What Tax Credits Are Available To Me For Offering Small Group Health Insurance

The Small Business Health Care Tax Credit is possible for employers who paid employee health insurance premiums purchased through a qualifying SHOP Marketplace plan. The tax credit offered is up to 50% of the premiums paid for qualifying health insurance coverage. To be eligible for the tax credit, employers must have paid 50% of the employee premium, have less than 25 full-time equivalent employees, and meet the average annual wage cap, which was less than $55,000 in 2019. The tax credit is only available for two consecutive years.

Insurance Options For Sole Proprietors

If you are a group of one, meaning you are the only person working at your company, you are considered a sole proprietor. While the Affordable Care Act says that insurers cannot deny you coverage based on health status and other factors, this does not mean you qualify for group health insurance.

Even if you consider yourself an employee of your company and take salary, the IRS does not consider self-employed individuals to be eligible for group health plans. In this case, youll need to look into individual and/or family health insurance plan options. The same is true if you and your spouse are the only workers at your company.

Whats The Group Health Insurance Definition Of An Employee

Your employees must be working full time or do the equivalent of full-time work. A full-time employee would be working at least 30 hours per week. The interesting definition of an equivalent would be a combination of employees who all dont necessarily work full time individually but amount to full-time hours. Think 3 employees who are working 10 hours per week.

Don’t Miss: Is There Health Insurance In The Philippines

What Are Group Health Insurance Benefits

Group health insurance plans offer medical coverage to members of an organization or employees of a company. They may also provide supplemental health planssuch as dental, vision, and pharmacyseparately or as a bundle. Risk is spread across the insured population, which allows the insurer to charge low premiums. And members enjoy low-cost insurance, which protects them from unexpected costs arising from medical events.

How Many Employees Do You Need To Qualify For Group Insurance

The Affordable Care Act does not require small businesses to offer health insurance to employees. Even so, most businesses would like to provide health insurance to their employees. It is a good practice to follow, as grouphealth benefitsare a critical part of anemployers employee value proposition.

Employees across all generations continue to report medical coverage as a top-tier benefit they consider when searching for jobs, researching companies, and determining whether to stay with their current employer. Employees dont want to stress over medical expenses that could lead to financial hardships.

In a 2019 Stress in America report, two in five American adults reported having challenges when paying for past medical bills.

Further, according to a study of 2,000 people conducted by research company Fractl, 88% of respondents indicated they would consider leaving a high-paying job with poor health benefits for a low-paying one with good health benefits.

KBI has been helping businesses of all sizes acquire group health insurance for years. Below are some frequently asked questions geared toward small businesses and group health insurance options.

Also Check: Can You Buy Individual Health Insurance

Full Time Vs Part Time Employees

Not every part-time employee qualifies for health insurance. While you can use part-time employees to pad your numbers if you need 50 group members for your plan , part-time employees are sometimes not offered health insurance. In 2014, Staples was accused of reducing employees hours, transitioning full-time workers to part-time status, to avoid having to pay for their Obamacare coverage. Their behavior prompted a response from then-President Barack Obama.

Legally, part-time employees work less than 35 hours per week. This is the prime distinction between part-time and full-time employees. This distinction often leads, however, to reduced benefits packages for part-time employees. It is common for full-time employees to receive better health insurance than part-time employees, if they receive it at all.

Consider Group Insurance in the Workplace

While not every employer provides health insurance to their part-time employees, or provides employer sponsored health insurance at all, every employer should consider offering group insurance to their employees. Group insurance is more affordable than individual or family plans for employees, and improves productivity in the workplace. Rewarding your employees is a great way to ensure they remain loyal, happy, and dedicated to their workplace.

How Employees Determine Group Insurance Plans

What Should I Do Next?

What Are Your Insurance Needs?

How Can I Find A One

Employees are unique, so a good first step is to find out what they value most from how much theyre willing to pay each month to which doctors and hospitals they want in their network. A simple poll can help you determine how the bulk of your employees feel.

Most plans today cover preventive care, so next, focus on the pros and cons of the three most common plan types:

- High deductible health plans : HDHPs have a higher deductible that must be met before insurance kicks in. Typically they have lower monthly premiums and may be attractive for groups interested in catastrophic coverage.

- Copay only plans: Copay only plans have no deductible for network services. Instead employees pay a fixed dollar amount when they receive care. These plans may be attractive for people who want predictable costs for care.

- Traditional plans: Traditional plans use a combination of co-pays, deductibles and coinsurance. The deductible and co-pay amounts are generally lower than other plan types, so premiums are often higher.

Finally, expand your benefits mix and satisfy more employees — by offering dental, vision and life coverage. Employees often pay the full cost of these voluntary benefits but enjoy the advantage of group rates when offered through their workplace.

Read Also: What Does Family Health Insurance Cost

Do Employers Have To Offer Health Insurance To Employee Dependents

If you offer group health insurance to your employees, you also have to allow plan-eligible employees to cover their dependents. Dependents include spouses, in some states, domestic partners, and natural and adopted children. Under the ACA, group insurance plans are required to extend coverage to dependent children through age 26, whether or not they live at home. Generally, dependents cannot enroll for coverage unless the employee has enrolled.

Employers have no obligation to pay for premiums for dependents. Employers may contribute towards premiums for dependents, but are free to require employees to pay for the full premium cost for covered dependents.

What Is Classified As A Large Group

Most states define a small group as one with less than 50 workers, and anything more than that is considered big. In some jurisdictions, the threshold is drawn at 100 workers, and anything above that is deemed huge. This definition is currently followed by California, Colorado, New York, and Vermont.

Don’t Miss: Can I Get Health Insurance Without Ssn

Aca Health Law Changes On Group Market

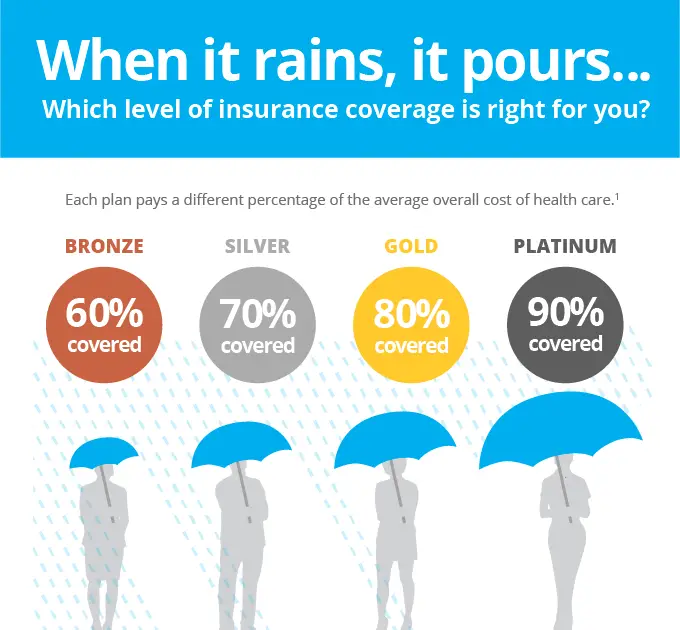

- Plans are now standardized along 4 levels: Bronze, Silver, Gold, and Platinum

- Small Group has increased to 100 lives

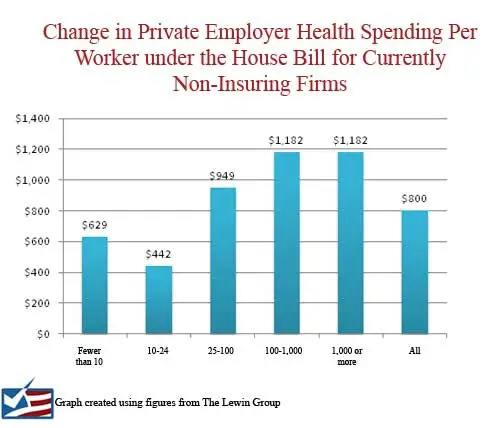

There are Group Tax Credits available. to see if you are eligible

- There are penalties for paying for individual/family plans on behalf of your employees

- There are penalties for not offering health insurance to employees based on size of company

Picking the best HR Benefits Online Platform Save time and money on day-to-day HR process

Review of Rippling HR Benefit System The clear winner for online HR/benefits

Minimum Value Notifications for Californiacompanies Key ACA reporting requirement

Group health penalty Will companies drop group health and take the penalty under reform?

Out of State Employees How do Group health plans handle Out of State Employees

Part Time Employees How are part time employees handled

Dual Coverage Dual coverage under two company insurance plans

Group Dental Introduction to Group dental insurance in California

Kaiser Small Group Group health insurance options from Kaiser of California

Vision Insurance Vision coverage for your California group benefits

California company size How company size affects your Group health insurance options

Group insurance eligibility Three main requirements for groups to qualify

How to Choose Group Plan Important tips to consider when choosing group coverage

New Company enrollment What issues arise when new Companies need health benefits

Reporting Information On Health Coverage By Employers And Insurance Companies

The health care law requires the following organizations and some other parties to report that they provide health coverage to their employees:

- Certain employers, generally those with 50 or more full-time and full-time equivalent employees

- Health insurance companies

Learn more about these reporting requirements from the IRS.

Read Also: What Is The Best Plan For Health Insurance

How Many Employees Do You Need To Get Group Health Insurance

Group health insurance can often be less expensive than individual plans that offer the same benefits and coverage options. However, not everyone qualifies for group coverage plans. If you have a small business, youll want to determine whether you qualify for group health insurance before you apply for coverage. The following information about health insurance for two employees or more will help you make informed decisions about health insurance for you and your employees.

What Are Employer Group Health Insurance Requirements

Here are most crucial Employer Group Health Insurance Requirements: 1. The minimum number of employees: According to IRDAI, minimum of 7 or more employees

Challenges like financial issues, healthcare costs, and troubled mental wellbeing exposed by the COVID-19 pandemic reached a new critical level.

With the link between workplace productivity and stress, as an employer, itâs in your best interest to make sure your workforce has all the pertinent resources to feel supported and safe. Proactive preparation will ensure you protect your business to weather the storm as well as maintain top-line growth.

Don’t Miss: Can You Add A Parent To Your Health Insurance

Which Law Applies To Employers With At Least 20 Employees

The Age Discrimination in Employment Act prohibits employers from discriminating against employees based on their age Private employers with 20 or more workers are subject to the ADEA. There are a few exceptions, such as some CEOs, university academics, and law enforcement and firefighting professionals.

Where To Find The Best Group Health Insurance Plans

Plans vary drastically among and between insurance providers, independent insurance agencies, and the state and federal exchanges. To learn how many employees you need, it is best to follow up with the insurance providers and independent insurance agencies in your area, as well as the state and federal exchanges. Start locally and expand your search if you are unsatisfied with the plans you are being offered.

Don’t Miss: How Do Employers Pay For Health Insurance

Buying Group Health Insurance With No Employees

If you work for yourself and have no employees, you are considered a small group of one. You can only buy group health insurance when you are self-employed through an insurance company or agent incertain states. Check with your state insurance department to verify if group health insurance policies are sold to small groups of one. In most cases, however, a self-employed person with no employees would have to buy an individual health insurance policy.7

Choosing A Health Insurance Plan When Self

The type of group health plan you choose may depend on whether or not you have employees. If you have no employees, then how you go about choosing group health insurance for your self-employed business may be the same as if you were buying individual health coverage or family health insurance. If you have employees, then you have to consider things like how much you can afford to contribute toward employee premiums ,16 the network of providers employees would have access to, and the amount employees would have to pay for a plan that has a deductible. Of course, the goal is to pick a plan that makes financial sense for your business while also being whats best for your employees.

The chart below shows features of different types of group health insurance plans.

| Plan Type |

|---|

You May Like: How Much Is Health Insurance Through Work

Where To Find Group Health Insurance Plans

The most common way to get group health insurance coverage is through an employer. If your employer doesnt offer health insurance due to the small size of the company or if youre unsatisfied with your employers coverage options, look into coverage through a membership organization. If you belong to a membership organization offering a group health plan, such as AARP, the National Association of Female Executives, the Writers Guild of America or the Freelancers Union, you may be able to get health insurance coverage through your membership.

Be wary of plans offered by some membership organizations, as many offer a health services discount plan, which may save you money on prescriptions but isnt a true health insurance plan.

Featured Small Business Health Insurance Partners

On Healthcare Marketplace’s Website

What About Types Of Employees

Although you may qualify for group health insurance if you only have one employee, this employee cannot be the owner or employer. In other words, at least one additional employee, who is not the employer, must exist and be registered in the group health insurance plan.

To help put things into perspective, this additional employee cannot be:

- The employer or owner.

- The spouse of the employer or owner of the business.

- Related to the employer or owner.

- A partner of the employer or owner.

- A seasonal employee hired on a temporary basis, even if theyre currently working full time.

- A contractor of the employer or owner, as contractors are usually not considered common law employees since the owner does not dictate how the contractor does his/her job.

Also Check: What If I Cannot Afford Health Insurance

What Are Some Of The Reasons For Having A Minimum Participation Requirement Before A Group Is Eligible For Insurance

Minimum participation is usually necessary to keep costs down per member and to ensure that the organization does not include a significantnumber of high-risk members. Noncontributory plans require the employer to pay the whole cost, allowing insurance coverage to be extended to all qualified employees.

Healthmarkets Reviews: Insurance For When You Move Or Travel

Are you planning a family trip or a big move? Between checklists, tickets, packing, and boxes, having an accident may seem like the worst case scenario. But it may become an unexpected reality, and we want you to be prepared, just in case. Thats why this week HealthMarkets is reviewing health insurance for those who

Recommended Reading: Who Can Be A Dependent On Health Insurance

Check Out Ourgoogle Reviewsto Understand How Far We Go Far For Our Clients

Small Group health insurance is currently available from 1 life up to100 in California.

This is the market place for employers who want to offer health benefits to their employees, owners, and officers as a qualified tax write off.

Group health is also affected by the ACA law significantly since Jan 1st 2014 which we’ll discuss.

You can always run your quote here:

How Do Group Benefits Work

Here are a few highlights from each: The plan members family is covered by group life insurance if he or she dies while enrolled in the plan. The benefit is usually calculated as a multiple of the plan participants earnings. Sometimes its a set quantity, and other times its a combination of both.

Don’t Miss: How To Find Health Insurance

How Many Employees To Qualify For Group Health Insurance

Contents

Similarly, How many employees are needed for a group health insurance plan?

Your business must have at least two workers, including the owner, to qualify for small group health insurance. To put it another way, a small company owner with only one additional full-time employee usually fits the employee limit under the small business definition and may be eligible for a group plan.

Also, it is asked, What qualifies as a group health plan?

Group health plans are plans that are sponsored by an employer or a group that offer healthcare to members and their families. Group health insurance, which is health insurance provided to members such as workers of a corporation or members of an organization, is the most popular form of group health plan.

Secondly, What is the minimum number of members required for group life insurance?

The insurance must cover at least 50 people at the time of issuance. The policys insurance amounts must be determined by a scheme that excludes individual selection by the insured people, trustees, employers, or unions.

Also, How many employees do you need for health benefits?

While the Affordable Care Act mandates companies with 50 or more full-time equivalent workers to provide affordable group health insurance with essential benefits or face a penalty, small company owners were never compelled to provide group health insurance to their employees.

Related Questions and Answers

Health Insurance Coverage As A Voluntary Benefit

Many smaller companies offer health insurance as a benefit, even if they arenât required to by law. In fact, the majority of Americans have health insurance coverage through an employer. A study by the Urban Institute reported that 83.1% of all workers were offered health insurance through an employer in the first quarter of 2016.

In other words, you are likely to receive health insurance through your company, but itâs perfectly legal for employers of any size to refuse to provide it.

Donât Miss: Kroger Employee Discount Card

Read Also: When Can I Apply For Health Insurance