Simple Saver Epo Catastrophic Plan

AmeriHealth New Jersey offers the Simple Saver EPO Catastrophic plan to individuals and families who qualify. Like all AmeriHealth New Jersey health plans, Simple Saver EPO covers the 10 Essential Health Benefits.

| Type |

|---|

What are the pros and cons of catastrophic health insurance?

- Pro: Catastrophic plans have lower monthly premiums than plans in the metallic categories.

- Con: Catastrophic plans have much higher deductibles and out-of-pocket costs than plans in the metallic categories. This could mean high costs if you get sick or hurt.

- Con: The Simple Saver EPO catastrophic plan does not have out-of-network coverage, except for emergency care services.

What do catastrophic health insurance plans cost?

Catastrophic plan monthly premiums are based on age and household size. Refer to the Monthly Premium Rate Card to view and compare monthly premiums.

What are my other health plan options?

AmeriHealth New Jersey offers a variety of EPO health plans for individuals and families. No matter which of our EPO plans you choose:

- You are not required to select a primary care physician.

- You do not need a referral to see a specialist.

- Some plans have an option to open a tax-advantaged health savings account .

Dont Miss: What Is The Deadline For Health Insurance Open Enrollment

What Health Plans Cover

Coverages vary by plan. Coverage requirements are different for plans you get at work and those you buy directly from an insurance company. Even among plans you get at work, the requirements are different depending on whether you work for a small employer or a large one. If you ask, your plan must give you a Summary of Benefits and Coverages.

Federal law requires individual and small-employer plans to cover 10 types of health care services, called essential health benefits. In addition, Texas requires some plans to include certain health benefits. Some plans might cover more services, like adult dental and vision care and weight management programs.

Learn more: How to get help with a mental health issue | Watch: How to get help with a mental health issue

If You Leave Your Job

You can usually continue your coverage temporarily under COBRA .

Learn more: Need health insurance? How to find a new health plan now.

What is COBRA?

COBRA is a federal law that lets employees continue their health coverage for a period of time after they leave their job. It applies to coverage from employers with 20 or more employees. It doesnt apply to plans offered by the federal government or some church-related groups.

You can get COBRA coverage if:

- You leave your job for any reason other than gross misconduct. Gross misconduct usually means doing something harmful to others, reckless, or illegal.

- You lose your coverage at work because you switch from working full-time to part-time.

If your family was on your health plan, you can continue their coverage under COBRA. Your spouse and children also can continue their coverage if you go on Medicare, you and your spouse divorce, or you die. They must have been on your plan for one year or be younger than 1 year old. Their coverage will end if they get other coverage, dont pay the premiums, or your employer stops offering health insurance.

You have 60 days after you leave your job to decide whether you want COBRA. You must tell your employer in writing that you want it. If you continue your coverage under COBRA, you must pay the premiums yourself. Your employer doesnt have to pay any of your premiums.

For more information about COBRA, call the Employee Benefits Security Administration at 866-444-EBSA .

Read Also: What Does Hmo Mean In Health Insurance

Is It Possible To Get Free Private Health Insurance

There is no such thing as free insurance in the private sector. Its vital to remember that free healthcare isnt necessarily free. Citizens indirectly fund the healthcare provided by government agencies. All government activities, including healthcare, are supported by their taxes. However, affordable private health insurance is available.

Is everyone eligible for private health insurance?

If you have a pre-existing condition, you may lose your eligibility for some private health insurance plans. Although, there are private health insurance companies that will accept everyone, so there will most likely be a private health insurance option for you.

Where can you buy private health insurance?

Private health insurance can be purchased through the health insurance marketplace, or outside the marketplace. Unless you are enrolled in a public health insurance plan like Medicaid or Medicare, you can safely assume you are enrolling in private health insurance.

Is private health insurance always more expensive?

No, private health insurance isnt always more expensive. In fact, if you dont qualify for government subsidies, buying private health insurance outside the marketplace can save you money.

Register And Log On To Your Insurance Account Online

Your health insurance plans website should contain information about your coverage and costs you can expect. Since insurers offer a variety of plans, make sure youre logged on and viewing your specific insurance plan.

If youre required to choose a therapist thats in your plans network, a list of providers should be available online. You can also call and ask that a local list be given to you by phone or mail.

Read Also: Are Chiropractors Covered By Health Insurance

How To Find An Affordable Plan That Meets Your Needs

Among eHealth customers who bought ACA individual health insurance, more than 75% chose Bronze or Silver plans. Your state may host an exchange for comparing and purchasing ACA plans or it may use the federal exchange at Healthcare.gov. Keep in mind, you arent limited to the exchange.

The licensed insurance brokers at eHealth can help you find the best health plan to meet your health coverage needs and your budget. They will listen to your priorities in health coverage and use their expertise to match your needs with health insurance options both on and off the exchange.

Cobra: Expensive But Good For A Coverage Gap

Beneficiaries who are aging off of their parent’s insurance can stay on the same plan through the Consolidated Omnibus Budget Reconciliation Act .

Insurance through COBRA is usually very expensive because the parent’s employer is no longer paying for the young adult’s coverage. That’s why COBRA should only be used as a temporary measure, bridging short coverage gaps until beneficiaries transition on to more permanent health care plans.

For example, if you’ve already met the plan’s yearly deductible, you may want to use COBRA to stay on the same plan until the end of the policy year.

Recommended Reading: How To Buy Health Insurance Online

The Cost Of Cancer Treatment

Cancer treatment can be expensive, and it is important to understand what your health insurance will cover before you begin treatment. Many health insurance plans will cover some of the costs of cancer treatment, but there may be some out-of-pocket expenses that you will be responsible for.Some of the costs that may be covered by your health insurance plan include: doctor visits, hospital stays, surgery, radiation therapy, and chemotherapy. Other costs that are often not covered by health insurance plans include: experimental treatments, prescription drugs, and home care services.It is important to talk to your doctor about the expected cost of your treatment so that you can plan accordingly. Many hospitals offer financial assistance programs to help patients with the cost of their care.

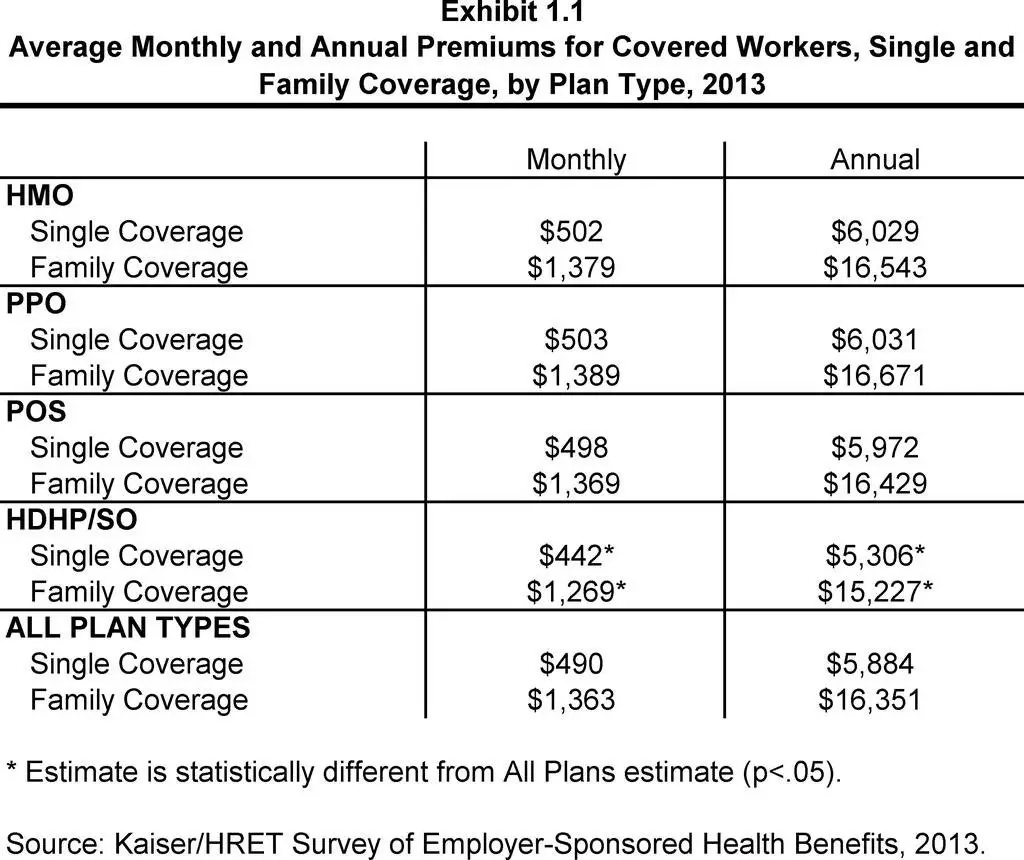

How Much Does Group Health Insurance Cost

About 156 million people are covered by employer-based health insurance, making it the most popular health insurance option today. Providing group health insurance can help businesses gain a competitive edge during hiring, retain their best employees, and enhance overall workplace satisfaction and productivity.

To offer a look into trends and cost of health insurance over the years, the Kaiser Family Foundation2 conducts an annual survey that provides some insight on employer-sponsored health insurance.

In 2022, the average dollar amount that employees contributed toward the cost of employer-sponsored health insurance premiums each month reached:

- $659 for self-only coverage

- $1,871 for family coverage

Since 2021, average employer-sponsored individual and family premiums have been roughly the same. However, the average premium for family coverage has increased 20% over the last five years and 43% over the previous ten years.

In 2022, employers contributed roughly $6,500 a year towards individual premiums and about $16,300 a year towards family premiums, while employees contributed roughly $1,327 and $6,100 a year, respectively.

Increases in group premiums impact not only employers, but employees as well. In addition to factoring in how much premiums will cost, employees should also consider their annual deductible amount when estimating the cost of health insurance.

Recommended Reading: How Do You Get Free Health Insurance

Shopping For A Health Plan

- Know what youll have to pay. Plans with higher deductibles, copayments, and coinsurance have lower premiums. But you’ll have to pay more out of pocket when you get care.

- Consider things other than cost. To learn a companys financial rating and complaints history, call our Help Line or visit our website.

- Get help. If you buy health insurance from the federal marketplace, you can get free help choosing a plan. Call the marketplace for more information.

- Buy only from licensed companies and agents. If you buy from an unlicensed insurance company, your claim could go unpaid if the company goes broke. Call our Help Line or visit our website to check whether a company or agent has a license.

- Get several quotes and compare coverages. Know what each plan covers. If you have doctors you want to keep, make sure theyre in the plans network. If theyre not, you might have to change doctors. Also make sure your medications are on the plans list of approved drugs. A plan wont pay for drugs that arent on its list.

- Fill out your application accurately and completely. If you lie or leave something out on purpose, an insurance company may cancel your coverage or refuse to pay your claims.

Use our Health plan shopping guide to shop smart for health coverage.

Surprise Balance Billing Protections

You likely know that you should select a surgeon and facility that are part of your insurance plan’s provider network. And it’s also a good idea to check to be sure that everyone participating in your surgery is part of your insurance plan’s provider network.

But this is less of a worry than it used to be, thanks to the No Surprises Act, which took effect in 2022. The No Surprises Act protects against surprise balance billing if a patient is treated at a hospital, hospital outpatient clinic, or ambulatory surgery center, which covers most places where surgeries are performed.

But some out-of-network providers are allowed to ask patients to waive their rights under the No Surprises Act. They cannot coerce consent, but they can refuse to provide services if the patient doesn’t agree to receive a balance bill.

So if you’re scheduling a surgery, it’s a good idea to find out how the various medical providers are handling the No Surprises Act. In addition to the surgeon and the facility itself, assistant surgeons, radiologists, anesthesiologists, and durable medical equipment suppliers are a few examples of providers who might be part of the care you receive.

Read Also: How To Get Health Insurance In Arizona

Average Obamacare Costs Per Month By Plan Type

| Health insurance plan member |

|---|

| $129,880 |

The ACA marketplace makes it easy to figure out if you qualify. You enter your household income information into the ACA marketplace website, which uses that information to provide estimates on how much youll pay for health insurance by plan available in your area.

The website will also let you know if you qualify for your states Medicaid program. Medicaid is a federal/state health insurance program for lower-income people. The comprehensive insurance plan costs little to nothing for those who qualify, depending on household income and family size.

If you dont qualify for advanced premium tax credits or a Medicaid plan, here are four ways to save on a plan through the Obamacare marketplace.

Whats A Catastrophic Plan

Catastrophic plans have low monthly payments but a high deductible. A deductible is the amount you pay for health care services before your insurance starts to pay. Once you meet your deductible, our Blue Cross® Value plans pay 100 percent for most services. Medical treatment for a serious illness or accident can cost thousands of dollars. So you can see how these plans protect you from catastrophic expensesand how theyre better than no insurance.

Heres a few other things you should know about catastrophic plans:

- They cover the same essential health benefits as other plans, including preventive care.

- You cant apply a subsidy to catastrophic plans.

- They dont pair with a health savings account.

Recommended Reading: How Much Does Student Health Insurance Cost

Ask The Therapist If They Accept Your Insurance

Therapists and other providers often change the insurance plans theyre willing to accept and may have opted out of your plan.

First, you cant be penalized for having a pre-existing condition or prior diagnosis of any type of mental illness. For that reason, you should be entitled to mental health services from day one of your plans start date.

Things that might affect when insurance coverage kicks in:

- After prior authorization. Some services may require pre-authorization before you can obtain coverage for them.

- After meeting a deductible. You may also have to meet an out-of-pocket deductible before your plan starts to cover therapy. Based on the type of plan you have, this amount may be significant.

- After spending a minimum. In some instances, your plan may require that you pay a specified dollar amount on medical services before your coverage for therapy can start.

Some mental health services that may be covered by insurance include:

- psychiatric emergency services

- co-occurring medical and behavioral health conditions, such as coexisting addiction and depression. This is often referred to as a dual diagnosis.

- medical detox services, including medications

Insurers only cover treatments that are considered medically necessary.

Since insurers offer an array of plans, its not possible to give the specifics of each plan they cover. Here are some examples of coverage you may be able to get for therapy from specific insurers:

Who Qualifies For Catastrophic Health Insurance

There are limitations as to who can qualify for catastrophic health insurance and some factors you should consider before making this purchase. Anyone under the age of 30 can qualify for catastrophic health insurance without any financial limitations. If youre over 30, youll need to meet specific income requirements, also called hardship exemption, which can vary by location and provider.

You can also qualify if youre facing one of these common exemptions:

If you live in one of these states, you should instead opt for the lowest level health care plan as alternative coverage.

Recommended Reading: How Much Is Upmc Health Insurance

What Is Individual Health Insurance

While many people get their health insurance through a group plan sponsored by their employer or union, others buy it themselves. If you are buying your own health insurance, you are purchasing an individual plan, even if you include family members on the plan. If this sounds like what you need, let eHealth show you all of your individual and family health insurance options, and use our free quote comparison tool to find an affordable plan that meets your needs.

Asa result of the Affordable Care Act , people can purchase individualhealth insurance through a government exchange or marketplace , or they can buy health insurance from privateinsurers. You may be restricted to purchasing health insurance through agovernment exchange to certain times of the year. Usually you can purchasehealth coverage from a private insurance company anytime.

ACAplans are a good starting place to understanding individual health insuranceoptions. ACA health plans are categorized by metals. You can learn more aboutthe metallic plans: Bronze, Silver, Gold, and Platinum.

How Much Does It Cost To Offer Health Insurance To My Employees

You already know the benefits of offering a group health plan, but if youre here, you are understandably worried about the cost. While health insurance is the most sought-after benefit among workers, it is also the most expensive.

Complete Payroll Solutions designs health benefit plans for employers of all sizes and industries throughout the Northeast, specializing in finding affordable coverage. In this article, well explain the factors that impact the cost of health insurance so you can understand what will drive up your expenses as well as share potential ways to save.

After reading, youll understand what you can expect to pay for coverage so you can decide if offering a group plan will fit your needs and budget.

You May Like: Can I Buy Health Insurance After An Accident

How Much Your Pregnancy Will Really Cost You

We wish we could give you a firm number, but prenatal health care and delivery costs vary radically. How much youll pay will depend on factors like where you live, whether you have any complications and whether you have a vaginal birth or a c-section. But here are some ballpark figures: Prenatal care and delivery costs can range from about $9,000 to over $250,000 . But before you freak out, know that were talking without insurance. With health insurance, the bulk of these expenses could be covered but thats not always true.

I have health insurance. What should I expect to pay for prenatal care and delivery?

Policies that cover maternity costsGood news: If you have insurance provided by your employer and the company employs at least 15 people full-time, your insurance must provide maternity services.

The percentage of prenatal and maternity costs that will be covered depends on your insurance carrier and which plan you have, but typically, employee plans cover between 25 percent and 90 percent of costs. Keep in mind that this is after the deductible has been met and that there may be a separate deductible for each family member, so youll likely be paying a bit more than that out of pocket. In other words, if each family member has a $2,000 deductible, youd have to pay the first $4,000 of expenses for both your and babys medical care, plus whatever else your plan doesnt pay for.

How can I make sure my health insurance provider pays for as much as possible?