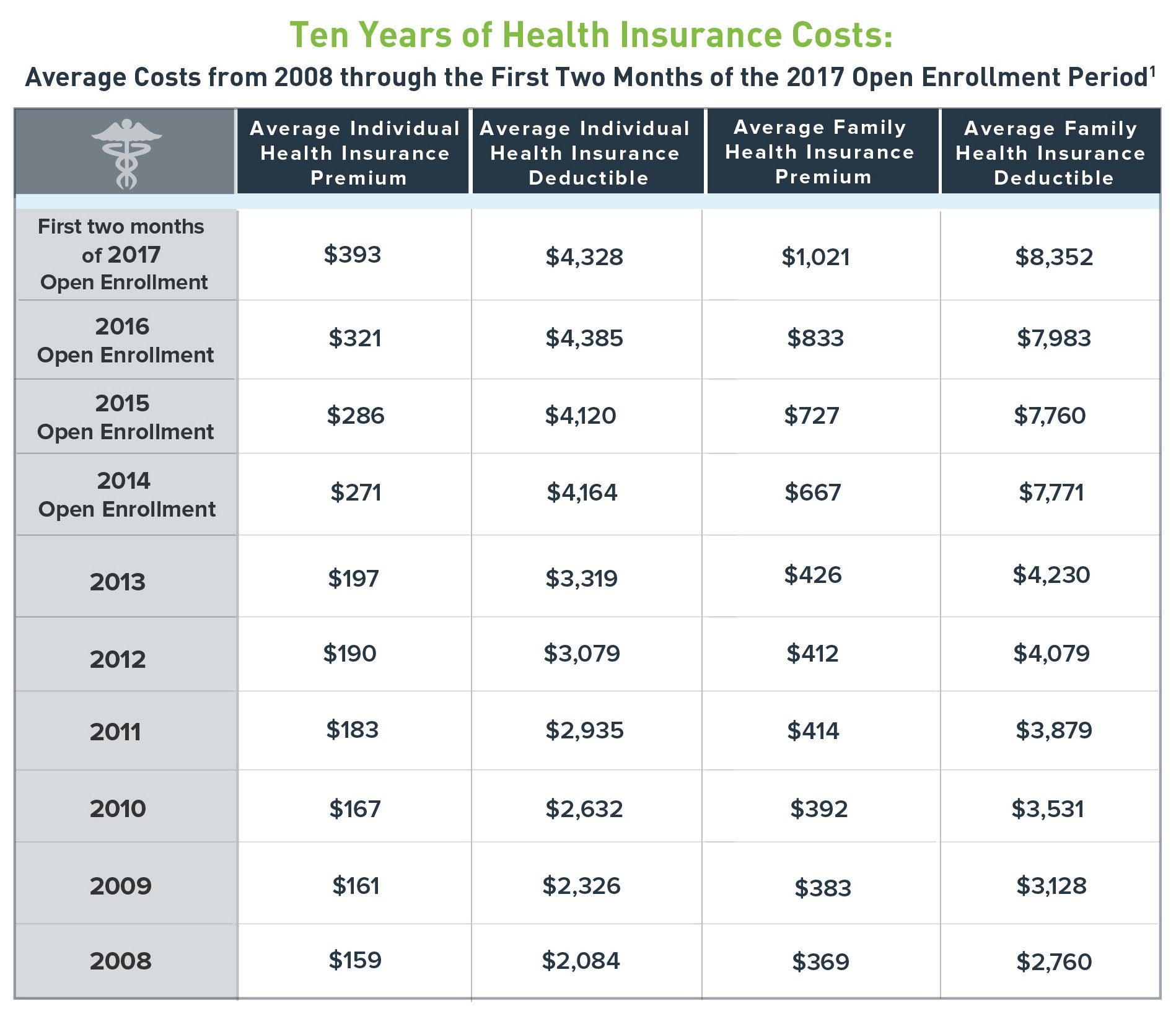

Breaking Down The Average Insurance Cost

If you buy an ACA plan as non-subsidized health insurance for the family consisting of 4 members, you can expect to be paid about $25,000 for the year in the premiums and deductibles. This will be breakdowns to an average of almost $17,244 in the annual premium cost for the insurance of health for the family of 4 members and $7,767 in the deductible expenses.

eHealth introducing the increasing cost of health care is most of the time alarming to most of the families. But dont feel demotivated at the idea of having to find the family health insurance that you can afford.

We are here to help find the best level of coverage for you and your family members at a most reasonable price. Also, you can easily make use of the subsidy calculator to help in determining whether you may be eligible for a tax subsidy or not. With eHealth:

- You can easily compare any individual or family health insurance options by occupying our user-friendly online services 24/7 and chatting with an eHealth representative anytime when you have a query.

- You can easily communicate with an eHealth licensed insurance agent who knows how to help with the requirement of affordable health coverage that will meet the facilities of you and also for your family members.

If he wants to get insurance, health insurance should need to explore family or individual health insurance options. By taking advantage of the eHealth services, he may get affordable options of the family health insurance.

The Private Health Insurance Rebate

Get up to 33.413% back on premiums when you qualify for a private health insurance tax return. This rebate can generally be claimed as an upfront reduction on your premiums or as a refund through your annual tax return. The deduction percentage youre entitled is calculated on your age and expected taxable income for the financial year.

Take note: Rebate percentages are adjusted yearly on the 1st of April.

Recommended Reading: How To Apply For Kaiser Health Insurance

Tips For Finding Healthcare Coverage

With the rising costs of healthcare, how can Americans save on healthcare and the cost of insurance? Be diligent, and do your research to compare plans. That way, you can get the most comprehensive health coverage you can afford.

If your employer offers health insurance and pays for a large portion of the premium, it is a great option to think about. If not, shop the health insurance exchange for affordable coverage. Check to see if you qualify for any subsidies to help offset the cost of health insurance. Health savings accounts can also help you pay for out-of-pocket expenses such as co-pays and deductibles.

Finally, if you have a catastrophic accident or illness, ask the hospital for help with a payment plan. Many hospitals will reduce their charges for those who are unable to obtain insurance.

Us Health Insurance Cost Calculator

To find out the amount that you have to pay for health insurance for your family, you need to do a lot of online research. There are multiple online websites with a health insurance cost calculator that can help you find out the expenses that you need to pay. Look at these online calculators and add all the required information. When you do this, the calculator will find out the health insurance cost for you.

Also Check: How Much Is Private Health Insurance In New York

Health Insurance Rate Changes In Texas

Health insurance premiums changes are set by the health insurance companies on a yearly basis. Before these premiums are set, they are first approved by the federal health insurance exchange.

In Texas, the prices of every metal plan increased from 2020 to 2021. The highest increase affected Gold plans, which rose by 11%. Catastrophic plans increased by 2%, the lowest increase among the metal tiers.

| Metal tier |

|---|

How The American Recovery Plan Act Makes Health Insurance Cheaper

Signed into law on March 11, 2021, the new $1.9 trillion COVD-19 stimulus package will have a major impact on the healthcare premiums of millions of Americans.

Officially known as the American Rescue Plan Act, this stimulus is expected to reduce healthcare premiums on some plans by as much as 20%. This will ultimately save millions of Americans hundreds of dollars on healthcare.

The stimulus plan reduces healthcare costs by expanding tax credits on many healthcare plans. Healthcare costs vary based upon an individualâs age, income and chosen plan but consider the following examples.

Stimulus impact for

Also Check: Does Short Term Health Insurance Cover Pregnancy

How Much Is Health Insurance Per Month For One Person

Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. The average national monthly health insurance cost for one person on an Affordable Care Act plan in 2019 was $612 before tax subsidies and $143 after tax subsidies are applied.

Wondering how insurance premiums are decided? The Affordable Care Act ensures that insurance companies cannot discriminate based on gender, current health status, or medical history. Here are factors that determine health insurance premiums.

What Is The Average Cost Of Health Insurance In Texas

The average cost of health insurance in Texas is $509 in 2021 for a 40-year-old. However, the cost of health insurance may change depending on variables such as location, age and the metal tier of coverage that you select. For example, a 40-year-old pays health insurance premiums that are 53% cheaper than that of a 60-year-old.

Also Check: Where To Go If You Have No Health Insurance

Read This Article To Know The Average Cost Of Health Insurance For A Family Of Five

In 2020, the normal public expense for medical coverage is $456 for an individual and $1,152 for a family for every month. In any case, costs shift among the wide choice of wellbeing plans. Understanding the connection between wellbeing inclusion and cost can assist you with picking the correct medical coverage for you.

Moreover, you must remember that the size of your family doesnt always decide what you spend on healthcare specialists and medicines. A sound and healthy family of five may end up spending much less on healthcare as compared to a wedded couple with constant and severe medical conditions. However, with regards to your medical coverage costs, the number of individuals on an arrangement influences what you pay.

If you want to know more about what the average cost of health insurance for a family of five is, then you have come to the right place. We have gathered all relevant information to help you know about all that you need to. So, what are you waiting for? Without much further ado, let us jump right in!

What Is A Deductible In Health Insurance

A deductible is the amount you pay for covered services before your plan starts paying. If you have a $1,000 deductible, you pay the first $1,000 in healthcare costs, and then your plan starts helping to cover costs. The higher your deductible is, the lower your premium will be. You need to be prepared for those initial out-of-pocket costs.

Also Check: Is Cigna Health Insurance Any Good

How Do Us Health Insurance Costs Stack Up Globally

Voluntary healthcare payments including for private health insurance totalled more than $1,685 per capita in the USA in 2019.

This is lower than the figure in Switzerland, where voluntary payments were worth $2,745 per capita.

However, the USAs private spending continues to soar far above that in many other nations. American private health spending is five times higher than Canadas, for instance.

American Health Insurance Vs International Cover: Whats The Cost Difference

International health insurance is a product designed to offer cross-border coverage. Many Americans are surprised by how affordable health coverage can be when they spend time overseas so how does this product compare to domestic cover?

At William Russell, our most comprehensive international health plans provide standard coverage in every country except the USA. Weve published a full guide on how we calculate premiums for health insurance. By comparing our typical premiums to U.S. averages, its possible to get an idea of the cost difference between health insurance in the USA and other nations.

| Typical US health insurance costs in 2020 | The average William Russell international health insurance premium in 2020* |

|---|---|

| Individual cover | |

| $8,419.90 |

*Based on William Russell premiums in Thailand and Vietnam

We have a full guide on how much expat health insurance can cost in different countries, together with a list of most expensive and cheapest countries for health insurance.

Recommended Reading: How Much Is Health Insurance For Seniors

Additional Family Health Insurance Costs

In addition to your premium and deductible, you can expect other costs with family health insurance, including the following:

- Copayment: A copayment is a fixed amount thatyou pay for a covered service. A copayment may come into effect before or afteryou have reached your deductible.

- Coinsurance: Coinsurance is a percentage you payfor covered service after reaching your deductible. You can expect to paycoinsurance until you have reached your out-of-pocket maximum.

- Out-of-Pocket Maximums: Out-of-pocket maximumsare limits on how much money you are required to pay for coverage. Once youhave reached your out-of-pocket limit, your insurance will pay for 100% of thecost of your covered benefits for the rest of the coverage year.

Average Cost Of Private Health Insurance For A Family Of 5

The below quotes show the average cost of health insurance for a family of five in the UK as of 22nd June 2021. Please note, these prices are based on several assumptions and are only meant to give you an idea as to what private medical insurance can cost.

- 30 year old adults, children under 15 – £87.84 per month

- 40 year old adults, children under 15 – £95.05 per month

- 50 year old adults, children under 15 – £127.58 per month

â*While every care has been taken to make these averages representative, the prices provided are purely examples the cost of your policy will be different. To find out what a policy would cost for your family, please request a comparison quote, and we will review the market on your behalf.

Read Also: Does Progressive Do Health Insurance

Average Health Insurance Cost Per Month

Medical coverage expenses have risen significantly over the previous decade. In the previous years, safety net providers would value your medical coverage dependent on quite a few components, yet after the Affordable Care Act, the quantity of factors that sway your medical coverage costs have been decreased significantly.

The normal month to month cost of medical coverage for an individual is around $456 every month and family inclusion arrived at the midpoint of $1,152.

Individual Health Insurance Premiums On The Exchanges

The federal exchange at healthcare.gov is alive and well in 2021, despite years of efforts to kill it by its political foes. It offers plans from about 175 companies. Many states operate their own exchanges, which basically mirror the federal site but focus on plans available to their residents. You can use either.

Each of the available plans is offered in four levels of coverage, each with its own price. In order of price, they are labeled platinum, gold, silver, and bronze. The benchmark plan is the second-lowest-cost silver plan available through the health insurance exchange in a given area, and it can vary even within the state where you live. It’s called the benchmark plan because it’s the plan the government usesalong with your incometo determine your premium subsidy, if any.

The good news is, prices are going down a bit. According to a government report, “the average premium for the second-lowest-cost silver plan is decreasing by 4% on HealthCare.gov from 2019 to 2020 for a 27-year-old. Six states experienced double-digit percentage declines in average second-lowest-cost silver plan premiums for 27-year-olds, including Delaware , Nebraska , North Dakota , Montana , Oklahoma , and Utah .”

Recommended Reading: Are Abortions Covered By Health Insurance

Will My Family’s Health Insurance Increase In Cost Each Year

In most cases, barring any provider promotions, you can expect your policy to increase in cost as you age and to factor in increases in the cost of accessing private healthcare. With this in mind, it’s always sensible to have your health insurance broker review your policy each year to make sure you’re still getting the best deal. With many of the best providers having highly rated products, you can often switch without losing significant benefits.

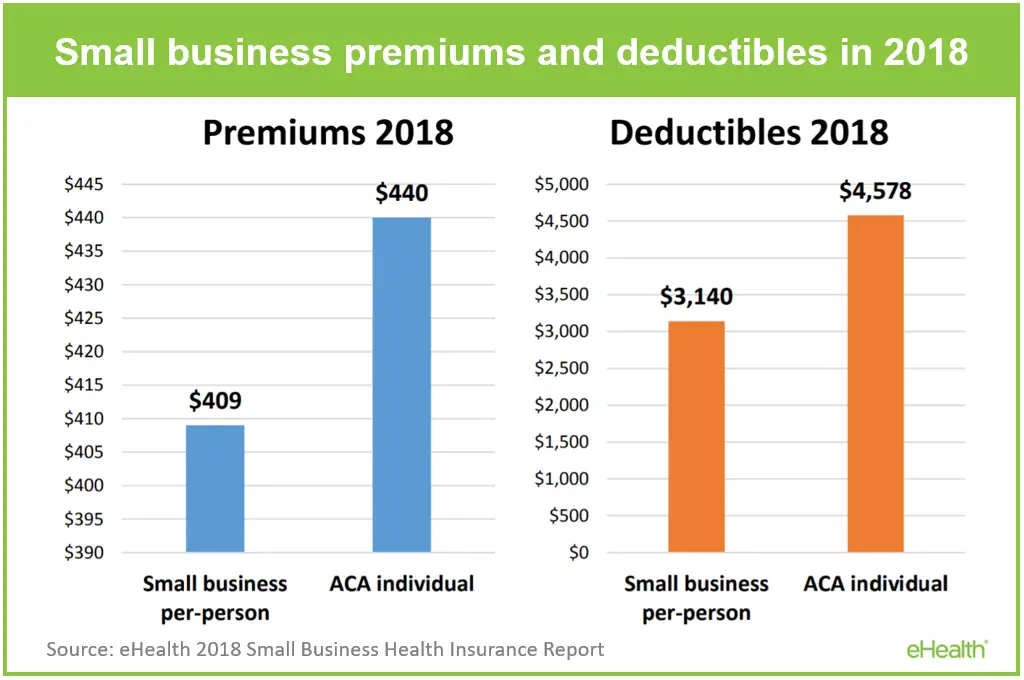

Individual Health Insurance And Health Reimbursement Arrangements

Group and individual health insurance plans are popular choices but theres another option that can benefit employees and employers called a health reimbursement arrangement that is growing in popularity and works in conjunction with individual health insurance.

HRAs allow employers to reimburse employees, tax-free, for healthcare, including individual health insurance premiums and qualifying out-of-pocket medical expenses.

With an HRA, employers set their own budgets by offering an allowance amount for each employee. Employees win big on flexibility by being able to choose their own individual health insurance plan thats tailored to their specific needs.

Lets take a look at two of the most popular HRAs which are the qualified small employer HRA and the individual coverage HRA .

Read Also: What To Do When You Lose Health Insurance

Factors Affecting The Health Insurance Costs

What amount does medical coverage cost? Over the United States, Americans pay extremely high expenses month to month or yearly for medical coverage. While these charges are not controlled by sexual orientation or prior medical issue, on account of the Affordable Care Act, various different components sway what you pay. Numerous components that influence the amount you pay for medical coverage are not inside your control. In any case, its acceptable to have a comprehension of what they are. Given below are these factors to assist you with figuring out the amount you may pay for medical coverage in 2020 and why. Here are some key factors that influence how much medical coverage charges cost:

How Much Does A Family Health Insurance Plan Cost

BY Anna Porretta Updated on May 04, 2021

Protecting your familys health is important, but so isprotecting your wallet from unexpected healthcare costs. Family healthinsurance keeps both your family and your finances healthy.

If a member of your family has a medical emergency and they are uncovered, you could end up paying the hospital bills and various related costs all out of pocket, which could have the potential to break anyones bank.

Recommended Reading: How Much Does Health Insurance Cost In Ct

Beyond Your Monthly Premium: Deductible And Out

- Deductible: How much you have to spend for covered health services before your insurance company pays anything

- Copayments and coinsurance: Payments you make each time you get a medical service after reaching your deductible

- Out-of-pocket maximum: The most you have to spend for covered services in a year. After you reach this amount, the insurance company pays 100% for covered services.

Choosing Health Insurance For Large Families

Choosing health insurance for large families can be more complex and more expensive. The specific price you pay depends heavily on how many people are in your family and what your specific health needs are. Generally, if everyone in your family is in good health, your premiums and deductibles will be lower. This makes it wise to invest in a family health insurance plan that covers preventative care, as that will help you stay healthy and achieve lower prices over the long haul.

If you are considering health insurance for large families, youre likely to pay more in total, but less per person. You are also likely to pay less if you get your family health insurance plan from your employer, since employer-sponsored health insurance often covers larger numbers of people and faces less risk per person.

Read Also: What Is Private Health Insurance

What Affects The Cost Of Family Health Insurance

Private medical insurance is one of the more complicated types of cover you can take out in the UK. Most plans are incredibly configurable, and we as individuals are very different from each other. Add into the mix more people, i.e. a family of 3, 4 or 5 then you’ve got an enormous number of variables that will affect the cost of your policy.

All of the following will affect the cost of your family’s private health insurance:

- The number of people on the policy

- The age of the family members

- The family’s location in the UK

- The medical history of the family

- Whether the parents are smokers

- The current cost of private medical treatments

- The hospital list selected

- The excess on the policy

- How the policy is underwritten

- The level of cover chosen

- Any optional extras