Instead Pick A Plan That Gives You:

- The right amount of coverage for your health needs

- A lower deductible

- Clear out-of-pocket costs

You may need more unexpected medical care if you have kids, even if theyre healthy. Make sure to think twice before picking a bargain plan. It could easily cost you more money and be a bigger headache in the end.

Choosing a health plan for your family is an important decision. I encourage you to consult an adviser, plan representative or other trusted partner to help make the decision.

Factors That Impact Health Insurance Rates

For a particular health insurance plan, the cost of coverage is determined by certain factors that have been set by law. States can limit the degree to which these factors impact your rates: For instance, some states like California and New York don’t allow the cost of health insurance to differ based on tobacco use.

- Age: The health care cost per person covered by a policy will be set according to their age, with rates increasing as the individual gets older. Children up to the age of 14 will cost a flat rate to add to a health plan, but premiums typically increase annually beginning at age 15.

- Where you live: Health insurance companies determine the set of policies offered and the cost of coverage based on the state and county you live in. So a resident of Miami-Dade County in southern Florida, for instance, may pay lower rates for the same policy than a resident of Jackson County, in the Florida Panhandle.

- Smoking/tobacco use: If you smoke, you could pay up to 50% higher rates for health insurance, though the maximum increase is determined by the state.

- Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each person’s age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

Why Do Insurance Premiums Change

In profitable years, an insurance company may not need to increase insurance premiums. In less profitable years, if an insurance company sustains more claims and losses than anticipated, then they may have to review their insurance premium structure and re-assess the risk factors in what they are insuring. In cases like this, premiums may go up.

Don’t Miss: How Much Does Starbucks Health Insurance Cost

How To Get The Lowest Insurance Premium

The trick to getting the lowest insurance premium is finding the insurance company that is most interested in insuring you.

When an insurance company’s rates go too high all of a sudden, it is always worth asking your representative if there is anything that can be done to reduce the premium.

If the insurance company is unwilling to change the premium they are charging you, then shopping around may find you a better price. Shopping around will also give you a better understanding of the average cost of insurance for your risk.

Asking your insurance representative or an insurance professional to explain the reasons why your premium increases or if there are any opportunities for getting discounts or reducing insurance premium costs will also help you understand if you are in a position to get a better price and how to do so.

Explore Your Options With Firstquote Health

The bottom line is this, if you have health insurance, you will pay for your care in one way or another. There are very few occasions where one might receive free healthcare, so it is important that you make the right financial choice for the long run. If you are ready to take the plunge, and purchase some health insurance, then FirstQuote Health is a great place to start.

FirstQuote Health takes the pain and hassles out of shopping around for health insurance plans by letting you compare quotes in your area side by side. To get started, enter your zip code, and get coverage for you and your family as quickly as today.

Popular Articles

Don’t Miss: Does Starbucks Have Health Insurance

How Do Premiums Deductibles Cost

Generally,the more benefits your plan pays, the more you pay in premium. But your medicalexpenses for care are lower.

Toillustrate how these costs may influence your choice of plans, consider the ACAplans.

Inaddition to the metallic plan categories, some people are eligible to purchasea plan with catastrophic coverage. Catastrophic plans have very low premiums andvery high annual deductibles . However, they pay for preventivecare regardless of the deductible. These plans may be a suitable insuranceoption for young, healthy people. To qualify for a Catastrophic plan, you mustbe under age 30 or be of any age with a hardship exemption or affordabilityexemption . Learnmore about Catastrophic coverage.

Examples Of Premium Use

1. short-term health insurance plan with a $100 per month premium. She chose a $10,000 deductible plan, since the monthly premium for a $5,000 deductible plan would be higher.

2. Mike and Mary have an Affordable Care Act marketplace silver plan from Molina. Mike and Mary are both covered, along with their two children. To insure 4 people, their total premium would be $1,200 per month.

Luckily, Mike and Mary qualify for monthly premium subsidies, since they make $65,000 per year. The government will send a check directly to their health insurance plan to cover some of their familys premium.

Before Mike and Mary chose their plan, they learned that their final premiums would be $400 per month total after those automatic subsidies, instead of $1,200. It will cost $4,800 to keep their family of 4 on a health plan for the entire year.

Read Also: Uber Driver Health Insurance

How To Pay Your Health Insurance Premium

If you have employer-sponsored health plan, its likely that your premium payment comes directly through a payroll deduction. You can check your paystub to confirm.

If you bought an individual plan on the Obamacare marketplace, you will make your payment to the insurer according to their terms. Each health insurance company has different guidelines regarding your payment options.

Tips When Shopping For Health Insurance With Austin

It is open enrollment, the time of year when people can choose a new health insurance plan. This year, many businesses and individuals will receive an unwelcome surprise a notice from their current health insurance company that their monthly premiums will jump.

Dr. Ben Aiken, vice president of medical affairs at Austin-based benefits company Decent, joined Studio 512 Co-Host Rosie Newberry to address your health insurance questions.

What is open enrollment?

Open enrollment is the time period each year when companies or individuals are allowed to start, stop or change their health insurance plan.

What are some key tips for choosing a health insurance plan?

Review your current plan option, even if you like yours. Know how much healthcare you or your employees want and need. Compare your annual costs, not just premiums . If you need help, ask a professional.

Nearly half of all workers in America work for small businesses. Yet most cant access affordable health insurance and other benefits like large corporations, because its just too costly. We want to help level the playing field for small businesses. And never has health insurance been more important than during COVID.

Where can people go to learn more about Decent?

For more information, visit Decent.com or reach out to Dr. Aiken directly via his email: [email protected].

Don’t Miss: Starbucks Health Insurance Part-time

Average Cost Of Health Insurance

One of the primary factors in your individual health insurance costs is your location, as prices will vary depending on the state and county in which you live. In this first table, we look at health insurance premiums for 2022 and how they differ by state.

| State |

|---|

Policy premiums are for a 40-year-old applicant on a silver plan.

How Can I Lower My Monthly Health Insurance Cost

Who is this for?

If you’re wondering how you can save money on your premium for individual and family health insurance, this explains some strategies.

You can’t control when you get sick or injured. But you do have options when it comes to what you pay for your health insurance premium. That’s the monthly payment you make to your health insurance company to maintain your health care coverage. Here’s how you may be able to lower your bill.

Also Check: Starbucks Health Insurance Plan

How Can I Lower My Health Insurance Premium

If you have an individual and family medical plan , federal financial assistance may be available to help lower your out-of-pocket medical expenses and/or your premium. To find out if you qualify, visit www.healthcare.gov.

Understanding key health insurance terms can help you decide what health plan may be the right choice for you. Your monthly health insurance premium is an important factor to consider.

How To Estimate Your Yearly Total Costs Of Care

In order to pick a plan based on your total costs of care, youll need to estimate the medical services youll use for the year ahead. Of course its impossible to predict the exact amount. So think about how much care you usually use, or are likely to use.

- Before you compare plans when youre logged in to HealthCare.gov or preview plans and prices before you log in, you can choose each family members expected medical use as low, medium, or high.

- When you view plans, youll see an estimate of your total costs including monthly premiums and all out-of-pocket costs based on your households expected use of care.

- Your actual expenses will vary, but the estimate is useful for comparing plans total impact on your household budget.

You May Like: Starbucks Insurance Plan

Keep Costs Down Stay In Network With Provider Finder

Before you go for care, make sure you go to a doctor or hospital in your health plan network. These providers have agreed to work with your health plan to keep your costs down. If you visit a doctor outside of your network, you may have to pay more for your care. In some cases, you may have to pay the full cost.

Register or log in to Blue Access for MembersSM, our secure member website, for a personalized search experience based on your health plan and network.

Choosing A Plan With The Right Monthly Fees

You might think that the best option is to choose the plan with the lowest monthly fee. However, this isnt always the case. Health insurance plans that have a lower premium tend to have higher deductibles and copays. A high deductible means you may have to pay more of your own money for healthcare costs before your insurance kicks in. High copays means youll have a higher set fee for certain services, like visiting your primary care doctor or a specialist.

Choosing the right plan comes down to how you expect to use your health insurance. People who live with a chronic illness, for example, might anticipate many doctor visits, prescription medicines, and even surgeries throughout the policy year. For them, it may be worthwhile to choose a plan with a high premium. That way, they may have a low deductible, copay, and coinsurance, which will help them afford their health care throughout the year.

On the other hand, a low-premium plan might work fine for people who are generally healthy and dont anticipate many doctor appointments throughout the year. They may only need to use basic services, such as an annual checkup, which may even be free under their plan.

Got more questions about premiums or how to pick the right plan for you? Talk to a representative from your health insurance company who can break it down and give you personalized advice based on you and your familys needs.

Reviewed by: Review date:

Recommended Reading: What Insurance Does Starbucks Offer

How Much Does Group Health Insurance Cost

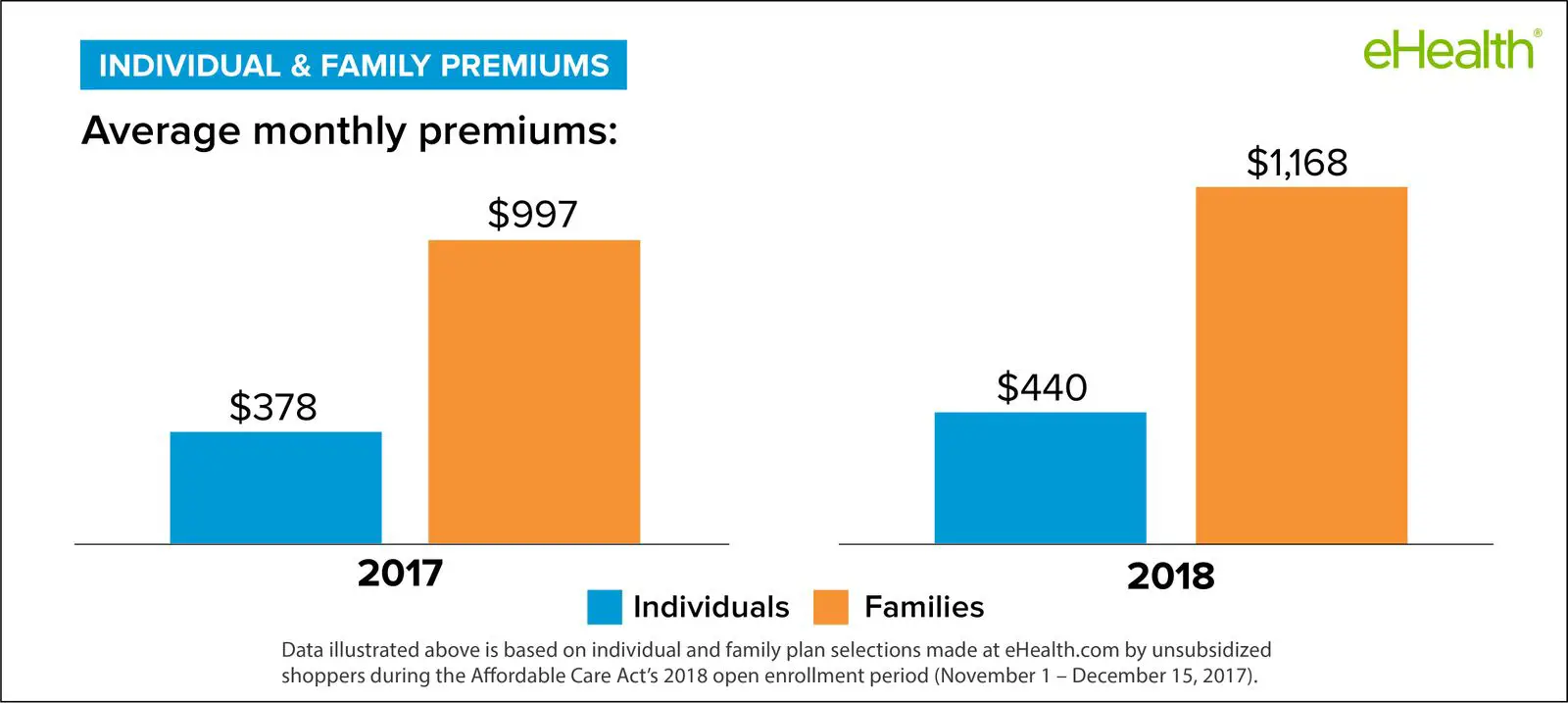

About 157 million people are covered by employer-based health insurance. But how much do companies pay for employee health insurance?

For a look into trends and costs over the years, the Kaiser Family Foundation conducts an annual survey.

In their recent findings, in 2020, the average monthly premiums for group health insurance increased from previous years to:

- $622 for individual coverage

- $1,778 for family coverage

Since 2019, average employer-sponsored individual premiums increased 4% and family premiums increased 4%. Moreover, the average premium for family coverage has increased 22% over the last five years and 55% over the last ten years.

Beyond Your Monthly Premium: Deductible And Out

- Deductible: How much you have to spend for covered health services before your insurance company pays anything

- Copayments and coinsurance: Payments you make each time you get a medical service after reaching your deductible

- Out-of-pocket maximum: The most you have to spend for covered services in a year. After you reach this amount, the insurance company pays 100% for covered services.

Also Check: What Benefits Does Starbucks Offer

Why Should You Buy Health Insurance Online

Safety

All insurance companies have made all the information available online. One can easily compile the same under one platform. It is always better that the policyholder selects and compares all the plans so that they can select the one that best suits their needs

Affordability

Online health insurance plans are more cost-efficient than offline ones. This is because of the no-involvement of agents and the policyholder can directly connect with the insurance company to buy the insurance

Flexibility

Online channels offer more flexibility to policyholders than offline channels, when it comes to buying insurance plans. Sitting in the comfort of our homes, one can compare and select different policies that suit oneâs needs

Choose A Plan That Pairs With A Health Savings Account

Health savings accounts, or HSAs, are accounts that you use to pay for medical expenses. You save on taxes with a health savings account because the money you put in and take out is either tax-free or tax-deductible.

You can also save on your monthly payment. Plans that pair with a health savings account have higher deductibles, so their premiums are lower.

Read Also: Does Starbucks Offer Health Insurance

Doing The Math On Hdhps

While it can seem like a straightforward choice based on how often youre using the health care system, its worth doing some side-by-side comparisons. Even with a chronic condition, a high-deductible plan with a low monthly premium and a generous employer HSA contribution might end up being cheaper than a traditional plan with a higher monthly premium and no employer contribution.

Costs to compare from plan to plan include:

-

Premium: This is the amount of money youll pay each month for the plan.

-

Deductible: This is the amount youll pay before your health insurance starts to cover care, with the exception of qualifying preventive care in some cases. Make sure you note if theres a deductible per person and an overall deductible for the family.

-

Copays and coinsurance: These are payments you make for medical services after youve hit your deductible. Copays are a set amount of money you pay for a particular service, such as $20 each time you see a specialist. Coinsurance is a percentage of the approved service cost, such as 20% of the cost of an office visit.

-

Out-of-pocket maximum: This is the most you could spend on covered health care in a year. There may be a per-person max and an overall family max.

-

Employer contribution: If youre comparing a high-deductible health plan to another plan, make sure you include any contribution your employer makes toward your HSA, which you can use to pay for medical care.

Two Things Determine Howmuch You Will Pay For A Year Of Healthcare

Premium

Think of this as your monthly bill the amount you must pay your insurance company on-time each month. It keeps your insurance active and helps cover the cost of services included in your plan like the preventive services.

Out-of-Pocket Costs

Health insurance is designed to share costs with you when you get healthcare or prescriptions. These shared costs come in two formscopayments and coinsurance. When these costs apply depends on the deductible and out-of-pocket maximum.

These shared costs come in two forms:

Copayments : A fixed amount $10 for example you owe for a medical visit or prescription that is covered by your health plan. It is usually due when you receive the service.

Coinsurance: A percentage of the costs 30% for example you owe for a medical visit or prescription that is covered by your health plan. You will receive a bill for this after you receive the service.

When these costs apply depends on two key details of your plan:

Deductible: The amount you have to spend on covered healthcare services and prescriptions before your health insurance company begins to pay a percentage of your bills.

Out-of-pocket maximum: The most youd ever have to pay for covered services and prescriptions in a plan year.

Read Also: Evolve Health Insurance

Think About Whether You Have:

- A favorite doctor or clinic

- Specialists

- A primary care doctor for chronic care or care coordination

I spoke to a member after she enrolled her family in a new plan for 2015. She took her two children for their regular check-ups at their usual clinic. She expected preventive care to be 100 percent covered. Unfortunately, their pediatrician is not covered by the new plan and the member had to pay for those services until she met her deductible .

Why Has The Provision Been Introduced

As per the Annual Report released by IRDAI for FY-2014-15 the general insurance industry has witnessed the issuance of approximately 1,09,00,000 health insurance policies. These policies are supposed to cover 28.80 crore people as policyholders. The data further showed that there is a major number of people who are covered by government schemes as well as group insurance policies, while the individual health insurance business has fallen marginally.

The main idea behind this regulatory move is as simple as it seems: making health insurance a more affordable product so that people who were unable to pay lump sums earlier may now be able to afford medical insurance. The other options also include payment of premiums on monthly, quarterly or half yearly as well as the currently in practice annual basis of instalments. Insurance policies which have higher amounts of sum assured earlier had multiple annual premiums to be paid for coverage. But is this move a great move or just not quite what it seems?

Read Also: Does Starbucks Provide Health Insurance