What To Know About Health Insurance In Massachusetts

MoneyGeek used private plans to complete this analysis, but its possible to find more affordable health insurance in Massachusetts once you apply for one through the Insurance Exchange. Older buyers should also check whether or not they qualify for Medicare or Medicaid. These are healthcare programs from the government and are likely to be cheaper than any private plan in the Insurance Exchange.

How Much Does Health Insurance Cost In The Usa

How much does health insurance cost? The cost of health insurance in the USA is a major talking point for Americans and visitors alike here, we explore the averages of health insurance costs and factors impacting policy fees. The USAs healthcare system is unlike many others, so we look at why the cost of average American healthcare insurance seems to be rising and how other nations compare.

Key takeaways:

- Age, geography, employer size and plan type all influence the cost.

- Healthcare costs in the USA are partly due to administrative factors.

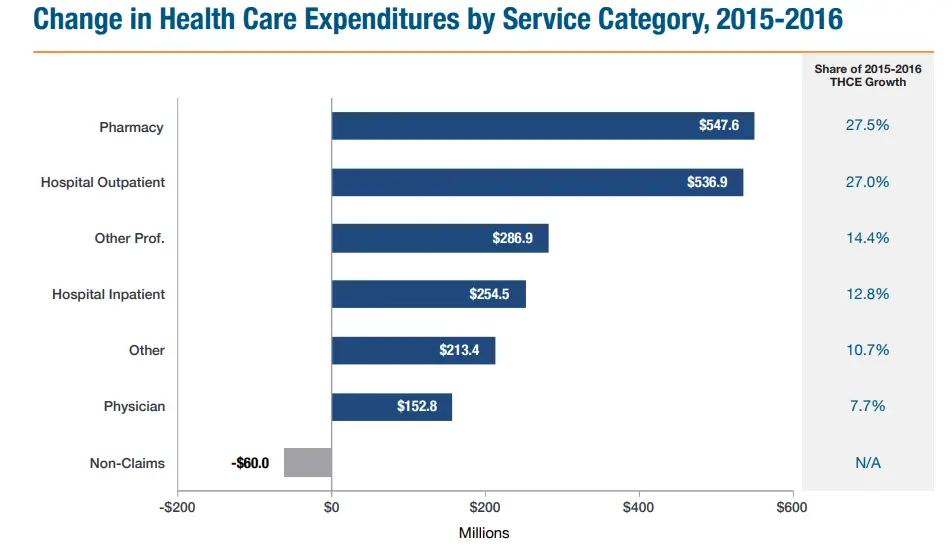

- Fees are going up, with plan trends contributing.

- Almost half of American adults were underinsured in 2020.

- Voluntary health payments are higher in Switzerland than the USA, though Americas costs are among the worlds highest.

- On the flipside, American expats abroad often find they pay less for insurance overseas.

How Much Does Health Insurance Cost

In 2022, the average cost of health insurance is $541 a month for a silver plan. However, costs will vary by location. Insurance is expensive in West Virginia and South Dakota, averaging more than $800 a month. States with cheaper health insurance include Georgia, New Hampshire and Maryland, averaging less than $375 a month.

Don’t Miss: Is Umr Insurance Good

Massachusetts Is Penalizing Employers If Employees Get Masshealth Or Connectorcare Coverage

In an effort to offset the financial impact of employers shifting the cost of health care onto the state, and to help cover the states increasing Medicaid expenses, Massachusetts enacted H.3822 in 2017. The legislation imposes a financial penalty on employers if they have employees who enroll in MassHealth or ConnectorCare . The penalty is called the Employer Medical Assistance Contribution Supplement, or EMAC Supplement, and has been implemented for 2018 and 2019.

The EMAC Supplement is collected as a line item on the employers quarterly unemployment contributions , and is equal to 5 percent of the wages of the employee who enrolled in MassHealth or ConnectorCare, although theres a cap on the penalty of $750 per year, per employee. The EMAC Supplement applies to employers with six or more employees a far lower threshold than the ACAs employer mandate, which only requires employers to offer health coverage if they have 50 or more employees.

To be clear, the new Massachusetts rule does not require small employers to offer coverage. But it charges them an assessment if their employees have income that makes them eligible for MassHealth or ConnectorCare. To avoid the EMAC Supplement charge, the employer can either boost wages or offer affordable coverage.

How Do Us Health Insurance Costs Stack Up Globally

Voluntary healthcare payments including for private health insurance totalled more than $1,685 per capita in the USA in 2019.

This is lower than the figure in Switzerland, where voluntary payments were worth $2,745 per capita. Check out how much medical treatment can cost abroad.

However, the USAs private spending continues to soar far above that in many other nations. American private health spending is five times higher than Canadas, for instance.

Recommended Reading: Health Insurance For Substitute Teachers

What Is The Aca Health Insurance Marketplace

Established by the Affordable Care Act , the Health Insurance Marketplace is a platform that offers medical insurance plans to individuals, families, and small businesses. Fourteen states and the District of Columbia offer their own marketplaces, also known as exchanges, while the federal government manages a marketplace open to residents of other states. Marketplace plans are divided into four categories that range in cost and coverage. Though offered by private companies, all must meet certain criteria established by the state or federal government.

The Cheapest Health Insurance In Massachusetts By County

Another factor that impacts the cost of health insurance in Massachusetts is the area in which you live. In Massachusetts, similar to other states, insurance providers use rating areas to calculate policy premiums. Rates are computed the same way for counties within each rating area.

Massachusetts has fourteen counties divided into seven rating areas. In Middlesex, its most populous county of the 14 counties in the state, the cheapest Silver plan is Standard Silver: BMC HealthNet Plan Silver A II by BMC HealthNet Plan. It costs $354 per month.

If you want to find the most affordable health insurance plan in Massachusetts for all metal tiers in your county, use the table below.

Cheapest Health Insurance Plans in Massachusetts by County

Sort by county:

Also Check: How Long Insurance After Quitting

How Do I Find The Right Health Insurance Company In Massachusetts

In Massachusetts, eight insurance companies offer various plan options on the state health insurance exchange. All plans available through the Massachusetts exchange are either HMOs or exclusive provider organizations . With these two plan types, you must receive health services within a specific provider network, except for emergencies. Therefore, it is important to review the plan’s provider listing to be sure your services will be covered. Some insurance plans provide added benefits such as gym memberships or a personalized telemedicine experience, although these extras may come at a higher premium.You should evaluate all your health care needs and your budget before selecting a health insurance provider. Read more.

Methodology

We gathered health insurance rates for shoppers in Massachusetts using the state’s exchange. Using the premiums, averages were calculated based on a variety of variables such as metal tier, age, family size and county.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Get personalized advice. Narrow down choices based on your unique situation.

Compare rates to maximize your savings. Get free quotes in an instant.

Find a provider you can trust. Our experts do the hard work for you.

What Is The Average Cost Of Health Insurance

Maybe youre wondering, How much does individual health insurance cost? Heres what you can expect. The average individual in America pays $452 per month for marketplace health insurance in 2021.2 The average family pays $1,779 per month.3

But the cost of health insurance varies widely based on a bunch of factors. Some things are in your control, some arent. Things like your age, how many people are on your plan, how much coverage you need, where you live and who your employer is all play a role in the price of your coverage.

Heres a breakdown showing the average costs depending on your state:

Kaiser Family Foundation, 2021.

Also Check: How To Enroll In Starbucks Health Insurance

Qualified Small Employer Hra

With a QSEHRA, employees purchase their own health insurance and get reimbursed for medical expenses, health insurance premiums, and other qualified costs with tax-free dollars from their employer. To qualify, a company must have fewer than 50 full-time employees and cant offer a group health insurance policy to any employee.

Individual and group health insurance premiums and deductibles typically vary on a yearly basis, but the QSEHRA has annual contribution limits that the IRS sets annually. This means that employers are limited in how much tax-free money they can offer their employees through the benefit.

Best Massachusetts Health Insurance Providers

The best Massachusetts health insurance depends heavily on your budget as well as what your healthcare needs are. Do you have a specific doctor or specialist that youd like to see? If so, then its a good idea to conduct a search through the providers below in order to get a quote and see if the healthcare provider you want accepts that brand of health insurance.

Read Also: Starbucks Health Insurance Eligibility

Average Health Insurance Cost By Plan

Less surprising, though, is how the cost will differ based on the plan you use. After all, different plans offer different services, and those with more services and flexibility come at the price of a higher premium.

The four types of plans you may be able to get for your health insurance are a health maintenance organization , point-of-service , preferred provider organization and exclusive provider organization . Per ValuePenguin, the average monthly rate for a 21-year-old on each plan is:

- HMO: $230

Massachusetts Health Insurance Costs And Rate Factors

Massachusetts residents spend an average of $10,559 per year on health care. That’s a few thousand more than the national average. What factors determine your health insurance price tag? Costs vary quite a bit depending on the person, but here’s what insurance companies look at to price your policy:

You May Like: Does Insurance Cover Chiropractic

Do I Have To Use The Massachusetts Health Connector The Health Care Marketplace In Massachusetts

No, you can still buy cheap health insurance from any insurance company. However, the private companies that sell insurance through the Massachusetts Health Connector have met all the rules and regulations required to provide comprehensive coverage to an individual or a family. The Massachusetts Health Connector can also help you find plans that can save you money on out-of-pocket costs.

Does Affordable Care Act Apply To Expats

Unfortunately, not anymore. Today, the US Government does not require anyone to subscribe to an ACA-compliant health insurance policy. However, a handful of states still impose a penalty on people who do not comply with the ACA. These are:

- California

- Massachusetts

- New Jersey

Other states are also currently processing legislation that will make health insurance compulsory, so before you move to the USA, check your new states laws.

Read Also: Can You Buy Dental Insurance Anytime

The Importance Of Subsidies

The good news is that many who purchase marketplace plans will pay lower premiums through what the government calls advanced premium tax credits, otherwise known as subsidies. In 2019, 88% of people who enrolled at HealthCare.gov were eligible for advanced premium tax credits.

What are these subsidies? They are credits the government applies to your health insurance premiums each month to make them affordable. Essentially, the government pays part of your premium directly to your health insurance company, and youre responsible for the rest.

As part of the American Rescue Plan Act passed in March 2021, subsidies have increased for lower-income Americans and extended to those with higher incomes. The ARPA expanded marketplace subsidies above 400% of the poverty level and increased subsidies for those making between 100% and 400% of the poverty level.

You can take your advance premium tax credit in one of three ways: equal amounts each month more in some months and less in others, which is helpful if your income is irregular or as a credit against your income tax liability when you file your annual tax return, which could mean you owe less tax or get a bigger refund. The tax credit is designed to make premiums affordable based on your household size and income.

Change In Average Health Insurance Cost For 2022

From 2021 to 2022, health insurance rates across the nation increased by less than 1%. South Dakota saw the largest year-over-year jump in health insurance costs for a 40-year old on a silver plan increasing just over 23%. Including South Dakota, 27 states had their rates increase on average from 2021 to 2022.

Year-over-year rates decreased the most in Georgia, South Carolina and Nebraska, which all fell by more than 10% . Overall, 21 states experienced a decrease in health insurance premiums. Two states Idaho and Virginia saw no year-over-year change.

| State |

|---|

Policy premiums are for a 40-year-old applicant on a silver plan.

You May Like: Kroger Part Time Health Insurance

American Health Insurance Vs International Cover: Whats The Cost Difference

International health insurance is a product designed to offer cross-border coverage. Many Americans are surprised by how affordable health coverage can be when they spend time overseas so how does this product compare to domestic cover?

At William Russell, our most comprehensive international health plans provide standard coverage in every country except the USA. Weve published a full guide on how we calculate premiums for health insurance. By comparing our typical premiums to U.S. averages, its possible to get an idea of the cost difference between health insurance in the USA and other nations.

| Typical US health insurance costs in 2020 | The average William Russell international health insurance premium in 2020* |

|---|---|

| Individual cover | |

| $8,419.90 |

*Based on William Russell premiums in Thailand and Vietnam

We have a full guide on how much expat health insurance can cost in different countries, together with a list of most expensive and cheapest countries for health insurance.

Blue Cross And Blue Shield Of Massachusetts

Offering HMO and PPO plans, Blue Cross and Blue Shield of Massachusetts is well known as a full-service health insurance provider offering a wide range of plans to fit a variety of needs and budgets.

A comprehensive online search network of doctors and hospitals makes it easy to see if your preferred healthcare practitioner accepts BCBS health insurance before you sign up.

Getting a quote is also easy and straightforward, and you have a variety of options to further customize your health insurance needs both for yourself and your family.

- Plans offered through regional companies, meaning you must look to your regional company for specific policies

- Main customer service helpline may be difficult to reach

Recommended Reading: Health Insurance Starbucks

Employee Health Insurance Premiums

If you work for a large company, health insurance might cost as much as a new car, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. Kaiser found that average annual premiums for family coverage were $21,342 in 2020, which was nearly identical to the base manufacturer’s suggested retail price of a 2022 Honda Civic$22,715.

Workers contributed an average of $5,588 toward the annual cost, which means employers picked up 73% of the premium bill. For a single worker in 2020, the average premium was $7,470. Of that, workers paid $1,243, or 17%.

Kaiser included health maintenance organizations , PPOs, point-of-service plans , and high-deductible health plans with savings options in arriving at the average premium figures. It found that PPOs were the most common plan type, insuring 47% of covered employees. HDHP/SOs covered 31% of insured workers.

| Average Employee Premiums in 2020 |

|---|

| Employee Share |

| $104 |

Of course, whatever employers spend on their workers’ health insurance leaves less money for wages and salaries. So workers are actually shouldering more of their premiums than these numbers show. In fact, one reason wages may not have risen much over the past two decades is because health costs have risen so much.

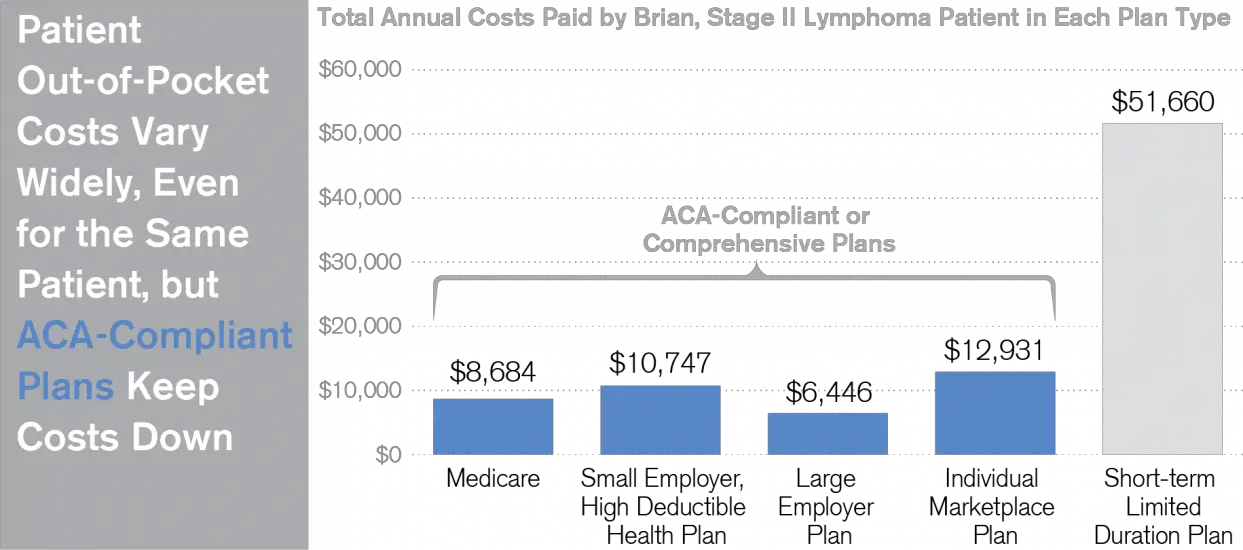

Which type of plan employees choose affects their premiums, deductibles, choice of healthcare providers and hospitals, and whether they can have a health savings account , among many choices.

Key Open Enrollment Dates For Coverage

- Open enrollment has typically been from Nov. 1 to Dec. 15.

- Some states have longer enrollment periods.

- Some states still have open enrollment for 2021 open, including California, Connecticut, Minnesota, New Jersey, New York and Vermont as well as Washington, D.C.

- The Department of Health and Human Services has proposed extending open enrollment to end Jan. 15

Note: Massachusetts has its own MA State Marketplace known as Massachusetts Health Connector. As a MA resident, this is how youll apply for marketplace coverage during open enrollment.

Read Also: Does Medicare Pay For Maintenance Chiropractic Care

Cheapest Health Insurance By Metal Tier

To help you find the best health insurance in Massachusetts, we compared health plans offered in the largest counties to find the most affordable option for each metal tier of coverage.

The average cost of a Silver health plan in Massachusetts is $535 per month for a 40-year-old.

When a health insurance provider calculates your monthly premium, age is a key factor. As you can see from the graph below, for every metal tier, the monthly premium gets more expensive as your age increases.

Finding The Best Health Insurance Coverage In Massachusetts

The best health insurance coverage for you will be determined by your level of income and expected medical costs. These factors will directly affect which plans will be affordable and appropriate for the medical services you require.

Massachusetts has adopted the expanded version of Medicaid. This allows anyone with a household income of less than 138% of the federal poverty level to enroll in Medicaid. If you are not eligible for this program, you can purchase an individual health insurance policy through the Massachusetts state marketplace.

To help you in choosing a tier level that fits your needs, we have detailed each level of coverage and who its best for.

Start with Silver plans

We recommend beginning your health insurance search with Silver metal tier plans. These policies have modest premiums and deductibles. For instance, the cheapest Silver plan has a monthly premium that is $74 more expensive than the cheapest Bronze plan but a deductible that is $1,200 less.

In some situations, a Silver plan can be the most cost-effective health policy due to cost-sharing reductions. These reductions decrease the amount you pay in deductibles, coinsurance and copays. However, you are only eligible for cost-sharing reductions if your household income falls below 250% of the federal poverty level.

Gold and Platinum plans: Great if you have expensive medical costs

Bronze: Best if you are young and healthy

You May Like: When Does Health Insurance Stop After Quitting Job