Explanation Of Above Claim

Because you pay a co-pay at your doctors office visit, your co-pay is deducted first: $250-$20 = $230. Next, your deductible applies: $230-$200 = $30. Your co-insurance applies next. You are responsible for 20% of $30, or $6. Your insurance company is responsible for 80% of $30, or $24. Therefore your total responsibility is $20 + $200 + $6 or $226.

How Much Does Travel Insurance Cost For 3 Months

Category: Insurance 1. How Much is Travel Insurance? Its More Affordable Than You How Much Does Travel Insurance Cost? Travel insurance typically costs 5 to 10 percent of your total trip cost, though that amount can be influenced by several What does travel insurance cost? While travel insurance costs

How A Marketplace Health Insurance Plan Protects You

When you have coverage, your plan protects you from high medical expenses 3 ways:

-

Reduced costs after you meet your deductible Once your spending for covered services reaches your plans deductible, the plan covers part of your medical expenses. Marketplace plans cover between 60% and 90% of your covered expenses after youve met your deductible.

- Example: If your plan has a $1,000 deductible, you pay the first $1,000 in covered services. After that, your plan pays between 60% and 90% of your covered expenses, depending of what kind of plan you have. You pay between 10% and 40% of the costs as coinsurance or copayments.

Out-of-pocket maximum This is the total amount you’ll have to pay no matter how much covered care you get in a plan year.

No yearly or lifetime limits Health plans in the Marketplace can’t put dollar limits on how much theyll spend each year or over your lifetime to cover essential health benefits.

Don’t Miss: Can Grandparents Get Health Insurance For Grandchildren

Private Health Insurance Plan Options

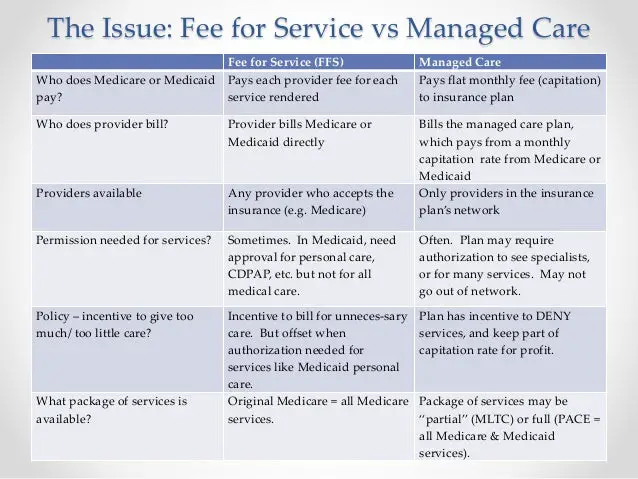

Managed Care Plans

Pros:

- Managed care plans usually offer low up-front costs or low premiums.

- There is little or less paper work needed in a typical health plan.

- Managed care provides medical care at special prices with significant incentives to their policyholders for using services in their network.

- Managed care offers highest level of coverage as compared to fee-for-service plans.

- The yearly deductible is reasonably low and also features lower copayments.

- Preventive care services are often included in this type of health plans.

Cons:

- The major disadvantage of a managed care is that you will have no or less flexibility of choices when it comes to choosing health care providers or doctors.

- You can seek medical care only within the network to get the full insurance benefit.

- If you need to visit a doctor or health care provider outside the network, you may need to get permission from the insurer.

- If you receive medical care outside the network, your medical cost will be higher. In addition, in some cases, your insurer may not pay at all.

- In any medical emergencies if hospitalization is required outside the network, you may need to get approval from the insurance authority. Otherwise, your medical bills may not be covered at all.

- In most cases, the special price and incentives are only limited in the given network.

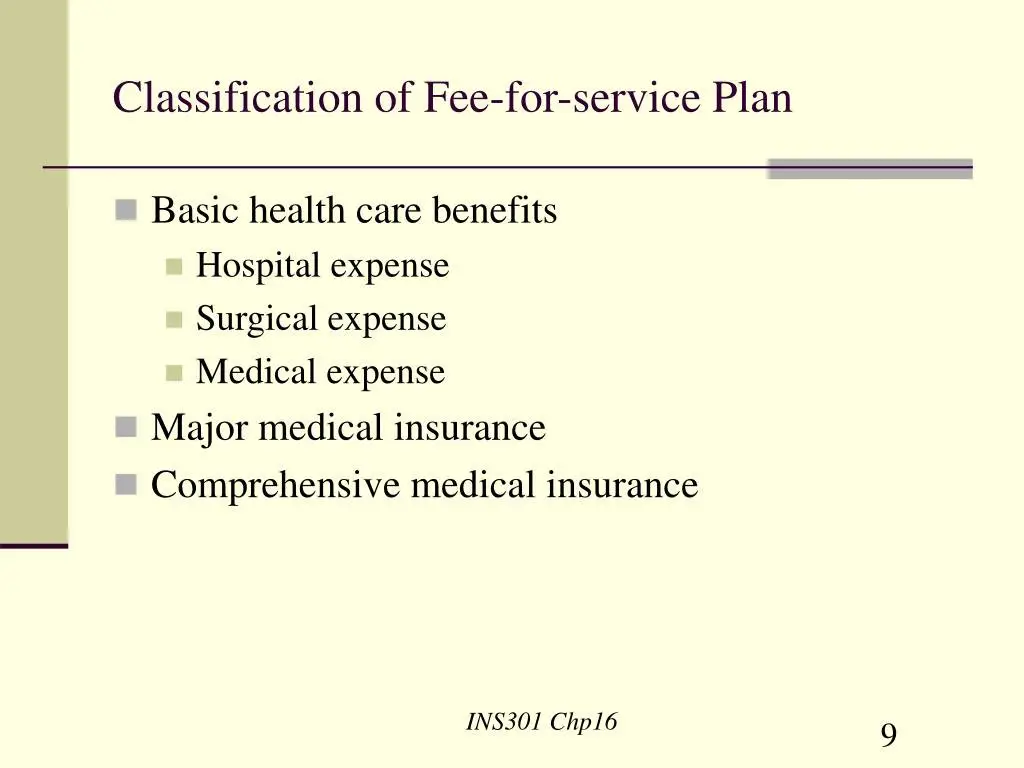

Fee-for-Service Plans

Pros:Cons:

- Get link

Cost Of Antibiotics Without Insurance

1. Cost of Antibiotics Without Insurance K Health While generic azithromycin costs about $32 for those who are uninsured, the brand name Zithromax costs about $73. If youre one of the How much do antibiotics cost without insurance? Azithromycin, $7.49 Amoxicillin, $5.03 Amoxicillin/Clavulanate, $11.90 Cephalexin,

Also Check: How To Purchase Health Insurance In Ny

Who Is The Target Audience

The target audience for indemnity plans is anyone who prefers flexibility over comprehensive coverage. If you are relatively healthy and dont have a medical history or any pre-existing conditions, a fee-for-service plan may actually be the best fit for you. Here is a list of people who would want to consider an indemnity plan.

- Anyone looking for flexibility when choosing a medical provider.

- Anyone who does not want to go through the referral process of managed care plans.

- Anyone who is healthy and qualifies for a tax penalty exemption.

- Anyone looking for supplemental coverage for specific medical services.

- Anyone who has a Health Savings Account to supplement high out-of-pocket costs.

How Much Will It Cost

Understanding what insurance coverage costs is actually quite complicated. In our overview, we talked about paying a premium to enroll in a plan. This is an up front cost that is transparent to you .

Unfortunately, for most plans, this is not the only cost associated with the care you receive. There is also typically cost when you access care. Such cost is captured as deductibles, coinsurance, and/or copays and represents the share you pay out of your own pocket when you receive care. As a general rule of thumb, the more you pay in premium up front, the less you will pay when you access care. The less you pay in premium, the more you will pay when you access care.

The question for our students is, pay now or pay later? Either way, you will pay the cost for care you receive. We have taken the approach that it is better to pay a larger share in the upfront premium to minimize, as much as possible, costs that are incurred at the time of service. The reason for our thinking is that we dont want any barrier to care, such as a high copay at the time of service, to discourage students from getting care. We want students to access medical care whenever its needed.

You May Like: How To Get Affordable Health Insurance

Patient Protection And Affordable Care Act

Basically, under the Patient Protection and Affordable Care Act for years 2018 and earlier, most individuals who are not covered by employer-sponsored health insurance, Medicare, Medicaid, or another government program are required to have minimum essential coverage or pay an annual penalty. Starting in 2019, if you don’t have coverage the annual penalty no longer applies. You will not need an exemption in order to avoid the penalty. If youre 30 or older and want to enroll in a catastrophic plan, you must claim a hardship exemption to qualify. A catastrophic health plan offers lower-priced coverage that mainly protects you from high medical costs if you get seriously hurt or injured.

Individuals and families who are not covered by employer-sponsored health plans and who can’t afford private health insurance may shop for coverage through health insurance marketplaces created under ACA. A health insurance marketplace is essentially a one-stop health insurance outlet. Marketplaces are not issuers of health insurance. Rather, they contract with insurance companies that make their insurance coverage available for examination and purchase through the marketplace. In essence, marketplaces are designed to bring buyers and sellers of health insurance together, with the goal of increasing access to affordable coverage.

BIGELOW INVESTMENT ADVISORS, LLC

Get Coverage For New Drugs

Many new drugs or services introduced in the market undergo trials to test additional benefits or uses. Consumers can try to get into one of the trials and get the service or product as part of the trial. However, although each trial is designed differently, many have a group of participants who receive a placebo , so you are not guaranteed the drug or service. Your physician should be able to inform you of any trials available as the Food and Drug Administration requires the listing of drug trials.

Recommended Reading: How Important Is Health Insurance

Find Out Which Services Most Plans Decline

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Navigating health insurance coverage is a monumental task. Consumers generally have no say in which services are rendered, which services are covered, and how much they will ultimately be responsible for paying. It is not uncommon that a doctor requests a service, the patient follows the doctor’s orders, insurance pays only a portion or none at all, and the patient is left holding the bagand the bill.

The No Surprises Act, part of the Consolidated Appropriations Act of 2021, forbids patients from receiving surprise medical bills when seeking emergency services or certain services from out-of-network providers at in-network facilities.

Health Insurance Terms & Definitions

The following are brief definitions of the terms and acronyms commonly used in regard to health insurance plans and health maintenance organizations.

Obtaining approval from the primary care physician as well as health plan prior to receiving health care services, such as visiting specialists, obtaining radiology scans and undergoing surgical procedures.

Claim

A claim is a request for payment for services and benefits you received.

Coinsurance

The share of health care services paid by an enrollee. Coinsurance is generally found in conjunction with a deductible. Once the deductible is met, the enrollee is typically responsible for a specified percentage of the medical bill.

Co-payment

The fixed fee paid by the enrollee at the time of service such as office and emergency room visits. Co-payments are generally charged by health maintenance organizations , point-of-service plans and some preferred provider organization plans.

Covered Benefit

A health service or item that is included in your health plan and that is paid for either partially or fully.

Deductible

The annual amount paid by the enrollee for services. The deductible must be met before the insurer pays for services.

Covered Charges

Services or benefits that a health plan makes either partial or full payment.

Enroll

To join a health plan.

Exclusive Provider Organization

Gatekeeper

The primary care physician in a managed care plan through which all other care , with the exception of emergencies, must be coordinated.

Read Also: Can You Buy One Month Of Health Insurance

List Of The Cons Of Fee For Service

1. Fee for service can result in the denial of care for some people. If you do not carry a healthcare insurance, are unable to qualify for Medicaid or Medicare, and do not have the funds to pay for the services that a provider offers, then this structure can sometimes permit the refusal of medical services. That is why you will see people going to hospital emergency rooms with simple problems. Care cannot be denied if you visit an ER complaining of a problem, even if that means the hospital provides services for free.

Private providers who treat a specific disease are typically the only ones who deny services outright without a significant financial deposit or evidence of financial health. Hospitals, clinics, and everyday providers will usually operate on a sliding scale cost schedule so that patients can pay an amount they can afford.

2. Indemnity insurance is more expensive than any other coverage plan. If you have healthcare insurance that covers the fee for service process, then you are paying for one of the most expensive plans that is available right now in the United States. Your budget gets hit in two ways with this type of coverage: you pay more in terms of premium cost and in what you must pay for your out-of-pocket expenses. Not only is there a deductible to consider with this insurance option, there is also co-insurance of up to 30%, and the you might need to pay for what your doctor bills that goes beyond what is considered a UCR charge.

What Does The Plan Cover

One of the things health care reform has done in the U.S. is to introduce more standardization to insurance plan benefits. Before such standardization, the benefits offered varied drastically from plan to plan. For example, some plans covered prescriptions, others did not. Now, plans in the U.S. are required to offer a number of “essential health benefits” which include

Emergency servicesPreventive services and management of chronic diseasesRehabilitation services

For our international population of students who might be considering coverage through a non U.S. based plan, asking the question, “what does the plan cover” is extremely important.

Also Check: How Much Is Health Insurance For A Single Person

Get Coverage For New Technology

For cases in which a new technology provides additional benefits as opposed to the older technology, consumers can try several methods for getting the insurance company to pay. Many insurance companies require doctors to “prove” why the costlier procedure or product is more beneficial. Additionally, an insurance company may pay a specific amount for a procedure, and the patient can pay the difference to get the new technologyin other words, partial coverage is available. The first step in this process is to discuss the coverage with the insurance company, determine what will be covered, and have an agreement with the physician for the total cost and what you will be required to pay.

Medical device companies can also lobby for inclusion. Within the Medicare system, they may apply for a new technology add-on payment. If accepted, Medicare will cover a portion of the device cost or the incremental costs associated with it.

True North Truck Insurance

1. Independent Contractor Insurance TrueNorth Companies Personal Property Insurance is designed to cover the special items you keep in your truck. The coverage provides replacement due to theft, accident or other Call Today 877-968-8785! Save time and money with TrueNorth and TSA! TrueNorth and the Truckers Service

Recommended Reading: Is Medicare Part A Considered Health Insurance

The Cons Of A Fee For Services Health Plan

Just a few years ago, more people were enrolled in an FFS plan than any other type. Now, its just the fifth most-popular type of health insurance policy. The main reason for this is because health insurance began shifting its focus to value-based care. Under FFS plans, if you get sick or injured, you pay the doctor to treat you. That approach leaves out preventable diseases or injuries. FFS plans dont offer the same kind of personal, managed care that other plans provide. While you can still receive preventive services and other essential health benefits with an FFS plan, keeping up with them is up to you.

FFS also became known for its charges. Critics say that an FFS approach causes doctors to force their patients into unnecessary services and treatments to line their pockets.

Lastly, FFS plans are among the most expensive. Youll generally have high deductibles and out-of-pocket costs to pay, along with a monthly premium.

- Costly: FFS plans have high out-of-pocket costs

- Less managed care: No primary care physician to remind or monitor you

- Upfront costs: pay your doctor directly, file a claim, then get reimbursed

Are you eligible for cost-saving Medicare subsidies?

Is There A Way To Anticipate How Much A Treatment Or Service Will Cost

Although the Transparency in Coverage Proposed Rule intended to make prices available to all, hospital systems and providers have been slow to adopt it. The only true way to know what price you’ll pay is by speaking to a representative of your insurance company. Some companies require pre-authorization or approval for services to be covered as well. Check the language of your plan and get your approval in writing.

Also Check: When Do You Lose Health Insurance At 26

The Pros Of A Fee For Services Health Plan

FFS customers dont have provider networksA provider network is a group of doctors, hospitals and other specialists who agree with an insurance company to treat its clients. It’s usually less expensive for you to see a doctor within your provider network. and typically enjoy the freedom to see any doctor they want. This can be a massive advantage if you spend a lot of time traveling. You also wont need to see a primary care physicianA Primary Care Physician is a doctor that oversees and monitors your medical care under some plan types. PCPs also may be responsible for referrals to specialists. or need referrals to see specialists. Plus, many providers will even negotiate pricing with customers who have FFS plans to help them control out-of-pocket costs.

- No provider networks: see any doctor you want, anywhere

- No referrals or pre-approvals: just make an appointment and go

- May negotiate rates: Some doctors will lower their prices for FFS customers

How Us Health Insurance Works

Health care in the United States can be very expensive. A single doctors office visit may cost several hundred dollars and an average three-day hospital stay can run tens of thousands of dollars depending on the type of care provided. Most of us could not afford to pay such large sums if we get sick, especially since we dont know when we might become ill or injured or how much care we might need. Health insurance offers a way to reduce such costs to more reasonable amounts.

The way it typically works is that the consumer pays an up front premium to a health insurance company and that payment allows you to share “risk” with lots of other people who are making similar payments. Since most people are healthy most of the time, the premium dollars paid to the insurance company can be used to cover the expenses of the small number of enrollees who get sick or are injured. Insurance companies, as you can imagine, have studied risk extensively, and their goal is to collect enough premium to cover medical costs of the enrollees. There are many, many different types of health insurance plans in the U.S. and many different rules and arrangements regarding care.

Following are three important questions you should ask when making a decision about the health insurance that will work best for you.

Recommended Reading: Why Do You Need Health Insurance