Hmo Vs Ppo Health Insurance

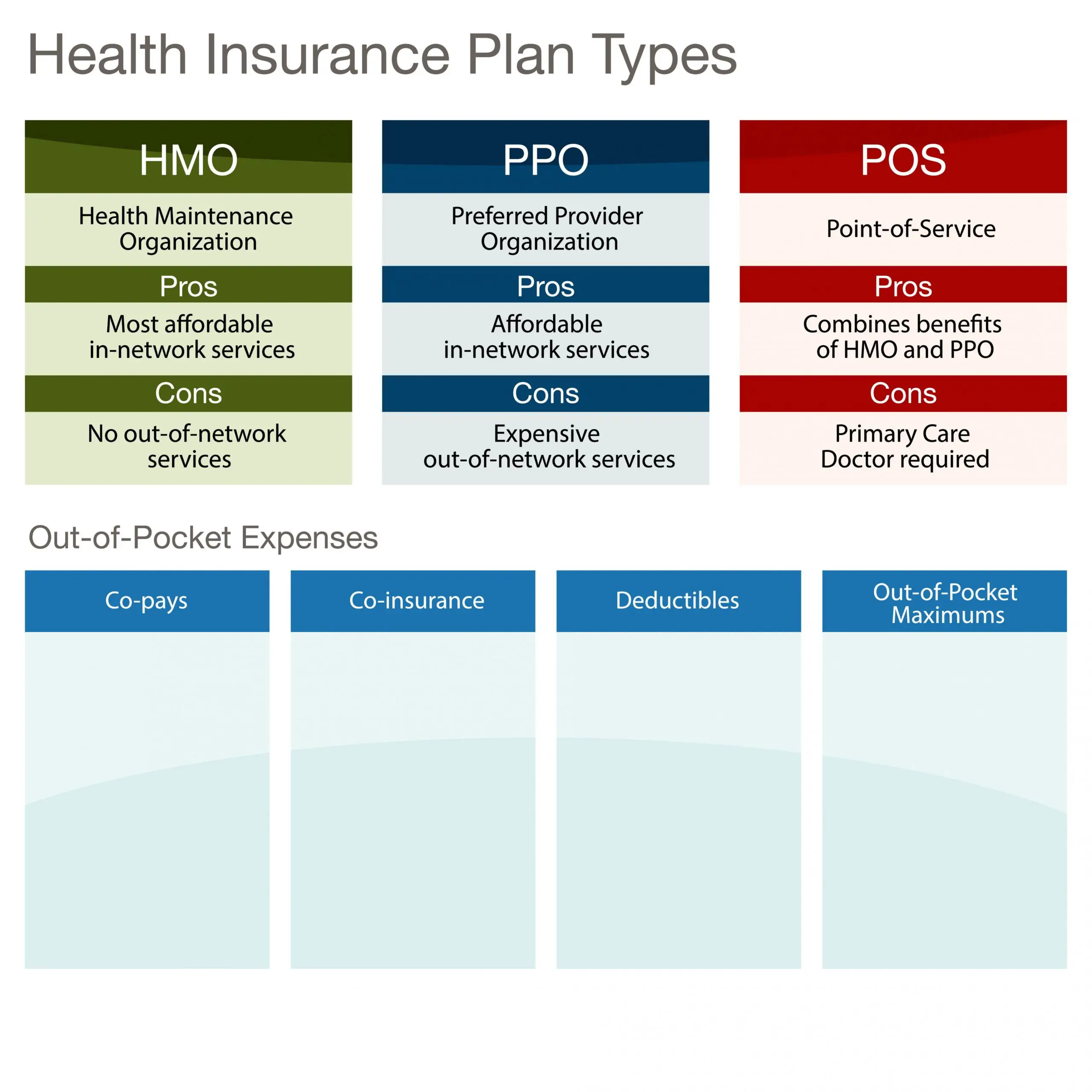

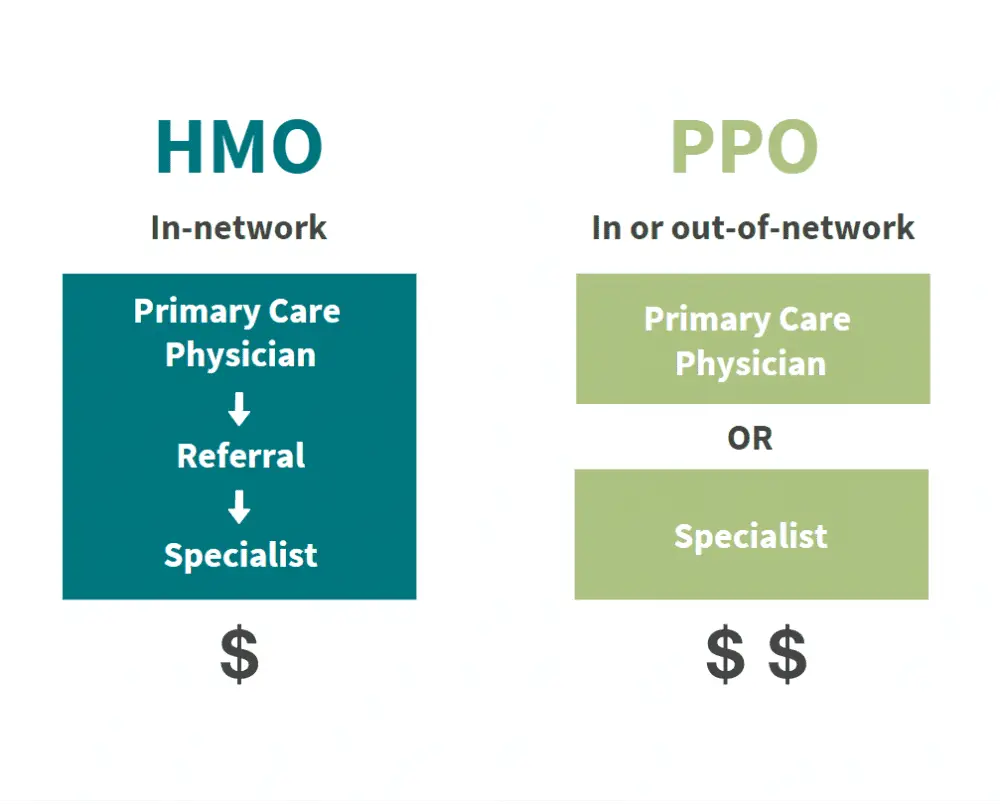

Lets take a look at how HMOs and PPOs differ.

- HMOs tend to have lower premiums but limit coverage to in-network providers out-of-network providers usually arent covered except for emergencies in HMOs.

- PPOs tend to have higher premiums but let you use both in-network and out-of-network providers. Copayments and coinsurance are higher for out-of-network providers.

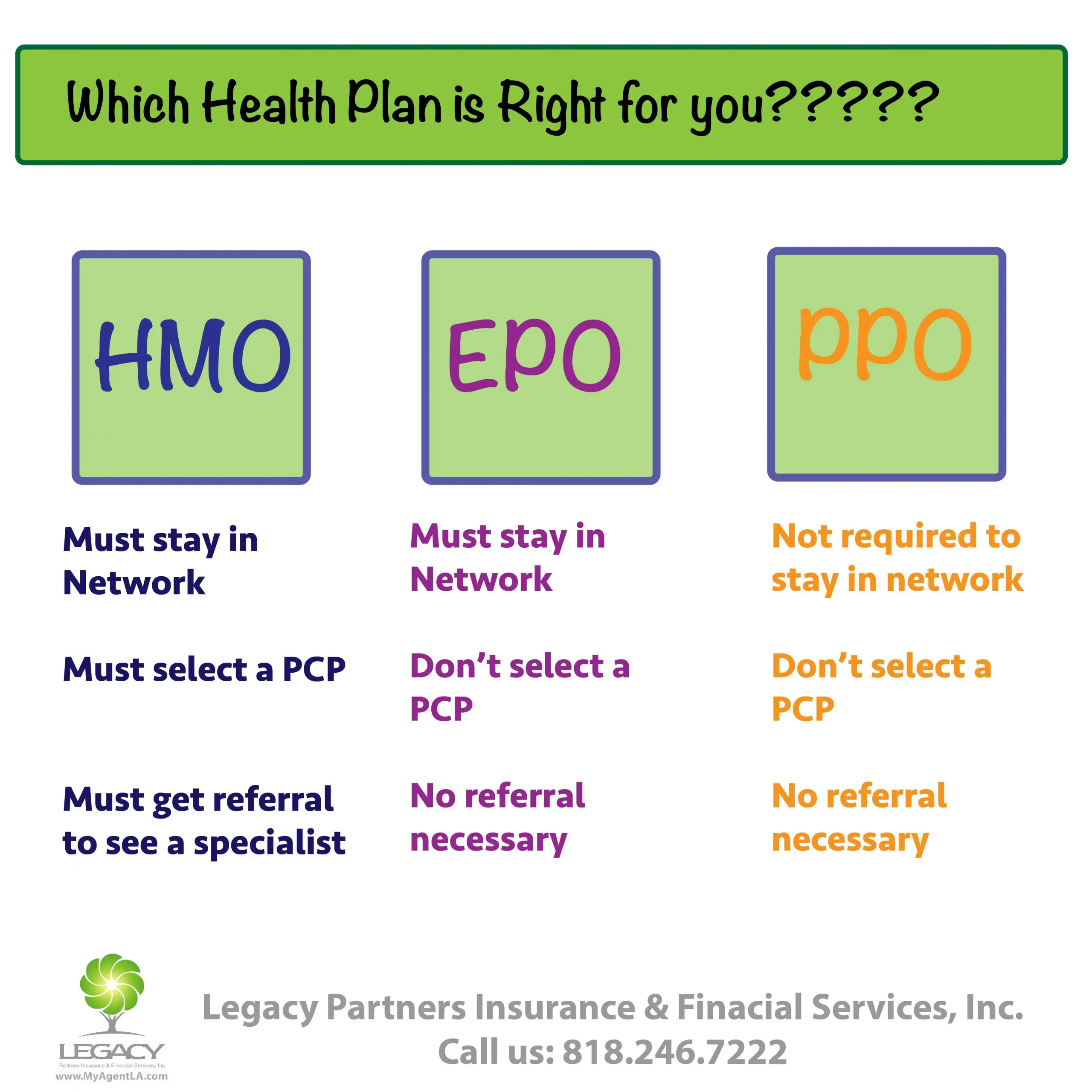

- HMOs generally require that you choose a primary care provider who manages your care. You dont have to choose a primary care provider with a PPO.

- HMOs usually require referrals from your primary care doctor before you can see specialists. PPOs dont require referrals to see specialists.

- HMOs tend to have low copayments for in-network providers and low or no deductibles. PPOs have low copayments for in-network providers and higher copayments for out-of-network providers but still provide coverage.

- PPOs tend to be most popular for employer plans, but HMOs tend to be more common for individual plans.

Pros And Cons Of Pos Insurance

POS insurance has some of the flexibility of a PPO but also some of the restrictions of an HMO. With a POS plan, you can use both in-network and out-of-network providers. You have higher cost-sharing if you go to out-of-network providers, but you still have coverage, similar to a PPO.

You pay the lower copayments if you use providers that are in the plans network, but you also have coverage for out-of-network providers. You just have to pay higher copayments to see them.

However, you may need to get a referral from your primary care provider before you can see a specialist or go to the hospital.

POS plans were an evolution from HMO on the way to the PPO, says Hope. As such, they are rarer these days, and we would not expect to see many, if any new POS plans offered in the future.

Premiums for POS plans tend to be higher than HMOs and lower than PPOs.

Unlike a PPO, you generally have a primary care provider who coordinates your care. The provider often serves as a gatekeeper before you can see a specialist. POS plans generally have lower premiums than PPOs.

Here are the pros and cons of a POS plan:

Pros

- Members can get out-of-network care

- Primary care provider coordinates care

Cons

- Higher premiums that other plans

- Need a referral to see a specialist

Who Would A Ppo Plan Be A Good Fit For

If you need the flexibility to see both in- and out-of-network providers, then a PPO may be a good fit for you. With a PPO, youll have access to an extensive network of doctors and hospitals and the freedom to see any doctor or specialist without a referral. But youll pay lower costs when you use in-network providers and higher costs for out-of-network providers.

Also Check: Starbucks Insurance Enrollment

Who Should Get A Ppo

If you expect to make several doctor visits or need continuous medication, a low-deductible health plan may be right for you. The same may apply to pregnant women who require frequent check-ups. In theory, both types of individuals will meet their deductibles and therefore insurance benefits sooner.

Several PPOs tend to carry lower deductibles as opposed to HDHPs. Of course, the true difference lies between which type of insurance carrier youre looking at and the types of services you need. But overall, PPO networks span large areas. So if you need frequent medical attention, youre likely to find in-network healthcare providers in your area.

And dont fret if youre traveling. Your PPO still covers out-of-network services. The types of services covered and to what extent again depends on the specific type of insurance companies youre considering.

Either way, remember both HDHPs and PPOs cover 100% of preventive services when provided in-network. These include the following.

- Alcohol misuse screening and counseling

- Blood pressure screening

- Immunization vaccines

What Network Should You Pick

Everyone is looking for something slightly different out of their health insurance, so this is really a question you have to answer for yourself. But there are a few pointers you can keep in mind:

- Before you start looking, make note of your need to haves and want to haves in terms of your provider network and benefits. Also, list any doctors or hospitals you want access to. Keep that information at hand while you shop.

- Check the networks youre considering for doctors, hospitals and pharmacies near to you before making any decisions, especially if easy access to care is important.

- If your doctors already in-network, or youre flexible about where you get care and can easily stay in-network, then choosing an HMO or EPO may mean a lower cost for you each month.

- If you need the freedom to go outside a narrow network and still get some benefits from your coverage, then look at PPOs or a more flexible POS plan.

Read Also: What Insurance Does Starbucks Offer

How Does Ppo Insurance Work

PPO insurance works by paying discounted rates to healthcare providers in exchange for a higher number of patients, explains Kronk. So if a provider is in-network, that means theyve agreed to a discounted rate for services given to people in that plan.

You still have the flexibility to choose an out-of-network provider, but you will have to pay more sometimes significantly more.

Hmo Vs Ppo: Which Is The Right Choice For You

HMO vs PPO: which is better? Both plans offer excellent options and support. But choosing which is right for you will require patients to discern their healthcare priorities.

For example, perhaps someone wants a primary care physician. It can be beneficial to have an ongoing relationship with someone who monitors your health. But sometimes, especially if you move around a lot, you do not need or want that type of doctor-to-patient relationship.

If someone already has a primary care physician before joining an HMO network and that physician is not a part of the HMO network, you will likely have to switch out your PCP for an in-network one. On the other hand, PPO plans allow patients to keep their current primary care physicians.

Don’t Miss: Starbucks Dental Insurance

If You Already Have A Doctor You Like Does The Plan You Are Considering Cover Visits With Him Or Her

While CareFirst’s HMO plans have especially wide networks compared to many other HMOs, the PPO plans still offer in-network coverage for more health care providers. If you would like to keep your doctor, you can determine whether he or she is in-network under an HMO plan, a PPO plan or both.

Choosing the right health plan can give you peace of mind, knowing that your insurance plan has your health needs covered.

Need an individual and family health insurance plan?

Which One Is Right For Me

If you prefer to have your care coordinated through a single doctor, an HMO plan might be right for you. And if you want greater flexibility or if you see a lot of specialists, a PPO plan might be what youre looking for.

For more information on HMO and PPO plans, check out our available individual and family plans.

You May Like: Starbucks Health Insurance Options

What Is Ppo Insurance Coverage

PPOs are the most common plan type in the United States, covering 47% of covered workers, according to the Kaiser Family Foundations 2020 Employer Health Benefits Survey.

PPO refers to the networks of physicians, hospitals, and other services that contract with insurance companies to provide care at a lower cost, explains Alex Kronk, writer for healthplancritic.com and author of The Pocket Guide to Medicare Advantage 2022.

These organizations still provide comprehensive health coverage but require utilization of a specific network of providers, he adds.

In other words, if you have PPO insurance coverage, going to in-network providers will save you a lot of money.

How Does A Ppo Work

A PPO is a health insurance plan that gives you access to a network of preferred health care providers physicians, specialists, hospitals, clinics, etc. The insurance company contracts with those doctors and hospitals so that they will charge set prices for certain services. You can visit these in-network providers at a lower cost than providers outside of your network. However, PPOs do not limit you from seeing doctors outside of the PPO network. You will very likely pay more for care at out-of-network providers than at in-network providers, but most PPO plans cover at least some of the bill for an out-of-network provider.

If youre traveling out of the state and need medical care, your PPO network may also cover a physician or hospital thats outside of your primary state of residence.

Ready to shop health insurance?

Don’t Miss: Starbucks Health Insurance Eligibility

How Do I Access My Out

In a PPO plan, you can go to doctors and other providers that arent in the plans network, but you usually have higher copayments and deductibles and you may have to file the claim yourself.

PPOs can go outside of their plan network without getting a referral. However, that usually comes at a higher cost and may mean more work for the patient getting preauthorization for services and working with the health insurance company to file claims.

What Are Disadvantages Of Ppo Plans

PPO plans tend to be more expensive than other managed-care options. They typically have higher monthly premiums and out-of-pocket costs, like deductibles. You often have both coinsurance and copays. This is the tradeoff for the flexibility PPOs provide, of letting you use providers both within and outside the PPO system, without needing referrals.

The costs for coinsurance and deductibles can be different for in-network and out-of-network providers and services. Some may find it onerous to have more responsibility for managing and coordinating their own care without a primary care doctor.

Also Check: Starbucks Open Enrollment

What Is An Epo Plan

An EPO means Exclusive Provider Organization. This plan provides members with the opportunity to choose in-network providers within a broader network and to visit specialists without a referral from their primary care doctor. EPO plans offer a larger network than an HMO plan and typically do not have the out-of-network benefits of PPO plans. Generally, EPO plans cost more than an HMO, but less than a PPO.

Pros And Cons Of Ppo Plans

Originally published on March 31, 2021. Last updated April 1, 2021.

If you ask your friend what kind of health insurance they have, chances are theyll say its a plan they got through their employer.

Research from the Kaiser Family Foundation finds that nearly half of covered workers in the U.S. are insured under an employer-sponsored health plan, which is usually a preferred provider organization plan.

Lets take a look at a few of the pros and cons of the most popular choice for health coverage in Americathe PPO plan.

Read Also: Starbucks Dental Coverage

Whats The Difference Between Hmo And Ppo Plans

Who is this for?

This information can help you if you’re shopping for health insurance and want to learn how HMO and PPO plans are different.

When youre shopping for health insurance, you have a lot of options to choose from.

Knowing the differences between plans can help you choose the one thats right for your health care needs and budget.

As you look at plans, you may notice that some plans are HMOs and some are PPOs, but what does that mean?

- HMO stands for health maintenance organization.

- PPO stands for preferred provider organization.

All these plans use a network of physicians, hospitals and other health care professionals to give you the highest quality care. The difference between them is the way you interact with those networks.

Which Is Better Pos Or Ppo

If you look at the premium cost alone, the POS is $56 cheaper a month, or $672 less a year. However, the deductible is $500 more per year as a family.

Tier 1 and 2 prescription drugs also cost more with the POS, but inpatient hospital stays and outpatient surgeries cost less. The PPO has a $250 per occurrence that has to be met before coinsurance kicks in for surgeries and hospital stays.

However, the PPO has better Rehab PT/OT benefits at a flat $30 versus 20% coinsurance after deductible with the POS plan.

What I also found interesting is the PPO example above doesnt cover OON benefits for Telemedicine, Preventative Care, Diagnostic Labs, or Chiropractic Care. So as you can see, not all PPOs provide OON benefits for every type of care.

Thats why you really have to know your individual health plan inside and out before signing up and getting services. There are SO many variances from one plan to the next even within the same plan type and metal tier. Always pay close attention to the nitty-gritty details when comparing health insurance plans.

And once again, if you plan to retire early with kids or become an entrepreneur, paying the full cost of your health insurance plan is one of the big downsides.

You May Like: Asares Advanced Fingerprint Solutions

How Is A Pos Different From A Preferred Provider Organization

The two biggest differences between a Point of Service and a Preferred Provider Organization plan are flexibility and cost. The more flexibility you want, the more you have to pay. PPO plans offer the most flexibility and thus have the highest premiums. POS plans cost less than PPOs due to offering fewer choices.

But theres more than just the monthly premium cost to consider when choosing between a POS and PPO plan. Youll also want to look at the cost of the deductibles, copays, and coinsurance. Most PPO plans have deductibles, whereas many POS plans do not if you use an in-network PCP and get referrals to see other providers as needed.

Copays, however, are common with both POS and PPO plans. They tend to be similar in cost within the same metal tier. Unless you have a lot of appointments each year, the difference in copay costs may not be significant between these plan types.

Youll also typically see coinsurance on both POS and PPO plans. However, you may be able to avoid coinsurance if you stay in-network and get referrals for specialists with a POS plan.

If you go with a POS plan, youll get the best value if you have a PCP that you really like and are fine going to see for referrals. If not, a PPO plan helps you avoid referrals and needing a PCP altogether if you dont want one.

Do You Stay Close To Home Or Do You Travel A Lot

If you travel frequently and are more likely to need care while away from home, especially if you are living with a chronic condition, or enjoy high-risk hobbies such as certain sports, you may need a PPO to provide the best coverage for your needs.

If you need a lot of specialist care, say you are managing a rare or chronic condition, you may also prefer the ease of choosing specialists and seeing them right away that you get with a HMO plan.

If you mostly get care in your home city or mostly from your family physician, an HMO is more likely to provide the right coverage for you.

You May Like: How To Enroll In Starbucks Health Insurance

Where To Find Healthcare Coverage Guidance Near You

Health insurance is necessary to provide medical protection for individuals and their families. J.C. Lewis Insurance Services offers a variety of affordable and flexible options for healthcare coverage suited to your specific needs.

We are a family-owned and operated California health insurance agent licensed to do business in California, and we specialize in medical insurance plans for small businesses, as well as for individuals and families, and people with Medicare.

At J.C. Lewis Insurance Services, we can tailor our recommendations to your particular needs since we are licensed with most major carriers in California. You save time and money, and we can quickly define your particular needs and recommend the best products and prices to meet those needs.

What Is The Difference Between An Hmo And A Ppo

- Patients in with an HMO must always first see their primary care physician . If your PCP cant treat the problem, they will refer you to an in-network specialist. With a PPO plan, you can see a specialist without a referral. .6

- With an HMO plan, you must stay within your network of providers to receive coverage. Under a PPO plan, patients still have a network of providers, but they arent restricted to seeing just those physicians. You have the freedom to visit any healthcare provider you wish.

So, whats the catch? Well, staying in your network with an HMO, you can expect the maximum insurance coverage for the services you receive according to your plan. Go outside of your network and your coverage disappears. With a PPO, you can visit doctors outside of your network and still get some coverage, but not as much as you would if you remained in your network.

So, because a PPO does not restrict you in your choice of physician, a PPO is the way to go, right? Not necessarily. There are many more things to consider when deciding between the two.

Lets discuss some of those now.

You May Like: Does Insurance Cover Chiropractic

How Does A Point Of Service Plan Work

A POS plan is a managed care health insurance plan with a network of health care providers. Like a PPO, you can see providers outside of the plans network, but you have higher copayments or other out-of-pocket costs.

Like an HMO, you may need to get a referral from your primary care provider for specialist and hospital visits.

The main difference between a PPO and a POS is the network. POS plans historically had a network that most closely resembled an HMO, meaning that the number of providers and hospitals might be a bit narrower than a PPO network, says Hope. I would say that the POS was a bit of an evolution from the HMO world to the PPO world.

How do plan costs compare? The employee pays on average $1,419 for single POS coverage annually, which is compared to $1,212 for HMO single coverage and $1,335 for PPO single coverage, according to the Kaiser Family Foundation.

The higher costs is one reason that members choose PPOs and HMOs more than POS plans. In 2020, 31% of the employers surveyed by the Kaiser Family Foundation offered POS plans, compared to 11% for HMOs, 56% for PPOs and 26% for high-deductible health plans. But few people chose the POS plans.

The 2020 market share for all covered employees was 8% for POS plans, 12% for HMOs, 31% for high-deductible health plans, and 47% chose PPOs. POS plans are more common in small firms than large firms with 17% of the market share at small firms and 5% at large firms.

Key Takeaways