Health Insurance Deductibles: What Can You Expect

On top of premiums, everyone who carries health insurance also pays a deductible. This means you pay 100% of your health expenses out of pocket until you have paid a predetermined amount. At that point, insurance coverage kicks in and you pay a percentage of your bills, with the insurer picking up the rest. Most workers are covered by a general annual deductible, which means it applies to most or all healthcare services. Here’s how general deductibles varied in 2020:

- $1,644: average general annual deductible for a single worker, employer plan

- $2,295: average annual deductible if that single worker was employed by a small firm

- $1,418: average annual deductible if that single worker was employed by a large firm

| Median Individual Deductible, Qualifying Health Plan Without Subsidies from HealthCare.gov., Plan Year 2020 |

|---|

| Bronze |

| $95 |

Individuals who are eligible for cost-sharing reductions are responsible for deductibles as low as $115 for those with household incomes closest to the federal poverty level.

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you need to do in order to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

How Do You Get Health Insurance In Florida

Florida residents can purchase plans from private providers or the federal exchange during open enrollment. Outside of open enrollment, you may qualify for a special enrollment period due to a qualifying life event, like getting married or losing coverage. Floridians can also enroll in short term plans without a qualifying life event for quick coverage outside of open enrollment.

You May Like: Where To Go If You Have No Health Insurance

You May Like: Can You Be Denied Health Insurance If You Have Cancer

Average Health Insurance Cost By Age

Age plays a big role in the cost of a premium for health insurance generally, younger people have lower premiums, as they are seen as less risky and less likely to require more medical care.

Often, the starting point for an insurance rate is based on that of an individual who is 21 years old. According to ValuePenguin, the average health insurance premium for a 21-year-old was $200 per month. This is also an average for a Silver insurance plan below Gold and Platinum plans, but above Bronze plans.

How does the breakdown of premiums by age look? Slowly in small increments, the average premium will increase. Ages 21-24 were all consistent at $200, but at 25 the premium goes up to $201 about 1.004 x $200.

Slowly the amount it goes up increases. At 26 the average premium is 1.024 times the base premium, up to $205. By the age of 30, though, it has gone up for an average premium to $227, or 1.135 x $200.

Going through the list of ages, this pattern is pretty consistent. The average premium for a policyholder at 35 years is $244, 1.222 times the base rate at 40, its 1.278 times that rate to bring the average premium up to $256.

From here, though, the premiums start going up at higher rates. The average health insurance premium for a policyholder at 45 is $289, up to 1.444 times the base rate, and by 50, its up to $357, which comes out to 1.786 x $200.

Dont Miss: Is It Required By Law To Have Health Insurance

How Much Is Family Health Insurance

As with almost all types of health coverage, there are several different costs associated with family plans, including:

- Premiums Premiums are monthly payments that you make to remain enrolled in your family health insurance plan. The average premium for major medical health insurance plans for families was $1,152 a month in 2020.

- Deductibles A deductible is the amount of money you must pay out of pocket for healthcare before your insurance kicks in. For example, if your family health insurance plan has a $10,000 deductible, youll need to pay all your medical bills until youve spent $10,000 your insurance will then cover much of the remaining care you get that year. On average, health insurance plans for families had deductibles of $8,439 in 2020. Average deductibles have also been rising, though not as rapidly as premiums.

- Various costs- There are other costs associated with health insurance plans like copayments, coinsurance, and out-of-pocket maximums. You will want to assess your familys health care needs to determine how these costs will affect you. If you foresee needing a lot of care, then you may want to opt for a plan with a higher premium, but lower costs elsewhere, like your coinsurance, copayment, and deductible.

While these are average costs, specific pricing will vary based on the plan you choose, the amount of coverage you receive, and the number of people in your family to be insured.

Also Check: Why Is Private Health Insurance So Expensive

Is United Health Group Part Of Unitedhealthcare

UnitedHealthcare is the insurance arm of UnitedHealth Group and the largest single health carrier in the U.S. UnitedHealth Group President David Wichmann oversees UnitedHealthcares domestic and international businesses.

Does United Healthcare pay for home care?

United Healthcare Insurance to Pay for In-Home Care Long term care policies are also a good source for in-home care coverage. Those covered typically have access to home health care aides in addition to skilled medical care for in-home physical, speech or occupational therapy.

Deduction On Preventive Health Check

You can get tax benefits up to 5000 in a year for preventive health check-ups.

Please note that the above-mentioned benefits are as per the current tax laws prevailing in the country. Your tax benefits may change subject to tax laws. It is advisable to reconfirm the same with your tax consultant. This is independent of your health insurance premium value.

Protect Your Family Against Coronavirus Hospitalization Expenses

Don’t Miss: How To Buy Your Own Health Insurance

How Does Health Insurance Work In Ontario

In Ontario, healthcare costs are covered by a mixture of universal public insurance known as OHIP and by private insurance from providers like Manulife, Sun Life, Canada Life or Blue Cross.

Individual health insurance helps pay medical expenses incurred from illness or injury. It can also cover some everyday medical costs like dental, vision and prescriptions. On top of access to universal public health insurance through Ontarios OHIP, one may obtain additional health insurance through ones employer or buy it independently.

Concerning health care for Indigenous peoples, including First Nations, Inuit and Métis, the federal, provincial and territorial levels of government share jurisdiction. The Canadian health system allows Indigenous peoples to access health services. Indigenous Services Canada directly provides services for First Nations and Inuit that supplement the health coverage provided by the government, including coverage such as primary health care.

About the Ontario Health Insurance Plan

OHIP, or the Ontario Health Insurance Plan, is Ontarios public health insurance. It covers many emergency and preventative medical care costs. It is funded through payroll deduction taxes and transfer payments from the federal government.

Many people are aware of the basics covered by OHIP, such as doctor visits and emergency health care. However, costs that are not covered can sometimes cause confusion, frustration and surprise expenses.

How To Choose The Best Health Insurance Plan For Your Child

Tomorrow wouldnt be worth the wait and yesterday wouldnt be worth remembering if it wasnt for ones children. Any parent would agree that children are the apple of our eye. Their health remains our primary concern, mainly when they are growing up. As a parent, you wouldnt want your child ever to fall sick, let alone compromise on the medical care and health plan for them. We all want only the best health insurance for our child, but how do we do that?

With a robust health insurance plan, you can ensure that there is no compromise in the medical care for your child. Lets see how you can make sure that you select the best health insurance among the various health insurance plans available in India for your child –

1. Find the right insurer

You must look at the benefits that the health insurance plan offers and how the health plan is applied. For instance, cashless hospitalization is more of a necessary minimum in health insurance plans and policy these days. Similarly, no claim bonus is another feature that can reduce your next premium or increase your sum assured under the health insurance, provided no health insurance claims have been made in the previous period. While we tend to underestimate the importance of additional health insurance benefits, they can assume particular significance in times of need.

2. Get a family floater plan

3. Avail the premium waiver option

4. Make use of benefits and riders

You May Like: Can A Child Have 2 Health Insurance Plans

Premiums And People On Your Plan

When you add a spouse or child onto a plan, your monthly payment goes up. That’s because you’re charged for each person covered by your plan. When you have more than three children under the age of 21, you only pay for the three oldest. Here’s how that works.

- Darrell and Tamara have five children, ages 5, 8, 12, 14 and 16. Although their health plan covers all seven of them, they’re only charged on their monthly premium for five people. They’re not charged for their two youngest children.

- Samar has two children, ages 7 and 10. So her health plan covers three people, and she’s charged for three people on her monthly premium.

- Terry and Joaquin have four children, ages 17, 20, 22 and 24. Their health plan covers six people. Because two of their children are over age 21, they’re charged on their monthly premium for all six people.

Digging Deeper For Pricing Information

However, it’s not universally good news. For more details, we consulted the CMS’ 2020 Health Insurance Exchange Premium Landscape Issue Brief. It indicates that 27-year-olds buying silver plans saw their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”

In 2021, that trend continues. The 2021 edition of the CMS Brief notes that, for example, while Wyomings average benchmark plan premium decreased 10% from PY20 to PY21, the average 27-year-old PY21 benchmark plan premium is $648the highest in the U.S. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Hampshire’s benchmark plan premium for a 27-year-old is the lowest in the nation at $273.

You May Like: Does Health Insurance Cover Eye Glasses

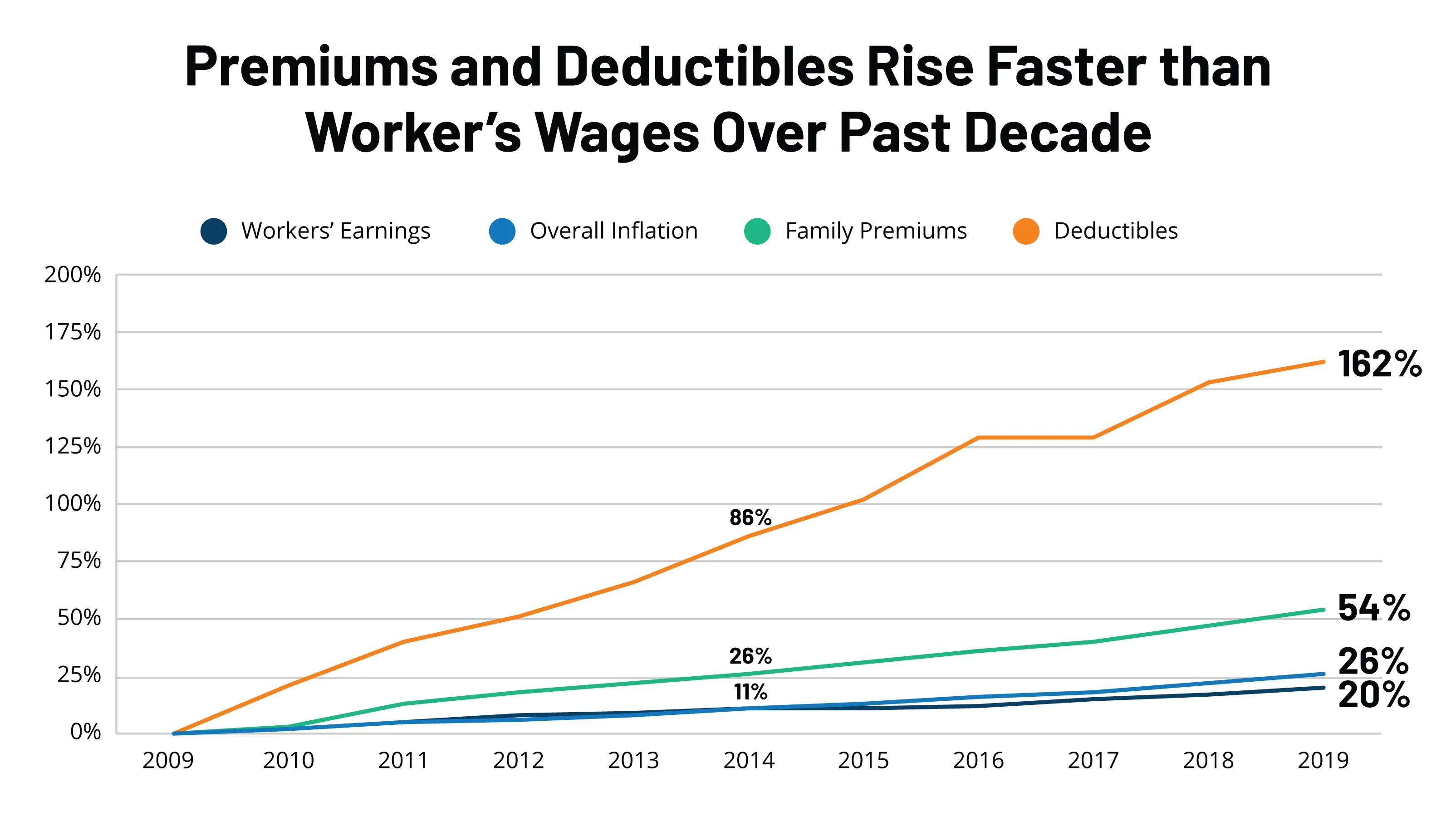

Health Insurance Costs Rising

All the noise pointed people away from the real meat of the Fraser studies. That was how much health costs had increased and how fast they were increasing.

For that average family, the cost of health insurance rose 1.4 times faster than their incomes did between 2006 and 2016. Incomes were up 26% in that time, but health insurance was up 37%.

To put it in perspective, the cost of shelter rose 36% during that time and the cost of food rose 30% during that time. Insurance costs rose 1.3 times as fast as these basic costs.

What Is The Average Price Of Non

What is the average monthly cost of your income if it exceeds 400% FPL ? A benchmark plan, such as the Silver one, has an average monthly premium of $462. Subsidized, it is $199. Subsidy assistance can reduce monthly premiums for ACA Marketplace plans. The actual cost of your plan will vary depending on where you live, your age and the health plan you choose.

Have a closer look. In a recent eHealth ACA Index report, we tracked costs and shopping trends among ACA plan enrollees who bought non-subsidized health insurance at ehealth.com during the nationwide open enrollment period for 2020 coverage.

Don’t Miss: What Is The Average Cost Of Self Employed Health Insurance

How To Find Better More Affordable Health Insurance

When it comes to drastically lowering your health insurance premium or deductible costs, experts say there arent many simple answers. However, among factors to consider are quitting any tobacco use and opting into a Health Savings Plan .

Handel says that an HSA is a type of savings account that allows a person to set aside money pre-tax, specifically to be used on health care costs now or down the road.

HSAs are useful, especially if you are higher income, Handel says. HSAs make the most sense for people in a higher income bracket because their marginal tax rate is higher, he adds. People in a lower income bracket, meanwhile, will not be saving as much because their tax rate is lower.

Some examples of how an HSA can be used include for doctor visit copays, dental expenses, vision expenses and for prescriptions. An individual can decide how much they want to contribute monthly or yearly to their HSA, which comes out of their paychecks, but the IRS caps the amount of how much someone can contribute to their HSA.

There are multitudes of variables that affect how much health insurance costs. And, while its not an easy expense to weigh or pay, the benefits of health insurance can outweigh the cost when it comes to routine care and medical emergencies.

Is Humana Or United Healthcare Better

Humana and UnitedHealthcare are both well-known and trusted health insurers. Both companies offer Medicare Advantage, Prescription Drug, and Medicare supplement insurance plans. UnitedHealthcare stands out for its partnership with the AARP. In contrast, Humana offers more general information that is easily accessible.

Do doctors prefer HMO or PPO?

In general, PPO networks tend to be broader, including more doctors and hospitals than HMO plans, giving you more choice. However, networks will differ from insurer to insurer, and plan to plan, so its best to research each plans network before you decide.

Don’t Miss: Can I Get Health Insurance Through My Llc

Are You Eligible For A Subsidy That Lowers The Cost Of Your Health Insurance

You must have a minimum income of between 100% and 400% to be eligible for federal tax subsidies in 2020. You should earn between:

- If you are single, $12,490 to $49,000.

- For a couple, $16,910 to $67,640

- For a family of four, $25,750 to $103,000

Your income for the entire year is what determines the subsidy. Therefore, you will need to calculate how much you will earn over the coverage year. Learn more about how to calculate your Subsidy Eligibility here

How The American Recovery Plan Act Makes Health Insurance Cheaper

Signed into law on March 11, 2021, the new $1.9 trillion COVD-19 stimulus package will have a major impact on the healthcare premiums of millions of Americans.

Officially known as the American Rescue Plan Act, this stimulus is expected to reduce healthcare premiums on some plans by as much as 20%. This will ultimately save millions of Americans hundreds of dollars on healthcare.

The stimulus plan reduces healthcare costs by expanding tax credits on many healthcare plans. Healthcare costs vary based upon an individualâs age, income and chosen plan but consider the following examples.

Stimulus impact for

You May Like: Should I Cancel My Health Insurance

Average Health Insurance Cost By Age And State

Healthcare has been one of the biggest talking points in politics over the past several decades. Health costs and the ability of the average person to afford them have been at the forefront of many presidential and Congressional debates â from arguments for and against the Affordable Care Act to the rise in insurance premiums to growing support for Medicare for All plan.

Many factors determine health insurance rates and premiums and whatâs offered. Individuals seeking healthcare may have options provided by an employer or may get health insurance through the ACA. Depending on a personâs income and health, he may have several options to choose from or may only be able to qualify for certain plans.

With this in mind, what does the average health insurance cost?

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

How Much Is Health Insurance By State

Wondering how much private health insurance costs? The answer is that monthly premiums can vary significantly depending on where you live.

Variation in rates stems from factors like how much competition there is in a given state, forcing insurers to offer attractive rates. Expenses may also vary because of the expected health costs of a population. For example, in states where people tend to be less healthy or where doctors and hospitals charge more, insurance companies set higher rates to cover those costs.

Average Health Insurance Premiums by State for 40-Year-Olds

Scroll for more

- $7,646

Average health insurance rates are only part of the story. Your actual plan may cost you much more or less than the typical person pays.

Thanks to federal subsidies, many people find their premiums are much more affordable. More than 50% of people can find a Silver plan for less than $10 per month with federal cost-sharing adjustments.

Another way to save money on premiums is to opt for higher-deductible plans. You may pay less each month, but you are on the hook for more of the bill if you use health care services until you reach your deductible. If you dont use many services, this kind of trade-off may save you money in the long run.

You May Like: How Far Back Does Health Insurance Cover