What Is The Minimum Employer Contribution For Health Insurance

There is no national rule governing the minimum employer contribution for health insurance. Many state legislatures have passed regulations that require employers to contribute at least 50% of employee health insurance costs, but in 2021, the Kaiser Family Foundation found that the average employer contributed 83% of the premium for individual coverage and 73% for family plans.

Sean Peek and Katharine Paljug contributed to the writing and reporting in this article. Source interviews were conducted for a previous version of this article.

What Impacts Expat Health Insurance Cost

The cost of expat health insurance varies so dramatically because there are so many factors affecting how we calculate premiums. The most important factors are:

- Where you need coverPrivate healthcare is more expensive in certain countries and regions.

- Your age Generally speaking, the older you are the more healthcare youre likely to need. Premiums get more expensive as you get older.

- Medical history Health insurance doesnt typically cover pre-existing medical conditions. Sometimes, you may need to pay an additional premium to get cover for such conditions.

- Optional extras Perhaps you need cover for complex dental treatment or temporary cover in the USA.

Unlike other providers, your claims history while youre a member with William Russell wont affect your renewal premium. Unlike other providers, we dont think its fair to penalise members based on legitimate claims theyve made in the past. Further, it discourages people from receiving the medical treatment they need because they are concerned about the cost of their renewal premium.

Weve published a full guide on how we calculate premiums for health insurance.

Worried about the cost of health insurance?

Read Also: How To Find Health Insurance In Colorado

What Does Commerce Consider In Reviewing Rates

Commerce does not set health insurance rates. Instead, it reviews information submitted by insurance companies to determine whether their proposed rates are justified. Rates must be justified both by the benefits that consumers receive for their premiums and by the insurance companies ability to pay expected medical claims costs. Premium rates typically rise each year due to increasing costs and use of medical care and prescription drugs.

Commerces annual review also ensures that policies comply with state and federal laws that protect consumers — including laws that require coverage of pre-existing conditions, no-cost preventive care, and an adequate provider network.

Recommended Reading: Does Farmers Insurance Sell Health Insurance

Prices Are Rising For Americans Looking For Health Coverage For The Coming Year Though Costs In Some States Have Reduced

Healthcare costs are increasing for most Americans in 2023. Without a public healthcare system price rises in some states may put thousands onto worse coverage plans and potentially leave them staring at financial ruin for a problem that was not their fault.

According to valuepenguin.com, the average monthly cost of health insurance in the United States is $560, a 4% increase on 2022s $531. This is based upon the average silver plan cost for a 40-year old applicant.

Here is the table of averages for the different plans.

| Tier | |

|---|---|

| $685 | 7.55% |

Two states, Wyoming and West Virginia, have healthcare costs that are 50% more expensive compared to the national average, with both having annual costs of over $10,000 a year on the silver plan alone.

SHAREHOLDERS CHOICE HEALTHCARE

Brittlestar

Three states have silver plans that cost less than half of this crazy figure: New Hampshire, Maryland, and Minnesota.

The states that are becoming much more expensive in 2023 compared to 2022 are: Georgia , Colorado , and Wyoming . The states becoming more affordable are: Virginia , Louisiana and Idaho .

What Can You Expect To Pay For Health Insurance Deductibles

The average health insurance deductible for an ACA marketplace plan is slightly more than $5,000.

Most ACA plans are either Bronze or Silver plans, which have deductibles that are often over $2,000. You may find a lower deductible plan, such as $1,000 or less, on the Gold tier, but those health plans come with higher premiums.

Don’t Miss: Can A Married Dependent Be On Health Insurance

Tips For Finding Healthcare Coverage

With the rising costs of healthcare, how can Americans save on healthcare and the cost of insurance? Be diligent, and do your research to compare plans. That way, you can get the most comprehensive health coverage you can afford.

If your employer offers health insurance and pays for a large portion of the premium, it is a great option to think about. If not, shop the health insurance exchange for affordable coverage. Check to see whether you qualify for any subsidies to help offset the cost of health insurance. Health savings accounts can also help you pay for out-of-pocket expenses such as co-pays and deductibles.

Finally, if you have a catastrophic accident or illness, ask the hospital for help with a payment plan. Many hospitals will reduce their charges for those who are unable to obtain insurance.

Firms Of All Sizes Are Feeling The Weight Of Rising Premiums

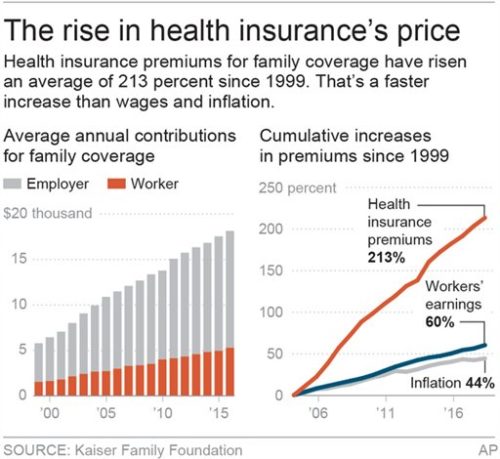

Health care has been one of the fastest-growing segments of the economy,69 rising from $2.6 trillion in 2010 to $4.1 trillion in 2020at which point it represented nearly 20 percent of U.S. gross domestic product.70 Premiums for ESI have also risen steadily for both individual and family coverage. According to the 2022 Kaiser Family Foundation Employer Health Benefits Survey, individual coverage premiums rose 58 percent, from an average of $5,049 annually in 2010 to $7,911 in 2022.71 Over the same period, family coverage premiums rose more than 63 percent, from $13,770 to $22,463.72 Put another way, the annual premium for individual coverage has risen more than $225 per year on average, and family coverage has risen more than $700 per year on average from 2010 to 2022.73

The annual premium for individual coverage has risen more than $225 per year on average, and family coverage has risen more than $700 per year on average from 2010 to 2022.

Among the tactics that employers can use to address rising premiums, besides switching the type of plans offered, are self-funding their insurance plan and modifying plan benefit design to shift costs from premiums to out of pocket.

Self-funded vs. fully funded ESI plans

How higher deductibles shift costs onto employees

Deductibles in ESI plans are becoming both more common and more expensive.

Don’t Miss: Why Is Health Insurance So Expensive

What Counts As Obamacare

When people say Obamacare insurance, they are typically referring to individual and family plans bought on the health insurance Marketplace created to help implement the Affordable Care Act. The ACA was created to expand healthcare access and reduce associated costs. All Obamacare plans include essential health benefits such as free preventive care and mental health services.

Dont Miss: Which Health Insurance Company Is The Best For Medicaid

Tax Relief In 202: Net Income Increases For Almost All Employees

Less

taxes

New tax rules ensure that the net income of almost all employees increases despite higher social security contributions.

The basic tax allowance increases in 2023 to 10,908 euros and in 2024 to 11,604 euros .

Furthermore, the full pension expenses will be tax deductible in future – up to a maximum of EUR 26,527.80.

Double the amount applies to married and officially civil partners.

Originally, only 96 percent of the expenses should be tax deductible in 2023.

As in previous years, the key values of the income tax rate will also be adjusted.

If you imagine a coordinate system, the tax rate is shifted to the right.

Higher tax rates are therefore only due with a higher income.

This is intended to compensate for the so-called cold progression.

High earners benefit

What will change in net wages at the end of the year?

There is definitely a plus.

Since employees with very high incomes in particular benefit from tax relief, they record a particularly high net plus at the turn of the year.

Employees in tax class I or IV, who earn a gross monthly income of 7,000 euros, still get a monthly plus of 82 euros – without further tax deductions.

For comparison: With a monthly gross of 2,000 euros, the monthly plus is only 16 euros .

single parent

For single parents who have a taxable income, 2023 will bring further relief.

The Annual Tax Act 2022 increased the tax relief to EUR 4,260 .

This amount applies to the first child.

Tip:

You May Like: What Are The Best Health Insurance Companies In New York

More Net From The Gross How Much Will The Tax Relief Bring In 2023 Five Tips For The New Year

More money in the new year: Almost all employees can count on tax relief in the coming year.

The higher the earnings, the greater the plus.

For almost all employees, the net wage increases at the turn of the year.

High earners have the biggest plus, as our overview shows.

Munich – 2023 the basic tax allowance will increase considerably.

Employees therefore have to pay less tax.

In the case of social insurance, on the other hand, it will be somewhat more expensive.

On average, employees have to pay 0.25 percentage points more in contributions.

The total is now 20.225 percent.

For childless people over the age of 23, 0.35 percentage points are added.

What is the development in the individual social insurances?

Does Aarp Have Burial Insurance

Yes and no. AARP is not a life insurance company. But, they do market burial insurance policies that are sold through New York Life.

You will want to do your homework here. AARPs burial insurance program includes premiums that increase as you age, often making the policy cost-prohibitive at some point.

Also Check: How To Be A Health Insurance Agent

How Is Medicare Changing With The 2023 Cola

For the first time in more than a decade some Medicare recipients will see a . Those in receipt of Part B coverage will have their standard monthly premium lowered by $5.20 in 2023, to $164.90.

Part B coverage focuses on two types of service: the medically necessary and preventative treatments. This covers everything from ambulance services and medical equipment to mental health support and a selection of outpatient prescription drugs.

Medicare Part A premiums will increase slightly in 2023, with monthly costs fixed between $278 and $506, depending on how long you or your spouse worked for and the amount of Medicare taxes paid.

The costs for Part C and Part D coverage will vary greatly between individuals because they are reflective of local state funding efforts and the price of drugs that you may be claiming through the insurance.

US NEWS

You Both Have Employer

If youre both employed by a company or companies that contribute to your health insurance premiums, maintaining your individual coverage with your respective employers is almost always the cheapest way to go.

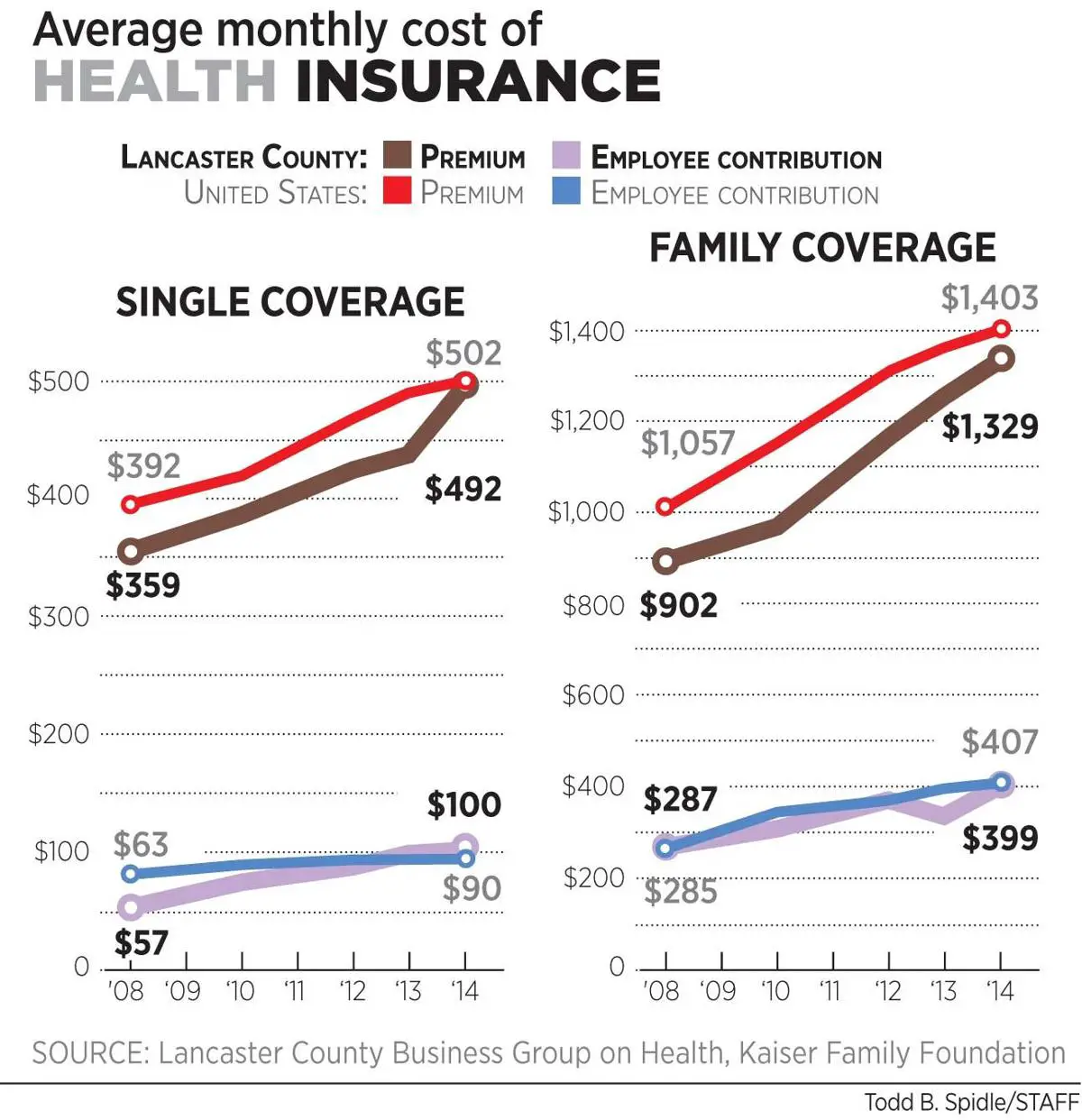

Thats because employers typically require very low contributions from their employees to the plan cost even if it feels like a lot coming out of your paycheck. According to the Kaiser Family Foundation , employees pay only 17% of the premiums on individual plans on average, which you can do if you both have that option, and 27% on family plans.

In 2020, that breaks down the average health insurance costs you can expect to pay for an individual or family plan:

Again, the cost of a family plan may vary depending on how many people youre adding to the plan. Also, its important to note that the cost of your premium will also depend on where youre located and the amount to which your employer is able and willing to contribute to your health insurance costs.

In some cases, an employer may pay the full amount, but most employees can pay at least some of the cost.

Speak with your human resources representative about how much it would cost to combine health insurance coverage with your partner into a single plan, and have your spouse do the same. Note that you can add your spouse to your plan within 60 days of getting married. Otherwise, youd need to wait until open enrollment.

Don’t Miss: How Much Does The Health Insurance Cost

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you need to do in order to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

How Much Does Health Insurance Cost In The Usa

See how much health insurance costs? Citizens across the United States of America pay premiums for health insurance, but these premiums paid monthly or annually vary greatly, as the value of these premiums is not determined according to health or gender, thanks to the Affordable Care Act – with some exceptions – but rather determined according to several factors We will address it below

Several factors contribute to determining the value of health insurance premiums such as state and federal laws that regulate costs, where you live, whether or not the job provides insurance, and the type of insurance plan chosen.

The annual value of insurance coverage for a family of four is $20,576, and 71% of this cost is borne by business owners .

Perhaps the rising cost of health insurance explains the lower salaries over the past two decades.

The highest premium for a standard insurance plan is $723 in Wyoming, while the lowest is $282 in New Mexico.

Deductions may vary based on the size of the company the insured works for, or based on the type of insurance plan.

Factors affecting the value of the insurance premium:

There are many factors that influence the amount of health insurance payments that are not under control, so it would be good to understand what those factors are. These factors are:

State and federal laws, which determine what insurance must cover and how much the insurance will cover.

Will the insured obtain insurance through his job or personally?

Service point plans.

Recommended Reading: What Is Meridian Health Insurance

Obvious Health Insurance Costs

Your health insurance plan premium is an obvious cost, and most people pay it on a monthly basis. Your premium is the payment you make to your health insurance company that keeps your coverage active. Other more obvious health insurance costs include deductibles, coinsurance and copayments. You may already be familiar with some of these terms. Here are quick definitions and simple examples.

What Determines The Cost Of Health Insurance

A handful of factors will influence how much health insurance costs for you.

- Age: Typically, the younger you are, the less health insurance costs and vice versa.10

- Location: As stated earlier, the state you live in will influence how much youll spend on health insurance costs.

- Type of Plan: HMOs are typically the least expensive health insurance plan, but you must receive care from a provider within the given organization.11 On the other hand, PPOs can be more expensive, but you can see a wider range of providers.12

- Tobacco Use: Using tobacco can dramatically increase the cost of health insurance.13

Recommended Reading: What Is Short Term Health Insurance

How Age Factors In

Young people, who are expected to benefit from lower premiums should the GOP repeal-and-replace efforts succeed, already pay the least. But even their costs can be considerable, depending on where they live. In 2016, the financial data siteValuePenguin found that the average costs for coverage for a 21-year-old go from $180 a month in Utah, plus a $2,160 deductible , to $426 a month in Alaska, with a $5,112 deductible .

As a reminder, 72 percent of young millennials, aged 18-24, have less than $1,000 in their savings accounts and 31 percent have nothing saved at all.

How Much Does A Burial Policy Cost

The cost of a burial policy varies depending on the type of coverage and provider.

Generally, final expense policies are less expensive than other types of insurance, because the coverage amounts are modest.

The amount you pay for a burial policy will depend on factors like your age, gender, health history and the death benefit amount you choose.

Premiums can range from $15 to $50 per month for smaller amounts of coverage , and up to several hundred dollars per month for larger death benefits .

Don’t Miss: Can I Still See A Doctor Without Health Insurance

Statistical Tests For Iv Validity

The complete tests for the validity of the IV analysis are available in the appendix tables, which report the linear first-stage insurance equation, the linear observational, and IV health status equations, and the regression of the residuals from the health status equation against the models exogenous variables. Each of the exogenous identifying variables is statistically significant, and the F-test for their joint significance is 15.9. Having a spouse who belonged to a union has a positive effect on insurance coverage, while involuntary job loss has a negative effect on coverage. People who were foreign born also have less coverage, although this effect diminishes the longer the time has passed since the person entered the U.S. The partial R2 for the additional variables is 0.021, which accounts for 12.3 percent of the variance explained by the first-stage model for insurance coverage.

In the second test, the R2 from the regression of all the independent variables against the residuals from the health model is 0.0008, which produces a test statistic of 2.85. The corresponding critical value of the 2 distribution is 7.78 at the 10 percent level of significance. Thus, we accept the null hypothesis that the exogenous variables are uncorrelated with the residuals. These results indicate that the insurance IV satisfies the standard tests for identifying a weak instrument.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees