Navigating Private And Public Coverage

In some cases, people use a combination of both public and private plans to access the drugs and treatments they or their family member needs Provincial and Territorial public drug programs also have an impact on private insurance coverage, as each program can vary slightly, and in many cases can coordinate with private insurance plans differently. The coordination of benefits is a process whereby payments are coordinated through two or more drug plans . One plan is considered the primary insurer. The primary insurer is defined in the policies of the insurance plan/drug program. The portion of the drug cost not paid for by the primary insurer is claimed through the secondary insurer.

Please watch for more information to come on how each public drug program works with private plans to coordinate benefits.

Explore A Student Plan

So youre off to school. Youve picked a major, met your roommate and have your class schedule. But do you have coverage in case you get sick at school?

If you are a college student but cant remain on your parents insurance, you may be eligible for low-cost insurance through your university.

To clarify, some colleges offer health insurance and then lump in the cost with your room and board.

Private companies can also offer lower premiums for students.

A company called University Health Plans helps administer low-cost health insurance for students at dozens of colleges around the country.

Another option is comparing rates with your current car insurance company. Their rates can be competitive with other insurance options.

Tip #: Know Where To Go

It’s not always obvious where to look for health insurance. “In this country it is a truly wacky patchwork quilt of options,” says Sabrina Corlette, who co-directs the Center on Health Insurance Reform at Georgetown University.

If you’re 65 or older, you’re eligible for Medicare. It’s a federally run program the government pays for much of your health care. You might also be eligible if you have certain disabilities. For those already enrolled in Medicare or in a Medicare Advantage plan, the open enrollment period to switch up your supplemental health and prescription drug plans for 2022 runs through Dec. 7 this year.

For those under age 65, Corlette says, “the vast majority of us get our coverage through our employer. The employer typically will cover between 70% and 90% of your premium costs, which is pretty nice.” Check with your supervisor or your company’s human resources department to find out what, if any, plans are available to you through your job.

Don’t Miss: Starbucks Insurance For Part Time Employees

What You Should Know About Affordable Individual And Family Health Insurance

- Insurance access varies: How you get health coverage depends on whether your employer offers coverage, your age, income, and other factors.

- Consider overall affordability: An affordable health insurance plan isnt just based on monthly premium, but all of your out-of-pocket costs including deductibles, copays, and coinsurance.

This guide provides guidance and resources for how to find affordable health insurance including:

How To Find Health Insurance When Youre Self Employed

Its disheartening to know that many Americans are stuck in jobs they hate, just so they can get health insurance. But long gone are the days when you have to stay at a job for the health insurance.

Many people have cut ties with their full-time jobs and are now freelancing, starting businesses, or working odd-jobs just to get by.

According to Forbes, around 53 million people in the US are considered self-employed a figure that continues to grow every year.

Theres something undeniably appealing about being your boss and pursuing your passions, but getting health insurance as someone self-employed can be tricky. In this article Ill show you how it can be done:

Don’t Miss: Starbucks Benefits Package

Individual Health Insurance Subsidies

People who buy an individual health plan through the ACA exchanges may be eligible for subsidies that reduce the cost of premiums.

The ACA allows tax credits and subsidies. Only people with household income below 400% of the federal poverty level are eligible for subsidies.

However, the American Rescue Plan of 2021 included a provision that opens up subsidies and tax credits to everyone with an ACA plan through 2022. People with an ACA plan will now pay up to 8.5% of their household income on ACA Plan premiums. The Centers for Medicare and Medicaid Services estimates the American Rescue Plan will temporarily save ACA members an average of $50per person per month and $85 per policy per month.

When you search for a plan through the ACA exchanges, the site provides cost estimates for plans with subsidies in mind.

Reminder: People with an individual health plan outside of the exchanges arent eligible for subsidies.

Finding Insurance On The Open Market

Don’t Miss: Can You Add A Boyfriend To Your Health Insurance

Go Through Your Employer

This choice is a no-brainer for anyone who works for a sizable company.

If your employer subsidizes the cost of health insurance, youll usually get better coverage and pay less than if you were to try and purchase insurance on your own.

In most cases, employers will allow you to buy insurance for not just yourself, but your immediate family.

Employers will often give you a choice between a more robust plan with higher premiums and a lower-cost plan with less coverage or more restrictions.

Companies often will offer dental insurance and vision plans as well.

The Kaiser Family Foundation reported that about 156 million people receive employer-sponsored insurance.

On average, most workers contribute between 0% and 25% of the premium cost to get health insurance.

And workers who received employer-sponsored insurance contributed an average of $5,588 in premiums in 2020, while employers contributed $15,754 .

I’ve Tried To Get On Medicaid In The Past But Couldn’t Will My Chances Be Better Under The Affordable Care Act

Possibly, but a lot depends on what state you live in.

Health reform called for more people to be able to get Medicaid. However, it’s up to each state to decide whether to expand the program.

To find out if you can get on Medicaid now, go to HealthCare.gov. If the federal government is running the Marketplace in your state, you can fill out an application there. If your state is running its own Marketplace, you will be directed to another website where you can fill out an application. You can fill out one application to see if you qualify for Medicaid or for a tax credit to buy insurance on the Marketplace.

Also Check: Starbucks Insurance Benefits

President Expands Special Enrollment Period For Low

The ACA marketplaces open enrollment is usually from in most states, but starting in 2022, low-income Americans will have more chances to get a marketplace plan.

People with income up to 150% of federal poverty level will be eligible for a special enrollment period each month. The Centers for Medicare and Medicaid Services estimates that about one-third of marketplace plan members will qualify.

If Your Employer Offers Health Insurance

Most people with health insurance get it through an employer. If your employer offers health insurance, you wont need to use the government insurance exchanges or marketplaces, unless you want to look for an alternative plan. But plans in the marketplace are likely to cost more than plans offered by employers. This is because most employers pay a portion of workers insurance premiums.

Don’t Miss: Part Time Starbucks Benefits

Deduction On Preventive Health Check

You can also claim tax benefits on preventive health check-ups annually under Section 80D of the Income Tax Act. You can claim up to 5,000 every budgetary year as expenses incurred for preventive health check-ups.

Please note that the above-mentioned benefits are as per the current tax laws prevailing in the country. Your tax benefits may change subject to tax laws. It is advisable to reconfirm the same with your tax consultant. This is independent of your health insurance premium value.

Utilize Tax Breaks For Self

Its always a good idea to pay attention to the tax breaks available for self-employed people. Its not enough just to sign up for a health insurance plan, you have to make sure that it fits with your current financial situation and works well with your overall tax scenario.

That said, here are some of the ways you can save money on your taxes while still maintaining health insurance coverage:

Use a Flexible Spending Account . This is an account that will allow you to set aside pre-tax dollars each year so they can be used toward medical expenses as they arise throughout the year.

The FSA has several restrictions based on annual income and family size that prevent many Americans from using them effectively however, if these restrictions dont apply in your case .

Then this could be an effective way for saving money on healthcare costs by offsetting them against taxes owed at the end of the year.

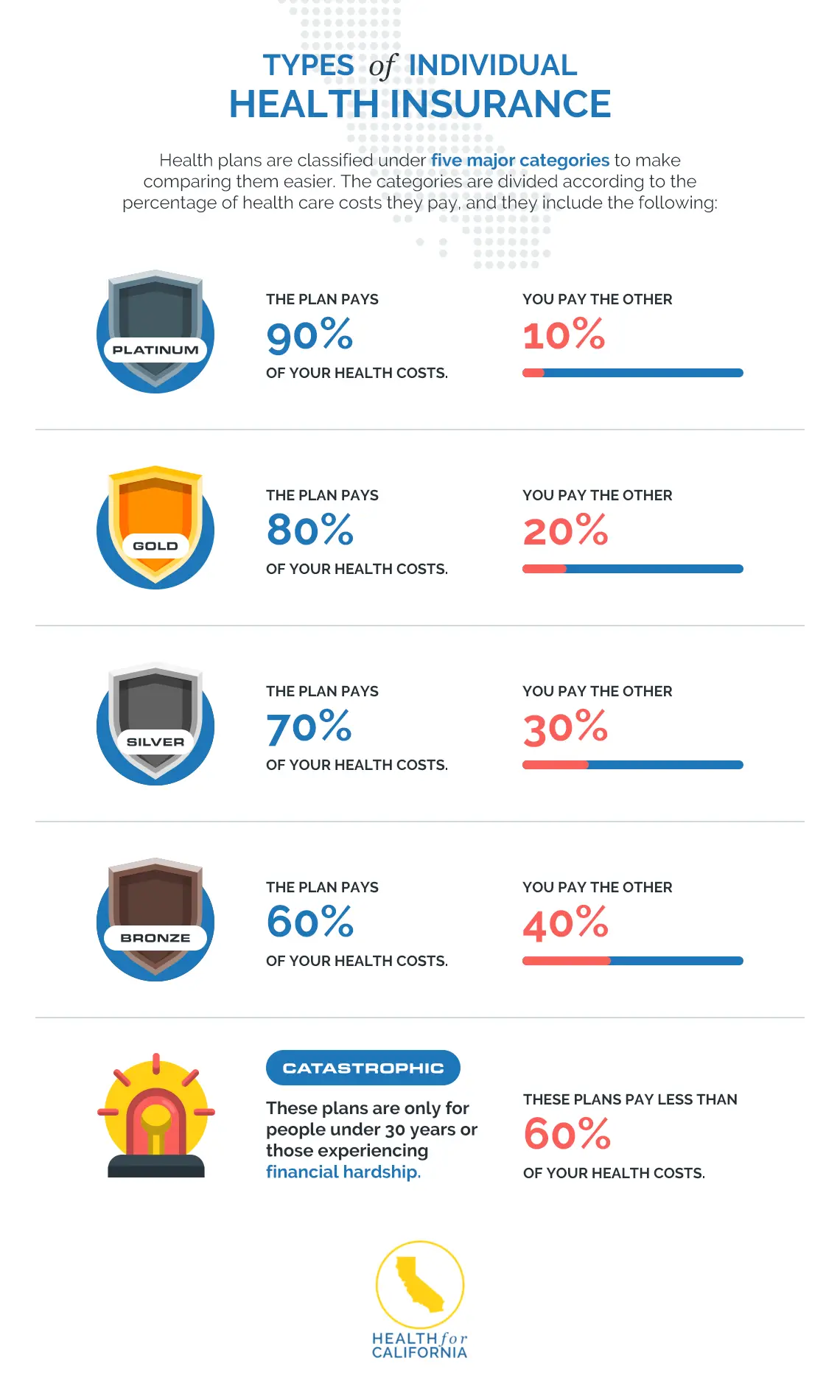

Buy high deductible plans or catastrophic plans rather than comprehensive plans .

If possible, try not to buy a plan with low deductibles because those will cost more out-of-pocket after paying premiums each month for 12 months straight!

Don’t Miss: Starbucks Health Insurance Part-time

If Your Employer Doesnt Offer Health Insurance

Shop your states online marketplace, if available, or the federal marketplace to find the plan that’s best for you. Start by going to HealthCare.gov and entering your ZIP code. Youll be sent to your states exchange, if there is one. Otherwise, youll use the federal marketplace.

You can also purchase health insurance through a private exchange or directly from an insurer. If you choose these options, you wont be eligible for premium tax credits, which are income-based discounts on your monthly premiums.

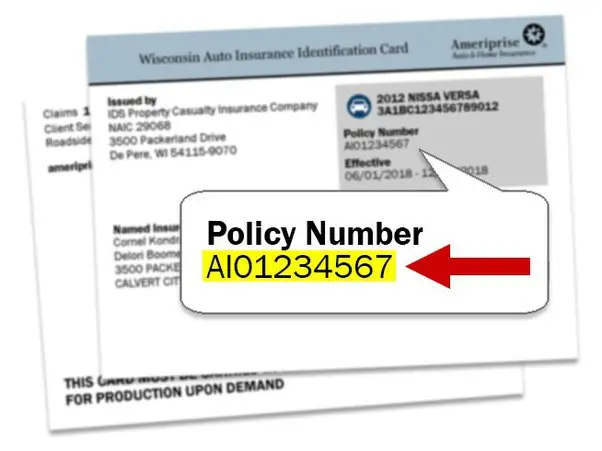

What If You Lose Your Health Insurance Card

When going to the doctor, you should bring an ID card such as a driverâs license, your health insurance card and payment to pay for any office visit copay amounts youâre responsible for.

That said, if you donât have your insurance card, you can usually still use your health plan. Many doctorsâ offices will accept your policy number for billing purposes, so itâs a good idea to have it written down somewhere in your wallet or in your phone.

If you misplace your health insurance card, youâll want to get a replacement. You can contact your insurance carrier to request a new card.

Or, most large insurance companies now host member portals where you can view information about your policy and claims, transact secure email communication, and process routine administrative requests such as printing a new insurance card.

In some cases, if you donât have your card or the policy number, you may need to pay your entire bill at the time of service, then file a claim with your insurance company for reimbursement after you receive your policy number or insurance card.

Also Check: Evolve Medical Insurance

Applying For Health Insurance Doesn’t Have To Be Confusing Here’s A Handy Glossary

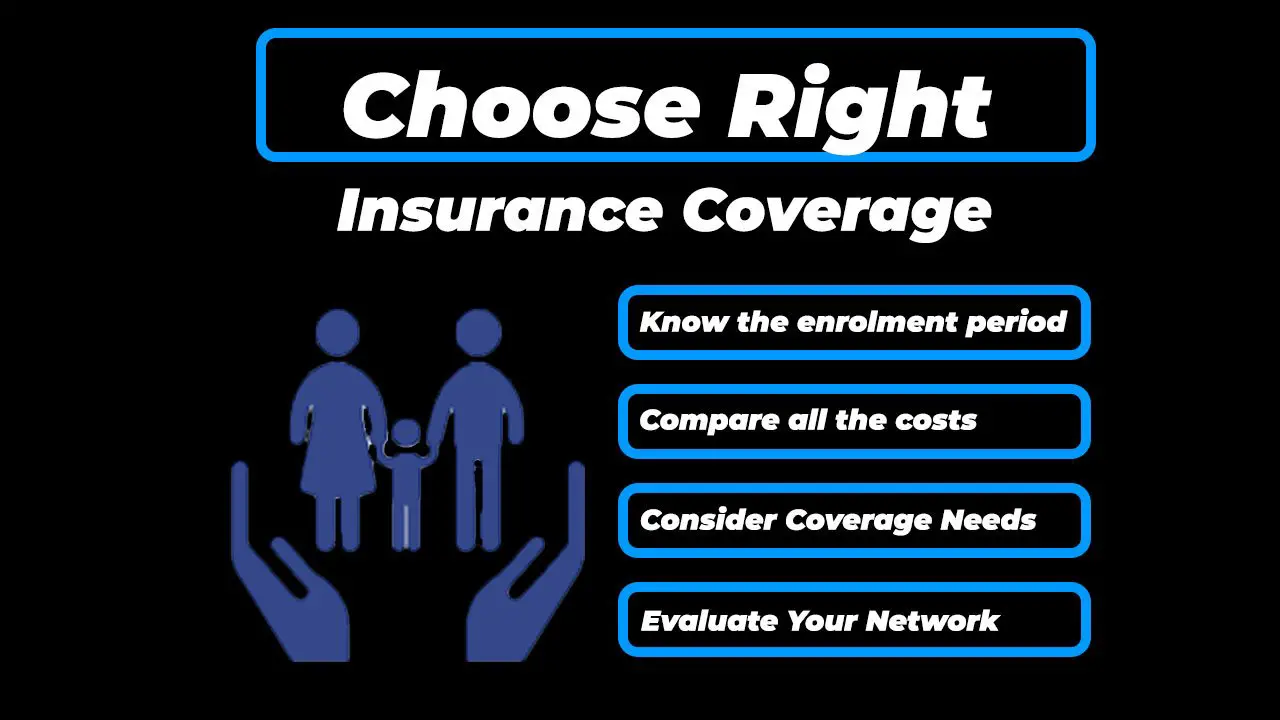

Whether you’re aging out of your parent’s plan and picking one for the first time, or you’re in a plan that no longer works for you and you’re ready to switch things up, or you’re uninsured and want to see if you have any workable options, there’s good news. Asking yourself a few simple questions can help you zero in on the right plan from all those on the market.

Here are some tips on where to look and how to get trustworthy advice and help if you need it.

Our Tips For Choosing Your Covid

Are you still hesitating before choosing the right Covid-19 travel insurance for you? Which company should you choose? Beyond the price, what guarantees make a difference? Discover our tips to help you make a decision that meets your needs and expectations.

Now you know what Covid-19 travel insurance is. You understand why this type of travel insurance is strongly recommended or even mandatory depending on your destination. To plan your trip with peace of mind, compare several travel insurance policies specifically related to Covid-19. Check the coverage levels and reimbursement limits. Select the Covid-19 travel insurance that meets your needs and expectations to ensure a well-insured trip in case of unforeseen events.

Also Check: Insusiance

Accessing Drugs Through Private Insurance

To gain access to health medications, devices and services not covered by the public health system, people must m pay out-of-pocket and/or acquire additional coverage to cover some or all of these costs. According to the Canadian Institute for Health Information , of the 36% of Canadians that have private coverage, 99% receive coverage through employee or group benefits plans. Employers purchase these plans and determine the terms of the plan for their employees. Some plans provide options to also cover the employees dependents. Some plans allow employees and/or their dependents to opt of their plan if comparable coverage is available. Sometimes opting out of or into a plan has a cost.

There are a number of factors that determine whether a drug will be covered, including but not limited to: internal and external prior authorization issues, the size/number of people the plan covers, ability to pay without increasing premiums, and other considerations. However, plans should also be considering the impact game-changing drugs like Trikafta has on individual employees and their ability to contribute to the workplace and broader society.

Research Prescription Drug Coverage

Prescription drug coverage varies based on the tier of individual health insurance you select. Before buying a policy, understand what youll pay for prescription drugs, so you are prepared to manage the cost of maintenance medicines, in particular. HealthCare.gov provides a tool so you can check the cost of your prescriptions with plans youre considering.

Read Also: Starbucks Partner Health Insurance

How To Get An Insurance Plan

In order to start the process of finding the best insurance policy for you or your employees, you need to contact us. We are available to take your call, respond through our online contact form or by email.

Schedule a discovery call with us and tell us about your company, what you want the policy to cover, what area you operate in and where you need the medical services to be located, etc. We will cover a lot of details during this stage, to make sure that the shortlist of insurers we will present to you are able to meet all your needs.

Dont hesitate to voice your wishes in terms of health plans, as our experience and authority in this industry allow us the flexibility you need. Contact us today and get a list of the best insurance plans available on the market.

How To Choose Health Insurance: Your Step

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here’s how we make money.

You typically have a limited amount of time to choose the best health insurance plan for your family, but rushing and picking the wrong coverage can be costly. Heres a start-to-finish guide to help you find affordable health insurance, whether its through a state or federal marketplace or through an employer.

Recommended Reading: Starbucks Insurance Part Time

Pay Less For Being Healthy

Are you a non-smoker? Are you willing to track steps? Do you belong to a gym?

Some insurance companies will offer discounts or other incentives for people who are healthy or willing to make certain lifestyle changes.

The Affordable Care Act allows insurance companies to charge more in premiums to tobacco users, making it financially sensible to quit smoking.

Several apps pay you to exercise too.

Moreover, your employer might offer financial incentives if you take part in a wellness program.

A survey from National Business Group on Health and Fidelity Investments noted that 86% of employers offer some sort of incentive, with the average incentive valued at $784.

Do I Really Need Health Insurance

When faced with the prospect of having to find and purchase their own health insurance, some otherwise healthy people may wonder whether it’s necessary. The answer to that question is a resounding: Yes.

For people without health insurance, dealing with the costs of an unexpected accident or serious illness can be financially devastating. Luckily, obtaining coverage for yourself or your family without the help of your employer is much easier than it used to be. Insurance companies can no longer deny coverage because of preexisting medical conditions. Additionally, policies must provide health screenings, yearly checkups and other preventive services with no out-of-pocket costs to you.

Recommended Reading: How To Get Insurance Between Jobs