Royal Sundaram Health Insurance Company

Royal Sundaram Alliance Insurance Company Limited is the first Indian private sector general insurance company to be licensed in October 2000 by the IRDAI. It is a joint venture between Sundaram Finance and RSA . The company has 156 branches across India and works with a team of more than 2000 employees. It offers a variety of general insurance solutions to individuals, families and businesses directly as well as through its intermediaries and distribution partners.

Know More About – Royal Sundaram Health Insurance

Best For Wellness Care: Molina Healthcare

Molina Healthcare

Moodys Investors Service recently upgraded its credit ratings, and the wellness and preventive care services are excellent.

-

Limited coverage territory

Molina Healthcare serves 17 states, but only offers private health insurance to residents in California, Florida, Michigan, Mississippi, New Mexico, Ohio, South Carolina, Texas, Utah, Washington, and Wisconsin. It insures more than 4.6 million members across the United States. Coverage options, plan choices, and benefits vary by state. Many of its health plans come with low co-pays and cover essential medical care such as prenatal, emergency services, hospital care, vaccinations, lab tests/x-rays, prescription drugs, doctors visits, and vision insurance.

Molina has some excellent perks, wellness care, and preventive health care services for its health insurance members including adult immunizations, adult preventive services, child and adolescent immunizations, pediatric preventive health care, prenatal and postnatal care.

Find Cheap Health Insurance Policies In Your Area

The best health insurance company for you will depend on your health situation and budget. But it’s not always about the price tag. Some health insurers offer cheap coverage but offer less-than-stellar customer service or a limited provider network.

To help you shop for the best deal, we looked through premium costs, customer service, provider networks and the financial strength of the top health insurance companies. Here’s what we found.

Also Check: How To Apply For Health Insurance As A College Student

National General Health Insurance

National Generals financial clout and its history in the industry puts it in a good position, and specializing in short-term health insurance plans means that it has become one of the leaders in this field. Although its policies come in at above the industry average in terms of pricing, it’s backed up by excellent ratings, additional programs, discounts and flexibility.

National Generals plans are perfect for anyone temporarily without health insurance, whether it’s due to an employment situation or missing a sign-up window. Health insurance coverage is also good for routine doctor visits, labs, X-rays, ER visits, ambulance usage and urgent care facilities.

How Do I Obtain A Health Insurance Quote

If your employer does not offer an affordable health insurance option and you do not qualify for subsidized insurance or Medicare, you can shop the open market for medical insurance. The health insurance companies we reviewed will allow you to request a quote online rather easily. Premium rates vary significantly by multiple factors. You’ll learn that the monthly rates increase quite a bit as you age. Smoking also increases the premium rate. In most cases you can select non-smoking if you have not smoked in over six months.

Services such as eHealthInsurance are simple to use and provide a variety of quotes but may not always show every option available. You may find more plan options by requesting plan information directly from the insurance company’s website. Before purchasing new insurance it is always a good idea to ensure that your preferred doctor accepts the insurance you are looking to purchase. While your doctor may be listed on the insurance company’s website, it is smart to call your doctor’s office directly to verify.

Even if the open-enrollment period has passed for signing up for insurance via one of the exchanges, you might still be able to purchase subsidized insurance if you’ve had a qualifying life event. Qualifying events include moving to a new state, change in income, change in family, loss of coverage and others.

You May Like: How Much Is Private Health Insurance In Spain

How Does Health Insurance Work

Health insurance works by allowing you to budget for medical expenses so you dont have to pay the entire cost out of your own pocket if a medical emergency occurs. You have a set amount to pay either monthly or when you access services through health insurance, and the health insurer pays the rest for covered services. By knowing how much you would be responsible for when accessing health services, you can be more financially prepared when you need care.

Can I Buy Affordable Health Insurance At Any Time

You may be able to buy short-term health insurance coverage at any time, but plans offered in conjunction with the ACA can only be purchased during open enrollment unless you qualify for a special enrollment period. Special enrollment periods can include any time you add a member to your family, move to a new coverage area, or experience another eligible life event.

MediGap coverage also has its own open enrollment period that starts during the month you first turn 65 and lasts for six months provided you are already enrolled in Medicare Part B. You may not be able to buy MediGap coverage after this time, or you may have to pay more for coverage.

Also Check: Where Can You Get Affordable Health Insurance

When Is Open Enrollment For Health Insurance For 2021

The open enrollment period for health insurance depends on whether you’re buying a Medicare plan, a policy from an employer, or an option from the HealthCare Marketplace.

The enrollment period for the HealthCare Marketplace runs from November 1 to December 15. The enrollment period for those newly eligible for Medicare is a seven-month window after turning 65. After that, the annual enrollment period is from October 15 to December 7.

Those who buy insurance from an employer should ask their HR department about the enrollment period because private companies can set their own deadlines.

Are The Large Insurance Companies Good Investments

Investing in insurance companies can be a safe option for some investors. Insurance companies are founded to deal with risk, which can ultimately reduce the risks associated with investing in them. Health insurance, subject to rapid changes, has the potential for significant growth compared to other types of insurance companies.

Read Also: Will Health Insurance Go Down

Universal Sompo Health Insurance Company

Universal Sompo General Insurance Company Limited was established in 2007. It is a joint venture between Allahabad Bank, Karnataka Bank, Indian Overseas Bank, Dabur Investment Corporation, and Sompo Japan Nipponkoa Insurance Inc. The company offers an extensive range of healthcare products & also deals in motor and commercial insurance.

Know More About – Universal Sompo Health Insurance

Care Health Insurance Company

Care Health Insurance Company Limited is a specialized health insurer that is engaged in providing different insurance products for individuals, the corporate sector and financial inclusion. The company has maintained a position for being one of the trusted insurance providers in the market and was recently awarded as the ‘Best Health Insurance Company’ at the ABP News-BFSI Awards & ‘Best Claims Service Leader of the Year- Insurance India Summit & Awards.

Know More About – Care Health Insurance

Recommended Reading: How To Be A Health Insurance Agent

Which Medical Insurance Companies Are The Best

The place to start is online. There are many resources to help you make your decision before purchasing the best international insurance for you.

- Learn more about International Health Insurance for comprehensive annual cover or

- Learn about options to cover you for one year or less: Best Travel Insurance Companies

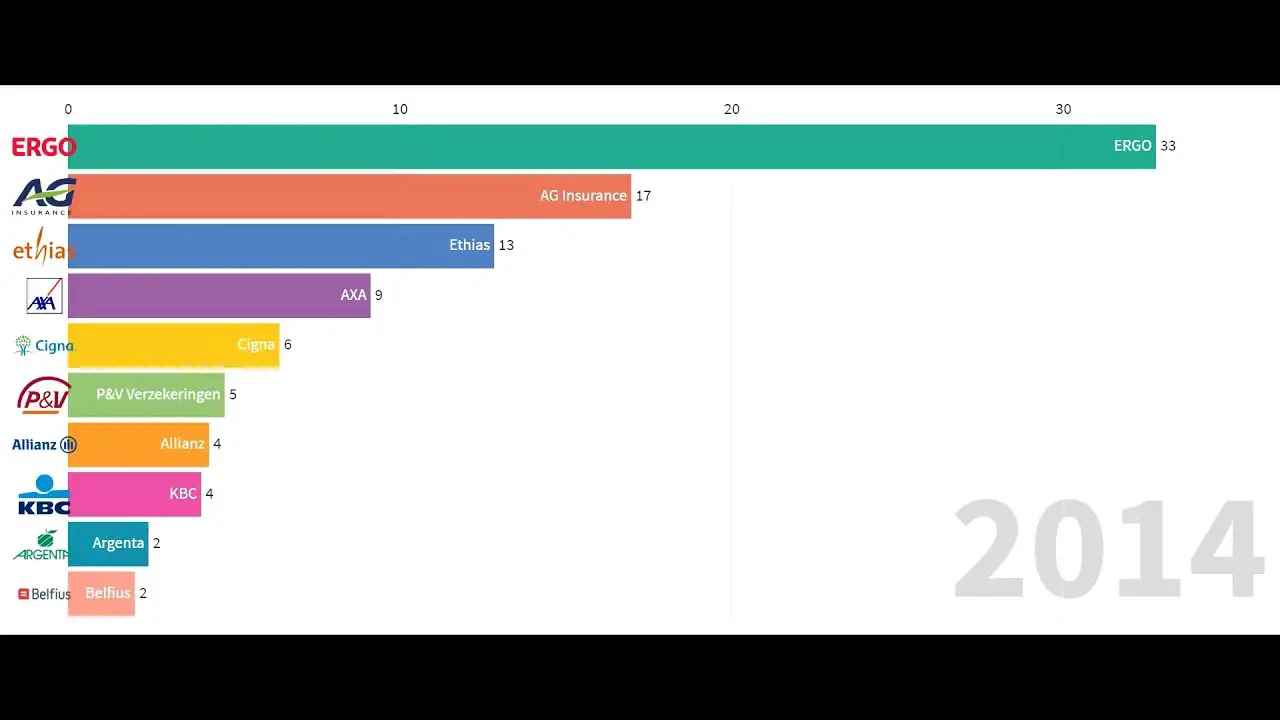

Unitedhealth Group Anthem Aetna And Cigna Returned To The List Of The Top Five Largest Health Insurers And One Newcomer Joined The List

September 29, 2021 – Overall, the list of the top five largest health insurers at the national level has remained stable over the past six years, but the list experienced some small shifts in 2020, according to data from the American Medical Associations annual health insurer competition report.

UnitedHealth Group, Anthem, Aetna, and Cigna held onto their status as the top four largest insurers, but in 2020 Kaiser rose to fifth place.

AMA was careful to point out that data on national insurer market shares do not reflect the consumers experience of the health insurance industry. Market-level data more accurately demonstrate the impact of industry consolidation on the average consumer, the provider organization stated.

Only the top three insurers breached ten percent of the market share, which is a testament to how few health insurers are national, according to AMA.

Three of the top ten insurers with the largest national market share are each located in a single state. They achieved the highest rankings because two of the statesCalifornia and Floridaare among the states with the largest markets and sizable populations. The thirdMichiganis not very large, but one insurer dominates nearly 70 percent of the market share there.

Despite these nuances, ranking the top five largest health insurers at the national level provides a helpful backdrop for the more localized data, AMA acknowledged.

Also Check: How To Become A Health Insurance Broker In California

Best Health Insurance Companies In Canada

compare health insurance quotes from 30+ companies in Ontario

One of the significant advantages that Canadians have is plenty of Insurance Companies to rely on. They provide different types of insurance. Many of them offer health insurance. It is great. However, it creates a challenge as to which ones are the best.

There are common denominators of what the health insurance covers. Each Insurance company likes to offer something that is unique. Or, something at least they feel is better than their competitors.

The following are ten of what many consider to be the best Insurance Companies. At least when it comes to the Health Insurance, they each have to offer.

How To Compare The Best Health Insurance Companies And Plans

Even plans of the best health insurance companies can vary greatly. But the general rule of thumb is that the less you pay per month, the higher your deductible is. Higher premiums are usually associated with lower deductibles. Generally it is beneficial for those with existing health issues to opt to pay more per month and less out-of-pocket for services.

Those in good health often opt for a high deductible option in hopes that they never have to actually pay the deductible but would mostly be covered if something major happened.

A prescription plan is another important consideration when looking for the best health insurance. If you need to take medications regularly you’ll want to choose a plan with a good prescription plan. If you need to insure your entire family, you’ll want to look at family deductibles and maximums. Only full-coverage options will satisfy the minimal essential health care insurance required to get around paying the fine.

Monthly PremiumThis is your monthly payment for health insurance. It may be worth asking if you can get discounts for paying in advance or if you set up direct payments from your bank account.

DeductibleThe amount you are required to pay, not counting preventive care, before the insurance company starts paying out. Low-deductible plans offer deductibles of about $500, whereas high-deductible plans might be as much as $6600.

Read Also: Does Short Term Health Insurance Cover Pre Existing Conditions

Blue Cross Blue Shield Of Florida Group

Nearly one in three Americans rely on Blue Cross Blue Shield companies for access to safe, quality, and affordable healthcare.

Blue Cross Blue Shield Association is a federation of 36 separate United States health insurance organizations and companies, providing health insurance in the United States to more than 106 million people.

Read: 20 Famous and Funny Car Life Quotes

How To Choose A Health Insurance Plan

Among the different varieties of health insurance policies available in the market, choosing the most suitable health plan might prove to be a challenge. So, here are some pointers on how you can choose the best health insurance plan for yourself and your family.

Types of health insurance plans in India:

These top 10 health insurance companies in India offer different types of health insurance plans. Lets find out the types of plans available and what exactly such plans cover

Indemnity Health Insurance Plans: This type of plan pays only for the expenses incurred during hospitalization.

Types of Fixed benefit health insurance policies in India:

These types of plans pay a fixed amount of money on diagnosis of the listed ailment, irrespective of the amount spent on hospitalization.

Under fixed benefit health insurance plans, the following types of plans can be found

Also Check: How Much Does Private Health Insurance Cost In California

United Healthcare: Best Health Insurance Provider For Add

The United Healthcare name is well recognized and the company certainly has the financial muscle to deliver many benefits to its customers. Its premiums are slightly higher than average, but you may feel the extra outlay is worth it to access the huge, nationwide network. That and the many features that come with the very impressive online access and mobile app United Healthcare offers.

In short, its worth looking at United Healthcare’s plan quotes no matter where you’re based, and though you may find that the prices quoted are a touch higher than some of United Healthcare’s competitors, the extra features and discounts should be factored in.

Top 25 Us Health Insurance Companies Listed By Market Share

Source: NAIC

To clarify, size of market share does not necessarily correlate with quality of product or service, nor does it guarantee the company will retain its position through the entire year. This list reflects data gathered through the end of 2020. If you’re shopping for an individual health insurance policy, we recommend visiting our partner, KindHealth, to help you find one.

Also Check: Where Do You Go If You Have No Health Insurance

Best For Health Savings Plan Option: Kaiser Permanente

Kaiser Foundation Health Plans

-

Kaiser offers its own HSA

-

ACA-compliant plans available for individuals and families

-

Several top ratings in J.D. Power’s 2021 U.S. Commercial Health Plan Study

-

Coverage only available in eight states and Washington D.C.

Kaiser began offering health insurance plans to the public starting in 1945 and has grown to become one of the largest not-for-profit health insurance providers in the nation. Kaiser serves more than 12.5 million members in eight states plus Washington D.C. We chose this provider due to the fact they offer their own Health Savings Account option, which lets you save money for health expenses if you have an eligible plan.

When you pair a high deductible health plan from Kaiser Permanente with a Health Savings Account , you get a convenient debit card that lets you cover eligible expenses with your HSA funds directly and without any added paperwork. Your HSA plan also comes with no hidden fees, and you can get the $3.25 monthly plan fee waived if you maintain an HSA balance of $2,000 or more.

Also be aware that Kaiser may offer ACA-compliant plans in your area, so it’s possible you could apply subsidies you receive to make your premiums more affordable.

Your Local Health Insurance Company Experts

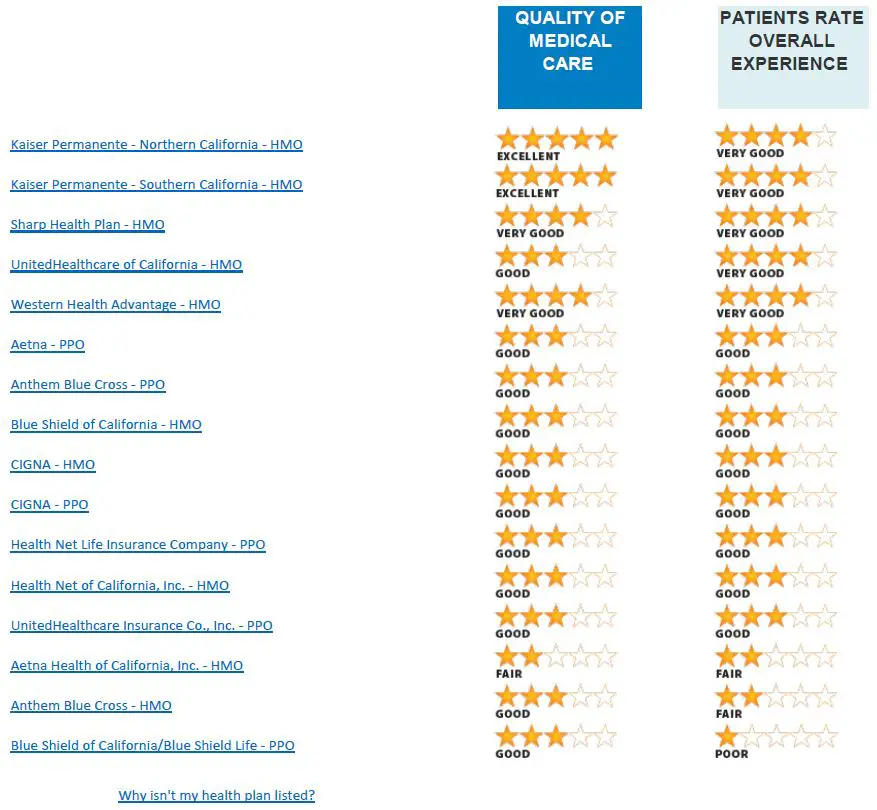

JC Lewis Insurance, a family-owned firm of expert brokers based in Sonoma County, offers California health insurance plans only from the leading health insurance carriers licensed to do business in California.

Not only are we expert brokers, we are licensed and certified by each of these insurance carriers to offer coverage to individuals, families, and small group employers in addition to Medicare supplemental and prescription drug plans for seniors.

If you are self-employed, or your employer doesnt provide health benefits, an individual or family plan may be the best option for you or you and your family.

And if youre looking to purchase medical insurance for you and your family, you will likely have many questions and concerns. Bring your questions about health coverage insurance and you can be confident that JC Lewis Insurance Services will help you find the right solution.

Recommended Reading: How To Enroll In Cigna Health Insurance

What Are The Biggest Health Insurance Companies

The biggest health insurance companies in the United States include well-known insurance providers. Many of these companies offer similar products, but some tend to specialize in additional products such as Medicaid and Medicare. Below, we break down the largest health insurers by market share, by membership, by revenue and by state.

Best Features Of Cigna Ttk Health Insurance Plans

- Availability of No Claim Bonus, Cumulative Bonus and Healthy Rewards to reduce premium

- Personal Health Wallet is available

- Day care procedures and Domiciliary treatment expenses are covered

- Coverage available for Organ Donor expenses

- Medical expenses abroad all over the world are reimbursed

- Availability of 100% Sum Insured restoration

- Ambulance expenses are covered

- Availability of Critical Illness add-on cover

- Availability of free opinion for critical illnesses

- Coverage available for Maternity and new born babys vaccinations expenses in the first year

- Availability of annual health check-up

Read Also: What Type Of Health Insurance Do I Need

Get Instant Access To Quotes

Health for California gives you quick and instant access to quotes for Obamacare individual, family and business plans. Our process is fast, easy and free. Simply tell us a few things about yourself, and well give you the best quotes from multiple California health insurance companies.

Not sure how Obamacare affects your health care plans in California? Learn how the ACA works in California, including benefits, costs and enrollment.

Kotak Mahindra Health Insurance

Kotak Mahindra General Insurance Company is a 100% subsidiary of the Kotak Mahindra Bank Ltd., India’s fastest growing bank. This insurance company offers a comprehensive range of healthcare products that allows the customers to choose the best one as per their needs. It has several branches across the country and has employed an army of agents to serve its customers.

Know More About – Kotak Mahindra Health Insurance

You May Like: What Causes Health Insurance Premiums To Increase