What Is Health Insurance For Students

With health insurance, you pay a company a monthly sumyour premium. In return, the company agrees to cover a percentage of your health care costs, such as doctor visits, prescription medications, or hospital stays.

A common myth is that college students dont need health insurance because theyre young and generally healthy. But one in six young adults has a chronic health condition, and nearly half of young adults report problems affording their medical bills. Getting health coverage is an essential safeguard for your finances.

As a college student, you have the following insurance options:

- Insurance through your parents: If you are under the age of 26, you can join your parents health insurance plan.

- School-offered coverage: Many colleges offer insurance plans for incoming students.

- Insurance through the Health Insurance Marketplace: You can enroll in an insurance plan on Healthcare.gov. Depending on your income, you may qualify for subsidies that make coverage more affordable, or you can purchase an inexpensive catastrophic plan.

- Medicaid: Depending on your income and location, you may be eligible for Medicaid, the federal insurance program for low-income individuals. You can apply for coverage through your state Medicaid agency.

- Private plans: You may also opt for an insurance plan offered by a private insurance company. These plans may or may not meet the requirements of the ACA, but can provide coverage against major accidents or illnesses.

What Are My Coverage Options

Once forced to choose between expensive, high-deductible, single-payer insurance and whatever coverage a school wanted to offer, college students now have better choices for health insurance. College students generally have four options for health insurance:

Wider Medicaid coverage has helped increase the number of insured college students. However, not all states elected to expand Medicaid benefits when the ACA was passed. Students interested in this option need to check their state’s requirements.

Medicaid is the best health insurance for college students with no income. Learners who are 26 and older often take advantage of this option. Pregnant people and people with a disability also have special eligibility for Medicaid.

Students with chronic health issues enjoy significant benefits from Medicaid â they only pay a very small amount each time they see the doctor or visit the hospital.

Not everyone qualifies for Medicaid. Students under 26 may not be able to access Medicaid, for example, if they file as a dependent on their family’s taxes. Some states have not expanded Medicaid, making this option inaccessible to most students. Students and recent graduates also lose access to Medicaid once they start earning a higher income.

Additionally, you must be a resident of the state where you apply for Medicaid. This can impact learners attending an out-of-state college.

Health Insurance At Concordia

Immigration Quebec regulations require that all international students be covered by a Quebec issued health insurance plan that meets government standards, while studying in Quebec. In keeping with this government directive, Concordia University has negotiated a compulsory health and accident insurance plan with Blue Cross at a competitive cost that all Concordia international students must have. Consequently, personal health insurance plans are not accepted.

Health insurance fees are automatically charged to all international students when registering for courses or when graduate students are Continuing in Program .

Please download and review your Blue Cross Health Insurance Policy Booklet carefully for the details of your coverage. Register and print your Blue Cross card online .

You can also contact your provincial Telehealth line .

If you think your health issue may require immediate attention, call your provincial Telehealth line to speak with a nurse for assessment and guidance.

If you think your life, or the life of someone you know, is in danger, go to the nearest emergency department or call 9-1-1. Those outside of Canada can consult International Emergency and Crisis Lines, by Country for resources.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

How To Get Health Insurance For International Students

There are three main options international students get health insurance:

- Through the school. Universities or colleges oftentimes offers international students a health insurance policy which they can subscribe to. In some cases, it is compulsory, other times you can opt-out and choose your own policy elsewhere. If your school offers you an opt-out policy, make sure to read it carefully before making a decision.

- Private health insurance. Anywhere you go, there will be private health insurance companies. You can compare them here. If your school does not offer a plan, you can do your research and buy a student visa-compliant insurance plan from a local company after you arrive at your destination. This is a good option if you do not intend to travel to other countries or return home during your studies.

- International student health insurance. You can get an international health insurance plan online. International plans are intended for expats, travellers, and international students because they offer coverage in more than one country as the name suggests. So, if you want to travel around or return home once in a while, you can rest assured you are covered.

You can get international health insurance through comparison websites, such as Insubuy, which allow you to compare plans side-by-side in a detailed manner, before settling on one. Regardless of what type of student health insurance you choose, remember to always read the policy carefully!

Explore Health Plans Just For Students

Taking new steps. Its part of growing up. When youre a college student, the steps may seem to get bigger by the minute.

One of these steps is choosing a health insurance plan. Its important to find a plan that works with where you areon campus and in life, so you have the benefits you need when you need them.

Find out how to get started with a student health plan.

Don’t Miss: How Much Is The Er Without Insurance

Prices Vary Among Schools

Several parents with more than one child in college wrote in with their experiences. Their stories show how different the cost can be depending on the school their kid attends.

Because her health plan has in-network providers near her sons college in Evanston, Illinois, one mother was able to waive coverage with a $4,000 premium. She wasnt so lucky with her daughter, who attends college in Montreal. With no coverage in Canada, they had to payout $1,500 for her schools health plan.

At Stanford University, the cost for Cardinal Care, its student insurance policy, was $5,208 for 2018-2019 school year, and rose to $5,592 for 2019-2020. Coverage runs from Sept. 1 to Aug. 31 and covers students on campus, nationwide and overseas.

Student health plans may be run by one of the big national insurers for example, Aetna Student Health or UnitedHealthcares UHC Student Resources. Another carrier is University Health Plans, a division of Risk Strategies, a national insurance brokerage and consulting firm.

I Need To Purchase Health Insurance

FSU has partnered with United Health Care Student Resources to provide our main campus students and their dependents with a comprehensive and cost-effective insurance option to meet the insurance requirement for attendance at FSU.

The policy is a gold-equivalent PPO plan that is widely accepted nationally through the United Choice Plus Network and provides unlimited medical and prescription benefits. Students covered by an HMO that does not include Leon County or a plan without a local network are encouraged to contact their insurance company for options or to purchase the UHCSR plan, which has a strong presence in Tallahassee, including access to a comprehensive network of specialists. If you are an international student studying on an F or J visa, the plan offers the required Evacuation and Repatriation coverage.

This policy can be used anywhere that accepts United Choice Plus, but when used at the Student Health Center to see a UHS provider, or at a local urgent care clinic, the co-insurance and deductibles are waived for this plan leaving you with the lowest out-of-pocket cost. Additionally, you will have unlimited no-cost access to a physician day or night via HealthiestYou, UHCSRs telemedicine service. To see more details about this plan, click on one of the links below to view the plan Brochure or Master Policy.

Go to to view plan brochures and master policies for the FSU student health plan.

Purchase Health insurance

You May Like: Starbucks Benefits For Part Time

If No One Claims You As A Dependent

- And you live separately from your parents : You should fill out your own separate application. Your savings will be based on only your income, not your parent’s.

- And you live with your parents: You should apply on your own separate application. But if you’re under 21, you may need to provide information about your parents and their income to complete the application.

When asked if you have health coverage, answer “No.” Choose “No” even if you have student health coverage and plan to drop it when you enroll in a Marketplace plan.

Costs Of Private Health Insurance In Germany

Only certain individuals in Germany are eligible for choosing private healthcare over public healthcare

This includes those earning over 60,750, freelancers, those earning under 450 and students over 30.

The cost of private health insurance in Germany is not regulated in the same way as the cost of public healthcare and can therefore vary hugely in price. Private premiums are set by the risk of the patient, which means those with chronic conditions and older people will generally pay more for private insurance. Find a holistic comparison of private health insurance pros and cons here.

Young people on high incomes will certainly make savings by choosing private over public. A young, healthy person can pay as little as 175 a month, which can be far less than public healthcare for those on high salaries. However, high-risk patients may have to pay private health premiums as high as 1,500 per month.

Most private healthcare providers offer savings on monthly premiums if you choose high deductibles. This may mean that you have to pay the first few thousand Euros for treatment, should the worst happen, but your monthly rate is quite low. Only choose this option if you have that amount of money in savings should you need it and you are generally in good health.

You can find out more about private health insurance on our Health Insurance in Germany page.

Also Check: Starbucks Dental Benefits

How Much Is Health Insurance For College Students

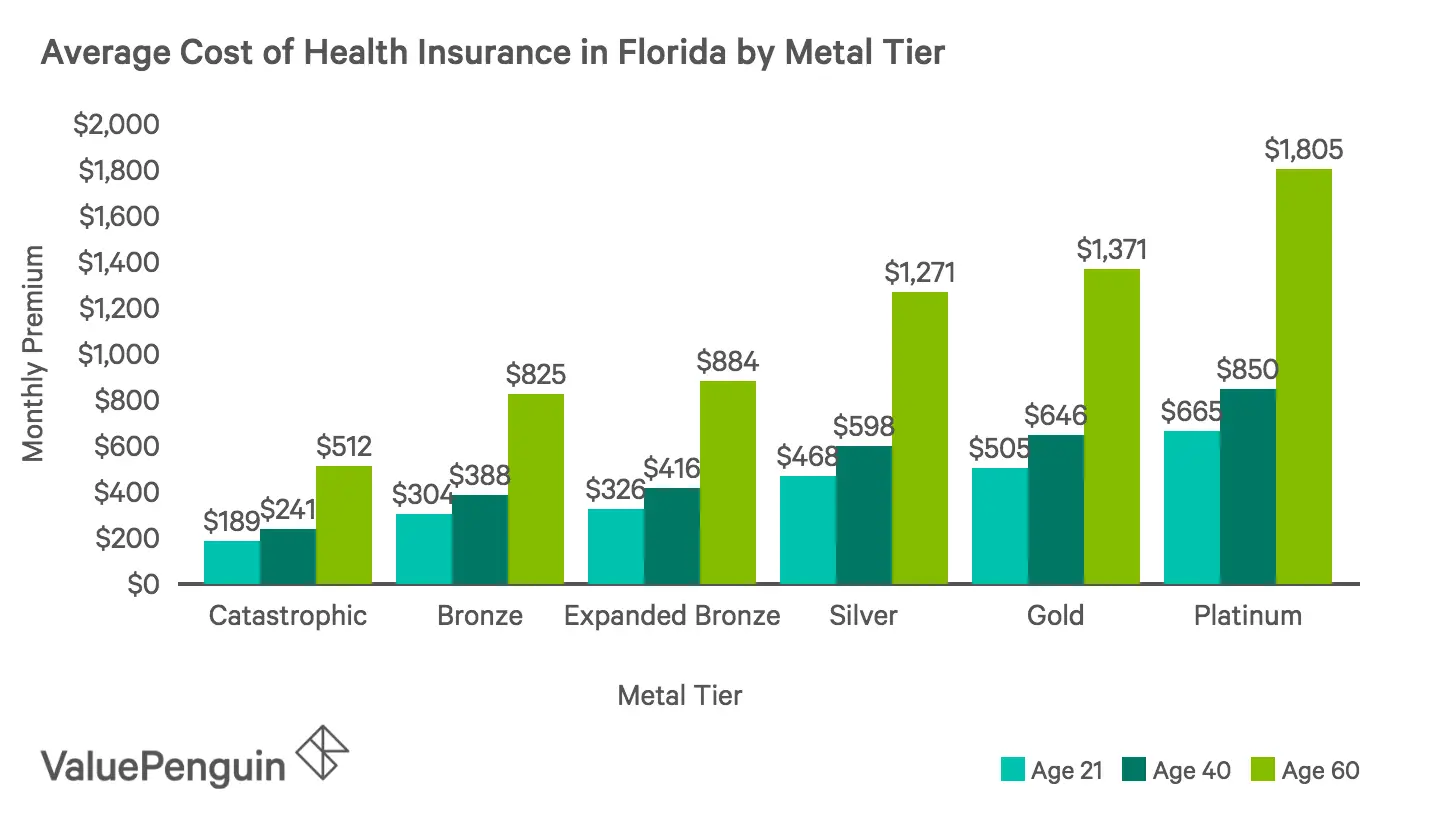

The cost of school-sponsored health insurance plans will vary at every university. Students applying for their own health insurance plan can generally expect to pay a national average of $158 per month* for a short-term plan or $231 per month* for a major medical plan.

*This is based on recent average prices of plans available from eHealth, but actual prices available depend on zip code, age, gender, and other factors. Get a personalized quote to see what may be available for you.

How Much Does Student Health Insurance In Germany Cost

Students aged under 30 do not need to pay 7.3% social security contributions towards healthcare insurance, instead they pay a set monthly amount of 105.05 or of 106.93 for long term care which covers both basic healthcare insurance and nursing care insurance. This amount is usually less than the cost of standard contributions based on earnings.

Read Also: Starbucks Benefits For Part Time Employees

How To Get Free Travel Insurance When Applying For Germany Student Visa

Travel insurance is a required document when applying for a German study visa.

- You will have to get travel insurance when you apply for the Student Visa anyway. This way, you get both types of health insurance at the same time for the same price.

- You can apply online from abroad.

- You will have adequate health coverage if you arrive in Germany earlier than the start of the semester. Long-term insurance only becomes active after the semester starts.

- You will immediately get the Insurance Certificates required for visa application and enrollment at university.

- You do not need to pay anything until you arrive in Germany if you dont have a German bank account at the time.

Can I Include Dependents On My Student Health Insurance

If your school offers you a health insurance policy to subscribe to, more often than not, you are not allowed to add your dependent family members. If they do allow it, then it will cost much more. If you are not inclined to accept this, you have the following options:

- Get family health insurance from an international company. If you can opt-out of your schools plan, then your best option is to get a family health insurance plan. Some companies even allow very young children to be added to the plan at no extra costs.

- Get international health insurance only for your dependents. If your school has an insurance plan you cannot opt-out of, then you can just purchase a separate international health insurance plan for your family members, while you keep the one offered.

Also Check: What Insurance Does Starbucks Offer

Phd Students Employed By The University

Many PhD Students are employed by the university as lecturers or research assistants, in which case they will be automatically enrolled in the public healthcare system, and pay the usual contribution of 7.3%, matched by their employer of another 7.3%.

It is highly unlikely that PhD students in such a role are earning above the threshold which allows them to choose private healthcare. The good news about being employed by the university is that you do not necessarily need to organize the healthcare cover yourself, as it will often be taken care of by the university. You can find out more about the public healthcare system on our Public Healthcare in Germany page.

Using The Provider Directory

Participating providers are independent contractors in private practice and are neither employees nor agents of Aetna Student Health or Columbia University. The availability of any particular provider cannot be guaranteed for referred or in-network benefits. Provider network composition is subject to change without notice.

Certain primary care physicians may be affiliated with an independent practice association, a physician medical group, an integrated delivery system, or one of other provider groups.

Not every provider listed in the directory will accept new patients. Although Aetna has identified providers who were accepting patients at the time the directory was created, the status of a provider’s practice may have changed. For the most current information, contact the selected physician or Aetna Student Health at 800-859-8471.

In the event of a problem with coverage, contact Aetna Student Health to learn how to utilize the complaint and appeals procedure when appropriate. All care and related decisions are the sole responsibility of participating providers. Aetna does not provide health care services and, therefore, cannot guarantee any results or outcomes.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

How To Enroll In Student Health Insurance

If youre already enrolled in your parents plan, your parents will re-enroll you when they renew their plan each year. If youre purchasing student health insurance through your school, your college or university will have an online or physical enrollment form you can fill out.

If youre enrolling for coverage on the marketplace, you typically will apply during your states open enrollment period. Typically, this period is between November 1 and mid-December. However, if youve recently turned 26, will be turning 26 or have experienced a loss in coverage, you can typically enroll during this life change event.

To learn more, visit healthcare.gov and find out if your life change allows you to enroll outside of the open enrollment period. On its site you can also find out if you qualify for Medicaid or CHIP, selecting your state and answering some income questions.

Best For Convenient Access: School

School-offered insurance plans are our top pick for students who are looking for convenience, affordability, and dont want to be overwhelmed by options.

-

You can use financial aid to pay your premiums

-

Coverage can be used at on-campus health centers

-

Plans are often cheaper than outside policies

-

Coverage options may be limited

-

You may have to be a full-time student to qualify

-

You may not be able to keep your current healthcare providers

School-provided insurance policies typically cost between $1,500 and $2,500 per year. Thats significantly cheaper than the average annual premium for an individual with non-school coverage. According to the Kaiser Family Foundation, the average annual premium for single coverage through a non-school provider is $7,470.

School insurance plan premiums are typically tacked onto your tuition and fees, so you can use financial aid to pay for your insurance premiums. With a school-offered plan, you can use your coverage at student health centers on-campus, making it convenient when youre ill.

However, school plans can vary widely in terms of coverage options and networks. You may not be able to customize your plan, and you may not be able to visit your current healthcare providers because they arent in-network. Additionally, you may have to maintain full-time student status to keep your coverage. If you need to take a break from school or decide to drop down to half-time status, youll have to find other insurance.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

What Is Student Health Insurance

Student health insurance is simply a health insurance plan that covers students, which can include health plans you purchase through your school.

Health problems tend to become more common with age, so young adults fortunate enough to be in good health may think that paying a monthly premium for coverage they wont use is a waste of money. But having insurance can actually save you money in the long run all it takes is one emergency or bout of illness to tack on some medical debt.

There is a variety of health insurance for college students available to choose from, depending on your specific situation. Typically, college students have the following options, which are explained in further detail below: