What’s The Biggest Factor When It Comes To Premium Increases

The biggest factor is whether or not you get premium subsidies. If you dont get a subsidy , your rate changes are pretty straightforward and just depend on how much your insurer is changing the premium for your plan next year .

But if you do get a subsidy, your rate change depends on multiple factors: How much your plans price changes, how much your areas benchmark plan price changes , as well as things like changes in your income and family size.

Because average benchmark premiums decreased for 2021, average premium subsidies were initially a little smaller in 2021 than they were in 2020 . And since the average benchmark premiums have decreased three years in a row, average premium subsidies have also decreased three years in a row . But that doesnt mean your subsidy is smaller, since theres a lot of variation from one area to another, and because your specific subsidy also depends on your own income, which can change from one year to the next.

And its important to keep in mind that although average benchmark premiums decreased slightly for 2021, average premiums across the whole individual market increased slightly. So it was common for 2021 to see people who get premium subsidies ending up with an small overall average increase in their premiums for 2021 assuming they werent enrolled in the benchmark plan in both years or willing to switch to a lower-cost plan for 2021 .

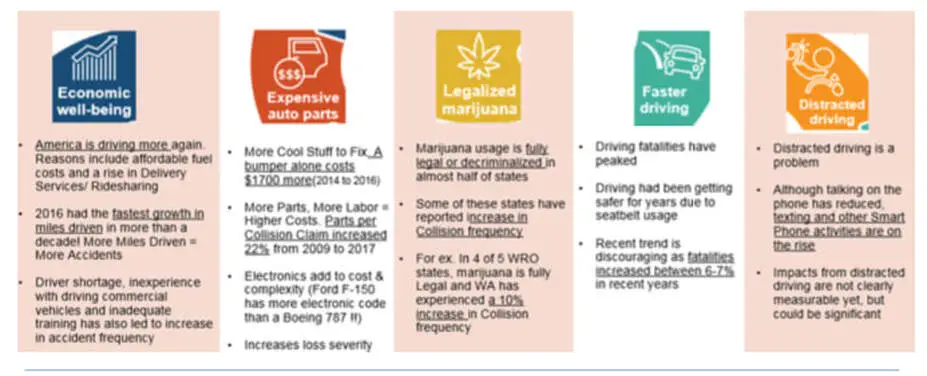

Why Car Insurance Rates Go Up

Why does my auto insurance go up every year?

Though, as noted by Business Insider, it seems like car insurance rates are always on the rise, we actually have a lot of control over what we pay and whether or not that rate will increase over time. Many factors go into how car insurance rates are determined.

We determine our driving record, what car we drive, and any change in coverage or insurance deductible.

Some of the main rating factors auto insurers use to determine what to charge for car insurance include the MVR, C.L.U.E. report, vehicle history, and financial responsibility reports.

Each ticket you receive and every claim you file, as well as your overall financial health, will show up on these reports.

Do speeding tickets affect insurance with Geico? How much does insurance go up after a speeding ticket with State Farm? How much does insurance go up after a speeding ticket with Progressive?How much will my USAA insurance go up with a speeding ticket? Regardless of your insurance company, a speeding ticket will probably affect your car insurance rates.

Lets take a look at how much does insurance go up after a ticket or at-fault accident.

Average Annual Car Insurance Rates Based on Driving History

| Insurance Companies |

|---|

So, just how much does your insurance go up for an accident? A clean record will cost you about $260 a month but an accident will increase your rates to an average of $340 a month, an increase of around $80 a month.

If You Cant Pay Your Premiums Because Of A Hardship Due To Covid

- Check with your insurance company about extending your premium payment deadline or ask if they will delay terminating your coverage if you cant pay your premiums.

- If your household income has changed, update your application immediately. You could qualify for more savings than you’re getting now.

- If youre getting financial assistance for Marketplace premiums, you have a three-month grace period to catch up on premium payments to avoid having your coverage terminated for non-payment. Most of the time, if you arent getting financial help with your premiums, you have a grace period determined by state law .

Don’t Miss: How To Become A Health Insurance Broker In California

Rate And Comment On The Answer

This site uses Akismet to reduce spam. .

Answer Rating:

I am 57 years old. This year I have insurance through my wifes employer at a cost to me of $434.81 per month. The deductible is $3000, and since I have maintained coverage all my adult life, pre-existing conditions are not an issue. As of December, my wifes employer will be compelled to comply with ACA rules. I was offered a silver plan with a $3500 deductible and a premium of $771.04 per month. My wifes company deliberately renewed the old policy in December of 2014 to delay the price increase to their employees as long as possible. In my case, a dramatic increase in cost and a reduction in benefits was the direct result of ACA compliance. I am currently looking for private insurance that I can actually afford.

The answer didnt mean YOUR pre-existing conditions. It meant that the new protection added numerous people with pre-existing conditions, which raised premiums to compensate, even if you yourself are perfectly healthy.

Take our country back from who? I am a middle aged white male and it is so annoying to hear or read about the comment you made. This was never our country to begin with, we stole it from native Americans by force, so stop saying that statement! Dont worry, our privileged position is secure for the next 50 years and by then you will be too old for it to matter! When this country falls, it will be from within, no outside help needed.

dude you took the ball and ran the other waysuch an idiot.

What Are The Benefits Of Health Insurance

![Why Do Insurance Rates Go Up? [Infographic] Why Do Insurance Rates Go Up? [Infographic]](https://www.healthinsurancedigest.com/wp-content/uploads/why-do-insurance-rates-go-up-infographic.jpeg)

here are several really important benefits that can make or break a future unexpected medical issue that you might have to deal with. Here are the top 5 reasons that you will need health insurance.

1) You Want Treatment Wherever and Whenever

2) Preventative Care

3) You Dont Want to Pay Full Price

4) You Matter

5) Follow Up Care after Accident

Don’t Miss: When Does New Health Insurance Start

Why Did Insurance Premiums Go Up

Actuaries use mathematics, financial theory and statistics to forecast the cost and probability of an event. In the insurance industry, actuaries spend a lot of time trying to predict how likely customers are to file a claim. The higher the probability, the more they can justify charging you higher insurance premiums. Its the first of several reasons why your premiums might have risen.

If You Already Have A Marketplace Plan

You can also wait until you file and “reconcile” your 2021 taxes next year to get the additional premium tax credit amount. But, we recommend you update your application and review your plan options. You may be able to choose a plan with lower out-of-pocket costs for the same price or less than what youre currently paying.

Note: If you didnt update your application by early August, we tried to automatically apply these savings for you, starting September 1, 2021. We weren’t able to do this for everyone, so the only way to be sure you get these savings is to log in, and update your application yourself.

Preview 2021 health insurance plans & prices before you log in.

Don’t Miss: What Health Insurance Is Available In Nc

What To Do If You Need More Cash Right Now

These rebates wont be going out until closer to the end of the year.

If your health care costs are eating up too much of your monthly income right now, the Biden administrations new Obamacare subsidies have made it easier for you to get affordable health insurance.

Thanks to the subsidies, which apply to plans available on healthcare.gov and other ACA exchanges during the current special enrollment period which ends Aug. 15 anyone making more than $51,000 a year will be able to find coverage for about $1,000 less per month than before the bill was passed.

And if you still need to find a little more room in your monthly budget, you have a few options.

If You Are Moving Out Of State However

If you are changing jobs, COBRA or another short-term option may be available. You are also going to have to look at plan options available in your new area, especially if you arent going to have coverage through work. Also, moving to a different state may be a challenge, depending on how healthy you are. If you have pre-existing conditions, you may not be able to obtain coverage for a new plan in a different state.

Also Check: How Much Does Health Insurance Cost In Ct

Can You Avoid Health Premium Increases

No matter what, you need to carefully compare your options when you enroll. If youre eligible for a premium subsidy, you need to shop in the exchange in your state.

And if you currently have a plan you purchased outside the exchange, be sure to double-check your on-exchange options for next year before deciding whether to renew your off-exchange plan. People with off-exchange plans should carefully consider the on-exchange options during the COVID-related enrollment window in 2021, as they may find that theyre newly eligible for premium subsidies as a result of the American Rescue Plan.

Even after 2022, when the ARPs subsidy enhancements are slated to end , its important to check on-exchange options each year before deciding to renew an off-exchange plan. As the poverty level numbers increase each year, the limits for subsidy eligibility go up as well. In 2014, a family of four had to have a household income of no more than $94,200 in order to get a subsidy. For 2020, that had grown to $103,000. There is no income limit for subsidy eligibility in 2021 and 2022, thanks to the ARP. But if and when an income limit is reinstated in 2023, it will have increased from the level that applied in 2020.

Taking The Next Steps

Whatever the situation, a delayed payment especially in the form of health insurance reimbursement can at best be a minor hassle and at worst a financial burden. Make sure you know who to reach out to in these situations. If youre having issues with your current coverage, we can help you look elsewhere.

If your delayed claim turns into a denied one, you may choose to appeal.

Also Check: What Is The Health Insurance For Low Income

The Initial Transition To Aca

The ACA makes health insurance available to anyone who applies and subsidizes the cost for people who need it the most.

Some people who dont get a premium subsidy saw sharp rate increases in 2014, with the transition to a guaranteed-issue market and plans that cover the essential health benefits. But even among people who pay full-price for their coverage, some enrollees may have experienced a rate decrease when they switched to an ACA-compliant plan, even without a subsidy. That could be the case for a variety of populations:

How Are The Rebates Calculated

The rebates are calculated based on the share of premium revenues that insurance companies put toward health care expenses and quality improvement.

Insurance companies use a three-year average to come up with their rebate figures, meaning this years number isnt solely influenced by the pandemic. In fact, a significant portion of this years rebates is being driven in large part by the big profits insurers saw in 2018 and 2019.

And while 2021s rebates are about $400 million less than last years record high, theyre still more than 50% higher than the previous record, in 2019, of $1.4 billion.

To put that into difference in dollars, the average consumer received a $208 rebate in 2019 and $322 in 2020, according to Kaiser research.

But how much youll get depends mostly on your market. In Kansas, for example, in 2019, the average eligible policyholder got back $1,359, while Delawares average was zero.

Also Check: What Are Some Good Health Insurance Plans

Heres How The New Program Could Affect Different People:

If you already bought health insurance on Healthcare.gov:

To get their costs reduced, everyone who already bought their own coverage on the Marketplace needs to go back to Healthcare.gov and confirm their choice, or make a new one.

This includes people who chose a plan last fall during the regular Open Enrollment, or continued their coverage from a previous year.

It even includes people who bought insurance recently under the special enrollment period that began in February. The new program that took effect April 1 wont automatically update their monthly cost.

In order to find out how much your plan will now cost, or what you might pay if you pick a different plan, you need to go back to Healthcare.gov and choose the report a life change option. Then, click change to my households income, and enter the information it asks for, even if your income hasnt actually changed.

Then, submit your application, and go into the Plan Compare section of the site you can either confirm that you want the same plan youre already in, or choose a new one.

Keep in mind, though, that if you have a deductible on your existing plan and youve already met part of it this year, youll be starting from scratch with a new plan.

Like Podcasts? Add the Michigan Medicine News Break on iTunes or anywhere you listen to podcasts.

If you looked at Healthcare.gov before, but didnt buy a plan because it seemed too expensive:

How Does The American Rescue Plan Affect Premiums For 2021

For many people who buy their own health insurance, the American Rescue Plan will make coverage more affordable in 2021 than it would otherwise have been. Most people who are receiving unemployment compensation in 2021 are eligible for $0 premium benchmark plans with robust cost-sharing reductions. And for 2021 and 2022, the subsidy cliff has been eliminated and the percentage of income that people have to pay for the benchmark plan has been reduced.

This comparison chart shows some examples of how the new rules result in increased premium subsidies for many enrollees, and lower after-subsidy premiums. The specifics will vary from one enrollee to another, since premiums depend on age and location. But in general, premiums for many enrollees are more affordable now that the American Rescue Plan has been enacted. The ARPs additional subsidies are retroactive to January 2021 for people who have been enrolled in marketplace plans all year. They can be claimed on 2021 tax returns, or enrollees can log back into their marketplace accounts in the coming months and follow the instructions for a subsidy redetermination so that the additional subsidies can be applied to their accounts in realtime.

You May Like: How To Enroll In Health Insurance

Keep Costs Down Stay In Network With Provider Finder

One way to help keep your health insurance costs down is to use only doctors, hospitals and other health care professionals in your plan’s network. If you go out of network, you might have to pay the entire bill. Not all plans have the same network. The best way to find in-network providers is byregistering or logging into Blue Access for MembersSM, our secure member website, for a personalized search based on your health plan and network using our Provider Finder®tool.

Still Dont Know What To Do And Still Have To Move

No matter the situation, Bernard Health is here to help. We can take a look at all the plan options in your new area and find the best solution. We will weigh new options against current ones, such as COBRA and short-term plans. We will do all of this in a no hassle-process so you can worry about moving and getting settled. Let us do the heavy lifting!

You May Like: How To Get Health Insurance Fast

Having A Claims History

As far as insurers are concerned, a history of claims increases the odds that youll make another one. Home insurers, for example, share information about claims from the last seven years through the Comprehensive Loss Underwriting Exchange , which can boost your premiums even if you werent the homeowner who made the claims. Car insurance claims are also registered by CLUE, and your rates may increase if youve made a lot of claims even if you werent at fault because you pose a higher risk, statistically speaking.

People Are Voicing Concerns Via Twitter

We conducted a quick analysis of Twitter and found that hundreds of people already received letters from insurance carriers saying that premiums will increase at a 20% on the lower end and up to 48% in selected cases. For high deductible plans, which already have a high cost-sharing level, increasing premiums could further push more employers to ration health benefits and push individuals into becoming uninsured.

Don’t Miss: What Type Of Health Insurance Do I Need

Aca Prices Remain Steady In 2021

In 2021, ACA Marketplace premiums stabilized, according to the Urban Institute. The national average benchmark premium fell again in 2021, following decreases in both 2019 and 2020remarkable because it contrasts with premium increases in the employer-sponsored insurance market over the same period. Note that the nationwide average belies variation in premiums across and within states. The Urban Institute found that insurer participation is key to setting premium levels and influencing growth over time.

The ACA made premium tax credits available to people purchasing health coverage on the marketplaces but only when their incomes fell between 100% and 400% of the federal poverty level. Millions of uninsured people are eligible for subsidized coverage on the ACA marketplaces but do not take advantage of this financial help. This may be that the financial help is not sufficient to make the premium or the deductible affordable. Moreover, a sharp cliff exists at 400% of the poverty level.

Most of the 29 million insured and eligible uninsured have lower health insurance premiums as a result of these subsidies, and many could also afford lower deductible plans as long as they take advantage of the new financial assistance.