How Do You Account For Payroll Withholdings For Health Insurance

Let’s assume that the cost of an employee’s health insurance is $300 per pay period and that the employee is responsible for paying 25% of that cost through payroll withholding. One way to handle the withholding is to Health Insurance Expense for the $75 withheld from the employee. The company will then debit Health Insurance Expense for the full insurance billing of $300. This will result in $225 being reported as the company’s health insurance expense for that pay period.

An alternative would be to credit a liability for the $75 withheld from the employee. When the company pays the insurance bill of $300, it will debit the liability account for $75.

Under either method, the company’s expense is $225 per pay period.

What Makes Health Care So Expensive

The price of medical care is the single biggest factor behind U.S. healthcare costs, accounting for 90% of spending. These expenditures reflect the cost of caring for those with chronic or long-term medical conditions, an aging population and the increased cost of new medicines, procedures and technologies.

How Much Does Health Insurance Cost A Company Per Employee

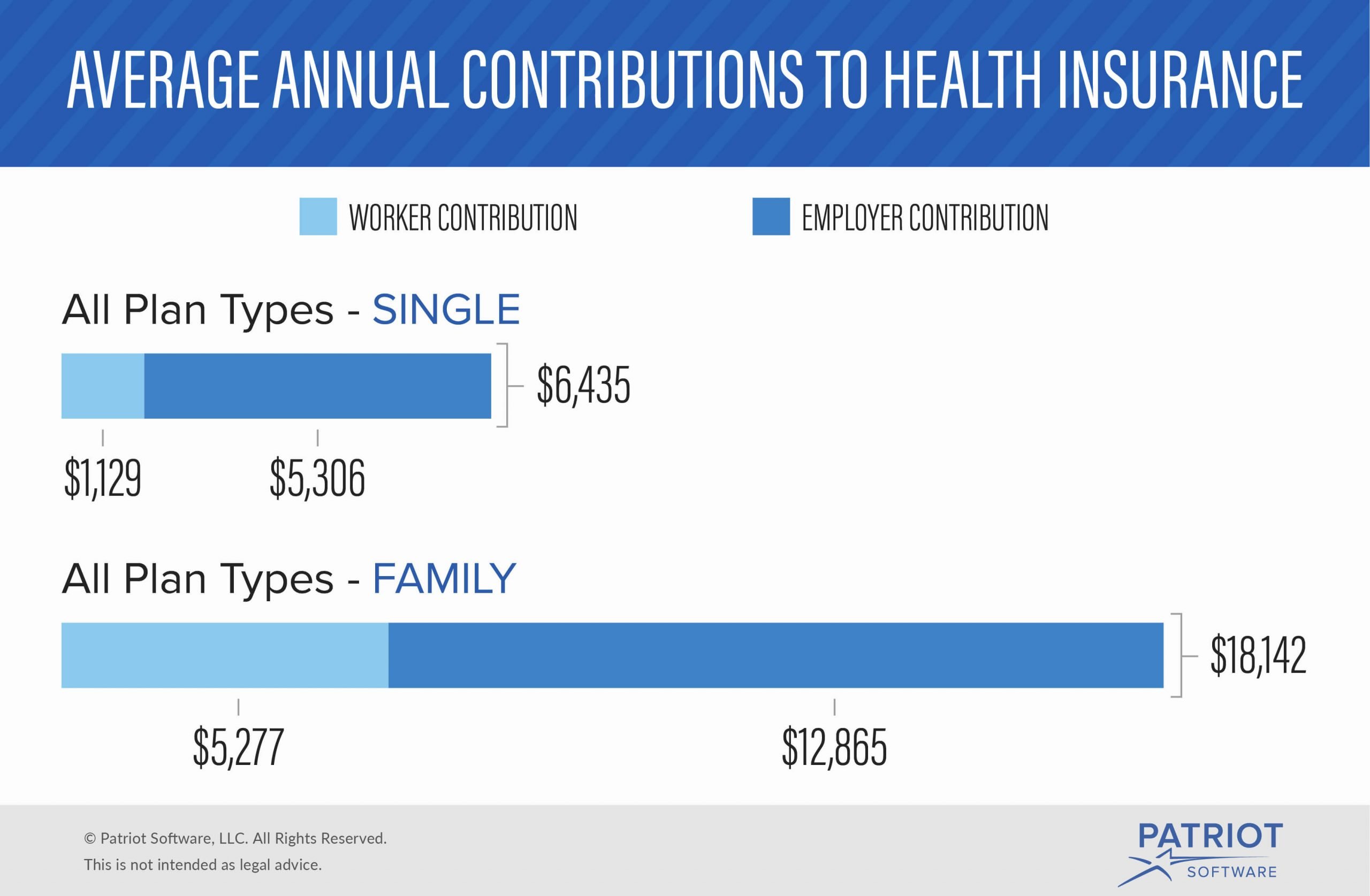

Health insurance costs vary widely but the average annual premiums for employer-sponsored coverage in 2020 were $7,470 for single coverage and $21,342 for family coverage. When you take into account the average contributions by workers, that brings the employer costs to $6,227 and $15,754 respectively.

The actual amount youll pay is based on a number of different factors, which well cover next.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Uniforms And Protective Clothing

Your employee does not receive a taxable benefit if either of the following conditions apply:

- you supply your employee with a distinctive uniform they have to wear while carrying out the employment duties

- you provide your employee with protective clothing designed to protect them from hazards associated with the employment

If you reimburse or pay an accountable advance to your employee to buy uniforms or protective clothing and require receipts to support the purchases, the reimbursement or accountable advance is not a taxable benefit if:

- the cost of the uniforms or protective clothing is reasonable

If you pay an allowance to your employee for the cost of protective clothing and did not require receipts to support the purchases, the allowance is not a taxable benefit if all of the following conditions apply:

- the employee used the allowance to buy protective clothing

- the amount of the allowance is reasonable

You may pay a laundry or dry cleaner to clean uniforms and protective clothing for your employee or you may pay a reasonable allowance to your employee . You may also reimburse the employee for these expenses when they present a receipt. If you do either of these, the amounts you pay are not taxable benefits for the employee.

You Probably Wont Qualify For Marketplace Savings

If you have an offer of job-based coverage and enroll in a Marketplace plan instead, you probably wont qualify for a premium tax credit and other savings even if your income would qualify you otherwise.

Youd have to pay full price for a Marketplace plan even if you dont enroll in the insurance your employer offers.

If you have an offer of job-based insurance, the only way youll qualify for savings on a Marketplace plan is if your employers insurance offer doesnt meet minimum standards for affordability and coverage. Most job-based plans meet these standards.

âAffordableâ plans and the 9.61% standard

A job-based health plan is considered âaffordableâ if your share of the monthly premiums for the lowest-cost self-only coverage that meets the minimum value standard is less than 9.61% of your household income.

You may pay more than 9.61% of your household income on monthly premiums if youre enrolled in your employers spouse or family coverage. But affordability is determined only by the amount youd pay for self-only coverage.

The minimum value standard

A health plan meets the minimum value standard if it pays at least 60% of the total cost of medical services for a standard population and offers substantial coverage of hospital and doctor services.

In other words, in most cases a plan that meets minimum value will cover 60% of covered medical costs. Youd pay 40%.

Most job-based plans meet the minimum value standard.

Read Also: Starbucks Health Insurance Cost

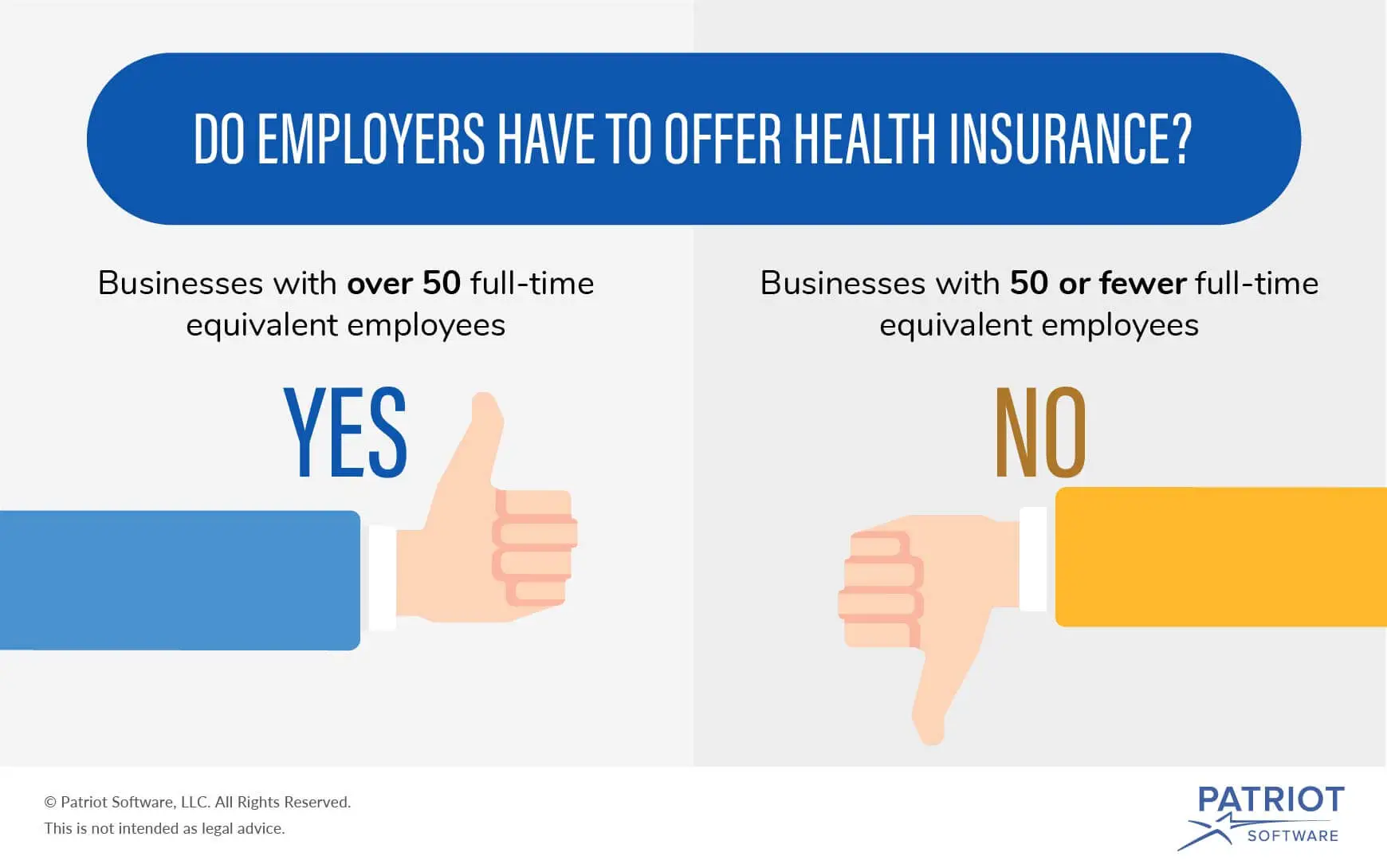

Is An Employer Required To Pay For Health Insurance

If you decide to offer health insurance to your team, in many cases, your responsibility doesnt end there. In the majority of states, carriers will require you to cover 50% of the premium cost for employees. This requirement, however, only applies to premiums for the employee, not their covered dependents. For other tiers of coverage, such as employee and spouse, employee and children, or family, the insurers want employers to pay 33%.

For 2020, the affordability threshold is 9.78% of an employees income.

Many employers even choose to contribute more than this amount. In fact, last year, on average, covered workers contributed only 17% of their premium for single coverage and 27% for family coverage. One reason for this, especially in companies with lower-wage workers, is that large employers covered by the ACA must offer affordable coverage or be penalized. For 2020, the affordability threshold is 9.78% of an employees income.

The Importance Of Affordable Employer

Understanding the average cost of employer-sponsored health insurance can help small business owners explore coverage options for themselves, their families, and their employees.

According to an of small business owners, the top two most important factors for small employers when choosing a group health plan are affordable monthly premiums and out-of-pocket costs.

Source: eHealth 2018 Small Business Health Insurance Report

Don’t Miss: Can I Go To The Er Without Health Insurance

What Does The Employer Mandate Require

If a business is classified as an ALE, it must offer affordable, comprehensive health coverage to any employee who works at least 30 hours per week.

But its also important to note that if an employer offers multiple plans, the least-expensive option is used to determine whether the employer is in compliance with the employer mandate . This is true even if an employee selects a more expensive option.

Where Do Health Reimbursement Arrangements Come From

Tax-free reimbursement used to be a common practice for small business owners. However, when the Affordable Care Act passed in 2010, the law had the unintended consequence of disallowing tax-free reimbursement for small companies. The primary hang-up was an interpretation that any company that reimbursed for health insurance was technically a group plan. According to the ACA, group plans are required to provide preventive care at no cost. Since employers that reimbursed for individual plans did not meet the preventive care requirements, they would be subject to group plan penalties of up to $100 per employee per day.

While Congress addressed the hotly debated topic of “Obamacare,” little was done to help fix the problem. In late 2015 the IRS started enforcing the provision and leveraging hefty fines and penalties for companies caught reimbursing for individual health insurance.

In late 2016, the bipartisan 21st Century Cures Act was signed into law by President Obama that opened up the doors for health reimbursement arrangements for small employers. Three years later, regulatory rule updates allowed for this same treatment to be used by employers of all sizes and with a greater degree of flexibility.

You May Like: Is Starbucks Health Insurance Good

Percentage Of Firms Offering Health Benefits

Not only do small employers have tighter budgets to begin with, the rising cost of health insurance makes it even harder to offer a benefit.

The average premium for family coverage has increased 22% over the last five years and 55% over the last ten years, significantly more than either workers wages or inflation. This steady increase in costs can make it difficult for small employers with tight budgets to continue to offer employees with a health benefit that will provide enough value.

Offering Health Benefits: A Competitive Advantage

According to the BLSs most recent Employment Situation Summary, the total of nonfarm payroll employment rose by 379,000, with the leisure and hospitality industries receiving the most positive impact.

It may seem a modest step forward towards recovery, especially after the COVID-19 pandemic. Still, it is a clear sign that, as the economy starts to recuperate, recruiters will start competing to gain the attention of talent who are looking to enter or reenter the workforce.

An attractive health benefits package is a magnet for top staff at any company and will also help you retain committed employees. Although health care is considered one of the most expensive benefits, it is undoubtedly an investment into your companys future.

Recommended Reading: Starbucks Insurance Benefits

Guide To Providing Health Care Benefits To Employees

How Does Health Insurance for Employees Work? Health insurance plans for employees are commonly How Much Does Health Insurance Usually Cost? employers pay $5,700 per employee for single coverage

Still paying or reimbursing your employees premiums for individual health who did not offer health insurance would often reimburse employees for individual plan Many smaller employers adopted per employee penalty if they reimburse or pay any portion of individual health

Discounts On Merchandise And Commissions From Personal Purchases

If you sell merchandise to your employee at a discount, the benefit they get from this is not usually considered a taxable benefit.

However, we consider discounts to be taxable in all of the following situations:

- you make a special arrangement with an employee or a group of employees to buy merchandise at a discount

- you make an arrangement that allows an employee to buy merchandise for less than your cost

- you make a reciprocal arrangement with one or more other employers so that employees of one employer can buy merchandise at a discount from another employer

If you determine the discount is taxable or you sell merchandise to your employee below cost, the taxable benefit is the difference between the fair market value of the goods and the price the employees pay.

Commissions that sales employees receive on merchandise they buy for personal use are not a taxable benefit. Similarly, when life insurance salespeople acquire life insurance policies, the commissions they receive are not taxable as long as they own the policies and have to make the required premium payments. This only applies where the income received is not significant and the insurance policy has no investment component or business use.

Note

This policy does not apply to discounts on services.

You May Like: Does Starbucks Provide Health Insurance

Affordability Standards With The Affordable Care Act

When determining how much youll contribute to your employees health insurance premiums, remember that the Affordable Care Act sets specific affordability standards.

The law says that, in order for health coverage to be deemed affordable, the lowest-priced individual plan offered by the employer must cost 9.56 or less of the employees household income. Note that this figure not only include the employees income, but also the total income for those contributing to the household.

This standard does not include employee plus spouse, employee plus children, or family coverage, nor any other out-of-pocket expenses, like deductibles, coinsurance, or copays. Of course, this is referring to the employee-paid portion of the premium not the entire premium.

For example, if an employees monthly household income is $4,083 , 9.56 percent of their income is $390 per month. If the employees portion of the lowest-priced health insurance plan is $390 per month or less, the plan is deemed affordable.

If your health coverage is deemed affordable and also meets the minimum value standard, employees who choose to purchase a plan on the ACA marketplace instead of enrolling in your employer-sponsored plan, would not qualify for any tax subsidies.

Your employer-sponsored plan meets the minimum value standard if both of the following requirements are met:

If My Employer Voluntarily Provides Health Insurance Benefits Is It Obligated To Provide Benefits To All Employees

Maybe, depending on the employer. Employers covered by Obamacare must provide health insurance to at least 95% of their full-time employees and dependents up to age 26. Otherwise, an employer is free to cover some, as opposed to all, of its employees. For example, salespersons can be excluded from an insurance plan while administrators are covered.

Exception: If an employee is entitled to participate in an employer-provided health benefits plan under ERISA, an employer may not wrongfully deny participation. To qualify, an individual must be classified as an employee, not a temporary worker or independent contractor and must be eligible to receive benefits according to the terms of the plan.

Don’t Miss: What Insurance Does Starbucks Offer

Which Hra Is Right For My Business

What makes sense for your company depends on a number of factors, like company size, budget, legal makeup, local insurance market factors, etc. Some cities have market conditions with competitive individual insurance markets that make them prime for this new reimbursement model.

For additional resources, check out our QSEHRA Guide, our ICHRA Guide, or our wildly popular ICHRA FAQ Page.

Our team of HRA experts is online and ready to walk you through your options. Give us a shout!

How Many Small Businesses Offer Employer

When considering the costs of health coverage for employees, small business owners may wonder how common it is to provide an employer-sponsored plan.

According to the KFF survey, 57 percent of all firms offered health benefits, while 71 percent of firms with 10 to 199 workers offered health coverage in 2019. The percentage was lower for very small groups, with the survey noting that only 47 percent of firms with 3 to 9 workers offered health coverage to their employees.

Source: Kaiser Family Foundation 2019 Employer Health Benefits Survey

Given that only about half of small businesses offeremployer-provided health insurance, companies that do offer this popular employee benefit have a competitive advantage. Offeringhealth insurance may be one way to stand out from other employers whilecontributing to a companys recruiting strategy and employee benefits package.

Overall, the KFF survey notes that trends in the employer-providedhealth insurance market have been moderate over the past several years.Premiums have increased annually, but in the low to mid-single digits,and cost sharing, especially for deductibles, has meaningfullyincreased over time.

Also Check: Where To Go If You Have No Health Insurance

You May Like: Does Starbucks Give Health Insurance

Where Can I Buy Private Health Insurance

A good place to start looking for coverage is the Health Insurance Marketplace created in 2014 by the Affordable Care Act . On the marketplace for your state, you can look through the details of private health insurance plans, and compare the cost and benefits of each. If your state does not have its own marketplace, use Healthcare.gov.

Read Also: How To Get Health Insurance In France

Can I Enroll In Marketplace Health Insurance If My Employer Offers Insurance

The Affordable Care Act ensures that almost all Americans can buy individual and family health insurance from the online Marketplace. To qualify to shop on the Marketplace, there are just a few general requirements. You need to live in the U.S., not be incarcerated, and be a U.S. citizen or hold a number ofpermitted immigration statuses that include being a refugee, a green card holder, a survivor of domestic violence, and more. If you meet these general criteria, you can shop for Obamacare plans during the annual Open Enrollment Period . You can also shop on the Marketplace during aSpecial Enrollment Period if you have aqualifying life event like a marriage, birth, or move.

Many people like to shop on the health insurance Marketplace for its comprehensive, affordable health insurance plans. Want to compare prices to see if Marketplace coverage might be less expensive than opting into your employer-provided plan? Youll need to consider a few things, especially when it comes to your bottom-line costs.

To see plans and prices in your area, enter your zip code below.

Also Check: Starbucks Perks For Employees

Do You Give Your Employee A Benefit An Allowance Or An Expense Reimbursement

Your employee has received a benefit if you pay for or give something that is personal in nature:

- directly to your employee

- to a person who does not deal at arms length with the employee

A benefit is a good or service you give, or arrange for a third party to give, to your employee such as free use of property that you own. A benefit includes an allowance or a reimbursement of an employees personal expense.

An allowance or an advance is any periodic or lump sum amount that you pay to your employee on top of salary or wages, to help the employee pay for certain anticipated expenses without having them support the expenses. An allowance or advance is:

- usually an arbitrary amount that is predetermined without using the actual cost

- usually for a specific purpose

- used as the employee chooses, since the employee does not provide receipts

An allowance can be calculated based on distance, time or something else, such as a motor vehicle allowance using the distance driven or a meal allowance using the type and number of meals per day.

A reimbursement is an amount you pay to your employee to repay expenses they incurred while carrying out the duties of employment. The employee has to keep proper records to support the expenses and give them to you.

How To Calculate The Amount Of The Gst/hst You Are Considered To Have Collected

The amount of the GST/HST you are considered to have collected on a taxable benefit is based on a percentage of the value of the benefit for GST/HST purposes. The percentage rate you use depends on:

- the province or territory in which the employee ordinarily reported to work

- if you are a large business on December 31, 2020, for the purpose of the recapture of input tax credits for the provincial part of the HST

- if the benefit is an automobile operating expense benefit

- some other type of benefit

Value of the benefit

The value of the benefit for GST/HST purposes is the total of the following two amounts:

- the amount reported on the T4 or T4A slip for the benefit

- if the taxable benefit is for a standby charge or the operating expense of an automobile, the amount, if any, that the employee or the employee’s relative reimbursed you for that benefit

Note

When an employee or an employee’s relative has reimbursed an amount equal to the entire taxable benefit for a standby charge or the operating expense of an automobile and, as a result, no benefit is reported on the T4 slip, the value of the benefit for GST/HST purposes is equal to the amount of the reimbursement.

Automobile operating expense benefits

- 11% for Prince Edward Island, or 9.4% if you are a large business on December 31, 2020, for the purposes of the recapture of input tax credits for the provincial part of the HST

- 11% for Nova Scotia, New Brunswick, and Newfoundland and Labrador

- 9% for Ontario

Also Check: Starbucks Healthcare Benefits