Option #: Enroll In A Health Insurance Policy Through The Small Business Health Options Program

Lastly, you can establish a group policy through SHOP via the federal marketplace as long as the policy is offered to all your employees. If you pay for at least 50% of your caregivers health insurance premiums, you can qualify for the Health Insurance Tax Credit for Small Employers if the average wages you pay your caregiver does not exceed $53,000. The tax credit maxes out at 50% of the amount you contribute and decreases as the average annual wages you pay to your caregiver increases toward $53,000.

Note: If you live in a state that set up their own health insurance marketplace, they may not allow you to set up a policy through SHOP. Please visit the SHOP website for more information.

If youd like an estimate of your savings by including health insurance as part of your caregivers compensation package, please give us a quick call at 273-3356.

Next Steps:

How Can A Federal Employee Keep Their Health Insurance After Retirement

OPM states that federal employees can keep their health insurance after retirement as long as you meet the following conditions:

- You retire on an immediate annuity or postponed retirement if you have reached your minimum retirement age and have 10 years of service. This means that you cannot take a deferred retirement and expect to retain your FEHB coverage. Importantly, the requirements to maintain FEHB upon retirement are different from those pertaining to voluntary retirement. To receive a full pension, you need to have 30 years of federal service and meet your minimum retirement age . You may also qualify for an immediate annuity at age 62 with 5 years of service or at age 60 with 20 years of service. However, FEHB is governed by the MRA+10 rule. In general, you need to be at your MRA and have 10 years of service to be eligible. Note: you may be able to get a waiver in certain instances, please check the OPM guidance.

- In addition to MRA+10 you also must have participated in the FEHB for the 5 years prior to your retirement. If you retire with less than 5 years of service in the federal government, you may still be eligible to continue your FEHB if you were enrolled in FEHB for your whole government career. Note that the 5 year coverage window applies to your federal career. If you took a career intermission, you would not need to work an additional 5 years before retiring, so long as you had been enrolled in FEHB before leaving the government.

No Mandatory Health Insurance: Advantages

The primary upside to health insurance no longer being mandatory at the federal level is the money you don’t have to spend on premiums that remains in your pocket.

“If you’re young and healthy, it’s possible to get by without paying a monthly bill for health insurance, which saves you money,” says Chane Steiner, CEO of Crediful, a personal finance website. That could be helpful if you’re trying to pay off student loans or save money toward a down payment on a home.

Of course, if your employer offers some type of health insurance coverage as part of your benefits package, you may be able to get affordable coverage anyway, without having to shop around for it.

Christina Nicholson, owner of Media Maven, opted to cancel her health insurance and pay out-of-pocket for pregnancy-related medical expenses that her plan didn’t cover. She first considered adding herself to her husband’s health insurance, but their premiums would have increased by over $1,000 per month so she opted to pay her own medical bills.

Fortunately, she was able to negotiate discounts from her hospitals and doctors, which ended up costing her significantly less money than she would have paid had she been covered. In one instance, the difference between the cost of medical tests with insurance was $1,900 more than her negotiated fee without insurance.

Also Check: Does Starbucks Offer Health Insurance

Options For Health Insurance Coverage

Before going without health insurance, Nicholson reviewed all of her options, which included being added to her husband’s plan and enrolling in a healthcare cost-sharing program. Those are also things you might consider if you’re without health insurance or thinking about canceling your plan since coverage is no longer mandatory.

You may consider short-term health insurance or catastrophic care policies, but these have their limitations, in terms of what’s covered and who’s eligible. Applying for Medicaid may also be an option, but whether you qualify is dependent on your income and family size. Each state has different guidelines with regard to the income and asset thresholds allowed for eligibility for Medicaid coverage.

Talk To The Department Of Insurance

We are the state agency that regulates the insurance industry. We also work to protect the rights of insurance consumers.

Contact the California Department of Insurance :

- If you feel that an insurance agent, broker, or company has treated you unfairly.

- If you have questions or concerns about health insurance.

- If you want to order CDI brochures.

- If you want to file a request for assistance against your agent, broker, or insurance company.

- If you are having difficulty opening a claim with your insurance company.

- To check the license of an agent, broker, or insurance company.

Recommended Reading: What Health Insurance Does Starbucks Offer

What Does Health Insurance Cover

Health insurance plans may cover a wide range of medical care and services. These often include preventive and non-preventive care, as well as emergency care, behavioral health, and sometimes vision and hearing.

What you pay out-of-pocket and what your plan helps pay for can depend on a number of factors. These factors include whether youve met your deductible, what your coinsurance is, if you are getting care from in-network providers and facilities, if your care is preventive or not, and more.

Here are examples of health insurance benefits your plan may cover:

Unitedhealthcare Motion Rewards Program For Apple Watch Get An Apple Watch For Free:

Other than collaborated with Fitbit, United healthcare has alsoteamed up with Apple for incentivizing its employees.

How about getting a free Apple Watch? Yes, you read the right thing. UnitedHealthcare Motion rewards program has made it possible for its consumers.

Its a digitalized national wellness program enabling eligiblemembers of the plan to get fitness trackers that will allow them to earn morethan $1,000 annually by fulfilling certain everyday walking goals.

Be FIT, Get Rewarded:

Employees who take part in UnitedHealthcare Motion will be able tomake a couple of bucks daily for meeting the following three goals:

- AFrequency goal will make you $1.50 daily if you reach 500 steps in 7 minutes, 6times daily with the distance of at least an hour.

- AnIntensity goal will get you $1.25 a day if you hit 3,000 steps in half an hour aday.

- A Tenacitystep will earn you $1.25 if you make 10,000 steps all through the day.

Want to get started? Sign up here.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

What Was The Purpose Of The Individual Mandate

The idea behind the individual mandate was to protect against whats known as adverse selection in the United States insurance market. That means without a mandate, a high percentage of the people who enroll in health insurance plans know they are going to utilize a lot of healthcare services. For example, the elderly and people with existing health conditions.

Since these kinds of people are expensive to insure, pre-ACA, insurance companies would either deny health benefits to those with pre-existing conditions or charge higher premiums based on age and medical history. The ACA not only made it illegal for insurance companies to deny coverage to those with pre-existing conditions, but used the individual mandate to make the pool bigger for who is insured. In other words, the individual mandate ensures that healthy people also get healthcare coverage. This lets health insurance companies lower insurance premiums for everybody.

Combined with the cost-savings and tax credits built-in to the ACA, the individual mandate changed the healthcare system by allowing more people to be insured at a smaller expense. And with everyone insured, American taxpayers werent footing as many medical bills belonging to those who were uninsured and could not pay for their care.

How Do You Get Health Insurance

Your employer may offer you a health plan as part of your job. They work with the insurance company to design the health plans they offer you. Your employer may also choose to add certain programs and services to your benefits, as well.

If you dont get a plan through your employer you can buy one on your own through a state or federal health exchange. You can also buy one directly through a health insurance company, like Cigna. Youll find a variety of plan options to help meet your specific needs.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

What Is The Affordable Care Act

The Affordable Care Act provides individuals and families greater access to affordable health insurance options including medical, dental, vision, and other types of health insurance that may not otherwise be available. Under the ACA:

-

You may be able to purchase health care coverage through a state or federal marketplace that offers a choice of plans.

-

Insurers can’t refuse coverage based on gender or a pre-existing condition.

-

There are no lifetime or annual limits on coverage.

-

Young adults can stay on their familys insurance plan until age 26.

-

Seniors who hit the Medicare Prescription Drug Plan coverage gap or “donut hole” can get a discount on medications.

Read the full text of the ACA and learn more about its provisions and relationship to patients, insurers, businesses, and families.

Will My Health Insurance Cover The Costs Of Coronavirus Testing And Treatment

Under the the Families First Coronavirus Response Act, Medicare, Medicaid, and private health insurance plans are required to fully cover the cost of COVID-19 testing. | Image: JDHT Productions / stock.adobe.com

- Health insurance & health reform authority

- If youre uninsured, you can sign up for coverage during the COVID-related enrollment window .

Q. Will my health insurance cover the costs of coronavirus testing and treatment?

A. The COVID-19 pandemic has drastically impacted the world over the last year. A common question that people have is How will my health insurance cover the coronavirus?

An executive order signed by President Biden has authorized a COVID-related special enrollment period on HealthCare.gov. The SEP will run from February 15 to August 15.

The short answer? It depends. With the exception of Original Medicare, health insurance differs greatly in the U.S., depending on where you live and how you obtain your coverage. Including the District of Columbia, there are 51 different sets of state insurance rules, separate rules that apply to self-insured group plans , and 51 different Medicaid/CHIP programs.

Nearly half of all Americans including a large majority of non-elderly Americans get their health coverage from an employer. Those plans are regulated by a combination of state and federal rules, depending on the size of the group and whether its self-insured or fully-insured.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Q My Photo Health Card Has Expired How Do I Renew My Health Card

Your photo health card has an expiry date that is linked to your date of birth. The first time you apply for a photo health card, the expiry date can be anywhere from two to seven years in the future. When your photo health card is renewed, the renewal date will always be five years in the future and linked to your date of birth.

Renewal notices for photo health cards are mailed approximately two months prior to the expiry date shown on the front of the photo health card however, if it is more convenient, you can renew up to six months prior to the date of expiry.

To learn more about renewing your Ontario photo health card, refer to the fact sheet .

Do Employers Have To Cover Family Members

With a group insurance plan, employers usually offer coverage to legal spouses and dependent children.

The ACA requires you to provide dependent coverage to age 26. If you do not, you might have to pay a penalty. You can choose to cover dependents over 26 years old, but you are not required to.

Employers are not obligated to pay premiums for dependents. However, you can contribute towards premiums for dependents. Or, you can require employees to pay the full premium cost for dependents.

You are not required to cover your employees spouses. Some companies decline coverage when a spouse can receive insurance from their own employer. Or, they might charge the employee more to cover the spouse.

According to the Kaiser Family Foundation, most small businesses pay part of their employees family plans. Compared to single plans, small employers usually pay the same amount or more:

- 45% provide the same dollar contribution for single and family plans

- 45% make a higher dollar contribution for family plans than single plans

- 3% vary their approach with the class of the employee

- 7% take a different approach

On average, small businesses contribute more to single coverage but less for family coverage than large companies do. Employees of small firms pay $1,021 for single coverage vs. the large firm cost of $1,176. Small firm employees pay $6,597 for family coverage vs. the large firm cost of $4,719.

Recommended Reading: Starbucks Part Time Health Insurance

Option #: Contribute Directly To Your Caregivers Individual Health Insurance Policy

If you only have one household employee, you can contribute to your caregivers health insurance policy premiums and treat that money as non-taxable compensation. That means the amount you pay wont be subject to taxes for both you and your caregiver.

Families that choose this route will save about 10% on the amount they contribute while their caregiver will save approximately 15-20%, says Desiree Leung, Head of Operations of Care.com HomePay. So if you assign $150 of your caregivers wages per month to health insurance, youll save about $180 annually in taxes and your caregiver will save around $300.

If you choose to go this route, you should pay the insurance company directly, if possible. This will eliminate any possibility of the money being used for other purposes and will make life much easier in the event of an audit. If thats not possible, have your caregiver make a copy of their health insurance invoices.

Other Types Of Health Coverage

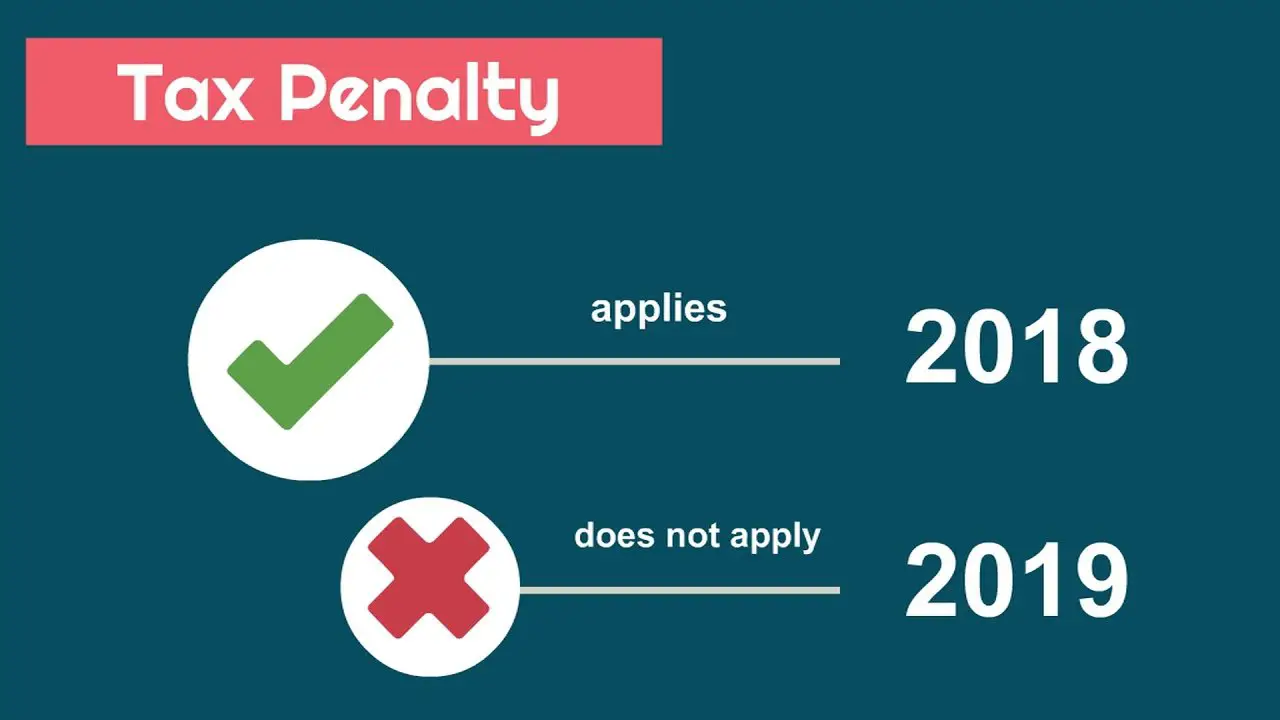

Other types of health coverage are sold in California, but if it will be your main source of coverage, you should make sure that it meets minimum essential coverage requirements. If your policy does not meet these requirements, you might have to pay a tax penalty to the IRS as if you did not have coverage at all.

High-Deductible Plans

These plans have lower premiums but high deductibles. The deductible each year can be over $5,000 for an individual and over $10,000 for a family. This means that you must pay a lot of money each year before your plan covers anything except preventive care.

Usually a high-deductible plan is combined with a Health Savings Account . You or your employer can put tax-free money into a savings account and use this money to pay your deductible.

Limited Benefit Plans

Limited benefit plans are also called mini-meds. They provide very limited benefits. They are advertised on TV as low-cost health insurance. You should read the policy very carefully. If you have a serious illness, you might run out of coverage quickly. These plans do not count as full health coverage and you may end up paying a penalty at the end of the year if you don’t have other coverage.

Discount Plans

Supplemental Health Insurance Policies

- What are the limitations and exclusions?

- How does the policy coordinate benefits with your main health insurance?

Why is Minimum Essential Coverage Important

Recommended Reading: Starbucks Health Care Benefits

Do Married Couples Have To Be On The Same Health Insurance

According to spouse health insurance laws 2020, couples are no longer required to be on the same health insurance. In other words, if you both already have individual health insurance plans that you are happy with, there is no good reason to get rid of that coverage.

That being said, spouses can share the same plan, which can be a more cost-effective option in some circumstances. Since it depends on each individual case, newlywed couples need to factor in all of the pros and cons of being in a joint policy or having separate individual health insurance coverage plans.

How Does Spouse Health Insurance Work?

Once two individuals get married, they will be eligible to join each others employer-sponsored health insurance. If a spouse has alternative health care coverage, an employee will have to pay a spousal surcharge, an additional fee or premium, for their policy.

Should I Add My Spouse to My Health Insurance?

In most cases, you can add your spouse to your health insurance plan. However, this needs to be done 60 days after your marriage date.

The good news is that if you and your partner are both in good health, you can end up saving money when combining your health insurance coverage.

However, if one spouse has been diagnosed with a chronic illness, you can opt for an insurance plan with a lowered deductible for one partner and a higher deductible and lower cost plan for the other one. In this case, two separate policies will be a more economical solution.

Buying Health Insurance Affects Your Taxes So Does Not Buying It

Whether you get your health insurance through an employer or the Health Insurance Marketplace, its important to understand how health insurance affects taxes so that youre better prepared to file your tax return.

When the Affordable Care Act was enacted in 2010 , the law made health insurance more widely available for some people. But it also made things a little more complicated for some during tax season.

Recommended Reading: Starbucks Insurance Part Time