Should Employee Health Benefits Be Paid By The Employer

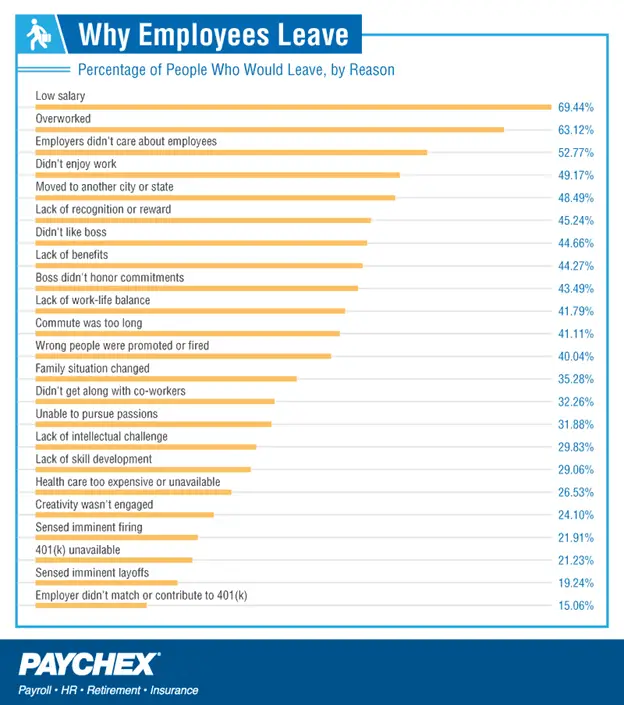

In summary, it is not necessary under federal laws to give equal benefits to all employees, but an employer should base benefit eligibility on tenure, full- or part-time status, exempt/nonexempt status, job group or even department. An employer must exercise due diligence to ensure its benefits are not discriminatory.

Adp Vs Paychex Comparison: The Bottom Line

Across all four plans, ADP Run easily integrates with other software. Beyond its full-service payroll processing, ADPs most prominent features are its extensive reporting and analytics, HR support, and time tracking. Additionally, 24/7 customer service can give small businesses peace of mind, especially if working outside standard 9-5 business hours. Since ADP doesnt disclose pricing, the time demand and uncertainty of negotiating a price plus hidden fees may make this payroll solution a bad fit for smaller businesses.

Paychex is another solid choice for strong payroll features, such as automatic payroll tax filing, direct deposit, and new hire reporting. Paychexs wealth of tools and features can be a big plus for securing a full-service payroll and HR system. While the lack of time-tracking and attendance capabilities, plus limited integrations, could increase costs through extra add-ons, a committed payroll specialist could reduce your payroll processing workload enough to justify the heftier price tag.

If youre still undecided about which payroll software solution would work best for your business, check out the best payroll software options on the market for small businesses. The detailed breakdown of the top payroll software options on the market will help you make an informed decision and narrow down your list of contenders.

How Does An Hsa Work For Employees

For employees covered under an HDHP, their designated contribution is deducted from each paycheck on a pre-tax basis and deposited to the HSA. When they have an eligible medical expense, they can use their HSA to pay for it. Employees who are younger than age 65 will be taxed on the distribution and also incur a 20% penalty if they withdraw money from an HSA plan for non-medical costs.

Also Check: How Much Is Health Insurance For A Family Of 5

Preparing For Aca Year

Part of a solid preparation plan involves gathering the data needed to complete the required IRS forms in time for ACA year-end reporting. An ALE will need a variety of information, including but not limited to:

- Employer Identification Number and business contact information

- Key contact person within the company and that individual’s contact information

- Total number of employees each month

- Total number of full-time employees each month

- Average hours worked by each employee each month

- Whether insurance was offered to each full-time employee

- The type of insurance coverage offered

- Monthly cost to each employee for the lowest-cost, self-only minimum essential coverage providing minimum value that is offered

- Individual employee names and Social Security numbers

- Proof that 95% or more of full-time employees and their dependents were offered minimum essential coverage

Is My Business Subject To Cobra

COBRA laws generally apply to group health, dental, and vision plans offered by private employers with 20 or more employees on 50 percent of its typical business days during the preceding calendar year. When determining if COBRA applies to a business, both full-time and part-time employees count toward this number the federal government calculates “full-time equivalent” employees, meaning the hours of two or more part-time workers will be combined to make a single full-time worker that counts toward the 20-employee threshold. Plans offered by state and local governments are also subject to COBRA however, plans offered by the federal government and churches of the Internal Revenue Code) typically are not.

Also Check: How To Apply For Medicaid Health Insurance

What Are The Differences Among State

A state-run sponsored IRA is one way to satisfy requirements and help employees save for retirement. However, it’s in businesses best interest to compare it with other financial options and decide which option best fits their needs and those of their employees.

The chart below shows key characteristics of a state-run IRA compared to a SIMPLE IRA and 401 plan, both of which Paychex offers. The biggest differences are the option for a company to match a portion of savers’ contributions, and the maximum amount employees can contribute.

|

The employer processes payroll contributions, updates contribution rates, adds newly eligible employees, etc. |

Paychex is the plan administrator |

Paychex is the plan administrator |

What Kind Of Notification Requirements Must Employers Follow

When offering a new QSEHRA, employers must notify their employees at least 90 days in advance of the start of the year, or the start of a new employee’s eligibility. It must also tell each employee:

- What the amount of the employees annual benefit is

- That the employee must report their QSEHRA benefit to the marketplace where they apply for premium tax credits and

- That they will have to pay taxes on the benefit for any month that they fail to maintain health coverage.

Small businesses have many options when it comes to providing their employees with health insurance or helping them pay for it. Paychex can help educate you, your management staff, and your employees on the health insurance options that best meet your company’s specific needs.

Tags

Recommended Reading: What Happens If My Health Insurance Lapses

Benefits Of Fsas And Hsas

FSA Benefits

FSAs do not restrict the type of healthcare plan a company must offer. Also, unused funds are reverted to employers at the end of the year, or after a grace period. Employers gain tax savings related to employees’ pre-tax contributions as they are not required to pay their share of Social Security tax on these amounts. In terms of employee satisfaction and retention, the small cost of administering an FSA often yields a valuable benefit for employees who choose to participate.

HSA Benefits

Offering an HSA in conjunction with an HDHP will generally yield cost savings for businesses compared to traditional health care plans, because an HDHP is a less expensive option. Like FSAs, HSAs also result in tax savings for employers. Additionally, HSAs offer potential retirement benefits to employees when unused funds are carried over and may be taxably withdrawn for nonmedical expenses when participants reach age 65.

Retirement Plans That Fit Your Business

SurePayrolls Sure401k service offers competitive and affordable 401 benefits to suit every business, including both traditional and safe-harbor 401 plans, as well as Solo plans for owner-only and family businesses. Youll also find several plan design options including the integration of payroll deferrals with the 401 plan.

Talk to a 401 specialist at .

Recommended Reading: Can I Cancel My Health Insurance At Any Time

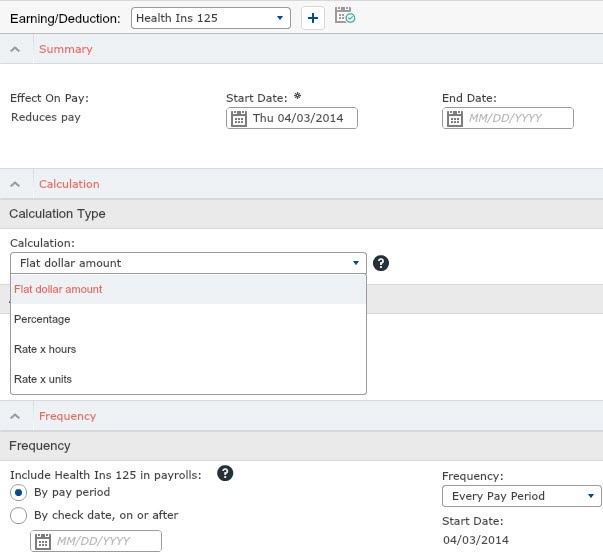

What Is A Section 125 Pop

Internal Revenue Code Section 125 allows employees to avoid paying any payroll income tax on health insurance premium and supplemental insurance such as dental, vision, cancer, term life insurance, accident and disability premium. The employee saves up to 40% and the employer saves the 7.65% matching FICA tax on every dollar diverted through the POP. The IRS requires that the POP be in writing hence the need for a formal plan document and why Paychex can charge $480 a year for the service. The good news is theres a much more affordable way to comply with this IRS formal plan document requirement.

Examples Of How Employee Financial Wellness Programs Can Help Employees

A financial wellness program can help employees with a variety of financial challenges. These can range from saving for a major life event a wedding, first home, education, or retirement to managing everyday expenses such as bills and debt payments. Employees may also struggle to understand the importance of having savings, and they may only fully understand the ramifications of this when they experience an emergency.

A lack of financial knowledge can hold anyone back. Left with few reliable resources like where to find information and get financial questions answered, your employees may continue to struggle. As diverse as your employees are, so too are their levels of financial knowledge. Common topics employees often need help with may include:

Don’t Miss: Can Unmarried Couples Be On The Same Health Insurance

How Do You Communicate To Employees About Fsas

If you want employees to take full advantage of an FSA benefit, you must strive to clearly communicate how they can best use the plan. A well-drawn FSA employee benefits communication strategy can enhance your employees’ understanding of how to enroll in the plan and receive the maximum benefits. While information on FSA accounts should be included in open enrollment, it must also be provided to new hires when they become eligible for employee benefits. FAQs and other health plan information may also be provided online via a company benefits portal. Keep in mind that employees’ communication preferences may vary, so you may want to make this information available in both print and digital formats.

What Is The Health Insurance Marketplace

The Health Insurance Marketplace is a government-run health insurance exchange established by The Affordable Care Act . It is located at HealthCare.gov and is often referred to by other names, such as the Health Insurance Exchange or simply the Marketplace. Using the Marketplace, individuals can shop for health insurance plans and easily compare various elements of the coverage across different plans, including:

- Benefits offerings

- Required monthly premiums

Recommended Reading: How Much Is Health Insurance For Kids

Licensed Agents Can Help You Select A Group Health Plan

Health Maintenance Organization , Preferred Provider Organization , Point-of-Service , or High Deductible Health Plan which is best for your business? Our licensed agents will explain the different group health plans and show you a comparison to help you decide. We also have dedicated insurance specialists wholl coordinate with your carrier and provide support.

Fsa Vs Hsa Comparison Chart: How Do These Accounts Differ

The relative benefits of FSAs vs. HSAs may make one a better choice for an employee based on their individual situation. In the midst of benefit negotiations, employees may request one type of account over the other. Businesses will want to weigh factors such as administrative costs and expected utilization before choosing to implement one or both plans.

Read Also: Do All Employers Have To Offer Health Insurance

Types Of Healthcare Plans

The two most popular plan types are known as a Health Maintenance Organization , and a Preferred Provider Organization , but there are other categories that affect what you pay for health insurance.

- Health Maintenance Organization: An HMO is a group health plan in which physicians and medical personnel can either work directly for the HMO or under contract to provide medical care to its members. A primary care provider must be chosen to provide and coordinate your care. There is often an emphasis on disease prevention and participation in programs for better health.

- Preferred Provider Organization: In a PPO, policyholders can use any medical provider in the PPO network and pay the co-payment amount for each regular service. If you choose to go to an out-of-network provider, you must often pay the doctor’s fees directly and file for reimbursement from the insurance company at a greater cost. For that reason, the PPO system encourages its policyholders to see doctors and health providers within the system.

- Point of Service : POS group insurance acts as a combination of an HMO and a PPO. You must usually use a primary care provider, but you can use other network health providers, when needed, without a referral. You may also use providers outside the network without a referral, but you will pay more.

Why Do I Need Hazard Insurance For A Small Business

While many states do not require business owners to carry hazard insurance, it’s a good idea to have to help cover the costs of damages you would otherwise have to pay out-of-pocket for. You may also need a specific hazard insurance policy if you’re planning to secure business funding from a lender. Loans from the U.S. Small Business Administration , for example, may require proof of business hazard coverage .

Read Also: Is Health Net Good Insurance

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

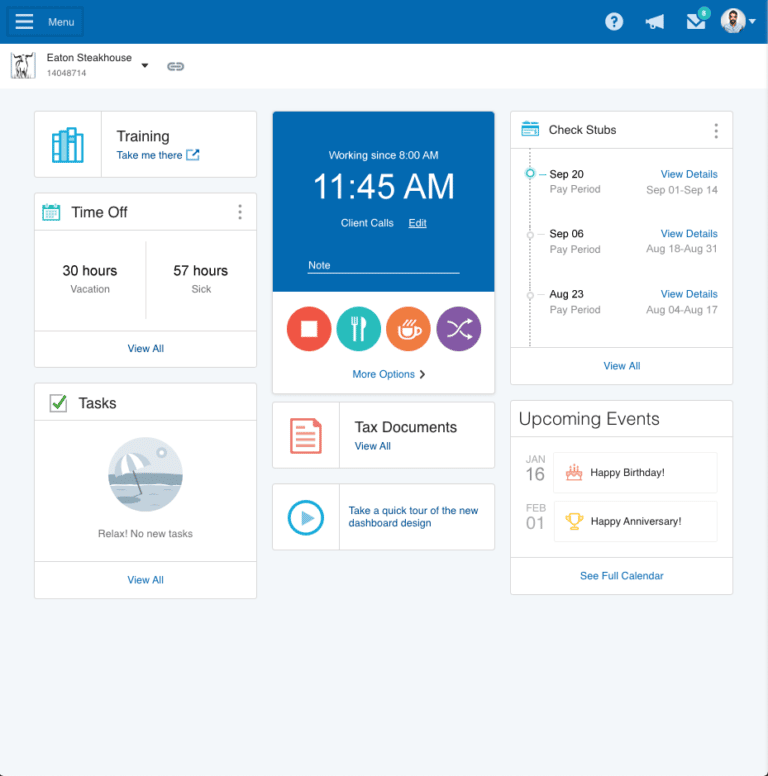

Paychex Pricing And Options

Unlike other payroll solutions out there, Paychex doesnt publicly list its pricing options. To find out how much youd be paying for a team of your size to use all of Paychexs features youll have to get in contact with its sales team to get a free company quote. Once you answer a few questions about your business here, you can get a free quote thats tailored to your business.

Don’t Miss: How Much Do Employers Cover For Health Insurance

Paychex Plans And Pricing

Paychex offers customers three payroll plansPaychex Flex Essentials, Paychex Flex Select and Paychex Flex Pro. Each plan allows companies to choose from a variety of payment methods including paper checks, payroll cards and direct deposits. Payroll can be scheduled on a weekly, biweekly or monthly basis.

Who Is Not Eligible For Cobra Coverage

An employer’s responsibility to offer COBRA coverage is not unlimited. Even if the business meets the 20-employee minimum, certain employees are not eligible for COBRA coverage based on their failure to elect a qualifying plan, their reason for termination, or other extenuating circumstances. This can include:

- Employees who are ineligible for coverage in the group plan

- Employees who declined to participate in the group health coverage

- Employees who are enrolled for benefits under Medicare

- Employees terminated for gross misconduct

Don’t Miss: Which State Has The Cheapest Health Insurance

Is Adp The Best Payroll Company

ADP is one of the best payroll software solutions on the market. The software offers essential payroll features, including tax support, direct deposit, auto-scheduled payroll, garnishments, deductions, PTO, time tracking, and much more. In addition to payroll features, ADP also includes HR, employee management features, and much more to help you run your business.

How To Start An Employee Financial Wellness Program

If you’re limited in the number of employee benefits you can offer job candidates and employees, don’t underestimate the power of providing resources such as financial wellness solutions, which can make a lasting impact in your employees’ lives. For Paychex payroll clients, FinFit is a free program that enables employers to offer benefits such as a personal financial wellness assessment, online educational tools and resources, and even short-term employee loans for unexpected expenses.

Recommended Reading: How Can Undocumented Immigrants Get Health Insurance

Hazard Insurance For Home

If you’re looking to protect a business you operate out of your house, your homeowner’s insurance policy might not provide adequate coverage for business property stored in your home. Hazard insurance may offer added coverage for your home-based business property that would otherwise not be covered by a homeowners policy or be covered at lower limits under a homeowners policy.

Who Is Required To Report Under The Affordable Care Act

Applicable large employers are required to report under the Affordable Care Act. ALEs have an average of 50 or more full-time employees, including full-time equivalent employees , during the prior year. This distinction is a key metric, since only ALEs are subject to the ACAs Employer Shared Responsibility provisions and must fulfill applicable ACA reporting requirements.

Read Also: How Much To Budget For Health Insurance In Retirement

Paychex Flex Payroll Review 202: Benefits Drawbacks Alternatives

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Paychex Flex, a cloud-based payroll platform from one of the most well-known names in payroll software, is a good choice for fast-growing businesses. With four plans and a broad range of add-on services, it stands out as an option that can easily scale with a company.

But its high cost can be a drawback. The basic package, Essentials, is more expensive than basic plans from competitors. The company also doesn’t publish pricing information for the more expensive packages.

Submitting Your Required Aca Forms To The Irs

Once the employer completes the required forms with the proper information, they should prepare them for transmission to the IRS. As with traditional business tax returns, ACA reporting forms can be submitted electronically or via regular mail. However, employers with 250 or more Forms 1095-C are required to submit all forms electronically.

You May Like: Is There Private Health Insurance In The Uk

What Health Expenses Can Qsehras Cover

QSEHRAs can reimburse eligible medical expenses that employees incur, as defined by IRS code 213. This includes the premiums they pay for their health insurance policy bought in the individual market, out-of-pocket medical costs, prescription drugs, and more. However, employers can choose to limit the list of eligible expenses.