What To Know About Insurance In Tennessee

- Coverage types: Almost 48% of Tennesseans receive health insurance through an employers health benefits. Just over 10% of residents are uninsured. An additional 5.6% of residents have individual policies, while 19.5% are enrolled in TennCare. Another 15% have Medicare.

- Multiple plans: Tennessee residents can have multiple health insurance policies and can purchase insurance from any health insurance company that offers coverage. A secondary plan can offset your out-of-pocket expenses and reduce the total cost of your health care.

- The Health Insurance Marketplace offers insurance plans that conform to Affordable Care Act standards. The annual open enrollment period is from November 1 to January 15. If you miss the enrollment period, youll need to qualify for a special enrollment period or wait until the next open enrollment to enroll through the marketplace.

- Special Enrollment: Special enrollment periods allow you to enroll for coverage if youve had a qualifying life event, such as having child, relocating, losing your job, or getting

- Premium tax credit: Tennessee allows residents to enroll through the federal Health Insurance Marketplace. You must enroll through the exchange to take advantage of the Advanced Premium Tax Credit.

- Individual policies: You can purchase an individual policy without consequence if youre not interested in receiving the Advanced Premium Tax Credit.

The Effect Of Insurance Deductibles On The Cost Of Health Care

TN residents insured through group, individual and medicare health plans generally have a deductible. Deductibles define the amount of the medical expenses the insured person must pay before the insurers coverage begins to pay the medical bills. The deductible amount depends on the insurance plan. Generally speaking, individual insurance has larger deductibles than other plans. Deductibles have the effect of increasing the cost of the insurance for people that file insurance claims. For example, a person on an individual plan paying the average price of $4,251 with a relatively common $6,000 deductible has an effective price of more than $10,000, if they use their insurance.

Frequency Of Using Medical Services Other Than A Doctor Or Hospital

Non-doctor health care visits is a measure of how often people receive medical care without seeing a doctor. This type of care excludes patients that have been admitted to hospitals or other institutions. Examples of non-physician health care includes appointments or walk-in clinics to see a nurse, physical therapist, counselor for mental health appointments or other non-physician medical personnel.

Non-doctor visits by Tennessee residents is below the national average for people with all types of insurance. Group and individual insurance uses non-physician health care approximately 70% less. Medicaid managed care and Medicare Advantage patients used non-physician services approximately 10% more than the national average.

Non-physician care tends to be an expensive form of treatment. The reason non-physician visits are expensive is that many times these are visits to outpatient facilities. Many outpatient facilities are owned and operated by hospitals. While hospital owned and operated medical facilities are less expensive than a hospital, oftentimes they are more expensive than a doctor visit.

Don’t Miss: Does Health Insurance Cover Tattoo Removal

Election : State Health Care Snapshots

Health care is a top issue for voters in the 2020 election. Polling indicates voter concerns range from the high cost of health coverage and prescription drugs, to protections for people with pre-existing conditions, to womens health issues.

To understand the health care landscape in which the 2020 election policy debates will unfold, these state health care snapshots provide data across a variety of health policy subjects, including health care costs, health coverageMedicaid, Medicare, private insuranceand the uninsured, womens health, health status, and access to care. They also describe each states political environment.

Please note, the data included in these snapshots come from a variety of different sources and time periods, and therefore, may not be comparable.

Do You Need A Tennessee Family Health Insurance Plan

If you cannot get a good group health insurance plan through your employer and you need coverage not only for yourself but also for your other household members, a family health insurance plan may be right for you.

How does it work? Your Tennessee family health insurance plan will require that you pay a set premium every month. That premium will cover most of your health care costs, though you may be responsible for a small co-payment at the time of your services. For example, it is typical for a family health insurance plan to require a $20 copay for doctor visits. You might also have a yearly deductible. That means that, for example, if you have a $200 deductible, your health coverage will not kick in until youve spent $200 on health care.

Why do you need it? Even if you think that youre healthy enough to go without health insurance, these policies are really designed to keep you prepared for the unexpected. If you fall and break your leg, or if you suddenly are diagnosed with a serious disease, your health care plan can help you cover your surgeries, prescriptions, and repeated doctor visits. If you wait until after your diagnosis to enroll, your plan most likely will not cover your treatment. Plus, family health plans often offer free or very low-cost preventative benefits, like cheap flu shots and free wellness visits with your primary physician.

Recommended Reading: How To Apply For Health Insurance As A College Student

Small Business Health Insurance Tax Penalties

Starting January 1, 2015, Employers with 50 or more full-time equivalents who do not offer minimum essential coverage can face monthly penalties if at least one employee uses a premium tax credit to obtain health insurance through the state health exchange. If you do not have more than 50 employees, you are not subject to these penalties.

How Much Do Short

Short-term plans tend to be less expensive than an ACA plan because theyre not required to cover as many medical conditions.

The cost of a short-term policy in Tennessee varies. Health insurance companies look at factors like your age, gender and where you live to determine how much your plan costs.

The costs you might see with your health insurance plan include:

Also Check: How Much Does Health Insurance Cost By Age

College And University Plans: Good For On

Full-time students attending a college or university may be able to obtain insurance through their schools health insurance plan if a plan is offered. This could be a good health insurance option for older students who cant continue their parent’s coverage. Its also useful for any student who is attending school out of state.

Lets say, for example, that a student from Texas, who is covered under a parents health maintenance organization in Texas, is attending college in Ohio and cannot access the list of designated medical providers that are located in Texas. It would make sense for the student to have their own health insurance plan in Ohio provided through a college or university.

One of the advantages of selecting a school policy is the monthly premium can be grouped with your tuition and room and board expenses, making it possible to use student loans to pay for your health insurance costs.

School-sponsored health care may not cover services received outside of the university. If you need to access services away from the school, for example, the policy may not cover the expenses.

Moreover, some university or college health plans do not adhere to ACA standards, meaning they may not cover preexisting conditions or they may impose caps on how much they will pay. It is thus important to read the terms of health plans provided by your college or university to determine if the plans cover needed benefits and services.

Rhode Island Individual Mandate

- Effective date: January 1, 2020

- Requires individuals and their dependents have ACA-compliant health insurance

- Imposes a penalty on residents who go without health insurance but can afford it

- Provides state subsidies to help lower income residents afford health insurance

The penalty for failure to have ACA-compliant health insurance is the same as it would have been under the federal individual mandate. It will cost a family $695 for each uninsured adult and $347.50 for each uninsured child or 2.5% of the household income, whichever amount is greater. Penalties also increase annually with inflation. However, the maximum a household can be penalized cant be greater than the total annual premium for an average bronze plan in Rhode Island.

Rhode Island allows for exemptions in certain situations. And, as of December 31, 2020, Rhode Island expanded its eligibility criteria to include a COVID hardship exemption. This new exemption recognized the impact that the pandemic may have had on residents ability to afford and get health insurance. If you live in Rhode Island, you may be eligible to file a hardship exemption if, as a result of the COVID pandemic:

- You lost minimum essential coverage in 2020, or

- You experienced a hardship that made you unable to get minimum essential coverage in 2020.

Recommended Reading: How To Find My Health Insurance

Private Insurance Regulation In Tennessee

Most private health insurance in Tennessee is regulated by the state and/or federal governments, but some individual market plans are not subject to regulation.

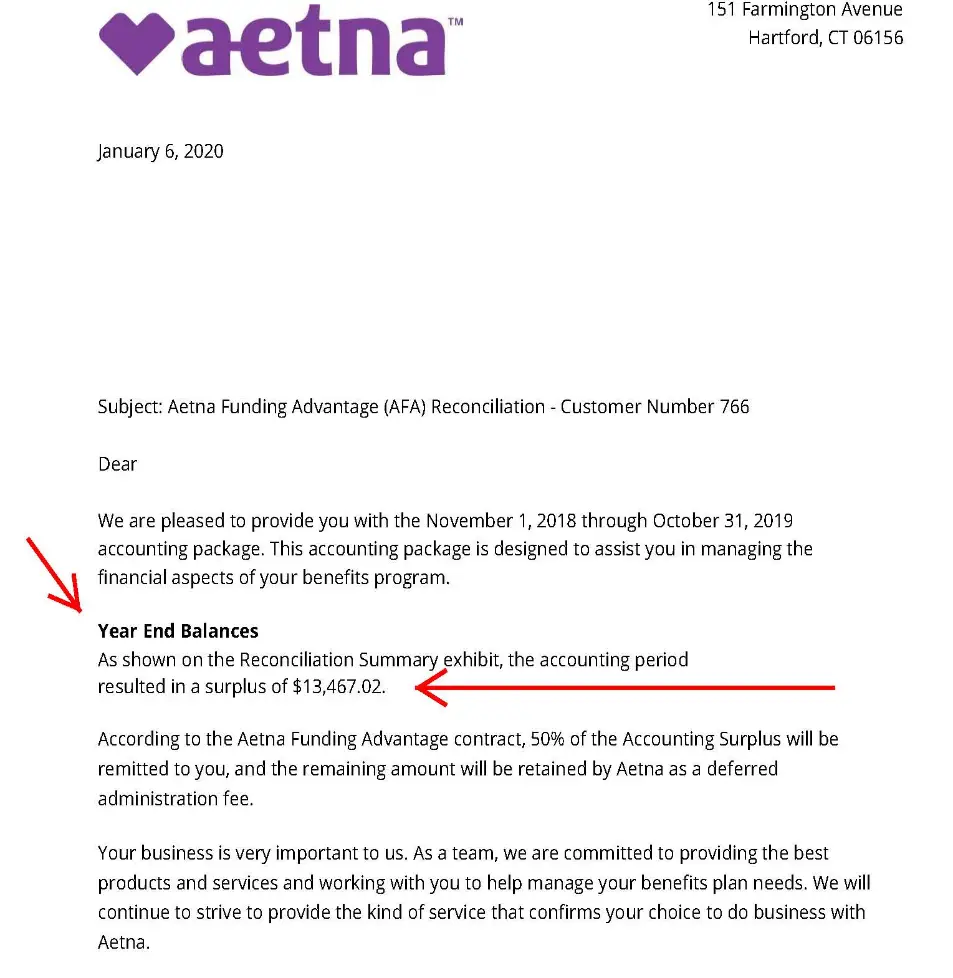

- Federal Regulation Only: Most employer plans are self-insured and regulated exclusively by the federal government. About 61% of workers nationally with job-based coverage are in self-insured plans. Under a self-insured plan, the employer not the insurance company takes on the financial risk of providing health benefits. Although these plans are self-insured, they are often administered by private health insurance companies.

- Joint State and Federal Regulation: The state and federal governments share responsibility for setting and enforcing the rules for all other types of private insurance. In 2018, Blue Cross Blue Shield covered more Tennesseans than any other private insurer in these markets .

Federal law sets the floor for state regulation. For example, the ACA put in place private individual market health insurance rules governing everything from annual reviews of premium changes to what plans must cover. Tennessees Department of Commerce and Insurance is responsible for ensuring that plans in Tennessee meet federal requirements and carrying out any state requirements .

Figure 4

Medicaid Coverage: Best For Those Who Have A Low Income

Medicaid provides free or cheap health insurance for those who are low-income, if you meet the eligibility criteria.

For young adults, Medicaid is a good option if they are unemployed or if their job does not provide health insurance benefits. One of the benefits of applying for an ACA marketplace plan is that the system automatically assesses whether you qualify for Medicaid.

Income eligibility varies by state, and it’s higher in 38 states that expanded Medicaid eligibility. In these states, residents qualify for Medicaid if their household incomes fall below 138% of the federal poverty level. Twelve states Alabama, Florida, Georgia, Kansas, Mississippi, North Carolina, South Carolina, South Dakota, Tennessee, Texas, Wisconsin and Wyoming have not expanded their Medicaid programs, and as a result, Medicaid eligibility is tighter in these states.

You May Like: What Is A Gap Plan Health Insurance

Do I Have To Use The Health Insurance Marketplace In Tennessee

Youre not required to use the marketplace, but most people use it because its the only way to qualify for the Advanced Premium Tax Credit. If you know that you wont qualify for any tax credit or subsidies, youre free to enroll in coverage directly with any insurer that offers you the policy you want. It may be more cost effective to research alternative options if your income is too high to qualify for affordable healthcare coverage on the marketplace.

Can I Get Financial Help To Lower My Tennessee Health Insurance Premium

Before 2021, if you earned between one to four times of the federal poverty level, you were eligible for subsidies to help you pay for any metal plan.

In 2021, the federal government expanded subsidies and removed the income cap for premium tax credits. Instead, you would pay no more than 8.5% of your annual household income on health insurance based on the price of the benchmark plan. The federal government would cover the balance through subsidies.

The amount of assistance you get is based on your modified adjusted gross income and estimated when you apply for coverage through Healthcare.gov. The average subsidy received in 2020 among Tennessee Marketplace enrollees was $578 per month.7

Here are some examples of how much you could save with subsidies:

A 25-year-old non-smoker in Nashville with an income of $28,000 in 2021 could get a silver plan for about $65 per month with subsidies or about $351 without thema savings of about $287.

A young family of four non-smokers in Memphis with an income of $45,000 in 2021 could get a silver plan for about $33 per month with subsidies. That policy would cost about $1,214 per month without subsidies, a savings of about $1,181.

Also Check: Can You Get Your Own Health Insurance

Looking For Plans Through Your Employer

This page features plans you can buy for yourself and your family. If you are looking for plans you might get through your employer, we can help get you there.

Find plans through your employer

Plans are insured by Cigna Health and Life Insurance Company or its affiliates: For Arizona residents, health plans are offered by Cigna HealthCare of Arizona, Inc. For Georgia residents, health plans are offered by Cigna HealthCare of Georgia, Inc. For Illinois residents, health plans are offered by Cigna HealthCare of Illinois, Inc. For North Carolina residents, health plans are offered by Cigna HealthCare of North Carolina, Inc.

1 Includes eligible in-network preventive care services. Some preventive care services may not be covered, including most immunizations for travel. Reference plan documents for a list of covered and non-covered preventive care service.

3 Refer to plan documents for a complete description and list of equipment, supplies, and tests that are covered at $0 through the condition specific plans.

4 2021 Special Enrollment Period for Marketplace Coverage Starts on HealthCare.gov Monday, February 15, Centers for Medicare & Medicaid Services, March 12, 2021, https://www.cms.gov/newsroom/press-releases/2021-special-enrollment-period-marketplace-coverage-starts-healthcaregov-monday-february-15

We were unable to load the ifp footnotes app, please try again later.

All applicants applying for enrollment must meet age, dependent status, and residency requirements.

Private Health Insurance On The Tennessee Marketplace

Healthcare plans in the Tennessee marketplace are divided into several metal tiers. Of these, Catastrophic and Bronze plans usually have the lowest premiums but the highest out-of-pocket expenses. Gold plans include higher monthly premiums but lower total costs if you have extensive medical needs.

Metal-tier health insurance plans all conform with state and federal health insurance guidelines, but each has its own pros and cons.

Based on your income level, you might qualify for even cheaper plans or increased coverage options.

You can be eligible for premium tax credits if your income falls between 100% and 400% of the federal poverty level. In Tennessee, a two-person household making between $17,420 and $69,680 per year would qualify for these credits. To learn more, use the HealthCare.gov calculator.

Open enrollment is when you can enroll in a new healthcare plan or renew an existing plan through the health insurance marketplace. The open enrollment period usually falls between November and December, but they have now been extended on account of COVID-19. You can also qualify for a special enrollment period after moving or changing your employment status.

Also Check: Should I Cancel My Health Insurance

Medicare And Medicare Advantage

The charts showing the cost the the number of enrollees includes people covered by all types of Medicare and Medicare Advantage. The cost of this type of health coverage includes participation from employers, individuals, federal, state and local government. Excluded from the costs are any form of co-pay or a deductible the individual must pay to receive care.

How enrollees use their health care services is based on enrollees in Medicare Advantage plans only. Medicare Advantage plans are Medicare health plans offered by private companies that contract with Medicare. Medicare Advantage plans include Health Maintenance Organizations , Preferred Provider Organizations , Private Fee for Service Plans, Special Needs Plans and Medicare Medical Savings Account Plans .

Buying Tennessee Health Insurance For Individuals Families And Self

You can enroll in Obamacare to access private health insurance for yourself or for you and your family, including if youre self-employed and have no employees. People who enroll in Obamacare are generally under 65. Those who are 65 or older generally have access to coverage through Medicare.

Obamacare plans cannot deny you coverage based on your medical status, exclude coverage for preexisting conditions, or charge you more because of your health. Plans include essential health benefits, such as hospitalization, mental healthcare, and free preventive services. If youre covering dependent children, the plan must offer them dental and vision benefits.

Obamacare plans come in different metal levels: bronze, silver, gold, and platinum. The federal Marketplace also offers catastrophic health plansbut they are available only to people under 30 years of age or people of any age who qualify via a hardship exemption or an affordability exemption, based on Marketplace or job-based insurance being unaffordable.

Each plan covers a certain percentage of your costs. For example, bronze ones pay for 60% of your eligible costs and usually have the cheapest monthly premiums. Platinum plans, on the other hand, cover 90% of covered expenses.

You May Like: Can I Change My Health Insurance Outside Of Open Enrollment

What To Know About Health Insurance In Tennessee

The sample rates included in MoneyGeekâs analysis are based on private plan data acquired from the Tennessee insurance marketplace. You might be able to find even more affordable options if you apply for a plan in the health insurance exchange. Lower-income or senior Tennessee residents might also be eligible for Medicare or Medicaid, which are usually much cheaper than private marketplace plans.