Pros And Cons Of Hmos

These are some advantages of HMOs, compared to other health insurance plans.

- Budget-friendly

- One doctor coordinates and manages your care

The disadvantages of HMOs, compared to other health insurance plans, include:

- Youâre limited to in-network providers, unless itâs an emergency.

- If you use an out-of-network provider, you may pay the full cost.

- To see a specialist, you need a referral from your primary care doctor.

- You need prior approval from the HMO for certain services.

- If your doctor is out-of-network, you may have to switch to another one.

- The HMO may require you to try less expensive tests or treatments before it covers more expensive ones.

What Companies Provide Hmo Plans

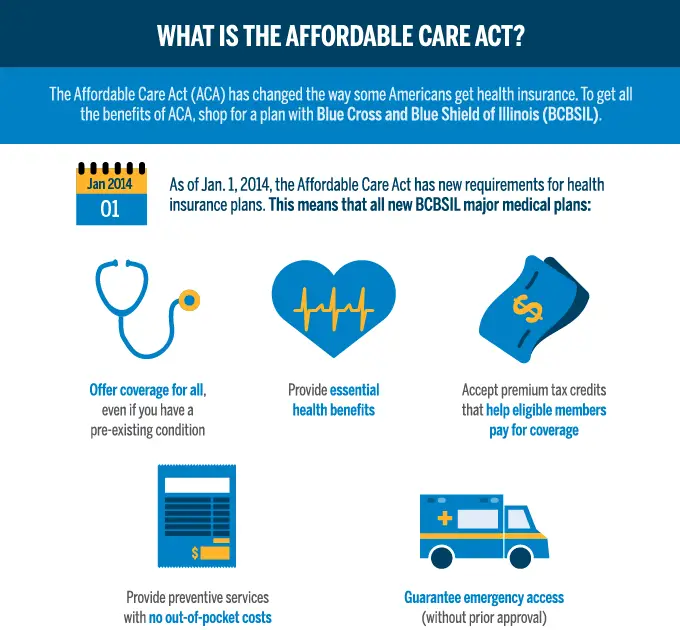

Many health insurance providers offer HMO plans. You can purchase an individual HMO plan through a private carrier, through the ACA marketplace, or through your employer. Some of the health insurance companies that sell HMOs include:

- Blue Cross Blue Shield

- Humana

- UnitedHealthcare

When comparing HMO plans, its essential to do your research. Many health insurance providers offer multiple HMO plans and some are more flexible than others. Additionally, some providers sell high-deductible HMO plans, which have an even lower premium but more out-of-pocket costs when you need care.

How Much Does An Hmo Plan Cost

HMO health insurance plans pay designated providers fixed fees for delivering a range of services to HMO beneficiaries. In turn, the beneficiaries then pay monthly premiums to receive care through the insurance plans. By restricting access to in-network providers, the HMO insurance plan is able to provide lower costs and care coordination, usually resulting in cheaper premiums, deductibles and co-pays. The average monthly cost of an HMO health insurance plan is $427 compared to $517 a month for a preferred provider organization, or PPO.

| Plan type |

|---|

| $517 |

Recommended Reading: What Is Catastrophic Health Insurance

Which One Is Right For Me

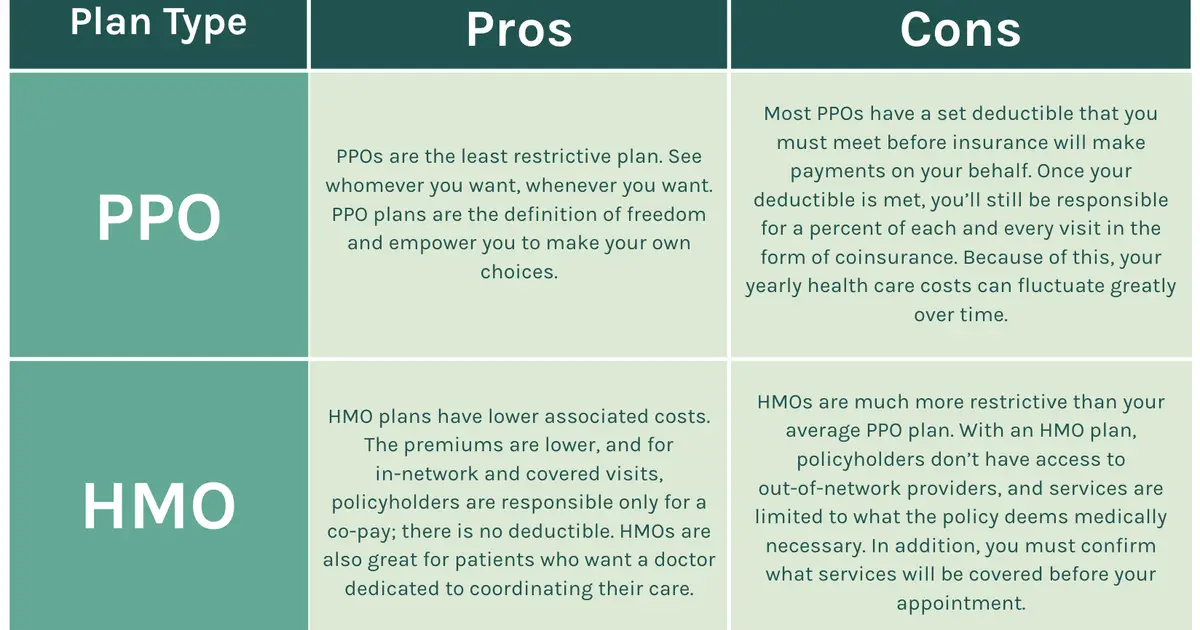

If you prefer to have your care coordinated through a single doctor, an HMO plan might be right for you. And if you want greater flexibility or if you see a lot of specialists, a PPO plan might be what youre looking for.

For more information on HMO and PPO plans, check out our available individual and family plans.

You Need A Primary Care Provider

Your primary care provider, usually a family practitioner, internist, or pediatrician, will be your main healthcare professional and coordinate all of your care in an HMO.

Your relationship with your primary care provider is very important in an HMO. Make sure you feel comfortable with them or make a switch.

You have the right to choose your own primary care provider as long as they are in the HMOs network. If you dont choose one yourself, your insurer will assign you one.

You May Like: Does Robert Half Offer Health Insurance

An Hmo Plan Vs A Ppo Plan Whats The Difference

HMO Health Insurance Plans. An HMO gives you access to certain doctors and hospitals within its network. A network is made up of providers that have agreed to lower their rates for plan members and also meet quality standards. But unlike PPO plans, care under an HMO plan is covered only if you see a provider within that HMOs network.

Hmo Plans: What Are They And How Do They Work

Find Cheap Health Insurance Quotes in Your Area

Health maintenance organizations, HMOs, are a type of provider network that requires beneficiaries to obtain care through that network except in cases of emergencies, making the plans more restrictive but less expensive than other health plans. With an average cost of $427, HMOs are the cheapest provider network available within health insurance.

Don’t Miss: Does Home Depot Have Health Insurance

What Does Hmo Mean

The designation HMO indicates some important things for a consumer. The consumer can expect low prices for services with low out-of-pocket expenses. HMO plans are often lower in price than comparable PPO plans because they do not pay for outside services.

The HMO model negotiates low prices with doctors and hospitals in its network and promises to send them high volumes of patients. The below-listed items describe the important features of the HMO.

Fffs: Fixed Fee For Services

Original Medicare is an excellent example of this type of care. The Centers for Medicare and Medicaid sets prices for services that it will pay to medical care providers that accept Medicare. The subscriber may have to pay the balance, or the provider may accept the Medicare payment in full and final settlement of the claim.

Don’t Miss: Can You Get A Physical Without Health Insurance

How Does An Hmo Plan Work

As a member of an HMO, you’ll be required to choose a primary care physician . Your PCP will take care of most of your healthcare needs. Before you can see a specialist, you’ll need to obtain a referral from your PCP.

Though there are many variations, HMO plans typically enable members to have lower out-of-pocket healthcare expenses. You may not be required to pay a deductible before coverage starts and your co-payments will likely be minimal. You also typically won’t have to submit any of your own claims to the insurance company. However, keep in mind that you’ll likely have no coverage for services rendered by out-of-network providers or for services rendered without a proper referral from your PCP.

Why Would A Person Choose A Ppo Over An Hmo

Choosing an HMO or PPO plan is based entirely on personal preference. Here are some facts that may help you decide whats best for you:11

- More people are enrolled in PPO plans than HMOs.

- In 2020, 47% of covered workers enrolled in an employer-supplied health insurance plan chose a PPO, compared to just 13% of covered workers who chose an HMO.

- HMO vs. PPO annual customer satisfaction ratings of more than 1,000 health insurance plans are conducted by the National Committee for Quality Assurance. Their most recent data set was published in 2019.12

Read Also: Do I Have To Have Health Insurance

Can I Change My Pcp

Of course! You can change your PCP or medical group/IPA at any time, except if you are hospitalized or in the 2nd or 3rd trimester of pregnancy.

- To change doctors within the same medical group: Search Provider Finder to find doctors in your medical group. Then, call the medical group on your BCBSIL ID card and ask to change doctors.

- To change to a different medical group:

- OnlineChoose the Change MG linkFollow the instructions

Hdhp With Hsa: Offset Out

A High Deductible Health Plan has low premiums but higher immediate out-of-pocket costs. Employers often pair HDHPs with a Health Savings Account funded to cover some or all of your deductible. You may also deposit pre-tax dollars in your account to cover medical expenses, saving you about 30%. And remember, depending on your age, services such as mammograms, colonoscopies, annual well visits and vaccinations may be covered free of charge, even if you havent met your deductible.

An HDHP can be an HMO, POS, PPO or EPO. People who are managing a health condition but cant afford higher monthly premiums may find that an HDHP saves them money in the long run.

Myron is a 60-year-old book editor in Philadelphia. He and his longtime boyfriend, Joseph, who maintain separate homes, love to travel. But lately, Myrons health issues, ranging from high blood pressure to weakened kidneys, have slowed them down. Myron is determined to get things back on track and that means keeping up with regular doctor visits. With that in mind, he switches to an HDHP.

Read Also: Can You Buy Out Of State Health Insurance

If You Already Have A Doctor You Like Does The Plan You Are Considering Cover Visits With Him Or Her

While CareFirst’s HMO plans have especially wide networks compared to many other HMOs, the PPO plans still offer in-network coverage for more health care providers. If you would like to keep your doctor, you can determine whether he or she is in-network under an HMO plan, a PPO plan or both.

Choosing the right health plan can give you peace of mind, knowing that your insurance plan has your health needs covered.

Need an individual or family health insurance plan?

What Is The Difference Between An Hmo And A Ppo

- Patients in with an HMO must always first see their primary care physician . If your PCP cant treat the problem, they will refer you to an in-network specialist. With a PPO plan, you can see a specialist without a referral. .6

- With an HMO plan, you must stay within your network of providers to receive coverage. Under a PPO plan, patients still have a network of providers, but they arent restricted to seeing just those physicians. You have the freedom to visit any healthcare provider you wish.

So, whats the catch? Well, staying in your network with an HMO, you can expect the maximum insurance coverage for the services you receive according to your plan. Go outside of your network and your coverage disappears. With a PPO, you can visit doctors outside of your network and still get some coverage, but not as much as you would if you remained in your network.

So, because a PPO does not restrict you in your choice of physician, a PPO is the way to go, right? Not necessarily. There are many more things to consider when deciding between the two.

Lets discuss some of those now.

You May Like: Is Family Health Insurance Cheaper Than Individual

American Disabilities Act Notice

In accordance with the requirements of the federal Americans with Disabilities Act of 1990 and Section 504 of the Rehabilitation Act of 1973 , UnitedHealthcare Insurance Company provides full and equal access to covered services and does not discriminate against qualified individuals with disabilities on the basis of disability in its services, programs, or activities.

Tips On Healthcare Funding

- There are many ways to approach funding healthcare costs. An experienced and qualified financial advisor can help choose the most cost-effective and flexible approach for you. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor, get started now.

- As you shop around for affordable healthcare, it is important to maintain a healthy budget. A comprehensive budget calculator can help you understand which options are good candidates for you.

You May Like: Does Health Insurance Cover Vision

Its All About You We Want To Help You Make The Right Legal Decisions

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesnt influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

HMO: An HMO is an organization that provides or arranges for coverage of certain health care services required by members of the organization. Typical HMO coverages include access to a primary care physician, emergency care, and specialists/hospitalization when needed.

Many HMOs operate with preventative medicine in mind by addressing your health care needs while you are healthy so as to prevent disease or illness.

Critics of HMOs address concerns as to a lack of selection of primary care physicians, assembly line medicine, and denial of adequate referrals in the event of disease or illness. Critics often claim that a HMO may deny certain claims and may make health care decisions based upon a pure profitability standpoint as opposed to decisions driven by providing the best level of care for its patients.

HMOs are valuable in providing good care for many members many HMOs organizations take very good care of their members health care needs while managing costs.

What Is A Ppo

A Preferred Provider Organization , is a type of health plan that offers a larger network so you have more doctors and hospitals to choose from. Your out-of-pocket costs are usually higher with a PPO than with an HMO or EPO plan. If you’re willing to pay a higher monthly premium to get more choice and flexibility in choosing your physician and health care options, you may want to choose a PPO health plan.

Recommended Reading: How Much Is Health Insurance When You Retire

Understanding The Advantages & Disadvantages Of Different Insurance Plans

One of the big decisions every American must make is what type of health insurance to select that best meets their health needs, allows them to see their preferred doctors, and is within their budget. The 2 primary options arePPO insurance and HMO insurance plans. PPO stands for preferred provider organization” and HMO means health maintenance organization. But what do they mean?

Although there is no cut-and-dry answer to which insurance works for everyone, there are clear advantages and disadvantages to each type of insurance plan that can guide you in making the decision that works best for your needs.

Ppo: The Plan With The Most Freedom

A Preferred Provider Organization has pricier premiums than an HMO or POS. But this plan allows you to see specialists and out-of-network doctors without a referral. Copays and coinsurance for in-network doctors are low. If you know youll need more health care in the coming year and you can afford higher premiums, a PPO is a good choice.

Jenelle, 38, of Jacksonville, FL, has been married for five years. The couple is having difficulty conceiving and has seen a number of fertility specialists. When her employer offered three choices for health plans, Jenelle picked the PPO. She pays more for one fertility doctor whos out of network, but she doesnt mind: Her mission is to get pregnant.

Read Also: Do You Have To Carry Health Insurance

Advantages And Disadvantages Of Msa Insurance

An MSA plan is good for a small business because the premiums are more affordable. Instead of having a policy with high premiums and low co-pays the MSA offers a high deductible in case of an emergency or a major medical expense. The member has complete control over doctor and facility selection. The MSA plan requires the member to make regular deposits into a medical savings account to cover minor expenses. The member has to be able to afford the bill before meeting the requirements for the deductible. All deductibles must be paid to in order to receive any kind of medical care. A disadvantage for large businesses is that this type of plan is not available. Deposits made toward the medical savings plan are one hundred percent tax–deductible, and can be used towards any out of pocket medical expenses. For example, deductibles and regular office visits would be paid using the MSA. This allows you to pay for healthcare expenses with pretax dollars, a great advantage. All of the money that is not used for medical expenses will stay in the account until needed. This plan is one of the most expensive plans giving the least amount of restrictions. Here is a link to a company that offers an MSA:.

What Are The Pros And Cons Of A Hmo

HMO properties offer a higher yield vs buy to let properties.

Is a HMO better than a PPO?

HMOs are more budget-friendly than PPOs. HMOs usually have lower monthly premiums. Both may require you to meet a deductible before services are covered, but its less common with an HMO.

Why to choose a HMO?

You have a true picture of your actual healthcare costs. Youd rather save money on lower premiums and pay more out-of-pocket when you do need care. You want to take advantage of contributing to a pre-tax Health Savings Account.

Don’t Miss: When Did Health Insurance Start In The Us

Insuranceopedia Explains Health Maintenance Organization

Typically, HMOs require members to choose a PCP who directs access to the necessary medical services. A PCP will not issue a referral unless it meets the HMO guidelines. However, other combined health insurance products, such as open access or point of service, may offer more freedom outside the approved provider network.

Moreover, HMOs often provide preventative services, such as physicals and immunizations, for free to lower the likelihood of the members developing preventable conditions that would later require various medical services and increases costs for the HMO.

Related Question

Hmo And Types Of Managed Care

The HMO was one of the early types of managed care it was distinguished by a major commitment to preventing illnesses rather than simply treating them. Most managed care systems have some of the elements of the HMO. The below-listed items provide descriptions of HMO and the other major types of managed care.

Read Also: Who Accepts Ambetter Health Insurance

What Do Hmos Cover

HMOs cover a wide variety of medical services, including doctor visits, urgent care, hospitalization, lab tests, imaging, and prescriptions, says Decker.

Preventative care services are typically covered at 100%, with no copayment or coinsurance. But remember, you can only get coverage for these services through an in-network doctor.

Although HMOs offer comprehensive coverage, there can be restrictions in terms of the number of visits allowed. If youre someone who visits the doctor frequently, you may find that an HMO doesnt offer enough coverage for your needs. Also, if you regularly see specialists, you may not like getting referrals from the primary care physician.