Change Of Residence: Gwen Moves Her Family Across The Country

Gwen, 46, is a single mom three boys in Raleigh, North Carolina. She just got some great news: Her employer has offered her a promotion overseeing a large sales force in Los Angeles. Her current plan features a robust network of health care providers in Raleigh, but none in Los Angeles. While not every change in residence is considered a qualifying life event, Gwens move outside her plans service area is. Gwen notifies her human resources department that she’d like to switch health plans so that finding covered providers near her new home won’t be a challenge.

If youve got questions about health savings accounts, read all about FSAs and HSAs.

Other changes in residence include:

- Moving to a different ZIP code or county

- A student moving to or from the place they attend school

- A seasonal worker moving to or from the place they live and work

- Moving to or from a shelter or other transitional housing

Can I Enroll In Employer

No. If you are seeking toenroll in employer-sponsored health insurance or other insurance obtained as a member of a group, you are not eligible for an open enrollment waiver. Your employer may limit health insurance enrollment to certain times during the year. You should talk to your employer about your needs.

When Can I Enroll During A Special Enrollment Period

The Special Enrollment Period is determined by the type of qualifying life event. In most cases, you will have 60 days after the qualifying life event to enroll in or make changes to a health plan.

Certain life events, like moving into the AmeriHealth New Jersey coverage area, allows you to apply for a health plan up to 60 days before a qualifying life event. If you are losing health care coverage provided by an employer, you will have up to 60 days before and after this qualifying life event to enroll in a health plan.

When you apply for a Special Enrollment Period for the following qualifying life events, you will be sent an Eligibility Notice for Coverage.

- Loss of minimum essential coverage

- Change in primary place of living

- Birth

- Gaining a dependent through adoption, placement for adoption, placement in foster care, or a child support or other court order

This notice will include a list of acceptable documents you may provide to prove your eligibility for the Special Enrollment Period. Please provide these documents by the deadline listed in the notice to avoid disruptions to your health care coverage. You must send the documents before you can start using your health care coverage. You can preview the Eligibility Notice . Learn more about acceptable documents and when the Health Insurance Marketplace requires you to submit documentation.

Don’t Miss: What Is The Self Employed Health Insurance Deduction

Changing Health Coverage Outside An Open Enrollment Period

It can be tricky to change your coverage to a spouses policy outside of the open enrollment period. Your current policys coverage period may not match up with your spouses policy coverage period and you could be refused coverage until open enrollment rolls around again.

If you are enrolled in a cafeteria plan and have had your hours reduced to 30 hours per week or less, or if youve purchased an individual health insurance plan through the federal Marketplace or state ACA exchange, among other specific instances, youre able to drop your group health insurance midyear.

Additionally, if your employer offers you a QSEHRA or an ICHRA, this triggers a special enrollment period , giving you 60 days from the time you are offered the HRA to change to your spouse’s individual insurance family plan.

How To Get Health Insurance After Open Enrollment Ends

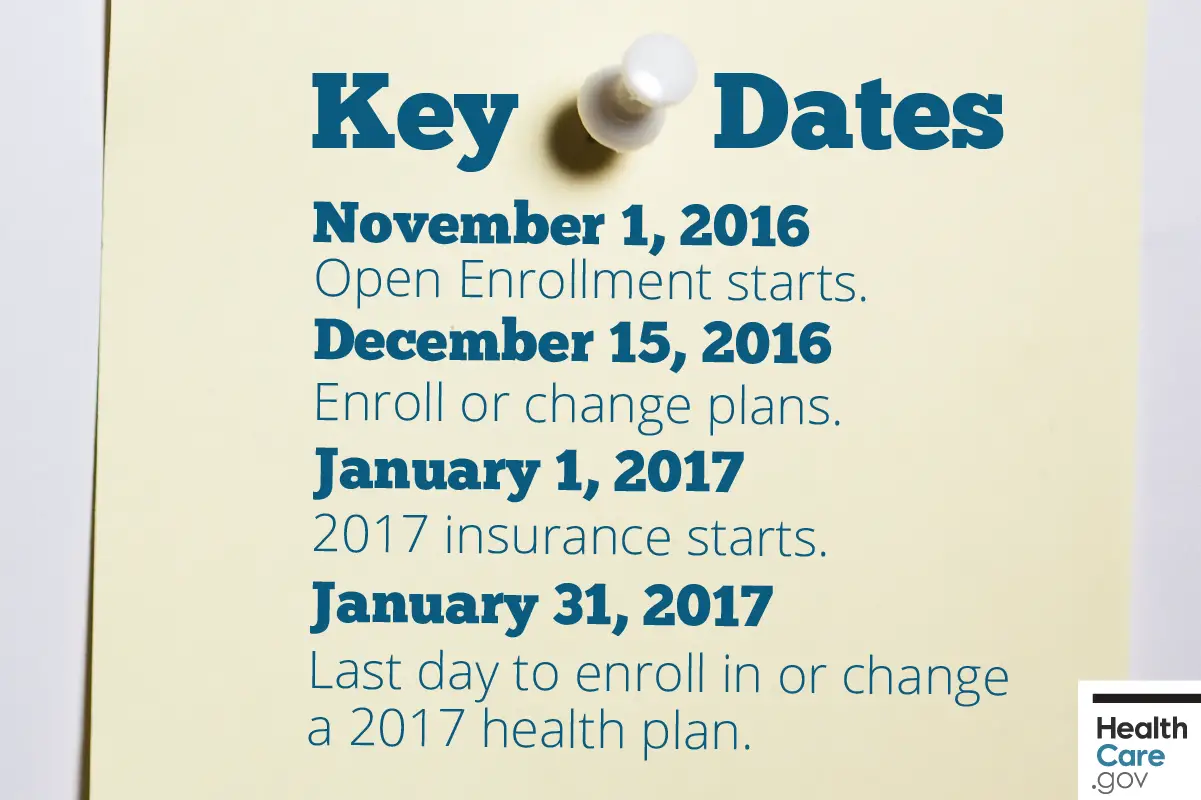

Open enrollment for the federal Health Insurance Marketplace typically runs from Nov. 1 to Dec. 15 annually. During the six-week period, customers are offered the opportunity to enroll in new healthcare coverage, switch their current health plan to a new one, and/or apply for cost assistance. Plans that were enrolled in during that time frame take effect on Jan. 1 of the next year.

Since millions of Americans have applied for jobless aid due to the COVID-19 pandemic, numerous people are faced with another challenge: losing their health insurance. If youre no longer receiving medical benefits, heres how to get health insurance after open enrollment.

Read Also: How Much Does It Cost To Get Health Insurance License

What Happens If You Dont Enroll During Open Enrollment

If you dont enroll during open enrollment, you might end up covered anyway. For example, Fronstin says that if you already have health insurance through an employer but dont choose coverage the next time open enrollment comes around, typically youre automatically re-enrolled in the same plan if you dont do anything.

You may also qualify to purchase coverage if you take on a new job that offers health care benefits. Another way to get insurance outside of the open enrollment period is to qualify for a special enrollment period or to qualify for a program such as Medicaid.

However, in other situations, you may not be able to find health insurance coverage until the next open enrollment period.

During A Special Enrollment Period

You might be able to switch health insurance plans outside of open enrollment if you experience a qualifying life event that impacts your coverage such as getting married or divorced, having a child, moving to a new coverage area or losing job-based coverage.

Such events trigger what is called a , a limited period of time during which you can buy a new ACA plan. In most circumstances, special enrollment lasts 60 days from the qualifying life event.

Read Also: Can I Go To The Er Without Health Insurance

What Qualifies For Special Enrollment

You qualify for a Special Enrollment Period if youve had certain life events, including losing health coverage, moving, getting married, having a baby, or adopting a child. Depending on your Special Enrollment Period type, you may have 60 days before or 60 days following the event to enroll in a plan.

What Is A Qualifying Event For Health Insurance

There are two types of triggers for SEPs:

- Loss of eligibility for health coverage

- Certain life events

Life events that create a special enrollment period include:

- Reduction in work hours

- Relocation

Your state may offer additional rules for life events that create an SEP. For example, in New York, women who become pregnant may add or change coverage.

Most qualifying events trigger a special enrollment period whether you have a , individual plan or workplace plan. However, thats not always the case. According to the Kaiser Family Foundation, some events only qualify you for a special enrollment period in the marketplace and don’t apply to the outside market. The exceptions are situations related to citizenship, native status and exceptional circumstances.

Also, the changes you make to your health plan due to a qualifying life event should be consistent with the event. For example, if you get married, you can drop your health insurance, but only if youre enrolling in your spouses health plan.

|

QUALIFYING LIFE EVENT |

|

|

*Insure.com works to keep an updated and comprehensive list however, the special enrollment chart may not apply to every benefit plan and individual circumstances should be verified with your health insurance administrator.

Recommended Reading: How To Get Health Insurance In France

Ready To Switch Health Insurance Plans Heres What To Keep In Mind

Whats the right health insurance plan? Everyone wants to know, but the truth is theres no easy answer. The right plan is different for everyone, and thats because health is different for everyone.

However, there are a few things you can compare and consider to help choose a plan thats right for you:

Not sure where to begin? At HealthPartners, we help people in Minnesota and western Wisconsin find the right plan with the right coverage.

Whether its open enrollment time or you have a special enrollment period, were here to help make things simple. That way, you can choose a health insurance plan youre confident in.

Can I Switch Plans Outside Of Open Enrollment

I have been insured for all of 2015 so far. However, I am EXTREMELY dissatisfied with my current provider , and want to change to a plan purchased through Obamacare. Would I qualify for a special enrollment period in this situation?

The other thing is, there is a good chance that I will be moving in September. If I keep my current insurance until I move, would I qualify for a special enrollment period after I arrive in North Carolina?

Thanks so much in advance for your response!

Don’t Miss: Can Aflac Replace Health Insurance

Your Employee Missed Open Enrollment Now What

When open enrollment ends, we know youll receive an influx of employee questions about their options to sign up for health care. Heres what to tell them.

No account yet? Register

For businesses that provide health care insurance for staff, open enrollment is a hectic time of year. Collecting all the documents needed to assure employees are enrolled properly is a complex process that requires a lot of organizational ability. Whether you manage open enrollment on your own or use an outside consultant, numerous reminders are sent urging employees to review their options, ask any questions and get their paperwork in by the deadline so they dont miss out.

How To Cancel Your Insurance Plan Without Replacing It

You can cancel your Marketplace plan any time, but there are important things to consider:

- No one plans to get sick or hurt, but bad things happen even to healthy people. Having medical debt can really limit your options. If you’re paying for every medical service yourself, you may make some health care decisions based on money instead of what’s best for your health.

Read Also: Does Mcdonald’s Have Health Insurance

How Do I Prepare For Open Enrollment

Choosing a health insurance package can be daunting, especially because you dont know in advance what your expenses will be over the following year.

You can’t always predict what the best plan’s going to be, Fronstin says. The whole point of insurance is to be there for unexpected expenses.

Take time to understand what you are purchasing, whether during the standard enrollment window or a special enrollment period.

If you have questions about finding the right plan for your needs, you may benefit from finding a reputable, licensed insurance broker or working with one of your state marketplaces navigators, whose job it is to point people toward workable plans.

However, in the end, remember that its often hard to know in advance whether youre making the right choice. Fronstin offers the example of a young person who is healthy and rarely visits the doctor. Such an individual may try to save money by choosing a cheap plan with a high deductible.

“But that doesn’t mean in hindsight after a year that will have been the best option for you, because maybe you broke your arm riding your bike, he says.

In the end, even a decision thats correct at the time you made it might be something you regret later. That’s the nature of insurance — you’re placing a bet, Fronstin says. Sometimes you win and sometimes you lose.

Which Health Insurance Options Dont Use Open Enrollment

Most health insurers in California use some sort of open enrollment program. But there are a few exceptions:

-

Medi-Cal: Medi-Cal doesnt limit enrollment to the open enrollment period. If youre eligible for Medi-Cal, youre allowed to enroll anytime.

-

CHIP: The Childrens Health Insurance Program doesnt limit enrollment to a specific time, either.

Not sure how Obamacare affects your health care plans in California? Learn how the ACA works in California, including benefits, costs and enrollment.

Read Also: Can You Go To The Health Department Without Insurance

Marketplace Special Enrollment Period

A qualifying life event for a Special Enrollment Period is defined as:

- A change in household

- A change in residence

- A loss in coverage

- Becoming a U.S. citizen

- Gaining membership in a federally recognized tribe or status as an Alaska Native Claims Settlement Act Corporation shareholder

- Starting or ending service as an AmeriCorps State and National, VISTA, or NCCC member

In order to find out if you qualify for a Special Enrollment Period for Marketplace plans, visit healthcare.gov to answer a few questions. If you do qualify, begin by filling out an application on the governments website, along with visiting this section of the site to review the current plans and pricing.

Can I Enroll In Health Insurance Outside Of The Open Enrollment Period

If you have a qualifying life eventlike getting married, losing a job, having a child, or losing health insuranceyou may be able to enroll in health insurance outside of the open enrollment period without requesting a waiver. To learn more about qualifying life events, visit the Connector.

Also, you can enroll any time of year if:

- You qualify for MassHealth.

- You now qualify for a ConnectorCare Plan through the Health Connector after not having qualified in the past, or after applying for the first time.

- You are applying for dental insurance.

- You are a member of a federally recognized tribe or Alaska Native shareholder.

You May Like: Do I Have To Offer Health Insurance To All Employees

Can You Just Cancel Your Aca Plan

Lets say you want to switch health insurance plans halfway through the year and dont qualify for special enrollment, but youd still like to cancel your current major medical coverage. Is that an option?

Yes, its possible. However, its important to remember that going without comprehensive major medical coverage could leave you vulnerable to unexpected medical bills should you become sick or injured.

Instead of and going without coverage, you may want to consider either keeping your comprehensive plan and adding or enrolling in a non-ACA-qualifying as an alternative to going uninsured if you qualify.

Lets look more closely at these options, both of which are available year-round in most states.

What Can I Do If I Cant Afford Health Insurance

If you cant afford health insurance, you might qualify for free or low-cost programs, such as Medicaid. This program is available to those whose incomes are low enough that they qualify. However, others also might be eligible, including pregnant women, the elderly and people with disabilities.

If you dont qualify for Medicaid, you may still be eligible to purchase marketplace coverage with subsidies that can dramatically reduce your costs.

You could also be added to your spouses health insurance or find some coverage through a short-term health insurance plan. Just be aware that short-term plans have coverage limitations.

Read Also: Can You Have Double Health Insurance

I Am Losing My Current Health Insurance Do I Have To Wait Until Open Enrollment To Enroll In A New Health Insurance

Typically, losing health insurance is considered a qualifying life event. This includes losing health insurance through a job, becoming ineligible for MassHealth or ConnectorCare, or aging out of your parents plan when turning 26.You have 60 days from the date when you lose your health insurance to enroll in new health insurance.

How To Change Employer Health Insurance Plans

To make changes with an employer-based plan, you typically will have to wait for open enrollment. This time period varies by employer, so ask your human resources department for more details.

Typically, employers who start new coverage options on Jan. 1 of each year will host open enrollment during the previous fall. Open enrollment typically lasts for two to four weeks, but its important to clarify these details with your employer.

You may also qualify for a special enrollment period if you face a qualifying life event like losing other coverage, having a baby or getting married. Check with your employers benefits department to determine specifics about your companys open enrollment and special enrollment periods.

Don’t Miss: When Does Health Insurance Enrollment Start

How To Change Aca Marketplace Plans

Changing marketplace plans isnt difficult. You can do so during open enrollment or if you qualify for a special enrollment period due to a life event.

If you live in a state that uses the federal marketplace, go to the federal marketplace website and either create an account or log in to your existing account. From that point, follow the prompts, which will differ depending on whether youre changing coverage during open enrollment or making changes due to a life change.

You can also make changes by phone by calling 1-800-318-2596 .

If youre enrolled in a plan through a state marketplace, go to your state’s website and follow the prompts there. If youre not sure whether your state has its own marketplace, you can start with the federal website and it will direct you to your state marketplace if applicable.

What Is Considered A Qualifying Life Event

Qualifying life events are those situations that cause a change in your life that has an effect on your health insurance options or requirements. The IRS states that a qualifying event must have an impact on your insurance needs or change what health insurance plans that you qualify for. In either case, the qualifying life event would trigger a special enrollment period that would make you eligible to select a new individual insurance policy through the state marketplace.

| Category | Examples of qualifying life events |

|---|---|

| Loss of health care coverage |

|

| Changes in household |

|

| Changes in residence |

|

| Other qualifying events |

|

Qualifying events are evaluated on a case-by-case basis by an underwriter. You can view a complete list of qualifying life events on HealthCare.gov.

You May Like: Can You Add Your Mom To Your Health Insurance